Chapter 7-8 (A).ppt

- Количество слайдов: 62

Chapter 7 Capital Budgeting and Basic Investment Appraisal Techniques

Investment appraisal 1) 2) 3) 4) 5) ROCE Payback Net present value Internal rate of return Probability Index

Capital Investment n Capital Investment: ¨ When a business spends money on new non- current assets , it is known as “Capital Investment” or “Capital Expenditure” ¨ Spending may be for: Maintenance n Profitability n Expansion n Indirect Purposes n

n Compare: ¨Revenue Expenditure: regular spending on the day-to-day running of the business where the benefit is expected to last for only one specific accounting period ¨Working capital investment: investment in short-term net assets

Capital Budgeting n A capital budget: ¨ Is a programme of capital expenditure covering several years ¨ Includes authorised future projects and projects currently under consideration n Investment Appraisal : the process of appraising the potential projects ¨ ROCE / AAR (Average Accounting Return) ¨ Payback ¨ NPV ¨ IRR ¨ Probability Index (PI Index)

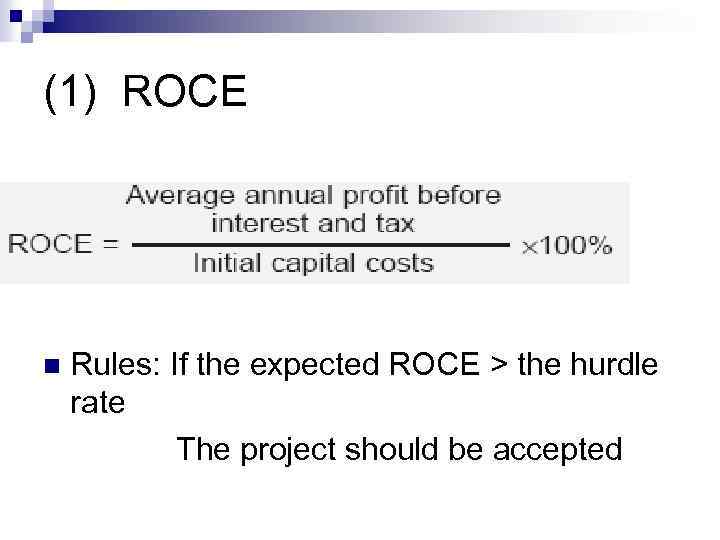

(1) ROCE Rules: If the expected ROCE > the hurdle rate The project should be accepted n

A project involves the immediate purchase of an item of plant costing $110, 000. It would generate annual cash flows of $24, 400 for five years, starting in Year 1. The plant purchased would have a scrap value of $10, 000 in five years, when the project terminates. Depreciation is on a straight-line basis. n Calculate the ROCE. n

Average annual depreciation =($110, 000 -$10, 000) ÷ 5 = $20, 000 n Average annual profit= $24, 400 - $20, 000 =$4, 400 n ROCE=(Average annual profit) ÷ (Initial capital cost) X 100% = ($4, 400 ÷ $110, 000) X 100% = 4 %

Other ROCE n Average carrying values of the assets over their life n First year’s profits n Total profits over the whole of the project’s life

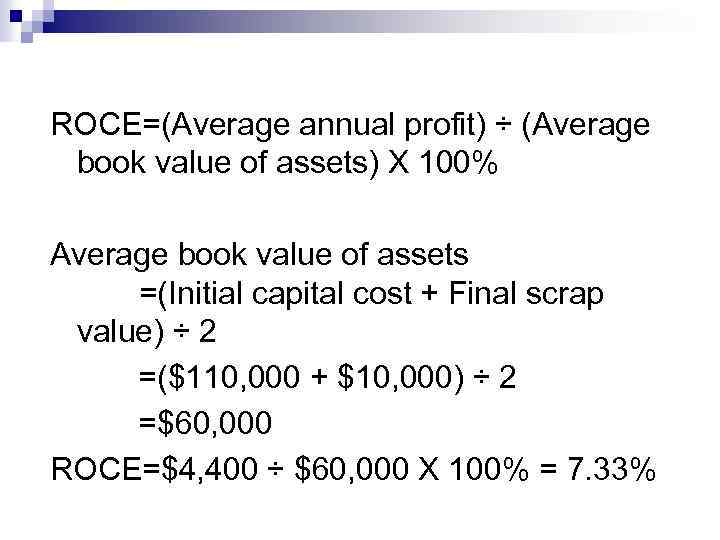

ROCE=(Average annual profit) ÷ (Average book value of assets) X 100% Average book value of assets =(Initial capital cost + Final scrap value) ÷ 2 =($110, 000 + $10, 000) ÷ 2 =$60, 000 ROCE=$4, 400 ÷ $60, 000 X 100% = 7. 33%

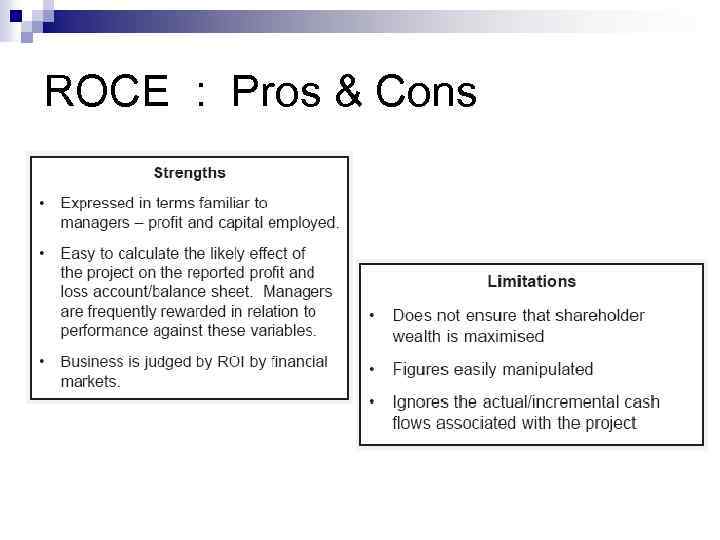

ROCE : Pros & Cons

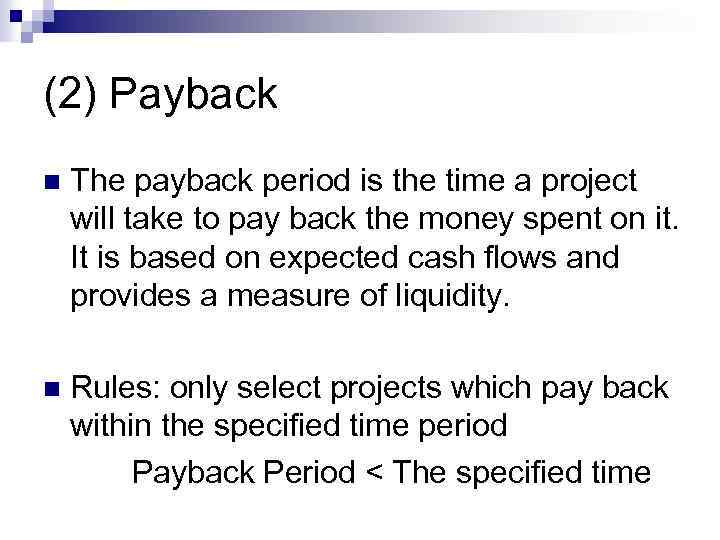

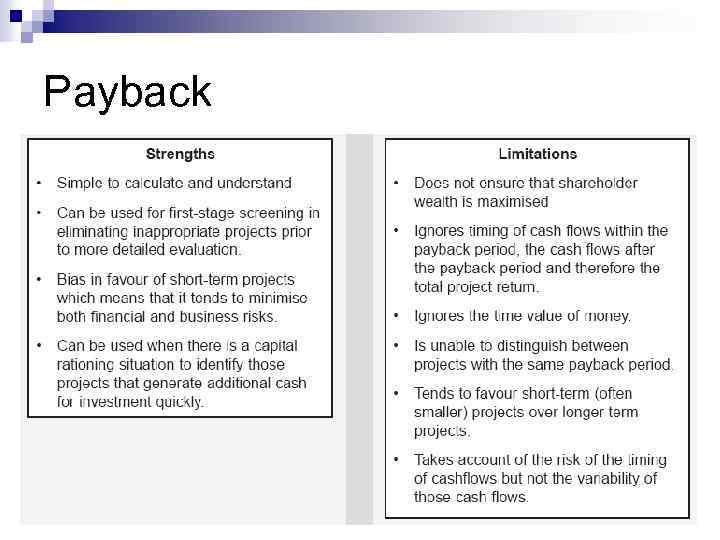

(2) Payback n The payback period is the time a project will take to pay back the money spent on it. It is based on expected cash flows and provides a measure of liquidity. Rules: only select projects which pay back within the specified time period Payback Period < The specified time n

