68774357ab16f04114ec8df84ddd5a5c.ppt

- Количество слайдов: 35

Chapter 8 • Commodity Bundling and Tie-in Sales 1

Introduction • Firms often bundle the goods that they offer – Microsoft bundles Windows and Explorer – Office bundles Word, Excel, Power. Point, Access • Bundled package is usually offered at a discount • Bundling may increase market power – GE merger with Honeywell • Tie-in sales ties the sale of one product to the purchase of another • Tying may be contractual or technological – IBM computer card machines and computer cards – Kodak tie service to sales of large-scale photocopiers – Tie computer printers and printer cartridges 2 • Why? To make money!

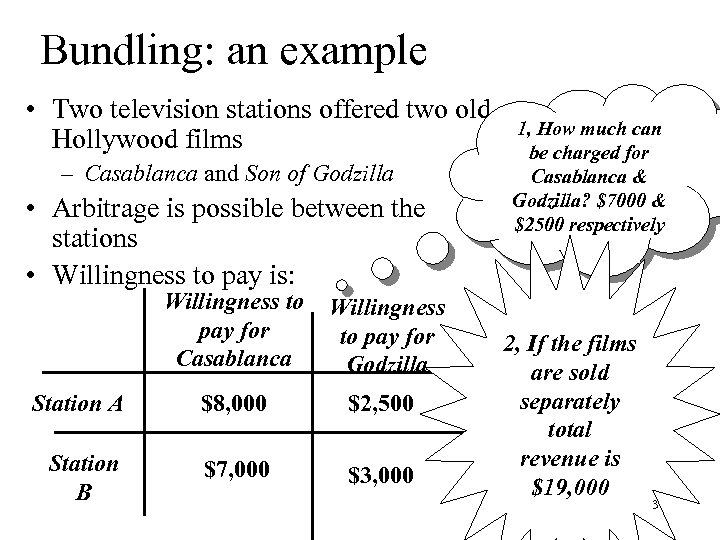

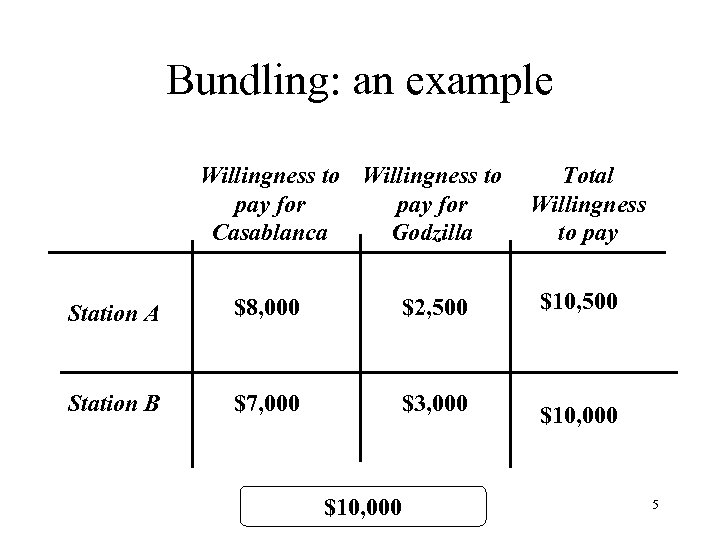

Bundling: an example • Two television stations offered two old Hollywood films – Casablanca and Son of Godzilla • Arbitrage is possible between the stations • Willingness to pay is: Willingness to pay for Casablanca Willingness to pay for Godzilla Station A $8, 000 $2, 500 Station B $7, 000 $3, 000 1, How much can be charged for Casablanca & Godzilla? $7000 & $2500 respectively 2, If the films are sold separately total revenue is $19, 000 3

Example on next page Now suppose that the two films are bundled and sold as a package How much can be charged for the package? If the films are sold as a package total revenue is $20, 000 Bundling is profitable because it exploits aggregate willingness pay 4

Bundling: an example Willingness to pay for Casablanca Godzilla Total Willingness to pay Station A $8, 000 $2, 500 $10, 500 Station B $7, 000 $3, 000 $10, 000 5

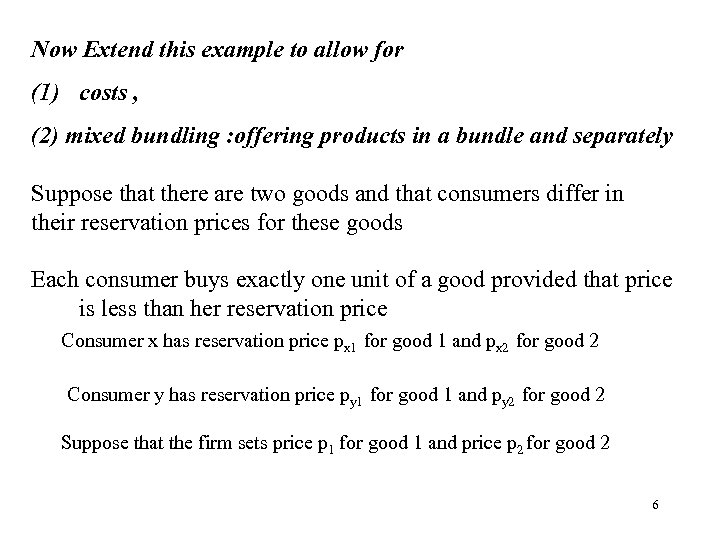

Now Extend this example to allow for (1) costs , (2) mixed bundling : offering products in a bundle and separately Suppose that there are two goods and that consumers differ in their reservation prices for these goods Each consumer buys exactly one unit of a good provided that price is less than her reservation price Consumer x has reservation price px 1 for good 1 and px 2 for good 2 Consumer y has reservation price py 1 for good 1 and py 2 for good 2 Suppose that the firm sets price p 1 for good 1 and price p 2 for good 2 6

