7f103b5e3477ffbd4a6870a54e4c470b.ppt

- Количество слайдов: 29

Chapter 7 • International Trade, Exchange Rates, and Macroeconomic Policy Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

Chapter 7 • International Trade, Exchange Rates, and Macroeconomic Policy Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

Key Questions • What are the basics of the current account, capital account and the balance of payments? • Why are foreigners willing to send capital to the United States to allow it to import more than it exports? • How is the exchange rate determined? • What is the interrelationship of exchange rates with monetary policy and interest rates? • How is the U. S. affected by the international “trilemma? ” (See next slide) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -2

Key Questions • What are the basics of the current account, capital account and the balance of payments? • Why are foreigners willing to send capital to the United States to allow it to import more than it exports? • How is the exchange rate determined? • What is the interrelationship of exchange rates with monetary policy and interest rates? • How is the U. S. affected by the international “trilemma? ” (See next slide) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -2

The International Trilemma • The international “trilemma” is the impossibility of any nation to simultaneously maintain all of the following: – Independent control of domestic monetary policy – Fixed exchange rates – Free flows of capital with other nations • The EU’s common currency (the Euro) and free flows of capital between countries prevent individual EU countries from pursuing independent monetary policies • The US has flexible exchange rates and free flows of capital, so it can run an independent monetary policy – But countries like Japan and China can buy USD to keep their own currencies undervalued to promote their exports Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -3

The International Trilemma • The international “trilemma” is the impossibility of any nation to simultaneously maintain all of the following: – Independent control of domestic monetary policy – Fixed exchange rates – Free flows of capital with other nations • The EU’s common currency (the Euro) and free flows of capital between countries prevent individual EU countries from pursuing independent monetary policies • The US has flexible exchange rates and free flows of capital, so it can run an independent monetary policy – But countries like Japan and China can buy USD to keep their own currencies undervalued to promote their exports Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -3

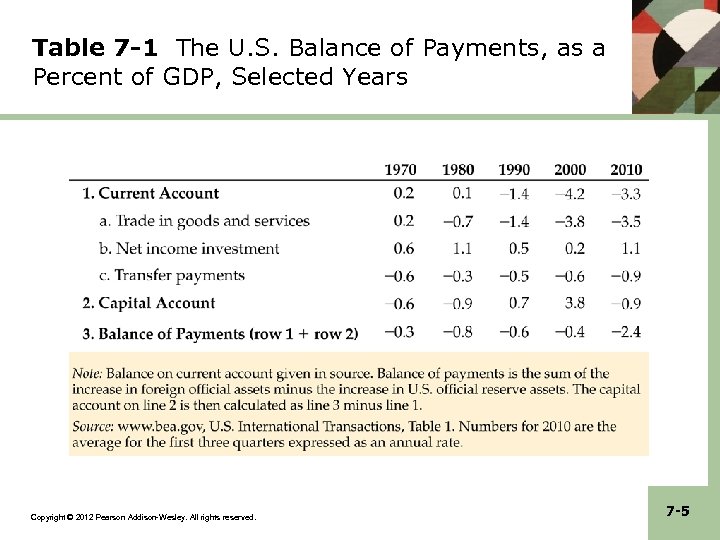

The Current Account and the BOP • The Current Account (CA) records the nation’s current international transactions including exports and imports of goods and services (i. e. NX), net income from abroad and net unilateral transfer payments. • The Capital Account (KA) records international capital flows, which consist of purchases and sales of foreign assets by domestic residents, as well as purchases and sales of domestic assets by foreign residents. • The Balance of Payments (BOP) is the record of a nation’s international transactions. – Algebraically: BOP = CA + KA Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -4

The Current Account and the BOP • The Current Account (CA) records the nation’s current international transactions including exports and imports of goods and services (i. e. NX), net income from abroad and net unilateral transfer payments. • The Capital Account (KA) records international capital flows, which consist of purchases and sales of foreign assets by domestic residents, as well as purchases and sales of domestic assets by foreign residents. • The Balance of Payments (BOP) is the record of a nation’s international transactions. – Algebraically: BOP = CA + KA Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -4

