696a3b45b482b610fbeb208170951d8f.ppt

- Количество слайдов: 24

Chapter 6 Vertical Integration

Chapter 6 Vertical Integration

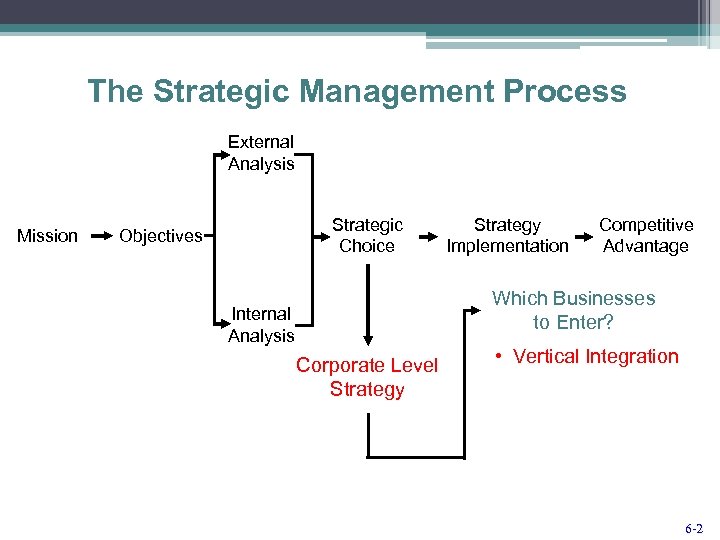

The Strategic Management Process External Analysis Mission Strategic Choice Objectives Strategy Implementation Competitive Advantage Which Businesses to Enter? Internal Analysis Corporate Level Strategy • Vertical Integration 6 -2

The Strategic Management Process External Analysis Mission Strategic Choice Objectives Strategy Implementation Competitive Advantage Which Businesses to Enter? Internal Analysis Corporate Level Strategy • Vertical Integration 6 -2

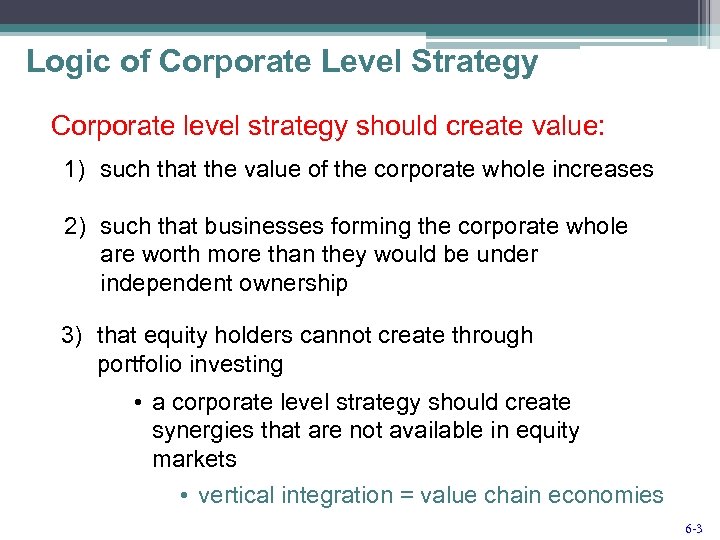

Logic of Corporate Level Strategy Corporate level strategy should create value: 1) such that the value of the corporate whole increases 2) such that businesses forming the corporate whole are worth more than they would be under independent ownership 3) that equity holders cannot create through portfolio investing • a corporate level strategy should create synergies that are not available in equity markets • vertical integration = value chain economies 6 -3

Logic of Corporate Level Strategy Corporate level strategy should create value: 1) such that the value of the corporate whole increases 2) such that businesses forming the corporate whole are worth more than they would be under independent ownership 3) that equity holders cannot create through portfolio investing • a corporate level strategy should create synergies that are not available in equity markets • vertical integration = value chain economies 6 -3

