3d00239c8c5bafaeeaf7a6e8ebed385c.ppt

- Количество слайдов: 24

Chapter 7 Risk, Return, and the Capital Asset Pricing Model 1

Chapter 7 Risk, Return, and the Capital Asset Pricing Model 1

Topics Covered l l l Measuring Market Risk Portfolio Betas Risk and Return CAPM and Expected Return Security Market Line CAPM and Stock Valuation 2

Topics Covered l l l Measuring Market Risk Portfolio Betas Risk and Return CAPM and Expected Return Security Market Line CAPM and Stock Valuation 2

Chapter 7 Objectives l l l To be able to measure and interpret the market risk, or beta of a security. Calculate a portfolio’s expected return and its beta. To relate the market risk of a security to the rate of return that investors demand apply this rate to stock valuation. 3

Chapter 7 Objectives l l l To be able to measure and interpret the market risk, or beta of a security. Calculate a portfolio’s expected return and its beta. To relate the market risk of a security to the rate of return that investors demand apply this rate to stock valuation. 3

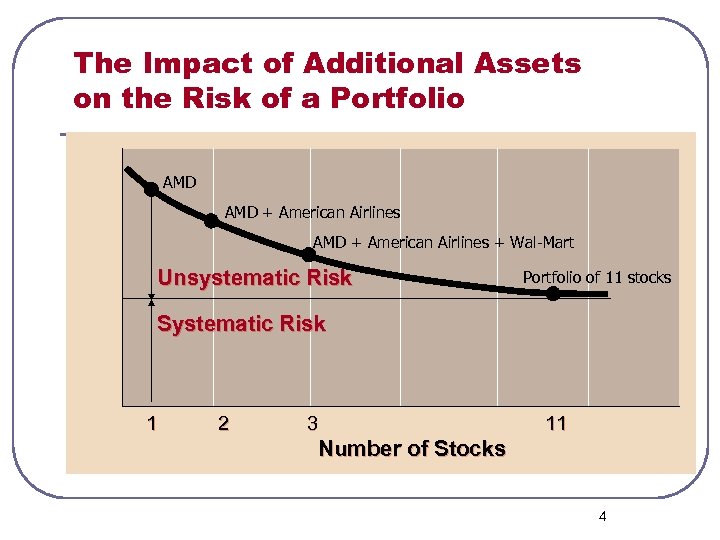

Portfolio Standard Deviation The Impact of Additional Assets on the Risk of a Portfolio AMD + American Airlines + Wal-Mart Unsystematic Risk Portfolio of 11 stocks Systematic Risk 1 2 3 11 Number of Stocks 4

Portfolio Standard Deviation The Impact of Additional Assets on the Risk of a Portfolio AMD + American Airlines + Wal-Mart Unsystematic Risk Portfolio of 11 stocks Systematic Risk 1 2 3 11 Number of Stocks 4

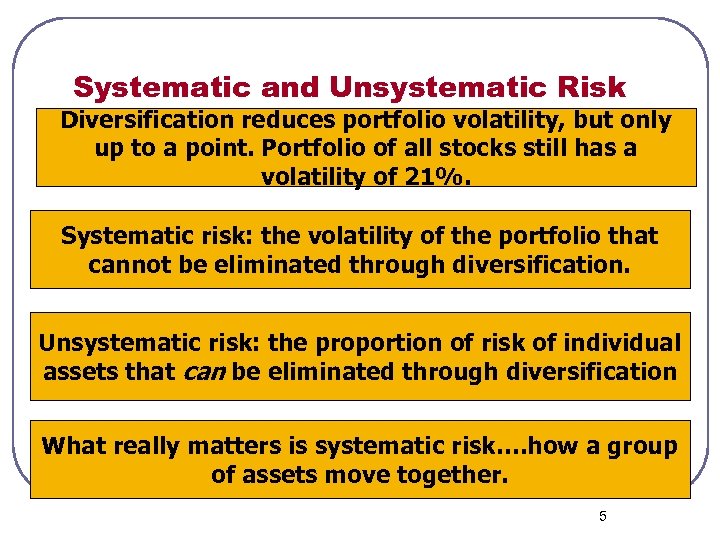

Systematic and Unsystematic Risk Diversification reduces portfolio volatility, but only up to a point. Portfolio of all stocks still has a volatility of 21%. Systematic risk: the volatility of the portfolio that cannot be eliminated through diversification. Unsystematic risk: the proportion of risk of individual assets that can be eliminated through diversification What really matters is systematic risk…. how a group of assets move together. 5

