CHAPTER 8_03.ppt

- Количество слайдов: 12

CHAPTER 8 VARIABLE COSTING: A Tool for Management

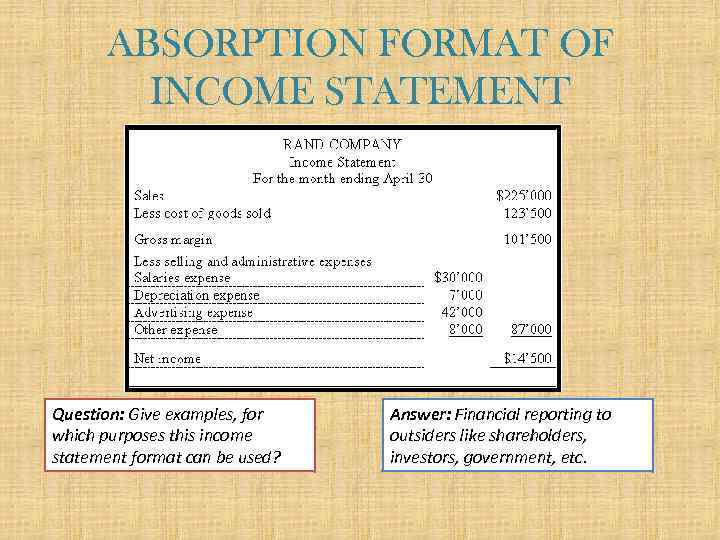

ABSORPTION FORMAT OF INCOME STATEMENT Question: Give examples, for which purposes this income statement format can be used? Answer: Financial reporting to outsiders like shareholders, investors, government, etc.

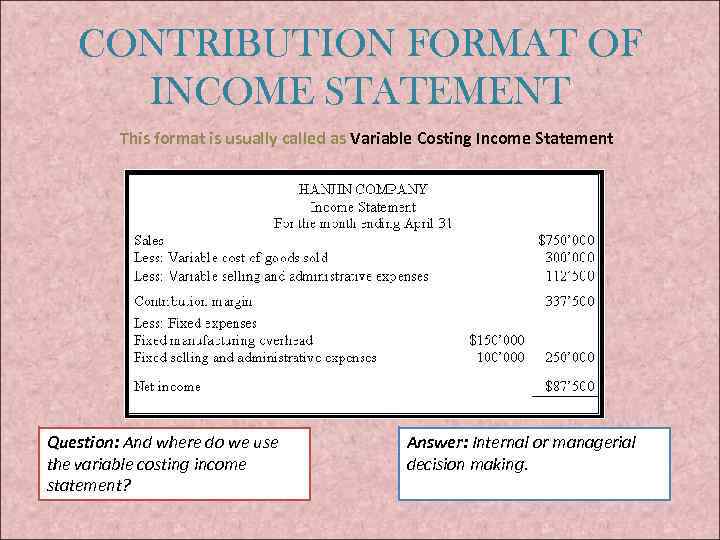

CONTRIBUTION FORMAT OF INCOME STATEMENT This format is usually called as Variable Costing Income Statement Question: And where do we use the variable costing income statement? Answer: Internal or managerial decision making.

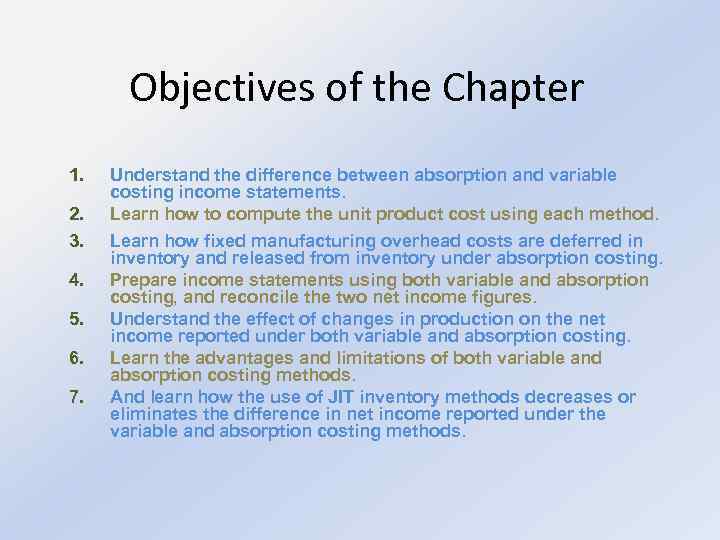

Objectives of the Chapter 1. 2. 3. 4. 5. 6. 7. Understand the difference between absorption and variable costing income statements. Learn how to compute the unit product cost using each method. Learn how fixed manufacturing overhead costs are deferred in inventory and released from inventory under absorption costing. Prepare income statements using both variable and absorption costing, and reconcile the two net income figures. Understand the effect of changes in production on the net income reported under both variable and absorption costing. Learn the advantages and limitations of both variable and absorption costing methods. And learn how the use of JIT inventory methods decreases or eliminates the difference in net income reported under the variable and absorption costing methods.

