702e554c279a8fd67012afa6e3163ff5.ppt

- Количество слайдов: 26

Chapter 7 The Production Process: The Behavior of Profit. Maximizing Firms © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Production Central to our analysis is production: • Production is the process by which inputs are combined, transformed, and turned into outputs. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

What Is A Firm? • A firm is an organization that comes into being when a person or a group of people decides to produce a good or service to meet a perceived demand. Most firms exist to make a profit. • Production is not limited to firms. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Perfect Competition: Characteristics • many firms, each small relative to the industry, • producing virtually identical products -Homogeneous products that are undifferentiated products or indistinguishable from, one another • in which no firm is large enough to have any control over prices of its products or the price of inputs they buy. • Hence, individual firms are price-takers. This means that firms have no control over price. Price is determined by the interaction of market supply and demand. • In perfectly competitive industries, new competitors can freely enter and exit the market. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

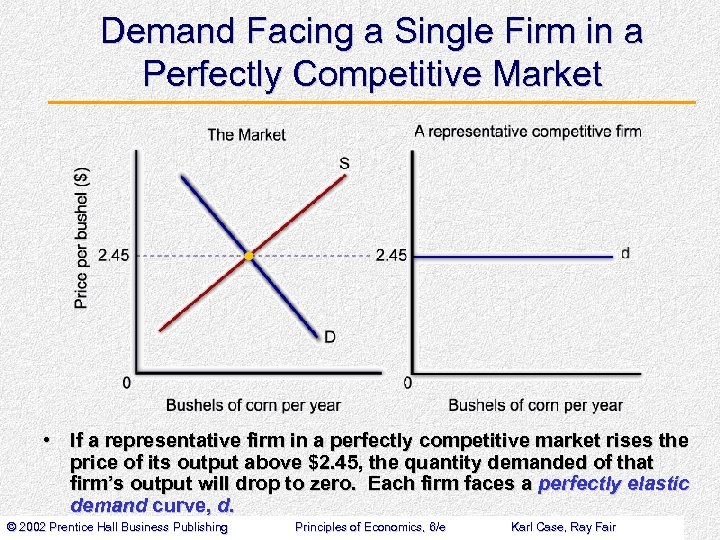

Demand Facing a Single Firm in a Perfectly Competitive Market • If a representative firm in a perfectly competitive market rises the price of its output above $2. 45, the quantity demanded of that firm’s output will drop to zero. Each firm faces a perfectly elastic demand curve, d. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Behavior of Profit-Maximizing Firms • The three decisions that all firms must make include: 1. 2. 3. How much output to supply Which production technology to use How much of each input to demand © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Behavior of Profit-Maximizing Firms • Once the level of output has been determined, the choice of technology determines the input demand • Change in technology changes both 1 st and 3 rd decision • With different technology, different levels of output can be produced or same level of output can also be produced • A profit maximizing firm chooses the technology that minimizes its cost for a given level of output © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Profits and Economic Costs • Profit (economic profit) is the difference between total revenue and total cost. • Total revenue is the amount received from the sale of the product: TR=(q X p) Profit = Total Revenue- Total Cost • Total cost (total economic cost) is the total of 1. Out of pocket costs- explicit costs/accounting costs 2. Opportunity cost of each factor of production- implicit costs Economic Profit = Total Revenue- Total Economic Cost © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Normal Rate of Return: The Opportunity cost of capital • The most important opportunity cost that is included in economic cost is the economic cost of capital, measured in terms of Normal rate of return. • Rate of Return= annual flow of net income generated by an investment, expressed as a % of total investment- also called yield on investment. • The normal rate of return is a rate of return on capital that is just sufficient to keep owners and investors satisfied. • Normal rate of return is considered to be a part of total cost of business • For relatively risk-free firms, it should be nearly the same as the interest rate on risk-free government bonds. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Implication • If a firm is earning exactly the normal rate of return on capital, it is earning zero profits • If the level of profit is positive, it means that the firm is earning above normal rate of return on capital. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