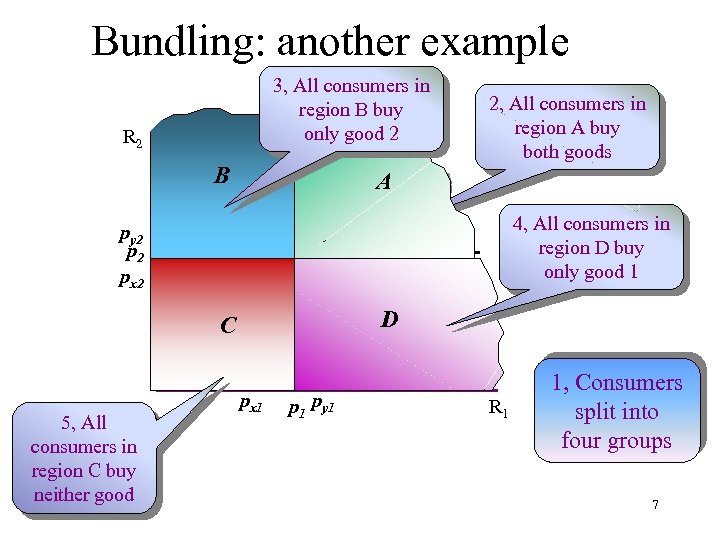

Bundling: another example 3, All consumers in region B buy only good 2 R 2 B A y py 2 px 2 4, All consumers in region D buy only good 1 x D C 5, All consumers in region C buy neither good 2, All consumers in region A buy both goods px 1 py 1 R 1 1, Consumers split into four groups 7

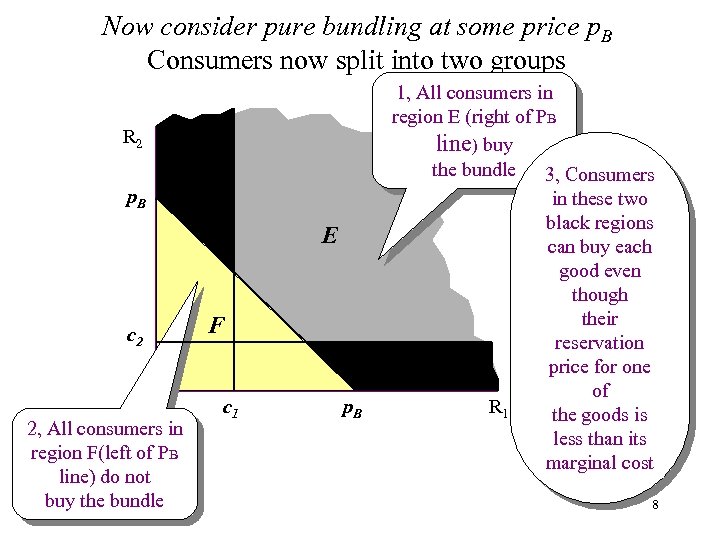

Now consider pure bundling at some price p. B Consumers now split into two groups R 2 p. B E c 2 2, All consumers in region F(left of PB line) do not buy the bundle F c 1 p. B 1, All consumers in region E (right of PB line) buy the bundle 3, Consumers in these two black regions can buy each good even though their reservation price for one of R 1 the goods is less than its marginal cost 8

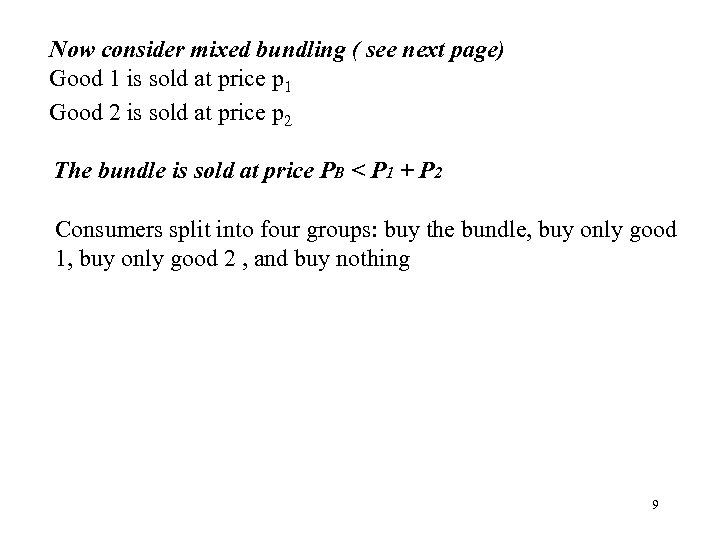

Now consider mixed bundling ( see next page) Good 1 is sold at price p 1 Good 2 is sold at price p 2 The bundle is sold at price PB < P 1 + P 2 Consumers split into four groups: buy the bundle, buy only good 1, buy only good 2 , and buy nothing 9