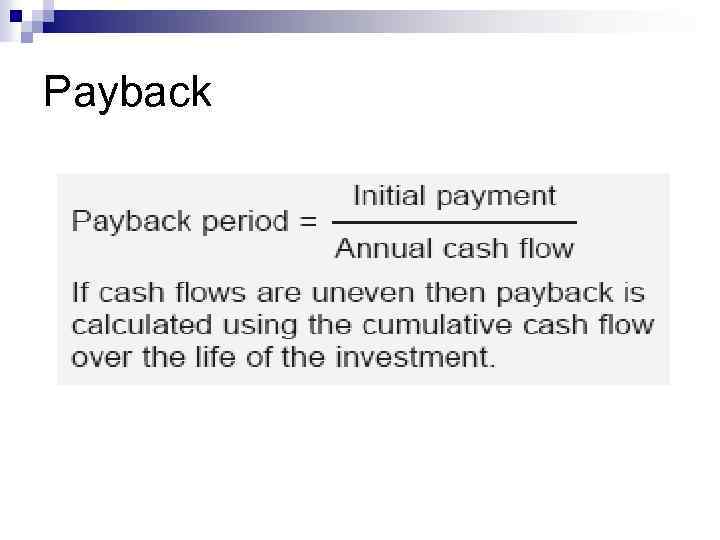

Payback

Payback

The time value of money Money received today is worth more than the same sum received in the future because of: n ¨ The potential for earning interest ¨ The impact of inflation ¨ The effect of risk

1 The One-Period Case n If you were to invest $10, 000 at 5 -percent interest for one year, your investment would grow to $10, 500. $500 would be interest ($10, 000 ×. 05) $10, 000 is the principal repayment ($10, 000 × 1) $10, 500 is the total due. It can be calculated as: $10, 500 = $10, 000×(1. 05) q The total amount due at the end of the investment is call the Future Value (FV).

Future Value n In the one-period case, the formula for FV can be written as: FV = C 0×(1 + r) Where C 0 is cash flow today (time zero), and r is the appropriate interest rate.

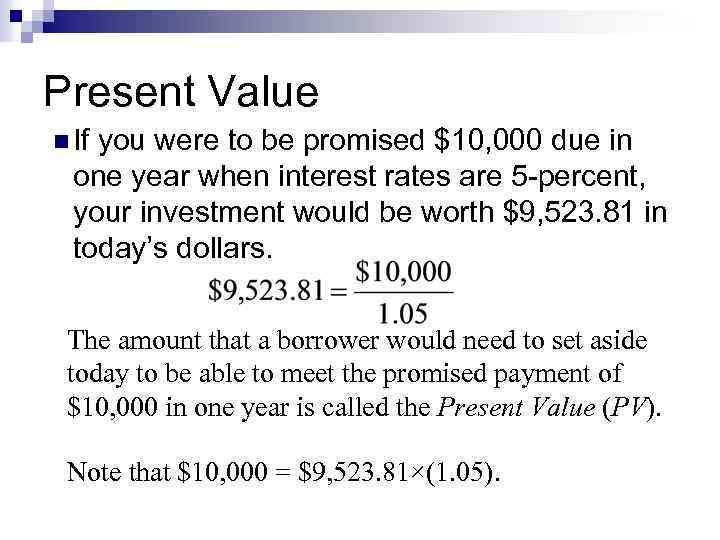

Present Value n If you were to be promised $10, 000 due in one year when interest rates are 5 -percent, your investment would be worth $9, 523. 81 in today’s dollars. The amount that a borrower would need to set aside today to be able to meet the promised payment of $10, 000 in one year is called the Present Value (PV). Note that $10, 000 = $9, 523. 81×(1. 05).

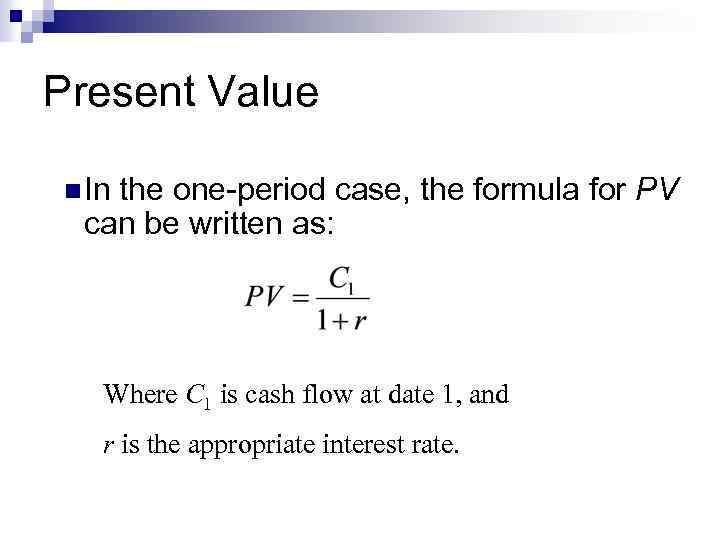

Present Value n In the one-period case, the formula for PV can be written as: Where C 1 is cash flow at date 1, and r is the appropriate interest rate.

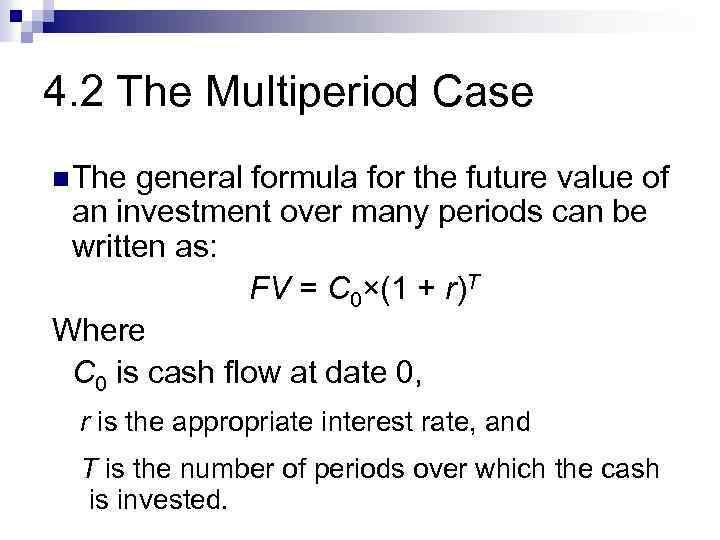

4. 2 The Multiperiod Case n The general formula for the future value of an investment over many periods can be written as: FV = C 0×(1 + r)T Where C 0 is cash flow at date 0, r is the appropriate interest rate, and T is the number of periods over which the cash is invested.

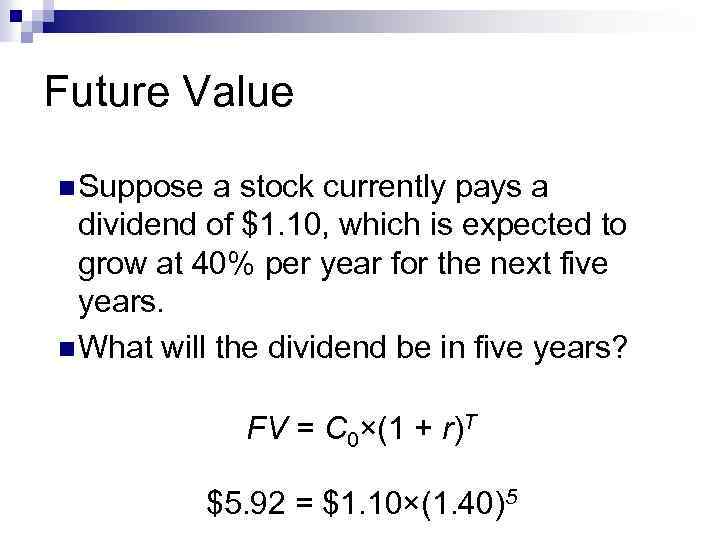

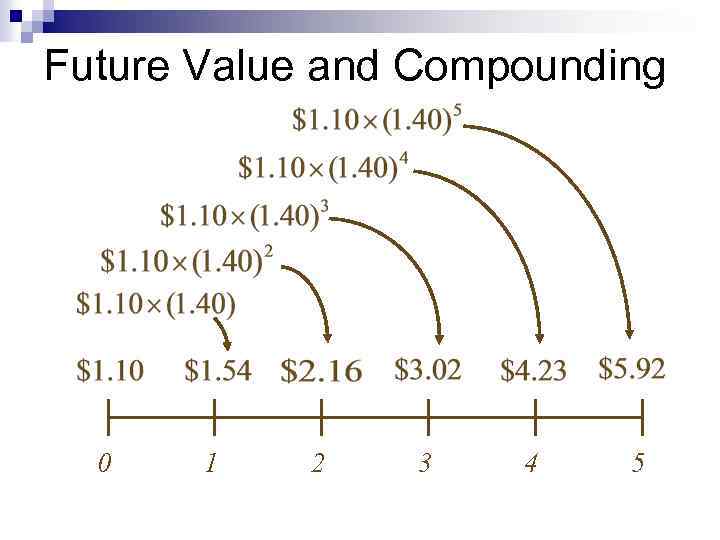

Future Value n Suppose a stock currently pays a dividend of $1. 10, which is expected to grow at 40% per year for the next five years. n What will the dividend be in five years? FV = C 0×(1 + r)T $5. 92 = $1. 10×(1. 40)5

