1a35e84b54530d379452ce351e874332.ppt

- Количество слайдов: 59

Chapter 8 The Efficient Market Hypothesis Mc. Graw-Hill/Irwin 8 -1 Copyright © 2010 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 8 The Efficient Market Hypothesis Mc. Graw-Hill/Irwin 8 -1 Copyright © 2010 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Learning outcomes By the end of the lecture students should able: To understand EMH Understand the three forms of EMH Implications of EMH to arbitragers and Speculaters 8 -2

Learning outcomes By the end of the lecture students should able: To understand EMH Understand the three forms of EMH Implications of EMH to arbitragers and Speculaters 8 -2

8. 1 Random Walks and the Efficient Market Hypothesis 8 -3

8. 1 Random Walks and the Efficient Market Hypothesis 8 -3

Efficient Market Hypothesis (EMH) Do security prices accurately reflect information? Informational Efficiency § Are price changes consistently predictable? ___________________ Allocational Efficiency § Are prices correct in that they accurately _________________ associated with the reflect the (relative) value security? § Huge implications concerning the answers to these questions ~ abnormal profits or waste of resources 8 -4

Efficient Market Hypothesis (EMH) Do security prices accurately reflect information? Informational Efficiency § Are price changes consistently predictable? ___________________ Allocational Efficiency § Are prices correct in that they accurately _________________ associated with the reflect the (relative) value security? § Huge implications concerning the answers to these questions ~ abnormal profits or waste of resources 8 -4

Implications of Efficiency • Allocational efficiency – If markets are not allocationally efficient then perhaps there is a ____________ role for greater government intervention ______ in capital markets. • Possible rules changes to attempt to improve allocational efficiency – Tax on trading activity – More taxes on short holding period returns – Changes in corporate compensation 8 -5

Implications of Efficiency • Allocational efficiency – If markets are not allocationally efficient then perhaps there is a ____________ role for greater government intervention ______ in capital markets. • Possible rules changes to attempt to improve allocational efficiency – Tax on trading activity – More taxes on short holding period returns – Changes in corporate compensation 8 -5

Implications of Efficiency Informational efficiency If markets are not informationally efficient Investors may not be able to trust that market prices are up to date and investors should then conduct their own research (or hire a researcher) to validate the price. Privileged groups of investors will be able to consistently take advantage of the general public. Active strategies could outperform passive strategies. 8 -6

Implications of Efficiency Informational efficiency If markets are not informationally efficient Investors may not be able to trust that market prices are up to date and investors should then conduct their own research (or hire a researcher) to validate the price. Privileged groups of investors will be able to consistently take advantage of the general public. Active strategies could outperform passive strategies. 8 -6

EMH and Competition * Competition among investors should imply that stock prices fully and accurately reflect publicly available information very quickly. Why? Else there are unexploited profit opportunities. * Once information becomes available, market participants quickly analyze it & trade on it & frequent, low cost trading assures prices reflect information. Questions arise about efficiency due to: • Unequal access to information • Structural market problems • Psychology of investors (Behavioralism) ~ irrational explanations like weather may have an impact on investment performance or people may be easily fooled, etc 8 -7

EMH and Competition * Competition among investors should imply that stock prices fully and accurately reflect publicly available information very quickly. Why? Else there are unexploited profit opportunities. * Once information becomes available, market participants quickly analyze it & trade on it & frequent, low cost trading assures prices reflect information. Questions arise about efficiency due to: • Unequal access to information • Structural market problems • Psychology of investors (Behavioralism) ~ irrational explanations like weather may have an impact on investment performance or people may be easily fooled, etc 8 -7

Random Price Changes Why are price changes random? In very competitive markets prices should react to only NEW information Flow of NEW information is random Therefore, price changes are random Idea that stock prices follow a “Random Walk” 8 -8

Random Price Changes Why are price changes random? In very competitive markets prices should react to only NEW information Flow of NEW information is random Therefore, price changes are random Idea that stock prices follow a “Random Walk” 8 -8

Random Walk and the EMH Random Walk: stock price ___________ changes are unpredictable A “pure” random walk implies informational efficiency Stock prices actually follow a __________ submartingale process Expected price change should be positive over time But random changes are superimposed on the positive trend E(pricej, t) > E(pricej, t-1) t = time period 8 -9

Random Walk and the EMH Random Walk: stock price ___________ changes are unpredictable A “pure” random walk implies informational efficiency Stock prices actually follow a __________ submartingale process Expected price change should be positive over time But random changes are superimposed on the positive trend E(pricej, t) > E(pricej, t-1) t = time period 8 -9

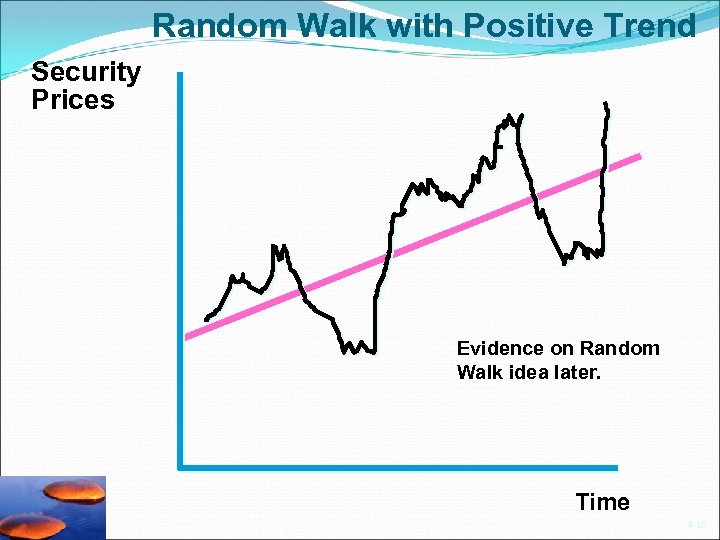

Random Walk with Positive Trend Security Prices Evidence on Random Walk idea later. Time 8 -10

Random Walk with Positive Trend Security Prices Evidence on Random Walk idea later. Time 8 -10

Forms of the EMH Prices reflect all relevant information Vary the ________ set Weak The relevant information is historical data such as past prices and trading volume. If the markets are weak form efficient, use of such information provides no benefit at the margin. 8 -11

Forms of the EMH Prices reflect all relevant information Vary the ________ set Weak The relevant information is historical data such as past prices and trading volume. If the markets are weak form efficient, use of such information provides no benefit at the margin. 8 -11

Forms of the EMH Semi-strong The relevant information is "all publicly available information, including the past data and information just released to the public. " If the markets are semi-strong form efficient, then studying earnings and growth forecasts and reacting to news provides no net benefit in predicting price changes at the margin. 8 -12

