8b04e6018e7c1be5abca1b6df1002fa8.ppt

- Количество слайдов: 40

Chapter 7 Forecasting Share Price Movements Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 1

Chapter 7 Forecasting Share Price Movements Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 1

Learning Objectives • Evaluate and apply bottom-up and top-down approaches to fundamental analysis • Describe and apply technical analysis techniques • Examine the role of program trading • Explain theoretical concepts and implications of the random walk and efficient market hypotheses when forecasting share price movements Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 2

Learning Objectives • Evaluate and apply bottom-up and top-down approaches to fundamental analysis • Describe and apply technical analysis techniques • Examine the role of program trading • Explain theoretical concepts and implications of the random walk and efficient market hypotheses when forecasting share price movements Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 2

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 3

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 3

7. 1 Fundamental Analysis: Top-down Approach • Share price is determined by supply and demand of a company’s shares • Expectation of bad company performance causes investors to sell their shares, increasing supply and reducing the price • Expectation of good company performance increases demand leads to an increase in share price Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 4

7. 1 Fundamental Analysis: Top-down Approach • Share price is determined by supply and demand of a company’s shares • Expectation of bad company performance causes investors to sell their shares, increasing supply and reducing the price • Expectation of good company performance increases demand leads to an increase in share price Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 4

7. 1 Fundamental Analysis: Top-down Approach (cont. ) • What causes the shifts in demand supply of a company’s securities on the secondary market? • Three approaches to answering this question – Fundamental analysis: top-down – Fundamental analysis: bottom-up – Technical analysis Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 5

7. 1 Fundamental Analysis: Top-down Approach (cont. ) • What causes the shifts in demand supply of a company’s securities on the secondary market? • Three approaches to answering this question – Fundamental analysis: top-down – Fundamental analysis: bottom-up – Technical analysis Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 5

7. 1 Fundamental Analysis: Top-down Approach (cont. ) • Fundamental analysis – Considers macro and micro factors that impact upon cash flows and future share prices of various industry sectors and firms § Macro factors include interest rates, economic growth, business investment § Micro factors are firm-specific and relate to management’s impact on company performance Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 6

7. 1 Fundamental Analysis: Top-down Approach (cont. ) • Fundamental analysis – Considers macro and micro factors that impact upon cash flows and future share prices of various industry sectors and firms § Macro factors include interest rates, economic growth, business investment § Micro factors are firm-specific and relate to management’s impact on company performance Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 6

7. 1 Fundamental Analysis: Top-down Approach (cont. ) • Top-down approach considers macro factors – – Economic growth of international economies Exchange rates Interest rates Domestic economy § § § Growth rate Balance of payments Inflation Wage and productivity growth Government responses to changes in the above factors Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 7

7. 1 Fundamental Analysis: Top-down Approach (cont. ) • Top-down approach considers macro factors – – Economic growth of international economies Exchange rates Interest rates Domestic economy § § § Growth rate Balance of payments Inflation Wage and productivity growth Government responses to changes in the above factors Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 7

Top-down approach—international economies • The higher the growth rate in the rest of the world, the greater the demand for Australian exports • Sectors benefitting from international growth determined by source of the growth • Growth can be driven by – Increased consumer demand – Increased business investment in equipment Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 8

Top-down approach—international economies • The higher the growth rate in the rest of the world, the greater the demand for Australian exports • Sectors benefitting from international growth determined by source of the growth • Growth can be driven by – Increased consumer demand – Increased business investment in equipment Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 8

Top-down approach—rate of growth of an economy • Generally, greater domestic growth leads to increased profitability of firms • But high growth can lead to any of the following factors, which can reduce firm profitability – – – Deterioration in balance of payments Increase in inflationary pressures Pressure on wages Depreciation of the exchange rate Rise in interest rates Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 9

Top-down approach—rate of growth of an economy • Generally, greater domestic growth leads to increased profitability of firms • But high growth can lead to any of the following factors, which can reduce firm profitability – – – Deterioration in balance of payments Increase in inflationary pressures Pressure on wages Depreciation of the exchange rate Rise in interest rates Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 9

