939eb2261d75c1d0db03a3271be5c3e1.ppt

- Количество слайдов: 67

CHAPTER 7 Equilibrium in the Flexible-Price Model 1 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Questions • When wages and prices are flexible, what economic forces keep total production equal to aggregate demand? • Why does the flow-of-funds through financial markets have to balance? • What are the components of savings flowing into financial markets? 2 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Questions • What is a “comparative statics” analysis? • What are “supply shocks”? • What are “real business cycles”? 3 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

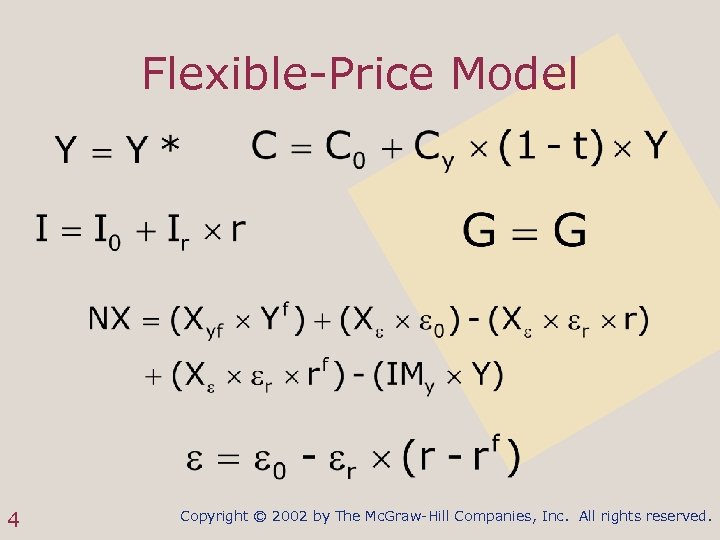

Flexible-Price Model 4 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

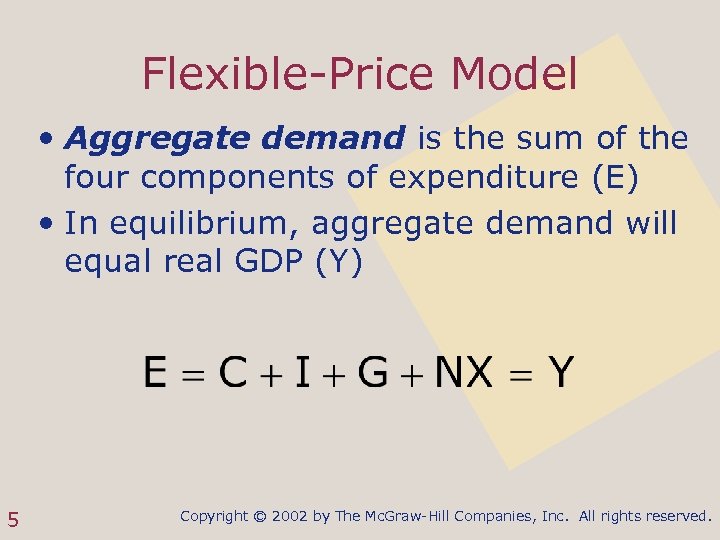

Flexible-Price Model • Aggregate demand is the sum of the four components of expenditure (E) • In equilibrium, aggregate demand will equal real GDP (Y) 5 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

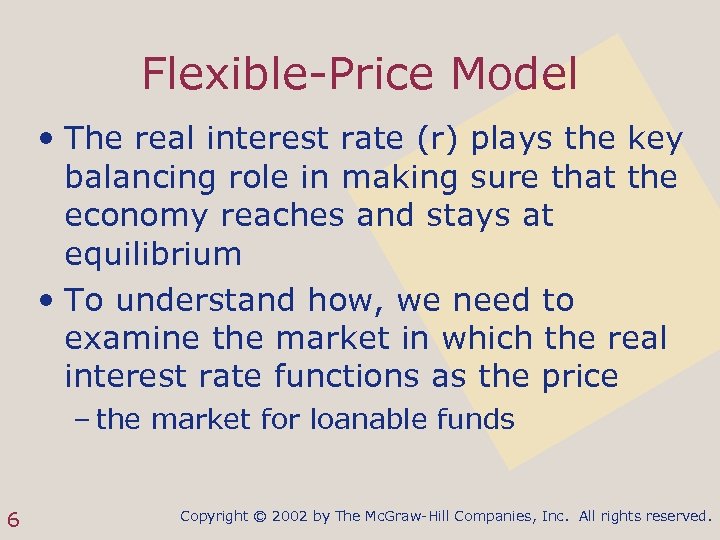

Flexible-Price Model • The real interest rate (r) plays the key balancing role in making sure that the economy reaches and stays at equilibrium • To understand how, we need to examine the market in which the real interest rate functions as the price – the market for loanable funds 6 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

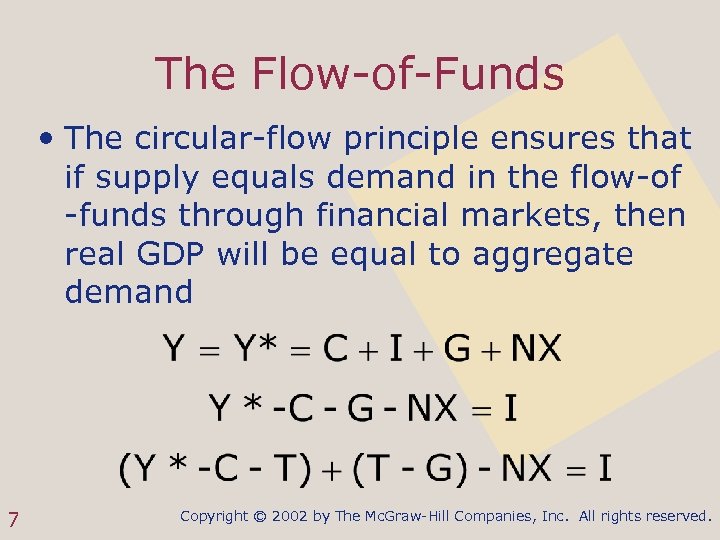

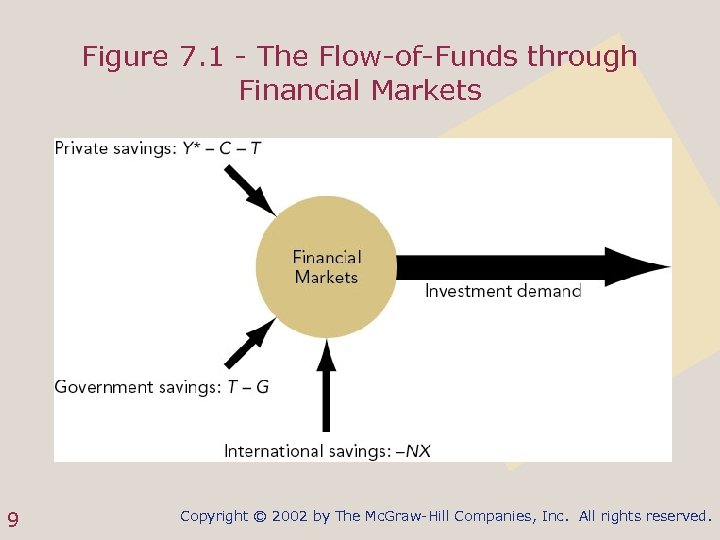

The Flow-of-Funds • The circular-flow principle ensures that if supply equals demand in the flow-of -funds through financial markets, then real GDP will be equal to aggregate demand 7 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

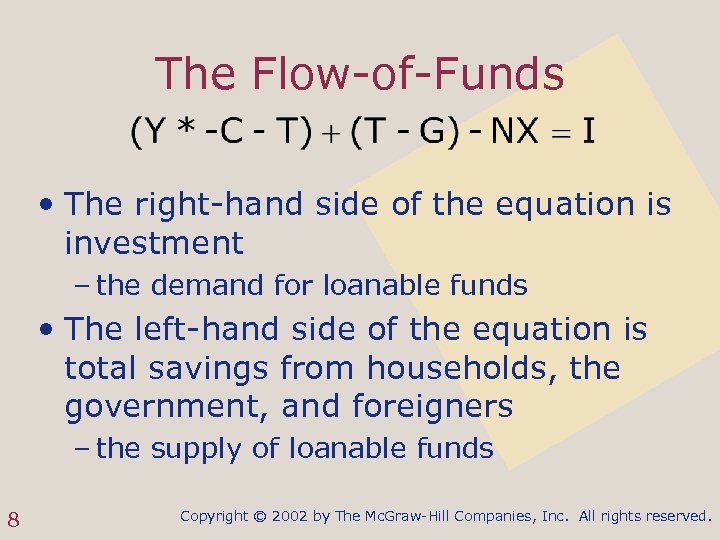

The Flow-of-Funds • The right-hand side of the equation is investment – the demand for loanable funds • The left-hand side of the equation is total savings from households, the government, and foreigners – the supply of loanable funds 8 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 1 - The Flow-of-Funds through Financial Markets 9 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

