cd7e695e9ccf35ce38ea637b32b615fd.ppt

- Количество слайдов: 23

Chapter 7 Customer Order and Account Management Business Processes

Presentation Outline I. Sales Order Processing II. Cash Received on Account III. Other Account Receivable Processing IV. Lock-Box Collection Systems V. Cash Sales

I. Sales Order Processing A. Order Entry B. Credit Approval C. Finished Goods D. Shipping E. Billing F. Accounts Receivable G. General Ledger

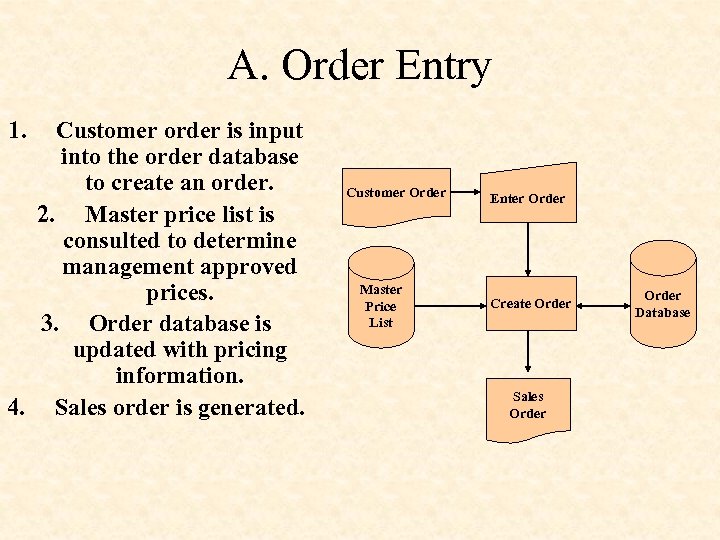

A. Order Entry 1. Customer order is input into the order database to create an order. 2. Master price list is consulted to determine management approved prices. 3. Order database is updated with pricing information. 4. Sales order is generated. Customer Order Master Price List Enter Order Create Order Sales Order Database

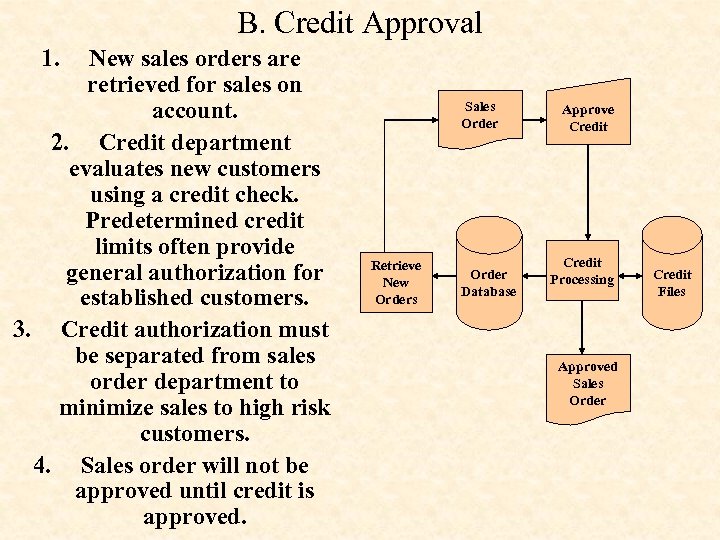

B. Credit Approval 1. New sales orders are retrieved for sales on account. 2. Credit department evaluates new customers using a credit check. Predetermined credit limits often provide general authorization for established customers. 3. Credit authorization must be separated from sales order department to minimize sales to high risk customers. 4. Sales order will not be approved until credit is approved. Sales Order Retrieve New Orders Order Database Approve Credit Processing Approved Sales Order Credit Files