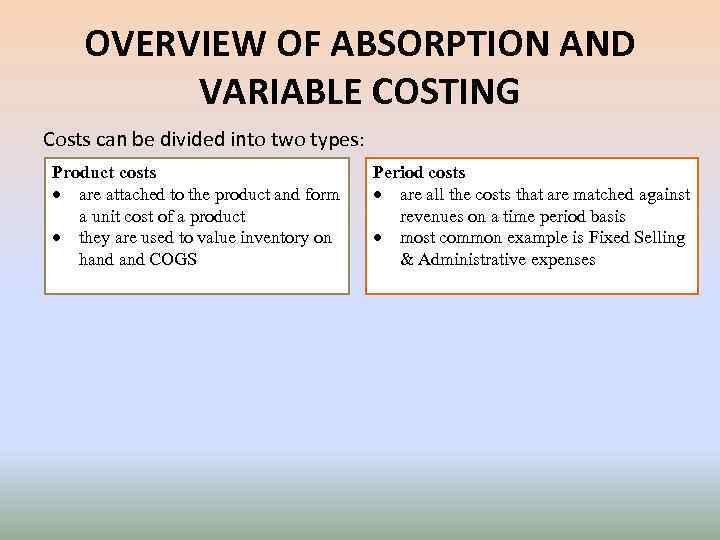

OVERVIEW OF ABSORPTION AND VARIABLE COSTING Costs can be divided into two types: Product costs are attached to the product and form a unit cost of a product they are used to value inventory on hand COGS Period costs are all the costs that are matched against revenues on a time period basis most common example is Fixed Selling & Administrative expenses

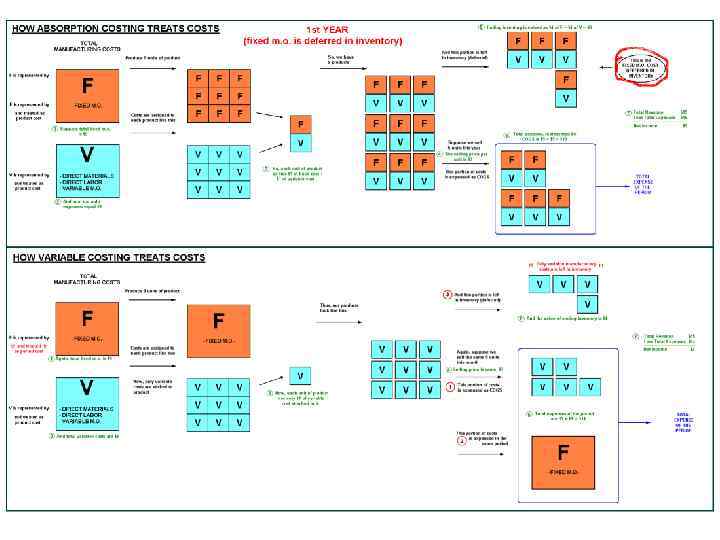

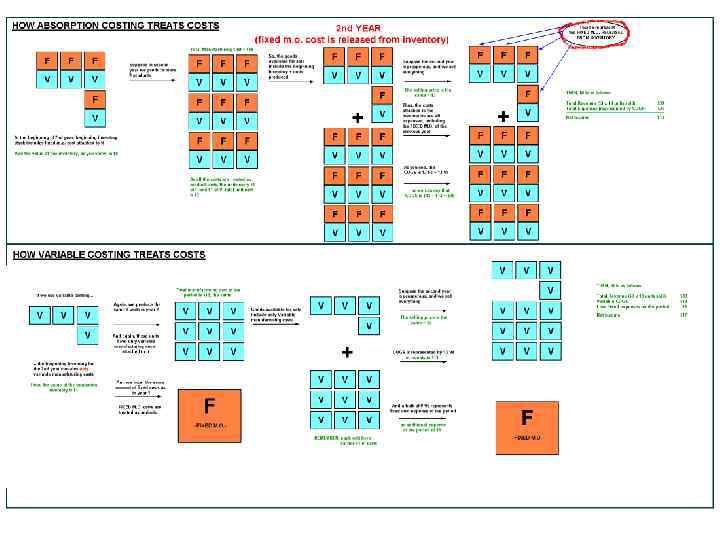

How do we treat costs under absorption and variable costing methods Absorption Costing • Treats all costs of production as product costs, regardless of whether they are variable or fixed in nature. Usually is called full cost method, because of inclusion of all production costs into product cost. • Cost of unit of product consists of: direct materials, direct labor, and both variable and fixed overhead. Variable Costing • Only those costs of production that vary with output are treated as product costs. • Cost of unit of product consists of: direct materials, direct labor, and the variable portion of the manufacturing overhead. Now students, let’s remind which costing method did we use when we assigned fixed overhead cost to the units of product using Job-Order, Process and Activity-Based costing?

