13725c9e2bee6c10a410fcefa7a1e6da.ppt

- Количество слайдов: 35

Chapter 6 The Expenditure Cycle Part II: Payroll Processing and Fixed Asset Procedures

Chapter 6 The Expenditure Cycle Part II: Payroll Processing and Fixed Asset Procedures

Objectives for Chapter 6 • Fundamental tasks of the payroll and fixed asset processes • Functional departments of payroll and fixed asset activities and the flow of transactions through the organization • Documents, journals, and accounts that provide audit trails, promote the maintenance of records, and support decision making and financial reporting • Exposures associated with payroll and fixed asset activities and the controls that reduce these risks • Operational features and the control implications of technology used in payroll and fixed asset systems

Objectives for Chapter 6 • Fundamental tasks of the payroll and fixed asset processes • Functional departments of payroll and fixed asset activities and the flow of transactions through the organization • Documents, journals, and accounts that provide audit trails, promote the maintenance of records, and support decision making and financial reporting • Exposures associated with payroll and fixed asset activities and the controls that reduce these risks • Operational features and the control implications of technology used in payroll and fixed asset systems

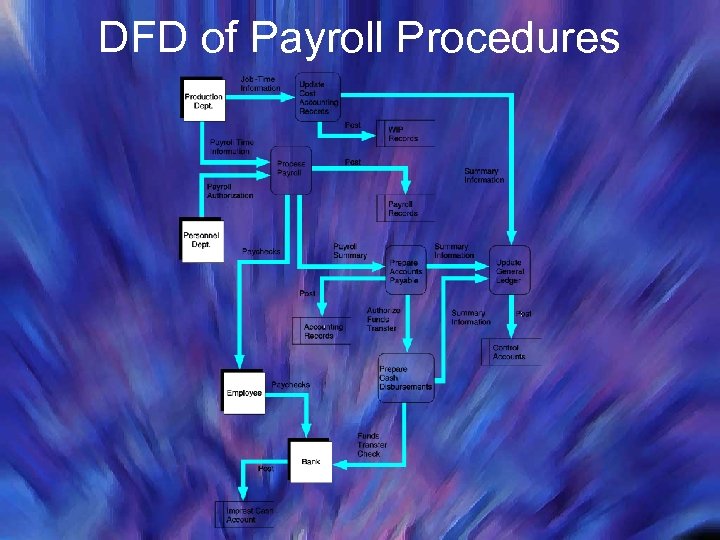

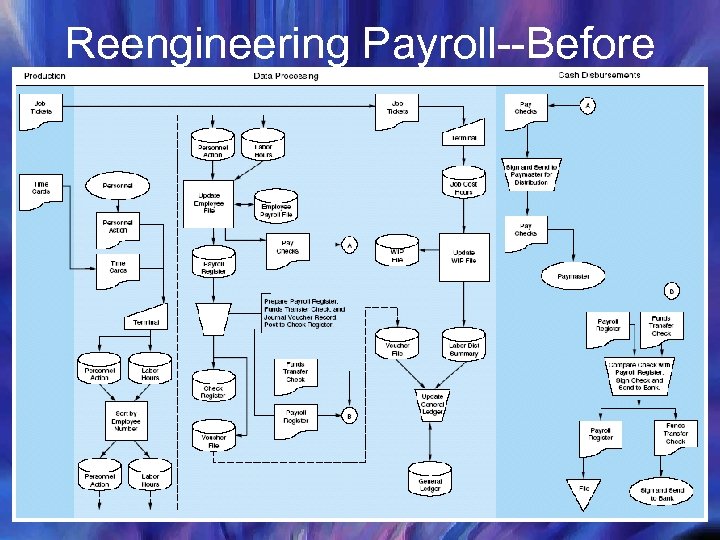

DFD of Payroll Procedures

DFD of Payroll Procedures

Manual Payroll System • The Personnel department uses personnel action forms to: – activate new employees – change the pay rate of employees – change marital status and/or number of dependents – terminate employees

Manual Payroll System • The Personnel department uses personnel action forms to: – activate new employees – change the pay rate of employees – change marital status and/or number of dependents – terminate employees

Manual Payroll System • The production employees fill out two forms: – job tickets - account for the time spent by the individual worker on each production job – time cards - used to capture the total time worked each pay period for payroll calculations; must be signed by a supervisor