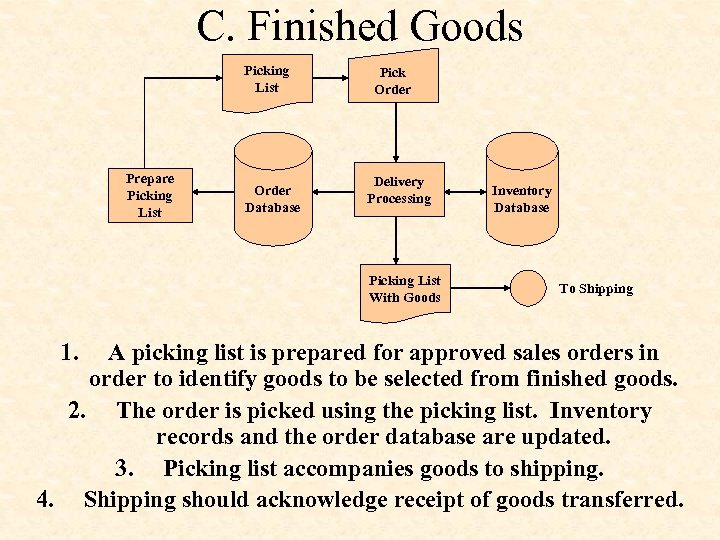

C. Finished Goods Picking List Prepare Picking List Order Database Pick Order Delivery Processing Picking List With Goods 1. Inventory Database To Shipping A picking list is prepared for approved sales orders in order to identify goods to be selected from finished goods. 2. The order is picked using the picking list. Inventory records and the order database are updated. 3. Picking list accompanies goods to shipping. 4. Shipping should acknowledge receipt of goods transferred.

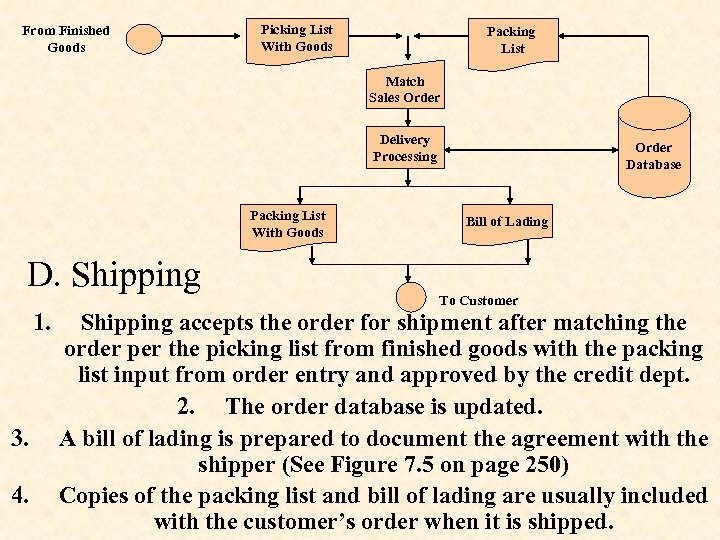

From Finished Goods Picking List With Goods Packing List Match Sales Order Delivery Processing Packing List With Goods D. Shipping 1. 3. 4. Order Database Bill of Lading To Customer Shipping accepts the order for shipment after matching the order per the picking list from finished goods with the packing list input from order entry and approved by the credit dept. 2. The order database is updated. A bill of lading is prepared to document the agreement with the shipper (See Figure 7. 5 on page 250) Copies of the packing list and bill of lading are usually included with the customer’s order when it is shipped.