Forms of the EMH Semi-strong The relevant information is "all publicly available information, including the past data and information just released to the public. " If the markets are semi-strong form efficient, then studying earnings and growth forecasts and reacting to news provides no net benefit in predicting price changes at the margin. 8 -12

Forms of the EMH Strong The relevant information is “all information” both public and private or “insider” information. If the markets are strong form efficient, use of any information (public or private) provides no benefit at the margin. SEC Rule 10 b-5 limits trading by corporate insiders (officers, directors and major shareholders) using the insider information. Insider trading must be reported. 8 -13

Forms of the EMH Strong The relevant information is “all information” both public and private or “insider” information. If the markets are strong form efficient, use of any information (public or private) provides no benefit at the margin. SEC Rule 10 b-5 limits trading by corporate insiders (officers, directors and major shareholders) using the insider information. Insider trading must be reported. 8 -13

Relationships between forms of the EMH • Notice that semi-strong efficiency implies weak ________________ form efficiency holds NOT vice versa _________ (but _______) • Strong form efficiency would imply that both semi-strong and weak form efficiency hold _____________________. 8 -14

Relationships between forms of the EMH • Notice that semi-strong efficiency implies weak ________________ form efficiency holds NOT vice versa _________ (but _______) • Strong form efficiency would imply that both semi-strong and weak form efficiency hold _____________________. 8 -14

8. 2 Implications of the EMH (for Security Analysis) 8 -15

8. 2 Implications of the EMH (for Security Analysis) 8 -15

Types of Stock Analysis & Relationship to the EMH Technical Analysis: Technical Analysis using prices and volume information to predict future price changes TA assumes prices follow predictable trends If the markets are efficient, will technical analysis be able to consistently predict price changes? NO 8 -16

Types of Stock Analysis & Relationship to the EMH Technical Analysis: Technical Analysis using prices and volume information to predict future price changes TA assumes prices follow predictable trends If the markets are efficient, will technical analysis be able to consistently predict price changes? NO 8 -16

Basic Types of Technical Analysis Support and resistance levels Support level: A price level below which it is supposedly unlikely for a stock or stock index to fall. Resistance level: A price level above which it is supposedly unlikely for a stock or stock index to rise. A resistance level may arise at say $31. 25 if a stock repeatedly rises to $31. 25 and then declines, indicating that investors are reluctant to pay more than this price for the stock. A stock price above $31. 25 would then indicate a 'breakout' which would be a bullish signal. 8 -17

Basic Types of Technical Analysis Support and resistance levels Support level: A price level below which it is supposedly unlikely for a stock or stock index to fall. Resistance level: A price level above which it is supposedly unlikely for a stock or stock index to rise. A resistance level may arise at say $31. 25 if a stock repeatedly rises to $31. 25 and then declines, indicating that investors are reluctant to pay more than this price for the stock. A stock price above $31. 25 would then indicate a 'breakout' which would be a bullish signal. 8 -17

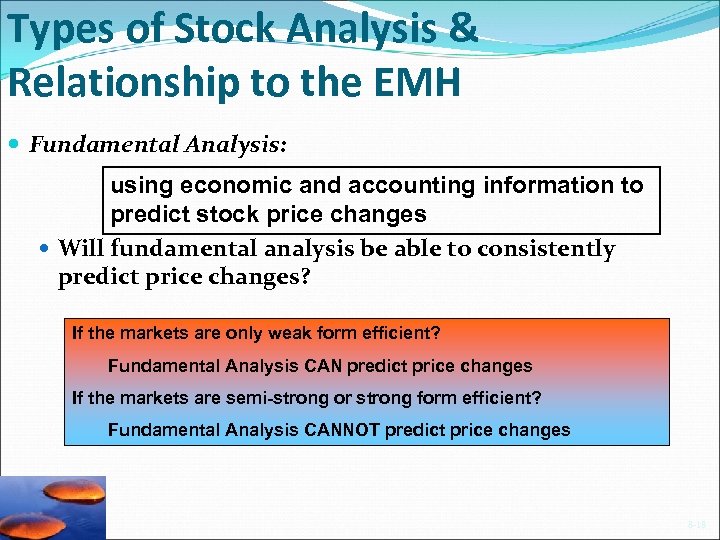

Types of Stock Analysis & Relationship to the EMH Fundamental Analysis: using economic and accounting information to predict stock price changes Will fundamental analysis be able to consistently predict price changes? If the markets are only weak form efficient? Fundamental Analysis CAN predict price changes If the markets are semi-strong or strong form efficient? Fundamental Analysis CANNOT predict price changes 8 -18

Types of Stock Analysis & Relationship to the EMH Fundamental Analysis: using economic and accounting information to predict stock price changes Will fundamental analysis be able to consistently predict price changes? If the markets are only weak form efficient? Fundamental Analysis CAN predict price changes If the markets are semi-strong or strong form efficient? Fundamental Analysis CANNOT predict price changes 8 -18

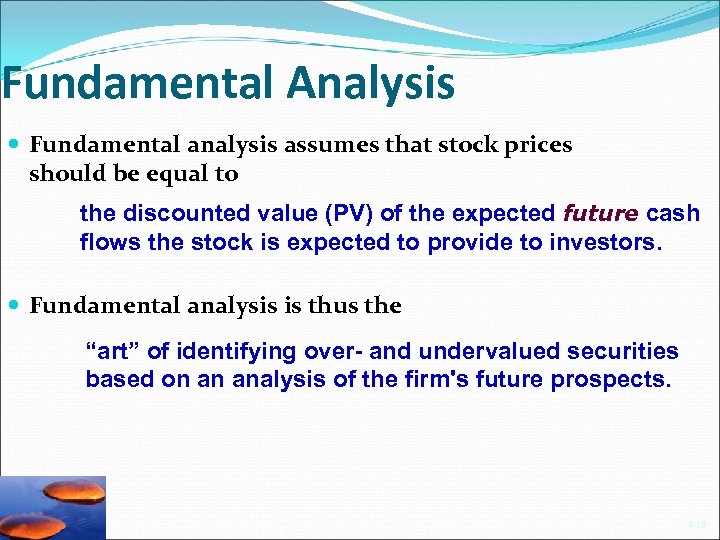

Fundamental Analysis Fundamental analysis assumes that stock prices should be equal to the discounted value (PV) of the expected future cash flows the stock is expected to provide to investors. Fundamental analysis is thus the “art” of identifying over- and undervalued securities based on an analysis of the firm's future prospects. 8 -19