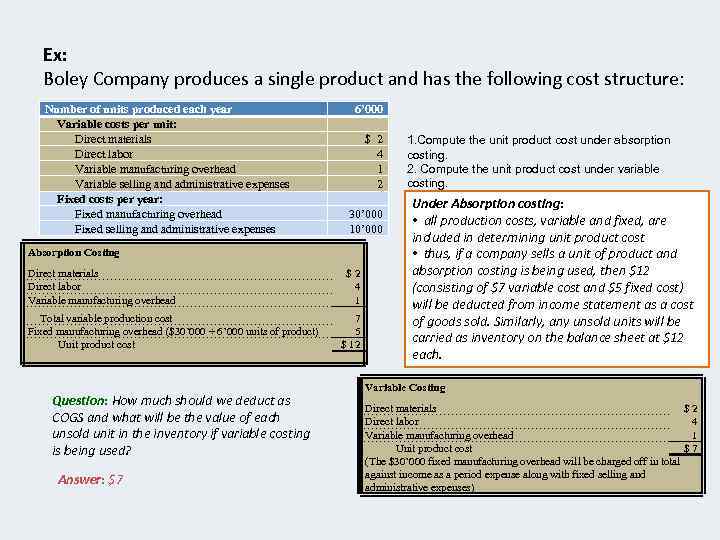

Ex: Boley Company produces a single product and has the following cost structure: Number of units produced each year Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expenses Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses 6’ 000 $ 2 4 1 2 30’ 000 10’ 000 Absorption Costing Direct materials Direct labor Variable manufacturing overhead Total variable production cost Fixed manufacturing overhead ($30’ 000 ÷ 6’ 000 units of product) Unit product cost Question: How much should we deduct as COGS and what will be the value of each unsold unit in the inventory if variable costing is being used? Answer: $7 $2 4 1 7 5 $ 12 1. Compute the unit product cost under absorption costing. 2. Compute the unit product cost under variable costing. Under Absorption costing: • all production costs, variable and fixed, are included in determining unit product cost • thus, if a company sells a unit of product and absorption costing is being used, then $12 (consisting of $7 variable cost and $5 fixed cost) will be deducted from income statement as a cost of goods sold. Similarly, any unsold units will be carried as inventory on the balance sheet at $12 each. Variable Costing Direct materials $2 Direct labor 4 Variable manufacturing overhead 1 Unit product cost $7 (The $30’ 000 fixed manufacturing overhead will be charged off in total against income as a period expense along with fixed selling and administrative expenses)

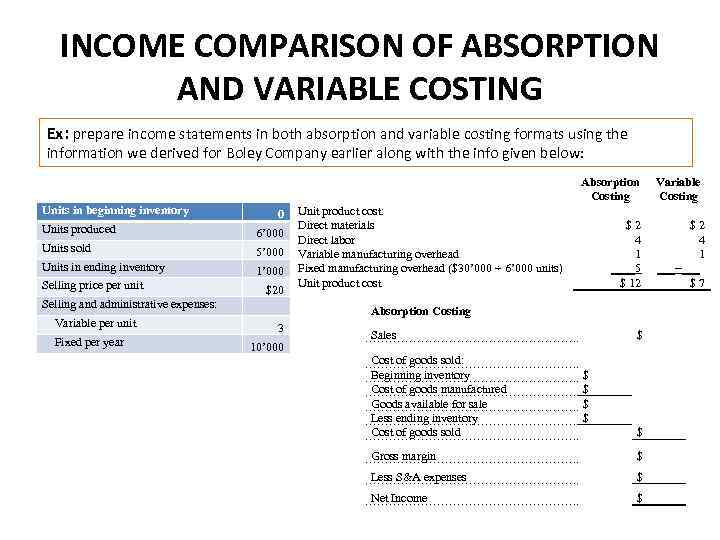

INCOME COMPARISON OF ABSORPTION AND VARIABLE COSTING Ex: prepare income statements in both absorption and variable costing formats using the information we derived for Boley Company earlier along with the info given below: Units in beginning inventory Absorption Costing 0 Units produced 6’ 000 Units sold 5’ 000 Units in ending inventory 1’ 000 Selling price per unit $20 Selling and administrative expenses: Variable per unit Fixed per year Unit product cost: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($30’ 000 ÷ 6’ 000 units) Unit product cost $2 4 1 ____5 $ 12 Absorption Costing 3 10’ 000 Sales Cost of goods sold: Beginning inventory Cost of goods manufactured Goods available for sale Less ending inventory Cost of goods sold $ $ $ Gross margin $ Less S&A expenses $ Net Income $ Variable Costing $2 4 1 ___−___ $7