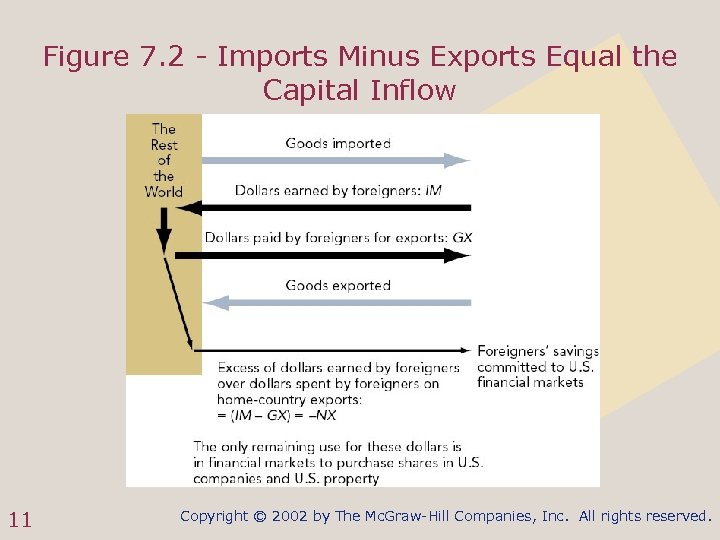

The Flow-of-Funds • (Y*-C-T) = households’ savings • (T-G) = government savings • (-NX) = the net flow of purchasing power that foreigners channel into domestic financial markets – dollars earned by foreigners selling imports above what is needed to buy our exports are used to purchase domestic assets 10 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 2 - Imports Minus Exports Equal the Capital Inflow 11 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

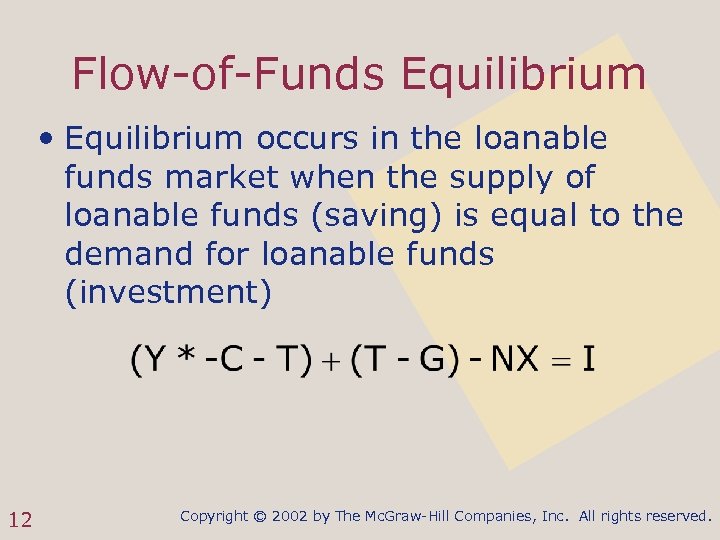

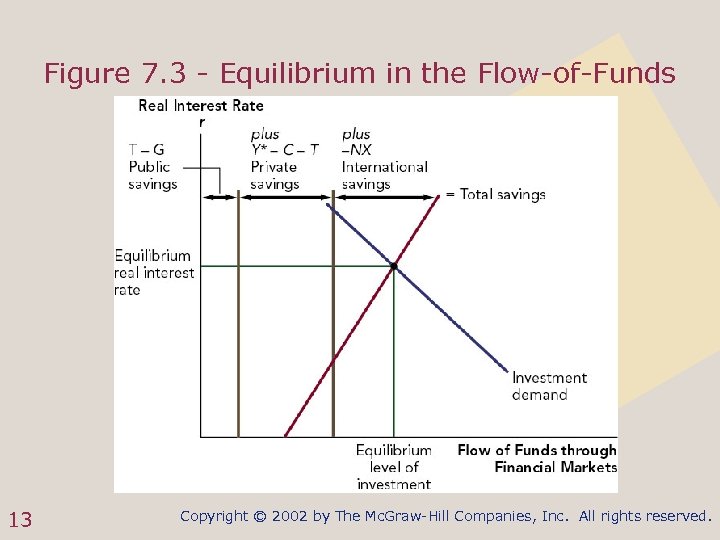

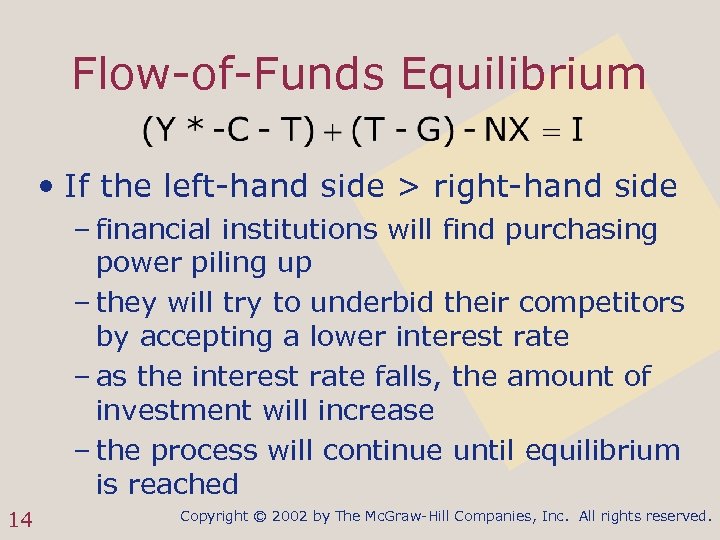

Flow-of-Funds Equilibrium • Equilibrium occurs in the loanable funds market when the supply of loanable funds (saving) is equal to the demand for loanable funds (investment) 12 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 3 - Equilibrium in the Flow-of-Funds 13 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

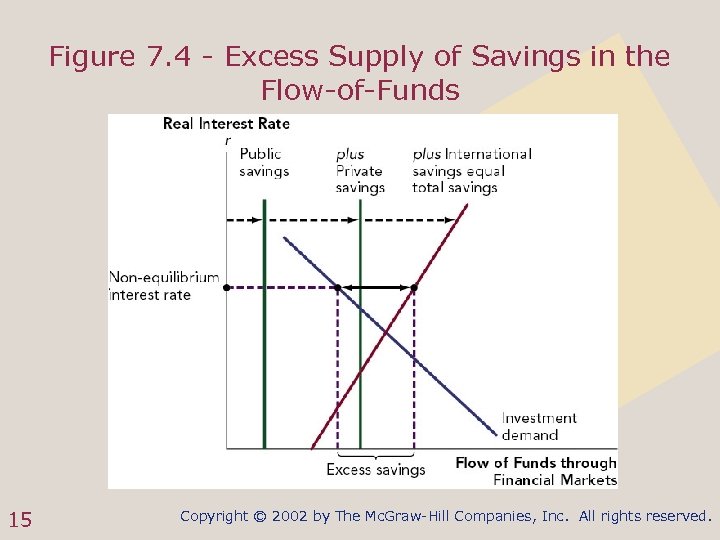

Flow-of-Funds Equilibrium • If the left-hand side > right-hand side – financial institutions will find purchasing power piling up – they will try to underbid their competitors by accepting a lower interest rate – as the interest rate falls, the amount of investment will increase – the process will continue until equilibrium is reached 14 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 4 - Excess Supply of Savings in the Flow-of-Funds 15 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