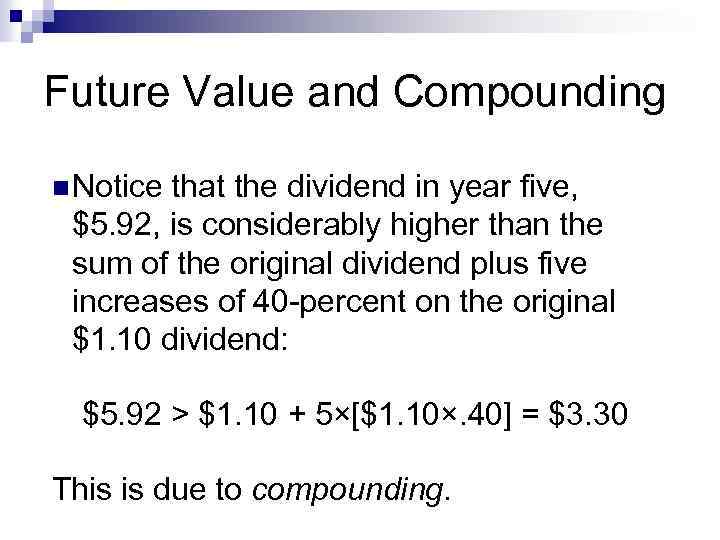

Future Value and Compounding n Notice that the dividend in year five, $5. 92, is considerably higher than the sum of the original dividend plus five increases of 40 -percent on the original $1. 10 dividend: $5. 92 > $1. 10 + 5×[$1. 10×. 40] = $3. 30 This is due to compounding.

Future Value and Compounding 0 1 2 3 4 5

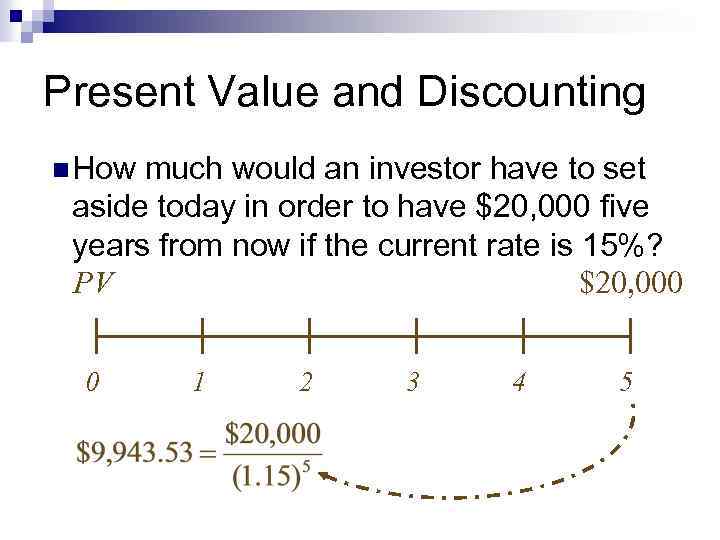

Present Value and Discounting n How much would an investor have to set aside today in order to have $20, 000 five years from now if the current rate is 15%? PV $20, 000 0 1 2 3 4 5

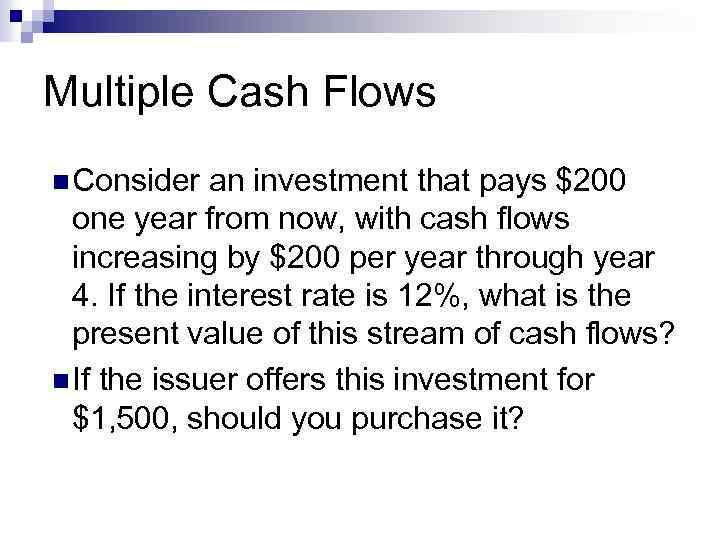

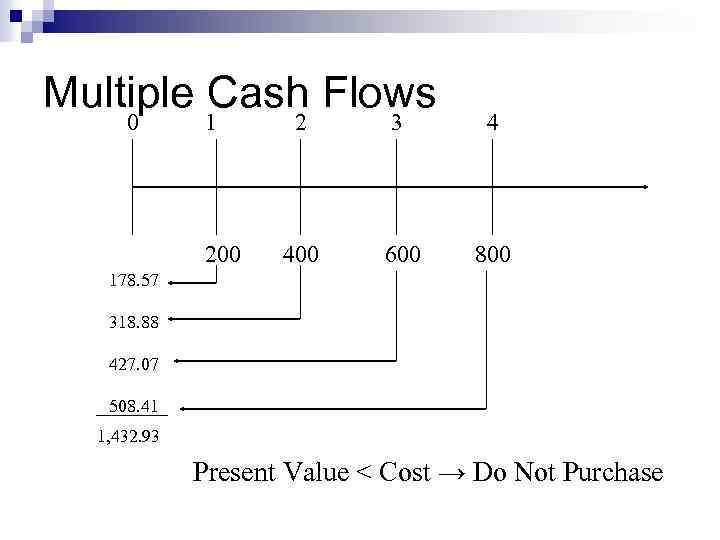

Multiple Cash Flows n Consider an investment that pays $200 one year from now, with cash flows increasing by $200 per year through year 4. If the interest rate is 12%, what is the present value of this stream of cash flows? n If the issuer offers this investment for $1, 500, should you purchase it?

Multiple Cash Flows 0 1 200 2 3 4 400 600 800 178. 57 318. 88 427. 07 508. 41 1, 432. 93 Present Value < Cost → Do Not Purchase

