52f095d0e5bf3fba3ebe5affc5a65ae0.ppt

- Количество слайдов: 36

Chapter 8 Principles of Corporate Finance Eighth Edition Risk and Return Slides by Matthew Will Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

Chapter 8 Principles of Corporate Finance Eighth Edition Risk and Return Slides by Matthew Will Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

Topics Covered Ø Markowitz Portfolio Theory Ø Risk and Return Relationship Ø Validity and the Role of the CAPM Ø Some Alternative Theories Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 2

Topics Covered Ø Markowitz Portfolio Theory Ø Risk and Return Relationship Ø Validity and the Role of the CAPM Ø Some Alternative Theories Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 2

Markowitz Portfolio Theory Ø Combining stocks into portfolios can reduce standard deviation, below the level obtained from a simple weighted average calculation. Ø Correlation coefficients make this possible. Ø The various weighted combinations of stocks that create this standard deviations constitute the set of efficient portfolios Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 3

Markowitz Portfolio Theory Ø Combining stocks into portfolios can reduce standard deviation, below the level obtained from a simple weighted average calculation. Ø Correlation coefficients make this possible. Ø The various weighted combinations of stocks that create this standard deviations constitute the set of efficient portfolios Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 3

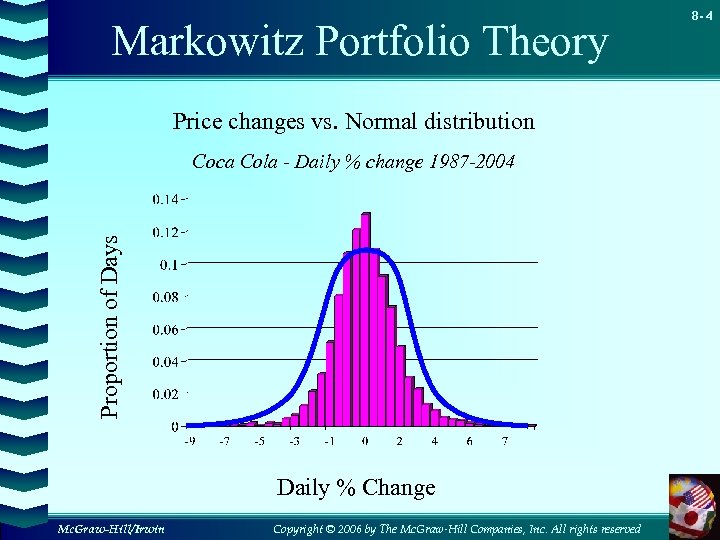

Markowitz Portfolio Theory Price changes vs. Normal distribution Proportion of Days Coca Cola - Daily % change 1987 -2004 Daily % Change Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 4

Markowitz Portfolio Theory Price changes vs. Normal distribution Proportion of Days Coca Cola - Daily % change 1987 -2004 Daily % Change Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 4

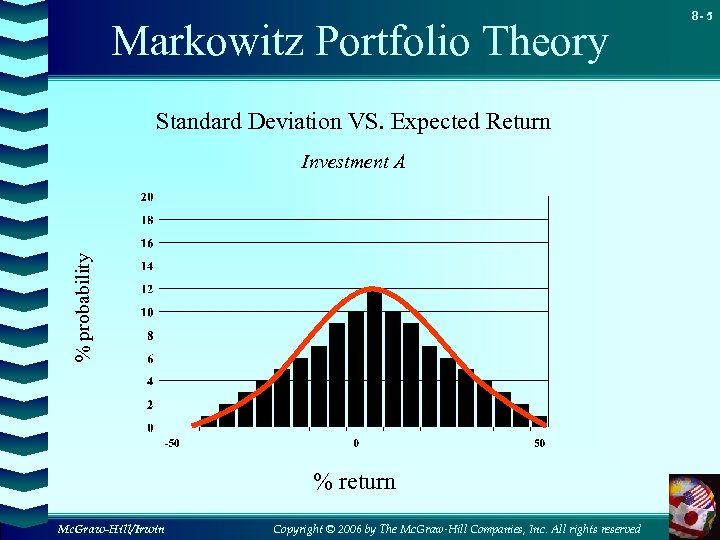

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment A % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 5

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment A % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 5

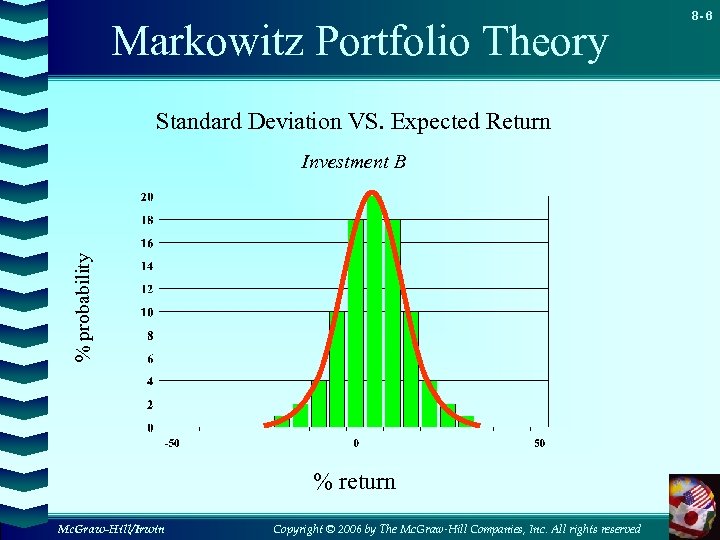

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment B % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 6

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment B % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 6

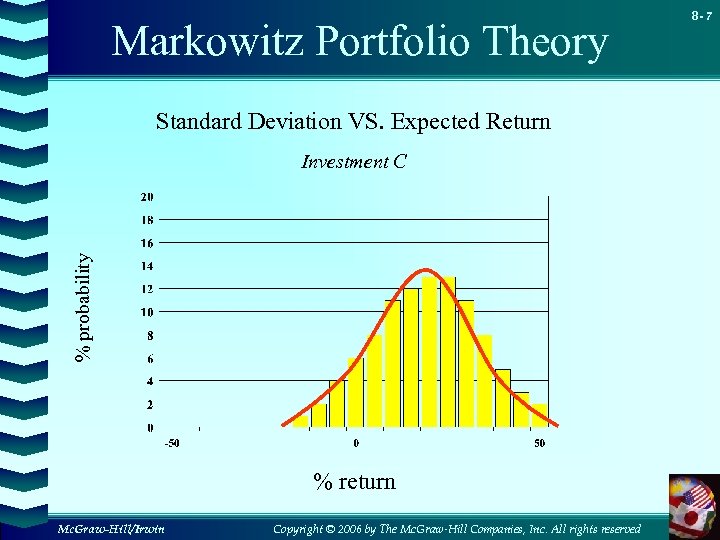

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment C % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 7