Mixed Bundling 5, Consume rs in this region buy only good 2 3, Consu mers in this region buy nothing R 2 p. B 8, In this region consumers buy either the bundle or product 2 p 2 1, Consumers in this region are willing to buy both goods. They buy the bundle 6, This leaves two regions, 7&8 7, In this region consumers buy either the bundle or product 1 p. B - p 1 2, Consumers in this region also buy the bundle p. B - p 2 p 1 p. B R 1 4, Consumers in this region buy only good 1 10

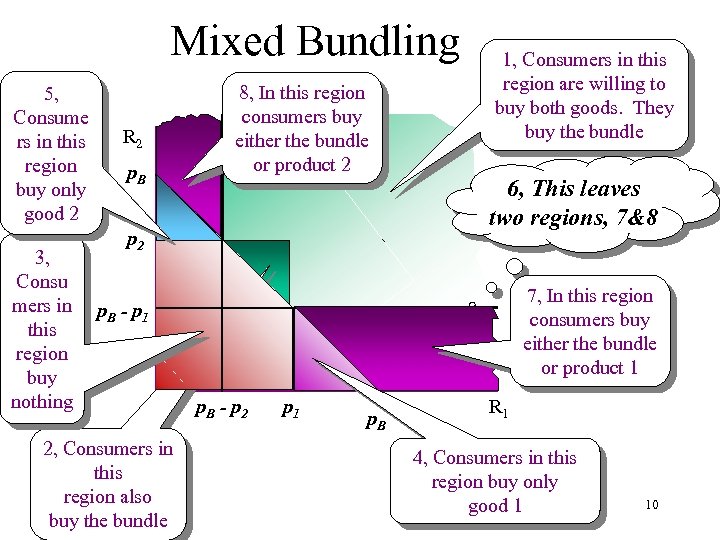

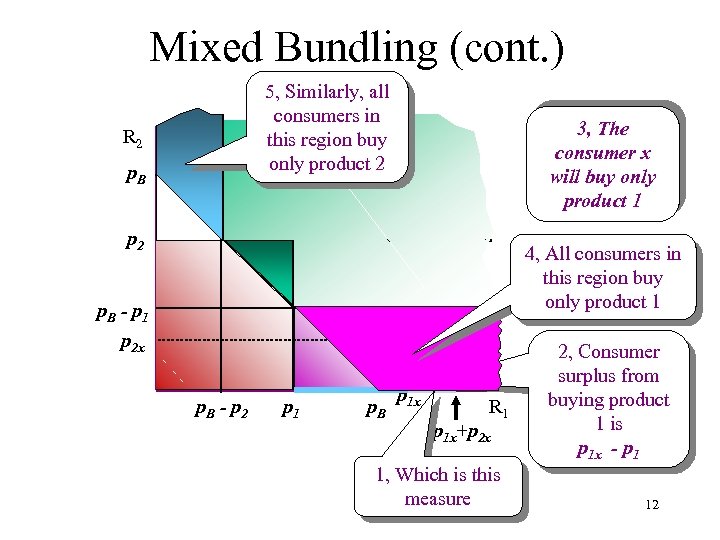

See next page Consider consumer x with reservation prices p 1 x for product 1 and p 2 x for product 2 Her aggregate willingness to pay for the bundle is p 1 x + p 2 x Consumer surplus from buying the bundle is p 1 x + p 2 x - p. B 11

Mixed Bundling (cont. ) 5, Similarly, all consumers in this region buy only product 2 R 2 p. B 3, The consumer x will buy only product 1 p 2 4, All consumers in this region buy only product 1 p. B - p 1 p 2 x x p. B - p 2 p 1 p. B p 1 x R 1 p 1 x+p 2 x 1, Which is this measure 2, Consumer surplus from buying product 1 is p 1 x - p 1 12

Mixed Bundling (cont. ) • What should a firm actually do? • There is no simple answer – mixed bundling is generally better than pure bundling – but bundling is not always the best strategy • Each case needs to be worked out on its merits 13

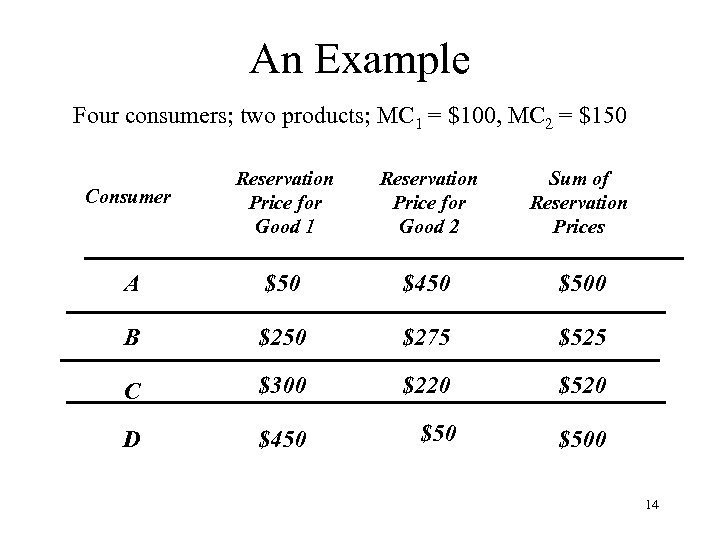

An Example Four consumers; two products; MC 1 = $100, MC 2 = $150 Consumer Reservation Price for Good 1 Reservation Price for Good 2 Sum of Reservation Prices A $50 $450 $500 B $250 $275 $525 C $300 $220 $520 D $450 $500 14