Table 7 -1 The U. S. Balance of Payments, as a Percent of GDP, Selected Years Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -5

Table 7 -1 The U. S. Balance of Payments, as a Percent of GDP, Selected Years Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -5

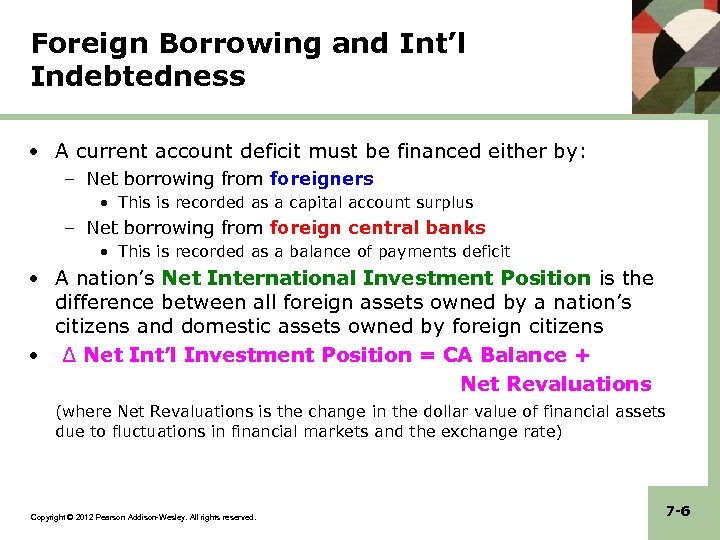

Foreign Borrowing and Int’l Indebtedness • A current account deficit must be financed either by: – Net borrowing from foreigners • This is recorded as a capital account surplus – Net borrowing from foreign central banks • This is recorded as a balance of payments deficit • A nation’s Net International Investment Position is the difference between all foreign assets owned by a nation’s citizens and domestic assets owned by foreign citizens • ∆ Net Int’l Investment Position = CA Balance + Net Revaluations (where Net Revaluations is the change in the dollar value of financial assets due to fluctuations in financial markets and the exchange rate) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -6

Foreign Borrowing and Int’l Indebtedness • A current account deficit must be financed either by: – Net borrowing from foreigners • This is recorded as a capital account surplus – Net borrowing from foreign central banks • This is recorded as a balance of payments deficit • A nation’s Net International Investment Position is the difference between all foreign assets owned by a nation’s citizens and domestic assets owned by foreign citizens • ∆ Net Int’l Investment Position = CA Balance + Net Revaluations (where Net Revaluations is the change in the dollar value of financial assets due to fluctuations in financial markets and the exchange rate) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -6

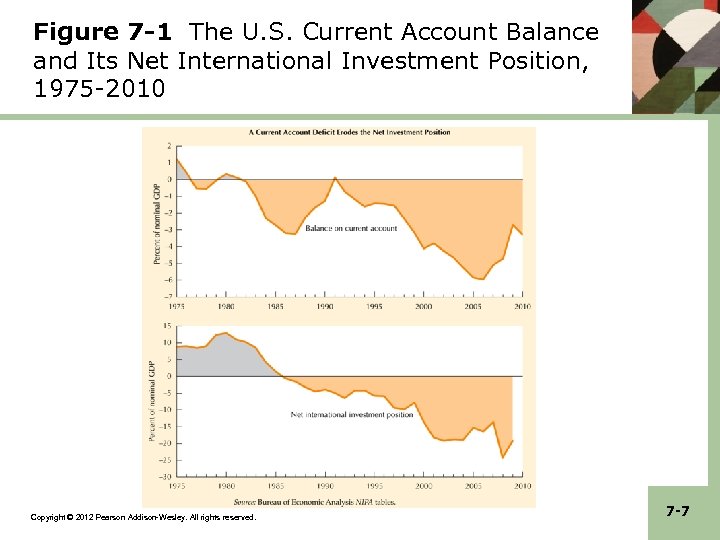

Figure 7 -1 The U. S. Current Account Balance and Its Net International Investment Position, 1975 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -7