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment C % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 7

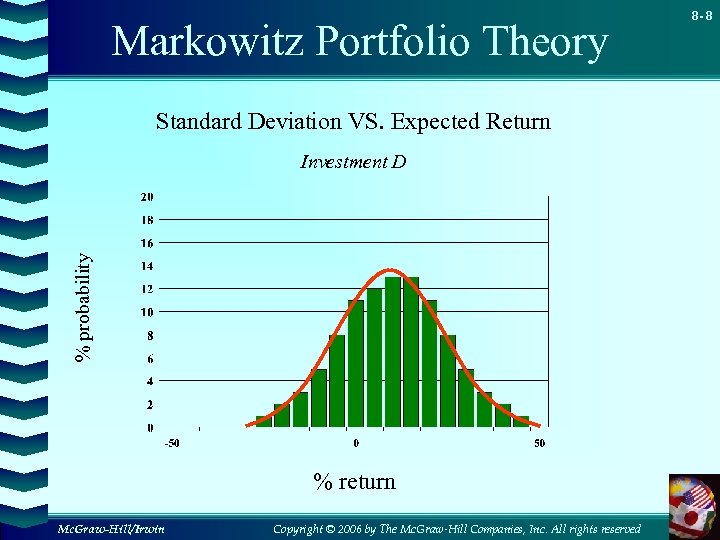

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment D % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 8

Markowitz Portfolio Theory Standard Deviation VS. Expected Return % probability Investment D % return Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 8

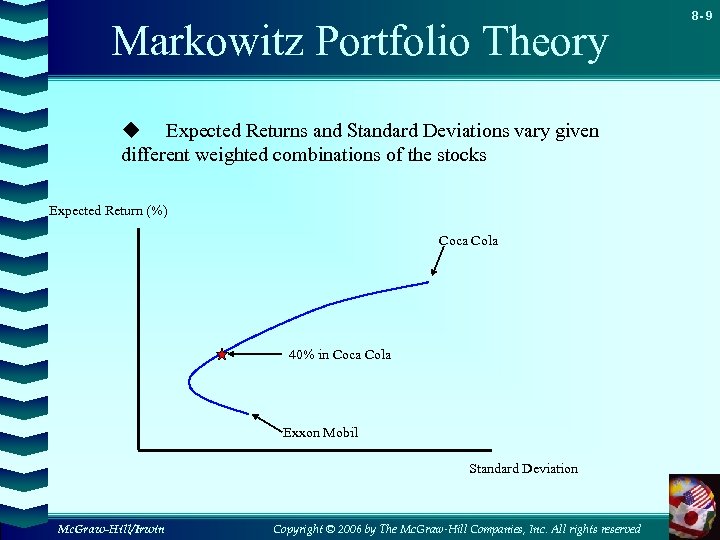

Markowitz Portfolio Theory u Expected Returns and Standard Deviations vary given different weighted combinations of the stocks Expected Return (%) Coca Cola 40% in Coca Cola Exxon Mobil Standard Deviation Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 9

Markowitz Portfolio Theory u Expected Returns and Standard Deviations vary given different weighted combinations of the stocks Expected Return (%) Coca Cola 40% in Coca Cola Exxon Mobil Standard Deviation Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 9

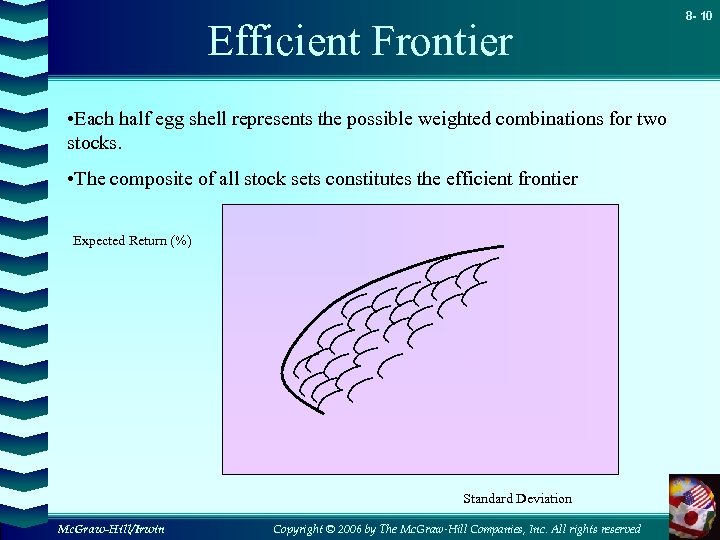

Efficient Frontier • Each half egg shell represents the possible weighted combinations for two stocks. • The composite of all stock sets constitutes the efficient frontier Expected Return (%) Standard Deviation Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 10

Efficient Frontier • Each half egg shell represents the possible weighted combinations for two stocks. • The composite of all stock sets constitutes the efficient frontier Expected Return (%) Standard Deviation Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 10

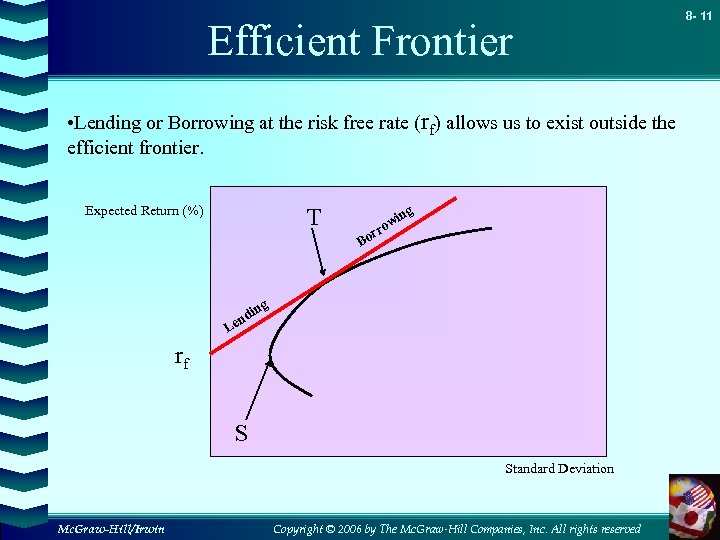

Efficient Frontier • Lending or Borrowing at the risk free rate (rf) allows us to exist outside the efficient frontier. Expected Return (%) T ng wi rro Bo g din en L rf S Standard Deviation Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 11

