2ade751e0a352fa23e707d8f87a6553e.ppt

- Количество слайдов: 17

Chapter 7 Bank Reconciliations Adapted from Financial Accounting 4 e by Porter and Norton

Cash Currency and coins on hand n Checks and money orders from customers n Deposits in checking and savings accounts n Compensating balance – the minimum amount a bank requires the company keep in their bank account as part of a credit-grant arrangement n

Cash Equivalents · 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 2111 2212 23 13 2414 25 26 27 2818 2919 30 20 3121 25 n n n 5 26 6 27 7 28 2 3 8 9 10 1 2 3 15 4 16 5 17 6 7 8 9 10 22 11 23 12 24 13 14 15 16 17 29 18 30 19 31 20 21 22 23 24 25 4 1 26 27 28 29 30 31 · Readily convertible to cash Original maturity to investor of 3 months or less Commercial paper U. S. Treasury bills Certain money market funds

Cash Management n l Necessary to ensure company has neither too little nor too much cash on hand Tools: Õ Cash Flows Statement Õ Bank Reconciliations Õ Petty Cash Funds

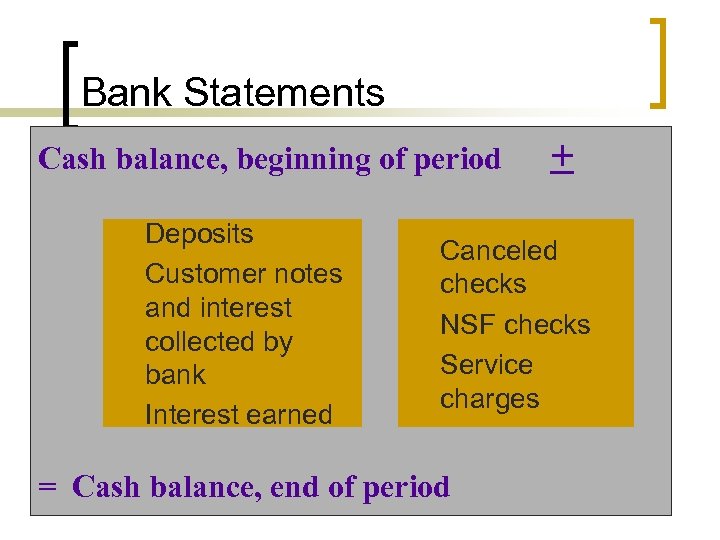

Bank Statements Cash balance, beginning of period + + + Deposits Customer notes and interest collected by bank Interest earned - + Canceled checks NSF checks Service charges = Cash balance, end of period

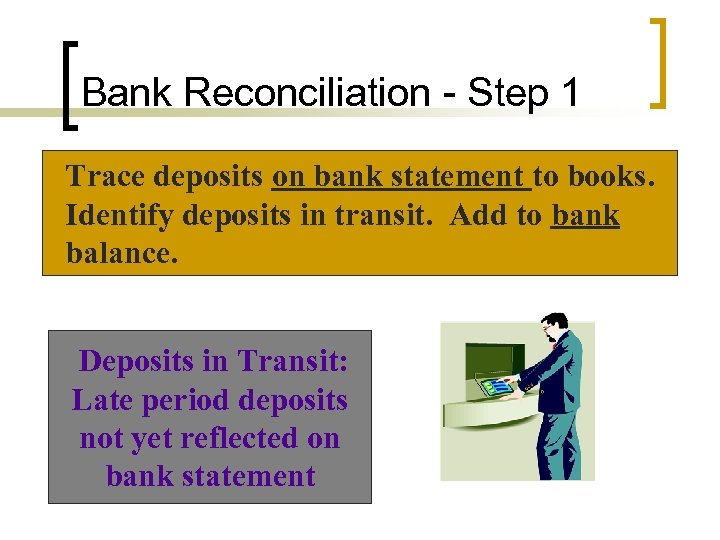

Bank Reconciliation - Step 1 Trace deposits on bank statement to books. Identify deposits in transit. Add to bank balance. Deposits in Transit: Late period deposits not yet reflected on bank statement

