Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

Chapter 8 - An Introduction to Asset Pricing Models

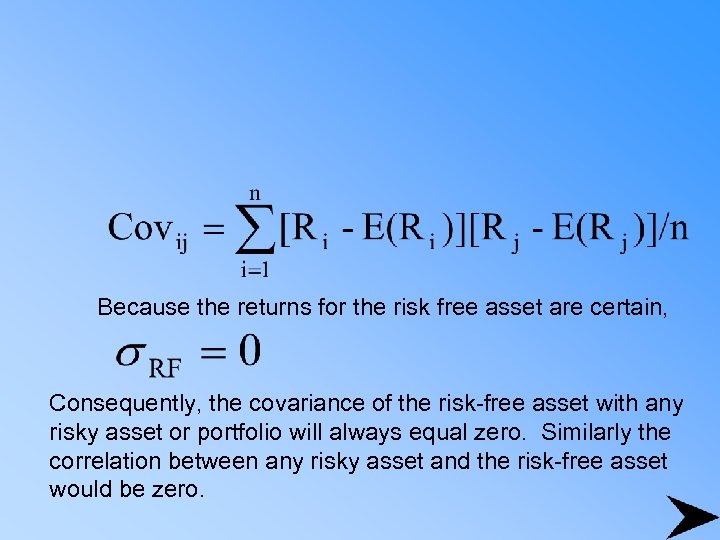

Because the returns for the risk free asset are certain, Consequently, the covariance of the risk-free asset with any risky asset or portfolio will always equal zero. Similarly the correlation between any risky asset and the risk-free asset would be zero.

Because the returns for the risk free asset are certain, Consequently, the covariance of the risk-free asset with any risky asset or portfolio will always equal zero. Similarly the correlation between any risky asset and the risk-free asset would be zero.

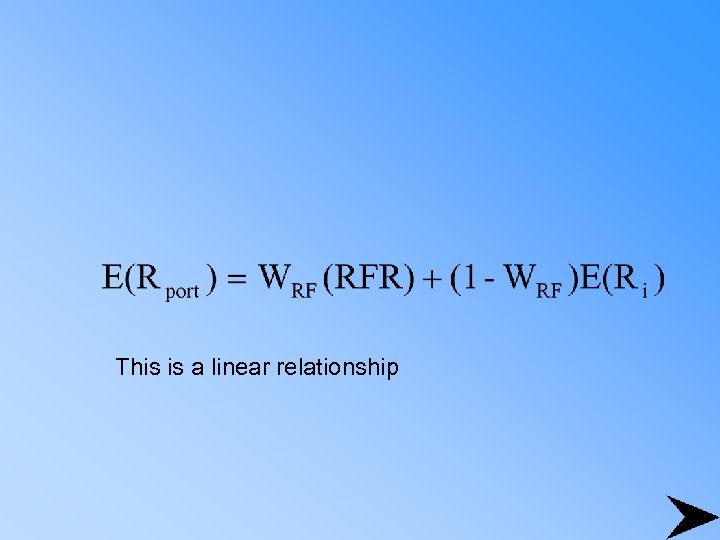

This is a linear relationship

This is a linear relationship

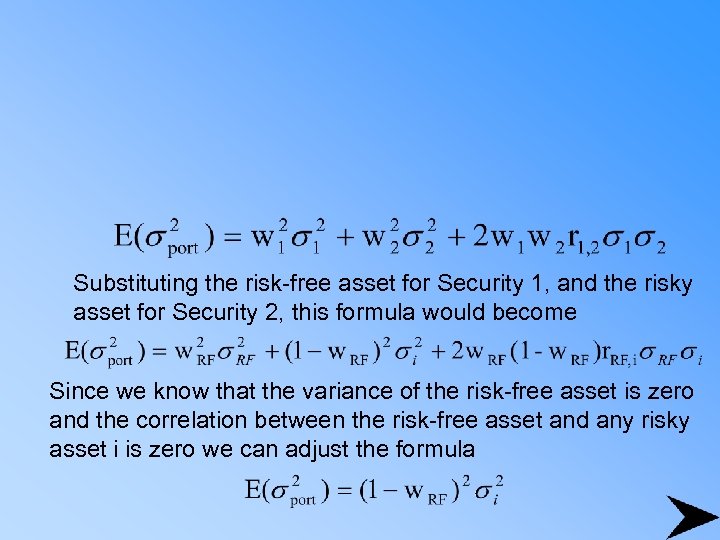

Substituting the risk-free asset for Security 1, and the risky asset for Security 2, this formula would become Since we know that the variance of the risk-free asset is zero and the correlation between the risk-free asset and any risky asset i is zero we can adjust the formula