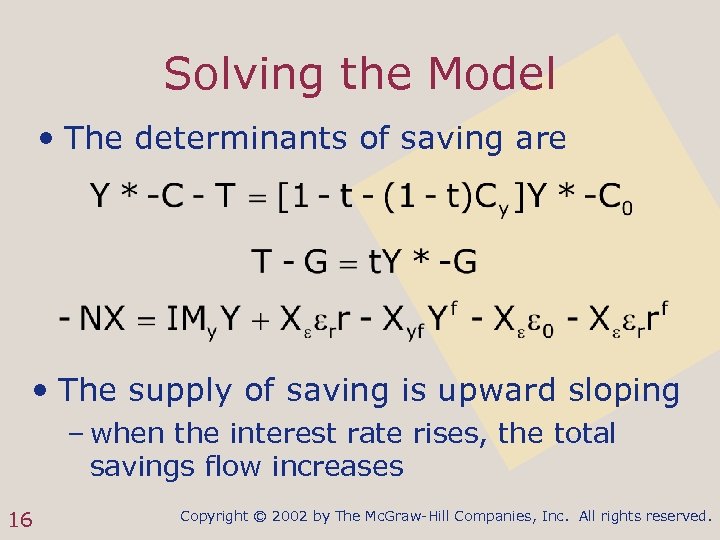

Solving the Model • The determinants of saving are • The supply of saving is upward sloping – when the interest rate rises, the total savings flow increases 16 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Solving the Model • The demand for loanable funds is the investment function • The demand for loanable funds is downward sloping – when the interest rate rises, investment falls 17 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

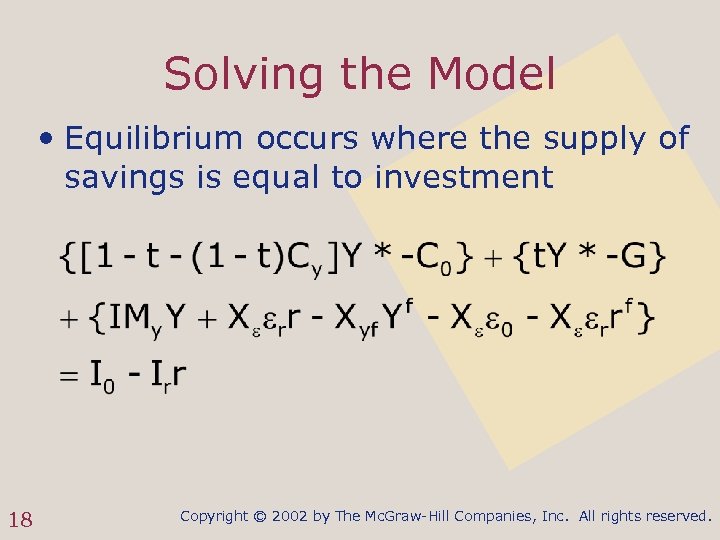

Solving the Model • Equilibrium occurs where the supply of savings is equal to investment 18 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

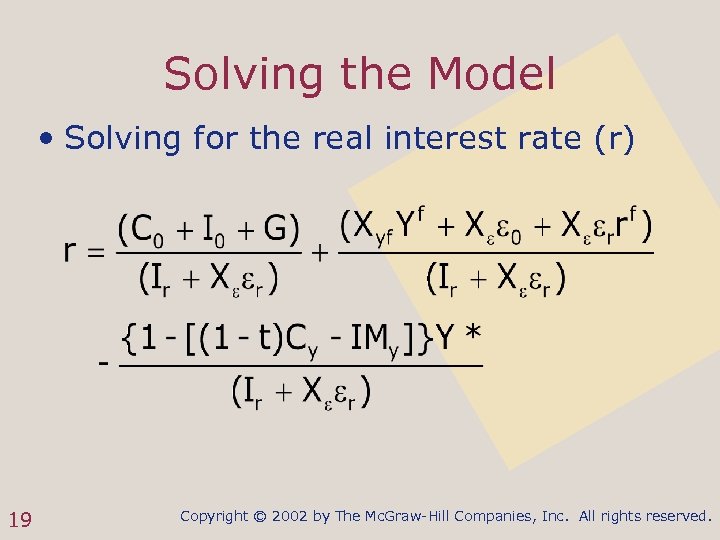

Solving the Model • Solving for the real interest rate (r) 19 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

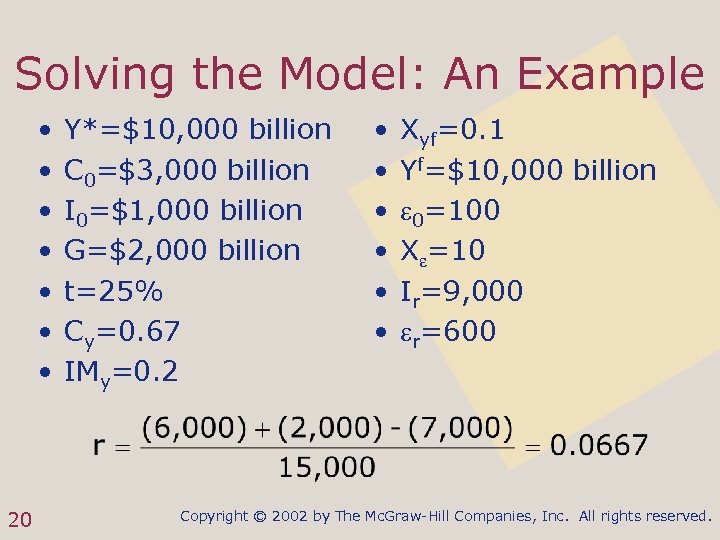

Solving the Model: An Example • • 20 Y*=$10, 000 billion C 0=$3, 000 billion I 0=$1, 000 billion G=$2, 000 billion t=25% Cy=0. 67 IMy=0. 2 • • • Xyf=0. 1 Yf=$10, 000 billion 0=100 X =10 Ir=9, 000 r=600 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

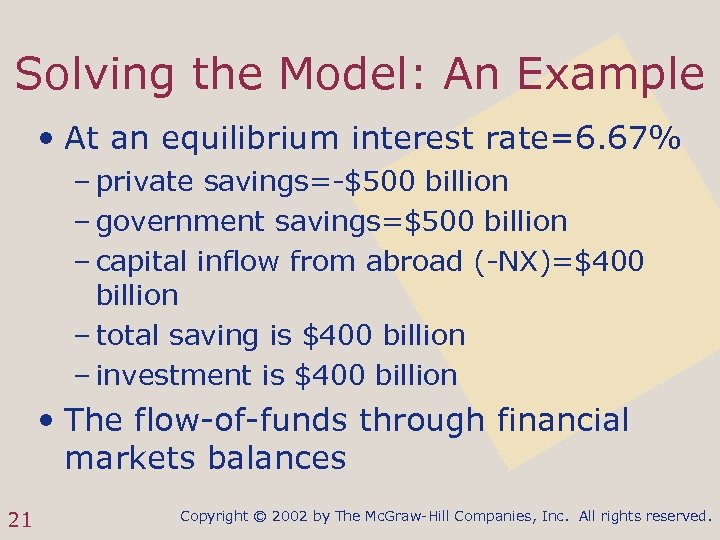

Solving the Model: An Example • At an equilibrium interest rate=6. 67% – private savings=-$500 billion – government savings=$500 billion – capital inflow from abroad (-NX)=$400 billion – total saving is $400 billion – investment is $400 billion • The flow-of-funds through financial markets balances 21 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Solving the Model: An Example • At an equilibrium interest rate=6. 67% – consumption spending=$8, 000 billion – investment spending=$400 billion – government purchases=$2, 000 billion – net exports=-$400 billion – total expenditure=$10, 000 billion – potential output=$10, 000 billion • Aggregate demand is equal to real GDP 22 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Comparative Statics • We can determine the response of the economy to a particular shift in the economic environment or policy – first, look at the initial equilibrium position of the economy – second, look at the equilibrium position of the economy after the shift – last, identify the difference in the two equilibrium positions as the change in the economy in response to the shift 23 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

