775938ba786624fdb0ffc7de928332ba.ppt

- Количество слайдов: 33

Chapter 8 – Entering Global Markets “…some foreign companies have tired of waiting and retreated from China, hoping to return at a more opportune moment…the Chinese may well consider such a retreat as typical of…self-interested outsiders and never let them back. ” Andrew Williamson, The Chinese Business Puzzle Mc. Graw-Hill/Irwin Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Outline Reasons for Internationalizing Factors in the Mode of Entry Decision Methods of Entry to International Markets • Direct or Indirect exporting • Licensing • Franchising • Contract Manufacturing • Turnkey Operations • Management Contracts • International Joint Ventures • International Business Alliances • Wholly Owned Subsidiaries Summary 8 -2

Reasons for Internationalizing Expand beyond a saturated domestic market Find new source of profits Add to the firm’s competitive edge Diversify and enlarge markets to hedge against economic crises Follow customers who are going abroad 8 -3

Factors that Influence the Mode of Entry Decision Management goes through a successive decision making process that includes answering the following questions: Can our product be marketed abroad? What the key success factors for our products? Is secondary data available for those markets/products? What additional data is needed and how can we get it? Which of our products have the highest potential abroad? Which markets have the greatest potential for our products? Do we have excess production capacity? What are the characteristics of our target market? What are the international capabilities of the firm? 8 -4

Internal Factors Encompass the firm’s resources, strategy, management mindset, time commitment and products considered for international markets. Specifically: Financial Resources Human Resources Type of Product and/or Service Time Horizons Risk Tolerance 8 -5

External Factors Target country factors • Market • Production conditions • Environmental condition Domestic country factors • Market size • Growth opportunities • Competition • Production costs 8 -6

Methods of Entry to International Markets Exporting Licensing Franchising Contract manufacturing Turnkey operations Note: Market entry is not static. entry modes may Management contracts have to be restructured as International joint environmental conditions change. ventures Wholly owned subsidiaries 8 -7

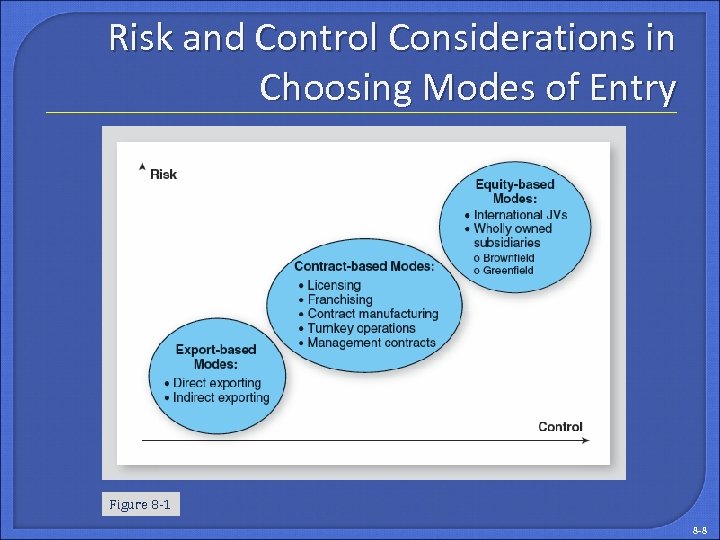

Risk and Control Considerations in Choosing Modes of Entry Figure 8 -1 8 -8

Exporting Low-risk Preferred by small / entrepreneurial businesses Well-suited for initial market tests Indirect exporting • Use of home-based intermediaries Direct exporting 8 -9

Example: Small Electronics Firm Indicators of distributor selection • Does the distributor have established connections in the targeted industries? • Is the distributor familiar with the type of products manufactured by the company? • Does the distributor have experience working with American companies? • What are the distributor’s size, current product lineup and revenues? • Will the distributor allow the company to conduct independent marketing and sales within the country? 8 -10

Challenges of Exporting Potential trade barriers: • High tariffs • Taxes • Currency exchange restrictions Challenges can be mitigated by: Conducting effective pre-entry research Finding the right distributor Know the country’s laws / regulations 8 -11

International Licensing The process of transferring the rights to a firm’s products for the purpose of local production and/or sales. For a fee, the licensor allows the licensee to use intellectual property to gain presence in the markets covered by the licensee • Small upfront cost/risk for licensee • Royalties can translate into direct profit for licensor This form of market entry is ideal for countries that impose imports and mature products with standardized production 8 -12

Challenges of Licensing firms can find themselves competing against former licensees Firms can guard against this risk with strident attention to detailed legal contracts 8 -13

International Franchising gives more control to the franchisor company over the franchisee who has licensed the company’s trademarks, products and/or services, and production and/or operation processes. Control is exerted through the franchise fee which can be expropriated if contracts are not adhered to, and elaborate contracts that govern the relationship between the franchisor and the franchisees. 8 -14

International Franchising Franchisee expands to new markets with little or no risk and investment Franchisee gets: • Proven brand • Marketing exposure • Established client base • Management expertise Things to consider: • Level of economic development • Economic growth rate • Market governance policies 8 -15

