5e2ec0b661a70d5d6fd537d608100c0f.ppt

- Количество слайдов: 44

Chapter 9 a: Corporate Strategy: Strategic Alliances and Mergers & Acquisitions

Chapter 9 a: Corporate Strategy: Strategic Alliances and Mergers & Acquisitions

2 Chapter Case 9: Disney: Building Billion Dollar Franchises Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

2 Chapter Case 9: Disney: Building Billion Dollar Franchises Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3 Disney: Building Billion Dollar Franchises • Disney: creates billion-dollar franchises – Frozen, Toy Story, Star Wars • Why this is risky: – Many obtained through acquisition (e. g. , Star Wars) • Only so many can be acquired. – This may reduce originality / increase boredom. • Recipe for success becomes predictable. – Half of Disney profits come from TV networks • This industry is being disrupted. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3 Disney: Building Billion Dollar Franchises • Disney: creates billion-dollar franchises – Frozen, Toy Story, Star Wars • Why this is risky: – Many obtained through acquisition (e. g. , Star Wars) • Only so many can be acquired. – This may reduce originality / increase boredom. • Recipe for success becomes predictable. – Half of Disney profits come from TV networks • This industry is being disrupted. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

4 Disney: Building Billion Dollar Franchises • Disney is the world’s largest media company – $50 billion in annual revenues – Has grown through high-profile acquisitions • Pixar (2006), Marvel (2009), and Lucasfilm (2012) • How Pixar became an acquisition – Originally produced graphic display systems, animated movies demonstrated systems capabilities – Steve Jobs bought it for $5 million – Rolled out one blockbuster after another • Toy Story, A Bug’s Life, Monsters, Inc. , • Finding Nemo, The Incredibles, and Cars Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

4 Disney: Building Billion Dollar Franchises • Disney is the world’s largest media company – $50 billion in annual revenues – Has grown through high-profile acquisitions • Pixar (2006), Marvel (2009), and Lucasfilm (2012) • How Pixar became an acquisition – Originally produced graphic display systems, animated movies demonstrated systems capabilities – Steve Jobs bought it for $5 million – Rolled out one blockbuster after another • Toy Story, A Bug’s Life, Monsters, Inc. , • Finding Nemo, The Incredibles, and Cars Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

5 Disney: Building Billion Dollar Franchises • Disney acquisitions – Pixar for $7. 4 billion in 2006 – Marvel for $4 billion in 2009 – Lucasfilm for $4 billion in 2012 • Franchise model – Get a big movie hit, then derive spin-offs • TV shows, theme park rides, video games, toys, clothing • Disney’s hit Frozen – Most successful animated movie ever – Grossed $1. 5 billion since 2013 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

5 Disney: Building Billion Dollar Franchises • Disney acquisitions – Pixar for $7. 4 billion in 2006 – Marvel for $4 billion in 2009 – Lucasfilm for $4 billion in 2012 • Franchise model – Get a big movie hit, then derive spin-offs • TV shows, theme park rides, video games, toys, clothing • Disney’s hit Frozen – Most successful animated movie ever – Grossed $1. 5 billion since 2013 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

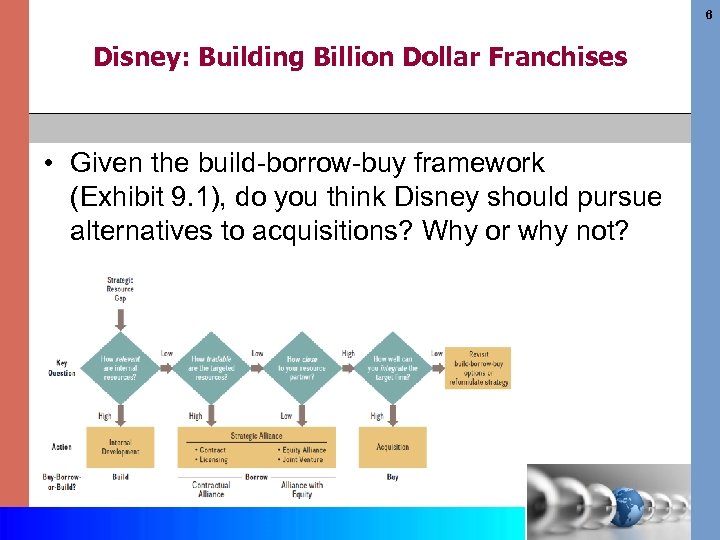

6 Disney: Building Billion Dollar Franchises • Given the build-borrow-buy framework (Exhibit 9. 1), do you think Disney should pursue alternatives to acquisitions? Why or why not? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