Manual Payroll System • The production employees fill out two forms: – job tickets - account for the time spent by the individual worker on each production job – time cards - used to capture the total time worked each pay period for payroll calculations; must be signed by a supervisor

Manual Payroll System • The Cost Accounting department: – uses the job tickets to allocate labor costs to WIP accounts – summarizes these charges in a labor distribution summary which is forwarded to the General Ledger department

Manual Payroll System • The Cost Accounting department: – uses the job tickets to allocate labor costs to WIP accounts – summarizes these charges in a labor distribution summary which is forwarded to the General Ledger department

Manual Payroll System • The Payroll department receives the personnel action forms and the time cards. • It uses them to perform the following tasks: – prepares the payroll register – enters the information into the employee payroll records – prepares paychecks – sends paychecks to Cash Disbursements and a copy of the payroll register to Accounts Payable

Manual Payroll System • The Payroll department receives the personnel action forms and the time cards. • It uses them to perform the following tasks: – prepares the payroll register – enters the information into the employee payroll records – prepares paychecks – sends paychecks to Cash Disbursements and a copy of the payroll register to Accounts Payable

Manual Payroll System • Accounts Payable department: – prepares a cash disbursements voucher for the total amount of the payroll – sends copies to the Cash Disbursements and General Ledger departments

Manual Payroll System • Accounts Payable department: – prepares a cash disbursements voucher for the total amount of the payroll – sends copies to the Cash Disbursements and General Ledger departments

Manual Payroll System • Cash Disbursements reviews and signs the paychecks and forwards them to a paymaster for distribution to the employees. • Cash Disbursements writes a check for the payroll and deposits it into the payroll imprest account.

Manual Payroll System • Cash Disbursements reviews and signs the paychecks and forwards them to a paymaster for distribution to the employees. • Cash Disbursements writes a check for the payroll and deposits it into the payroll imprest account.

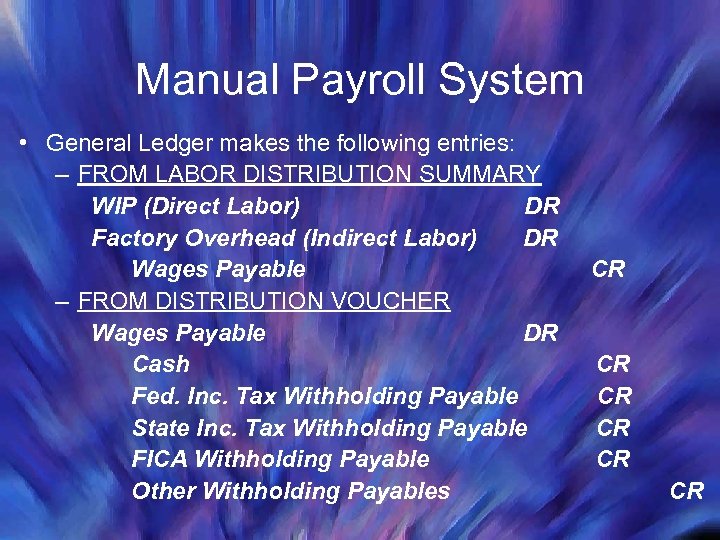

Manual Payroll System • General Ledger makes the following entries: – FROM LABOR DISTRIBUTION SUMMARY WIP (Direct Labor) DR Factory Overhead (Indirect Labor) DR Wages Payable – FROM DISTRIBUTION VOUCHER Wages Payable DR Cash Fed. Inc. Tax Withholding Payable State Inc. Tax Withholding Payable FICA Withholding Payable Other Withholding Payables CR CR CR

Manual Payroll System • General Ledger makes the following entries: – FROM LABOR DISTRIBUTION SUMMARY WIP (Direct Labor) DR Factory Overhead (Indirect Labor) DR Wages Payable – FROM DISTRIBUTION VOUCHER Wages Payable DR Cash Fed. Inc. Tax Withholding Payable State Inc. Tax Withholding Payable FICA Withholding Payable Other Withholding Payables CR CR CR

Manual Payroll System • Further, the General Ledger department needs to make a journal entry to transfer the cash from the operating bank account to the payroll imprest account: Cash - Payroll Imprest Account Cash - Operating Account DR CR

Manual Payroll System • Further, the General Ledger department needs to make a journal entry to transfer the cash from the operating bank account to the payroll imprest account: Cash - Payroll Imprest Account Cash - Operating Account DR CR