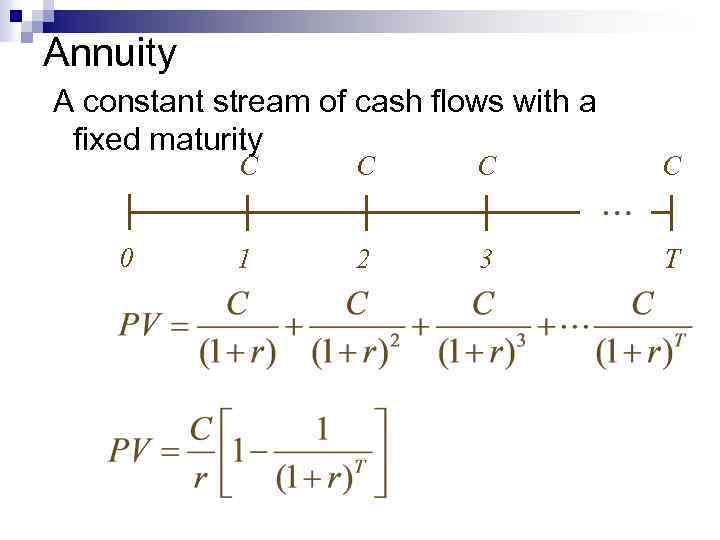

Annuity A constant stream of cash flows with a fixed maturity C 0 C C C 1 2 3 T

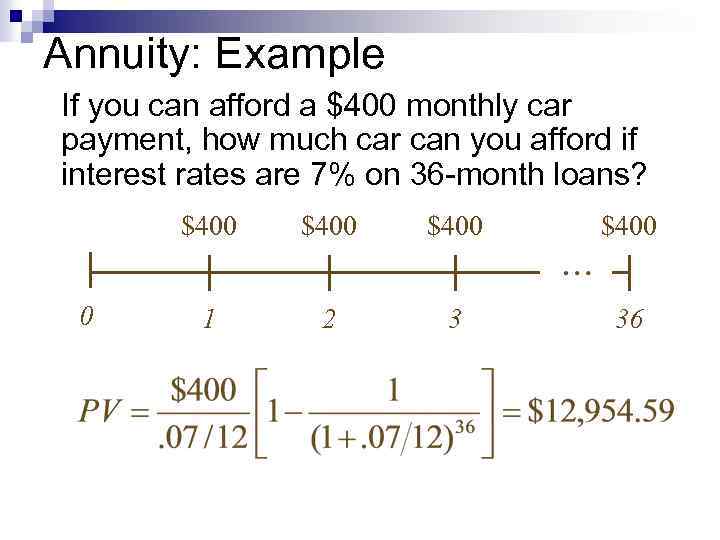

Annuity: Example If you can afford a $400 monthly car payment, how much car can you afford if interest rates are 7% on 36 -month loans? $400 0 $400 1 2 3 36

What is the present value of a four-year annuity of $100 per year that makes its first payment two years from today if the discount rate is 9%? $297. 22 0 $323. 97 1 $100 2 $100 3 $100 4 $100 5 2 -29

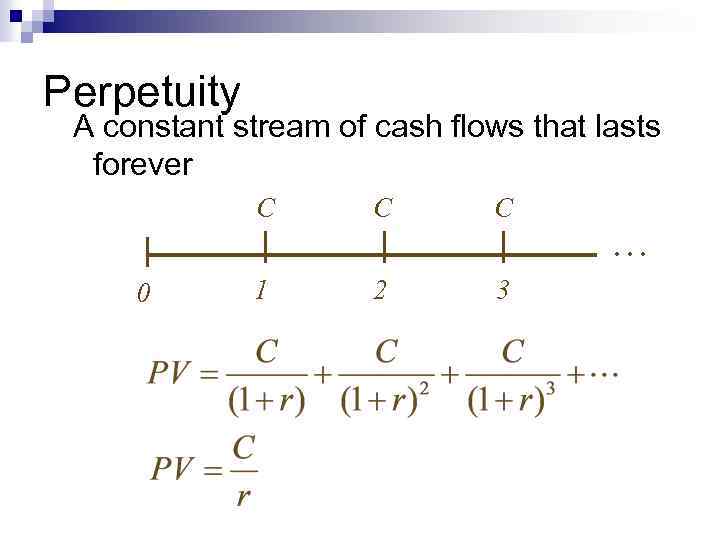

Perpetuity A constant stream of cash flows that lasts forever C 0 C C 1 2 3 …

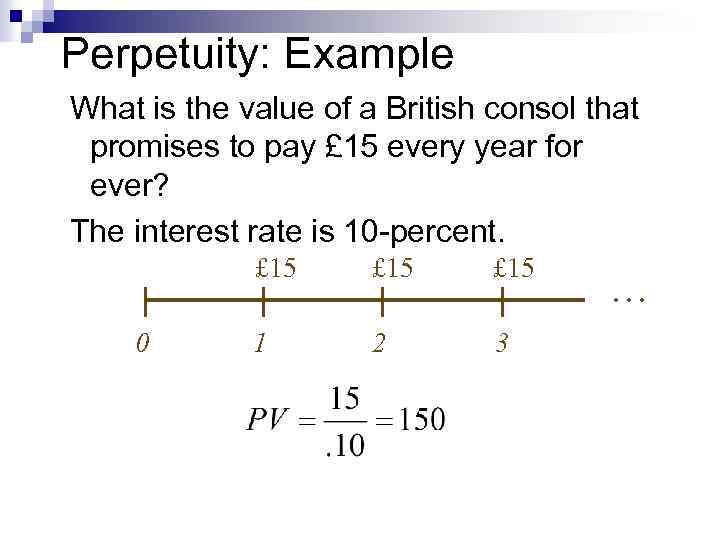

Perpetuity: Example What is the value of a British consol that promises to pay £ 15 every year for ever? The interest rate is 10 -percent. £ 15 0 £ 15 1 2 3 …

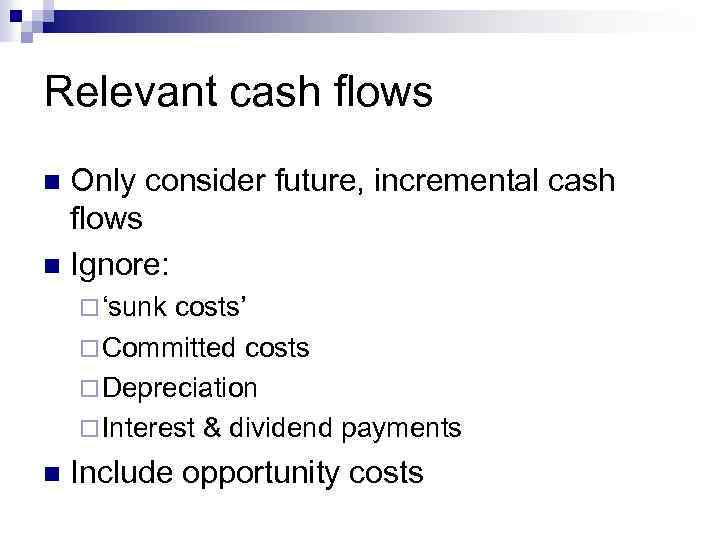

Relevant cash flows Only consider future, incremental cash flows n Ignore: n ¨ ‘sunk costs’ ¨ Committed costs ¨ Depreciation ¨ Interest & dividend payments n Include opportunity costs

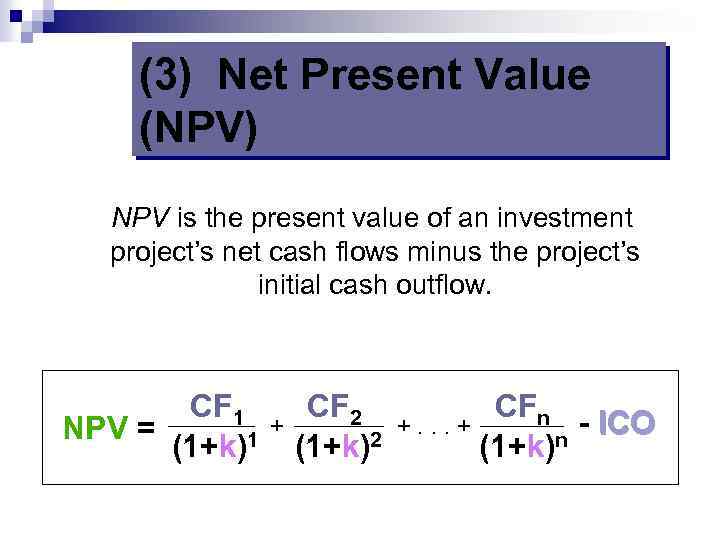

(3) Net Present Value (NPV) NPV is the present value of an investment project’s net cash flows minus the project’s initial cash outflow. CF 1 NPV = (1+k)1 + CF 2 (1+k)2 CFn - ICO +. . . + n (1+k)