Substituting the risk-free asset for Security 1, and the risky asset for Security 2, this formula would become Since we know that the variance of the risk-free asset is zero and the correlation between the risk-free asset and any risky asset i is zero we can adjust the formula

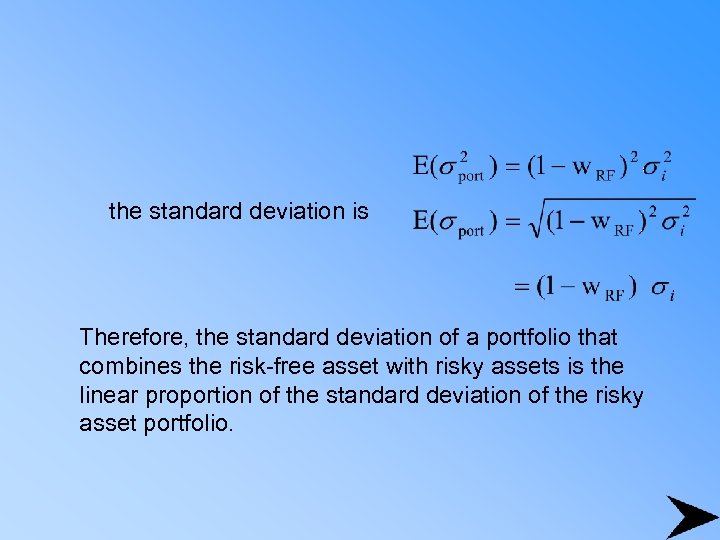

the standard deviation is Therefore, the standard deviation of a portfolio that combines the risk-free asset with risky assets is the linear proportion of the standard deviation of the risky asset portfolio.

the standard deviation is Therefore, the standard deviation of a portfolio that combines the risk-free asset with risky assets is the linear proportion of the standard deviation of the risky asset portfolio.