Systematic and Unsystematic Risk Diversification reduces portfolio volatility, but only up to a point. Portfolio of all stocks still has a volatility of 21%. Systematic risk: the volatility of the portfolio that cannot be eliminated through diversification. Unsystematic risk: the proportion of risk of individual assets that can be eliminated through diversification What really matters is systematic risk…. how a group of assets move together. 5

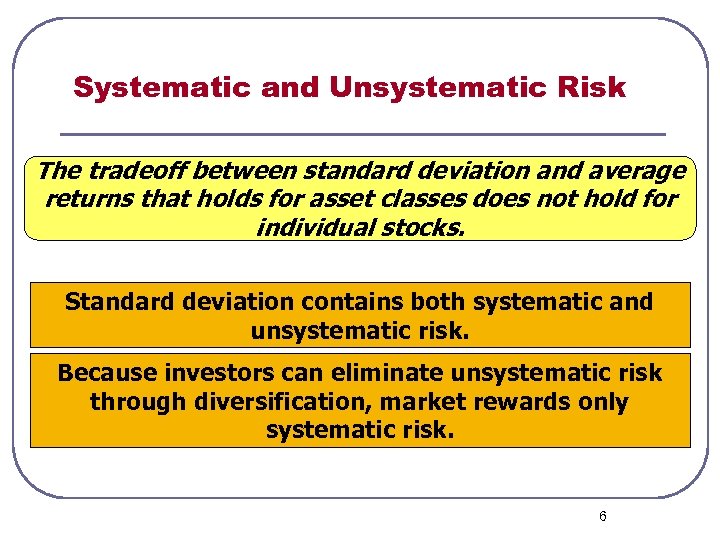

Systematic and Unsystematic Risk The tradeoff between standard deviation and average returns that holds for asset classes does not hold for individual stocks. Standard deviation contains both systematic and unsystematic risk. Because investors can eliminate unsystematic risk through diversification, market rewards only systematic risk. 6

Systematic and Unsystematic Risk The tradeoff between standard deviation and average returns that holds for asset classes does not hold for individual stocks. Standard deviation contains both systematic and unsystematic risk. Because investors can eliminate unsystematic risk through diversification, market rewards only systematic risk. 6

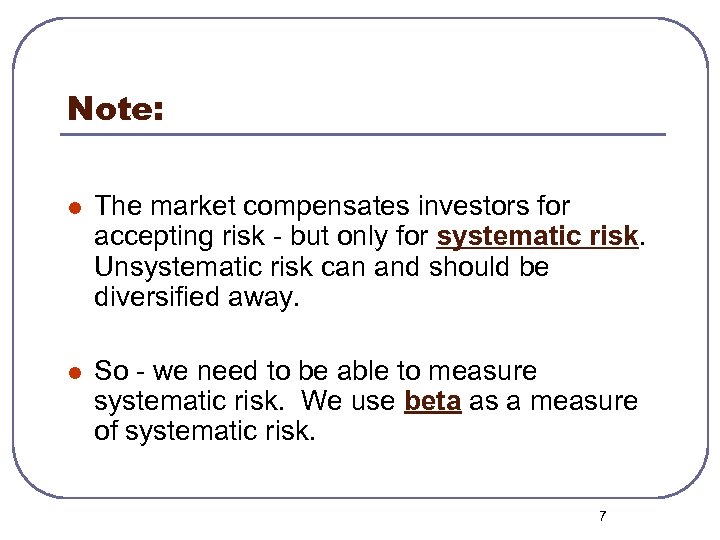

Note: l The market compensates investors for accepting risk - but only for systematic risk. Unsystematic risk can and should be diversified away. l So - we need to be able to measure systematic risk. We use beta as a measure of systematic risk. 7