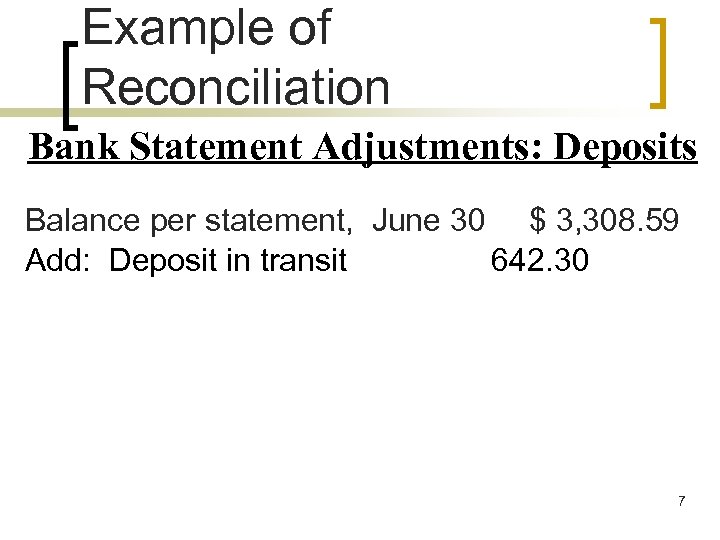

Example of Reconciliation Bank Statement Adjustments: Deposits Balance per statement, June 30 $ 3, 308. 59 Add: Deposit in transit 642. 30 7

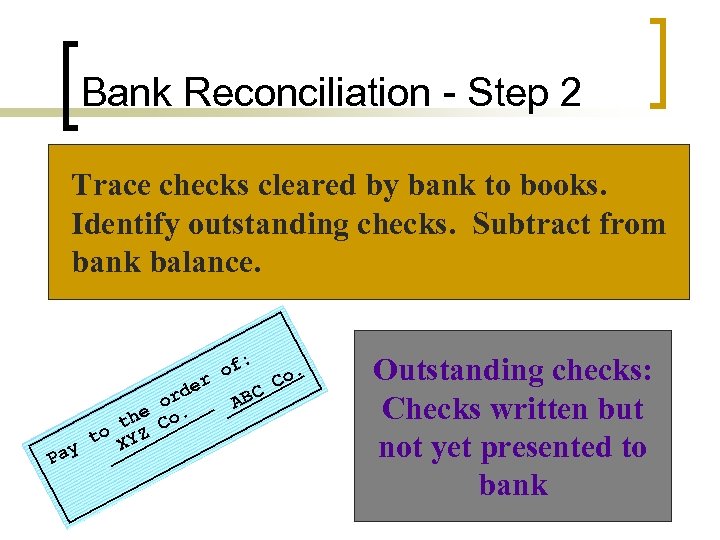

Bank Reconciliation - Step 2 Trace checks cleared by bank to books. Identify outstanding checks. Subtract from bank balance. d or e th Co. to XYZ y Pa er of : AB C . Co Outstanding checks: Checks written but not yet presented to bank

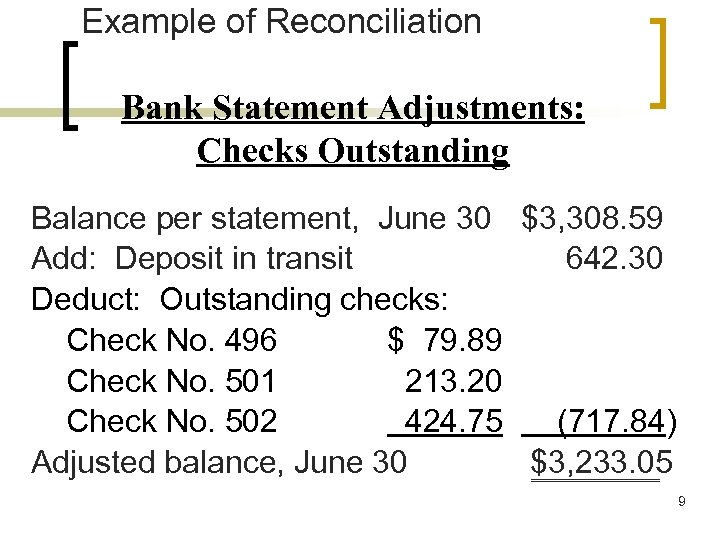

Example of Reconciliation Bank Statement Adjustments: Checks Outstanding Balance per statement, June 30 $3, 308. 59 Add: Deposit in transit 642. 30 Deduct: Outstanding checks: Check No. 496 $ 79. 89 Check No. 501 213. 20 Check No. 502 424. 75 (717. 84) Adjusted balance, June 30 $3, 233. 05 9