Figure 7 -1 The U. S. Current Account Balance and Its Net International Investment Position, 1975 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -7

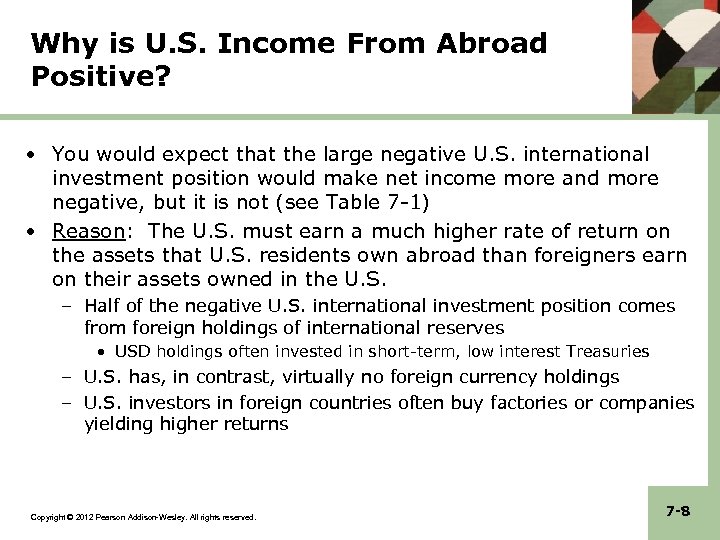

Why is U. S. Income From Abroad Positive? • You would expect that the large negative U. S. international investment position would make net income more and more negative, but it is not (see Table 7 -1) • Reason: The U. S. must earn a much higher rate of return on the assets that U. S. residents own abroad than foreigners earn on their assets owned in the U. S. – Half of the negative U. S. international investment position comes from foreign holdings of international reserves • USD holdings often invested in short-term, low interest Treasuries – U. S. has, in contrast, virtually no foreign currency holdings – U. S. investors in foreign countries often buy factories or companies yielding higher returns Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -8

Why is U. S. Income From Abroad Positive? • You would expect that the large negative U. S. international investment position would make net income more and more negative, but it is not (see Table 7 -1) • Reason: The U. S. must earn a much higher rate of return on the assets that U. S. residents own abroad than foreigners earn on their assets owned in the U. S. – Half of the negative U. S. international investment position comes from foreign holdings of international reserves • USD holdings often invested in short-term, low interest Treasuries – U. S. has, in contrast, virtually no foreign currency holdings – U. S. investors in foreign countries often buy factories or companies yielding higher returns Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -8

The Current Account and National Saving • National Saving is the sum of private and government saving: NS = S + (T – G) • Recall the Magic Equation: T – G = (I + NX) – S Rearranging yields S + (T – G) = I + NX NS = I + NX **OR** -NX = I – NS (1) • Recall that a current account deficit NX < 0 – Amount borrowed from foreigners = foreign borrowing = -NX • Equation (1) foreign borrowing rises because: – Investment increases – National savings falls Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -9

The Current Account and National Saving • National Saving is the sum of private and government saving: NS = S + (T – G) • Recall the Magic Equation: T – G = (I + NX) – S Rearranging yields S + (T – G) = I + NX NS = I + NX **OR** -NX = I – NS (1) • Recall that a current account deficit NX < 0 – Amount borrowed from foreigners = foreign borrowing = -NX • Equation (1) foreign borrowing rises because: – Investment increases – National savings falls Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -9