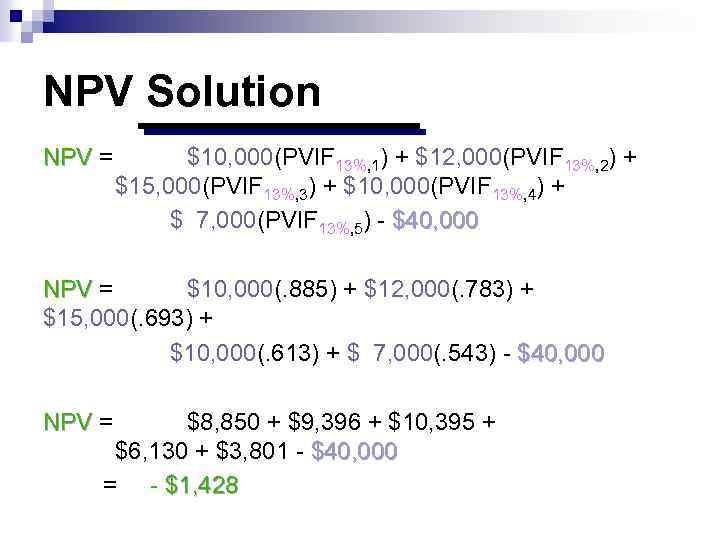

NPV Solution NPV = $10, 000(PVIF 13%, 1) + $12, 000(PVIF 13%, 2) + NPV $15, 000(PVIF 13%, 3) + $10, 000(PVIF 13%, 4) + $ 7, 000(PVIF 13%, 5) - $40, 000 NPV = $10, 000(. 885) + $12, 000(. 783) + NPV $15, 000(. 693) + $10, 000(. 613) + $ 7, 000(. 543) - $40, 000 NPV = $8, 850 + $9, 396 + $10, 395 + NPV $6, 130 + $3, 801 - $40, 000 = - $1, 428

NPV Acceptance Criterion The management of Basket Wonders has determined that the required rate is 13% for projects of this type. Should this project be accepted? No! The NPV is negative. This means that the project is reducing shareholder wealth. [Reject as NPV < 0 ] NPV

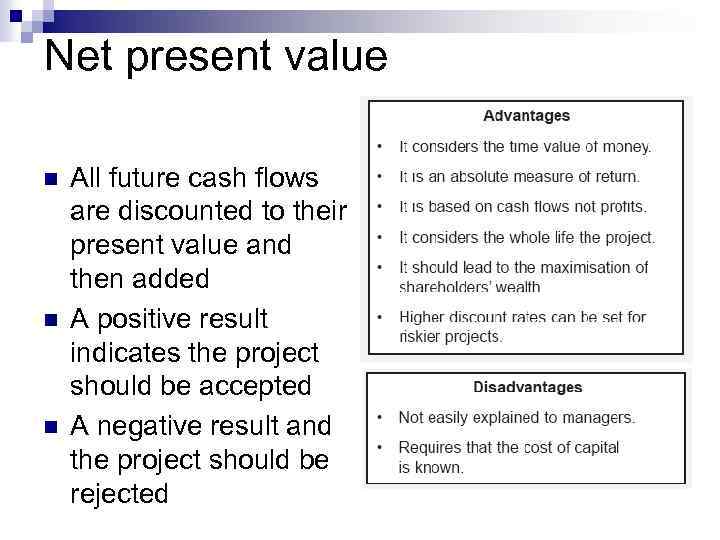

Net present value n n n All future cash flows are discounted to their present value and then added A positive result indicates the project should be accepted A negative result and the project should be rejected

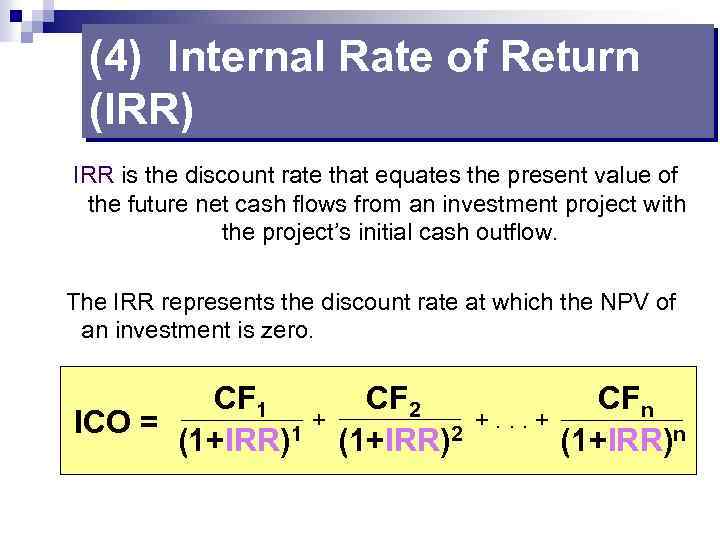

(4) Internal Rate of Return (IRR) IRR is the discount rate that equates the present value of the future net cash flows from an investment project with the project’s initial cash outflow. The IRR represents the discount rate at which the NPV of an investment is zero. CF 1 ICO = (1+IRR)1 + CF 2 (1+IRR)2 +. . . + CFn (1+IRR)n

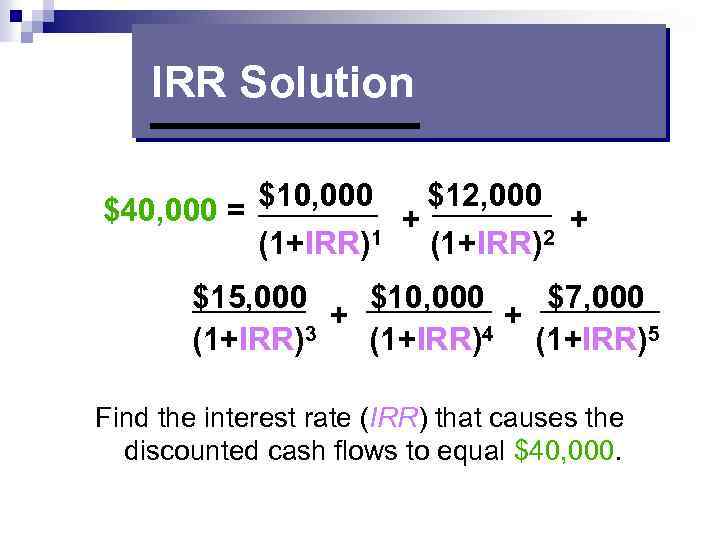

IRR Solution $10, 000 $12, 000 $40, 000 = + + (1+IRR)1 (1+IRR)2 $15, 000 $10, 000 $7, 000 + + (1+IRR)3 (1+IRR)4 (1+IRR)5 Find the interest rate (IRR) that causes the discounted cash flows to equal $40, 000.

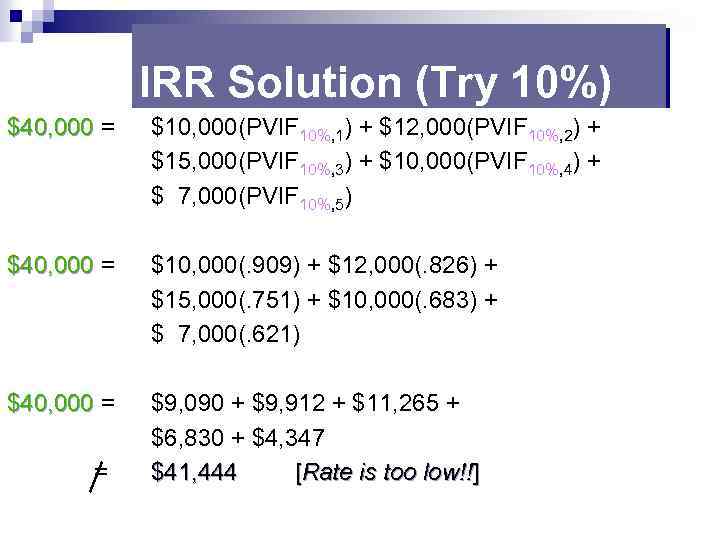

IRR Solution (Try 10%) $40, 000 = $40, 000 $10, 000(PVIF 10%, 1) + $12, 000(PVIF 10%, 2) + $15, 000(PVIF 10%, 3) + $10, 000(PVIF 10%, 4) + $ 7, 000(PVIF 10%, 5) $40, 000 = $40, 000 $10, 000(. 909) + $12, 000(. 826) + $15, 000(. 751) + $10, 000(. 683) + $ 7, 000(. 621) $40, 000 = $40, 000 $9, 090 + $9, 912 + $11, 265 + $6, 830 + $4, 347 $41, 444 [Rate is too low!!] =