Fundamental Analysis Fundamental analysis assumes that stock prices should be equal to the discounted value (PV) of the expected future cash flows the stock is expected to provide to investors. Fundamental analysis is thus the “art” of identifying over- and undervalued securities based on an analysis of the firm's future prospects. 8 -19

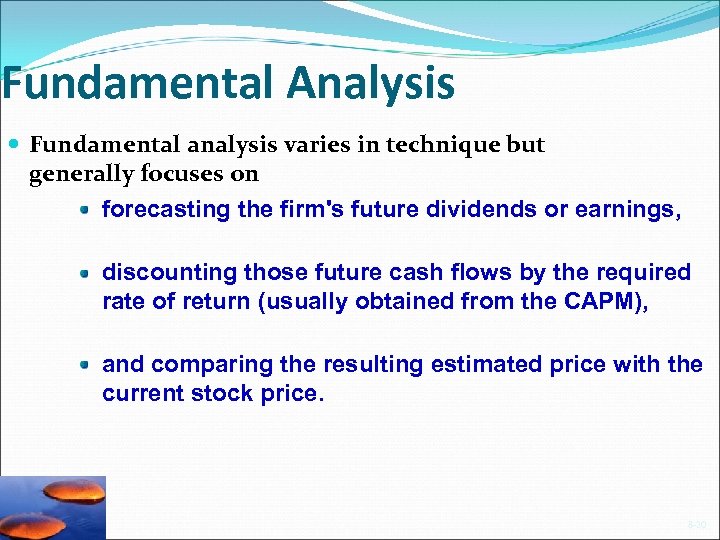

Fundamental Analysis Fundamental analysis varies in technique but generally focuses on forecasting the firm's future dividends or earnings, discounting those future cash flows by the required rate of return (usually obtained from the CAPM), and comparing the resulting estimated price with the current stock price. 8 -20

Fundamental Analysis Fundamental analysis varies in technique but generally focuses on forecasting the firm's future dividends or earnings, discounting those future cash flows by the required rate of return (usually obtained from the CAPM), and comparing the resulting estimated price with the current stock price. 8 -20

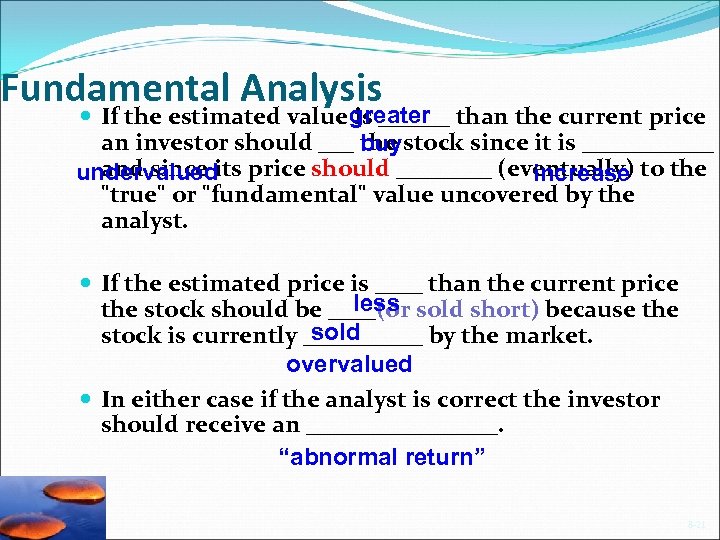

Fundamental Analysis If the estimated value greater than the current price is ______ an investor should ___ buy stock since it is ______ the and since undervaluedits price should ____ (eventually) to the increase "true" or "fundamental" value uncovered by the analyst. If the estimated price is ____ than the current price less the stock should be ____(or sold short) because the sold stock is currently _____ by the market. overvalued In either case if the analyst is correct the investor should receive an ________. “abnormal return” 8 -21

Fundamental Analysis If the estimated value greater than the current price is ______ an investor should ___ buy stock since it is ______ the and since undervaluedits price should ____ (eventually) to the increase "true" or "fundamental" value uncovered by the analyst. If the estimated price is ____ than the current price less the stock should be ____(or sold short) because the sold stock is currently _____ by the market. overvalued In either case if the analyst is correct the investor should receive an ________. “abnormal return” 8 -21

Fundamental Analysis For FA to add value, your forecast must be better than the consensus forecast. Not enough to find a good company, you must find a company that is better than others believe, i. e. , mispriced. 8 -22

Fundamental Analysis For FA to add value, your forecast must be better than the consensus forecast. Not enough to find a good company, you must find a company that is better than others believe, i. e. , mispriced. 8 -22

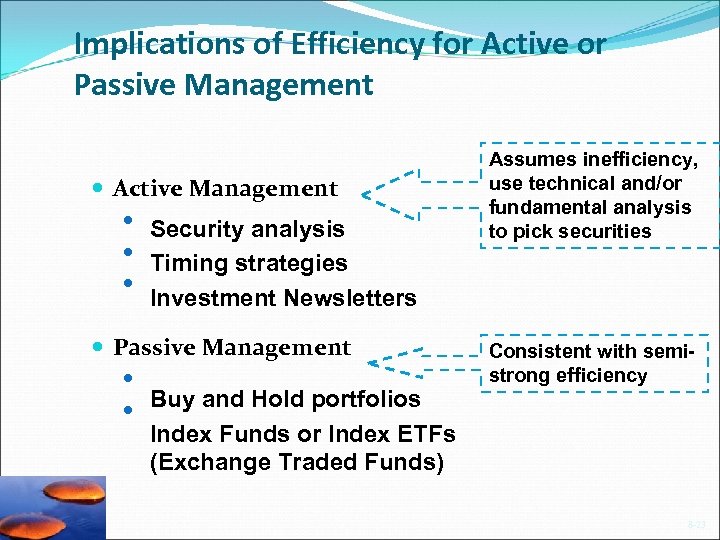

Implications of Efficiency for Active or Passive Management Active Management Security analysis Assumes inefficiency, use technical and/or fundamental analysis to pick securities Timing strategies Investment Newsletters Passive Management Buy and Hold portfolios Index Funds or Index ETFs (Exchange Traded Funds) Consistent with semistrong efficiency 8 -23

Implications of Efficiency for Active or Passive Management Active Management Security analysis Assumes inefficiency, use technical and/or fundamental analysis to pick securities Timing strategies Investment Newsletters Passive Management Buy and Hold portfolios Index Funds or Index ETFs (Exchange Traded Funds) Consistent with semistrong efficiency 8 -23

Market Efficiency and Portfolio Management Even if the market is efficient (=> “the price is right ” & you cannot beat the market ex-ante), a role still exists for portfolio management Identify risk & choose appropriate risk level Tax considerations Other considerations such as liquidity needs or diversify away from the client’s industry. Aside) EMH=> The price is right and you get what you paid for. No ripoffs & No great deals! However, you still need to know what you want (e. g. , read consumer reports, etc). You don’t want to buy a car 8 -24 with A/C in Alaska.