6 Disney: Building Billion Dollar Franchises • Given the build-borrow-buy framework (Exhibit 9. 1), do you think Disney should pursue alternatives to acquisitions? Why or why not? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

7 Disney: Building Billion Dollar Franchises • Why do you think Disney was so successful with the Pixar and Marvel acquisitions, while other media interactions such as Sony’s acquisition of Columbia Pictures or New Corp’s acquisition of My. Space were much less successful? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

7 Disney: Building Billion Dollar Franchises • Why do you think Disney was so successful with the Pixar and Marvel acquisitions, while other media interactions such as Sony’s acquisition of Columbia Pictures or New Corp’s acquisition of My. Space were much less successful? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

8 Disney: Building Billion Dollar Franchises • Given the build-borrow-buy framework (Exhibit 9. 1), do you think Disney should pursue alternatives to acquisitions? Why or why not? • Why do you think Disney was so successful with the Pixar and Marvel acquisitions, while other media interactions such as Sony’s acquisition of Columbia Pictures or New Corp’s acquisition of My. Space were much less successful? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

8 Disney: Building Billion Dollar Franchises • Given the build-borrow-buy framework (Exhibit 9. 1), do you think Disney should pursue alternatives to acquisitions? Why or why not? • Why do you think Disney was so successful with the Pixar and Marvel acquisitions, while other media interactions such as Sony’s acquisition of Columbia Pictures or New Corp’s acquisition of My. Space were much less successful? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

9 How Firms Achieve Growth Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

9 How Firms Achieve Growth Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

10 The Build-Borrow-or-Buy Framework • Conceptual model • Aids in determining whether firms should pursue: – Internal development (build) – Enter a contract / strategic alliance (borrow) – Acquire new resources, capabilities, and competencies (buy) Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

10 The Build-Borrow-or-Buy Framework • Conceptual model • Aids in determining whether firms should pursue: – Internal development (build) – Enter a contract / strategic alliance (borrow) – Acquire new resources, capabilities, and competencies (buy) Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

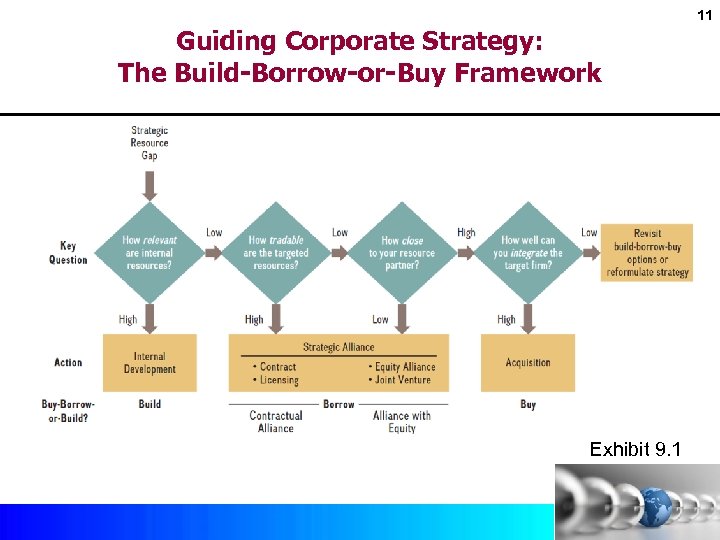

11 Guiding Corporate Strategy: The Build-Borrow-or-Buy Framework Placeholder Exhibit 9. 1 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

11 Guiding Corporate Strategy: The Build-Borrow-or-Buy Framework Placeholder Exhibit 9. 1 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

12 The Main Issues in the Build-Borrow-or-Buy Framework • Relevancy – How relevant are existing internal resources to solving the resource gap – do they pass the VRIO(N) test (chapter 4)? • Tradability – How tradable are the targeted resources that may be available externally? -- e. g. , biotech firm licenses to pharmaceutical company. • Closeness – How close do you need to be to your external resource partner? • Integration – How well can you integrate the targeted firm should you determine you need to acquire the resource partner? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

12 The Main Issues in the Build-Borrow-or-Buy Framework • Relevancy – How relevant are existing internal resources to solving the resource gap – do they pass the VRIO(N) test (chapter 4)? • Tradability – How tradable are the targeted resources that may be available externally? -- e. g. , biotech firm licenses to pharmaceutical company. • Closeness – How close do you need to be to your external resource partner? • Integration – How well can you integrate the targeted firm should you determine you need to acquire the resource partner? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