Note: l The market compensates investors for accepting risk - but only for systematic risk. Unsystematic risk can and should be diversified away. l So - we need to be able to measure systematic risk. We use beta as a measure of systematic risk. 7

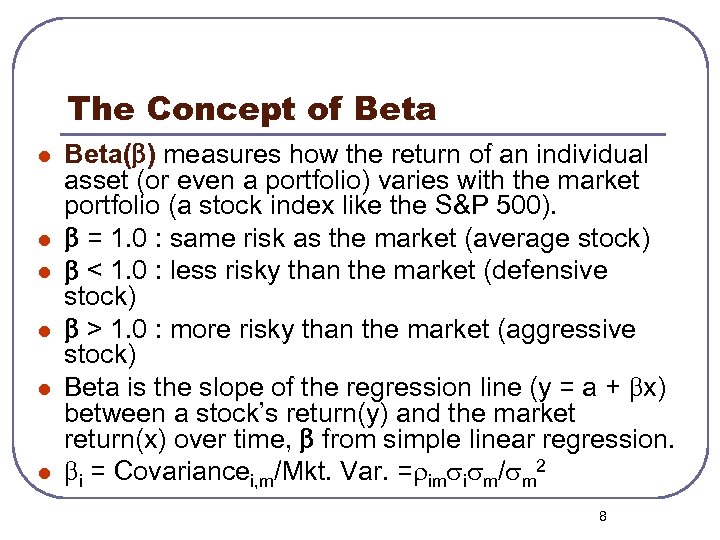

The Concept of Beta l l l Beta( ) measures how the return of an individual asset (or even a portfolio) varies with the market portfolio (a stock index like the S&P 500). = 1. 0 : same risk as the market (average stock) < 1. 0 : less risky than the market (defensive stock) > 1. 0 : more risky than the market (aggressive stock) Beta is the slope of the regression line (y = a + bx) between a stock’s return(y) and the market return(x) over time, from simple linear regression. bi = Covariancei, m/Mkt. Var. =rimsism/sm 2 8

The Concept of Beta l l l Beta( ) measures how the return of an individual asset (or even a portfolio) varies with the market portfolio (a stock index like the S&P 500). = 1. 0 : same risk as the market (average stock) < 1. 0 : less risky than the market (defensive stock) > 1. 0 : more risky than the market (aggressive stock) Beta is the slope of the regression line (y = a + bx) between a stock’s return(y) and the market return(x) over time, from simple linear regression. bi = Covariancei, m/Mkt. Var. =rimsism/sm 2 8

Relating Systematic Risk and Expected (or Required) Return: the CAPM l l l Here’s the word story: a stock’s required (expected) rate of return = risk-free rate + the (stock’s) risk premium. The main assumption is investors hold well diversified portfolios = only concerned with systematic risk. A stock’s risk premium = measure of systematic risk X market risk premium. 9

Relating Systematic Risk and Expected (or Required) Return: the CAPM l l l Here’s the word story: a stock’s required (expected) rate of return = risk-free rate + the (stock’s) risk premium. The main assumption is investors hold well diversified portfolios = only concerned with systematic risk. A stock’s risk premium = measure of systematic risk X market risk premium. 9