Market Efficiency and Portfolio Management Even if the market is efficient (=> “the price is right ” & you cannot beat the market ex-ante), a role still exists for portfolio management Identify risk & choose appropriate risk level Tax considerations Other considerations such as liquidity needs or diversify away from the client’s industry. Aside) EMH=> The price is right and you get what you paid for. No ripoffs & No great deals! However, you still need to know what you want (e. g. , read consumer reports, etc). You don’t want to buy a car 8 -24 with A/C in Alaska.

8. 3 Are Markets Efficient? 8 -25

8. 3 Are Markets Efficient? 8 -25

Empirical Tests of Informational Efficiency Recall that over time stock prices tend to follow a submartingale process __________ => a randomly chosen portfolio of securities is expected to have a positive return. 8 -26

Empirical Tests of Informational Efficiency Recall that over time stock prices tend to follow a submartingale process __________ => a randomly chosen portfolio of securities is expected to have a positive return. 8 -26

Empirical Tests of Informational Efficiency This means that when trying to figure out if some portfolio manager is earning abnormal compare their performance returns we try to ______________ to a ___________ in an ex-ante sense. randomly chosen portfolio outperform the random portfolio I. E. they must ______________, or in some benchmark rate practice they must beat __________ of return _______ on a consistent basis. 8 -27

Empirical Tests of Informational Efficiency This means that when trying to figure out if some portfolio manager is earning abnormal compare their performance returns we try to ______________ to a ___________ in an ex-ante sense. randomly chosen portfolio outperform the random portfolio I. E. they must ______________, or in some benchmark rate practice they must beat __________ of return _______ on a consistent basis. 8 -27

a. Empirical Tests of Informational Efficiency Can anyone consistently earn an abnormal return? b. Do investors systematically misinterpret information? This says that EMH=> investors do not repeat the same mistakes over and over in an irrational fashion. For example, sometimes they may overestimate the impact on earnings of some event and sometimes they underestimate the impact on earnings but on average the estimates are unbiased. 8 -28

a. Empirical Tests of Informational Efficiency Can anyone consistently earn an abnormal return? b. Do investors systematically misinterpret information? This says that EMH=> investors do not repeat the same mistakes over and over in an irrational fashion. For example, sometimes they may overestimate the impact on earnings of some event and sometimes they underestimate the impact on earnings but on average the estimates are unbiased. 8 -28

Empirical Tests of Informational Efficiency Event studies Examine how quickly information is integrated into prices around an informational event. EMH suggests a rapid assimilation of information into prices. Assessing performance of professional managers Can professional managers, using their resources and tools, “beat” the market after considering risk? EMH suggests professionals will not outperform the market. Testing a trading rule Testing whether a rule that uses available information can earn abnormal returns after considering the risk and cost of using the rule. EMH suggests that such rules will not work. 8 -29

Empirical Tests of Informational Efficiency Event studies Examine how quickly information is integrated into prices around an informational event. EMH suggests a rapid assimilation of information into prices. Assessing performance of professional managers Can professional managers, using their resources and tools, “beat” the market after considering risk? EMH suggests professionals will not outperform the market. Testing a trading rule Testing whether a rule that uses available information can earn abnormal returns after considering the risk and cost of using the rule. EMH suggests that such rules will not work. 8 -29

How Tests Are Structured 1. Examine prices and returns around some material announcement 8 -30

How Tests Are Structured 1. Examine prices and returns around some material announcement 8 -30

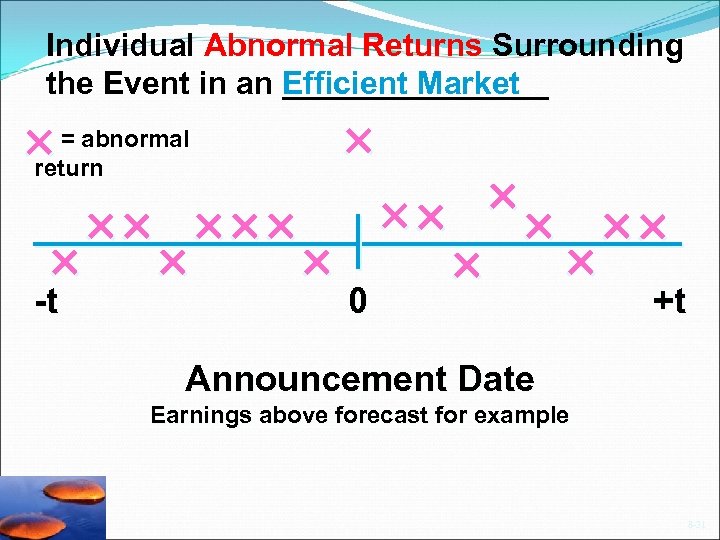

Individual Abnormal Returns Surrounding the Event in an Efficient Market ________ = abnormal return -t 0 +t Announcement Date Earnings above forecast for example 8 -31

Individual Abnormal Returns Surrounding the Event in an Efficient Market ________ = abnormal return -t 0 +t Announcement Date Earnings above forecast for example 8 -31

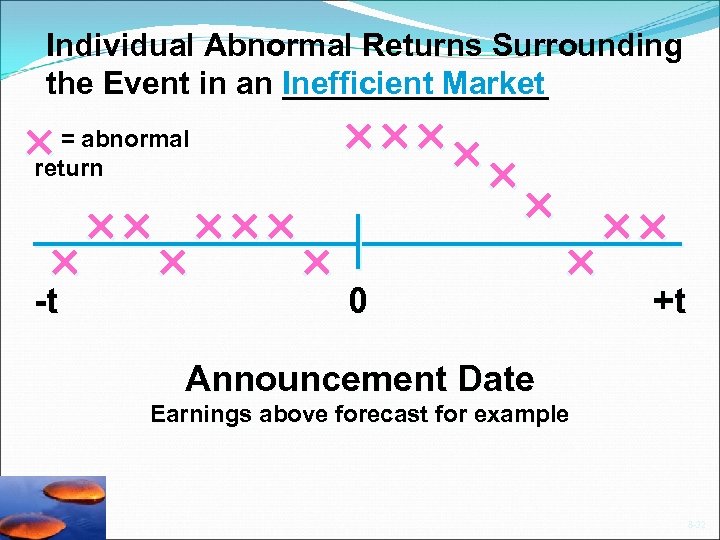

Individual Abnormal Returns Surrounding the Event in an Inefficient Market ________ = abnormal return -t 0 +t Announcement Date Earnings above forecast for example 8 -32