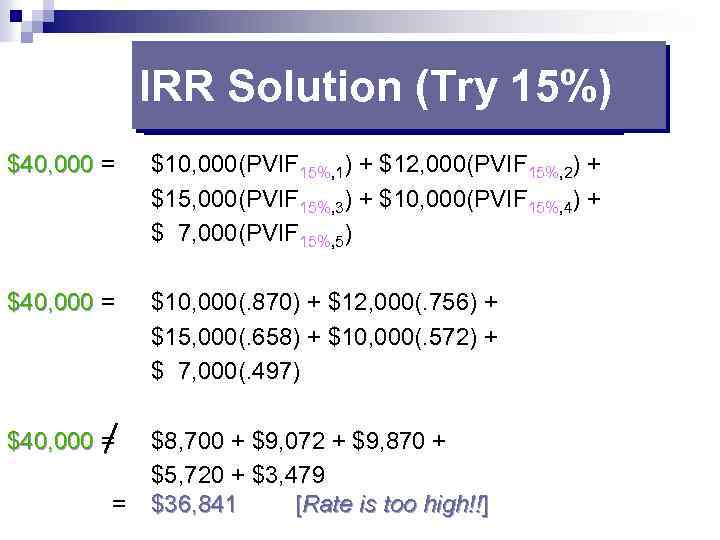

IRR Solution (Try 15%) $40, 000 = $40, 000 $10, 000(PVIF 15%, 1) + $12, 000(PVIF 15%, 2) + $15, 000(PVIF 15%, 3) + $10, 000(PVIF 15%, 4) + $ 7, 000(PVIF 15%, 5) $40, 000 = $40, 000 $10, 000(. 870) + $12, 000(. 756) + $15, 000(. 658) + $10, 000(. 572) + $ 7, 000(. 497) $40, 000 = $40, 000 $8, 700 + $9, 072 + $9, 870 + $5, 720 + $3, 479 $36, 841 [Rate is too high!!] =

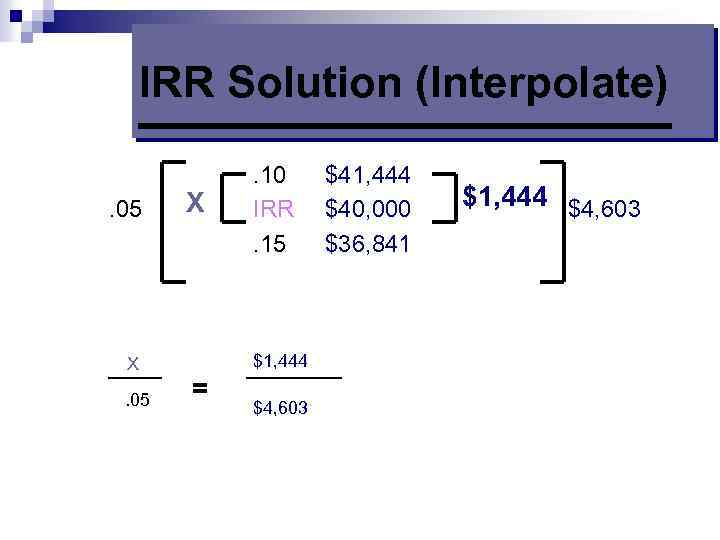

IRR Solution (Interpolate). 05 X . 10 IRR. 15 X. 05 $1, 444 = $4, 603 $41, 444 $40, 000 $36, 841 $1, 444 $4, 603

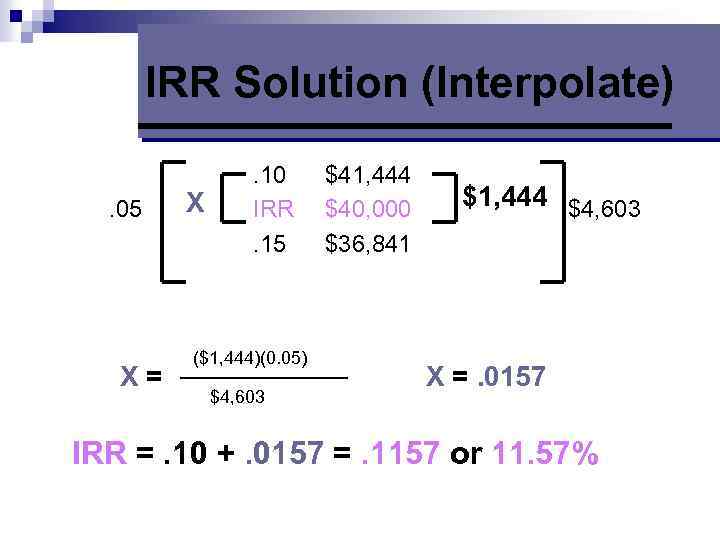

IRR Solution (Interpolate). 05 X . 10 IRR. 15 $41, 444 $40, 000 $36, 841 $1, 444 $4, 603 X= ($1, 444)(0. 05) $4, 603 X =. 0157 IRR =. 10 +. 0157 =. 1157 or 11. 57%

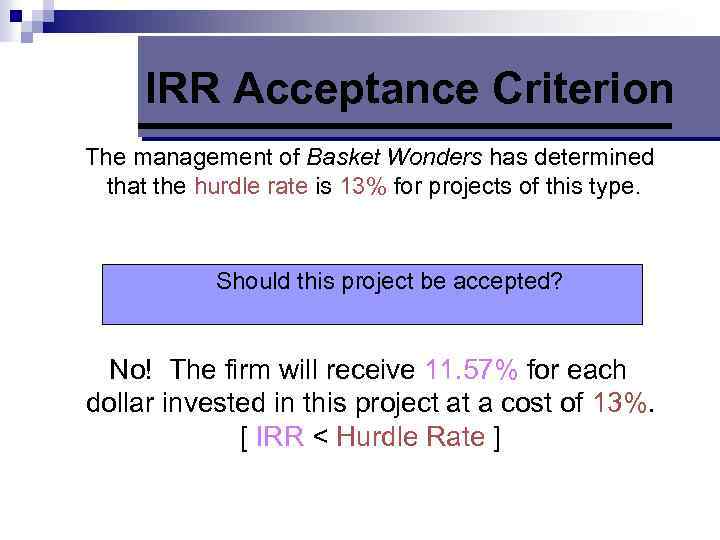

IRR Acceptance Criterion The management of Basket Wonders has determined that the hurdle rate is 13% for projects of this type. Should this project be accepted? No! The firm will receive 11. 57% for each dollar invested in this project at a cost of 13%. [ IRR < Hurdle Rate ]

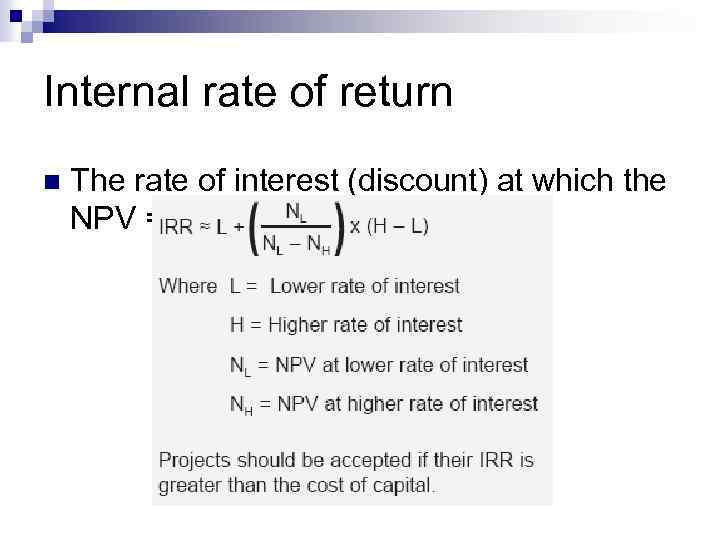

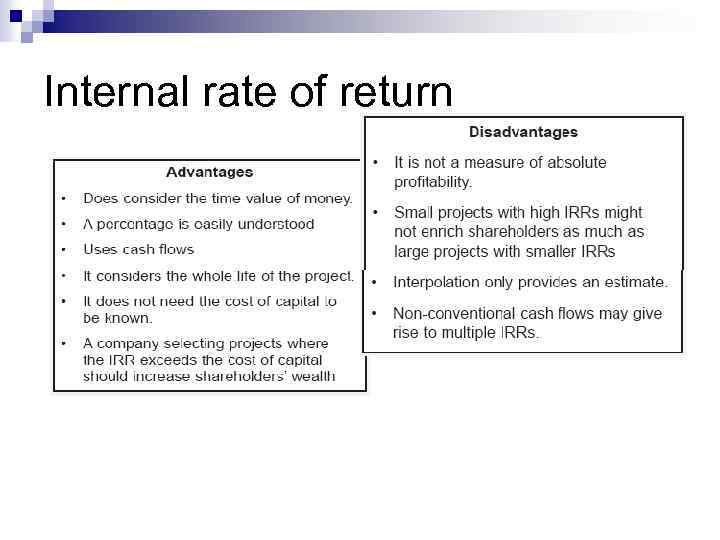

Internal rate of return n The rate of interest (discount) at which the NPV = 0

IRR Decision Rule n Projects should be accepted if their IRR is greater than the cost of capital

