a24a6d6850d99bc5043e139e73b4c66d.ppt

- Количество слайдов: 34

CHAPTER 8 BOND VALUATION AND INTEREST RATES

Chapter outline • • • Introduction What is a bond? Characteristics of bonds How to value a bond The different types of bonds Bond markets and bond ratings What determines bond yields? The influence of interest and inflation rates on bonds Conclusions

Learning outcomes By the end of this chapter, you should be able to: • Explain what a bond is and the main characteristics of a bond • Calculate the value of a bond • Describe the various types of bonds, bond markets and bond ratings • Examine what determines bond yields • Explain the relationship between bonds, interest rates and the inflation rate.

Introduction • A form of debt financing • Used by governments and the corporate sector, usually to finance expansion • Determine a bond’s current value by calculating the present value of all the future cash flows

What is a bond? • Companies or governments in need of bonds can borrow money from the public on a long-term basis • The public buys the bond from the borrower (bond issuer) and becomes the lender (bond holder) • The bond issuer is obliged to pay interest (coupons) to the lender at fixed intervals • At the end of the life of the bond (maturity), the bond issuer has to repay the principal amount (par/nominal amount) to the bond holder • Bond issuer generally uses to funds from the bond issue to finance long-term investments/current expenditure

Characteristics of a bond • Nominal amount • Amount borrowed and repaid at the end of the life of the bond • Coupon rate • Fixed interest rate that the issuer pays the bond holder every period • Coupon • Amount that the issuer pays the bond holder every period • Maturity • Time left until the bond reaches the end of its term and the nominal value has to be repaid • Yield-to-maturity (YTM) • Interest rate required on bonds. Not fixed rate, but fluctuates

Characteristics of a bond • Bonds = interest-only loans • Annuity = makes fixed payments for a specific period of time • Therefore, bond = annuity • If YTM > coupon rate § Investors in the market receive a higher interest rate than bond investors § To attract investors they should be compensated by selling the bond at a cheaper price (trading at a discount) • If coupon rate > YTM § Bond investors will receive a higher interest rate than investors in the market § They will have to pay for the privilege by selling the bond at a more expensive price (trading at a premium)