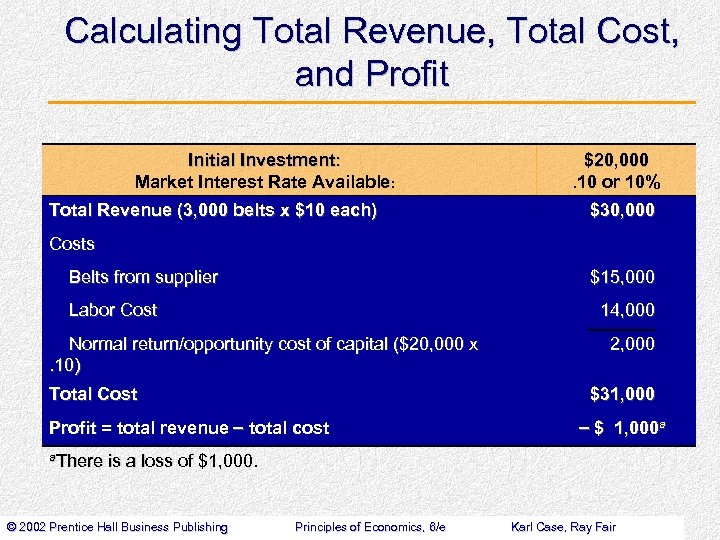

Calculating Total Revenue, Total Cost, and Profit Initial Investment: Market Interest Rate Available: Total Revenue (3, 000 belts x $10 each) $20, 000. 10 or 10% $30, 000 Costs Belts from supplier $15, 000 Labor Cost 14, 000 Normal return/opportunity cost of capital ($20, 000 x. 10) Total Cost $31, 000 Profit = total revenue - total cost a. There 2, 000 - $ 1, 000 a is a loss of $1, 000. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Short-Run Versus Long-Run Decisions • The short run is a period of time for which two conditions hold: 1. The firm is operating under a fixed scale (fixed factor) of production, and 2. Firms can neither enter nor exit an industry. - Which factors are fixed in the short run differs from industry to industry - No hard and fast rule to define the period of short run © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Short-Run Versus Long-Run Decisions • The long run is a period of time for which there are no fixed factors of production. Firms can increase or decrease scale of operation, and new firms can enter and existing firms can exit the industry. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The basis of decisions: Market price of outputs, available technology and input prices - Market price of output determines the Revenues - Techniques of production and Price of Inputs determines the Costs • The optimal method of production is the method that minimizes cost. • With cost determined and market price of output known, a firm makes the final judgment about the quantity of product to produce and quantity of each input to demand © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

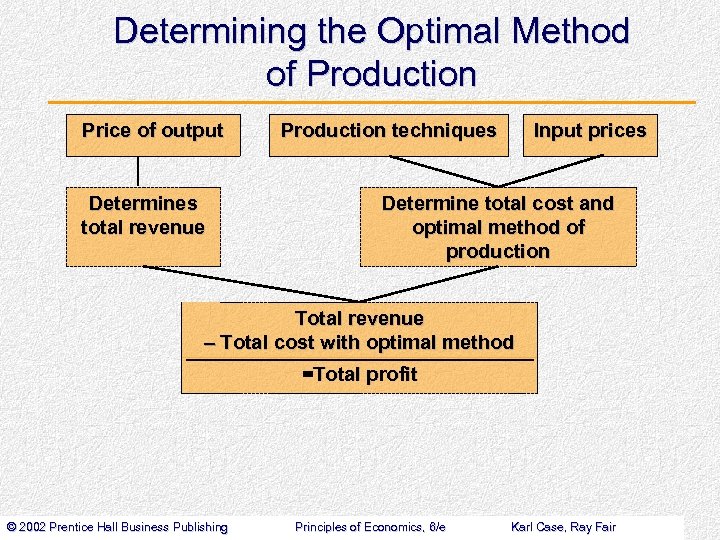

Determining the Optimal Method of Production Price of output Determines total revenue Production techniques Input prices Determine total cost and optimal method of production Total revenue - Total cost with optimal method =Total profit © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Production Process • Production technology refers to the quantitative relationship between inputs and outputs. Most outputs can be produced by a number of different techniques which include: • A labor-intensive technology relies heavily on human labor instead of capital. • A capital-intensive technology relies heavily on capital instead of human labor. • The final choice of technology should be the one that minimizes cost. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Production Function • The production function or total product function is a numerical or mathematical expression of a relationship between inputs and outputs. • It shows units of total product as a function of units of inputs. Q= f(X 1, X 2, X 3, . . . , Xn) where: • Q = quantity of output • X 1, X 2, X 3, . . . , Xn = factor inputs (such as capital, labour, land or raw materials © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