Efficient Frontier • Lending or Borrowing at the risk free rate (rf) allows us to exist outside the efficient frontier. Expected Return (%) T ng wi rro Bo g din en L rf S Standard Deviation Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 11

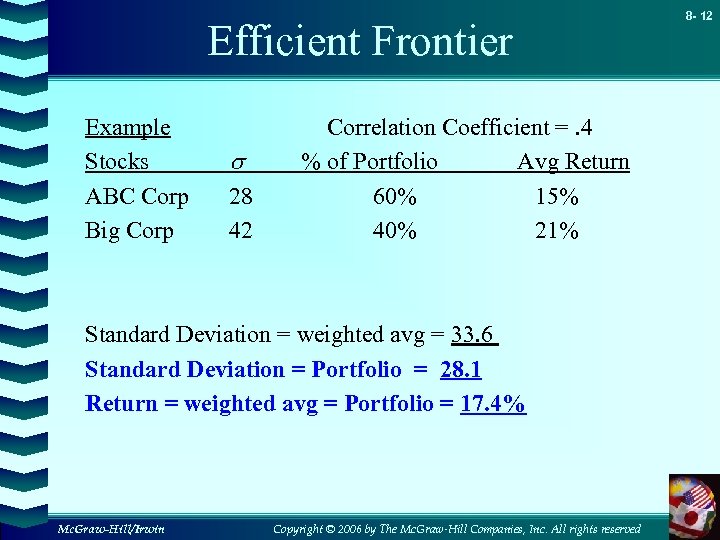

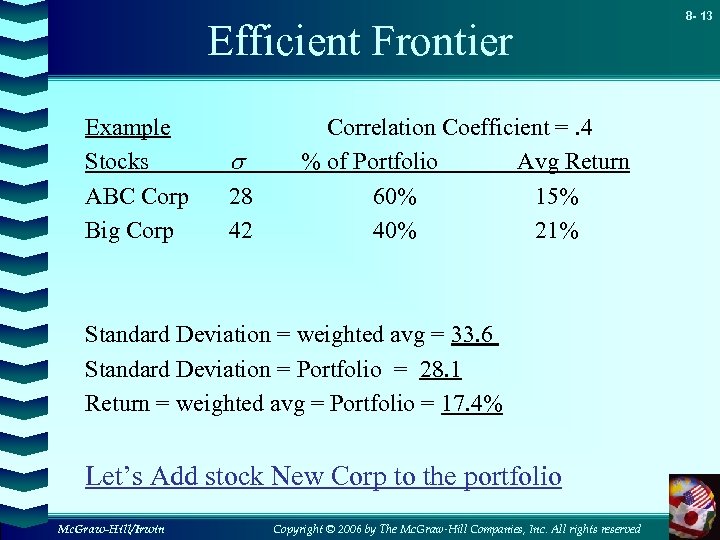

Efficient Frontier Example Stocks ABC Corp Big Corp s 28 42 Correlation Coefficient =. 4 % of Portfolio Avg Return 60% 15% 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 12

Efficient Frontier Example Stocks ABC Corp Big Corp s 28 42 Correlation Coefficient =. 4 % of Portfolio Avg Return 60% 15% 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 12

Efficient Frontier Example Stocks ABC Corp Big Corp s 28 42 Correlation Coefficient =. 4 % of Portfolio Avg Return 60% 15% 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% Let’s Add stock New Corp to the portfolio Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 13

Efficient Frontier Example Stocks ABC Corp Big Corp s 28 42 Correlation Coefficient =. 4 % of Portfolio Avg Return 60% 15% 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% Let’s Add stock New Corp to the portfolio Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 13

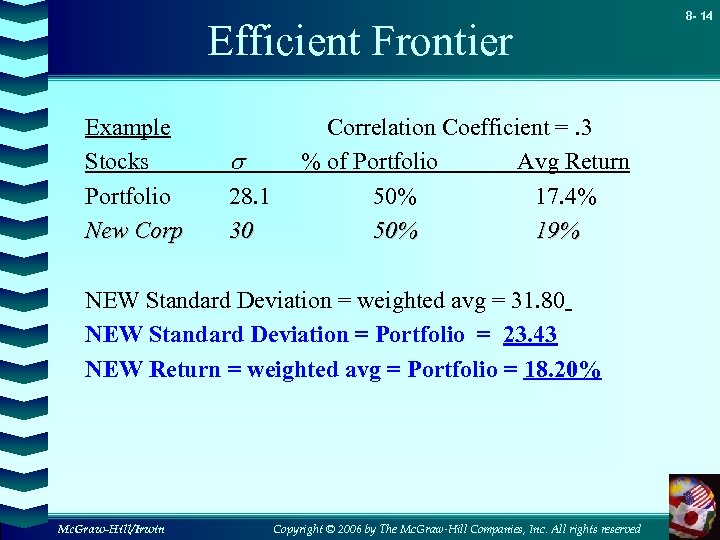

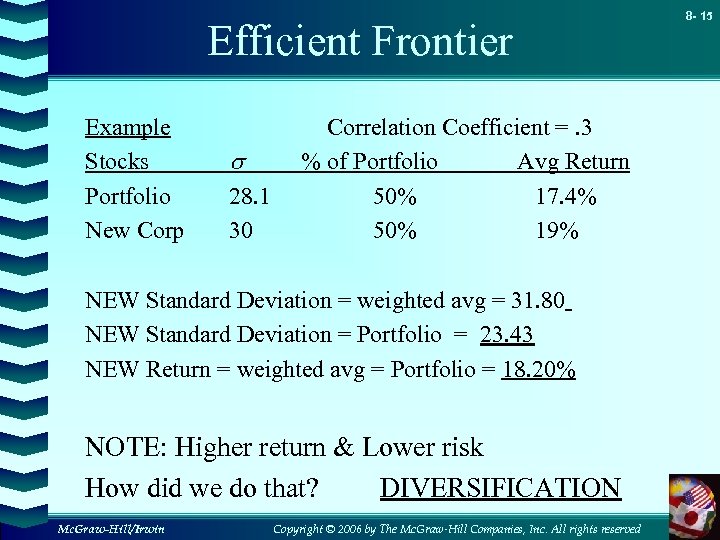

Efficient Frontier Example Stocks Portfolio New Corp s 28. 1 30 Correlation Coefficient =. 3 % of Portfolio Avg Return 50% 17. 4% 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 14