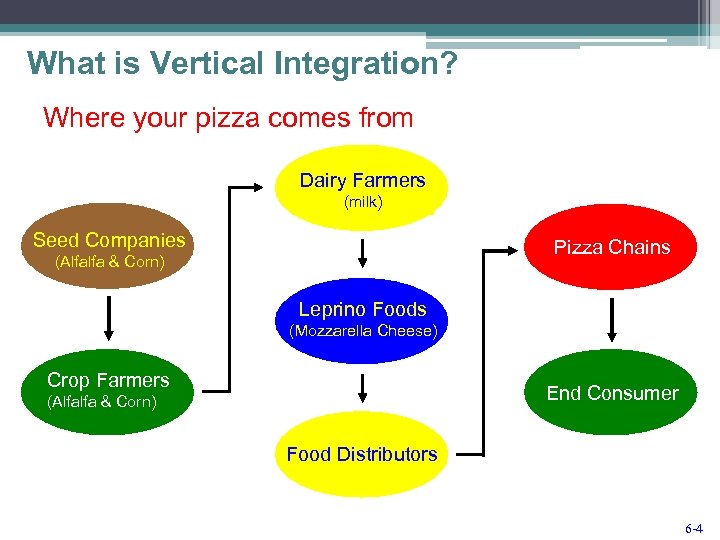

What is Vertical Integration? Where your pizza comes from Dairy Farmers (milk) Seed Companies Pizza Chains (Alfalfa & Corn) Leprino Foods (Mozzarella Cheese) Crop Farmers End Consumer (Alfalfa & Corn) Food Distributors 6 -4

What is Vertical Integration? Where your pizza comes from Dairy Farmers (milk) Seed Companies Pizza Chains (Alfalfa & Corn) Leprino Foods (Mozzarella Cheese) Crop Farmers End Consumer (Alfalfa & Corn) Food Distributors 6 -4

What is Vertical Integration? Dairy Farmers Backward Vertical Integration (milk) Seed Companies Pizza Chains (Alfalfa & Corn) Leprino Foods (Mozzarella Cheese) Crop Farmers End Consumer (Alfalfa & Corn) Food Distributors Forward Vertical Integration 6 -5

What is Vertical Integration? Dairy Farmers Backward Vertical Integration (milk) Seed Companies Pizza Chains (Alfalfa & Corn) Leprino Foods (Mozzarella Cheese) Crop Farmers End Consumer (Alfalfa & Corn) Food Distributors Forward Vertical Integration 6 -5

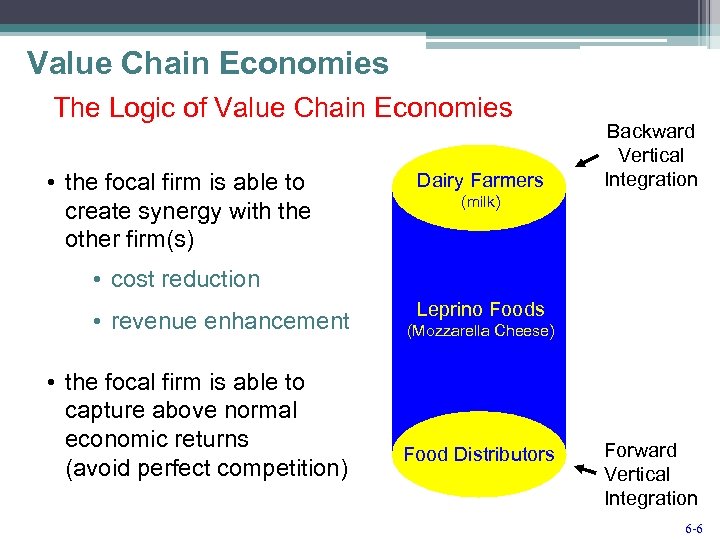

Value Chain Economies The Logic of Value Chain Economies • the focal firm is able to create synergy with the other firm(s) Dairy Farmers Backward Vertical Integration (milk) • cost reduction • revenue enhancement • the focal firm is able to capture above normal economic returns (avoid perfect competition) Leprino Foods (Mozzarella Cheese) Food Distributors Forward Vertical Integration 6 -6