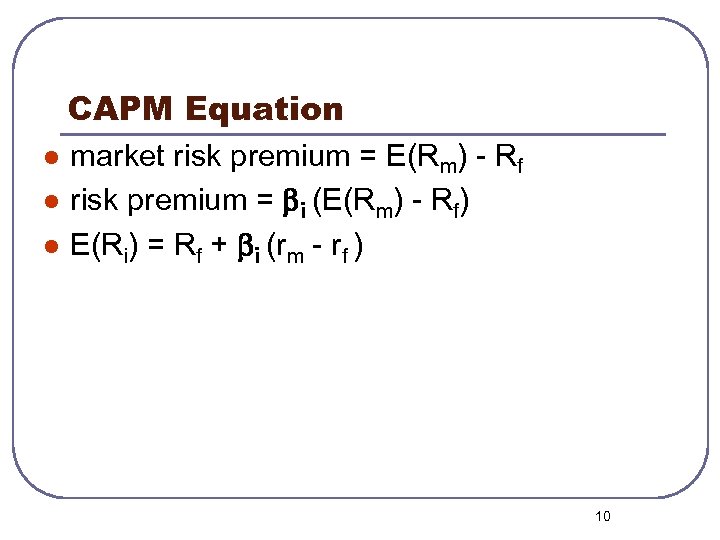

CAPM Equation l l l market risk premium = E(Rm) - Rf risk premium = i (E(Rm) - Rf) E(Ri) = Rf + i (rm - rf ) 10

CAPM Equation l l l market risk premium = E(Rm) - Rf risk premium = i (E(Rm) - Rf) E(Ri) = Rf + i (rm - rf ) 10

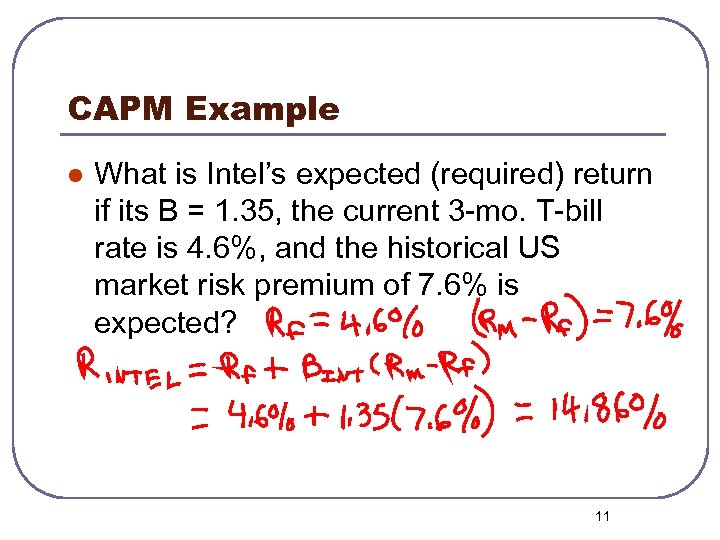

CAPM Example l What is Intel’s expected (required) return if its B = 1. 35, the current 3 -mo. T-bill rate is 4. 6%, and the historical US market risk premium of 7. 6% is expected? 11

CAPM Example l What is Intel’s expected (required) return if its B = 1. 35, the current 3 -mo. T-bill rate is 4. 6%, and the historical US market risk premium of 7. 6% is expected? 11

Portfolio Beta and Expected Return l l The b for a portfolio of stocks is the weighted average of the individual stock bs. bp = Swjbj The expected return for a portfolio is the weighted average of the expected returns of the individual stocks. RP = Swj. Rj or use the portfolio beta in the CAPM to find the portfolio’s expected return. 12

Portfolio Beta and Expected Return l l The b for a portfolio of stocks is the weighted average of the individual stock bs. bp = Swjbj The expected return for a portfolio is the weighted average of the expected returns of the individual stocks. RP = Swj. Rj or use the portfolio beta in the CAPM to find the portfolio’s expected return. 12