Contract Manufacturing (Outsourcing) Definition: • using cheaper overseas labor for the production of finished goods or parts by following an established production process Benefits: • Lower production costs • Entry to a new market with small amounts of capital 8 -16

Challenges of Contract Manufacturing Loss of control over: • Manufacturing Process • Working Conditions • Poor Publicity • Financial Damage to Brand Examples of • Nike • Timberland bad CM: 8 -17

Destination Countries for Outsourcing: Leading Outsourcing Recipients Figure 8 -2 8 -18

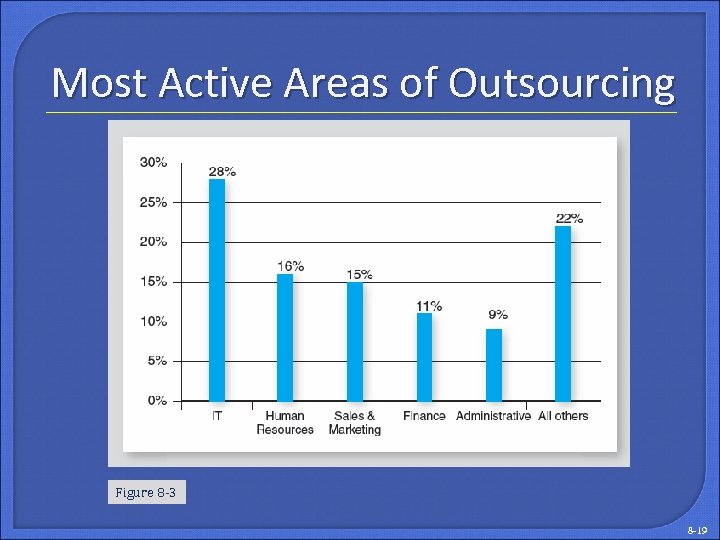

Most Active Areas of Outsourcing Figure 8 -3 8 -19

Turnkey Operations Overseas company takes care of • Design • Construction • Equipment • And often initial personnel training Then turns the operation over to the purchaser Usually contracted by governments for large projects Require long-term resource commitment 8 -20

Management Contracts A company in one country can utilize the expertise, technology, or specialized services of a company from another country to run its business for a set time and fee or percentage of sales Most widely used by hotel and airline industry Management company responsible for day-to-day operations Other decisions stay with owner No long-term financial/legal obligations 8 -21

International Joint Ventures (IJV) Form of foreign direct investment Two or more companies share ownership of a third commercial entity Ease of market entry Shared risk, knowledge and expertise Potential for synergy and competitive advantage 8 -22

Forms of IJV Two or more companies from the same country form an alliance to enter another country An overseas company joins a local company to enter its domestic market Firms from two or more countries band together in a JV formed in a third country. A foreign private business and a government agree to join forces in a pursuit of mutual interests A foreign private firm enters into a JV with a government -owned firm to enter into a third national market 8 -23