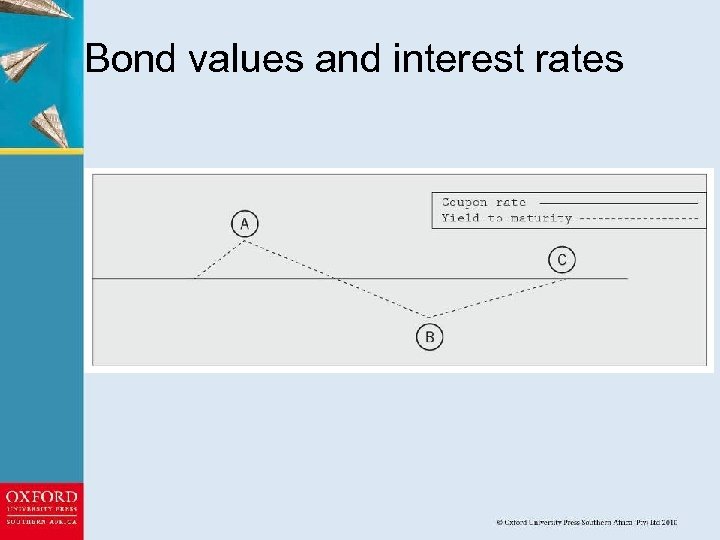

Bond values and interest rates

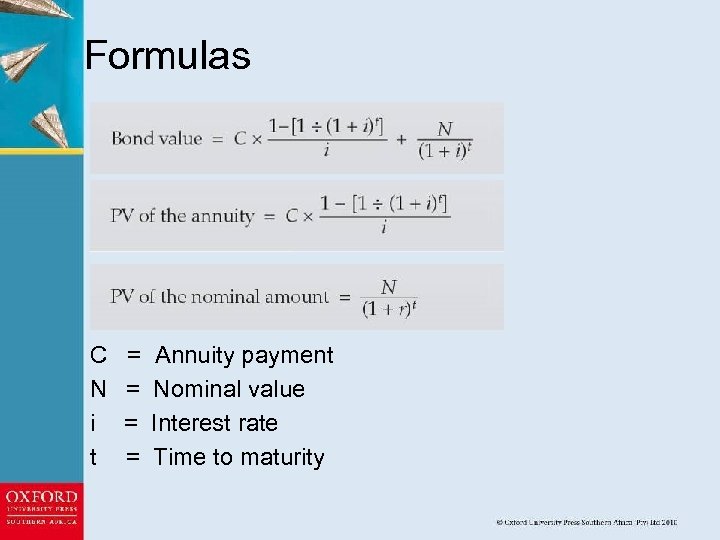

How to value a bond • • Calculating the value of a bond = 5 variables With any 4 variables, the 5 th can be calculated Bond = annuity PV of an annuity: Calculating all the future cash flows and adding them together • Bond = 2 parts § Annuity part (coupon payments) § Nominal value (paid at maturity) • Calculated separately and added together • Bond PV = PV of annuity + PV of nominal value

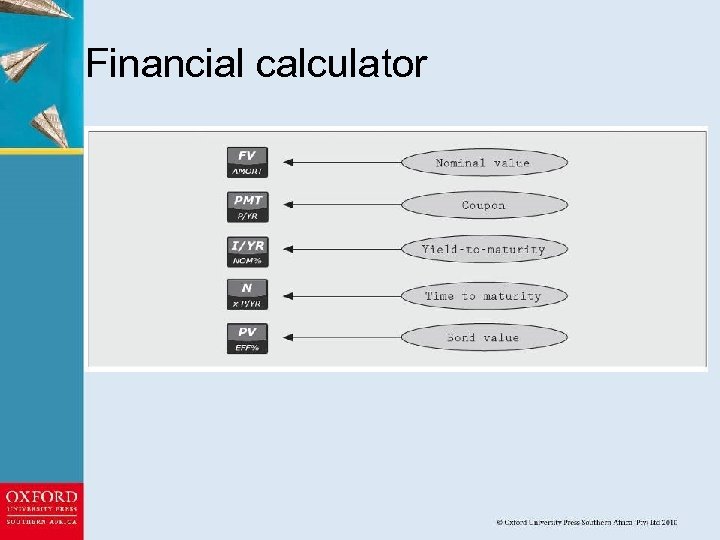

Financial calculator

Formulas C N i t = = Annuity payment Nominal value Interest rate Time to maturity

Calculating the PV of the bond Ladybird Ltd. wants to sell bonds with a nominal value of R 1 000 that pay annual coupons at a rate of 12% for a period of 7 years. The interest rate in the market is 13%. What is the current value of the Ladybird bond? Formula Annuity Financial Calculator 1 -[1/(1+i)t] =Cx i 1 -[1/(1. 13)7] = 120 x 0. 13 = 120 x 4. 422610 = 530. 71 Nominal = = = N (1+i)t 1000 (1. 13)7 425. 06 R 530. 71 + R 425. 06 = R 955. 77 1000 120 13 7 PV = FV PMT I/YR N -955. 77

Timeline of cash inflows and outflows

Semi-annual payments • South African bonds are mostly semi-annual • Make 2 payments a year (every 6 months) • Therefore, 3 things needs to happen: § The maturity has to double (maturity x 2) § The coupon rate has to be halved (coupon rate ÷ 2) § The yield-to-maturity has to be halved (YTM ÷ 2)

Semi-annual payments • The reason for this is that instead of receiving for instance 10% per year in coupons for a 10 year period, the company: § Makes 2 payments a year of 5% each § There are 2 payments a year for 10 years, therefore 20 periods § The YTM also has to be halved

