cef6ddf2fa071f9e0a9f335e45909421.ppt

- Количество слайдов: 21

Chapter 8 The Efficient Market Hypothesis

Chapter 8 The Efficient Market Hypothesis

Efficient Market Hypothesis (EMH) • • Do security prices reflect information ? Why look at market efficiency • Implications for business and corporate finance • Implications for investment Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Efficient Market Hypothesis (EMH) • • Do security prices reflect information ? Why look at market efficiency • Implications for business and corporate finance • Implications for investment Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Random Walk and the EMH • Random Walk - stock prices are random • Actually submartingale • • Mc. Graw-Hill/Irwin Expected price is positive over time Positive trend and random about the trend © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Random Walk and the EMH • Random Walk - stock prices are random • Actually submartingale • • Mc. Graw-Hill/Irwin Expected price is positive over time Positive trend and random about the trend © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

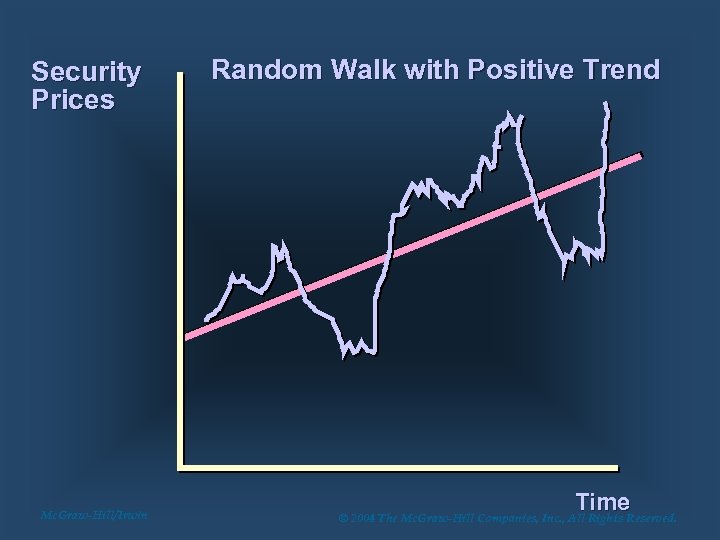

Security Prices Mc. Graw-Hill/Irwin Random Walk with Positive Trend Time © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Security Prices Mc. Graw-Hill/Irwin Random Walk with Positive Trend Time © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Random Price Changes • Why are price changes random? • Prices react to information • Flow of information is random • Therefore, price changes are random Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Random Price Changes • Why are price changes random? • Prices react to information • Flow of information is random • Therefore, price changes are random Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

EMH and Competition • • • Stock prices fully and accurately reflect publicly available information Once information becomes available, market participants analyze it Competition assures prices reflect information Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

EMH and Competition • • • Stock prices fully and accurately reflect publicly available information Once information becomes available, market participants analyze it Competition assures prices reflect information Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Forms of the EMH • • • Weak Semi-strong Strong Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Forms of the EMH • • • Weak Semi-strong Strong Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Types of Stock Analysis • Technical Analysis - using prices and volume information to predict future prices • Weak form efficiency & technical analysis • Fundamental Analysis - using economic and accounting information to predict stock prices • Semi strong form efficiency & fundamental analysis Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Types of Stock Analysis • Technical Analysis - using prices and volume information to predict future prices • Weak form efficiency & technical analysis • Fundamental Analysis - using economic and accounting information to predict stock prices • Semi strong form efficiency & fundamental analysis Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Implications of Efficiency for Active or Passive Management • Active Management • Security analysis • Timing • Passive Management • Buy and Hold • Index Funds Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Implications of Efficiency for Active or Passive Management • Active Management • Security analysis • Timing • Passive Management • Buy and Hold • Index Funds Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Market Efficiency and Portfolio Management Even if the market is efficient a role exists for portfolio management • Appropriate risk level • Tax considerations • Other considerations Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Market Efficiency and Portfolio Management Even if the market is efficient a role exists for portfolio management • Appropriate risk level • Tax considerations • Other considerations Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Empirical Tests of Market Efficiency • • • Event studies Assessing performance of professional managers Testing some trading rule Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Empirical Tests of Market Efficiency • • • Event studies Assessing performance of professional managers Testing some trading rule Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

How Tests Are Structured 1. Examine prices and returns over time Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

How Tests Are Structured 1. Examine prices and returns over time Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

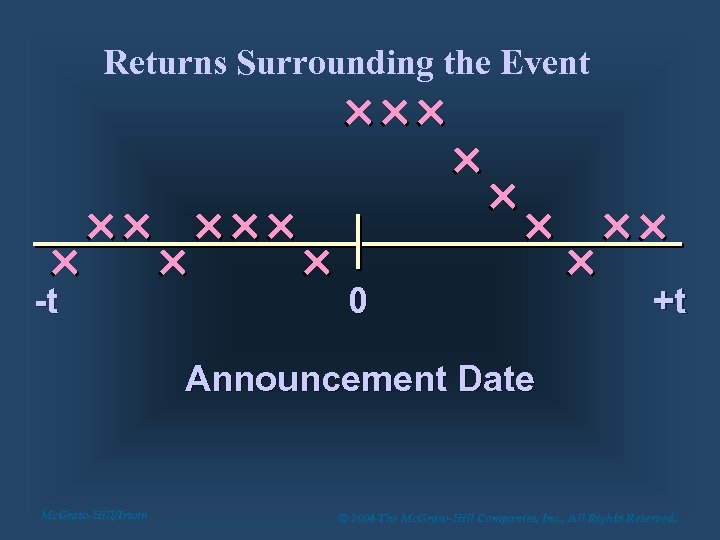

Returns Surrounding the Event -t 0 +t Announcement Date Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Returns Surrounding the Event -t 0 +t Announcement Date Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