Individual Abnormal Returns Surrounding the Event in an Inefficient Market ________ = abnormal return -t 0 +t Announcement Date Earnings above forecast for example 8 -32

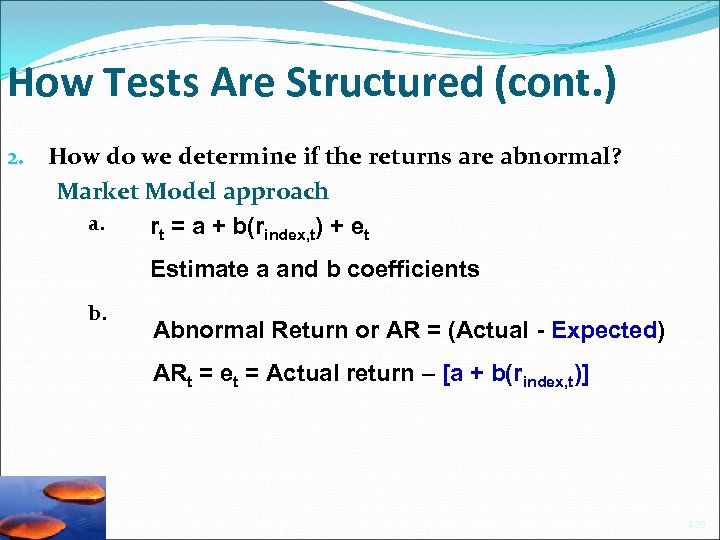

How Tests Are Structured (cont. ) 2. How do we determine if the returns are abnormal? Market Model approach a. rt = a + b(rindex, t) + et Estimate a and b coefficients b. Abnormal Return or AR = (Actual - Expected) ARt = et = Actual return – [a + b(rindex, t)] 8 -33

How Tests Are Structured (cont. ) 2. How do we determine if the returns are abnormal? Market Model approach a. rt = a + b(rindex, t) + et Estimate a and b coefficients b. Abnormal Return or AR = (Actual - Expected) ARt = et = Actual return – [a + b(rindex, t)] 8 -33

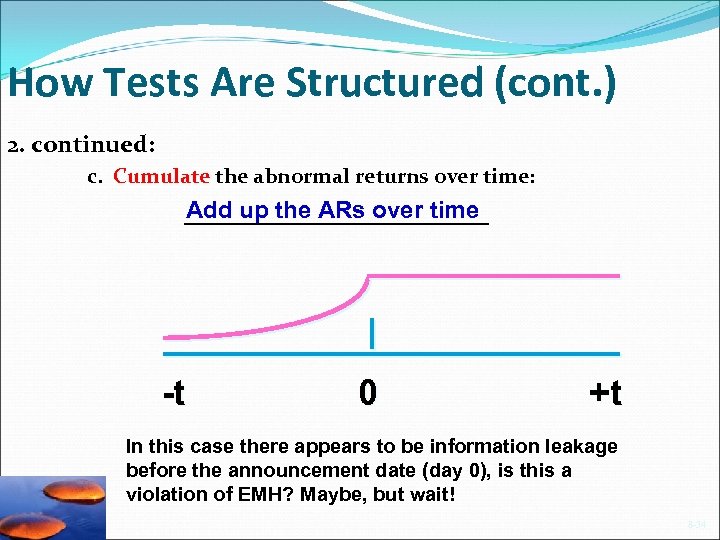

How Tests Are Structured (cont. ) 2. continued: c. Cumulate the abnormal returns over time: Add up the ARs over time -t 0 +t In this case there appears to be information leakage before the announcement date (day 0), is this a violation of EMH? Maybe, but wait! 8 -34

How Tests Are Structured (cont. ) 2. continued: c. Cumulate the abnormal returns over time: Add up the ARs over time -t 0 +t In this case there appears to be information leakage before the announcement date (day 0), is this a violation of EMH? Maybe, but wait! 8 -34

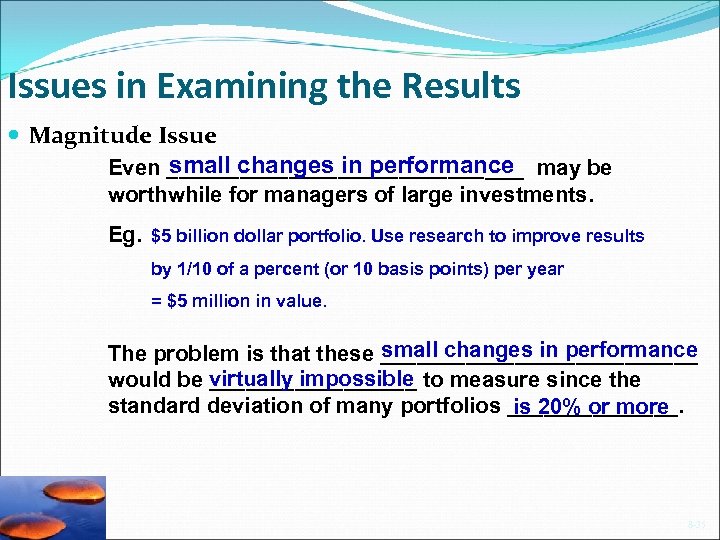

Issues in Examining the Results Magnitude Issue small changes in performance Even _______________ may be worthwhile for managers of large investments. Eg. $5 billion dollar portfolio. Use research to improve results by 1/10 of a percent (or 10 basis points) per year = $5 million in value. small changes in performance The problem is that these _____________ would be virtually impossible to measure since the _________ standard deviation of many portfolios _______. is 20% or more 8 -35

Issues in Examining the Results Magnitude Issue small changes in performance Even _______________ may be worthwhile for managers of large investments. Eg. $5 billion dollar portfolio. Use research to improve results by 1/10 of a percent (or 10 basis points) per year = $5 million in value. small changes in performance The problem is that these _____________ would be virtually impossible to measure since the _________ standard deviation of many portfolios _______. is 20% or more 8 -35