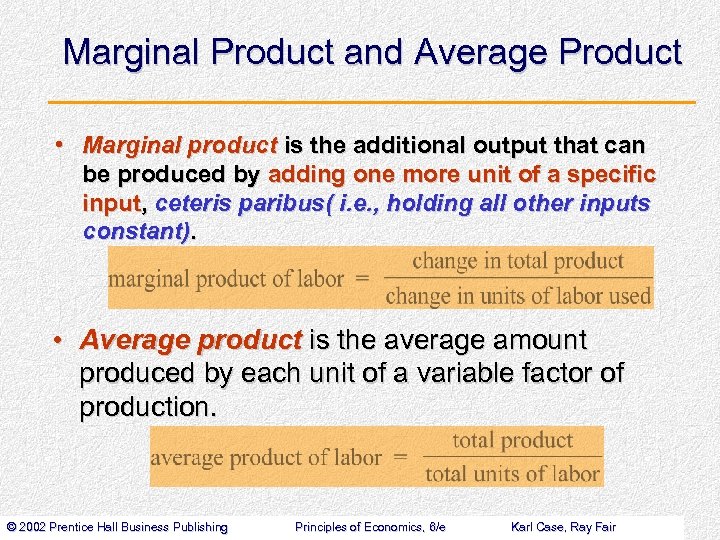

Marginal Product and Average Product • Marginal product is the additional output that can be produced by adding one more unit of a specific input, ceteris paribus( i. e. , holding all other inputs constant). • Average product is the average amount produced by each unit of a variable factor of production. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

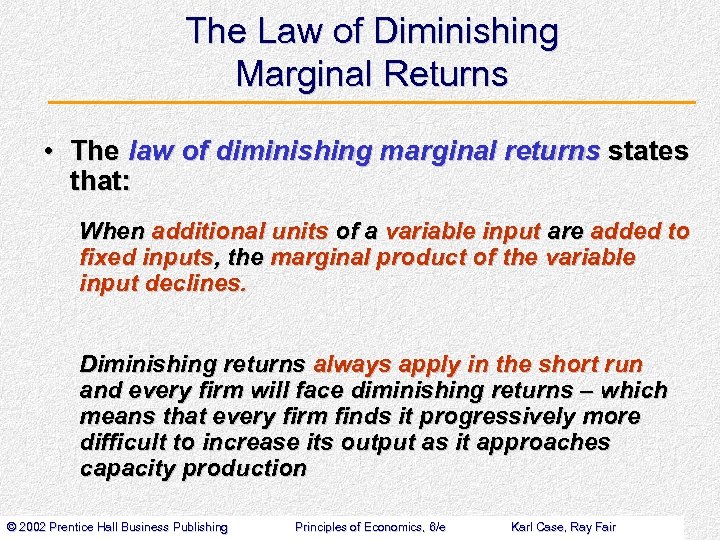

The Law of Diminishing Marginal Returns • The law of diminishing marginal returns states that: When additional units of a variable input are added to fixed inputs, the marginal product of the variable input declines. Diminishing returns always apply in the short run and every firm will face diminishing returns – which means that every firm finds it progressively more difficult to increase its output as it approaches capacity production © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

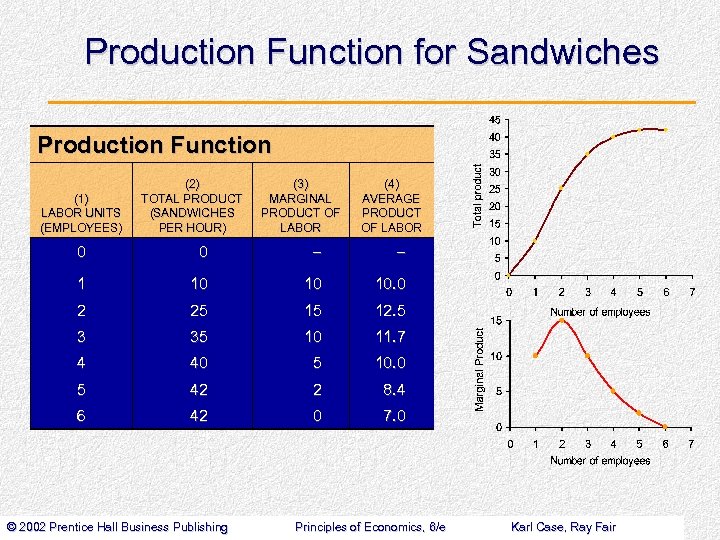

Production Function for Sandwiches Production Function (1) LABOR UNITS (EMPLOYEES) (2) TOTAL PRODUCT (SANDWICHES PER HOUR) (3) MARGINAL PRODUCT OF LABOR (4) AVERAGE PRODUCT OF LABOR 0 0 - - 1 10 10 10. 0 2 25 15 12. 5 3 35 10 11. 7 4 40 5 10. 0 5 42 2 8. 4 6 42 0 7. 0 © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

