Chapter 8 The Valuation of Stock

Chapter 8 The Valuation of Stock

Valuation of Preferred Stock • Perpetual preferred • Present value of the dividends

Valuation of Preferred Stock • Perpetual preferred • Present value of the dividends

Valuation of Perpetual Preferred Stock • Pp = Dp/Kp • If Dp = $4, Kp =. 08 • Pp = $4/. 08 = $50

Valuation of Perpetual Preferred Stock • Pp = Dp/Kp • If Dp = $4, Kp =. 08 • Pp = $4/. 08 = $50

Valuation of Preferred Stock • Finite life preferred • Present value of the dividend and the repayment of the par value

Valuation of Preferred Stock • Finite life preferred • Present value of the dividend and the repayment of the par value

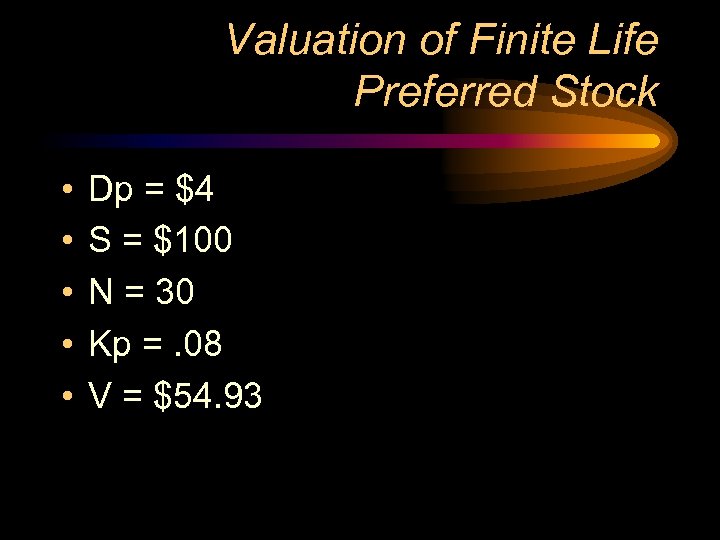

Valuation of Finite Life Preferred Stock • • • Dp = $4 S = $100 N = 30 Kp =. 08 V = $54. 93

Valuation of Finite Life Preferred Stock • • • Dp = $4 S = $100 N = 30 Kp =. 08 V = $54. 93

Investing in Common Stock • Source of Return – Dividends – Capital gains

Investing in Common Stock • Source of Return – Dividends – Capital gains

Realized Return • Difference in short and longterm capital gains taxation favor capital gains • Transactions costs (e. g. , commissions) favor dividend income

Realized Return • Difference in short and longterm capital gains taxation favor capital gains • Transactions costs (e. g. , commissions) favor dividend income

Common Stock Valuation • The determination of what a stock is worth; the stock's intrinsic value • If the price exceeds the valuation, buy the stock • If the price is less than the valuation, short the stock

Common Stock Valuation • The determination of what a stock is worth; the stock's intrinsic value • If the price exceeds the valuation, buy the stock • If the price is less than the valuation, short the stock

Common Stock Valuation Assuming a Fixed Dividend • V=D/k • Same as perpetual, preferred stock valuation

Common Stock Valuation Assuming a Fixed Dividend • V=D/k • Same as perpetual, preferred stock valuation

Common Stock Valuation The Dividend -- Growth Model • Value depends on the –the required return –the dividend –the growth in the dividend • V = D(1+g)/(k-g)

Common Stock Valuation The Dividend -- Growth Model • Value depends on the –the required return –the dividend –the growth in the dividend • V = D(1+g)/(k-g)

Dividend - Growth Model Illustration • • D = $1 K =. 1 (10%) g =. 06 (6%) V = $1(1. 06)/(. 1 -. 06) = $26. 50

Dividend - Growth Model Illustration • • D = $1 K =. 1 (10%) g =. 06 (6%) V = $1(1. 06)/(. 1 -. 06) = $26. 50