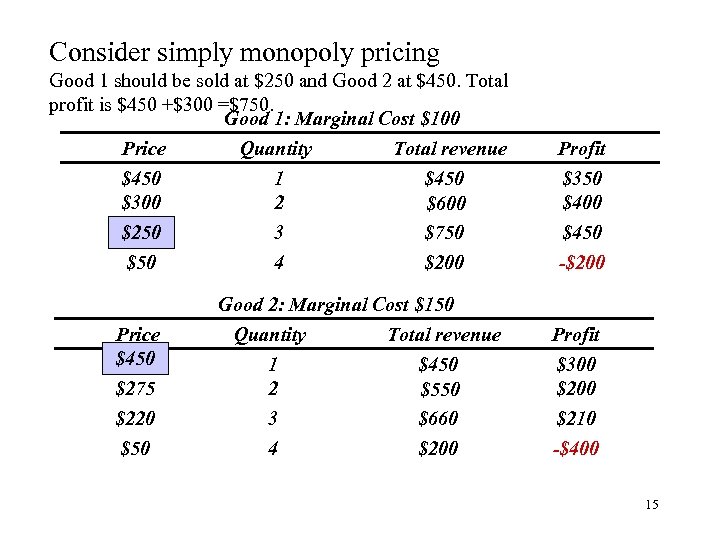

Consider simply monopoly pricing Good 1 should be sold at $250 and Good 2 at $450. Total profit is $450 +$300 =$750. Good 1: Marginal Cost $100 Price $450 $300 $250 $50 Price $450 $275 $220 $50 Quantity 1 2 3 4 Total revenue $450 $600 $750 $200 Profit $350 $400 $450 -$200 Good 2: Marginal Cost $150 Quantity Total revenue 1 $450 2 $550 3 $660 4 $200 Profit $300 $210 -$400 15

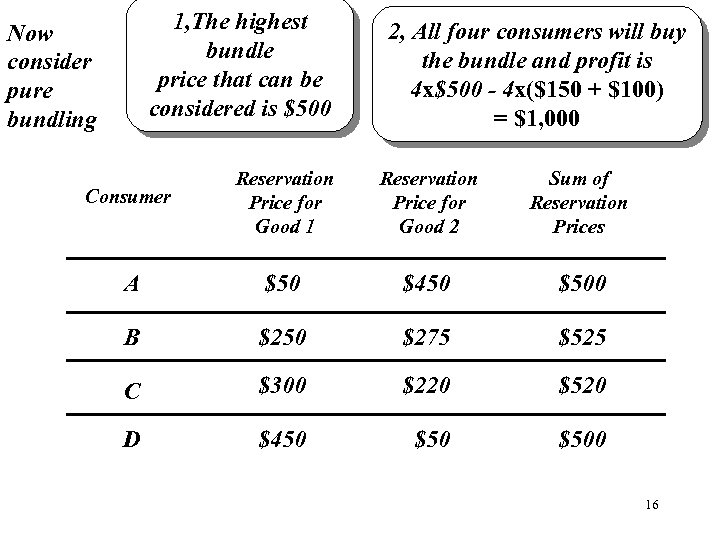

1, The highest bundle price that can be considered is $500 Now consider pure bundling 2, All four consumers will buy the bundle and profit is 4 x$500 - 4 x($150 + $100) = $1, 000 Consumer Reservation Price for Good 1 Reservation Price for Good 2 Sum of Reservation Prices A $50 $450 $500 B $250 $275 $525 C $300 $220 $520 D $450 $500 16

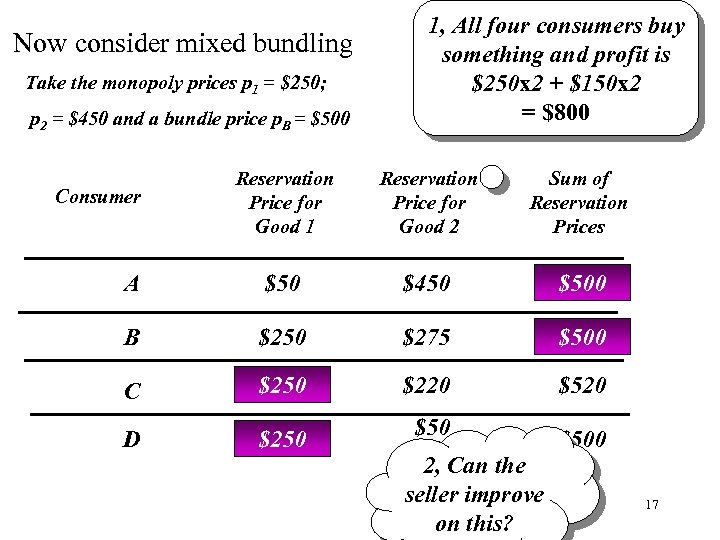

Now consider mixed bundling Take the monopoly prices p 1 = $250; p 2 = $450 and a bundle price p. B = $500 1, All four consumers buy something and profit is $250 x 2 + $150 x 2 = $800 Reservation Price for Good 1 Reservation Price for Good 2 Sum of Reservation Prices A $50 $450 $500 B $250 $275 $500 $525 C $250 $300 $220 $520 D $250 $450 $500 Consumer 2, Can the seller improve on this? 17