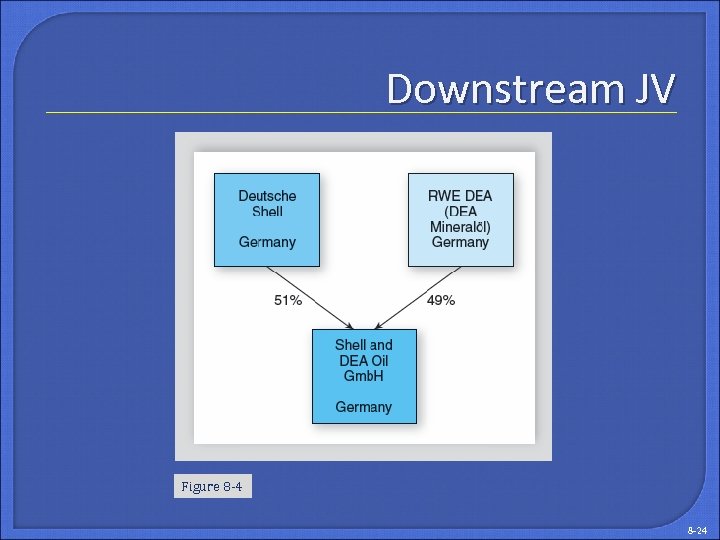

Downstream JV Figure 8 -4 8 -24

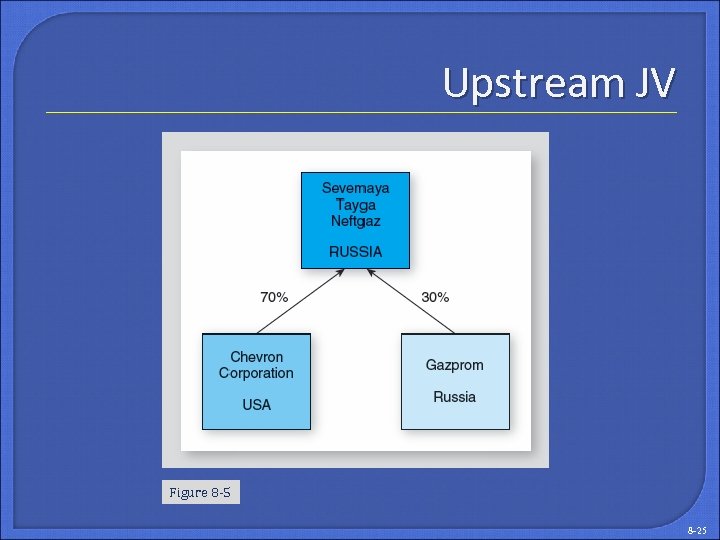

Upstream JV Figure 8 -5 8 -25

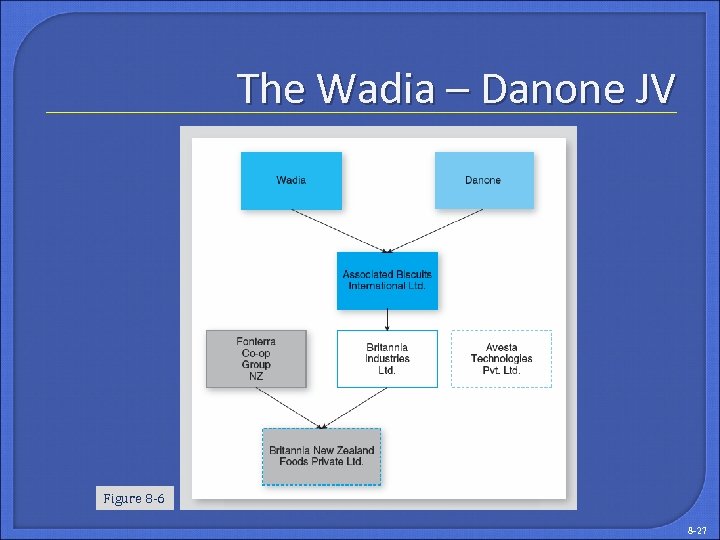

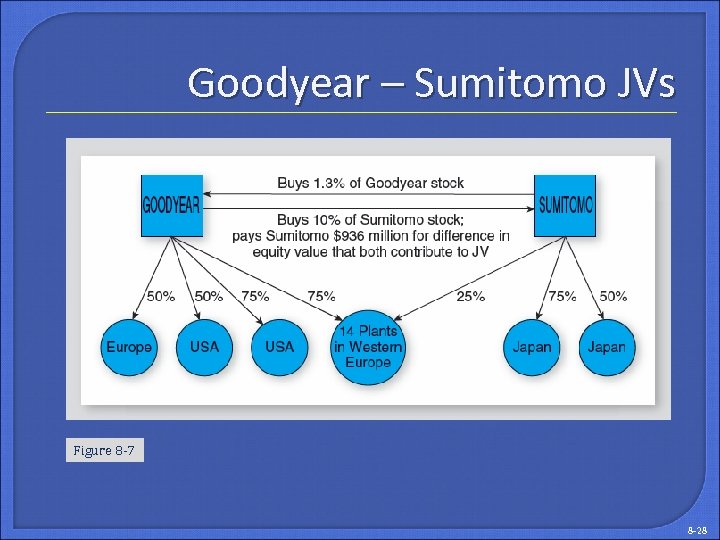

Do JVs Work? Many fail because of ‘The Prisoner’s Dilemma’ Examples: • The Wadia – Danone JV (1995) • Goodyear – Sumitomo JV (1999) 8 -26

The Wadia – Danone JV Figure 8 -6 8 -27

Goodyear – Sumitomo JVs Figure 8 -7 8 -28

Global Tire Market Shares 8 -29

Challenges/Remedies of IJV Discord Bad ideas - Reconsider arrangement Insufficient planning - Parties should agree to a comprehensive written plan Inadequate capitalization - Plan must accommodate both present and future capital needs Lack of leadership - Governing document should dictate who takes leadership in specific scenarios Lack of commitment Cultural and ideological differences - Seek corporate compatibility prior to signing 8 -30

Strategic Alliances A strategic alliance is a formal, contractual relationship between two or more firms that share resources to pursue a common goal. Non-equity agreement Vertical • Firms from different industries cooperate Horizontal • Firms are from the same industry 8 -31

Wholly Owned Subsidiaries Most capital intensive Methods: • Buy an existing Business (Brownfield Strategy) • Build new Facilities (Greenfield Strategy) Highest level of political, environmental, legal and financial risks 8 -32

Summary Several alternative entry strategies are available for global marketers. Different entry modes may be required for each market Ventures requiring limited assets may use non-equity modes of entry. High level of asset investments require equity modes of entry The more stable and economically and politically secure the country, the more inviting equity modes of entry will be Equity modes are also more appropriate for businesses with strong internal cultures and regulations. SMEs can use transaction cost theory to make informed entry decisions The choice of entry mode should be carefully considered and planned 8 -33

775938ba786624fdb0ffc7de928332ba.ppt