13 Strategic Alliances Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

13 Strategic Alliances Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

14 What are Strategic Alliances? • A voluntary arrangement between firms • Involves the sharing of: – Knowledge – Resources – Capabilities with the intent of developing: • Processes • Products • Services Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

14 What are Strategic Alliances? • A voluntary arrangement between firms • Involves the sharing of: – Knowledge – Resources – Capabilities with the intent of developing: • Processes • Products • Services Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

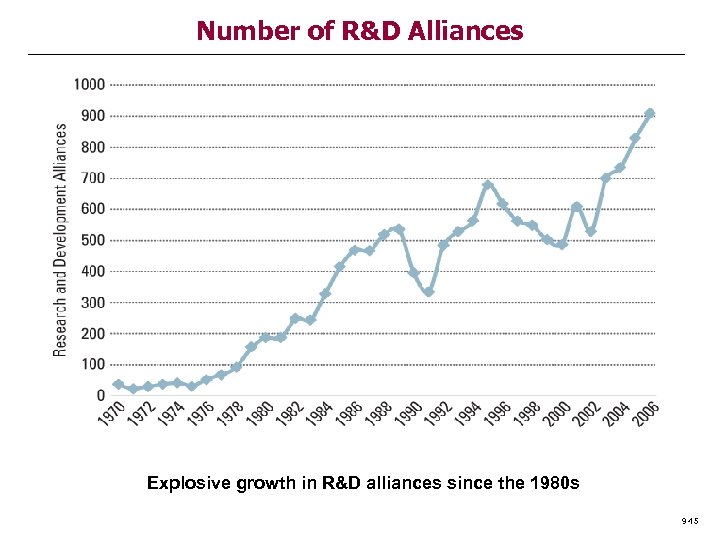

Number of R&D Alliances Explosive growth in R&D alliances since the 1980 s 9 -15

Number of R&D Alliances Explosive growth in R&D alliances since the 1980 s 9 -15

16 How Do Strategic Alliances Assist Firms? • They may complement a firm’s value chain. • They may focus on similar value chain activities. • They enable: – Firm’s to achieve their goals faster – Lower cost – Fewer legal repercussions • An alliance qualifies as strategic if: – It has the potential to affect a firm’s (sustainable) competitive advantage Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

16 How Do Strategic Alliances Assist Firms? • They may complement a firm’s value chain. • They may focus on similar value chain activities. • They enable: – Firm’s to achieve their goals faster – Lower cost – Fewer legal repercussions • An alliance qualifies as strategic if: – It has the potential to affect a firm’s (sustainable) competitive advantage Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

17 Why Do Firms Enter Strategic Alliances? • Strengthen competitive position • Enter new markets • Hedge against uncertainty • Access critical complementary assets • Learn new capabilities Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

17 Why Do Firms Enter Strategic Alliances? • Strengthen competitive position • Enter new markets • Hedge against uncertainty • Access critical complementary assets • Learn new capabilities Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

18 Strengthen Competitive Position • Strategic alliances can help: – Change industry structure to the firm’s favor – Influence industry standards • Example: IBM & Apple – Entered a strategic alliance – Desired to strengthen their competitive position • In mobile computing and business productivity apps – Put competitive pressure on rivals such as Microsoft Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

18 Strengthen Competitive Position • Strategic alliances can help: – Change industry structure to the firm’s favor – Influence industry standards • Example: IBM & Apple – Entered a strategic alliance – Desired to strengthen their competitive position • In mobile computing and business productivity apps – Put competitive pressure on rivals such as Microsoft Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

IBM and Apple: From Big Brother to Alliance Partner • IBM was a fierce competitor with Apple (1980 s). • Then Apple dominated • 2014: Apple and IBM form a strategic partnership – Apple sold mostly to consumers, IBM to businesses. – IBM and Apple -- long-time rivals – have formed a strategic alliance to created simple-to-use business productivity apps and to sell i. Phones and i. Pads to corporate clients. Discuss how each company might benefit through this alliance. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 19

IBM and Apple: From Big Brother to Alliance Partner • IBM was a fierce competitor with Apple (1980 s). • Then Apple dominated • 2014: Apple and IBM form a strategic partnership – Apple sold mostly to consumers, IBM to businesses. – IBM and Apple -- long-time rivals – have formed a strategic alliance to created simple-to-use business productivity apps and to sell i. Phones and i. Pads to corporate clients. Discuss how each company might benefit through this alliance. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 19

20 Enter New Markets • Product markets • Service markets • Geographical markets – Governments such as Saudi Arabia or China may require that foreign firms have a local joint venture partner before doing business in their countries. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