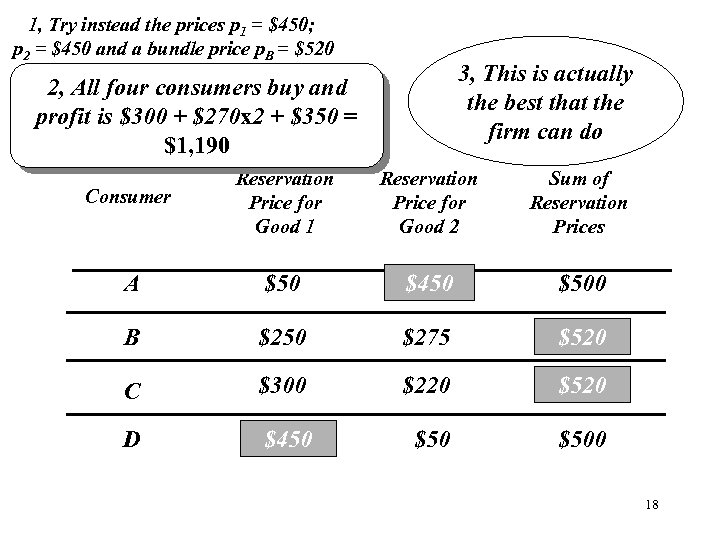

1, Try instead the prices p 1 = $450; p 2 = $450 and a bundle price p. B = $520 3, This is actually the best that the firm can do 2, All four consumers buy and profit is $300 + $270 x 2 + $350 = $1, 190 Consumer Reservation Price for Good 1 Reservation Price for Good 2 Sum of Reservation Prices A $50 $450 $500 B $250 $275 $520 $525 C $300 $220 $520 D $450 $500 18

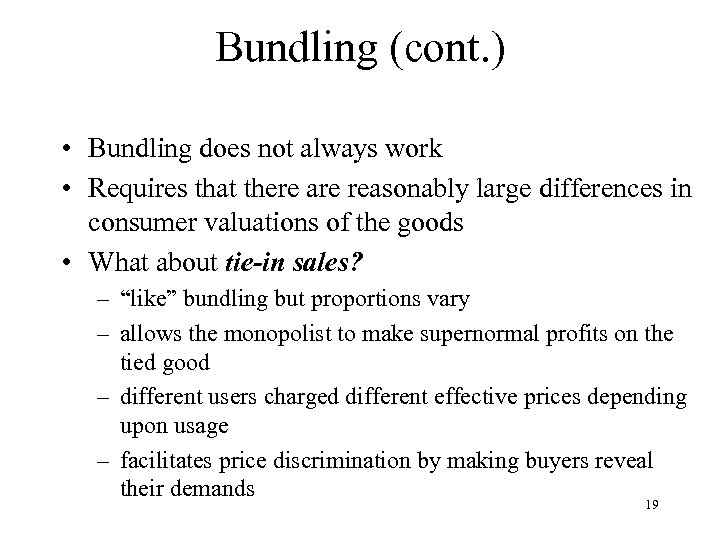

Bundling (cont. ) • Bundling does not always work • Requires that there are reasonably large differences in consumer valuations of the goods • What about tie-in sales? – “like” bundling but proportions vary – allows the monopolist to make supernormal profits on the tied good – different users charged different effective prices depending upon usage – facilitates price discrimination by making buyers reveal their demands 19