The Exchange Rate • The foreign exchange rate for a nation’s currency is the amount of one nation’s money that can be obtained in exchange for a unit of another nation’s money. – Convention: The foreign exchange rate of the dollar is usually quoted as units of foreign currency per dollar. • Example: e´ = 106. 00 ¥ / $ = Value of the Dollar – Exception: The Euro-USD and the pound-USD exchange rates are quoted as dollars per Euro and dollars per pound. • Example: $1. 41 / € = Value of the Euro • The USD is said to appreciate (depreciate) if the value of the dollar rises (falls) relative to another currency. Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -10

The Exchange Rate • The foreign exchange rate for a nation’s currency is the amount of one nation’s money that can be obtained in exchange for a unit of another nation’s money. – Convention: The foreign exchange rate of the dollar is usually quoted as units of foreign currency per dollar. • Example: e´ = 106. 00 ¥ / $ = Value of the Dollar – Exception: The Euro-USD and the pound-USD exchange rates are quoted as dollars per Euro and dollars per pound. • Example: $1. 41 / € = Value of the Euro • The USD is said to appreciate (depreciate) if the value of the dollar rises (falls) relative to another currency. Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -10

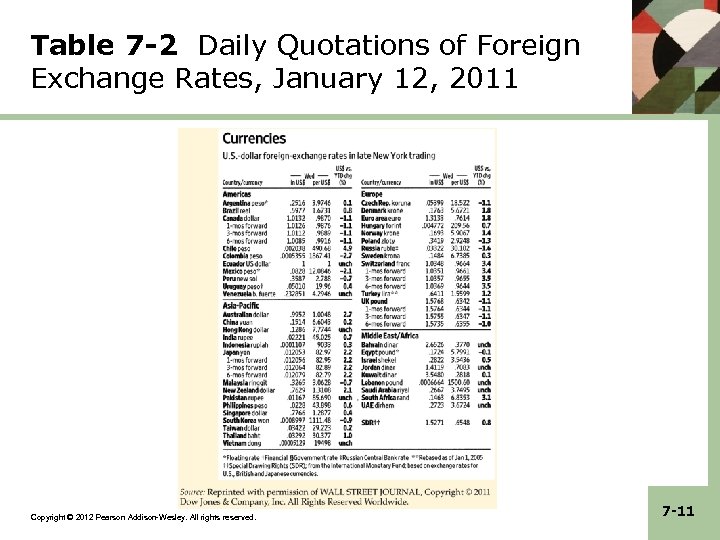

Table 7 -2 Daily Quotations of Foreign Exchange Rates, January 12, 2011 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -11

Table 7 -2 Daily Quotations of Foreign Exchange Rates, January 12, 2011 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -11

The Market for Foreign Exchange • Why do people hold U. S. dollars? – To buy U. S. goods and services U. S. exports lead to D$ ↑ – To buy USD-denominated financial assets capital inflows lead to D$ ↑ – For the convenience and/or safety of holding USD D$↑ • Why do people sell U. S. dollars? – To buy foreign currencies to buy foreign goods U. S. imports lead to S$↑ – To buy foreign currencies to buy foreign $-denominated financial assets capital outflows lead to S$↑ • What determines slopes of D$ and S$? – Price elasticity of foreign demand for U. S. X D$ slope – Price elasticity of U. S. demand for (foreign) M S$ slope Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -12

The Market for Foreign Exchange • Why do people hold U. S. dollars? – To buy U. S. goods and services U. S. exports lead to D$ ↑ – To buy USD-denominated financial assets capital inflows lead to D$ ↑ – For the convenience and/or safety of holding USD D$↑ • Why do people sell U. S. dollars? – To buy foreign currencies to buy foreign goods U. S. imports lead to S$↑ – To buy foreign currencies to buy foreign $-denominated financial assets capital outflows lead to S$↑ • What determines slopes of D$ and S$? – Price elasticity of foreign demand for U. S. X D$ slope – Price elasticity of U. S. demand for (foreign) M S$ slope Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -12

Figure 7 -2 Foreign Exchange Rates of the Dollar Against Four Major Currencies, Monthly, 1970 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -13