20 Enter New Markets • Product markets • Service markets • Geographical markets – Governments such as Saudi Arabia or China may require that foreign firms have a local joint venture partner before doing business in their countries. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

21 Hedge Against Uncertainty • Real-options perspective: – Approach to strategic decision making – Breaks down a larger investment decision into a set of smaller decisions – Staged sequentially over time – Allows firms to obtain information in stages v Roche invests in Genentech 1990 and buys it in 2009 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

21 Hedge Against Uncertainty • Real-options perspective: – Approach to strategic decision making – Breaks down a larger investment decision into a set of smaller decisions – Staged sequentially over time – Allows firms to obtain information in stages v Roche invests in Genentech 1990 and buys it in 2009 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

22 Access Critical Complementary Assets • Complementary assets such as: – Marketing – Manufacturing – After-sale service • Helps complete the value chain: – From upstream innovation to downstream commercialization Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

22 Access Critical Complementary Assets • Complementary assets such as: – Marketing – Manufacturing – After-sale service • Helps complete the value chain: – From upstream innovation to downstream commercialization Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

23 Learn New Capabilities • Firms are motivated by the desire to learn from their partners (e. g. , GM & Toyota (NUMMI) – formed in 1984) • Co-opetition – Cooperation by competitors to achieve a strategic objective • Learning can take place at different rates. – The firm that learns more quickly is motivated to exit the alliance / reduce knowledge sharing. – Referred to as “learning races” Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

23 Learn New Capabilities • Firms are motivated by the desire to learn from their partners (e. g. , GM & Toyota (NUMMI) – formed in 1984) • Co-opetition – Cooperation by competitors to achieve a strategic objective • Learning can take place at different rates. – The firm that learns more quickly is motivated to exit the alliance / reduce knowledge sharing. – Referred to as “learning races” Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

24 Governing Strategic Alliances • Non-Equity Alliances – Partnerships based on contracts – Examples: supply agreements, distribution agreements, and licensing agreements • Equity Alliances – One partner takes partial ownership in the other. • (Equity) Joint Ventures (JVs) – A standalone organization created and jointly owned by two or more parent companies Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

24 Governing Strategic Alliances • Non-Equity Alliances – Partnerships based on contracts – Examples: supply agreements, distribution agreements, and licensing agreements • Equity Alliances – One partner takes partial ownership in the other. • (Equity) Joint Ventures (JVs) – A standalone organization created and jointly owned by two or more parent companies Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Equity Alliances and Equity JVs • At least one partner takes partial ownership position Ø Stronger commitment toward the relationship • Allow the sharing of tacit knowledge Ø Tacit knowledge concerns the “know how” • Partners exchange personnel to acquire tacit knowledge Ø 1984 Toyota + GM = NUMMI (New United Motor Manufacturing Inc. ) Ø 2010 Toyota + Tesla to use the NUMMI plant • Corporate venture capital is another equity source Ø Established firms invest in new startups • Tends to produce stronger ties and greater trust (due to greater alignment of incentives) 9– 25

Equity Alliances and Equity JVs • At least one partner takes partial ownership position Ø Stronger commitment toward the relationship • Allow the sharing of tacit knowledge Ø Tacit knowledge concerns the “know how” • Partners exchange personnel to acquire tacit knowledge Ø 1984 Toyota + GM = NUMMI (New United Motor Manufacturing Inc. ) Ø 2010 Toyota + Tesla to use the NUMMI plant • Corporate venture capital is another equity source Ø Established firms invest in new startups • Tends to produce stronger ties and greater trust (due to greater alignment of incentives) 9– 25