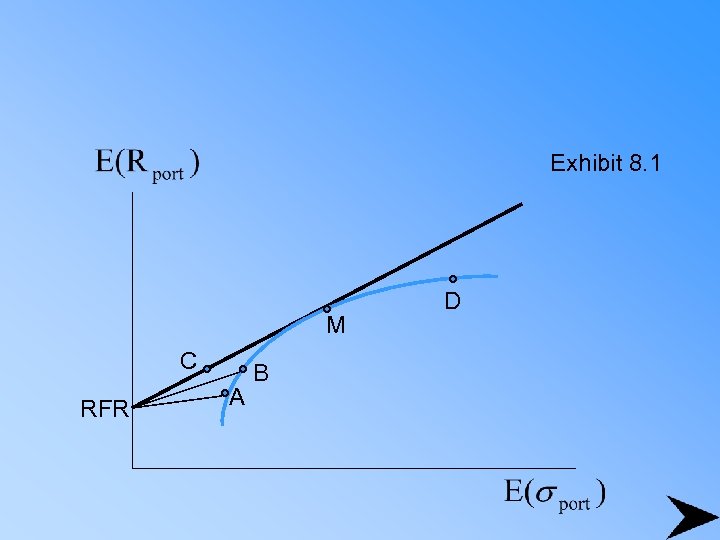

Exhibit 8. 1 M C RFR A B D

Exhibit 8. 1 M C RFR A B D

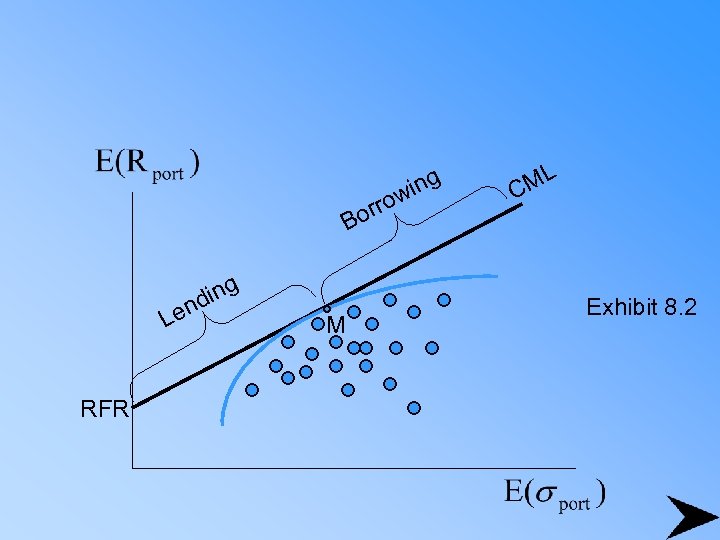

orr B ing nd Le RFR M o ing w ML C Exhibit 8. 2

orr B ing nd Le RFR M o ing w ML C Exhibit 8. 2

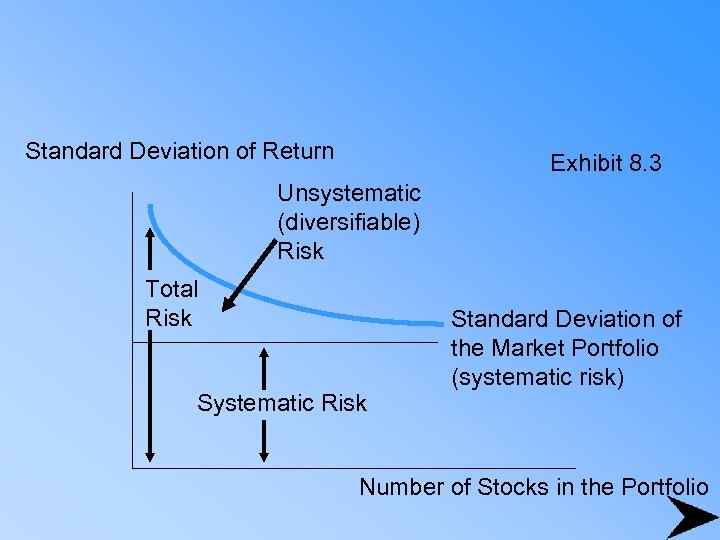

Standard Deviation of Return Exhibit 8. 3 Unsystematic (diversifiable) Risk Total Risk Systematic Risk Standard Deviation of the Market Portfolio (systematic risk) Number of Stocks in the Portfolio

Standard Deviation of Return Exhibit 8. 3 Unsystematic (diversifiable) Risk Total Risk Systematic Risk Standard Deviation of the Market Portfolio (systematic risk) Number of Stocks in the Portfolio