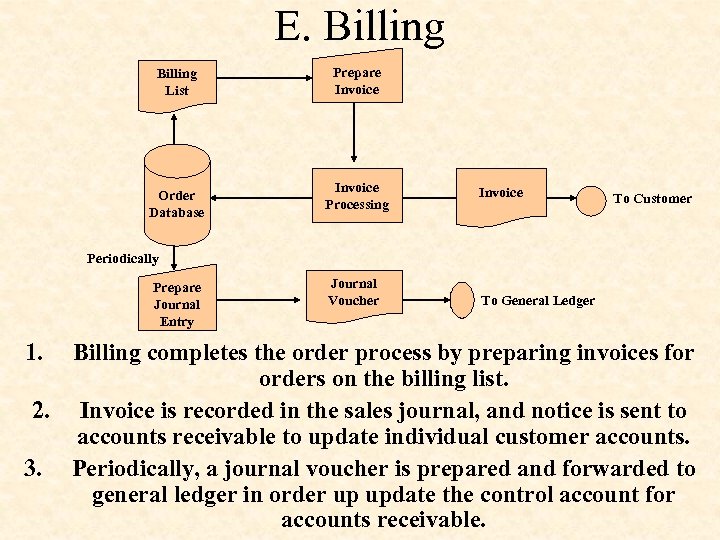

E. Billing List Order Database Prepare Invoice Processing Invoice To Customer Periodically Prepare Journal Entry 1. Journal Voucher To General Ledger Billing completes the order process by preparing invoices for orders on the billing list. 2. Invoice is recorded in the sales journal, and notice is sent to accounts receivable to update individual customer accounts. 3. Periodically, a journal voucher is prepared and forwarded to general ledger in order up update the control account for accounts receivable.

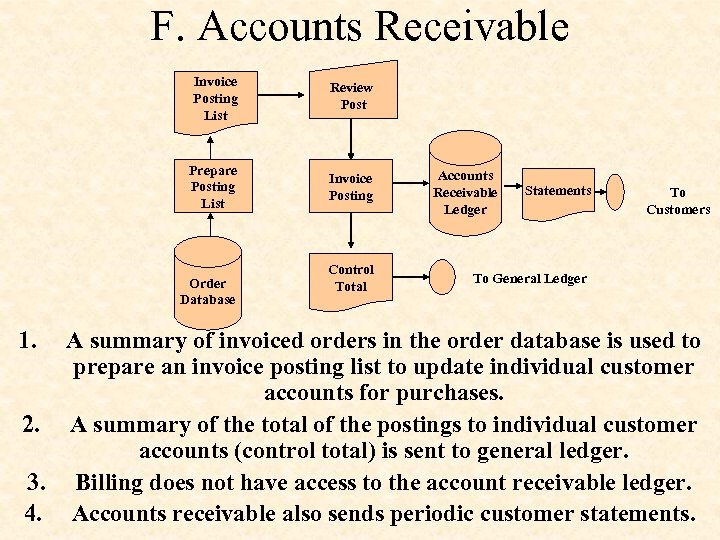

F. Accounts Receivable Invoice Posting List Review Post Prepare Posting List Invoice Posting Order Database 1. Control Total Accounts Receivable Ledger Statements To Customers To General Ledger A summary of invoiced orders in the order database is used to prepare an invoice posting list to update individual customer accounts for purchases. 2. A summary of the total of the postings to individual customer accounts (control total) is sent to general ledger. 3. Billing does not have access to the account receivable ledger. 4. Accounts receivable also sends periodic customer statements.