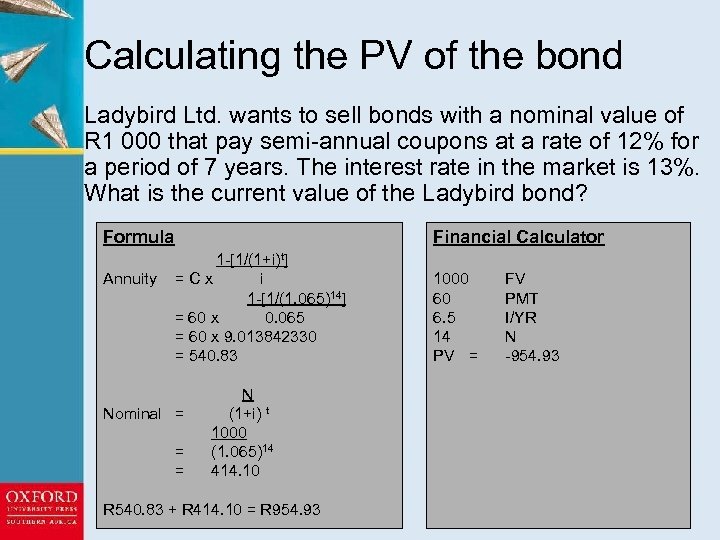

Calculating the PV of the bond Ladybird Ltd. wants to sell bonds with a nominal value of R 1 000 that pay semi-annual coupons at a rate of 12% for a period of 7 years. The interest rate in the market is 13%. What is the current value of the Ladybird bond? Formula Annuity Financial Calculator 1 -[1/(1+i)t] =Cx i 1 -[1/(1. 065)14] = 60 x 0. 065 = 60 x 9. 013842330 = 540. 83 Nominal = = = N (1+i) t 1000 (1. 065)14 414. 10 R 540. 83 + R 414. 10 = R 954. 93 1000 60 6. 5 14 PV = FV PMT I/YR N -954. 93

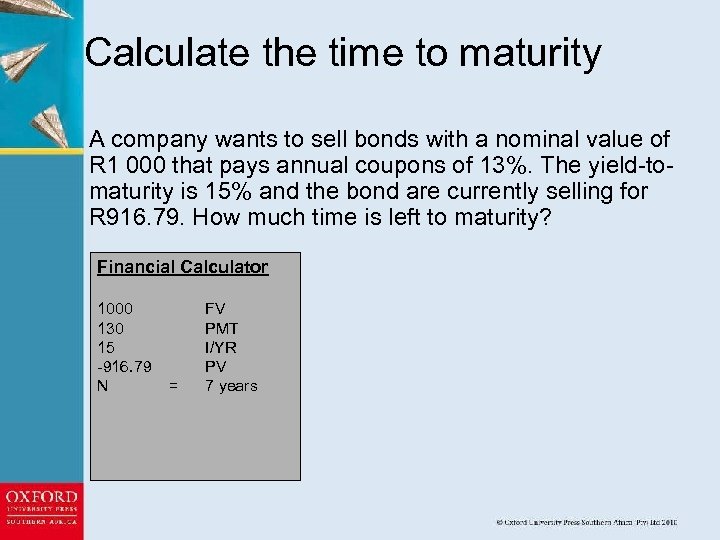

Calculate the time to maturity A company wants to sell bonds with a nominal value of R 1 000 that pays annual coupons of 13%. The yield-tomaturity is 15% and the bond are currently selling for R 916. 79. How much time is left to maturity? Financial Calculator 1000 130 15 -916. 79 N = FV PMT I/YR PV 7 years

![Calculate the coupon rate Formula 1 -[1/(1+i)t] Annuity = C x i 1 -[1/(1. Calculate the coupon rate Formula 1 -[1/(1+i)t] Annuity = C x i 1 -[1/(1.](https://present5.com/presentation/a24a6d6850d99bc5043e139e73b4c66d/image-18.jpg)

Calculate the coupon rate Formula 1 -[1/(1+i)t] Annuity = C x i 1 -[1/(1. 15)6] =Cx 0. 15 = C x 3. 7844827 N Nominal = (1+i)t 1000 = (1. 15)6 = 432. 33 R 921 - R 432. 33 = R 488. 67 = C x 3. 7844827 C = 129. 12 Coupon rate = 129. 12/1 000 = 12. 91% A company wants to sell bonds with a nominal value of R 1 000 that pays annual coupons for 6 years. The yield-to-maturity is 15% and the bond are currently selling for R 921. What is the coupon rate of the bond? Financial Calculator 1000 6 15 -921 PMT Coupon rate = FV N I/YR PV 129. 125 = = 129. 125/1 000 12. 91%