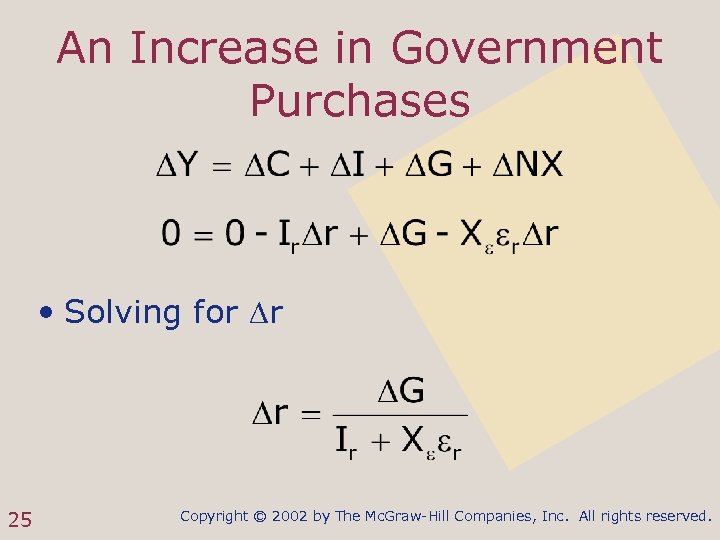

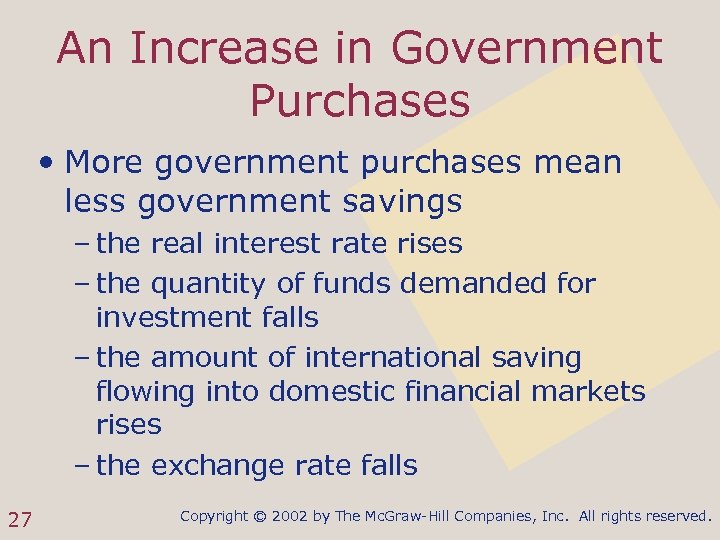

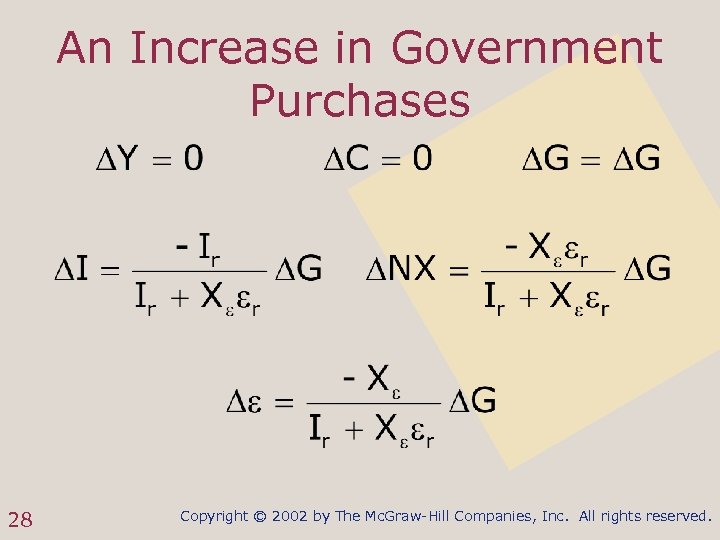

An Increase in Government Purchases • Policy makers decide to increase annual government purchases by G – no change in consumption [ C=0] – change in investment due to the change in the interest rate [ I=-Ir r] – change in net exports due to the change in the interest rate [ NX=-X r r] – no change in potential output or real GDP [ Y= Y*=0] 24 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

An Increase in Government Purchases • Solving for r 25 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

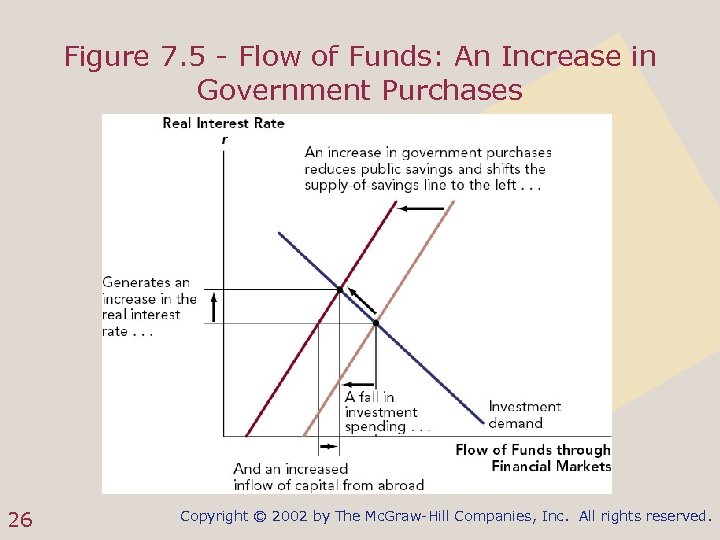

Figure 7. 5 - Flow of Funds: An Increase in Government Purchases 26 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

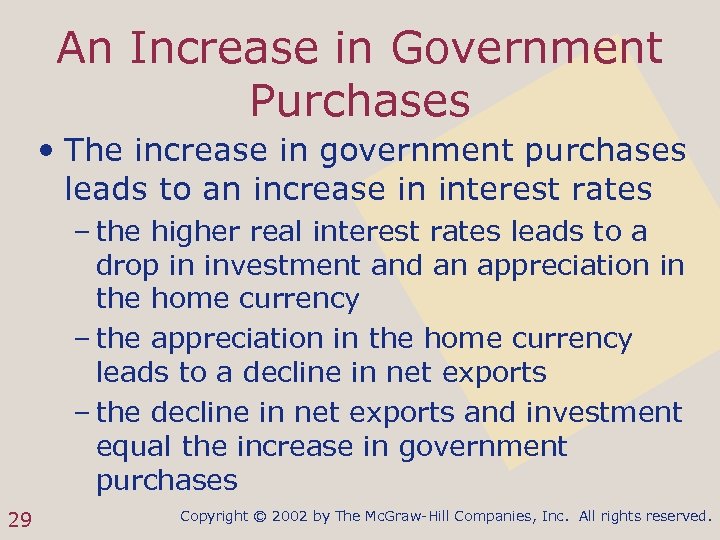

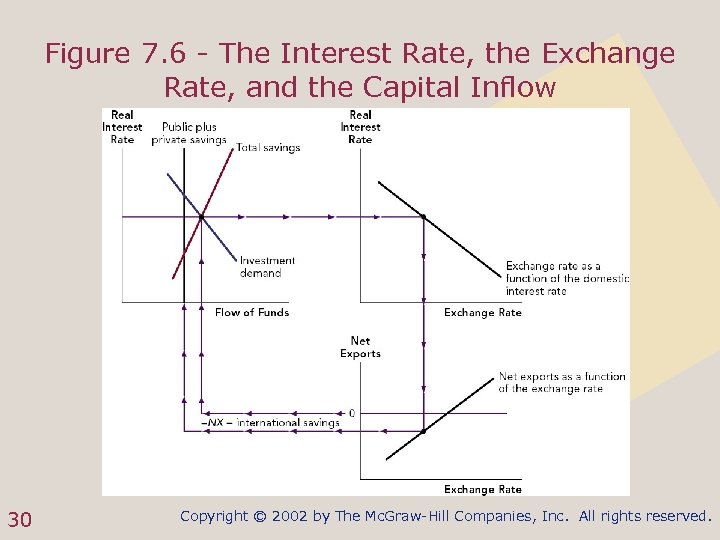

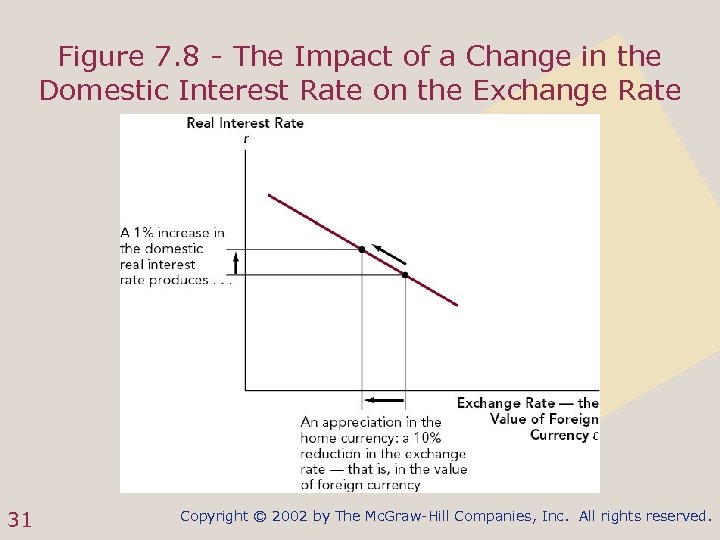

An Increase in Government Purchases • More government purchases mean less government savings – the real interest rate rises – the quantity of funds demanded for investment falls – the amount of international saving flowing into domestic financial markets rises – the exchange rate falls 27 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

An Increase in Government Purchases 28 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