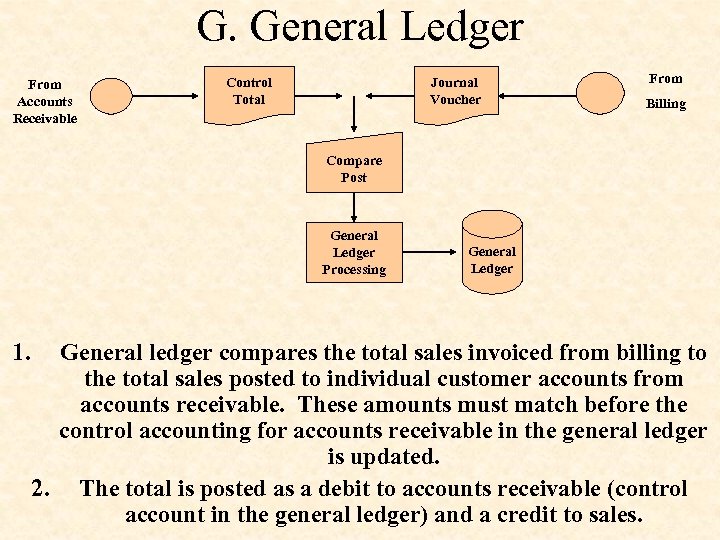

G. General Ledger From Accounts Receivable Control Total Journal Voucher From Billing Compare Post General Ledger Processing 1. General Ledger General ledger compares the total sales invoiced from billing to the total sales posted to individual customer accounts from accounts receivable. These amounts must match before the control accounting for accounts receivable in the general ledger is updated. 2. The total is posted as a debit to accounts receivable (control account in the general ledger) and a credit to sales.

II. Cash Received on Account A. Mailroom B. Cash Receipts C. Accounts Receivable D. General Ledger E. Internal Audit and the Bank Reconciliation Note: Flowcharts in this section may not contain some aspects of the figures that they represent from the text. Space considerations required an abbreviated version on the slides. Please see the text for the complete diagrams.

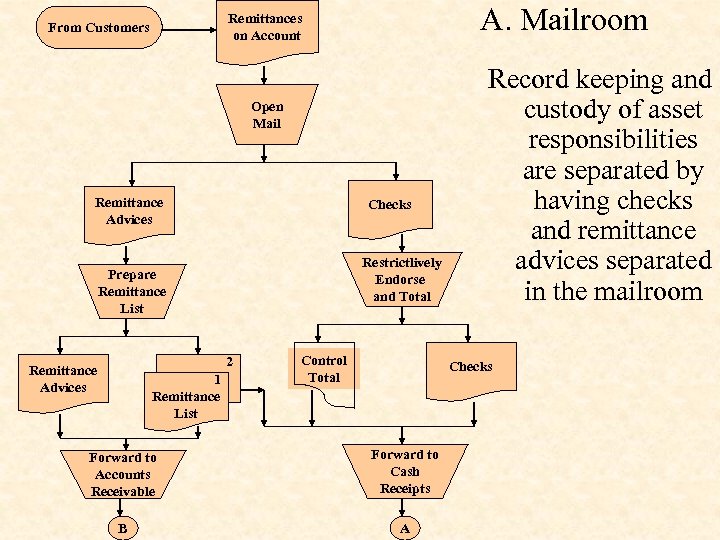

A. Mailroom Remittances on Account From Customers Open Mail Remittance Advices Checks Restrictlively Endorse and Total Prepare Remittance List 2 Remittance Advices 1 Remittance List Control Total Record keeping and custody of asset responsibilities are separated by having checks and remittance advices separated in the mailroom Checks Forward to Accounts Receivable Forward to Cash Receipts B A

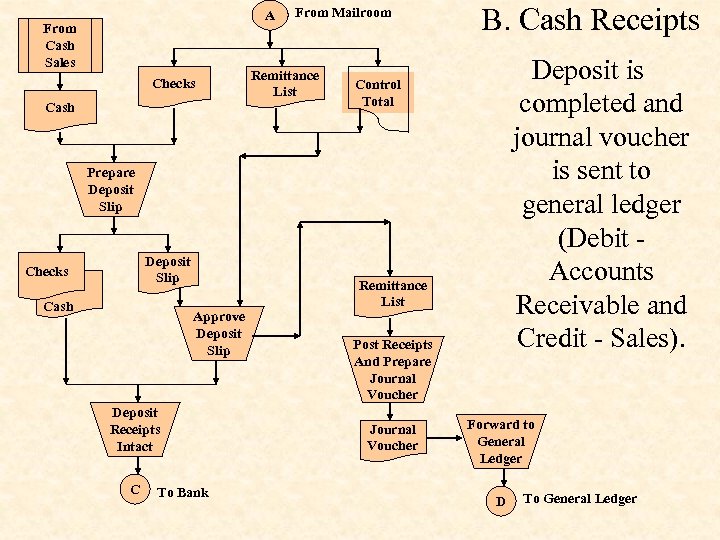

A From Cash Sales Checks Cash From Mailroom Remittance List B. Cash Receipts Deposit is completed and journal voucher is sent to general ledger (Debit Accounts Receivable and Credit - Sales). Control Total Prepare Deposit Slip Checks Cash Approve Deposit Slip Deposit Receipts Intact C To Bank Remittance List Post Receipts And Prepare Journal Voucher Forward to General Ledger D To General Ledger