Internal rate of return

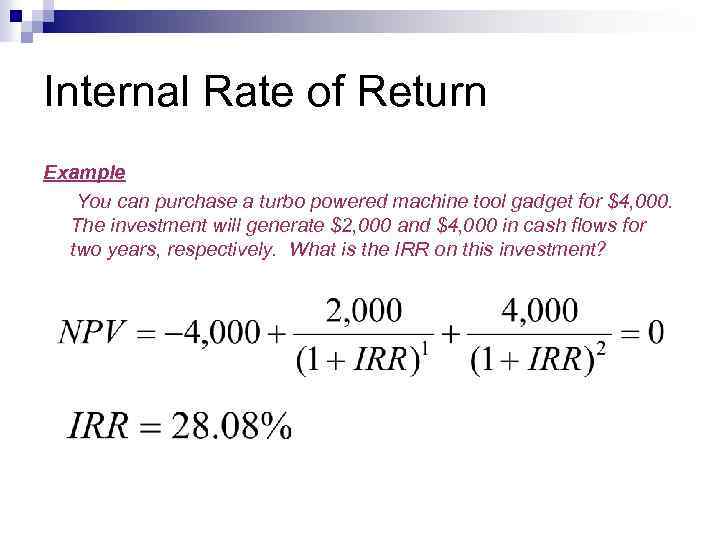

Internal Rate of Return Example You can purchase a turbo powered machine tool gadget for $4, 000. The investment will generate $2, 000 and $4, 000 in cash flows for two years, respectively. What is the IRR on this investment?

Internal Rate of Return Example You can purchase a turbo powered machine tool gadget for $4, 000. The investment will generate $2, 000 and $4, 000 in cash flows for two years, respectively. What is the IRR on this investment?

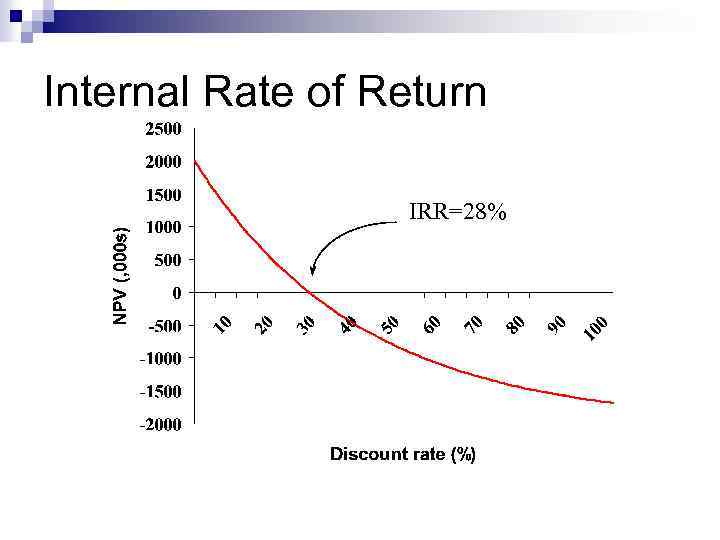

Internal Rate of Return IRR=28%

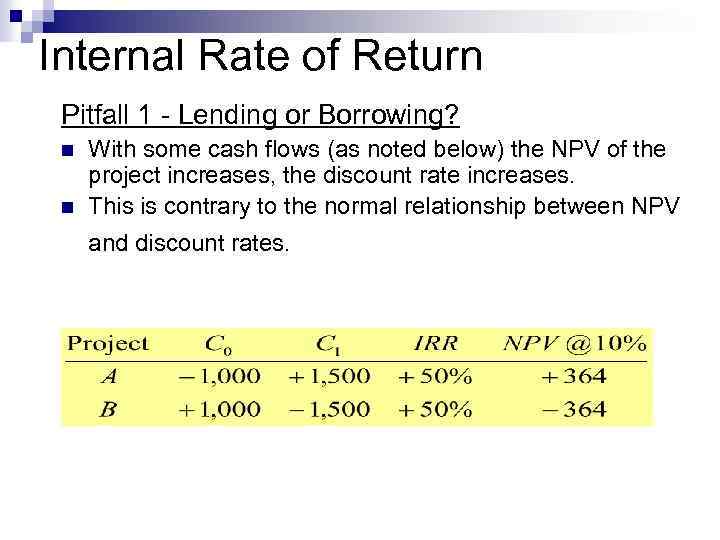

Internal Rate of Return Pitfall 1 - Lending or Borrowing? n n With some cash flows (as noted below) the NPV of the project increases, the discount rate increases. This is contrary to the normal relationship between NPV and discount rates.

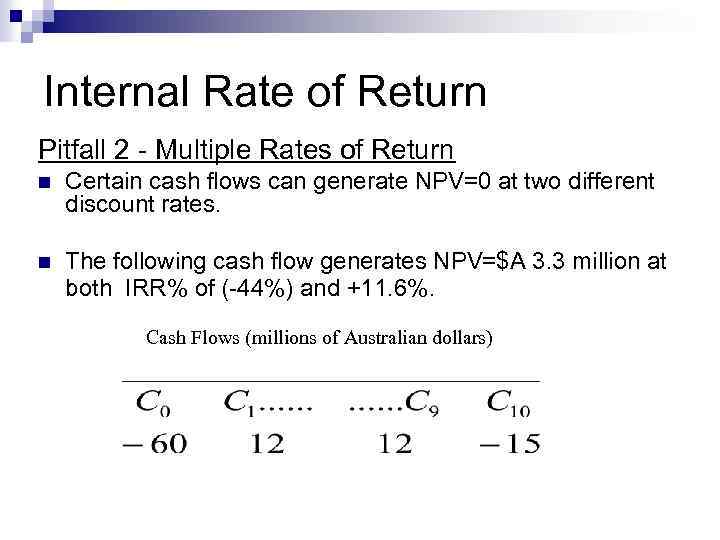

Internal Rate of Return Pitfall 2 - Multiple Rates of Return n Certain cash flows can generate NPV=0 at two different discount rates. n The following cash flow generates NPV=$A 3. 3 million at both IRR% of (-44%) and +11. 6%. Cash Flows (millions of Australian dollars)

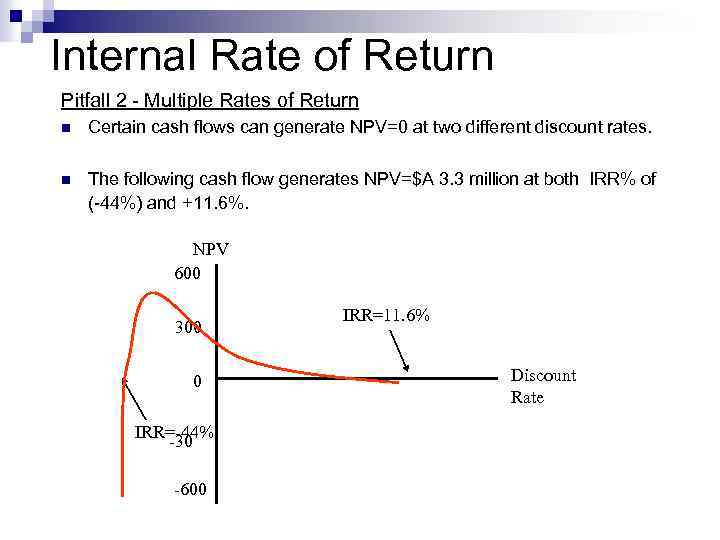

Internal Rate of Return Pitfall 2 - Multiple Rates of Return n Certain cash flows can generate NPV=0 at two different discount rates. n The following cash flow generates NPV=$A 3. 3 million at both IRR% of (-44%) and +11. 6%. NPV 600 300 0 IRR=-44% -30 -600 IRR=11. 6% Discount Rate

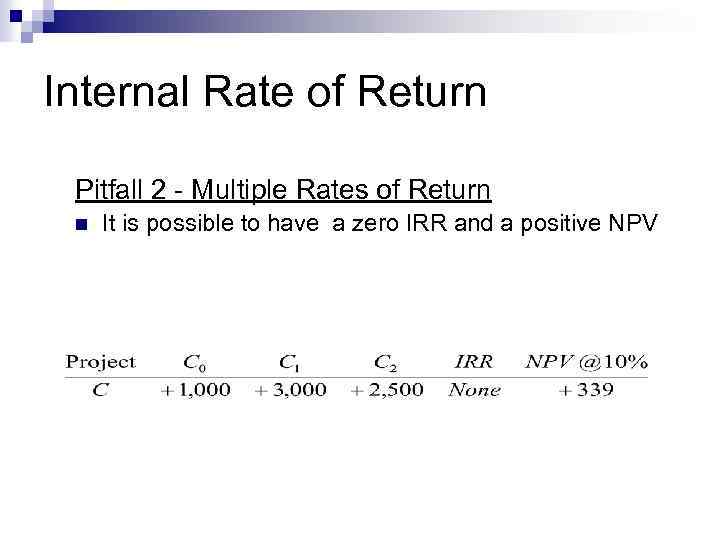

Internal Rate of Return Pitfall 2 - Multiple Rates of Return n It is possible to have a zero IRR and a positive NPV