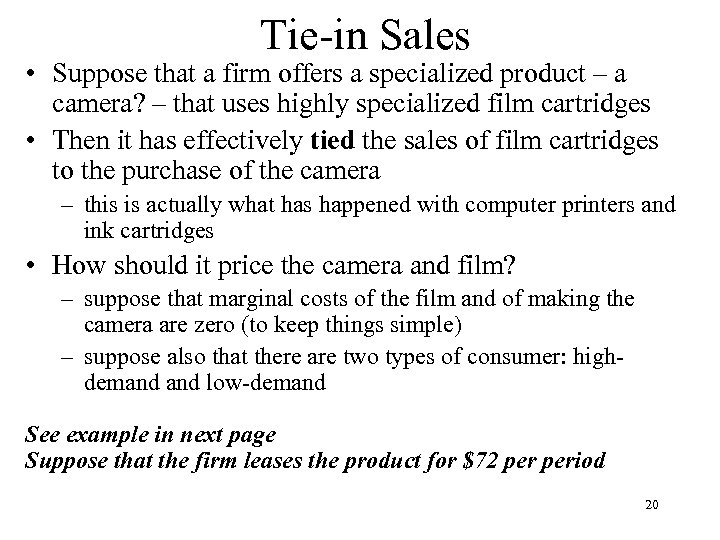

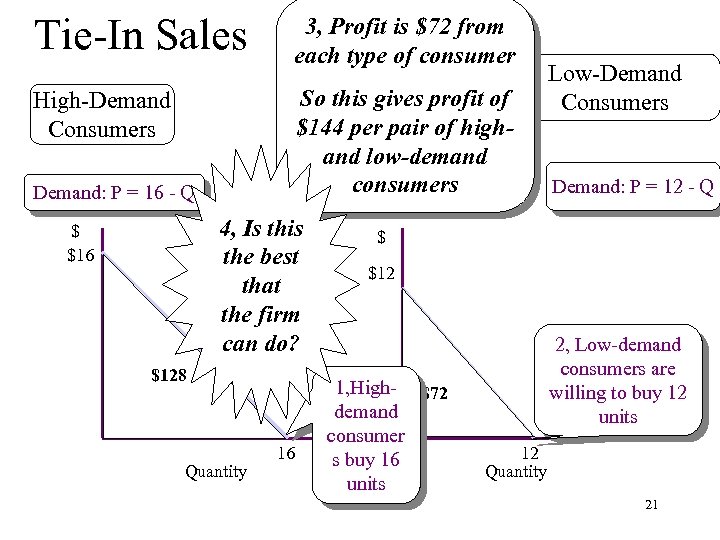

Tie-in Sales • Suppose that a firm offers a specialized product – a camera? – that uses highly specialized film cartridges • Then it has effectively tied the sales of film cartridges to the purchase of the camera – this is actually what has happened with computer printers and ink cartridges • How should it price the camera and film? – suppose that marginal costs of the film and of making the camera are zero (to keep things simple) – suppose also that there are two types of consumer: highdemand low-demand See example in next page Suppose that the firm leases the product for $72 period 20

Tie-In Sales 3, Profit is $72 from each type of consumer So this gives profit of $144 per pair of highand low-demand consumers High-Demand Consumers Demand: P = 16 - Q 4, Is this the best that the firm can do? $ $16 $128 Quantity 16 Low-Demand Consumers Demand: P = 12 - Q $ $12 1, High- $72 demand consumer s buy 16 units 2, Low-demand consumers are willing to buy 12 units 12 Quantity 21

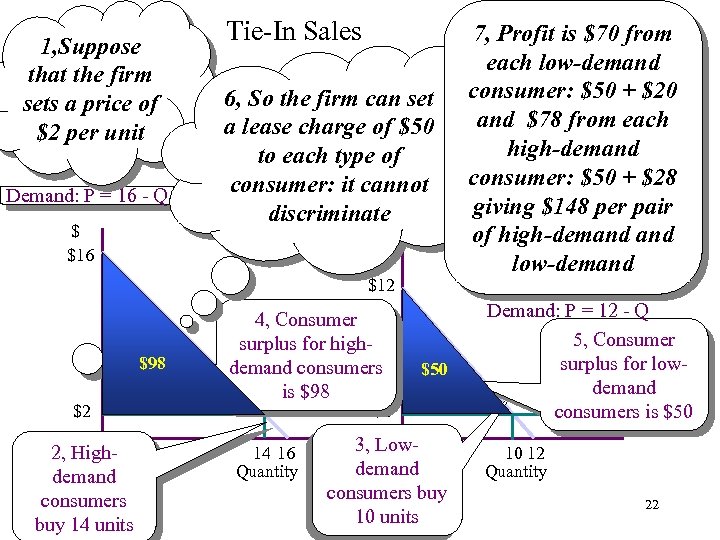

1, Suppose that the firm sets a price of $2 per unit Demand: P = 16 - Q $ $16 Tie-In Sales 7, Profit is $70 from each low-demand 6, So the firm can set consumer: $50 + $20 and $78 from each a lease charge of $50 Low-Demand high-demand Consumers to each type of consumer: $50 consumer: it cannot Demand: P = 12 - Q + $28 giving $148 per pair discriminate of high-demand $ low-demand $12 $98 $2 2, Highdemand consumers buy 14 units 4, Consumer surplus for highdemand consumers is $98 $50 $2 14 16 Quantity 3, Lowdemand consumers buy 10 units Demand: P = 12 - Q 5, Consumer surplus for lowdemand consumers is $50 10 12 Quantity 22

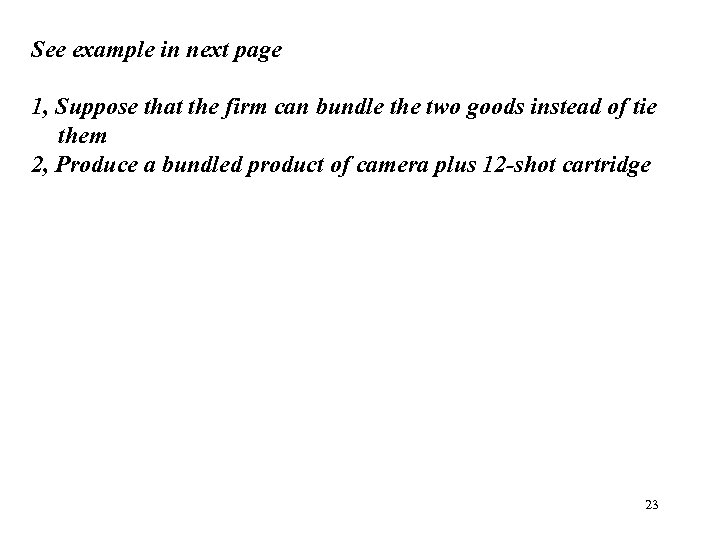

See example in next page 1, Suppose that the firm can bundle the two goods instead of tie them 2, Produce a bundled product of camera plus 12 -shot cartridge 23