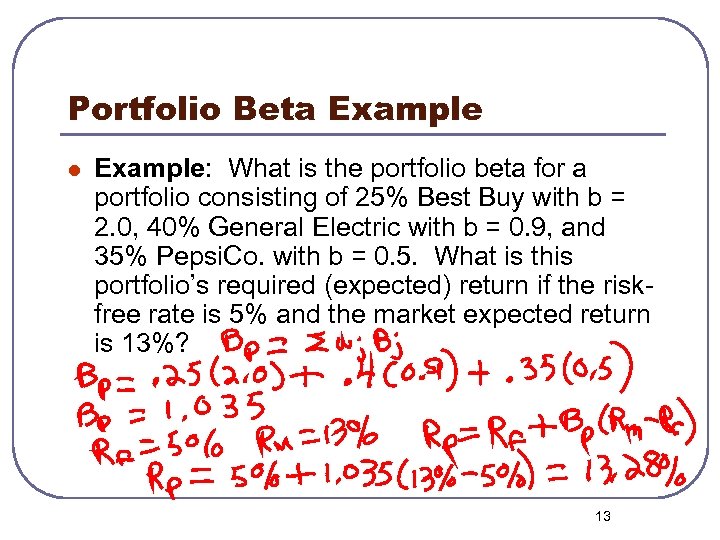

Portfolio Beta Example l Example: What is the portfolio beta for a portfolio consisting of 25% Best Buy with b = 2. 0, 40% General Electric with b = 0. 9, and 35% Pepsi. Co. with b = 0. 5. What is this portfolio’s required (expected) return if the riskfree rate is 5% and the market expected return is 13%? 13

Portfolio Beta Example l Example: What is the portfolio beta for a portfolio consisting of 25% Best Buy with b = 2. 0, 40% General Electric with b = 0. 9, and 35% Pepsi. Co. with b = 0. 5. What is this portfolio’s required (expected) return if the riskfree rate is 5% and the market expected return is 13%? 13

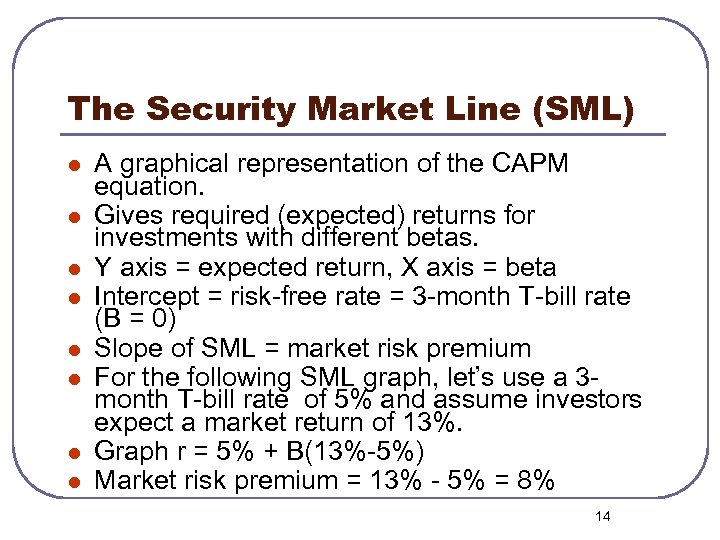

The Security Market Line (SML) l l l l A graphical representation of the CAPM equation. Gives required (expected) returns for investments with different betas. Y axis = expected return, X axis = beta Intercept = risk-free rate = 3 -month T-bill rate (B = 0) Slope of SML = market risk premium For the following SML graph, let’s use a 3 month T-bill rate of 5% and assume investors expect a market return of 13%. Graph r = 5% + B(13%-5%) Market risk premium = 13% - 5% = 8% 14

The Security Market Line (SML) l l l l A graphical representation of the CAPM equation. Gives required (expected) returns for investments with different betas. Y axis = expected return, X axis = beta Intercept = risk-free rate = 3 -month T-bill rate (B = 0) Slope of SML = market risk premium For the following SML graph, let’s use a 3 month T-bill rate of 5% and assume investors expect a market return of 13%. Graph r = 5% + B(13%-5%) Market risk premium = 13% - 5% = 8% 14