Efficient Frontier Example Stocks Portfolio New Corp s 28. 1 30 Correlation Coefficient =. 3 % of Portfolio Avg Return 50% 17. 4% 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 14

Efficient Frontier Example Stocks Portfolio New Corp s 28. 1 30 Correlation Coefficient =. 3 % of Portfolio Avg Return 50% 17. 4% 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% NOTE: Higher return & Lower risk How did we do that? DIVERSIFICATION Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 15

Efficient Frontier Example Stocks Portfolio New Corp s 28. 1 30 Correlation Coefficient =. 3 % of Portfolio Avg Return 50% 17. 4% 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% NOTE: Higher return & Lower risk How did we do that? DIVERSIFICATION Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 15

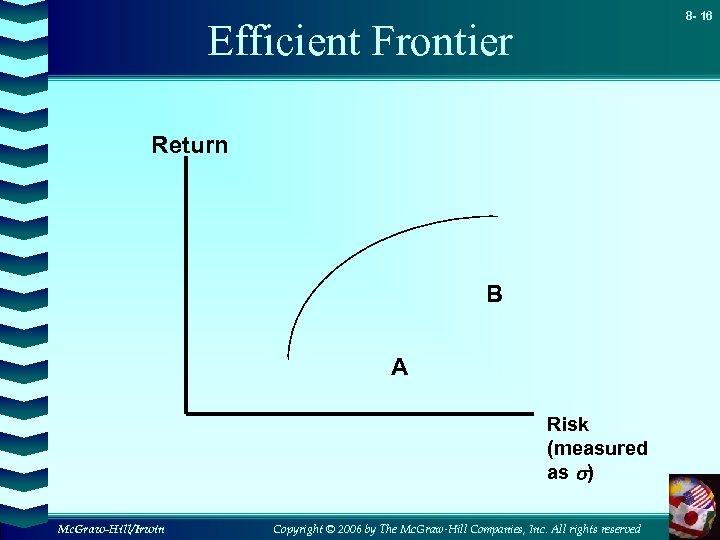

8 - 16 Efficient Frontier Return B A Risk (measured as s) Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 16 Efficient Frontier Return B A Risk (measured as s) Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

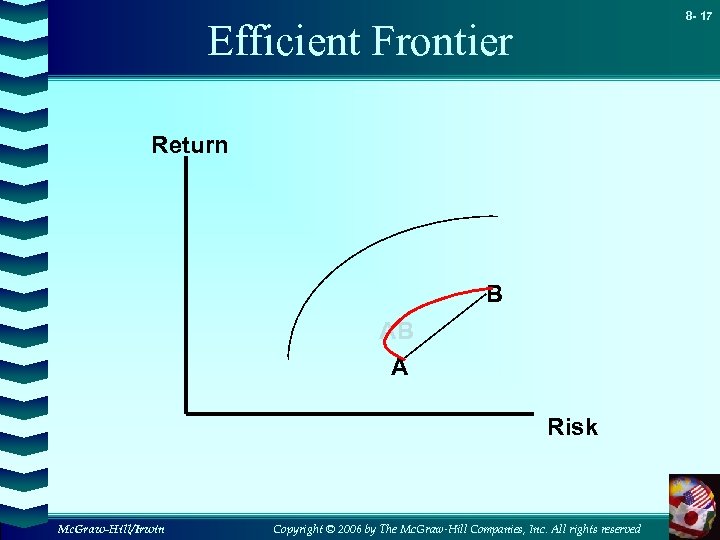

8 - 17 Efficient Frontier Return B AB A Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 17 Efficient Frontier Return B AB A Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

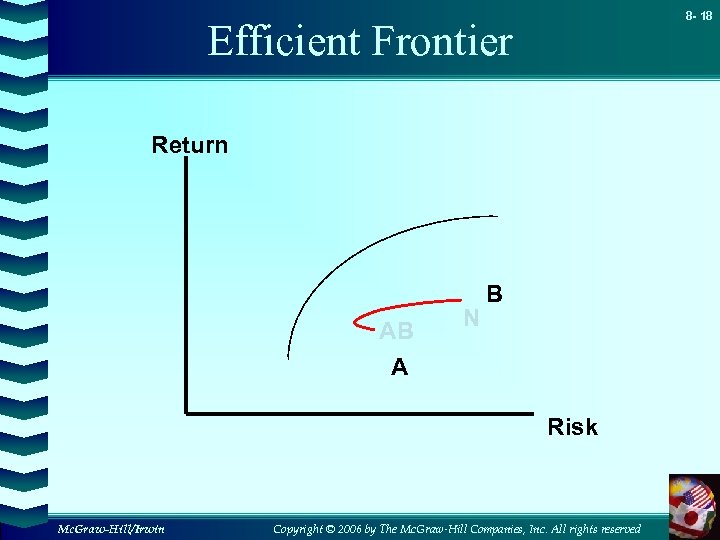

8 - 18 Efficient Frontier Return AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 18 Efficient Frontier Return AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

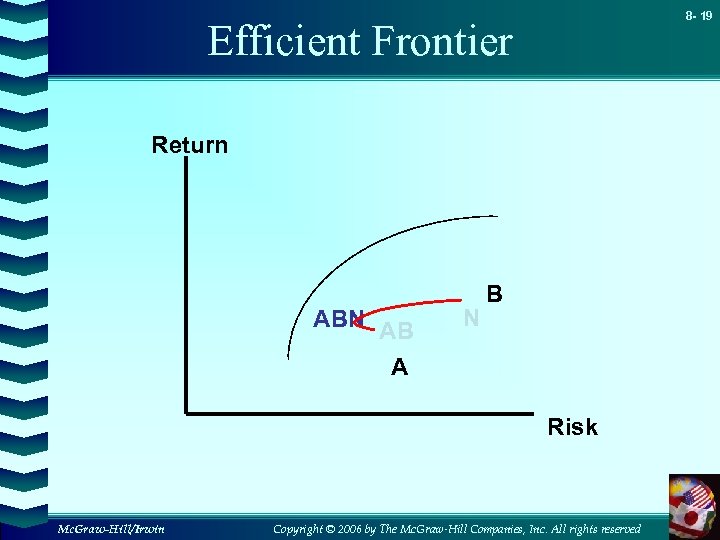

8 - 19 Efficient Frontier Return ABN AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 19 Efficient Frontier Return ABN AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