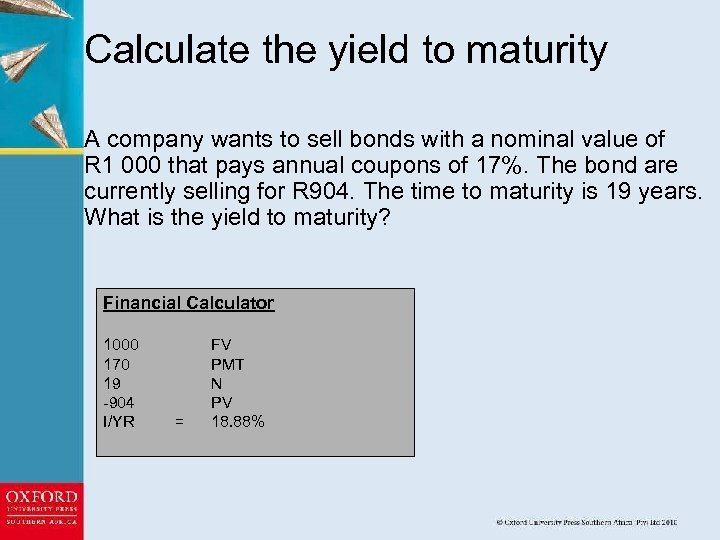

Calculate the yield to maturity A company wants to sell bonds with a nominal value of R 1 000 that pays annual coupons of 17%. The bond are currently selling for R 904. The time to maturity is 19 years. What is the yield to maturity? Financial Calculator 1000 170 19 -904 I/YR = FV PMT N PV 18. 88%

The different types of bonds • Government bonds § Treasury bills: maturity of less than 1 year § Treasury notes: maturity between 1 and 10 years § Treasury bonds: maturity longer than 10 years • Municipal bonds § Municipalities support debt with property taxes • Corporate bonds § Higher yields – higher risk (lower than governments) § Companies are classified according to: • Specific industry • Credit rating

The different types of bonds • Convertible bonds § Gives the owner the right to convert the nominal amount to ordinary shares You own a R 1000 bond and you can convert your bond into ordinary shares at a ratio of 4: 1. Therefore, with R 1000, you can get R 250 worth of shares (R 1000/4) • Junk bonds § High-yield bonds § Highly risky and speculative § Higher return

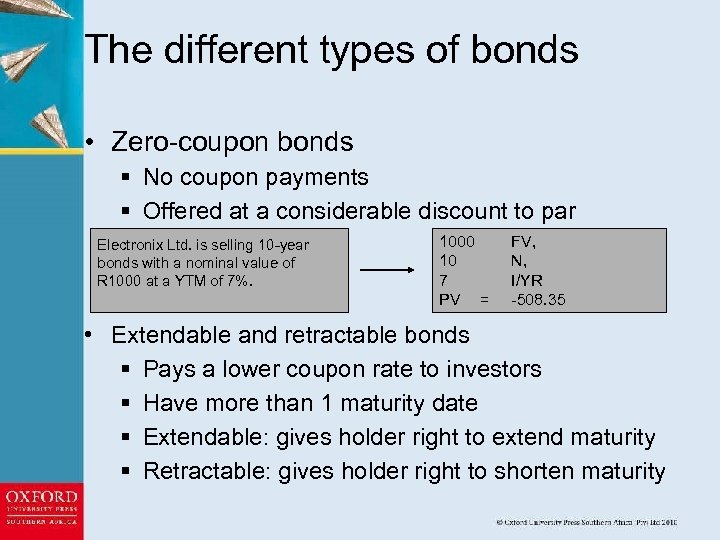

The different types of bonds • Zero-coupon bonds § No coupon payments § Offered at a considerable discount to par Electronix Ltd. is selling 10 -year bonds with a nominal value of R 1000 at a YTM of 7%. 1000 10 7 PV = FV, N, I/YR -508. 35 • Extendable and retractable bonds § Pays a lower coupon rate to investors § Have more than 1 maturity date § Extendable: gives holder right to extend maturity § Retractable: gives holder right to shorten maturity

The different types of bonds • Foreign-currency bonds § Issued in a currency other than the issuer’s own currency § USA = Yankee bonds § Japanese Yen bonds = Samurai bonds § British Pound bonds = Bulldog bonds § New Zealand dollar bonds = Kiwi bonds • Inflation-linked bonds § Provides protection against inflation § Increasing the nominal value by the change in inflation

Bond markets and reporting • Most markets are OTC markets (over-thecounter) • Collection of dealers around the world who buy and sell bonds (via electronic networks) • Bond markets = debt, credit or fixed-income markets • NYSE: both a stock and a bond exchange • JSE: Bought BESA (Bond Exchange of South Africa), therefore the JSE trade in both shares and bonds