Figure 7 -2 Foreign Exchange Rates of the Dollar Against Four Major Currencies, Monthly, 1970 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -13

Figure 7 -3 Determination of the Price in Euros of the Dollar Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -14

Figure 7 -3 Determination of the Price in Euros of the Dollar Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -14

How Governments Can Affect Exchange Rates? • To prevent its currency from being too strong, or equivalently, to make its currency more competitive, a country’s central bank can sell the home currency (and simultaneously buy foreign $) – This would encourage the country’s exports – A central bank has the ability to create an unlimited amount of its home currency no limit to this FX intervention – Example: China and Japan have bought massive quantities of USD to keep their currencies from appreciating • To prevent its currency from falling in value, or equivalently, to protect its currency, a country’s central bank can would buy the home currency (and simultaneously sell foreign $) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -15

How Governments Can Affect Exchange Rates? • To prevent its currency from being too strong, or equivalently, to make its currency more competitive, a country’s central bank can sell the home currency (and simultaneously buy foreign $) – This would encourage the country’s exports – A central bank has the ability to create an unlimited amount of its home currency no limit to this FX intervention – Example: China and Japan have bought massive quantities of USD to keep their currencies from appreciating • To prevent its currency from falling in value, or equivalently, to protect its currency, a country’s central bank can would buy the home currency (and simultaneously sell foreign $) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -15

The Real Exchange Rate • The real exchange rate (e) is equal to the average nominal exchange rate (e )׳ between a country and its trading partners, with an adjustment for the difference in inflation rates between that country and its partners • Algebraically, the real exchange rate is defined below: where P = home price level and Pf = foreign price level • Example: Suppose e = 01׳ pesos/$ and P = Pf = 100 – Now suppose that Mexican inflation causes Pf↑ to Pf = 200 • Assume e ׳ and P are unchanged – Result: e = (10 pesos/$)x(100/200) = 5 pesos/$ real depreciation of $! – Note: Usually when countries experience rapid inflation, the real exchange rate does not change. Then e ↑׳ nominal appreciation of $! Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -16

The Real Exchange Rate • The real exchange rate (e) is equal to the average nominal exchange rate (e )׳ between a country and its trading partners, with an adjustment for the difference in inflation rates between that country and its partners • Algebraically, the real exchange rate is defined below: where P = home price level and Pf = foreign price level • Example: Suppose e = 01׳ pesos/$ and P = Pf = 100 – Now suppose that Mexican inflation causes Pf↑ to Pf = 200 • Assume e ׳ and P are unchanged – Result: e = (10 pesos/$)x(100/200) = 5 pesos/$ real depreciation of $! – Note: Usually when countries experience rapid inflation, the real exchange rate does not change. Then e ↑׳ nominal appreciation of $! Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -16

Purchasing Power Parity (PPP) • The purchasing power parity (PPP) theory holds that the prices of identical goods should be the same in all countries, differing only by the cost of transport and any import duties – Implication: The real exchange rate (e) should be constant We can choose e = 1 • The theory can also be expressed in terms of rates of growth: Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -17

Purchasing Power Parity (PPP) • The purchasing power parity (PPP) theory holds that the prices of identical goods should be the same in all countries, differing only by the cost of transport and any import duties – Implication: The real exchange rate (e) should be constant We can choose e = 1 • The theory can also be expressed in terms of rates of growth: Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -17

International Perspective Big Mac Meets PPP Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -18

International Perspective Big Mac Meets PPP Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -18

Figure 7 -4 Nominal and Real Effective Exchange Rates of the Dollar, 1980 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -19

Figure 7 -4 Nominal and Real Effective Exchange Rates of the Dollar, 1980 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -19