Bank Reconciliation - Step 3 List all other additions (credit memoranda) shown on the bank statement. Add to book balance. Credit memoranda: Interest earned, customer notes collected

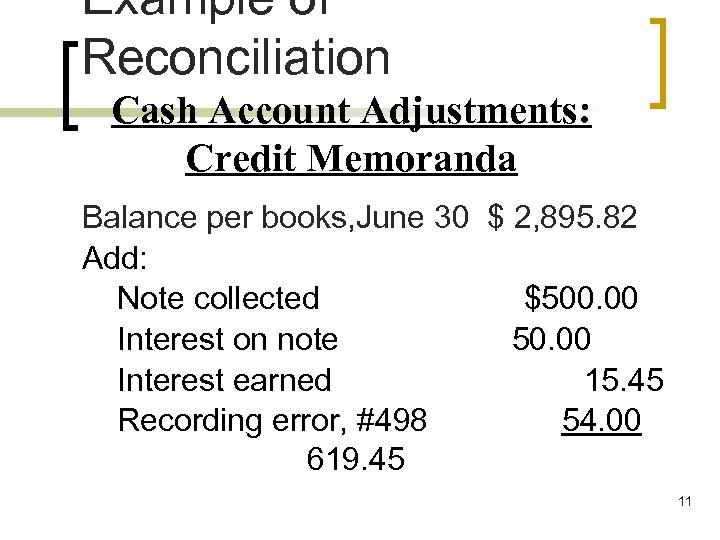

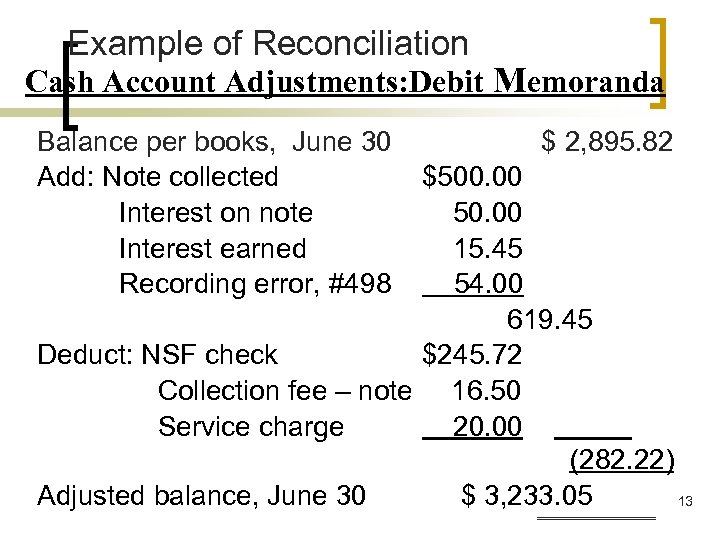

Example of Reconciliation Cash Account Adjustments: Credit Memoranda Balance per books, June 30 $ 2, 895. 82 Add: Note collected $500. 00 Interest on note 50. 00 Interest earned 15. 45 Recording error, #498 54. 00 619. 45 11

Bank Reconciliation - Step 4 List all other subtractions (debit memoranda) shown on the bank statement. Subtract from book balance. te Da unds ent F No ffici n-Su Debit memoranda: NSF checks, service charges, etc.

Example of Reconciliation Cash Account Adjustments: Debit Memoranda Balance per books, June 30 Add: Note collected Interest on note Interest earned Recording error, #498 $ 2, 895. 82 $500. 00 50. 00 15. 45 54. 00 619. 45 Deduct: NSF check $245. 72 Collection fee – note 16. 50 Service charge 20. 00 (282. 22) Adjusted balance, June 30 $ 3, 233. 05 13

Bank Reconciliation - Step 5 Identify errors made by the bank or the company in recording transactions during the period.