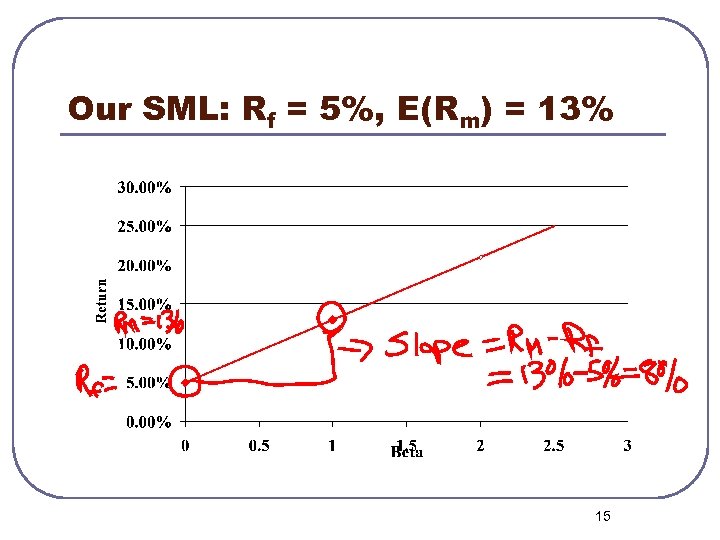

Our SML: Rf = 5%, E(Rm) = 13% 15

Our SML: Rf = 5%, E(Rm) = 13% 15

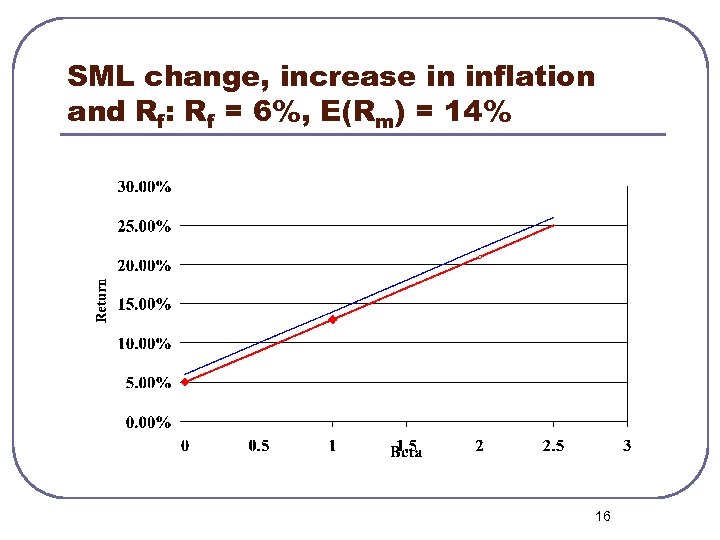

SML change, increase in inflation and Rf: Rf = 6%, E(Rm) = 14% 16

SML change, increase in inflation and Rf: Rf = 6%, E(Rm) = 14% 16

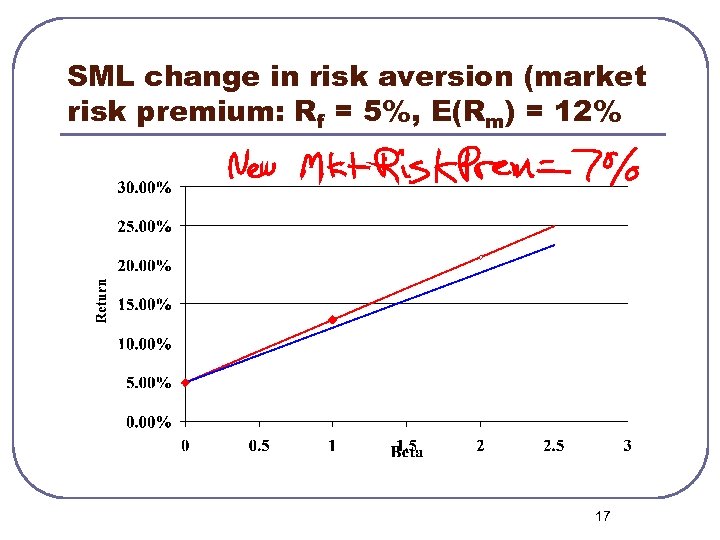

SML change in risk aversion (market risk premium: Rf = 5%, E(Rm) = 12% 17

SML change in risk aversion (market risk premium: Rf = 5%, E(Rm) = 12% 17

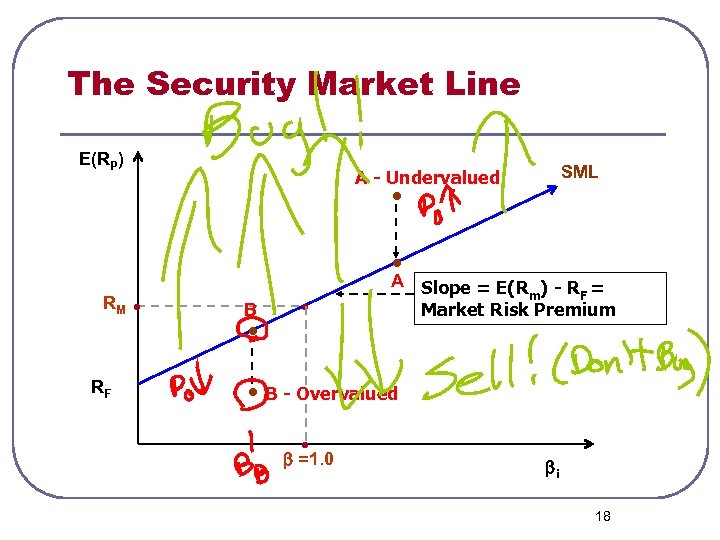

The Security Market Line E(RP) SML A - Undervalued • • RM RF • B • • A Slope = E(R ) - R = m F Market Risk Premium • B - Overvalued • =1. 0 i 18

The Security Market Line E(RP) SML A - Undervalued • • RM RF • B • • A Slope = E(R ) - R = m F Market Risk Premium • B - Overvalued • =1. 0 i 18