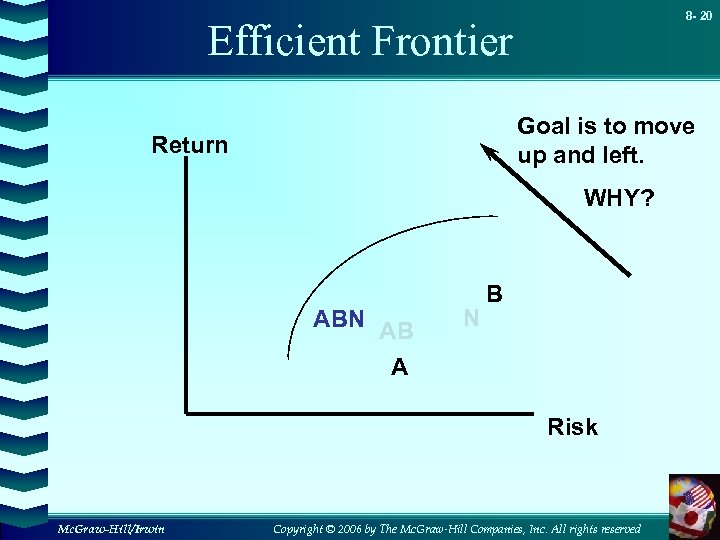

8 - 20 Efficient Frontier Goal is to move up and left. Return WHY? ABN AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 20 Efficient Frontier Goal is to move up and left. Return WHY? ABN AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

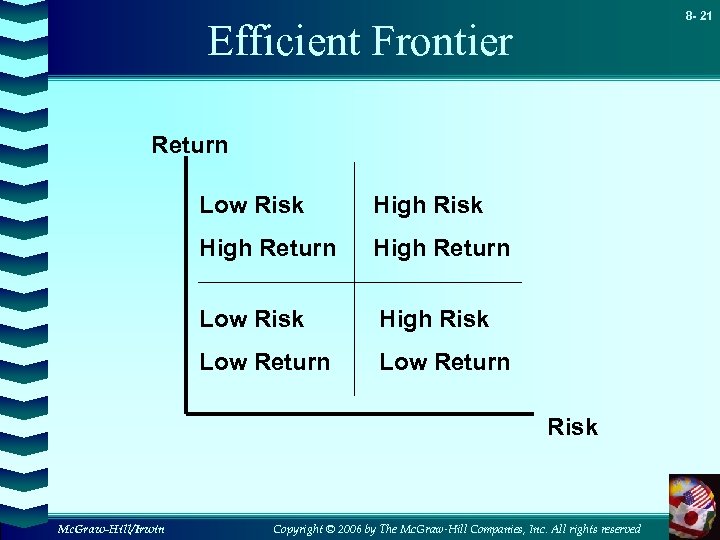

8 - 21 Efficient Frontier Return Low Risk High Return Low Risk High Risk Low Return Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 21 Efficient Frontier Return Low Risk High Return Low Risk High Risk Low Return Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

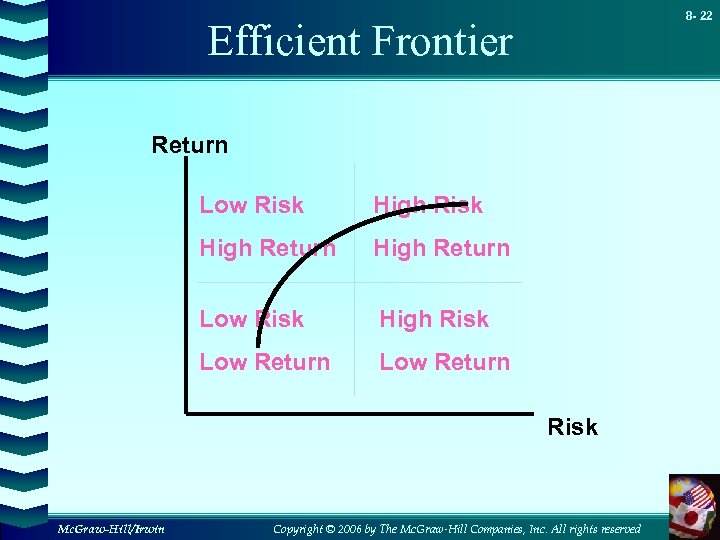

8 - 22 Efficient Frontier Return Low Risk High Return Low Risk High Risk Low Return Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 22 Efficient Frontier Return Low Risk High Return Low Risk High Risk Low Return Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

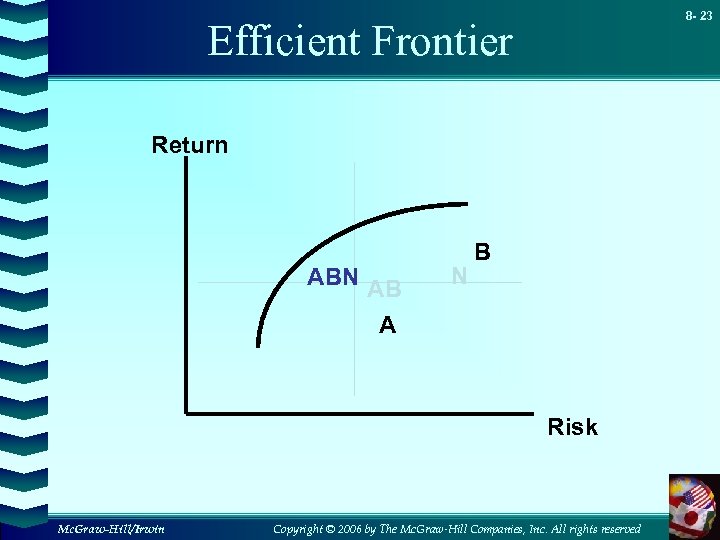

8 - 23 Efficient Frontier Return ABN AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 23 Efficient Frontier Return ABN AB A N B Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

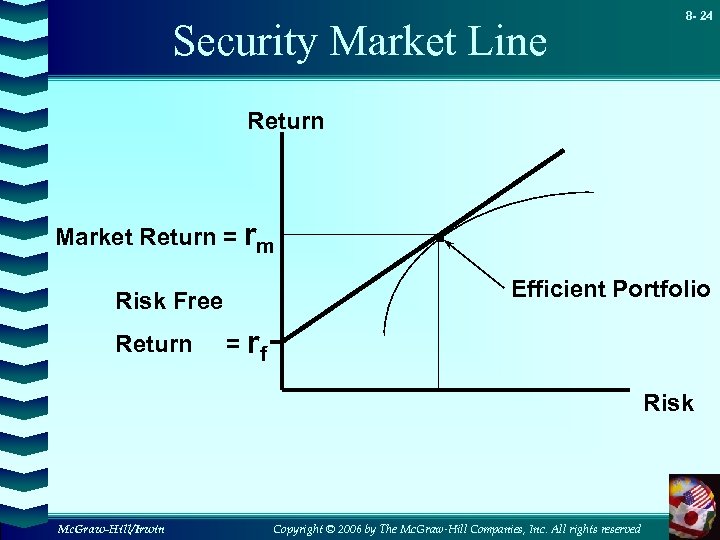

Security Market Line 8 - 24 Return Market Return = rm Efficient Portfolio Risk Free Return . = rf Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