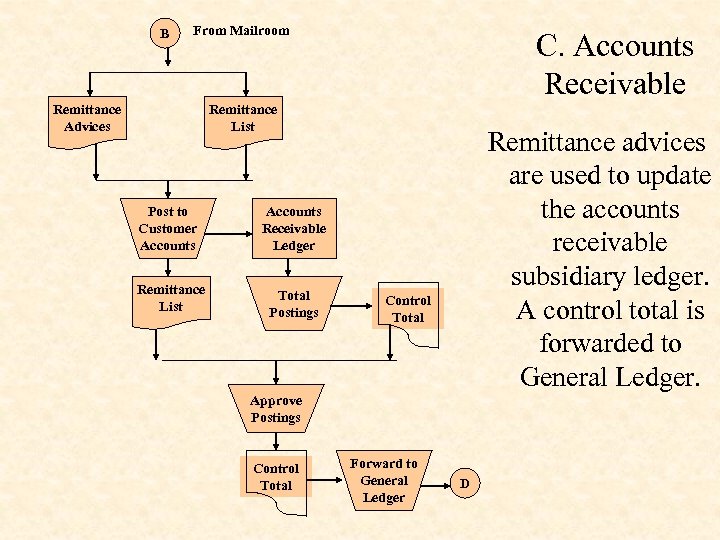

B From Mailroom Remittance Advices C. Accounts Receivable Remittance List Post to Customer Accounts Receivable Ledger Remittance List Total Postings Remittance advices are used to update the accounts receivable subsidiary ledger. A control total is forwarded to General Ledger. Control Total Approve Postings Control Total Forward to General Ledger D

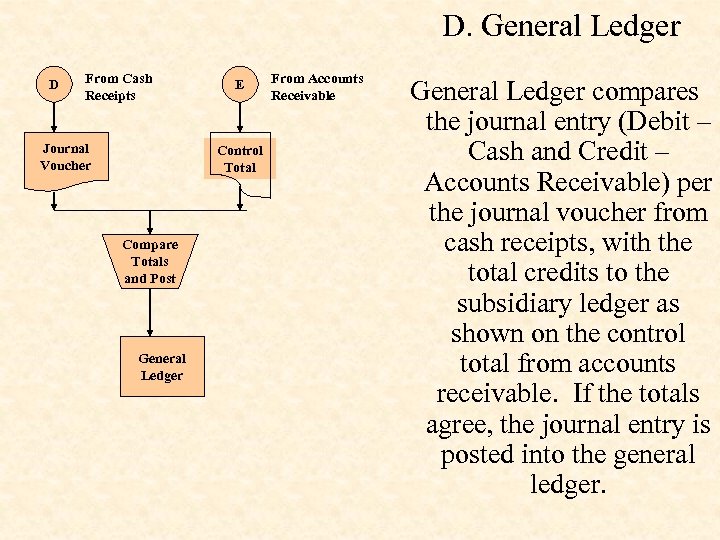

D. General Ledger D From Cash Receipts Journal Voucher E Control Total Compare Totals and Post General Ledger From Accounts Receivable General Ledger compares the journal entry (Debit – Cash and Credit – Accounts Receivable) per the journal voucher from cash receipts, with the total credits to the subsidiary ledger as shown on the control total from accounts receivable. If the totals agree, the journal entry is posted into the general ledger.