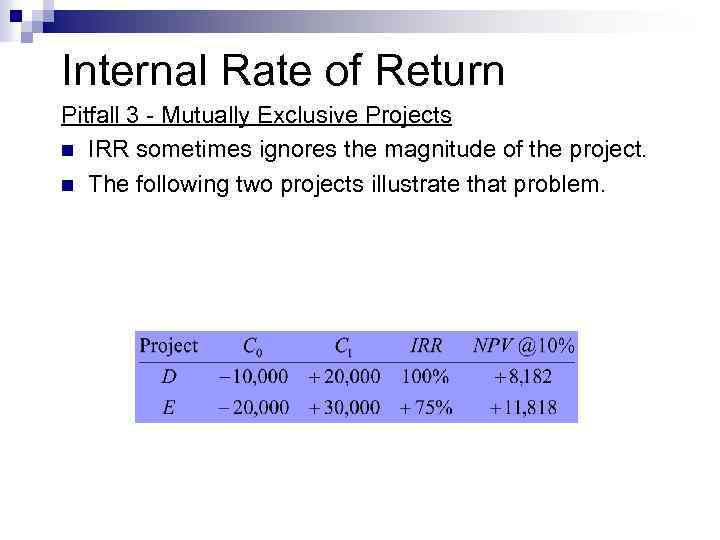

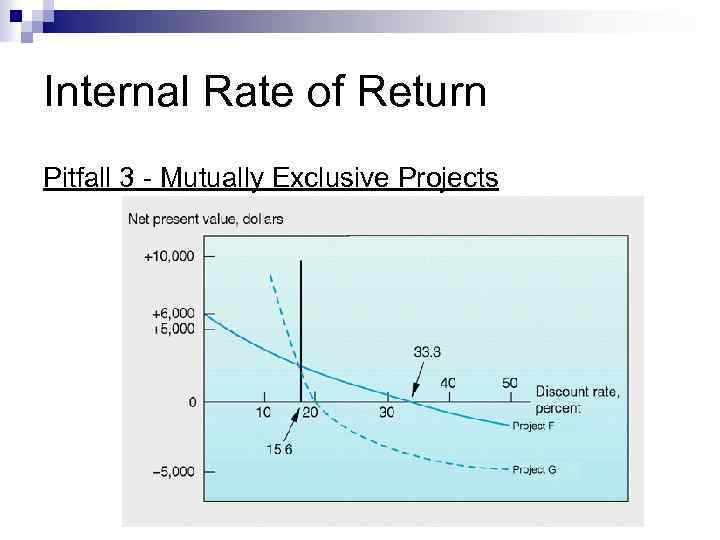

Internal Rate of Return Pitfall 3 - Mutually Exclusive Projects n IRR sometimes ignores the magnitude of the project. n The following two projects illustrate that problem.

Internal Rate of Return Pitfall 3 - Mutually Exclusive Projects

Internal Rate of Return Pitfall 4 - Term Structure Assumption n We assume that discount rates are stable during the term of the project. n This assumption implies that all funds are reinvested at the IRR. n This is a false assumption.

(5) Profitability Index n When resources are limited, the profitability index (PI) provides a tool for selecting among various project combinations and alternatives n A set of limited resources and projects can yield various combinations.

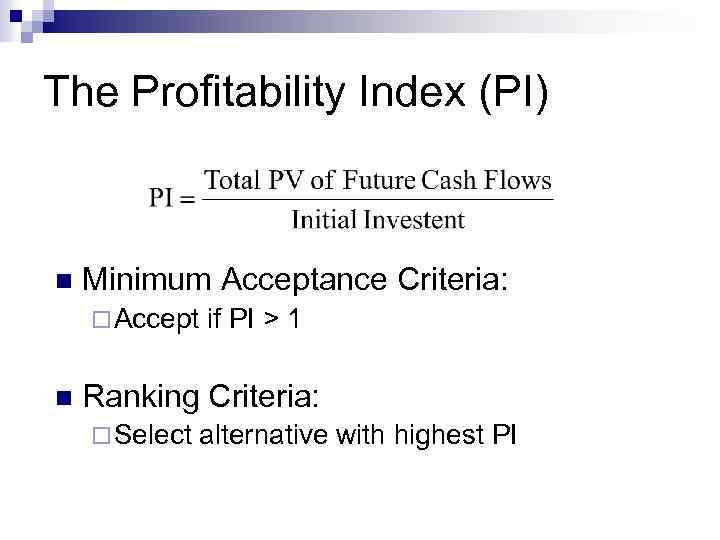

The Profitability Index (PI) n Minimum Acceptance Criteria: ¨ Accept if PI > 1 n Ranking Criteria: ¨ Select alternative with highest PI

Profitability Index n The aim when managing capital rationing is to maximize the PV earned per $1 invested in projects. n Rules : The highest weighted average PI can indicate which projects to select.

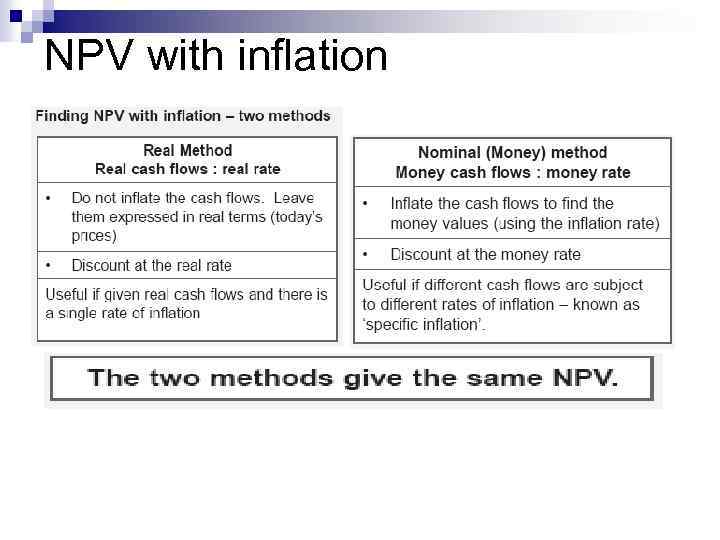

NPV with inflation

Lease versus buy decision Compare the present value cost of leasing with the present value cost of borrowing to buy n Leasing cash flows: n ¨ Rental payments ¨ Tax relief on the rental payments n Buying cash flows: ¨ Asset purchase ¨ Writing down allowances

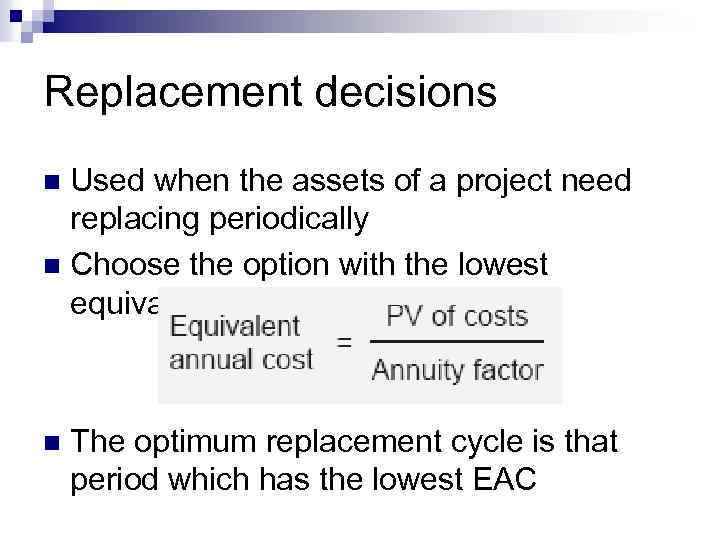

Replacement decisions Used when the assets of a project need replacing periodically n Choose the option with the lowest equivalent annual cost n n The optimum replacement cycle is that period which has the lowest EAC

Chapter 7-8 (A).ppt