Security Market Line 8 - 24 Return Market Return = rm Efficient Portfolio Risk Free Return . = rf Risk Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

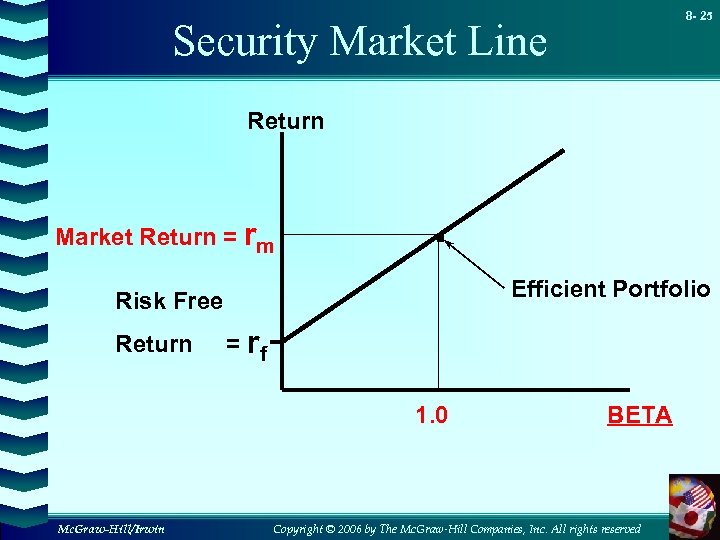

8 - 25 Security Market Line Return Market Return = rm . Efficient Portfolio Risk Free Return = rf 1. 0 Mc. Graw-Hill/Irwin BETA Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 25 Security Market Line Return Market Return = rm . Efficient Portfolio Risk Free Return = rf 1. 0 Mc. Graw-Hill/Irwin BETA Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

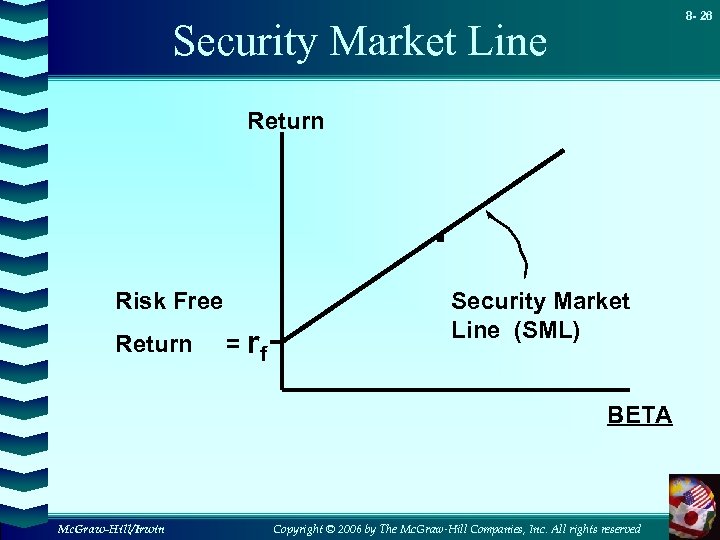

8 - 26 Security Market Line Return . Risk Free Return = rf Security Market Line (SML) BETA Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 26 Security Market Line Return . Risk Free Return = rf Security Market Line (SML) BETA Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

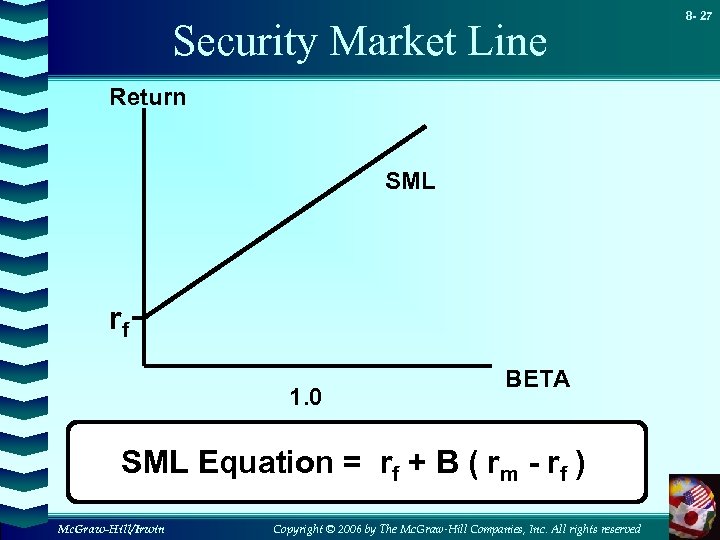

Security Market Line Return SML rf 1. 0 BETA SML Equation = rf + B ( rm - rf ) Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 27

Security Market Line Return SML rf 1. 0 BETA SML Equation = rf + B ( rm - rf ) Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 27

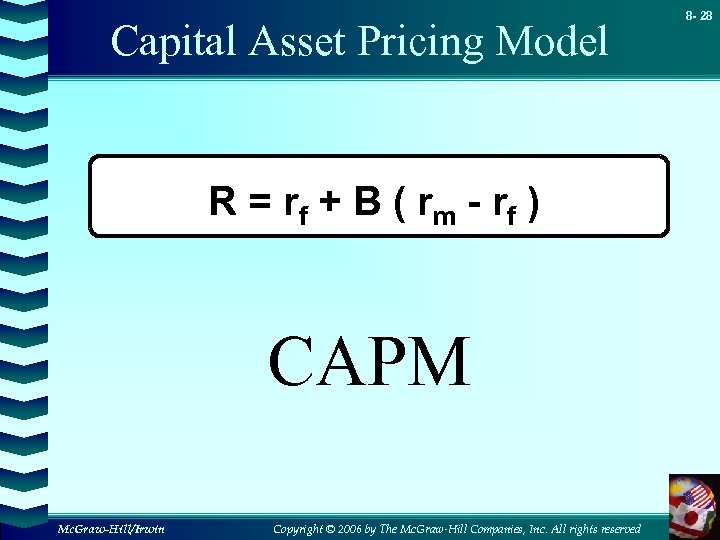

Capital Asset Pricing Model R = r f + B ( r m - rf ) CAPM Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 28