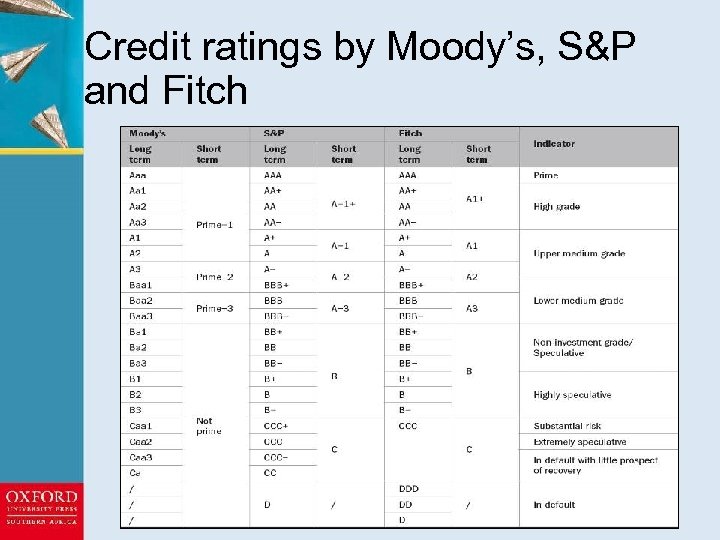

Bond ratings • Bonds are rated according to the creditworthiness of the issuing entity • World’s leading rating agencies: § Moody’s § Standard & Poor’s (S&P) § Fitch • All bonds with a rating of BB and less can be rated as junk bonds • South Africa: BBB+ = Strong capacity to pay interest and repay principal, but susceptible to adverse effects and economic conditions

Credit ratings by Moody’s, S&P and Fitch

What determines bond returns? • Real interest rate & expected inflation rate § Increase in these rates increases the return • Interest rate risk and time to maturity § The longer the time to maturity, the higher the return § Risk of interest rate changes (interest rate premium) • Default risk § The risk of default (non-payment) § Credit risk premium • Lack of liquidity § The ease with which assets are converted into cash § Liquidity premium

The influence of interest and inflation rates • Major influence on bond yield is the inflation and market interest rate • Nominal interest rate: has not been adjusted for inflation (inflation is still included) • Real interest rate: has been adjusted for inflation (inflation not included) • Inflation: the sustained, rapid increase in the general price level (decreasing purchasing power of the currency) FV of the investment 1 – inflation rate = real amount Real amount – original amount x 100 = real interest rate

The Fisher Effect • The relationship between the nominal interest rate, real interest rate and inflation rate is important to ultimately know what you can buy with your money (purchasing power) • Necessary to receive compensation for the effect that inflation has on purchasing power • Fisher effect: 1 + n = (1 + r) x (1 + i) Where n = nominal rate r = real rate i = inflation rate

Conclusion • A bond is a debt instrument issued either by a government or a corporation in need of funds. The bond pays interest on the nominal amount (coupon payments). The loan has a fixed maturity and when it reaches maturity, the nominal amount is repaid. • A bond consists of the following variables: § § § Nominal value Coupon rate Coupon YTM Maturity Price of the bond

Conclusion (cont. ) • When the YTM (the interest rate in the market) and the coupon rate differ, the price of the bond will also differ from the nominal value of the bond. When the interest rate in the market goes up, the price of the bond goes down to compensate the investor for earning a lower coupon rate (trading at a discount). • When the YTM is lower then the coupon rate, the price of the bond will increase relative to the nominal value. The price of the bond will be more because the bond will pay a higher coupon rate than in the market and, therefore, the investor has to pay more for that privilege.

Conclusion (cont. ) • If the YTM and the coupon rate are equal, then the price of the bond will equal the nominal value. • When calculating the price of a bond, the PV of the lump sum paid out at maturity (the nominal value) will have to be calculated and added to the PV of all the future cash flows (the coupon payments). • A bond that makes semi-annual payments makes two payments a year – once ever six months. This means that the coupon rate has to be divided by two, and the coupon payment and maturity will have to be multiplied by two.

Conclusion (cont. ) • There are various types of bonds, namely government, municipal, corporate, convertible, zero-coupon, extendable, retractable, foreign currency, junk and inflation-linked bonds. • The New York Stock Exchange is the biggest bond exchange in the world; South Africa’s BESA is a leader in emerging economies. Mostly, the bond market is an OTC market. • Moody’s, Standard & Poor’s and Fitch are three main credit-rating agencies.

Conclusion (cont. ) • Bonds are rated in order to indicate to investors the level of risk of payment default. • The bond coupon rate is dependent on the real interest rate implicit in the coupon, the expected inflation rate, the time left to maturity, and the interest rate risk, default risk and liquidity risk. • The difference between real and nominal interest rates is that the real interest rate has been adjusted for inflation, where the nominal rate has not been adjusted for inflation. • The Fisher Effect illustrates the relationship between the nominal rate, real rate and inflation rate.

a24a6d6850d99bc5043e139e73b4c66d.ppt