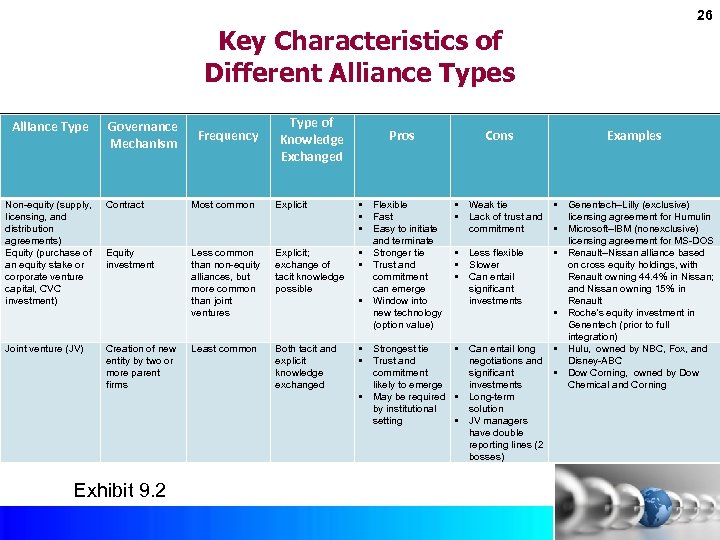

26 Key Characteristics of Different Alliance Types Alliance Type Governance Mechanism Frequency Type of Knowledge Exchanged Non-equity (supply, licensing, and distribution agreements) Equity (purchase of an equity stake or corporate venture capital, CVC investment) Contract Most common Explicit Equity investment Less common than non-equity alliances, but more common than joint ventures Explicit; exchange of tacit knowledge possible Joint venture (JV) Creation of new entity by two or more parent firms Least common Both tacit and explicit knowledge exchanged Pros Cons Examples • Flexible • Fast • Easy to initiate and terminate • Stronger tie • Trust and commitment can emerge • Window into new technology (option value) • Weak tie • Lack of trust and commitment • Genentech–Lilly (exclusive) licensing agreement for Humulin • Microsoft–IBM (nonexclusive) licensing agreement for MS-DOS • Renault–Nissan alliance based on cross equity holdings, with Renault owning 44. 4% in Nissan; and Nissan owning 15% in Renault • Roche’s equity investment in Genentech (prior to full integration) • Hulu, owned by NBC, Fox, and Disney-ABC • Dow Corning, owned by Dow Chemical and Corning • Less flexible • Slower • Can entail significant investments • Strongest tie • Can entail long • Trust and negotiations and commitment significant likely to emerge investments • May be required • Long-term by institutional solution setting • JV managers have double reporting lines (2 bosses) Exhibit 9. 2 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

26 Key Characteristics of Different Alliance Types Alliance Type Governance Mechanism Frequency Type of Knowledge Exchanged Non-equity (supply, licensing, and distribution agreements) Equity (purchase of an equity stake or corporate venture capital, CVC investment) Contract Most common Explicit Equity investment Less common than non-equity alliances, but more common than joint ventures Explicit; exchange of tacit knowledge possible Joint venture (JV) Creation of new entity by two or more parent firms Least common Both tacit and explicit knowledge exchanged Pros Cons Examples • Flexible • Fast • Easy to initiate and terminate • Stronger tie • Trust and commitment can emerge • Window into new technology (option value) • Weak tie • Lack of trust and commitment • Genentech–Lilly (exclusive) licensing agreement for Humulin • Microsoft–IBM (nonexclusive) licensing agreement for MS-DOS • Renault–Nissan alliance based on cross equity holdings, with Renault owning 44. 4% in Nissan; and Nissan owning 15% in Renault • Roche’s equity investment in Genentech (prior to full integration) • Hulu, owned by NBC, Fox, and Disney-ABC • Dow Corning, owned by Dow Chemical and Corning • Less flexible • Slower • Can entail significant investments • Strongest tie • Can entail long • Trust and negotiations and commitment significant likely to emerge investments • May be required • Long-term by institutional solution setting • JV managers have double reporting lines (2 bosses) Exhibit 9. 2 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

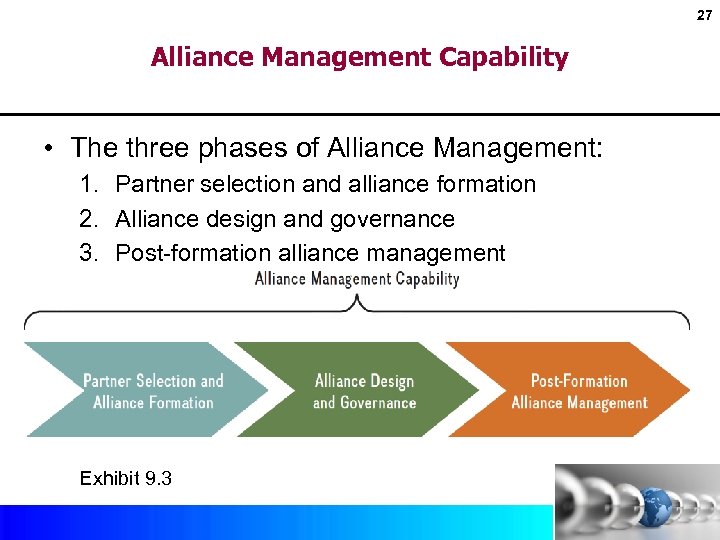

27 Alliance Management Capability • The three phases of Alliance Management: 1. Partner selection and alliance formation 2. Alliance design and governance 3. Post-formation alliance management • Can lead to a competitive advantage Exhibit 9. 3 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