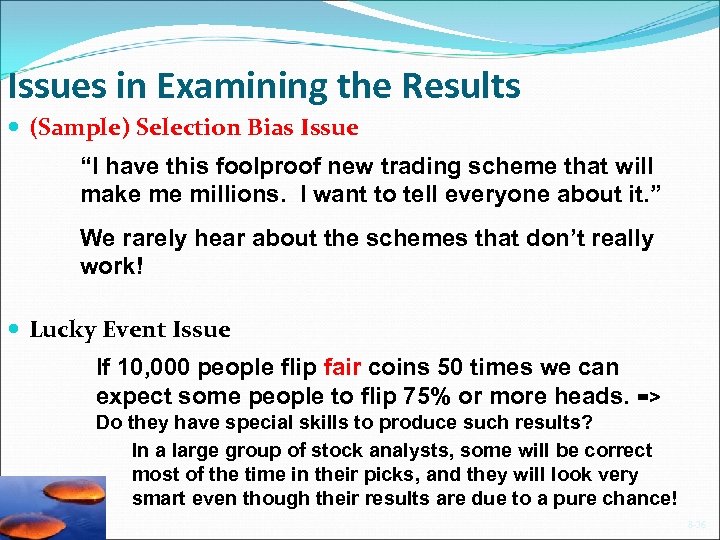

Issues in Examining the Results (Sample) Selection Bias Issue “I have this foolproof new trading scheme that will make me millions. I want to tell everyone about it. ” We rarely hear about the schemes that don’t really work! Lucky Event Issue If 10, 000 people flip fair coins 50 times we can expect some people to flip 75% or more heads. => Do they have special skills to produce such results? In a large group of stock analysts, some will be correct most of the time in their picks, and they will look very smart even though their results are due to a pure chance! 8 -36

Issues in Examining the Results (Sample) Selection Bias Issue “I have this foolproof new trading scheme that will make me millions. I want to tell everyone about it. ” We rarely hear about the schemes that don’t really work! Lucky Event Issue If 10, 000 people flip fair coins 50 times we can expect some people to flip 75% or more heads. => Do they have special skills to produce such results? In a large group of stock analysts, some will be correct most of the time in their picks, and they will look very smart even though their results are due to a pure chance! 8 -36

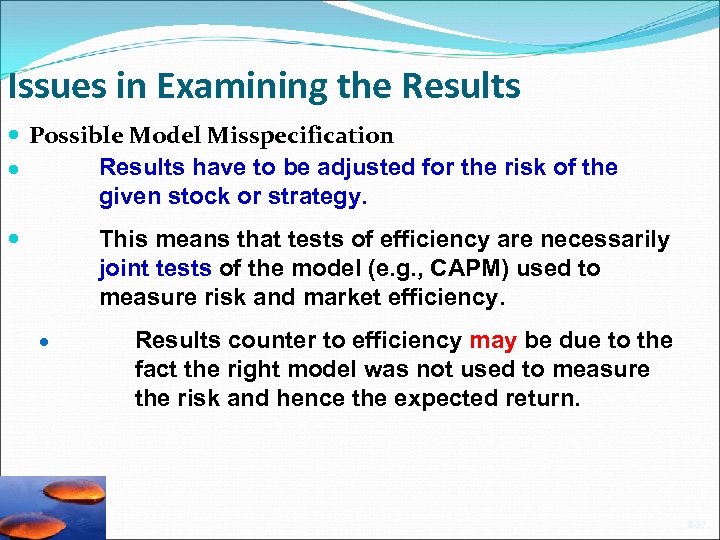

Issues in Examining the Results Possible Model Misspecification Results have to be adjusted for the risk of the given stock or strategy. This means that tests of efficiency are necessarily joint tests of the model (e. g. , CAPM) used to measure risk and market efficiency. Results counter to efficiency may be due to the fact the right model was not used to measure the risk and hence the expected return. 8 -37

Issues in Examining the Results Possible Model Misspecification Results have to be adjusted for the risk of the given stock or strategy. This means that tests of efficiency are necessarily joint tests of the model (e. g. , CAPM) used to measure risk and market efficiency. Results counter to efficiency may be due to the fact the right model was not used to measure the risk and hence the expected return. 8 -37

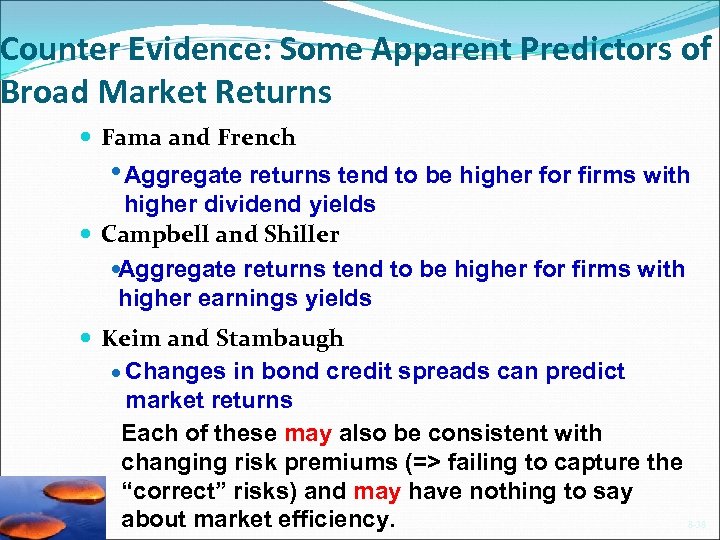

Counter Evidence: Some Apparent Predictors of Broad Market Returns Fama and French Aggregate returns tend to be higher for firms with higher dividend yields Campbell and Shiller Aggregate returns tend to be higher for firms with higher earnings yields Keim and Stambaugh Changes in bond credit spreads can predict market returns Each of these may also be consistent with changing risk premiums (=> failing to capture the “correct” risks) and may have nothing to say about market efficiency. 8 -38

Counter Evidence: Some Apparent Predictors of Broad Market Returns Fama and French Aggregate returns tend to be higher for firms with higher dividend yields Campbell and Shiller Aggregate returns tend to be higher for firms with higher earnings yields Keim and Stambaugh Changes in bond credit spreads can predict market returns Each of these may also be consistent with changing risk premiums (=> failing to capture the “correct” risks) and may have nothing to say about market efficiency. 8 -38

Bubbles and Market Efficiency Periodically stock prices appear to undergo a ‘speculative bubble. ’ A speculative bubble is said to occur if prices do not equal the intrinsic value of the security. Does this imply that markets are not efficient? Very difficult to predict if you are in a bubble or not and when the bubble will burst. Stock prices are estimates of future economic performance of the firm and these estimates can change rapidly. Risk premiums can change rapidly and dramatically. 8 -39

Bubbles and Market Efficiency Periodically stock prices appear to undergo a ‘speculative bubble. ’ A speculative bubble is said to occur if prices do not equal the intrinsic value of the security. Does this imply that markets are not efficient? Very difficult to predict if you are in a bubble or not and when the bubble will burst. Stock prices are estimates of future economic performance of the firm and these estimates can change rapidly. Risk premiums can change rapidly and dramatically. 8 -39

Bubbles and Market Efficiency With hindsight it appears that there are times when stock prices decouple from intrinsic or fundamental value, sometimes for years. Prices eventually conform to intrinsic value. => EMH 8 -40