An Increase in Government Purchases • The increase in government purchases leads to an increase in interest rates – the higher real interest rates leads to a drop in investment and an appreciation in the home currency – the appreciation in the home currency leads to a decline in net exports – the decline in net exports and investment equal the increase in government purchases 29 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 6 - The Interest Rate, the Exchange Rate, and the Capital Inflow 30 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 8 - The Impact of a Change in the Domestic Interest Rate on the Exchange Rate 31 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

A Decrease in Tax Rates • The effects of a cut in tax rates are very similar but not identical to an increase in government purchases – a tax cut increases household incomes, leading to a rise in consumption and household saving 32 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

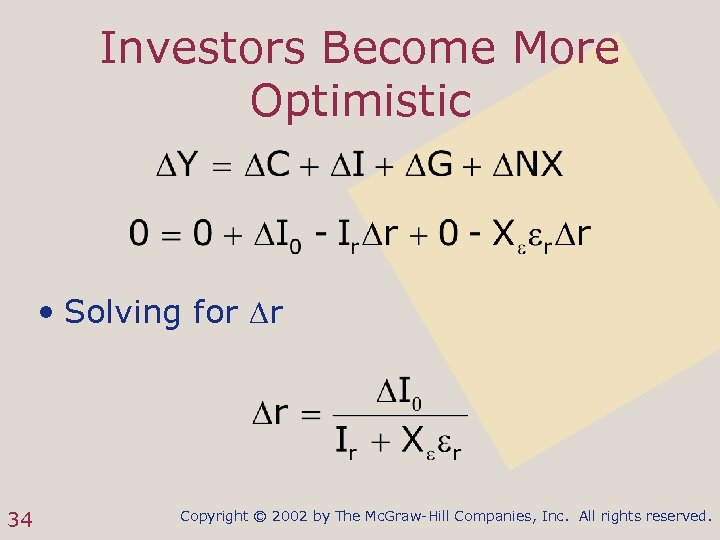

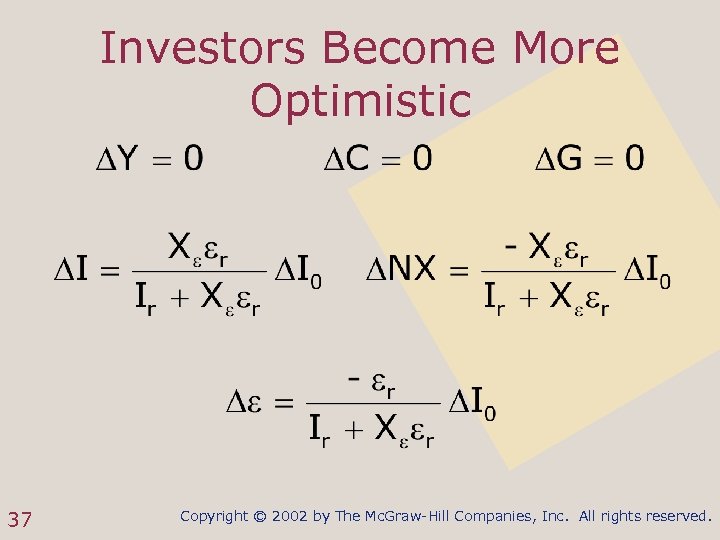

Investors Become More Optimistic • If investors become more optimistic, I 0 will rise by I 0 – no change in consumption or government purchases [ C= G=0] – change in investment due to the change in optimism and the change in the interest rate [ I= I 0 -Ir r] – change in net exports due to the change in the interest rate [ NX=-X r r] 33 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Investors Become More Optimistic • Solving for r 34 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

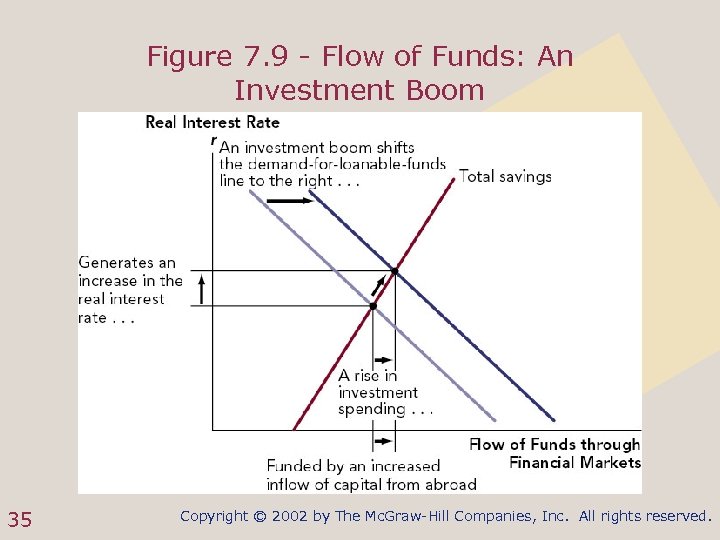

Figure 7. 9 - Flow of Funds: An Investment Boom 35 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

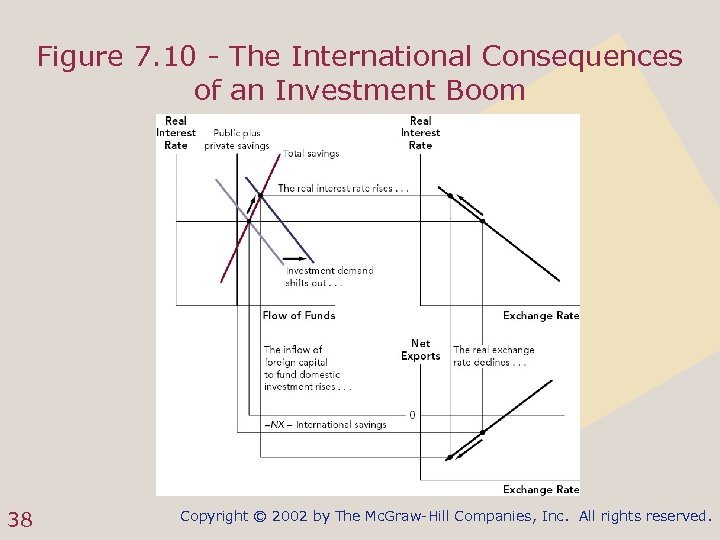

Investors Become More Optimistic • The increase in investment increases the demand for loanable funds – the real interest rate rises – the amount of international saving flowing into domestic financial markets rises – the exchange rate falls – net exports falls 36 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Investors Become More Optimistic 37 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 10 - The International Consequences of an Investment Boom 38 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

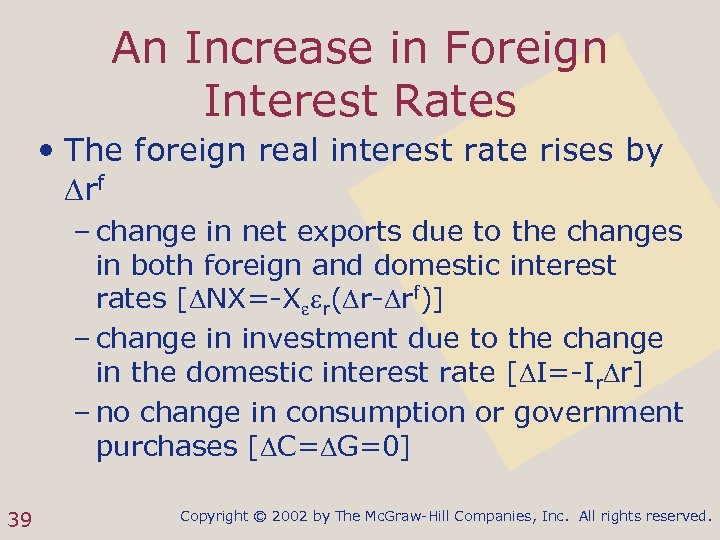

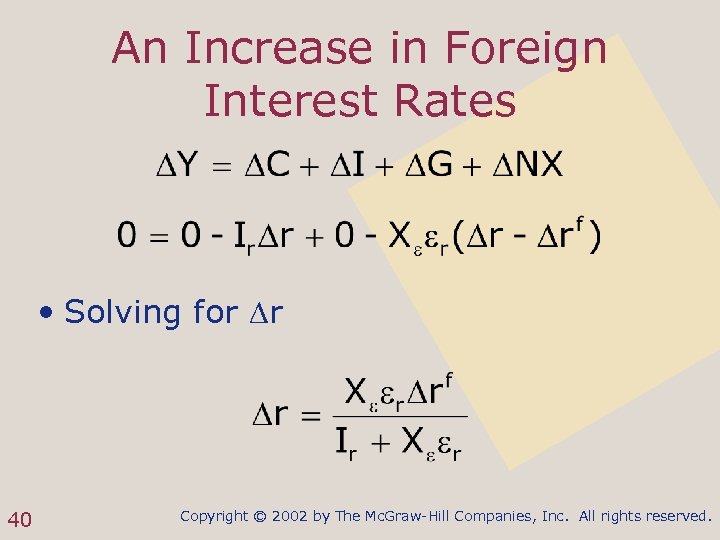

An Increase in Foreign Interest Rates • The foreign real interest rate rises by rf – change in net exports due to the changes in both foreign and domestic interest rates [ NX=-X r( r- rf)] – change in investment due to the change in the domestic interest rate [ I=-Ir r] – no change in consumption or government purchases [ C= G=0] 39 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