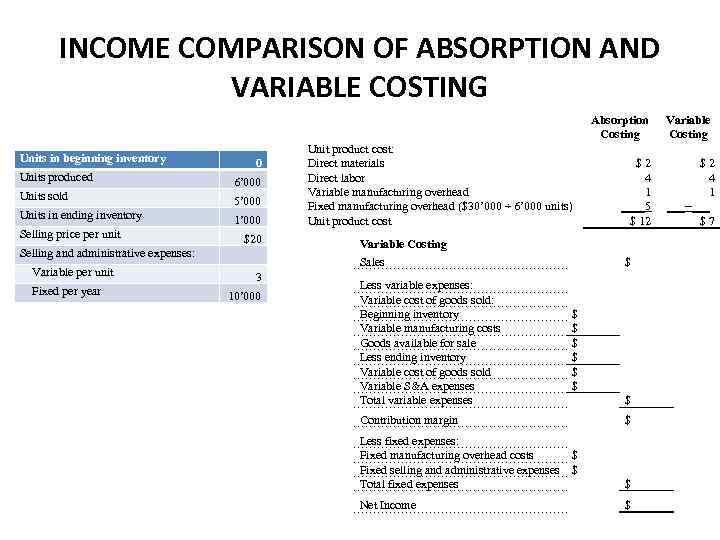

INCOME COMPARISON OF ABSORPTION AND VARIABLE COSTING Absorption Costing Units in beginning inventory 0 Units produced 6’ 000 Units sold 5’ 000 Units in ending inventory 1’ 000 Selling price per unit $20 Selling and administrative expenses: Variable per unit Fixed per year 3 10’ 000 Unit product cost: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($30’ 000 ÷ 6’ 000 units) Unit product cost Variable Costing Sales Less variable expenses: Variable cost of goods sold: Beginning inventory Variable manufacturing costs Goods available for sale Less ending inventory Variable cost of goods sold Variable S&A expenses Total variable expenses $2 4 1 ____5 $ 12 $ $ $ $ Contribution margin $ Less fixed expenses: Fixed manufacturing overhead costs $ Fixed selling and administrative expenses $ Total fixed expenses $ Net Income $ Variable Costing $2 4 1 ___−___ $7

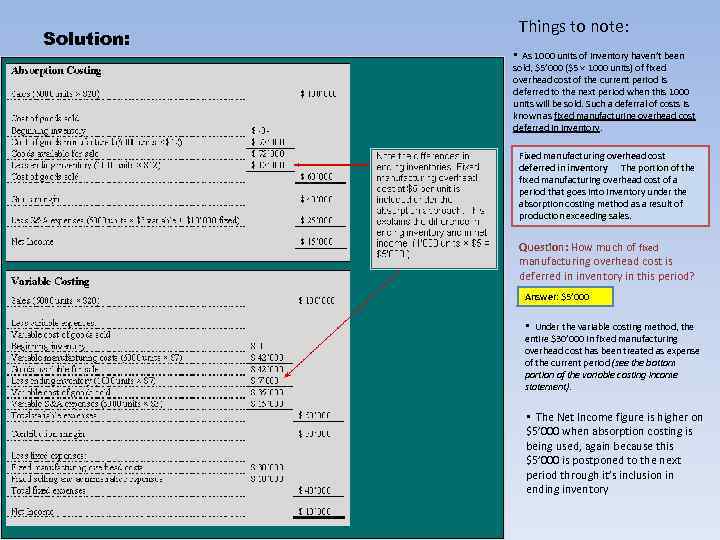

Solution: Things to note: • As 1000 units of inventory haven’t been sold, $5’ 000 ($5 × 1000 units) of fixed overhead cost of the current period is deferred to the next period when this 1000 units will be sold. Such a deferral of costs is known as fixed manufacturing overhead cost deferred in inventory. Fixed manufacturing overhead cost deferred in inventory The portion of the fixed manufacturing overhead cost of a period that goes into inventory under the absorption costing method as a result of production exceeding sales. Question: How much of fixed manufacturing overhead cost is deferred in inventory in this period? Answer: $5’ 000 • Under the variable costing method, the entire $30’ 000 in fixed manufacturing overhead cost has been treated as expense of the current period (see the bottom portion of the variable costing income statement). • The Net Income figure is higher on $5’ 000 when absorption costing is being used, again because this $5’ 000 is postponed to the next period through it’s inclusion in ending inventory

CHAPTER 8_03.ppt