Bubbles and Market Efficiency With hindsight it appears that there are times when stock prices decouple from intrinsic or fundamental value, sometimes for years. Prices eventually conform to intrinsic value. => EMH 8 -40

Summary: What Does the Evidence Show? Technical Analysis (TA) Stocks do not follow a pure random walk, so there is hope for technical trading strategies. => However, it should be more than a pure random walk, given some positive return expected. Most TA rules utilize short term trading strategies that generate excessive transaction costs and are not profitable. There appears to be some long term trend reversals. 8 -41

Summary: What Does the Evidence Show? Technical Analysis (TA) Stocks do not follow a pure random walk, so there is hope for technical trading strategies. => However, it should be more than a pure random walk, given some positive return expected. Most TA rules utilize short term trading strategies that generate excessive transaction costs and are not profitable. There appears to be some long term trend reversals. 8 -41

Summary: What Does the Evidence Show? Fundamental Analysis Appears to be difficult to consistently generate abnormal returns using fundamental analysis. This is because the analysis/investment industry is so competitive. May help you avoid seriously overvalued investments. 8 -42

Summary: What Does the Evidence Show? Fundamental Analysis Appears to be difficult to consistently generate abnormal returns using fundamental analysis. This is because the analysis/investment industry is so competitive. May help you avoid seriously overvalued investments. 8 -42

Summary: What Does the Evidence Show? Fundamental Analysis Without fundamental analysis the markets would surely be inefficient, & Abnormal profit opportunities would exist, Leading to profitable fundamental analysis Grossman & Stiglitz AER, 1980 8 -43

Summary: What Does the Evidence Show? Fundamental Analysis Without fundamental analysis the markets would surely be inefficient, & Abnormal profit opportunities would exist, Leading to profitable fundamental analysis Grossman & Stiglitz AER, 1980 8 -43

Summary: What Does the Evidence show? Anomalies Exist Small Firm in January Effect Book to Market Ratios Long Term Reversals Post-Earnings Announcement Drift (Momentum) 8 -44

Summary: What Does the Evidence show? Anomalies Exist Small Firm in January Effect Book to Market Ratios Long Term Reversals Post-Earnings Announcement Drift (Momentum) 8 -44

Behavioralism bias Motivation Stock prices in the 1990 s did not appear to match “fundamentals, ” e. g. , high price earnings ratios Evidence of refusal to sell losers (Why? ) Economics discipline is exploring behavioral aspects of decision making 8 -45

Behavioralism bias Motivation Stock prices in the 1990 s did not appear to match “fundamentals, ” e. g. , high price earnings ratios Evidence of refusal to sell losers (Why? ) Economics discipline is exploring behavioral aspects of decision making 8 -45

What does it all mean? Technical Analysis: Your choices It may be an item in your toolkit but be careful relying on it too much. Pick stocks yourself, based on fundamental analysis, but diversify Pick one or more mutual funds Unlikely to consistently earn + abnormal returns Pros paying attention to market and firm conditions Index or otherwise passively diversify. 8 -46

What does it all mean? Technical Analysis: Your choices It may be an item in your toolkit but be careful relying on it too much. Pick stocks yourself, based on fundamental analysis, but diversify Pick one or more mutual funds Unlikely to consistently earn + abnormal returns Pros paying attention to market and firm conditions Index or otherwise passively diversify. 8 -46

Selected Problems 8 -47

Selected Problems 8 -47

Problem 1 Zero, otherwise returns from the prior period could be used to predict returns in the subsequent period. 8 -48

Problem 1 Zero, otherwise returns from the prior period could be used to predict returns in the subsequent period. 8 -48

Problem 2 No. Why? Maybe due to a higher risk? Maybe due to constant surprises beyond expected surprise earnings. 8 -49

Problem 2 No. Why? Maybe due to a higher risk? Maybe due to constant surprises beyond expected surprise earnings. 8 -49

Problem 3 Not necessarily, Why? It could indicate information leakage (=> a violation of EMH) or it could indicate that splits occur during price runups (=> still consistent of EMH). 8 -50

Problem 3 Not necessarily, Why? It could indicate information leakage (=> a violation of EMH) or it could indicate that splits occur during price runups (=> still consistent of EMH). 8 -50

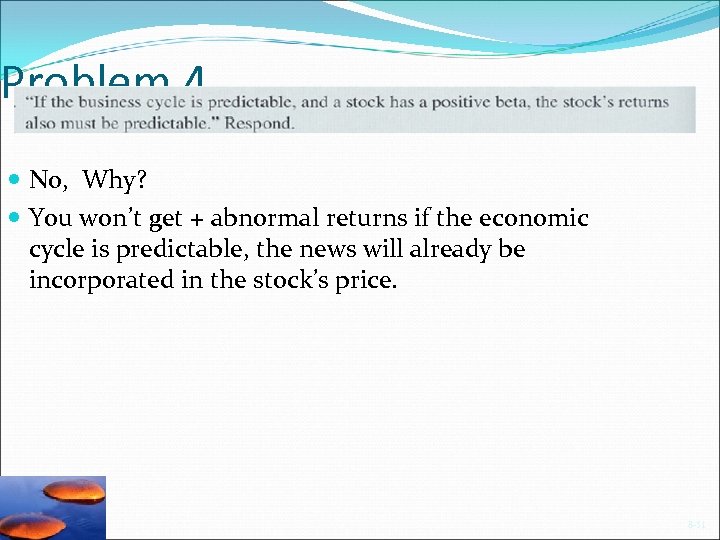

Problem 4 No, Why? You won’t get + abnormal returns if the economic cycle is predictable, the news will already be incorporated in the stock’s price. 8 -51

Problem 4 No, Why? You won’t get + abnormal returns if the economic cycle is predictable, the news will already be incorporated in the stock’s price. 8 -51

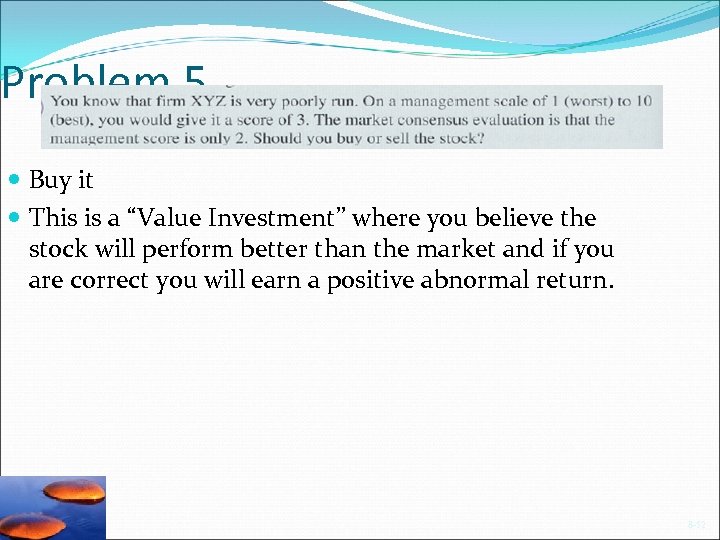

Problem 5 Buy it This is a “Value Investment” where you believe the stock will perform better than the market and if you are correct you will earn a positive abnormal return. 8 -52