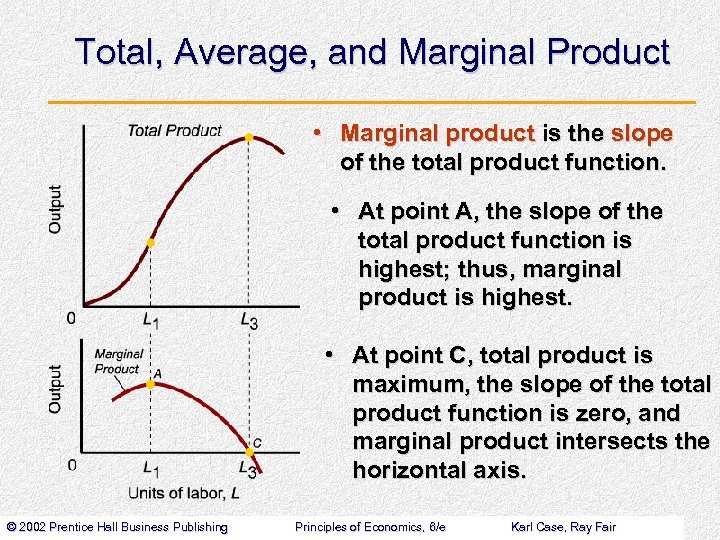

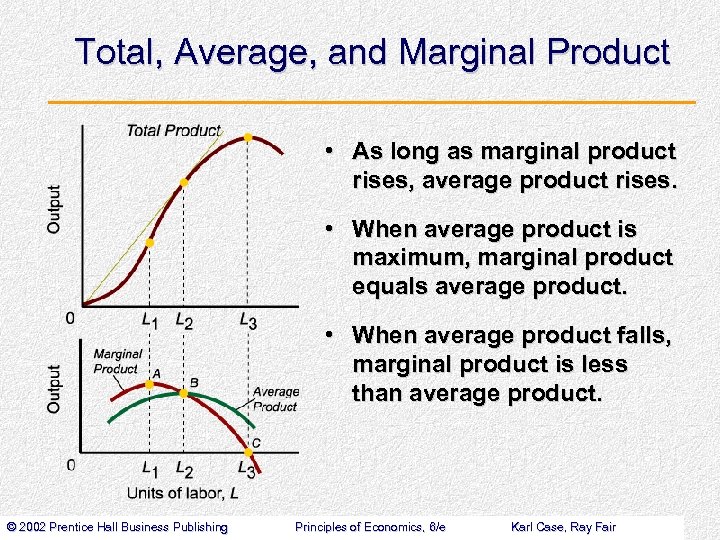

Total, Average, and Marginal Product • Marginal product is the slope of the total product function. • At point A, the slope of the total product function is highest; thus, marginal product is highest. • At point C, total product is maximum, the slope of the total product function is zero, and marginal product intersects the horizontal axis. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Total, Average, and Marginal Product • As long as marginal product rises, average product rises. • When average product is maximum, marginal product equals average product. • When average product falls, marginal product is less than average product. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

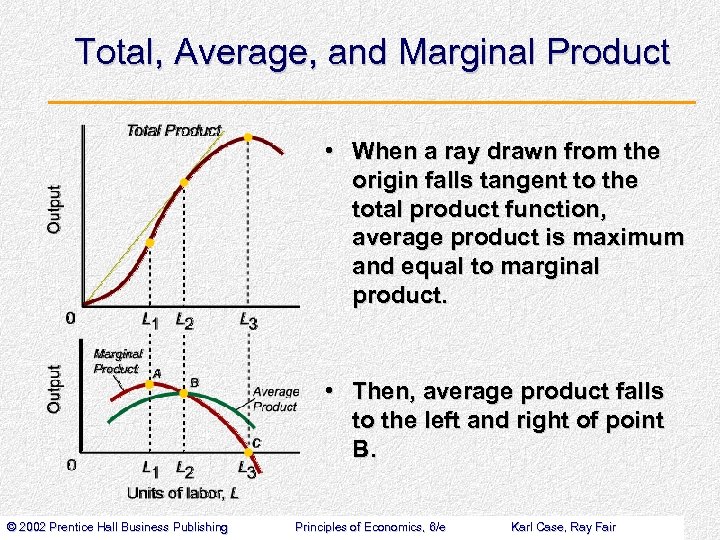

Total, Average, and Marginal Product • When a ray drawn from the origin falls tangent to the total product function, average product is maximum and equal to marginal product. • Then, average product falls to the left and right of point B. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