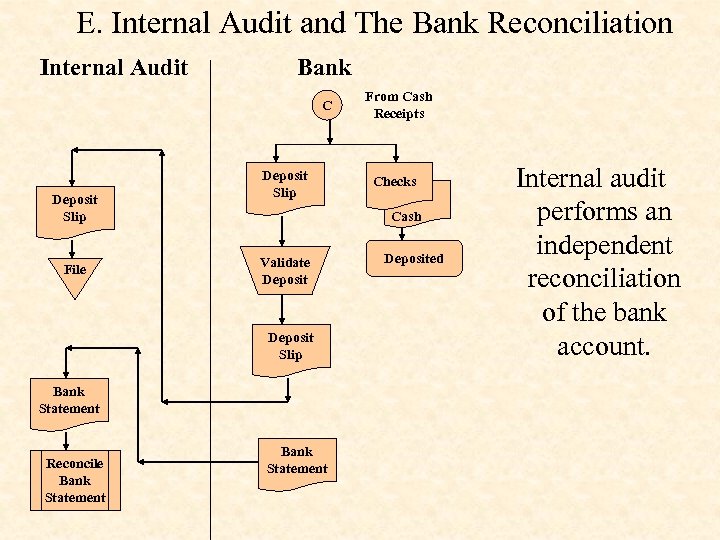

E. Internal Audit and The Bank Reconciliation Internal Audit Bank C Deposit Slip File Deposit Slip Checks Cash Validate Deposit Slip Bank Statement Reconcile Bank Statement From Cash Receipts Bank Statement Deposited Internal audit performs an independent reconciliation of the bank account.

III. Other Account Receivable Processing A. Sales Returns B. Sales Allowances C. Write-off of Accounts Receivable Note: Flowcharts in this section may not contain some aspects of the figures that they represent from the text. Space considerations required an abbreviated version on the slides. Please see the text for the complete diagrams.

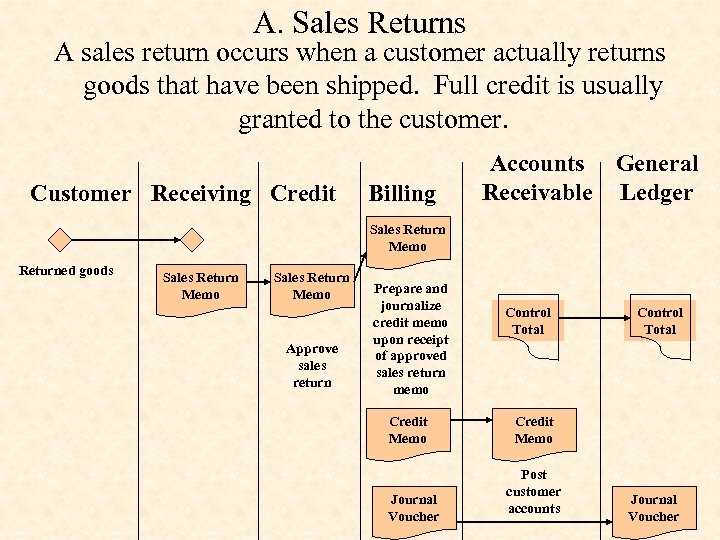

A. Sales Returns A sales return occurs when a customer actually returns goods that have been shipped. Full credit is usually granted to the customer. Customer Receiving Credit Billing Accounts General Receivable Ledger Sales Return Memo Returned goods Sales Return Memo Approve sales return Prepare and journalize credit memo upon receipt of approved sales return memo Credit Memo Journal Voucher Control Total Credit Memo Post customer accounts Journal Voucher

B. Sales Allowances v Allowances occur because of damaged merchandise, shortages in shipments, clerical errors, etc. v Amount of allowance is negotiated with customer. v Allowance is reviewed and approved by an independent party (usually the credit department). v Credit department forwards approved sales allowance memo to billing. v Billing prepares a credit memo for the allowance. v The handling the credit memo is the same as for credit memos for sales returns. (see prior slide)