An Increase in Foreign Interest Rates • Solving for r 40 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

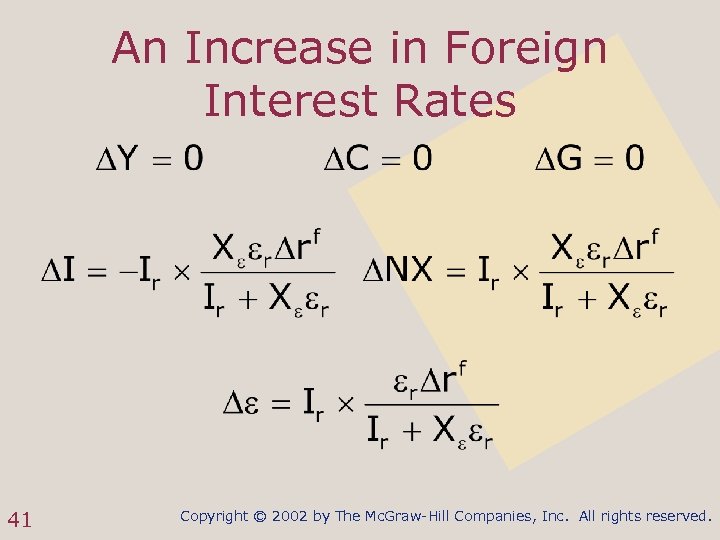

An Increase in Foreign Interest Rates 41 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

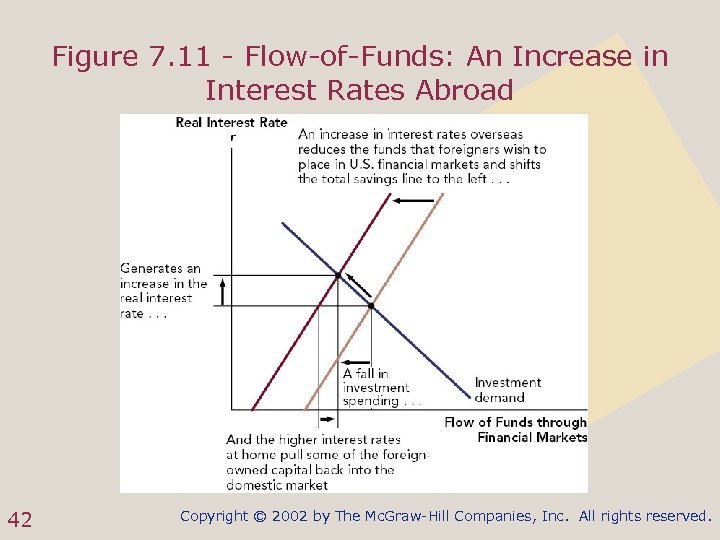

Figure 7. 11 - Flow-of-Funds: An Increase in Interest Rates Abroad 42 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

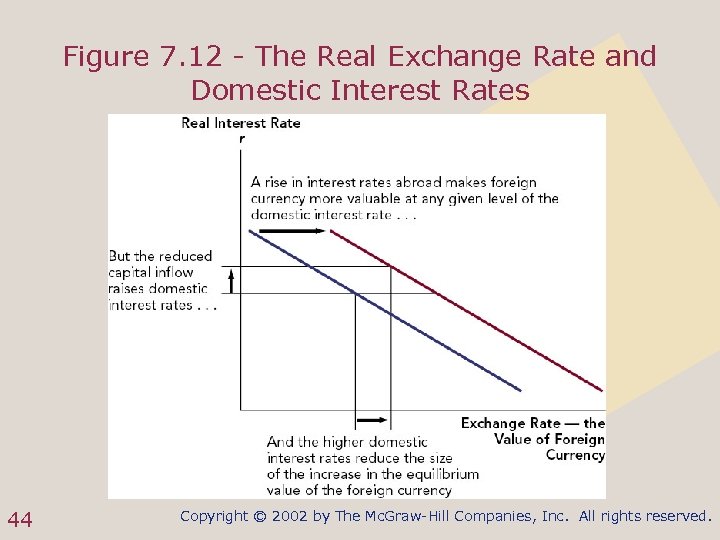

An Increase in Foreign Interest Rates • The rise in foreign interest rates reduces the supply of loanable funds – the domestic real interest rate rises (but by less than the increase in the foreign interest rate) – the amount of investment falls – the exchange rate rises – net exports rises 43 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 12 - The Real Exchange Rate and Domestic Interest Rates 44 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

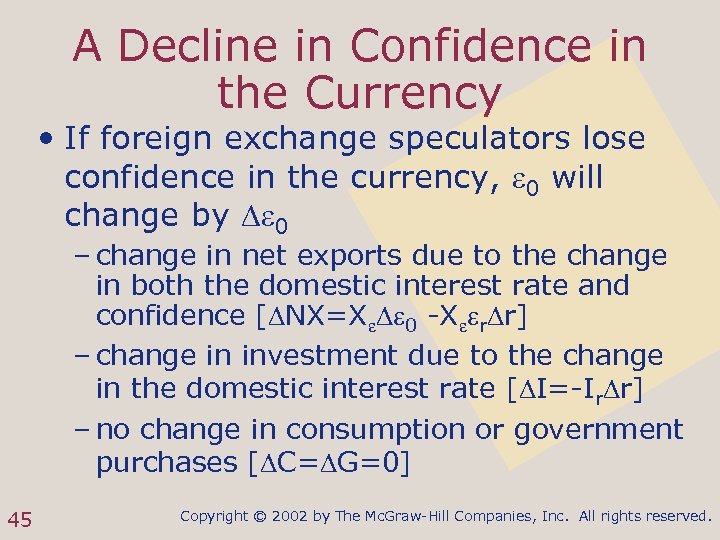

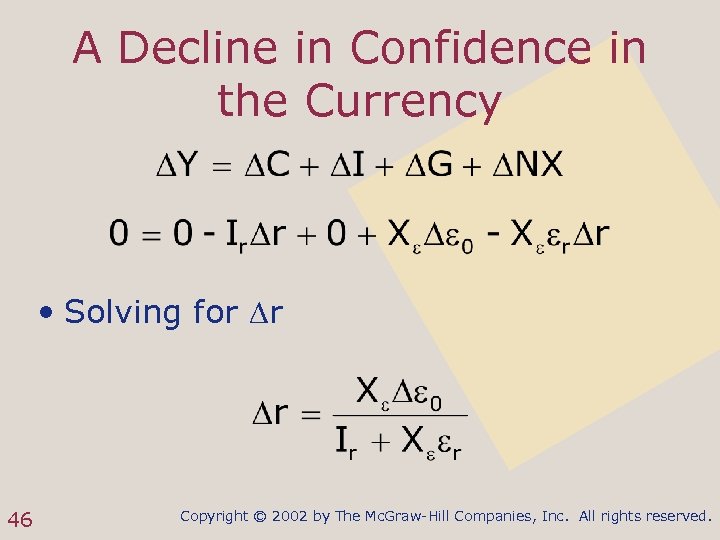

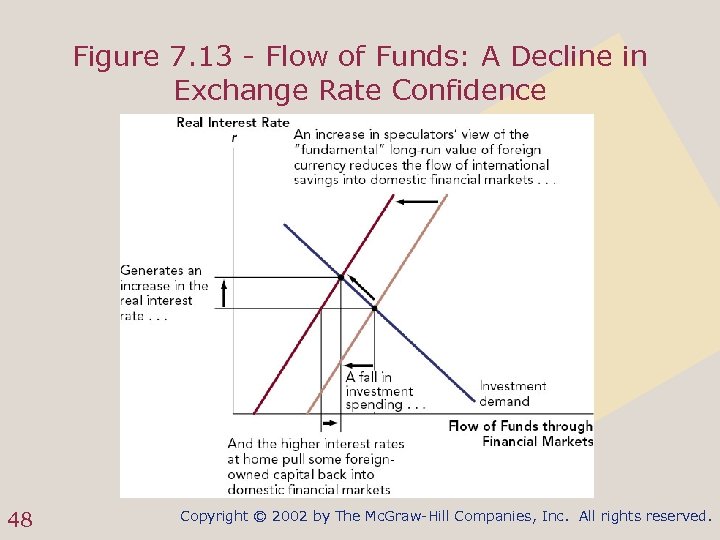

A Decline in Confidence in the Currency • If foreign exchange speculators lose confidence in the currency, 0 will change by 0 – change in net exports due to the change in both the domestic interest rate and confidence [ NX=X 0 -X r r] – change in investment due to the change in the domestic interest rate [ I=-Ir r] – no change in consumption or government purchases [ C= G=0] 45 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