Value Chain Economies The Logic of Value Chain Economies • the focal firm is able to create synergy with the other firm(s) Dairy Farmers Backward Vertical Integration (milk) • cost reduction • revenue enhancement • the focal firm is able to capture above normal economic returns (avoid perfect competition) Leprino Foods (Mozzarella Cheese) Food Distributors Forward Vertical Integration 6 -6

End Segment 1 6 -7

End Segment 1 6 -7

Section 2 Competitive Advantage in Vertical Integration 6 -8

Section 2 Competitive Advantage in Vertical Integration 6 -8

Competitive Advantage If a vertical integration strategy meets the VRIO criteria… Is it Valuable? Is it Rare? Is it costly to Imitate? Is the firm Organized to exploit it? …it may create competitive advantage. 6 -9

Competitive Advantage If a vertical integration strategy meets the VRIO criteria… Is it Valuable? Is it Rare? Is it costly to Imitate? Is the firm Organized to exploit it? …it may create competitive advantage. 6 -9

Value of Vertical Integration Market vs. Integrated Economic Exchange • markets and integrated hierarchies are ‘forms’ in which economic exchange can take place • economic exchange should be conducted in the form that maximizes value for the focal firm • thus, firms assess which form is likely to generate more value Integration makes sense when the focal firm can capture more value than a market exchange provides 6 -10

Value of Vertical Integration Market vs. Integrated Economic Exchange • markets and integrated hierarchies are ‘forms’ in which economic exchange can take place • economic exchange should be conducted in the form that maximizes value for the focal firm • thus, firms assess which form is likely to generate more value Integration makes sense when the focal firm can capture more value than a market exchange provides 6 -10

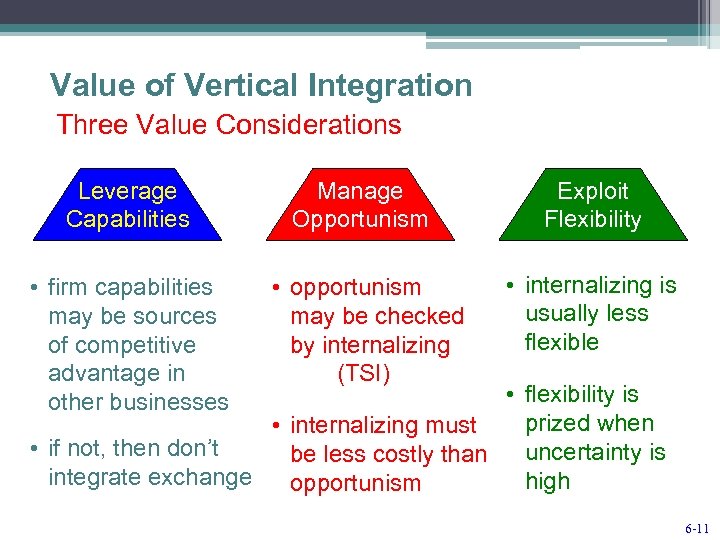

Value of Vertical Integration Three Value Considerations Leverage Capabilities • firm capabilities may be sources of competitive advantage in other businesses Manage Opportunism • opportunism may be checked by internalizing (TSI) Exploit Flexibility • internalizing is usually less flexible • flexibility is prized when • internalizing must • if not, then don’t uncertainty is be less costly than integrate exchange high opportunism 6 -11

Value of Vertical Integration Three Value Considerations Leverage Capabilities • firm capabilities may be sources of competitive advantage in other businesses Manage Opportunism • opportunism may be checked by internalizing (TSI) Exploit Flexibility • internalizing is usually less flexible • flexibility is prized when • internalizing must • if not, then don’t uncertainty is be less costly than integrate exchange high opportunism 6 -11

Rarity of Vertical Integration vs. Non-Integration • a firm’s integration strategy may be rare because the firm integrates or because the firm does not integrate • thus, the question of rareness does not depend on the number of forms observed • a firm’s integration strategy is rare or common with respect to the value created by the strategy Example: Toyota’s Choice Not to Integrate Suppliers 6 -12