Capital Asset Pricing Model R = r f + B ( r m - rf ) CAPM Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 28

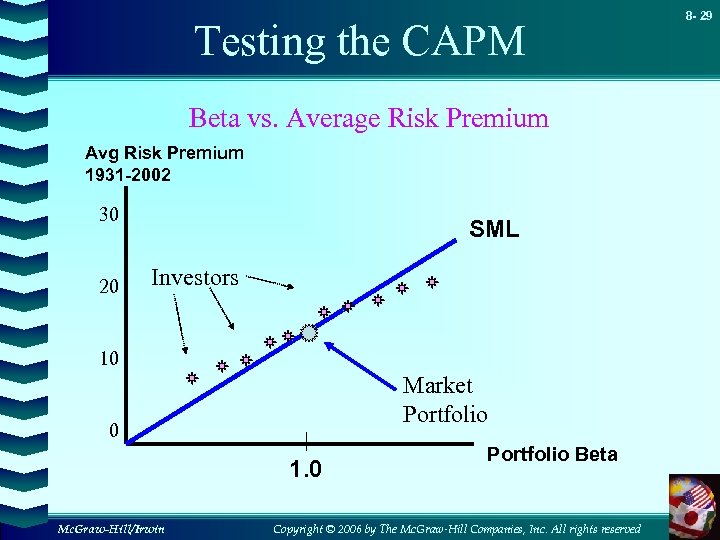

Testing the CAPM Beta vs. Average Risk Premium Avg Risk Premium 1931 -2002 30 20 SML Investors 10 Market Portfolio 0 1. 0 Mc. Graw-Hill/Irwin Portfolio Beta Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 29

Testing the CAPM Beta vs. Average Risk Premium Avg Risk Premium 1931 -2002 30 20 SML Investors 10 Market Portfolio 0 1. 0 Mc. Graw-Hill/Irwin Portfolio Beta Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 29

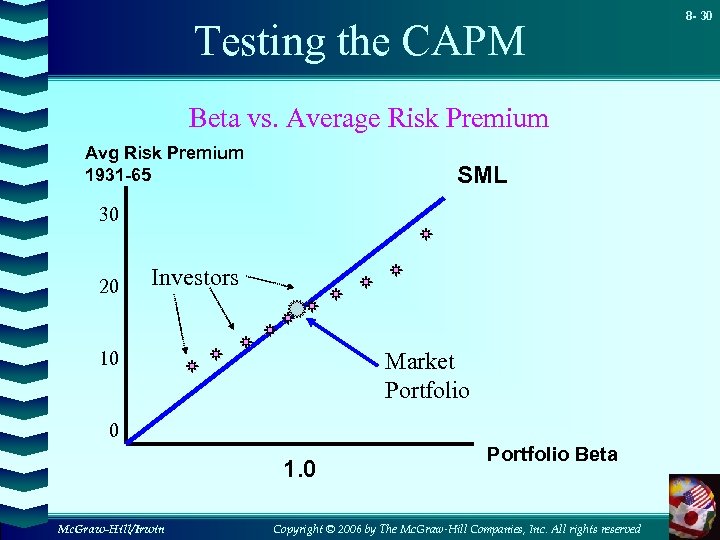

Testing the CAPM Beta vs. Average Risk Premium Avg Risk Premium 1931 -65 SML 30 20 Investors 10 Market Portfolio 0 1. 0 Mc. Graw-Hill/Irwin Portfolio Beta Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 30

Testing the CAPM Beta vs. Average Risk Premium Avg Risk Premium 1931 -65 SML 30 20 Investors 10 Market Portfolio 0 1. 0 Mc. Graw-Hill/Irwin Portfolio Beta Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 30

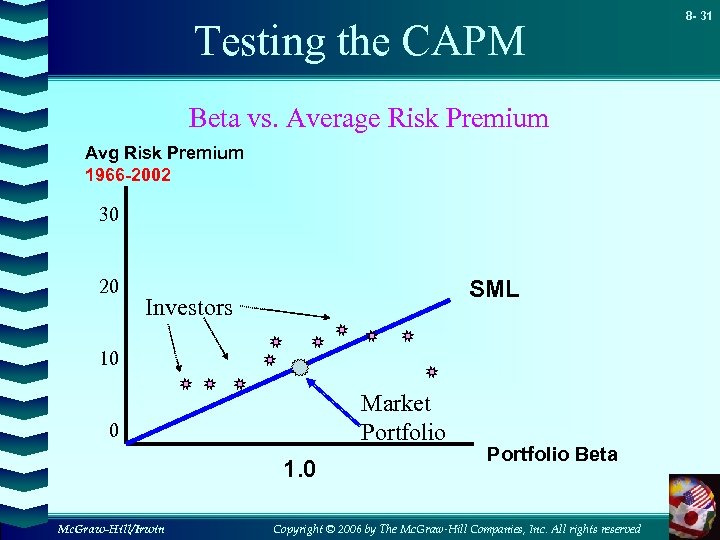

Testing the CAPM Beta vs. Average Risk Premium Avg Risk Premium 1966 -2002 30 20 SML Investors 10 Market Portfolio 0 1. 0 Mc. Graw-Hill/Irwin Portfolio Beta Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 31

Testing the CAPM Beta vs. Average Risk Premium Avg Risk Premium 1966 -2002 30 20 SML Investors 10 Market Portfolio 0 1. 0 Mc. Graw-Hill/Irwin Portfolio Beta Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 31

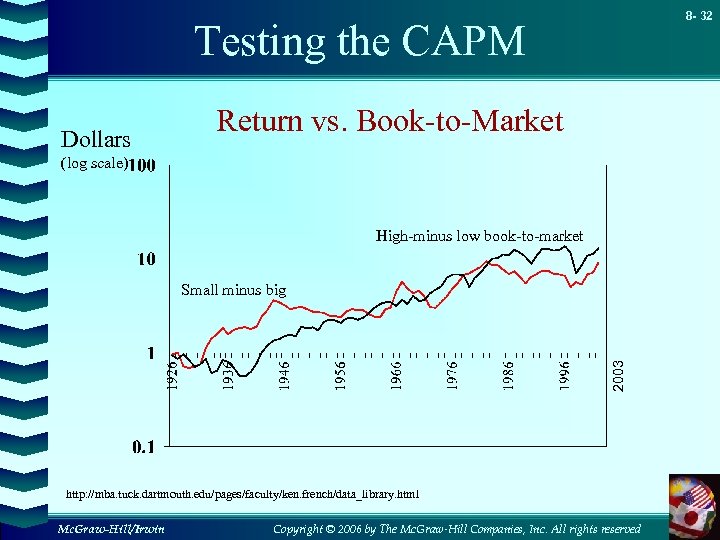

8 - 32 Testing the CAPM Dollars Return vs. Book-to-Market (log scale) High-minus low book-to-market 2003 Small minus big http: //mba. tuck. dartmouth. edu/pages/faculty/ken. french/data_library. html Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