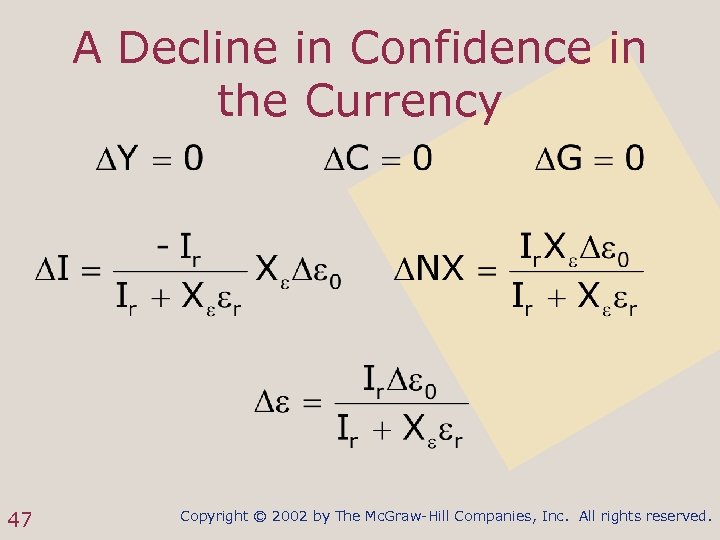

A Decline in Confidence in the Currency • Solving for r 46 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

A Decline in Confidence in the Currency 47 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Figure 7. 13 - Flow of Funds: A Decline in Exchange Rate Confidence 48 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

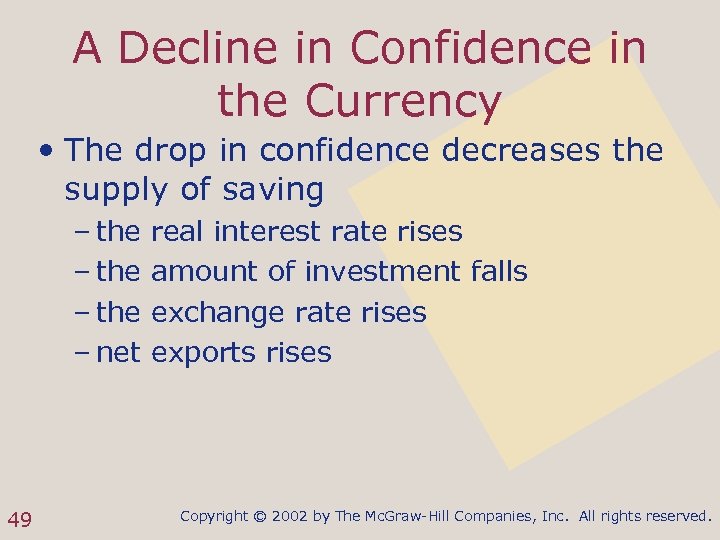

A Decline in Confidence in the Currency • The drop in confidence decreases the supply of saving – the – net 49 real interest rate rises amount of investment falls exchange rate rises exports rises Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

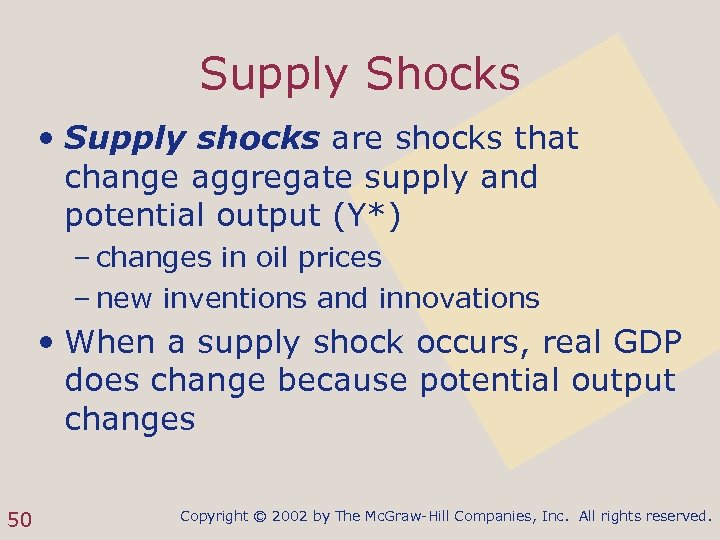

Supply Shocks • Supply shocks are shocks that change aggregate supply and potential output (Y*) – changes in oil prices – new inventions and innovations • When a supply shock occurs, real GDP does change because potential output changes 50 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

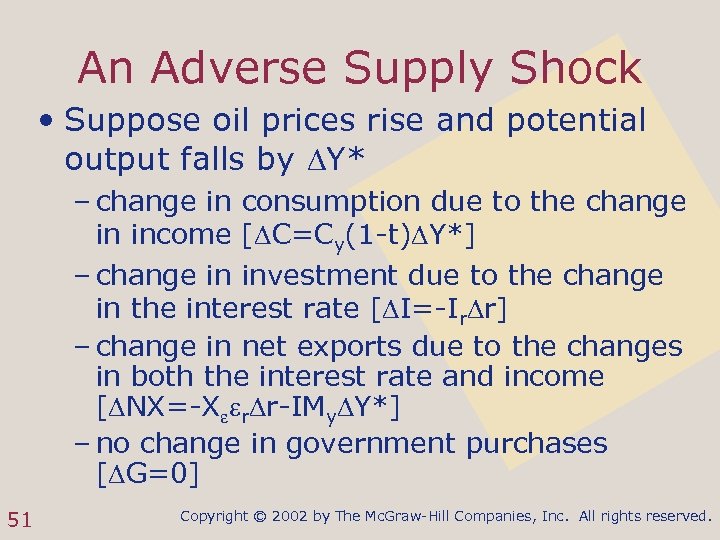

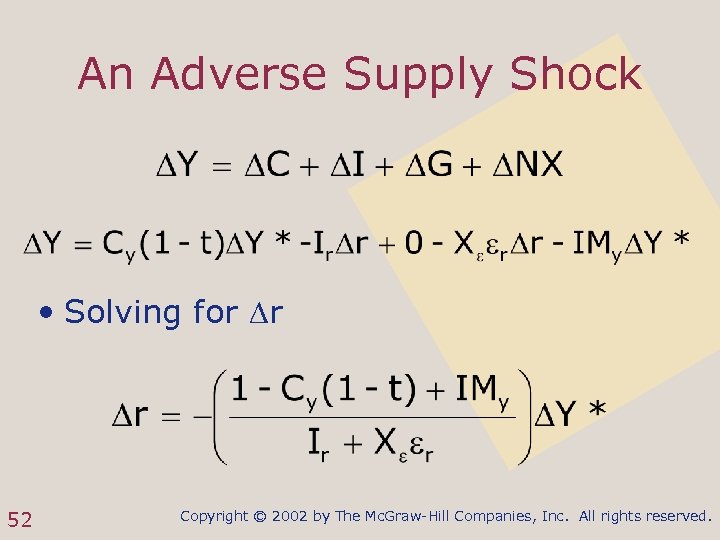

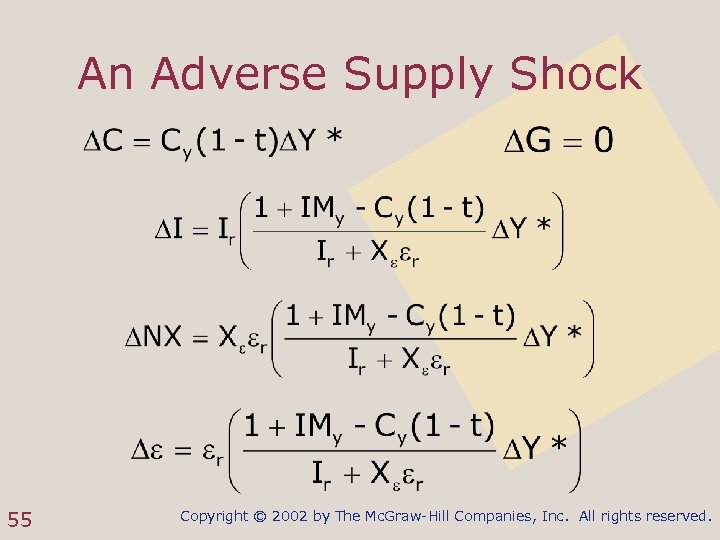

An Adverse Supply Shock • Suppose oil prices rise and potential output falls by Y* – change in consumption due to the change in income [ C=Cy(1 -t) Y*] – change in investment due to the change in the interest rate [ I=-Ir r] – change in net exports due to the changes in both the interest rate and income [ NX=-X r r-IMy Y*] – no change in government purchases [ G=0] 51 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