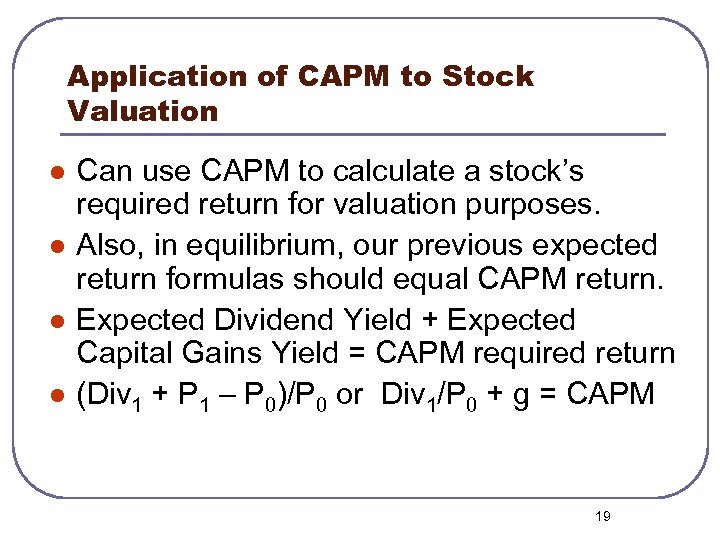

Application of CAPM to Stock Valuation l l Can use CAPM to calculate a stock’s required return for valuation purposes. Also, in equilibrium, our previous expected return formulas should equal CAPM return. Expected Dividend Yield + Expected Capital Gains Yield = CAPM required return (Div 1 + P 1 – P 0)/P 0 or Div 1/P 0 + g = CAPM 19

Application of CAPM to Stock Valuation l l Can use CAPM to calculate a stock’s required return for valuation purposes. Also, in equilibrium, our previous expected return formulas should equal CAPM return. Expected Dividend Yield + Expected Capital Gains Yield = CAPM required return (Div 1 + P 1 – P 0)/P 0 or Div 1/P 0 + g = CAPM 19