Exchange Rate Systems • • In a (pure) flexible exchange rate system, the foreign exchange rate is free to change every day in order to establish an equilibrium between Q S and QD of a nation’s currency In a fixed exchange rate system, the foreign exchange rate is fixed for long periods of time – Maintained by central bank purchases and sales of the nation’s currency • • If there is an excess demand of the home currency CB sells currency / buys USD If there is an excess supply of the home currency CB buys currency / sells USD – When the CB purchases (sells) foreign currency, its holdings of foreign exchange reserves increase (decrease) – Under a fixed exchange rate system, an increase (decrease) in the value of the currency is known as a revaluation (devaluation) • The current system of exchange rates is not a pure flexible exchange rate system because of CB intervention in FX markets – 1986 -2009: Foreign CB’s intervened by buying over $4 trillion USD Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -20

Exchange Rate Systems • • In a (pure) flexible exchange rate system, the foreign exchange rate is free to change every day in order to establish an equilibrium between Q S and QD of a nation’s currency In a fixed exchange rate system, the foreign exchange rate is fixed for long periods of time – Maintained by central bank purchases and sales of the nation’s currency • • If there is an excess demand of the home currency CB sells currency / buys USD If there is an excess supply of the home currency CB buys currency / sells USD – When the CB purchases (sells) foreign currency, its holdings of foreign exchange reserves increase (decrease) – Under a fixed exchange rate system, an increase (decrease) in the value of the currency is known as a revaluation (devaluation) • The current system of exchange rates is not a pure flexible exchange rate system because of CB intervention in FX markets – 1986 -2009: Foreign CB’s intervened by buying over $4 trillion USD Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -20

Figure 7 -5 Foreign Official Holdings of Dollar Reserves as a Percent of U. S. GDP, 1980 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -21

Figure 7 -5 Foreign Official Holdings of Dollar Reserves as a Percent of U. S. GDP, 1980 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -21

Net Exports and the Foreign Exchange Rate • Net Exports (NX) are affected by both income (Y) and the real foreign exchange rate (e): – If Y spending on imports NX – If e exports are more expensive, and imports are cheaper NX • Algebraically, NX = NXa – nx. Y – ue where NXa is autonomous net exports nx and u are positive parameters Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -22

Net Exports and the Foreign Exchange Rate • Net Exports (NX) are affected by both income (Y) and the real foreign exchange rate (e): – If Y spending on imports NX – If e exports are more expensive, and imports are cheaper NX • Algebraically, NX = NXa – nx. Y – ue where NXa is autonomous net exports nx and u are positive parameters Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -22

Figure 7 -6 U. S. Real Net Exports and the Real Exchange Rate of the Dollar, 1980 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -23

Figure 7 -6 U. S. Real Net Exports and the Real Exchange Rate of the Dollar, 1980 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -23

The Real Exchange Rate and Interest Rate • Recall: D and S of FX determines the nominal exchange rate – “Fundamentals” driving X and M change slowly over time – Volatility of exchange rates therefore attributed to international financial capital flows • The relative attractiveness of U. S. and foreign securities depends on the interest rate differential (r. US – rf), which is the average U. S. interest rate minus the average foreign interest rate – If (r. US – rf) ↑ U. S. financial assets more attractive ppl buy $ e ↑׳ Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -24

The Real Exchange Rate and Interest Rate • Recall: D and S of FX determines the nominal exchange rate – “Fundamentals” driving X and M change slowly over time – Volatility of exchange rates therefore attributed to international financial capital flows • The relative attractiveness of U. S. and foreign securities depends on the interest rate differential (r. US – rf), which is the average U. S. interest rate minus the average foreign interest rate – If (r. US – rf) ↑ U. S. financial assets more attractive ppl buy $ e ↑׳ Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -24

Figure 7 -7 The U. S. Real Corporate Bond Rate and the Real Exchange Rate of the Dollar, 1978 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -25

Figure 7 -7 The U. S. Real Corporate Bond Rate and the Real Exchange Rate of the Dollar, 1978 -2010 Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -25