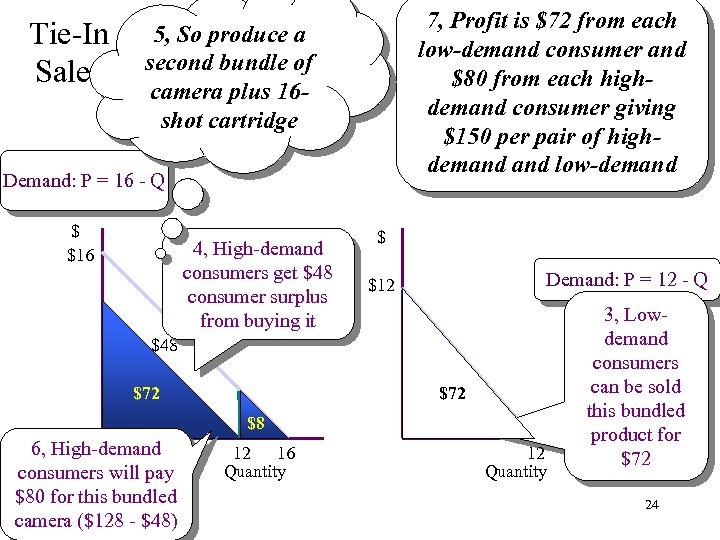

Tie-In Sales 7, Profit is $72 from each low-demand consumer and $80 from each highdemand consumer giving Low-Demand $150 per pair of high. Consumers demand low-demand 5, So produce a second bundle of camera plus 16 shot cartridge Demand: P = 16 - Q $ $16 4, High-demand consumers get $48 consumer surplus from buying it $ Demand: P = 12 - Q $12 $48 $72 $8 6, High-demand consumers will pay $80 for this bundled camera ($128 - $48) 12 16 Quantity 12 Quantity 3, Lowdemand consumers can be sold this bundled product for $72 24

Complementary Goods • Complementary goods are goods that are consumed together – nuts and bolts – PC monitors and computer processors • How should these goods be produced? • How should they be priced? • Take the example of nuts and bolts – these are perfect complements: need one of each! • Assume that demand for nut/bolt pairs is: Q = A - (PB + PN) 25

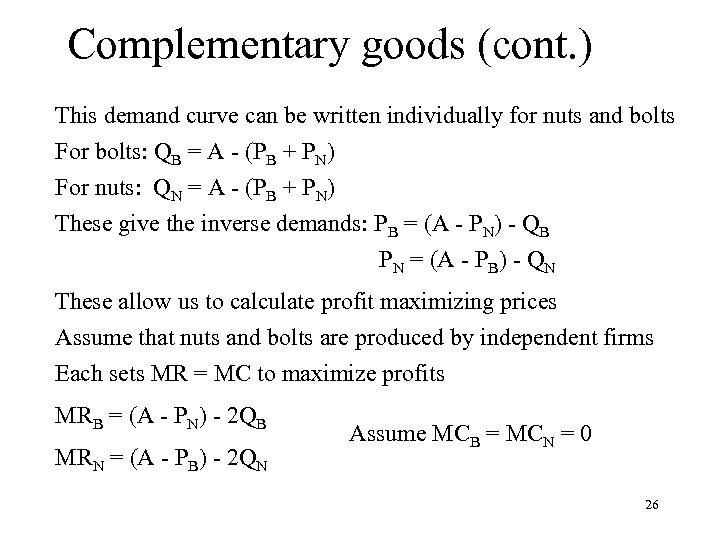

Complementary goods (cont. ) This demand curve can be written individually for nuts and bolts For bolts: QB = A - (PB + PN) For nuts: QN = A - (PB + PN) These give the inverse demands: PB = (A - PN) - QB PN = (A - PB) - QN These allow us to calculate profit maximizing prices Assume that nuts and bolts are produced by independent firms Each sets MR = MC to maximize profits MRB = (A - PN) - 2 QB MRN = (A - PB) - 2 QN Assume MCB = MCN = 0 26

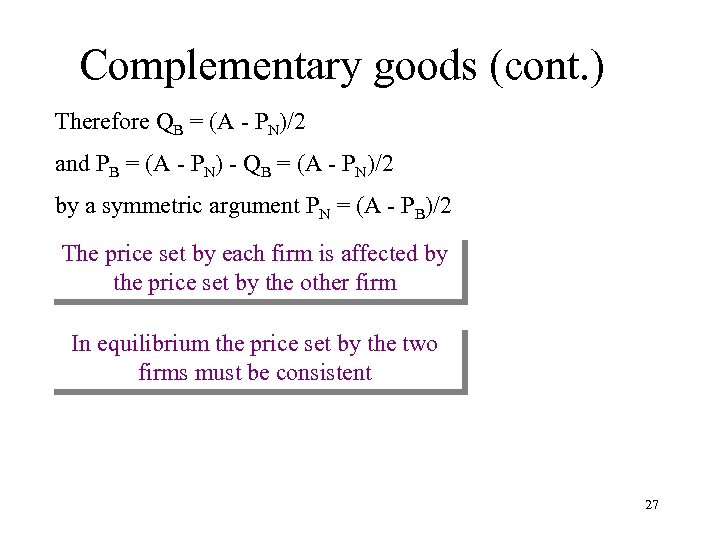

Complementary goods (cont. ) Therefore QB = (A - PN)/2 and PB = (A - PN) - QB = (A - PN)/2 by a symmetric argument PN = (A - PB)/2 The price set by each firm is affected by the price set by the other firm In equilibrium the price set by the two firms must be consistent 27