Top-down approach—exchange rates • Affect the domestic currency profit of exporters that quote their products in foreign currency prices – A strengthening Australian dollar (AUD) makes these firms worse off because the AUD value of their exports is less • Exchange rates also affect firms indirectly – e. g. devaluation of currency increases cost of imports, thereby increasing inflation Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 10

Top-down approach—exchange rates • Affect the domestic currency profit of exporters that quote their products in foreign currency prices – A strengthening Australian dollar (AUD) makes these firms worse off because the AUD value of their exports is less • Exchange rates also affect firms indirectly – e. g. devaluation of currency increases cost of imports, thereby increasing inflation Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 10

Top-down approach—domestic economy Interest rates • Have both a direct and indirect impact on a firm’s value – Direct effect on profitability § Represents the cost of debt finance for borrowers and the return for finance providers – Indirect effect on profitability § Rise in interest rates may indicate a slowing of economic activity § Future reduction in profitability Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 11

Top-down approach—domestic economy Interest rates • Have both a direct and indirect impact on a firm’s value – Direct effect on profitability § Represents the cost of debt finance for borrowers and the return for finance providers – Indirect effect on profitability § Rise in interest rates may indicate a slowing of economic activity § Future reduction in profitability Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 11

Top-down approach—domestic economy (cont. ) Current account of balance of payments • If current account is in deficit (i. e. total international payments exceed total international receipts) then – Some export income is diverted to service debt – Need to borrow foreign currency to service debt • Indirect effect on firms’ profitability – Government may increase interest rates to slow economic growth and control the debt Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 12

Top-down approach—domestic economy (cont. ) Current account of balance of payments • If current account is in deficit (i. e. total international payments exceed total international receipts) then – Some export income is diverted to service debt – Need to borrow foreign currency to service debt • Indirect effect on firms’ profitability – Government may increase interest rates to slow economic growth and control the debt Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 12

Top-down approach—domestic economy (cont. ) Inflationary pressures • Effect of inflation on firm’s real profit • Tax treatment of inflation – Makes historical-based depreciation allowances inappropriate – Combined with higher replacement costs leads to an overstatement of after-tax profit • Inventory – ‘Inflated’ selling price of inventory creates an illusion of inventory profits Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 13

Top-down approach—domestic economy (cont. ) Inflationary pressures • Effect of inflation on firm’s real profit • Tax treatment of inflation – Makes historical-based depreciation allowances inappropriate – Combined with higher replacement costs leads to an overstatement of after-tax profit • Inventory – ‘Inflated’ selling price of inventory creates an illusion of inventory profits Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 13

Top-down approach—domestic economy (cont. ) Wages growth • Increase in wages growth raises the amount of business profit used for salaries • This will impact most heavily on those firms that are highly labour intensive Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 14

Top-down approach—domestic economy (cont. ) Wages growth • Increase in wages growth raises the amount of business profit used for salaries • This will impact most heavily on those firms that are highly labour intensive Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 14

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 15

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 15

7. 2 Fundamental Analysis: Bottom-up Approach • Following identification of the best economies and industry sectors for investment using the top-down approach, the bottom-up approach can be used to identify the best companies within these • Bottom-up approach considers micro factors using ratios and other measures of a firm’s financial characteristics and performance Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 16

7. 2 Fundamental Analysis: Bottom-up Approach • Following identification of the best economies and industry sectors for investment using the top-down approach, the bottom-up approach can be used to identify the best companies within these • Bottom-up approach considers micro factors using ratios and other measures of a firm’s financial characteristics and performance Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 16