An Adverse Supply Shock • Solving for r 52 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

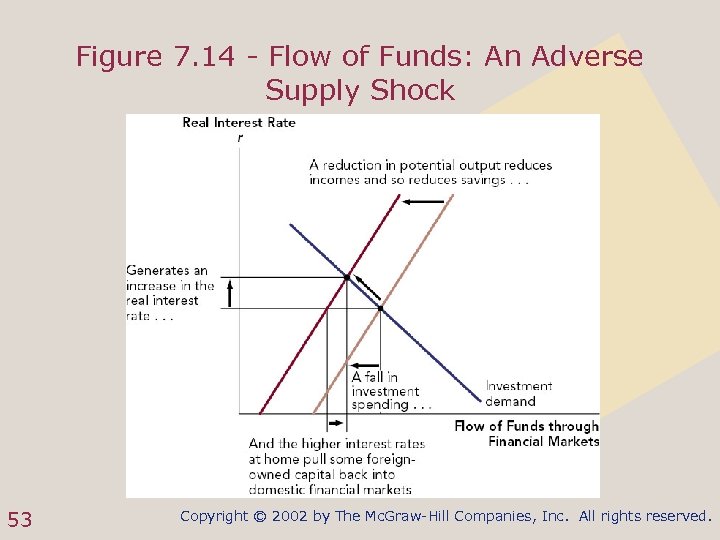

Figure 7. 14 - Flow of Funds: An Adverse Supply Shock 53 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

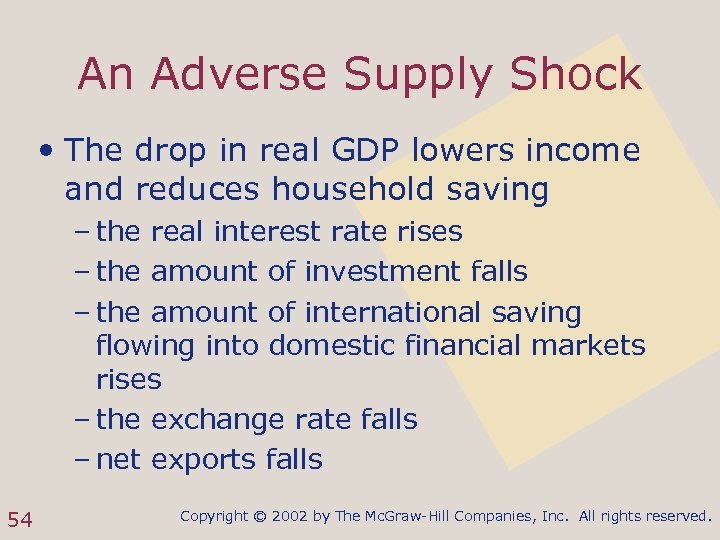

An Adverse Supply Shock • The drop in real GDP lowers income and reduces household saving – the real interest rate rises – the amount of investment falls – the amount of international saving flowing into domestic financial markets rises – the exchange rate falls – net exports falls 54 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

An Adverse Supply Shock 55 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Real Business Cycles • Economist Joseph Schumpeter believed that changes in technology were the principal force driving business cycles – booms occurred when new technology diffused rapidly throughout the economy – periods of relative stagnation occurred when the pace of technological innovation and diffusion was much slower 56 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

A Shift in Technology • Suppose a shift in technology occurs that involves two components – a sudden increase in the efficiency of labor – a sudden rise in investment demand • This shock will have both supply and demand components – potential output will rise – there is an increase in the demand for funds 57 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

A Shift in Technology • To examine the effects of such a change, we can add together the effects of a supply shock to the effects of an increase in investment demand 58 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

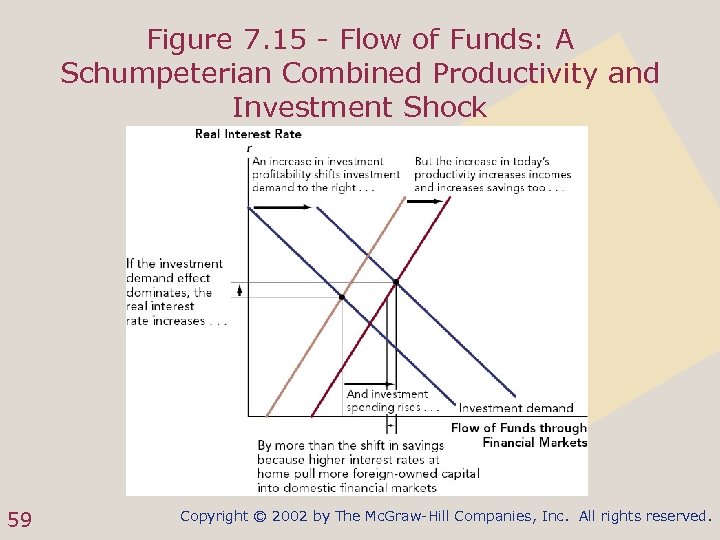

Figure 7. 15 - Flow of Funds: A Schumpeterian Combined Productivity and Investment Shock 59 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

A Shift in Technology • Higher productivity – household savings increase as incomes rise – this will put downward pressure on the interest rate • Increase in investment demand – this will put upward pressure on interest rates • The end result depends on which effect is dominant 60 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

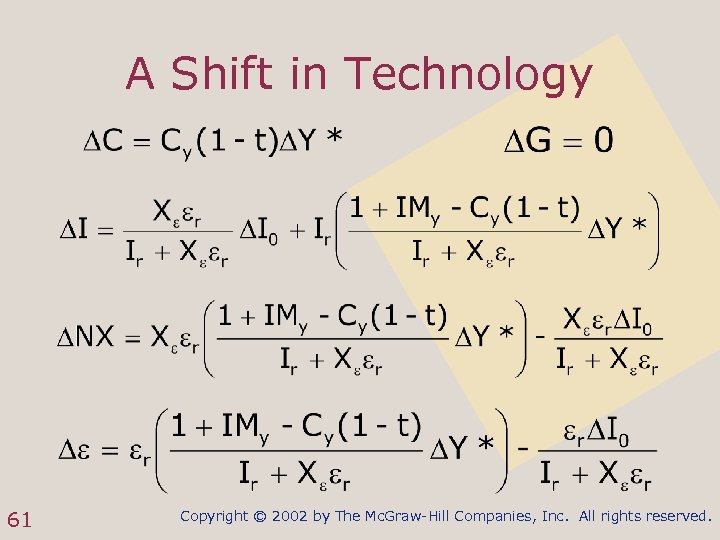

A Shift in Technology 61 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

A Shift in Technology • This technology shock produced –a –a rise in output sharp rise in investment decline in the exchange rate decrease in net exports • These shifts in the economy are typically found in a business cycle boom 62 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Real Business Cycle Theory • While the real business cycle theory may be able to explain booms – it contains no mention of changes in unemployment • full employment is assumed throughout – it is unable to fully explain recessions or depressions 63 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter Summary • When the economy is at full employment, real GDP is equal to potential output • In a flexible-price economy, the interest rate shifts in response to changes in policy or the economic environment to keep real GDP equal to potential output 64 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter Summary • The real interest rate balances the supply of loanable funds committed to financial markets by savers with the demand for funds to finance investments. The circular-flow principle guarantees that when savings equals investment, aggregate demand real GDP will equal potential output 65 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter Summary • How does the full-employment equilibrium of an economy shift in response to economic policy or shocks to the economic environment? – This is what the flexible-price macroeconomic model can analyze • Supply shocks are sharp, sudden changes in costs that shift the efficiency of labor 66 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter Summary • Real business cycle theory attempts to use this chapter’s model to account for not just changes in the short-run composition of real GDP but changes in the short-run level of real GDP as well – it may be (and it may not be) a good theory for booms, but it is hard to see how it could ever become a good explanation of recessions or depressions 67 Copyright © 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

939eb2261d75c1d0db03a3271be5c3e1.ppt