Rarity of Vertical Integration vs. Non-Integration • a firm’s integration strategy may be rare because the firm integrates or because the firm does not integrate • thus, the question of rareness does not depend on the number of forms observed • a firm’s integration strategy is rare or common with respect to the value created by the strategy Example: Toyota’s Choice Not to Integrate Suppliers 6 -12

Imitability of Vertical Integration Form vs. Function • the form, per se, is usually not costly to imitate • the value-producing function of integration may be costly to imitate, if: • the integrated firm possesses resource combinations that are the result of: • historical uniqueness • causal ambiguity • social complexity • small numbers prevent further integration • capital requirements are prohibitive 6 -13

Imitability of Vertical Integration Form vs. Function • the form, per se, is usually not costly to imitate • the value-producing function of integration may be costly to imitate, if: • the integrated firm possesses resource combinations that are the result of: • historical uniqueness • causal ambiguity • social complexity • small numbers prevent further integration • capital requirements are prohibitive 6 -13

Imitability of Vertical Integration Modes of Entry • acquisition and internal development are alternative modes of entry into vertical integration • thus, one firm may acquire a supplier while a competitor could imitate that strategy through internal development • in both cases, the boundaries of the firm would encompass the new business • strategic alliances can be viewed as a substitute for vertical integration—without the costs of ownership 6 -14

Imitability of Vertical Integration Modes of Entry • acquisition and internal development are alternative modes of entry into vertical integration • thus, one firm may acquire a supplier while a competitor could imitate that strategy through internal development • in both cases, the boundaries of the firm would encompass the new business • strategic alliances can be viewed as a substitute for vertical integration—without the costs of ownership 6 -14

Organizing Vertical Integration Functional Structure (U-Form) CEO’s Role Cooperation Conflict Finance Marketing HR Engineering Original Business Original Business New Business New Business Cooperation Accounting Conflict 6 -15

Organizing Vertical Integration Functional Structure (U-Form) CEO’s Role Cooperation Conflict Finance Marketing HR Engineering Original Business Original Business New Business New Business Cooperation Accounting Conflict 6 -15

Organizing Vertical Integration Management Controls What needs to be ‘controlled’ in a vertically integrated firm? • managers’ efforts to achieve the desired value chain economies • cooperation and competition among and between functions • the integration of new businesses into the existing business • time horizon of managers 6 -16

Organizing Vertical Integration Management Controls What needs to be ‘controlled’ in a vertically integrated firm? • managers’ efforts to achieve the desired value chain economies • cooperation and competition among and between functions • the integration of new businesses into the existing business • time horizon of managers 6 -16

Organizing Vertical Integration Management Controls Budgets • separating strategic and operational budgets • strategic: inputs & outputs Board Committees • provide oversight and direction to managers • help ensure that strategic direction is maintained • operational: outputs These mechanisms focus management attention on achieving value chain economies 6 -17

Organizing Vertical Integration Management Controls Budgets • separating strategic and operational budgets • strategic: inputs & outputs Board Committees • provide oversight and direction to managers • help ensure that strategic direction is maintained • operational: outputs These mechanisms focus management attention on achieving value chain economies 6 -17