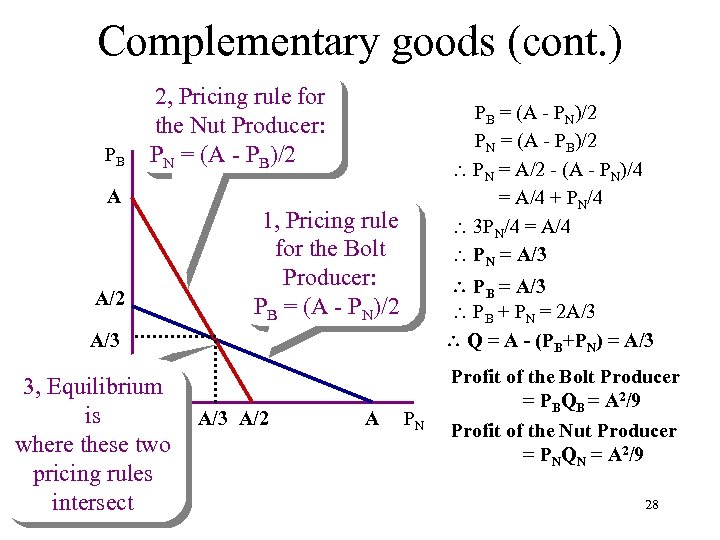

Complementary goods (cont. ) PB 2, Pricing rule for the Nut Producer: PN = (A - PB)/2 A A/2 PB = (A - PN)/2 PN = (A - PB)/2 PN = A/2 - (A - PN)/4 = A/4 + PN/4 3 PN/4 = A/4 PN = A/3 1, Pricing rule for the Bolt Producer: PB = (A - PN)/2 PB = A/3 PB + PN = 2 A/3 Q = A - (PB+PN) = A/3 3, Equilibrium is where these two pricing rules intersect A/3 A/2 A PN Profit of the Bolt Producer = PBQB = A 2/9 Profit of the Nut Producer = PNQN = A 2/9 28

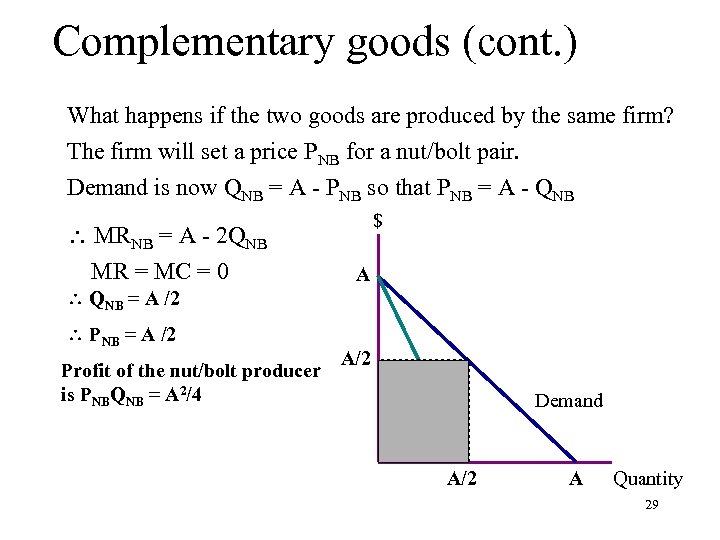

Complementary goods (cont. ) What happens if the two goods are produced by the same firm? The firm will set a price PNB for a nut/bolt pair. Demand is now QNB = A - PNB so that PNB = A - QNB MRNB = A - 2 QNB MR = MC = 0 QNB = A /2 PNB = A /2 Profit of the nut/bolt producer is PNBQNB = A 2/4 $ A A/2 Demand MR A/2 A Quantity 29

Merger of the two firms results in consumers being charged lower prices and the firm making greater profits. Why? Because the merged firm is able to coordinate the prices of the two goods 30

Complementary goods • Don’t necessarily need a merger to get these benefits – product network • ATM networks • airline booking systems – one of the markets is competitive • price equals marginal cost in this market • leads to the “merger” outcome • There may also be a countervailing force – network externalities • value of a good to consumers increases when more consumers use the good 31

Network externalities • Product complementarities can generate network effects – Windows and software applications • substantial economies of scale • strong network effects – leads to an applications barrier to entry • new operating system will sell only if applications are written for it • but… • So product complementarities can lead to monopoly power being extended 32

Anti-trust and bundling • The Microsoft case is central – accusation that used power in operating system (OS) to gain control of browser market by bundling browser into the OS – need to show • monopoly power in OS • OS and browser are separate products that do not need to be bundled • abuse of power to maintain or extend monopoly position – Microsoft argued that technology required integration – further argued that it was not “acting badly” • consumers would benefit from lower price because 33 of the complementarity between OS and browser

Microsoft and Netscape • Complementarity products – so merge? – what if Netscape refuses? – then Microsoft can develop its own browser – MC ≈ 0 so competition in the browser market drives price close to zero – but then get the outcome of merger firm through competition • So Microsoft is not “acting badly” • But – JAVA allows applications to be run on Internet browsers – Netscape then constitutes a threat 34 – need to reduce their market share

Antitrust and tying arrangements • Tying arrangements have been the subject of extensive litigation • Current policy – tie-in violates antitrust laws if • there exists distinct products: tying product and tied one • firm tying the products has sufficient monopoly power in the tying market to force purchase of the tied good • tying arrangement forecloses or has the potential to foreclose a substantial volume of trade 35

68774357ab16f04114ec8df84ddd5a5c.ppt