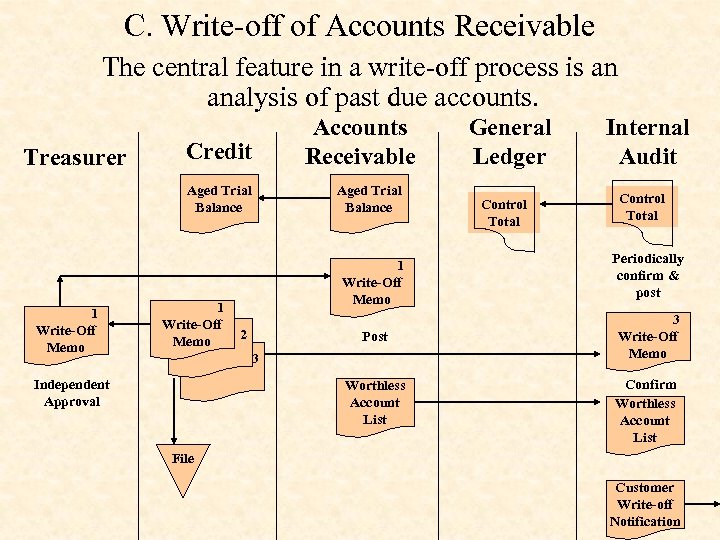

C. Write-off of Accounts Receivable The central feature in a write-off process is an analysis of past due accounts. Treasurer Credit Aged Trial Balance 1 Write-Off Memo Accounts Receivable Aged Trial Balance 1 Write-Off Memo 2 Post 3 Independent Approval Worthless Account List General Ledger Control Total Internal Audit Control Total Periodically confirm & post 3 Write-Off Memo Confirm Worthless Account List File Customer Write-off Notification

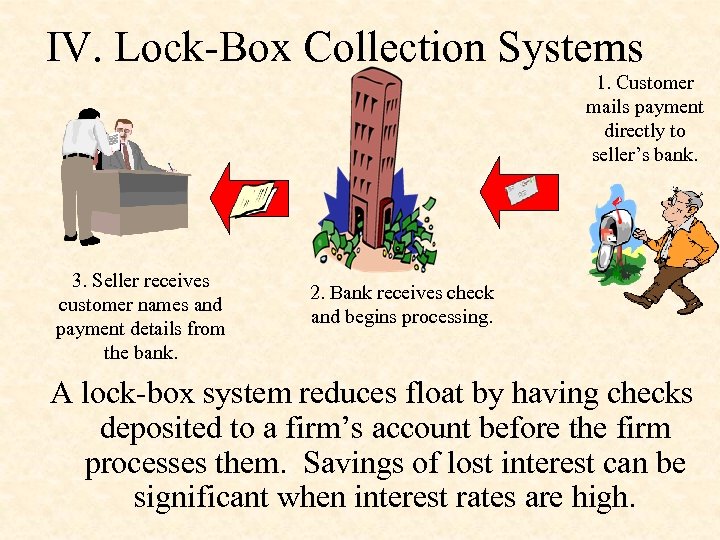

IV. Lock-Box Collection Systems 1. Customer mails payment directly to seller’s bank. 3. Seller receives customer names and payment details from the bank. 2. Bank receives check and begins processing. A lock-box system reduces float by having checks deposited to a firm’s account before the firm processes them. Savings of lost interest can be significant when interest rates are high.

V. Cash Sales Unlike cash collections on account, cash sales have no prior record of occurrence. It is imperative that the sale be recorded so that any shortage of cash will be noticed. Customer audit is a general term used to describe procedures in which the customer acts as a control over the initial documentation of a transaction. Examples include: v Pricing items so that customers expect change. v Awarding prices for certain receipts. v No charge if a receipt is not offered.

Summary Ø Sales Order Processing Ø The Accounts Receivable System Ø Write-off of Accounts Receivable Ø Lock-Box Collection System Ø Customer Audit of Cash Sales

cd7e695e9ccf35ce38ea637b32b615fd.ppt