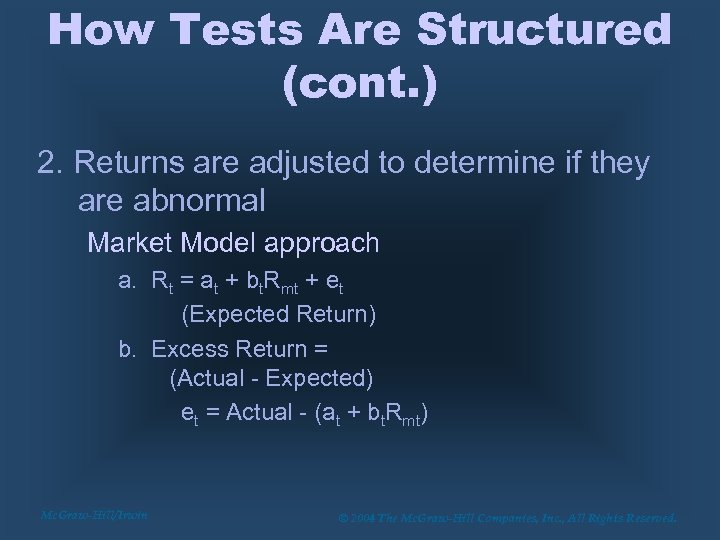

How Tests Are Structured (cont. ) 2. Returns are adjusted to determine if they are abnormal Market Model approach a. Rt = at + bt. Rmt + et (Expected Return) b. Excess Return = (Actual - Expected) et = Actual - (at + bt. Rmt) Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

How Tests Are Structured (cont. ) 2. Returns are adjusted to determine if they are abnormal Market Model approach a. Rt = at + bt. Rmt + et (Expected Return) b. Excess Return = (Actual - Expected) et = Actual - (at + bt. Rmt) Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

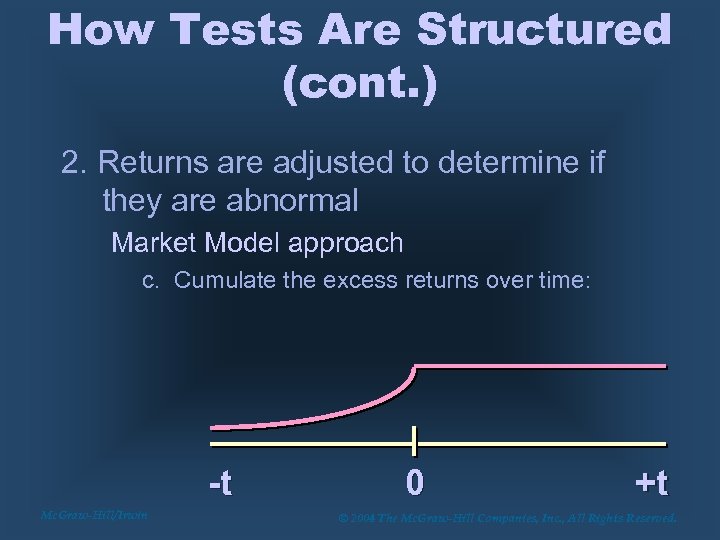

How Tests Are Structured (cont. ) 2. Returns are adjusted to determine if they are abnormal Market Model approach c. Cumulate the excess returns over time: -t Mc. Graw-Hill/Irwin 0 +t © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

How Tests Are Structured (cont. ) 2. Returns are adjusted to determine if they are abnormal Market Model approach c. Cumulate the excess returns over time: -t Mc. Graw-Hill/Irwin 0 +t © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Issues in Examining the Results • • • Magnitude Issue Selection Bias Issue Lucky Event Issue Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Issues in Examining the Results • • • Magnitude Issue Selection Bias Issue Lucky Event Issue Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Tests of Weak Form • Returns over short horizons • Very short time horizons small magnitude of positive trends • 3 -12 month some evidence of positive momentum • • Returns over long horizons – pronounced negative correlation Evidence on Reversals Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Tests of Weak Form • Returns over short horizons • Very short time horizons small magnitude of positive trends • 3 -12 month some evidence of positive momentum • • Returns over long horizons – pronounced negative correlation Evidence on Reversals Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Tests of Semi-strong Form: Anomalies • • • Small Firm Effect (January Effect) Neglected Firm Market to Book Ratios Post-Earnings Announcement Drift Higher Level Correlation in Security Prices Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Tests of Semi-strong Form: Anomalies • • • Small Firm Effect (January Effect) Neglected Firm Market to Book Ratios Post-Earnings Announcement Drift Higher Level Correlation in Security Prices Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Implications of Test Results • • • Risk Premiums or market inefficiencies Anomalies or data mining Behavioral Interpretation • Inefficiencies exist • Caused by human behavior Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Implications of Test Results • • • Risk Premiums or market inefficiencies Anomalies or data mining Behavioral Interpretation • Inefficiencies exist • Caused by human behavior Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Behavioral Possibilities • • Forecasting Errors Overconfidence Regret avoidance Framing and mental accounting errors Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Behavioral Possibilities • • Forecasting Errors Overconfidence Regret avoidance Framing and mental accounting errors Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Mutual Fund and Professional Manager Performance • • Some evidence of persistent positive and negative performance Potential measurement error for benchmark returns • Style changes • May be risk premiums • Superstar phenomenon Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Mutual Fund and Professional Manager Performance • • Some evidence of persistent positive and negative performance Potential measurement error for benchmark returns • Style changes • May be risk premiums • Superstar phenomenon Mc. Graw-Hill/Irwin © 2004 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.