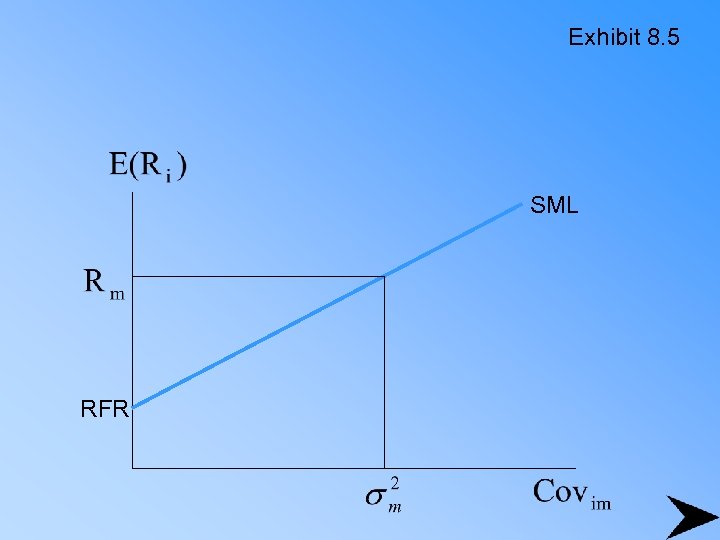

Exhibit 8. 5 SML RFR

Exhibit 8. 5 SML RFR

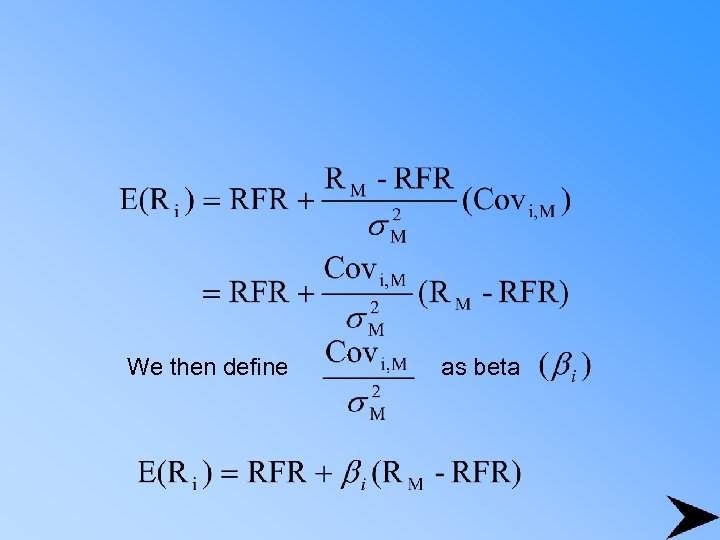

We then define as beta

We then define as beta

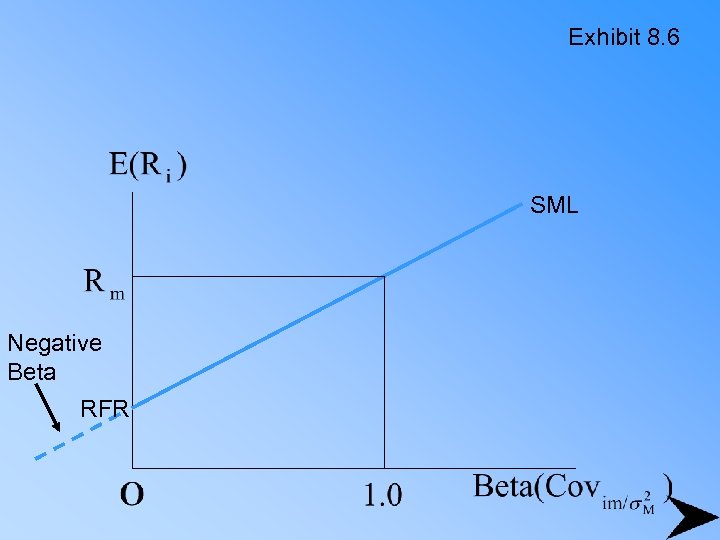

Exhibit 8. 6 SML Negative Beta RFR

Exhibit 8. 6 SML Negative Beta RFR

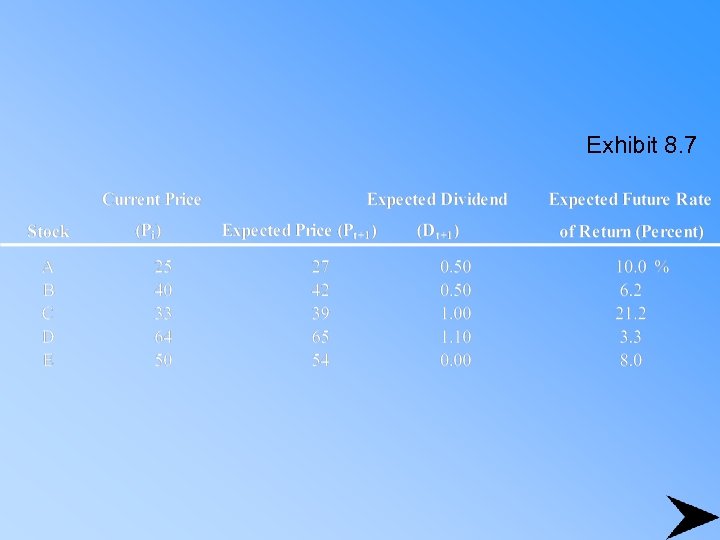

Exhibit 8. 7

Exhibit 8. 7

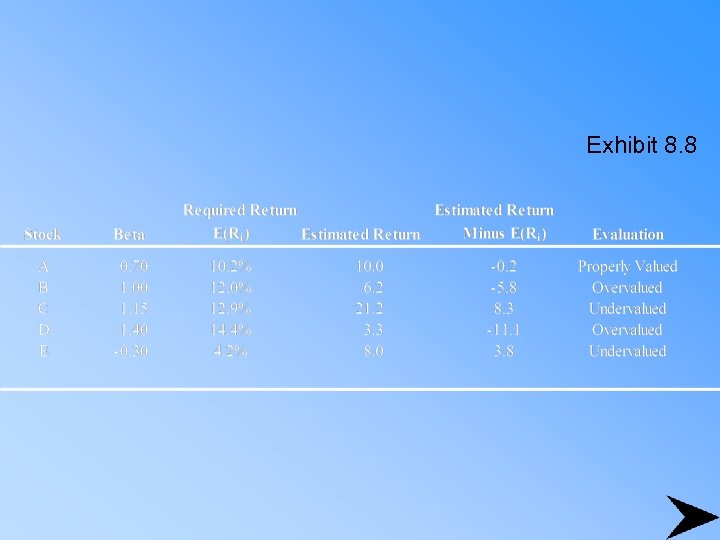