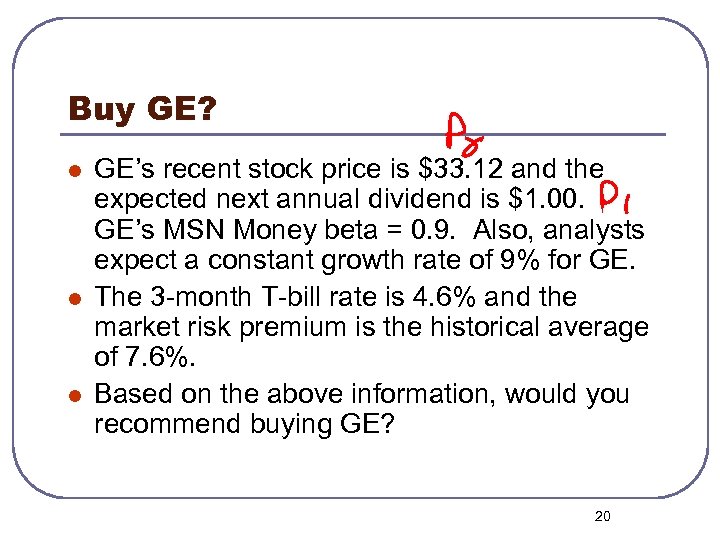

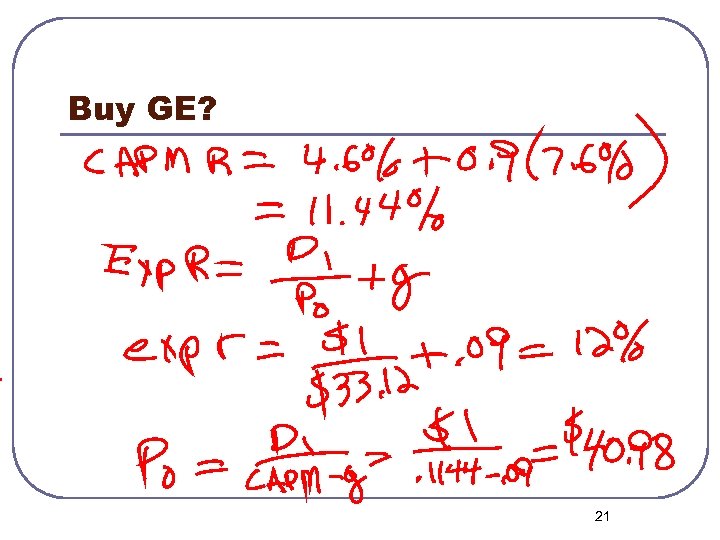

Buy GE? l l l GE’s recent stock price is $33. 12 and the expected next annual dividend is $1. 00. GE’s MSN Money beta = 0. 9. Also, analysts expect a constant growth rate of 9% for GE. The 3 -month T-bill rate is 4. 6% and the market risk premium is the historical average of 7. 6%. Based on the above information, would you recommend buying GE? 20

Buy GE? l l l GE’s recent stock price is $33. 12 and the expected next annual dividend is $1. 00. GE’s MSN Money beta = 0. 9. Also, analysts expect a constant growth rate of 9% for GE. The 3 -month T-bill rate is 4. 6% and the market risk premium is the historical average of 7. 6%. Based on the above information, would you recommend buying GE? 20

Buy GE? 21

Buy GE? 21

Buy GE? What is it’s value today? 22

Buy GE? What is it’s value today? 22

Efficient Markets Efficient market hypothesis (EMH): in an efficient market, prices rapidly incorporate all relevant information Financial markets much larger, more competitive, more transparent, more homogeneous than product markets Much harder to create value through financial activities Changes in asset price respond only to new information. This implies that asset prices move almost randomly. 23

Efficient Markets Efficient market hypothesis (EMH): in an efficient market, prices rapidly incorporate all relevant information Financial markets much larger, more competitive, more transparent, more homogeneous than product markets Much harder to create value through financial activities Changes in asset price respond only to new information. This implies that asset prices move almost randomly. 23

Efficient Markets If asset prices unpredictable, then what is the use of CAPM? CAPM gives analyst a model to measure the systematic risk of any asset. On average, assets with high systematic risk should earn higher returns than assets with low systematic risk. CAPM offers a way to compare risk and return on investments alternatives. 24

Efficient Markets If asset prices unpredictable, then what is the use of CAPM? CAPM gives analyst a model to measure the systematic risk of any asset. On average, assets with high systematic risk should earn higher returns than assets with low systematic risk. CAPM offers a way to compare risk and return on investments alternatives. 24