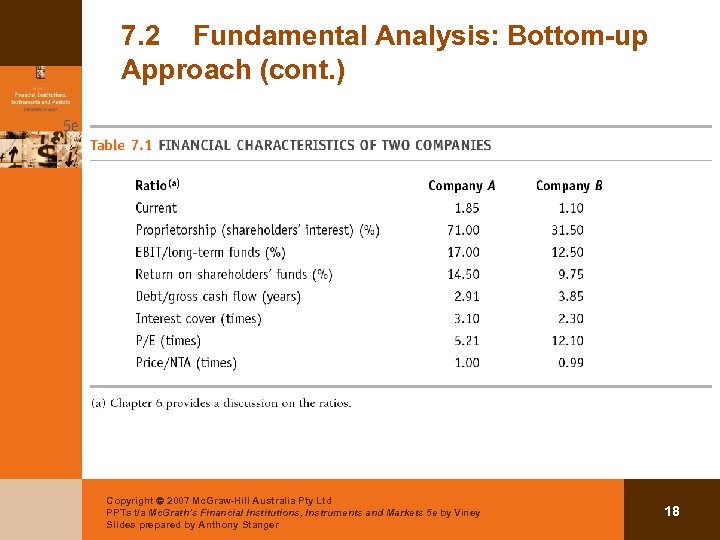

7. 2 Fundamental Analysis: Bottom-up Approach (cont. ) • Considers factors like the following – Accounting ratios that assess a company’s capital structure, liquidity, debt servicing, profitability, share price and risk (see Chapter 6), observing the trend and making comparisons with firms in the same industry – Additional information on key management changes, corporate governance and strategic direction Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 17

7. 2 Fundamental Analysis: Bottom-up Approach (cont. ) • Considers factors like the following – Accounting ratios that assess a company’s capital structure, liquidity, debt servicing, profitability, share price and risk (see Chapter 6), observing the trend and making comparisons with firms in the same industry – Additional information on key management changes, corporate governance and strategic direction Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 17

7. 2 Fundamental Analysis: Bottom-up Approach (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 18

7. 2 Fundamental Analysis: Bottom-up Approach (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 18

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 19

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 19

7. 3 Technical Analysis • Explains and forecasts share price movements based on past price behaviour • Assumes markets are dominated at certain times by a mass psychology, from which regular patterns emerge • Two main forecasting models – Moving averages (MA) – Charting Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 20

7. 3 Technical Analysis • Explains and forecasts share price movements based on past price behaviour • Assumes markets are dominated at certain times by a mass psychology, from which regular patterns emerge • Two main forecasting models – Moving averages (MA) – Charting Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 20

Moving Averages (MA) Models • Smooth out a series facilitating the identification of trends in the series • Calculation of MA – Assuming a five-day moving average, the MA is calculated by taking the average of the price series for the preceding five days Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 21

Moving Averages (MA) Models • Smooth out a series facilitating the identification of trends in the series • Calculation of MA – Assuming a five-day moving average, the MA is calculated by taking the average of the price series for the preceding five days Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 21

Moving Averages (MA) Models (cont. ) • Trading rules – Buy when the price series cuts the MA from below – Buy when the MA series is rising strongly and the price series cuts or touches the MA from above for only a few observations – Sell when the MA flattens or declines and the price series cuts MA from above – Sell when the MA is in decline and the price series cuts or touches the MA from below for only a few observations Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 22

Moving Averages (MA) Models (cont. ) • Trading rules – Buy when the price series cuts the MA from below – Buy when the MA series is rising strongly and the price series cuts or touches the MA from above for only a few observations – Sell when the MA flattens or declines and the price series cuts MA from above – Sell when the MA is in decline and the price series cuts or touches the MA from below for only a few observations Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 22

Moving Averages (MA) Models (cont. ) • Typically for daily price series both 10 -day (shortterm) and 30 -day (medium-term) moving averages are calculated • Weighted MA – The most recent information is given the greatest weight Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 23

Moving Averages (MA) Models (cont. ) • Typically for daily price series both 10 -day (shortterm) and 30 -day (medium-term) moving averages are calculated • Weighted MA – The most recent information is given the greatest weight Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 23

Charting • Investigating patterns in price charts • Several techniques – – Trend lines Support and resistance lines Continuation patterns Reversal patterns Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 24