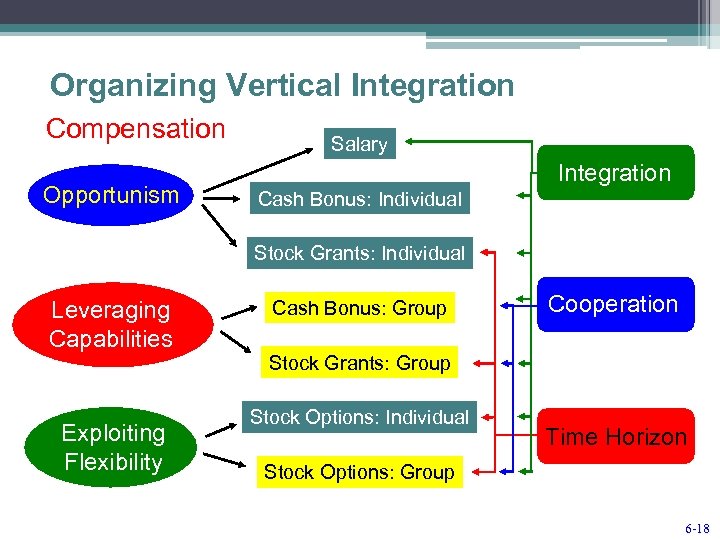

Organizing Vertical Integration Compensation Opportunism Salary Integration Cash Bonus: Individual Stock Grants: Individual Leveraging Capabilities Exploiting Flexibility Cash Bonus: Group Cooperation Stock Grants: Group Stock Options: Individual Time Horizon Stock Options: Group 6 -18

Organizing Vertical Integration Compensation Opportunism Salary Integration Cash Bonus: Individual Stock Grants: Individual Leveraging Capabilities Exploiting Flexibility Cash Bonus: Group Cooperation Stock Grants: Group Stock Options: Individual Time Horizon Stock Options: Group 6 -18

Summary Vertical Integration… • makes sense when value chain economies can be created and captured • may allow a firm to leverage capabilities • may be a response to the threat of opportunism and uncertainty • as a form of exchange per se, is not rare nor costly to imitate 6 -19

Summary Vertical Integration… • makes sense when value chain economies can be created and captured • may allow a firm to leverage capabilities • may be a response to the threat of opportunism and uncertainty • as a form of exchange per se, is not rare nor costly to imitate 6 -19

Summary Vertical Integration… • is an important consideration in the decision to expand internationally (range of possibilities) • makes sense when done for the right reasons, under the right circumstances • can be a costly mistake if done wrong Ownership is costly—integrate only when the benefits outweigh the costs of integration! 6 -20

Summary Vertical Integration… • is an important consideration in the decision to expand internationally (range of possibilities) • makes sense when done for the right reasons, under the right circumstances • can be a costly mistake if done wrong Ownership is costly—integrate only when the benefits outweigh the costs of integration! 6 -20

Segment 3 Scope of the firm 6 -21

Segment 3 Scope of the firm 6 -21

![Transactions Costs and the Scope of the Firm Vertical Product Geographical Scope [A] Single Transactions Costs and the Scope of the Firm Vertical Product Geographical Scope [A] Single](https://present5.com/presentation/696a3b45b482b610fbeb208170951d8f/image-22.jpg) Transactions Costs and the Scope of the Firm Vertical Product Geographical Scope [A] Single Integrated Firm [B] Several Specialized Firms Linked by Markets V 1 V 2 V 3 V 1 V 2 Scope P 1 P 2 Scope P 3 C 1 C 2 C 3 V 3 In situation [A] businesses 1, 2 & 3 are integrated within a single firm. In situation [B] businesses 1, 2 & 3 are independent firms linked by markets. Which situation is more efficient? Depends upon whether the administrative costs of the integrated firm are less than the transaction costs of markets? 6 -22

Transactions Costs and the Scope of the Firm Vertical Product Geographical Scope [A] Single Integrated Firm [B] Several Specialized Firms Linked by Markets V 1 V 2 V 3 V 1 V 2 Scope P 1 P 2 Scope P 3 C 1 C 2 C 3 V 3 In situation [A] businesses 1, 2 & 3 are integrated within a single firm. In situation [B] businesses 1, 2 & 3 are independent firms linked by markets. Which situation is more efficient? Depends upon whether the administrative costs of the integrated firm are less than the transaction costs of markets? 6 -22