Problem 5 Buy it This is a “Value Investment” where you believe the stock will perform better than the market and if you are correct you will earn a positive abnormal return. 8 -52

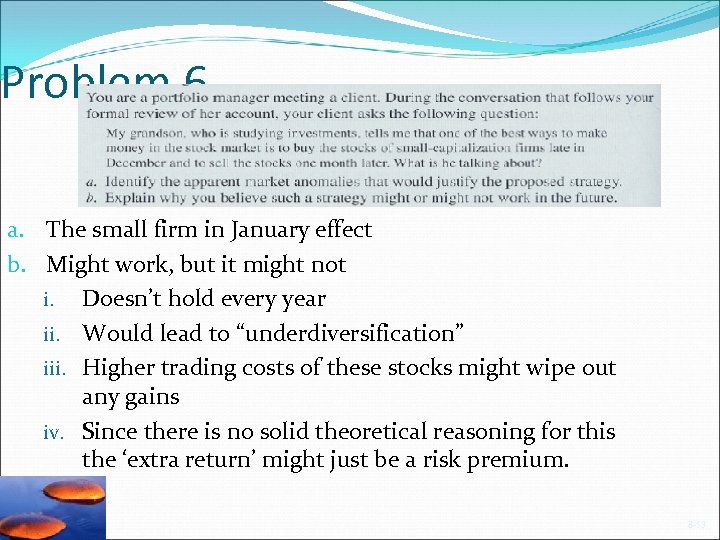

Problem 6 a. The small firm in January effect b. Might work, but it might not i. Doesn’t hold every year ii. Would lead to “underdiversification” iii. Higher trading costs of these stocks might wipe out any gains iv. Since there is no solid theoretical reasoning for this the ‘extra return’ might just be a risk premium. 8 -53

Problem 6 a. The small firm in January effect b. Might work, but it might not i. Doesn’t hold every year ii. Would lead to “underdiversification” iii. Higher trading costs of these stocks might wipe out any gains iv. Since there is no solid theoretical reasoning for this the ‘extra return’ might just be a risk premium. 8 -53

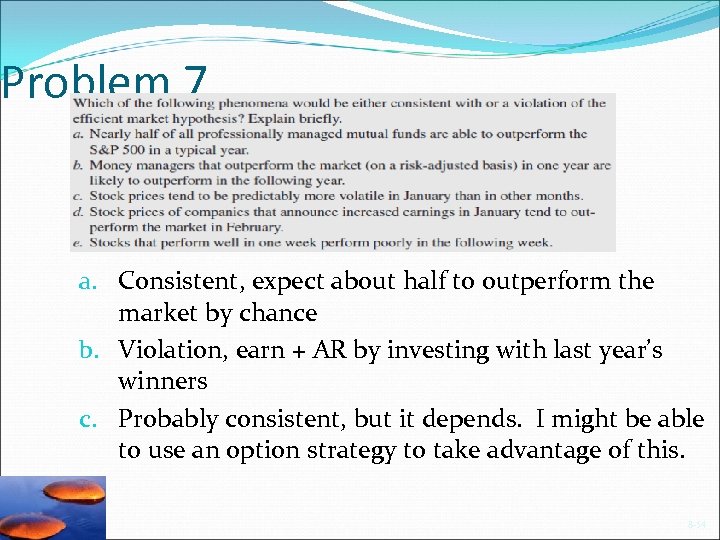

Problem 7 a. Consistent, expect about half to outperform the market by chance b. Violation, earn + AR by investing with last year’s winners c. Probably consistent, but it depends. I might be able to use an option strategy to take advantage of this. 8 -54

Problem 7 a. Consistent, expect about half to outperform the market by chance b. Violation, earn + AR by investing with last year’s winners c. Probably consistent, but it depends. I might be able to use an option strategy to take advantage of this. 8 -54

Problem 7 d. e. Violation, you have exploitable price momentum persisting into February Violation, the reversal offers an exploitable opportunity, namely buy last week’s losers 8 -55

Problem 7 d. e. Violation, you have exploitable price momentum persisting into February Violation, the reversal offers an exploitable opportunity, namely buy last week’s losers 8 -55

Problem 8 i. Implicit in the dollar-cost averaging strategy is the notion that stock prices fluctuate around a “normal” level. Otherwise, there is no meaning to statements such as: “when the price is high. ” ii. How do we know, for example, whether a price of $25 today will be viewed as high or low compared to the stock price six months from now? 8 -56

Problem 8 i. Implicit in the dollar-cost averaging strategy is the notion that stock prices fluctuate around a “normal” level. Otherwise, there is no meaning to statements such as: “when the price is high. ” ii. How do we know, for example, whether a price of $25 today will be viewed as high or low compared to the stock price six months from now? 8 -56

Problem 9 The market expected earnings to increase by more than they actually did. 8 -57

Problem 9 The market expected earnings to increase by more than they actually did. 8 -57

Problem 10 a. The prices of growth stocks may be consistently bid too high due to investor overconfidence. Investors/analysts may extrapolate recent earnings (and dividend) growth too far into the future and thereby inflate stock prices, forcing poor returns eventually on growth portfolios. At any given time, historically high growth firms may revert to lower growth and value stocks may revert to higher growth, changing return patterns, this may happen over an extended time horizon. 8 -58

Problem 10 a. The prices of growth stocks may be consistently bid too high due to investor overconfidence. Investors/analysts may extrapolate recent earnings (and dividend) growth too far into the future and thereby inflate stock prices, forcing poor returns eventually on growth portfolios. At any given time, historically high growth firms may revert to lower growth and value stocks may revert to higher growth, changing return patterns, this may happen over an extended time horizon. 8 -58

Problem 10 b. Enough investors should prefer value stocks to growth stocks and bid up the prices of value stocks and drive down the prices of growth stocks until the “extra” return on the value stocks was eliminated. 8 -59

Problem 10 b. Enough investors should prefer value stocks to growth stocks and bid up the prices of value stocks and drive down the prices of growth stocks until the “extra” return on the value stocks was eliminated. 8 -59