Charting • Investigating patterns in price charts • Several techniques – – Trend lines Support and resistance lines Continuation patterns Reversal patterns Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 24

Charting (cont. ) Trend lines • Trends are regular movements in share prices • Two types of trends – Uptrend line—connecting the lower points of rising price series – Downtrend line—connecting the higher points of falling price series § Return line—line drawn parallel to a trend line to create a trend channel • Critical issue is to determine when the trend line is going to change Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 25

Charting (cont. ) Trend lines • Trends are regular movements in share prices • Two types of trends – Uptrend line—connecting the lower points of rising price series – Downtrend line—connecting the higher points of falling price series § Return line—line drawn parallel to a trend line to create a trend channel • Critical issue is to determine when the trend line is going to change Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 25

Charting (cont. ) Support and resistance lines • Support levels—where there is sufficient demand to halt further price falls • Resistance levels—where there is sufficient supply to halt further price increases • ‘Strong’ levels—historical support and resistance • ‘Weak’ levels—support and resistance based on more recent activity Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 26

Charting (cont. ) Support and resistance lines • Support levels—where there is sufficient demand to halt further price falls • Resistance levels—where there is sufficient supply to halt further price increases • ‘Strong’ levels—historical support and resistance • ‘Weak’ levels—support and resistance based on more recent activity Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 26

Charting (cont. ) Continuation patterns • Sideways share trading that does not normally signal a change in a trend • Two types – Triangles—composed of a series of price fluctuations, each smaller than its predecessor § Symmetrical triangle (no change in trend); ascending triangle (uptrend); descending triangle (downtrend) – Pennants and flags—formed during a sharp rise in prices (‘the pole’); trading volume then reduces and then increases suddenly to take prices sharply higher Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 27

Charting (cont. ) Continuation patterns • Sideways share trading that does not normally signal a change in a trend • Two types – Triangles—composed of a series of price fluctuations, each smaller than its predecessor § Symmetrical triangle (no change in trend); ascending triangle (uptrend); descending triangle (downtrend) – Pennants and flags—formed during a sharp rise in prices (‘the pole’); trading volume then reduces and then increases suddenly to take prices sharply higher Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 27

Charting (cont. ) Reversal patterns • Occur after a major market move • Result in a ‘head and shoulders’ pattern – Three successive rallies and reactions, the second rally being stronger than the first and third rallies § Left shoulder—formed by volume-strong rally on uptrend, followed by reduced-volume reaction § Head—second rally increases price before reaction moves price back to previous low § Right shoulder—final rally marked by reduced volume indicating price weakness Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 28

Charting (cont. ) Reversal patterns • Occur after a major market move • Result in a ‘head and shoulders’ pattern – Three successive rallies and reactions, the second rally being stronger than the first and third rallies § Left shoulder—formed by volume-strong rally on uptrend, followed by reduced-volume reaction § Head—second rally increases price before reaction moves price back to previous low § Right shoulder—final rally marked by reduced volume indicating price weakness Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 28

Charting (cont. ) Elliott wave theory • The existence of distinctive wave patterns that characterise share-market cycles • Key proposition is that a bull market consists of three major waves upwards, followed by two major down-legs, resulting in a reversion of share prices to about 60% of the peak Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 29

Charting (cont. ) Elliott wave theory • The existence of distinctive wave patterns that characterise share-market cycles • Key proposition is that a bull market consists of three major waves upwards, followed by two major down-legs, resulting in a reversion of share prices to about 60% of the peak Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 29

7. 3 Technical Analysis (cont. ) • Validity of technical analysis – Even where techniques have no apparent underlying validity, if they are followed by enough participants they may impact share price behaviour at times – More likely to forecast successfully when share prices move out of a range explained by economic and financial fundamentals Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 30

7. 3 Technical Analysis (cont. ) • Validity of technical analysis – Even where techniques have no apparent underlying validity, if they are followed by enough participants they may impact share price behaviour at times – More likely to forecast successfully when share prices move out of a range explained by economic and financial fundamentals Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 30