27 Alliance Management Capability • The three phases of Alliance Management: 1. Partner selection and alliance formation 2. Alliance design and governance 3. Post-formation alliance management • Can lead to a competitive advantage Exhibit 9. 3 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

28 Partner Selection and Alliance Formation • The benefits must exceed the costs. • Five reasons for alliance formation: – – – To strengthen competitive position To enter new markets To hedge against uncertainty To access critical complementary resources To learn new capabilities • Partner compatibility and commitment are necessary. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

28 Partner Selection and Alliance Formation • The benefits must exceed the costs. • Five reasons for alliance formation: – – – To strengthen competitive position To enter new markets To hedge against uncertainty To access critical complementary resources To learn new capabilities • Partner compatibility and commitment are necessary. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

29 Alliance Design and Governance • Possible governance mechanisms: – Non-equity contractual agreement – Equity alliances – (Equity) Joint venture • Joining specialized complementary assets increases the likelihood that the alliance is governed hierarchically. • Inter-organization trust is critical. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

29 Alliance Design and Governance • Possible governance mechanisms: – Non-equity contractual agreement – Equity alliances – (Equity) Joint venture • Joining specialized complementary assets increases the likelihood that the alliance is governed hierarchically. • Inter-organization trust is critical. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

30 Post-Formation Alliance Management • To create VRIO resource combinations: – Make relation-specific investments. – Establish knowledge-sharing routines. – Build interfirm trust. • Build capability through repeated experiences over time. – Repeated alliance exposure improves learning. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

30 Post-Formation Alliance Management • To create VRIO resource combinations: – Make relation-specific investments. – Establish knowledge-sharing routines. – Build interfirm trust. • Build capability through repeated experiences over time. – Repeated alliance exposure improves learning. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

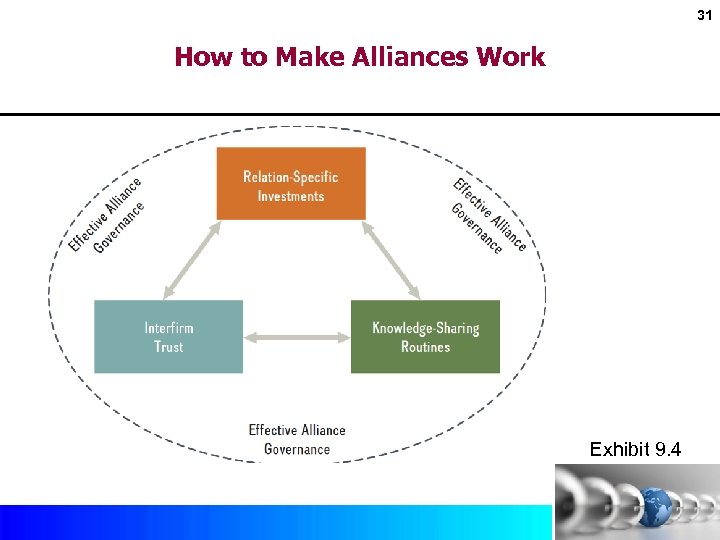

31 How to Make Alliances Work Exhibit 9. 4 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

31 How to Make Alliances Work Exhibit 9. 4 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

32 Mergers & Acquisitions Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

32 Mergers & Acquisitions Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

33 Mergers & Acquisitions • Merger: – The joining of two independent companies – Forms a combined entity • Acquisition: – Purchase of one company by another – Can be friendly or unfriendly. – Hostile takeover: • The target company does not wish to be acquired. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

33 Mergers & Acquisitions • Merger: – The joining of two independent companies – Forms a combined entity • Acquisition: – Purchase of one company by another – Can be friendly or unfriendly. – Hostile takeover: • The target company does not wish to be acquired. Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