Perfect Capital Mobility (PCM) • Perfect capital mobility (PCM) occurs when investors regard foreign assets as a perfect substitute for domestic assets, and when investors respond instantaneously to an interest rate differential between domestic and foreign assets by moving sufficient assets to eliminate that differential • Under perfect capital mobility no control over the interest rate – Fixed Exchange Rates: A stimulative monetary policy (or contractionary fiscal policy) will not reduce the domestic interest rate, but will instead cause the country to lose foreign reserve holdings – Flexible Exchange Rates: A stimulative monetary policy (or contractionary fiscal policy) generates an excess supply of dollars USD depreciates, but i unchanged – This assumes that the economy is a Small Open Economy (or SOE), which is considered too small for its domestic policies to affect the world interest rate Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -26

Perfect Capital Mobility (PCM) • Perfect capital mobility (PCM) occurs when investors regard foreign assets as a perfect substitute for domestic assets, and when investors respond instantaneously to an interest rate differential between domestic and foreign assets by moving sufficient assets to eliminate that differential • Under perfect capital mobility no control over the interest rate – Fixed Exchange Rates: A stimulative monetary policy (or contractionary fiscal policy) will not reduce the domestic interest rate, but will instead cause the country to lose foreign reserve holdings – Flexible Exchange Rates: A stimulative monetary policy (or contractionary fiscal policy) generates an excess supply of dollars USD depreciates, but i unchanged – This assumes that the economy is a Small Open Economy (or SOE), which is considered too small for its domestic policies to affect the world interest rate Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -26

SOE IS/LM Model with Fixed ER’s • Monetary Expansion – Fed MS↑ LM shifts right Normally r↓ and Y↑ but PCM implies huge financial capital outflows pressure on e ↓׳ CB must buy $ (MS↓) by selling holdings of foreign $ (reserve holdings↓) – Ultimate result: r unchanged and ineffective monetary policy • Fiscal Expansion – Fiscal stimulus IS shifts right Normally r↑ and Y↑ PCM implies huge financial capital inflows pressure on e ↑׳ CB must sell $ (MS↑) by buying holdings of foreign $ (reserve holdings↑) LM shifts right – Ultimate result: r unchanged, but Y↑↑ Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -27

SOE IS/LM Model with Fixed ER’s • Monetary Expansion – Fed MS↑ LM shifts right Normally r↓ and Y↑ but PCM implies huge financial capital outflows pressure on e ↓׳ CB must buy $ (MS↓) by selling holdings of foreign $ (reserve holdings↓) – Ultimate result: r unchanged and ineffective monetary policy • Fiscal Expansion – Fiscal stimulus IS shifts right Normally r↑ and Y↑ PCM implies huge financial capital inflows pressure on e ↑׳ CB must sell $ (MS↑) by buying holdings of foreign $ (reserve holdings↑) LM shifts right – Ultimate result: r unchanged, but Y↑↑ Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -27

SOE IS/LM Model with Flexible ER’s • Monetary Expansion – Fed MS↑ LM shifts right Normally r↓ and Y↑ but PCM implies huge financial capital outflows e ↓׳ NX↑ IS shifts right – Ultimate result: r unchanged, but Y↑↑ • Fiscal Expansion – Fiscal stimulus IS shifts right Normally r↑ and Y↑ PCM implies huge financial capital inflows e ↑׳ NX↓ IS shifts left – Ultimate result: r and Y unchanged – Domestic crowding out is replaced by international crowding out The twin deficits are identical! Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -28

SOE IS/LM Model with Flexible ER’s • Monetary Expansion – Fed MS↑ LM shifts right Normally r↓ and Y↑ but PCM implies huge financial capital outflows e ↓׳ NX↑ IS shifts right – Ultimate result: r unchanged, but Y↑↑ • Fiscal Expansion – Fiscal stimulus IS shifts right Normally r↑ and Y↑ PCM implies huge financial capital inflows e ↑׳ NX↓ IS shifts left – Ultimate result: r and Y unchanged – Domestic crowding out is replaced by international crowding out The twin deficits are identical! Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -28

Summary of Monetary and Fiscal Policy Effects in Open Economics Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -29

Summary of Monetary and Fiscal Policy Effects in Open Economics Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 7 -29