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 31

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 31

7. 4 Program Trading • Refers to buy and sell strategies generated by computer programs • Programs range between – Simple buy/sell orders based on moving averages – Complex monitoring of both derivatives and share markets for the purpose of hedging a share portfolio • Program trading increases the speed at which prices change Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 32

7. 4 Program Trading • Refers to buy and sell strategies generated by computer programs • Programs range between – Simple buy/sell orders based on moving averages – Complex monitoring of both derivatives and share markets for the purpose of hedging a share portfolio • Program trading increases the speed at which prices change Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 32

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 33

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 33

7. 5 Random Walk and Efficient Market Hypotheses • Two theories on security values and changes in price • Random walk – Share price is assumed to be formed by investor’s expectations of future cash flows, i. e. intrinsic value – Price will change in response to new information; since information arrives in a random fashion, stock prices adjust in an unpredictable fashion Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 34

7. 5 Random Walk and Efficient Market Hypotheses • Two theories on security values and changes in price • Random walk – Share price is assumed to be formed by investor’s expectations of future cash flows, i. e. intrinsic value – Price will change in response to new information; since information arrives in a random fashion, stock prices adjust in an unpredictable fashion Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 34

7. 5 Random Walk and Efficient Market Hypotheses (cont. ) • Random walk (cont. ) – Each observation in the (price) series is assumed to be independent of the previous price – There is an equal probability that the next price will move up, down or remain unchanged Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 35

7. 5 Random Walk and Efficient Market Hypotheses (cont. ) • Random walk (cont. ) – Each observation in the (price) series is assumed to be independent of the previous price – There is an equal probability that the next price will move up, down or remain unchanged Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 35

7. 5 Random Walk and Efficient Market Hypotheses (cont. ) • Efficient market hypothesis (EMH) – EMH proposes that markets are information-efficient if prices adjust immediately to new information – It is not possible for an investor to make abnormal profits through superior information Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 36

7. 5 Random Walk and Efficient Market Hypotheses (cont. ) • Efficient market hypothesis (EMH) – EMH proposes that markets are information-efficient if prices adjust immediately to new information – It is not possible for an investor to make abnormal profits through superior information Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 36

7. 5 Random Walk and Efficient Market Hypotheses (cont. ) • Efficient market hypothesis (EMH) (cont. ) – Three forms § Weak form—historic price data reflected in share price § Semi-strong form—all publicly available information is reflected in share price § Strong form—public and private information is fully reflected in share price Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 37

7. 5 Random Walk and Efficient Market Hypotheses (cont. ) • Efficient market hypothesis (EMH) (cont. ) – Three forms § Weak form—historic price data reflected in share price § Semi-strong form—all publicly available information is reflected in share price § Strong form—public and private information is fully reflected in share price Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 37

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 38

Chapter Organisation 7. 1 7. 2 7. 3 7. 4 7. 5 7. 6 Fundamental Analysis: Top-down Approach Fundamental Analysis: Bottom-up Approach Technical Analysis Program Trading Random Walk and Efficient Market Hypotheses Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 38

7. 7 Summary • Demand supply determines the price of shares • Demand supply of shares is determined by expectations about future – Company performance § Fundamental analysis • Top-down approach • Bottom-up approach – Share price movement § Technical analysis • Moving averages models • Charting Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 39

7. 7 Summary • Demand supply determines the price of shares • Demand supply of shares is determined by expectations about future – Company performance § Fundamental analysis • Top-down approach • Bottom-up approach – Share price movement § Technical analysis • Moving averages models • Charting Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 39

7. 7 Summary (cont. ) • Program trading involves buy and sell orders generated by computer programs • Random walk hypothesis—the price of a share is independent of its previous price • Efficient market hypothesis—prices adjust immediately to new information Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 40

7. 7 Summary (cont. ) • Program trading involves buy and sell orders generated by computer programs • Random walk hypothesis—the price of a share is independent of its previous price • Efficient market hypothesis—prices adjust immediately to new information Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 40