Exhibit 8. 8

Exhibit 8. 8

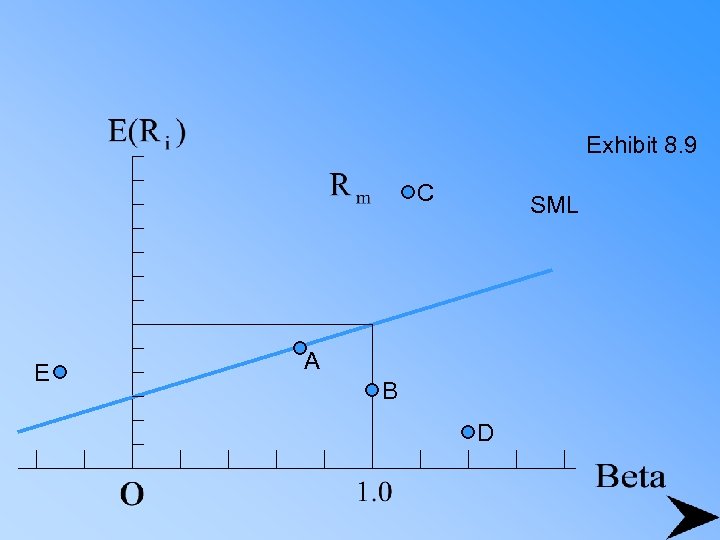

Exhibit 8. 9 C E SML A B D

Exhibit 8. 9 C E SML A B D

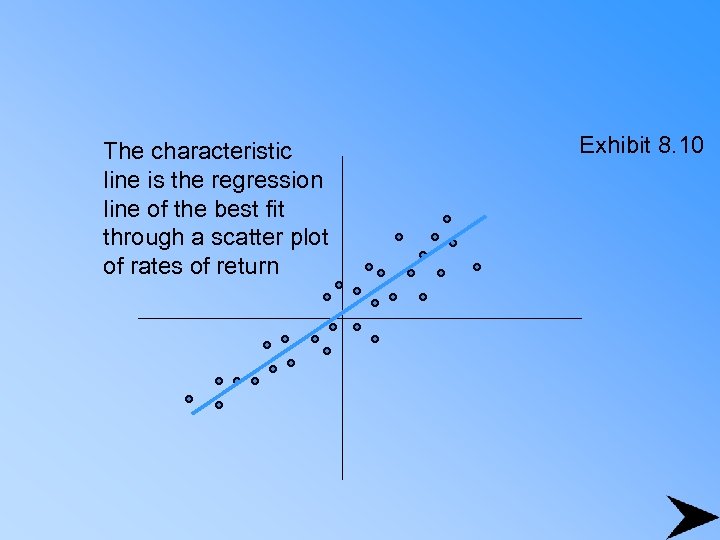

The characteristic line is the regression line of the best fit through a scatter plot of rates of return Exhibit 8. 10

The characteristic line is the regression line of the best fit through a scatter plot of rates of return Exhibit 8. 10