8 - 32 Testing the CAPM Dollars Return vs. Book-to-Market (log scale) High-minus low book-to-market 2003 Small minus big http: //mba. tuck. dartmouth. edu/pages/faculty/ken. french/data_library. html Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

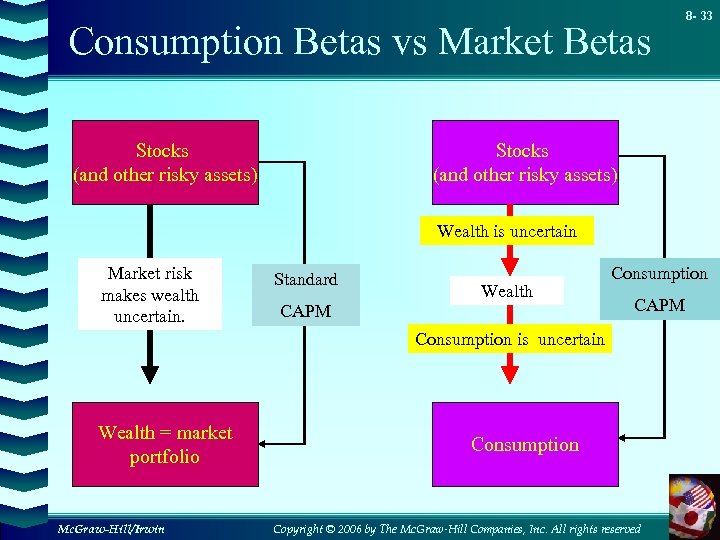

Consumption Betas vs Market Betas Stocks (and other risky assets) 8 - 33 Stocks (and other risky assets) Wealth is uncertain Market risk makes wealth uncertain. Standard Wealth CAPM Consumption is uncertain Wealth = market portfolio Mc. Graw-Hill/Irwin Consumption Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

Consumption Betas vs Market Betas Stocks (and other risky assets) 8 - 33 Stocks (and other risky assets) Wealth is uncertain Market risk makes wealth uncertain. Standard Wealth CAPM Consumption is uncertain Wealth = market portfolio Mc. Graw-Hill/Irwin Consumption Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

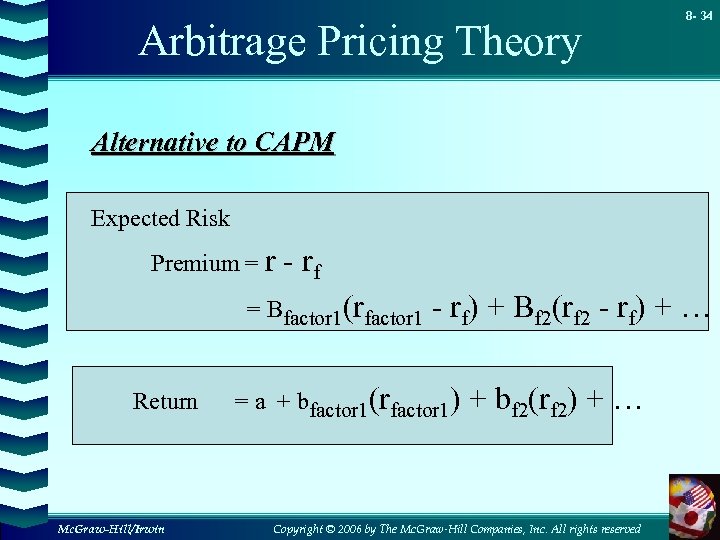

Arbitrage Pricing Theory 8 - 34 Alternative to CAPM Expected Risk Premium = r - rf = Bfactor 1(rfactor 1 Return Mc. Graw-Hill/Irwin - rf) + Bf 2(rf 2 - rf) + … = a + bfactor 1(rfactor 1) + bf 2(rf 2) + … Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

Arbitrage Pricing Theory 8 - 34 Alternative to CAPM Expected Risk Premium = r - rf = Bfactor 1(rfactor 1 Return Mc. Graw-Hill/Irwin - rf) + Bf 2(rf 2 - rf) + … = a + bfactor 1(rfactor 1) + bf 2(rf 2) + … Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved

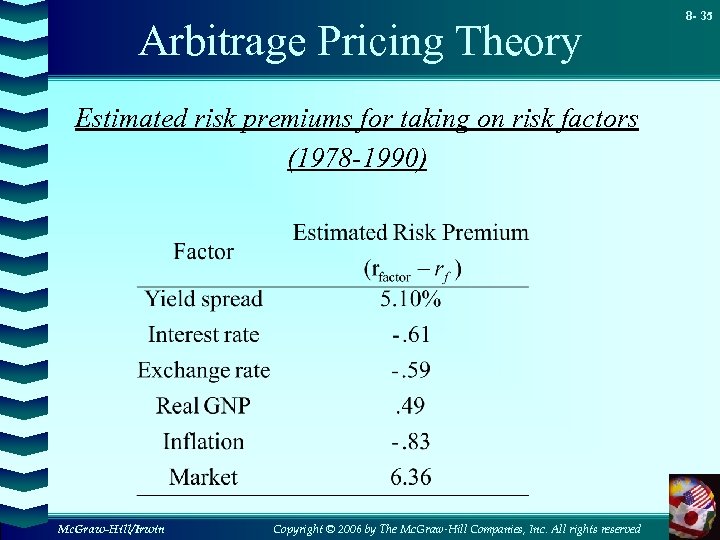

Arbitrage Pricing Theory Estimated risk premiums for taking on risk factors (1978 -1990) Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 35

Arbitrage Pricing Theory Estimated risk premiums for taking on risk factors (1978 -1990) Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 35

Web Resources Click to access web sites Internet connection required www. finance. yahoo. com/ www. duke. edu/~charvey www. mba. tuck. dartmouth. edu/pages/faculty/ken. french www. globalfindata. com Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 36

Web Resources Click to access web sites Internet connection required www. finance. yahoo. com/ www. duke. edu/~charvey www. mba. tuck. dartmouth. edu/pages/faculty/ken. french www. globalfindata. com Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved 8 - 36