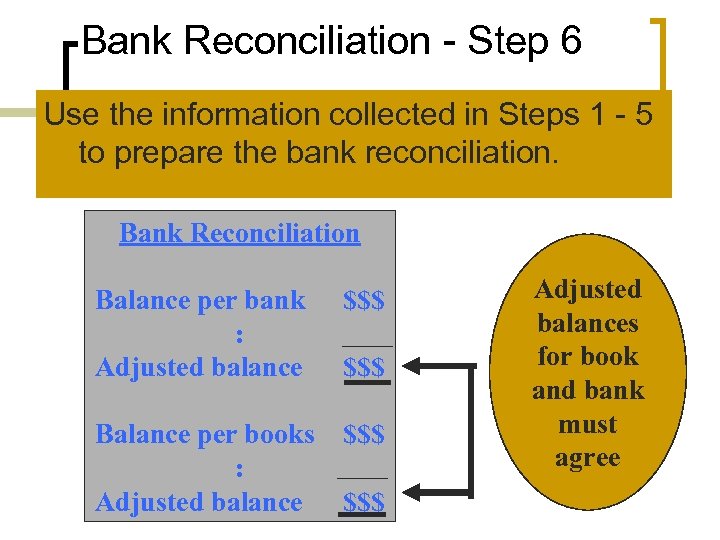

Bank Reconciliation - Step 6 Use the information collected in Steps 1 - 5 to prepare the bank reconciliation. Bank Reconciliation Balance per bank : Adjusted balance $$$ Balance per books : Adjusted balance $$$ $$$ Adjusted balances for book and bank must agree

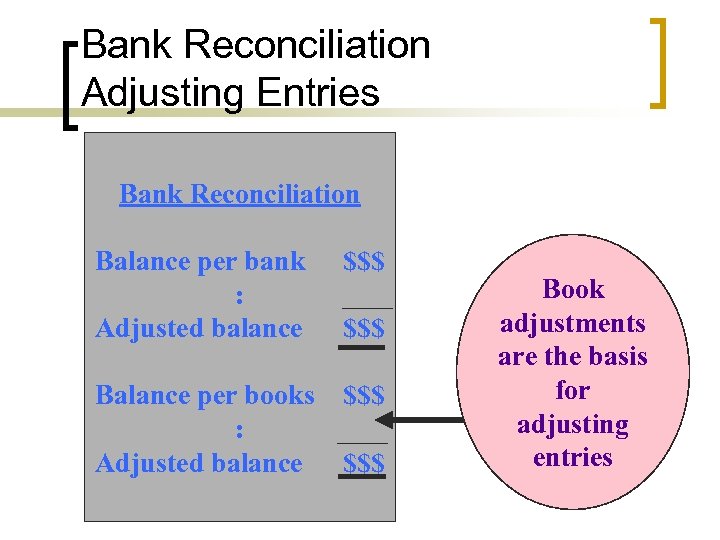

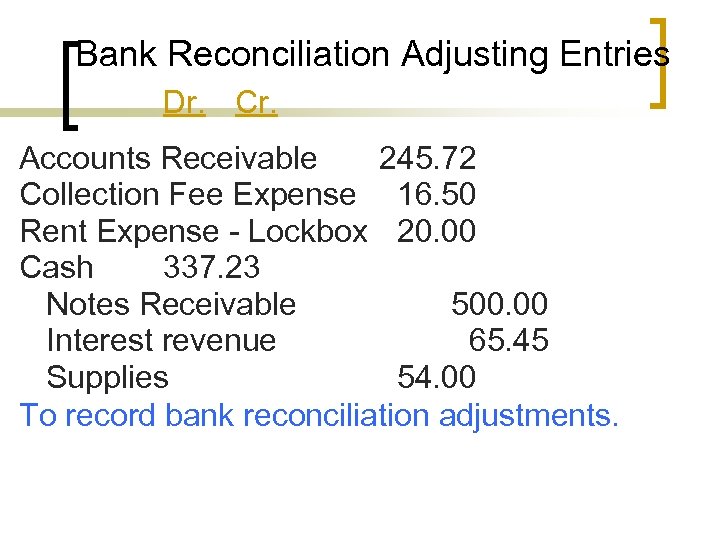

Bank Reconciliation Adjusting Entries Bank Reconciliation Balance per bank : Adjusted balance $$$ Balance per books : Adjusted balance $$$ $$$ Book adjustments are the basis for adjusting entries

Bank Reconciliation Adjusting Entries Dr. Cr. Accounts Receivable 245. 72 Collection Fee Expense 16. 50 Rent Expense - Lockbox 20. 00 Cash 337. 23 Notes Receivable 500. 00 Interest revenue 65. 45 Supplies 54. 00 To record bank reconciliation adjustments.

2ade751e0a352fa23e707d8f87a6553e.ppt