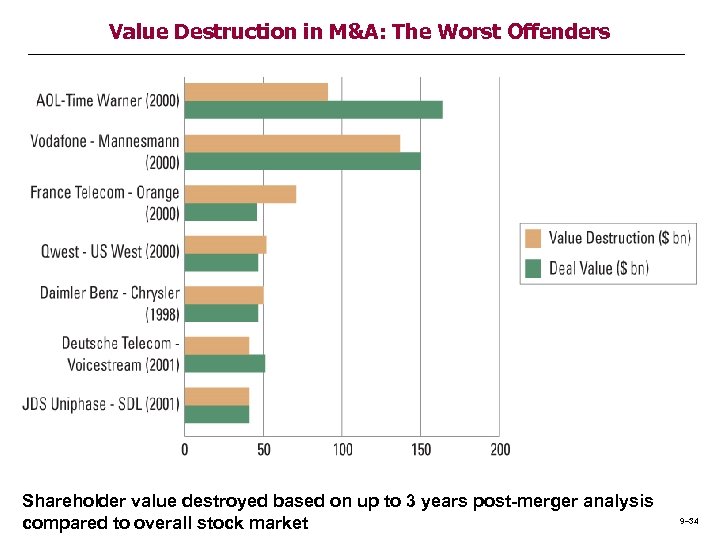

Value Destruction in M&A: The Worst Offenders Shareholder value destroyed based on up to 3 years post-merger analysis compared to overall stock market 9– 34

Value Destruction in M&A: The Worst Offenders Shareholder value destroyed based on up to 3 years post-merger analysis compared to overall stock market 9– 34

Mergers & Acquisitions • Many M&As actually destroy shareholder value! Ø When there is value, it often goes to the acquiree v Acquirers tend to pay a premium • Why are M&As still desired? 9– 35

Mergers & Acquisitions • Many M&As actually destroy shareholder value! Ø When there is value, it often goes to the acquiree v Acquirers tend to pay a premium • Why are M&As still desired? 9– 35

36 Why Do Firms Merge? • Horizontal integration: – The process of merging with competitors – (e. g. , Nation buys Ticketmaster in 2010) – Leads to industry consolidation • Three main benefits: 1. Reduction in competitive intensity • Changes underlying industry structure in favor of surviving firms 2. Lower costs • Economies of scale 3. Increased differentiation • Fills product gaps Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

36 Why Do Firms Merge? • Horizontal integration: – The process of merging with competitors – (e. g. , Nation buys Ticketmaster in 2010) – Leads to industry consolidation • Three main benefits: 1. Reduction in competitive intensity • Changes underlying industry structure in favor of surviving firms 2. Lower costs • Economies of scale 3. Increased differentiation • Fills product gaps Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

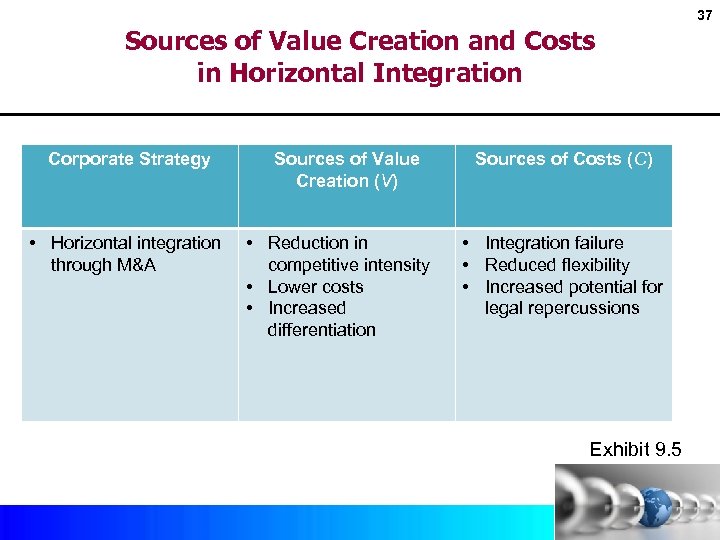

37 Sources of Value Creation and Costs in Horizontal Integration Corporate Strategy • Horizontal integration through M&A Sources of Value Creation (V) • Reduction in competitive intensity • Lower costs • Increased differentiation Sources of Costs (C) • Integration failure • Reduced flexibility • Increased potential for legal repercussions Exhibit 9. 5 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

37 Sources of Value Creation and Costs in Horizontal Integration Corporate Strategy • Horizontal integration through M&A Sources of Value Creation (V) • Reduction in competitive intensity • Lower costs • Increased differentiation Sources of Costs (C) • Integration failure • Reduced flexibility • Increased potential for legal repercussions Exhibit 9. 5 Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Food Fight: Kraft Hostile Takeover of Cadbury • Kraft acquired Cadbury in UK Ø Hostile takeover in 2012, $20 billion deal Ø Cadbury has strong position in emerging economies v Perfected distribution system in countries like India Ø Kraft faces strong rivalries worldwide, including China • The acquisition forces Hershey and other competitors to rethink their strategies Ø Hershey 90% revenues from U. S. market 9– 38 1– 38