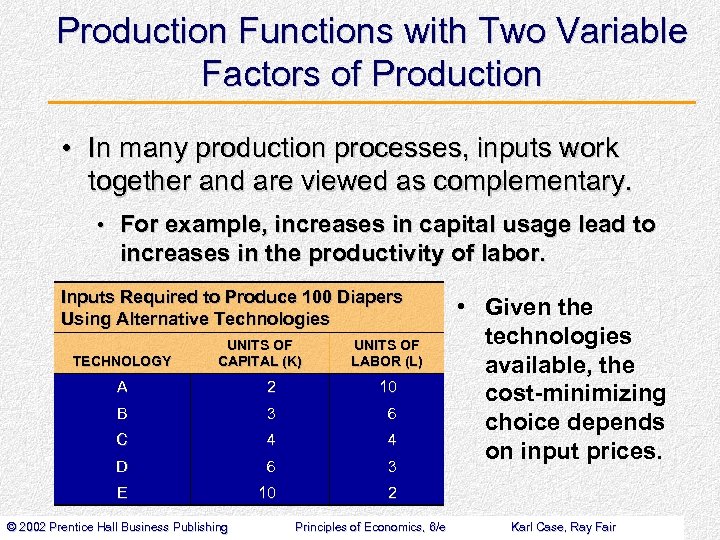

Production Functions with Two Variable Factors of Production • In many production processes, inputs work together and are viewed as complementary. • For example, increases in capital usage lead to increases in the productivity of labor. Inputs Required to Produce 100 Diapers Using Alternative Technologies TECHNOLOGY UNITS OF CAPITAL (K) UNITS OF LABOR (L) A 2 10 B 3 6 C 4 4 D 6 3 E 10 • Given the technologies available, the cost-minimizing choice depends on input prices. 2 © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

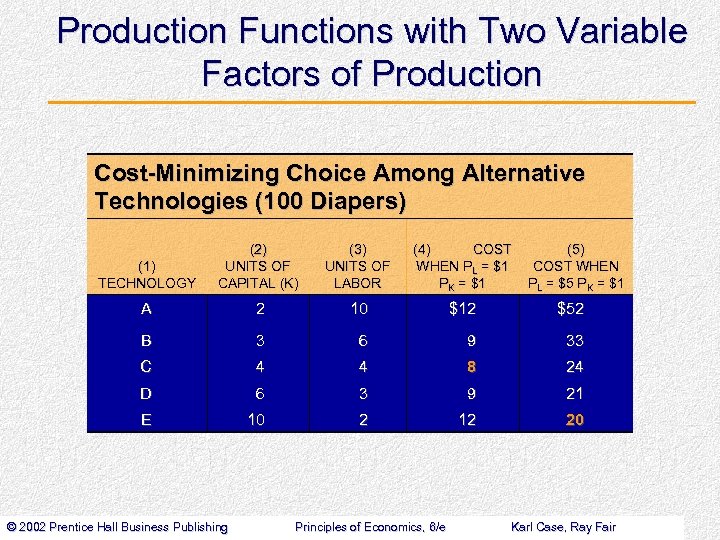

Production Functions with Two Variable Factors of Production Cost-Minimizing Choice Among Alternative Technologies (100 Diapers) (1) TECHNOLOGY (2) UNITS OF CAPITAL (K) (3) UNITS OF LABOR (4) COST WHEN PL = $1 PK = $1 A 2 10 $12 $52 B 3 6 9 33 C 4 4 8 24 D 6 3 9 21 E 10 2 12 20 © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e (5) COST WHEN PL = $5 PK = $1 Karl Case, Ray Fair

Hence , two things determine cost of production: 1. technologies that are available and 2. input prices Profit maximizing firm chooses that technology that minimizes cost of production at the given current market price of inputs © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

702e554c279a8fd67012afa6e3163ff5.ppt