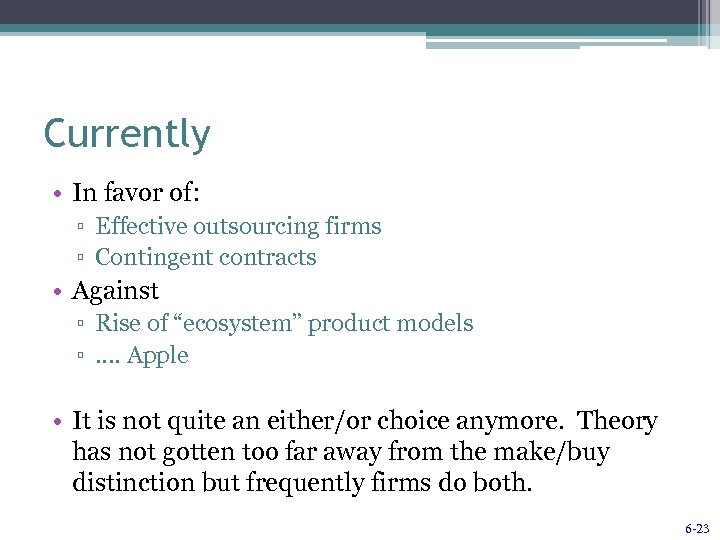

Currently • In favor of: ▫ Effective outsourcing firms ▫ Contingent contracts • Against ▫ Rise of “ecosystem” product models ▫ …. Apple • It is not quite an either/or choice anymore. Theory has not gotten too far away from the make/buy distinction but frequently firms do both. 6 -23

Currently • In favor of: ▫ Effective outsourcing firms ▫ Contingent contracts • Against ▫ Rise of “ecosystem” product models ▫ …. Apple • It is not quite an either/or choice anymore. Theory has not gotten too far away from the make/buy distinction but frequently firms do both. 6 -23

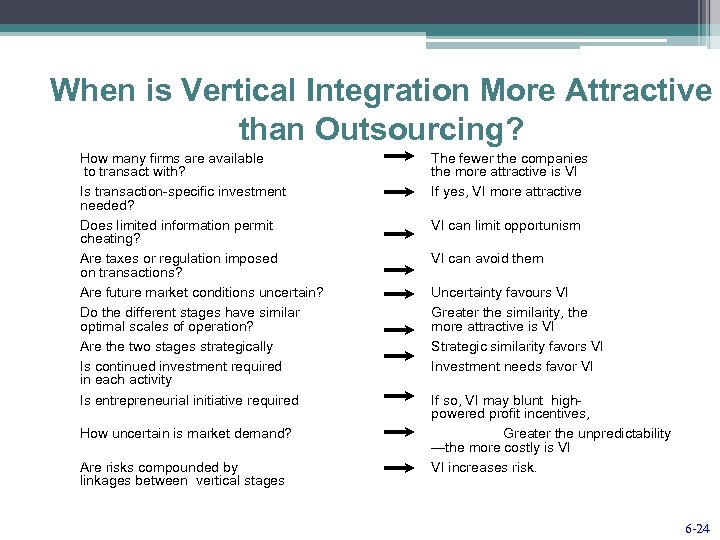

When is Vertical Integration More Attractive than Outsourcing? How many firms are available to transact with? Is transaction-specific investment needed? Does limited information permit cheating? Are taxes or regulation imposed on transactions? Are future market conditions uncertain? Do the different stages have similar optimal scales of operation? Are the two stages strategically Is continued investment required in each activity Is entrepreneurial initiative required How uncertain is market demand? Are risks compounded by linkages between vertical stages The fewer the companies the more attractive is VI If yes, VI more attractive VI can limit opportunism VI can avoid them Uncertainty favours VI Greater the similarity, the more attractive is VI Strategic similarity favors VI Investment needs favor VI If so, VI may blunt highpowered profit incentives, Greater the unpredictability —the more costly is VI VI increases risk. 6 -24

When is Vertical Integration More Attractive than Outsourcing? How many firms are available to transact with? Is transaction-specific investment needed? Does limited information permit cheating? Are taxes or regulation imposed on transactions? Are future market conditions uncertain? Do the different stages have similar optimal scales of operation? Are the two stages strategically Is continued investment required in each activity Is entrepreneurial initiative required How uncertain is market demand? Are risks compounded by linkages between vertical stages The fewer the companies the more attractive is VI If yes, VI more attractive VI can limit opportunism VI can avoid them Uncertainty favours VI Greater the similarity, the more attractive is VI Strategic similarity favors VI Investment needs favor VI If so, VI may blunt highpowered profit incentives, Greater the unpredictability —the more costly is VI VI increases risk. 6 -24