Food Fight: Kraft Hostile Takeover of Cadbury • Kraft acquired Cadbury in UK Ø Hostile takeover in 2012, $20 billion deal Ø Cadbury has strong position in emerging economies v Perfected distribution system in countries like India Ø Kraft faces strong rivalries worldwide, including China • The acquisition forces Hershey and other competitors to rethink their strategies Ø Hershey 90% revenues from U. S. market 9– 38 1– 38

39 Food Fight: Kraft Hostile Takeover of Cadbury • In 2015, Kraft merged with Heinz. – Is now the 5 th largest food competitor in the world • What are the advantages of the (hostile takeover) Cadbury acquisition on the new $37 billion Kraft Heinz merged firm? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

39 Food Fight: Kraft Hostile Takeover of Cadbury • In 2015, Kraft merged with Heinz. – Is now the 5 th largest food competitor in the world • What are the advantages of the (hostile takeover) Cadbury acquisition on the new $37 billion Kraft Heinz merged firm? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

40 Why Do Firms Acquire Other Firms? • To access new markets and distribution channels – To overcome entry barriers (e. g. , Kraft acquiring Cadbury) • To access new capabilities or competencies • To preempt rivals – Example: Facebook acquired: • Instagram (photo & video sharing) • Whats. App (text messaging service) • Oculus (virtual reality headsets) – Example: Google acquired: • You. Tube (video sharing) • Motorola (mobile technology) • Waze (interactive mobile maps) Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

40 Why Do Firms Acquire Other Firms? • To access new markets and distribution channels – To overcome entry barriers (e. g. , Kraft acquiring Cadbury) • To access new capabilities or competencies • To preempt rivals – Example: Facebook acquired: • Instagram (photo & video sharing) • Whats. App (text messaging service) • Oculus (virtual reality headsets) – Example: Google acquired: • You. Tube (video sharing) • Motorola (mobile technology) • Waze (interactive mobile maps) Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Mergers & Acquisitions • Desire to Overcome Competitive Disadvantage Ø Adidas acquired Reebok in 2006 Benefits from economies of scale and scope v Compete more effectively with #1 Nike v • Superior Acquisition and Integration Capability • Some firms have superior M&A abilities Ø They identify, acquire, and integrate target companies v Example: Cisco Systems • Sought complementary assets • Bought over 130 firms since 2001, including large firms: Linksys, Scientific Atlanta, & Web. Ex

Mergers & Acquisitions • Desire to Overcome Competitive Disadvantage Ø Adidas acquired Reebok in 2006 Benefits from economies of scale and scope v Compete more effectively with #1 Nike v • Superior Acquisition and Integration Capability • Some firms have superior M&A abilities Ø They identify, acquire, and integrate target companies v Example: Cisco Systems • Sought complementary assets • Bought over 130 firms since 2001, including large firms: Linksys, Scientific Atlanta, & Web. Ex

Mergers & Acquisitions • Principal–agent problems Ø Managers have incentives to diversify through M&As to receive more prestige, power, and pay. v Not for shareholder value appreciation, but rather to build a large empire; this is a principal—agent problem • Managerial hubris Ø Self-delusion Beliefs in their own capability despite evidence to the contrary v Example: Quaker Oats purchase of Snapple at an unwarranted high price. v

Mergers & Acquisitions • Principal–agent problems Ø Managers have incentives to diversify through M&As to receive more prestige, power, and pay. v Not for shareholder value appreciation, but rather to build a large empire; this is a principal—agent problem • Managerial hubris Ø Self-delusion Beliefs in their own capability despite evidence to the contrary v Example: Quaker Oats purchase of Snapple at an unwarranted high price. v

Sony vs Apple: Whatever Happened to Sony? • Activist investors argue that Sony is spread too thin over too many businesses, and that its corporate strategy needs a major refocus. • What recommendations do you have to restructure Sony? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 43

Sony vs Apple: Whatever Happened to Sony? • Activist investors argue that Sony is spread too thin over too many businesses, and that its corporate strategy needs a major refocus. • What recommendations do you have to restructure Sony? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 43

44 Struggling Samsung Electronics: • What makes Samsung a conglomerate? • What type of diversification does Samsung pursue? • Identify possible factors such as core competencies, economies of scale, and economies of scope that were the basis of its past success as a widely diversified chaebol? • Why is Samsung as a conglomerate struggling today? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

44 Struggling Samsung Electronics: • What makes Samsung a conglomerate? • What type of diversification does Samsung pursue? • Identify possible factors such as core competencies, economies of scale, and economies of scope that were the basis of its past success as a widely diversified chaebol? • Why is Samsung as a conglomerate struggling today? Copyright © 2017 by Mc. Graw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.