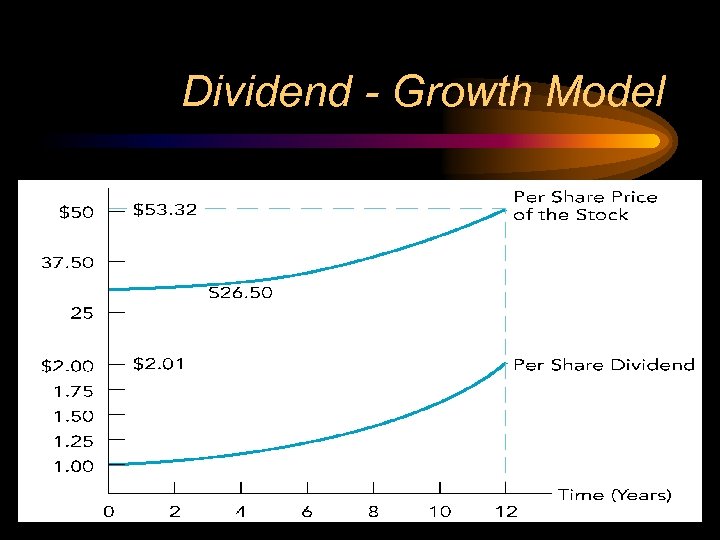

Dividend - Growth Model

Dividend - Growth Model

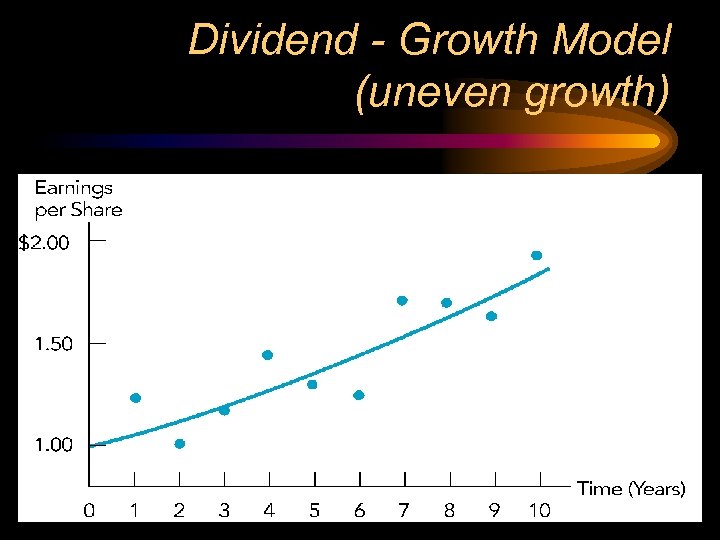

Dividend - Growth Model • Growth may be uneven • Fundamental concept still applies

Dividend - Growth Model • Growth may be uneven • Fundamental concept still applies

Dividend - Growth Model (uneven growth)

Dividend - Growth Model (uneven growth)

The Risk-adjusted Required Return • Adjustment depends on – the risk-free rate (rf) – the return on the market (rm) – the stock's beta

The Risk-adjusted Required Return • Adjustment depends on – the risk-free rate (rf) – the return on the market (rm) – the stock's beta

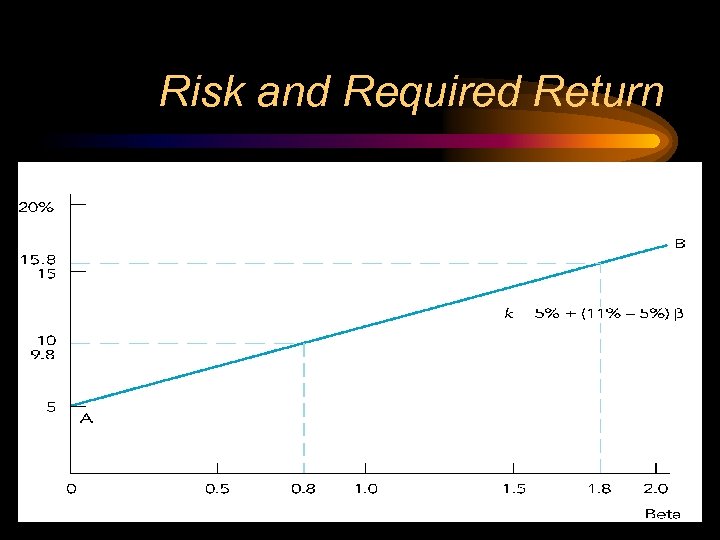

Risk and Required Return

Risk and Required Return

Alternative Valuation Techniques: Use of Ratios • Price-earnings ratios • Value = Earnings x Earnings multiple

Alternative Valuation Techniques: Use of Ratios • Price-earnings ratios • Value = Earnings x Earnings multiple

Weaknesses in P/E Ratios • Which earnings to use • The appropriate multiplier

Weaknesses in P/E Ratios • Which earnings to use • The appropriate multiplier

Other Ratios • Price / Sales • Price / Book Value

Other Ratios • Price / Sales • Price / Book Value