Payroll Controls • Transaction authorization - the personnel action form is important in preventing: – terminated employees from receiving checks – wage rates from being improperly changed for current employees

Payroll Controls • Transaction authorization - the personnel action form is important in preventing: – terminated employees from receiving checks – wage rates from being improperly changed for current employees

Payroll Controls • Segregation of Duties - timekeeping and personnel functions should be separated • Supervision - need to monitor employees to ensure they are not “clocking in” for one another

Payroll Controls • Segregation of Duties - timekeeping and personnel functions should be separated • Supervision - need to monitor employees to ensure they are not “clocking in” for one another

Payroll Controls • Accounting Records - audit trail includes: – time cards – job tickets – disbursement vouchers – labor distribution summary – payroll register – subsidiary ledger accounts – general ledger accounts

Payroll Controls • Accounting Records - audit trail includes: – time cards – job tickets – disbursement vouchers – labor distribution summary – payroll register – subsidiary ledger accounts – general ledger accounts

Payroll Controls • Access Controls - need to prevent employees from having improper access to: – accounting records, such as time cards which can be altered – unsigned checks

Payroll Controls • Access Controls - need to prevent employees from having improper access to: – accounting records, such as time cards which can be altered – unsigned checks

Payroll Controls • Independent Verification: – verification of time cards – distribution of paychecks to authorized employees – verification of accuracy of payroll register by accounts payable – general ledger reconciles the labor distribution summary and the payroll disbursement voucher

Payroll Controls • Independent Verification: – verification of time cards – distribution of paychecks to authorized employees – verification of accuracy of payroll register by accounts payable – general ledger reconciles the labor distribution summary and the payroll disbursement voucher

Computer-Based Payroll Systems • Payroll is well-suited to batch processing and sequential files, since a majority of the employees on the master file will receive a paycheck every pay period. • The computer program performs the detailed record-keeping, check-writing, and general ledger functions.

Computer-Based Payroll Systems • Payroll is well-suited to batch processing and sequential files, since a majority of the employees on the master file will receive a paycheck every pay period. • The computer program performs the detailed record-keeping, check-writing, and general ledger functions.

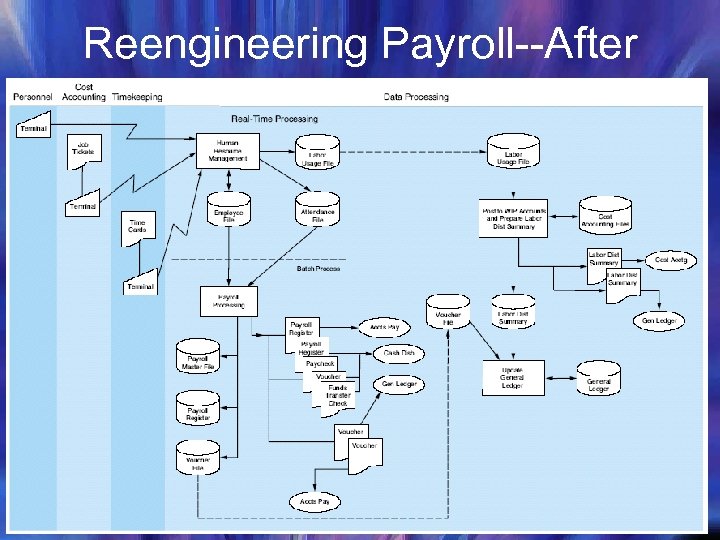

Human Resource Management (HRM) Systems • A re-engineered IT that captures and processes a wide range of personnelrelated data, including: – employee benefits – labor resource planning – employee skills – pay rates and deductions – evaluations – payroll

Human Resource Management (HRM) Systems • A re-engineered IT that captures and processes a wide range of personnelrelated data, including: – employee benefits – labor resource planning – employee skills – pay rates and deductions – evaluations – payroll

Key Features of HRM Systems • Personnel - can make changes to the employee file in real time • Cost Accounting - enters job cost data either daily or in real time • Timekeeping - enters the attendance file daily • Data Processing - still uses batch processing and prepares all reports, the checks, and updates the general ledger

Key Features of HRM Systems • Personnel - can make changes to the employee file in real time • Cost Accounting - enters job cost data either daily or in real time • Timekeeping - enters the attendance file daily • Data Processing - still uses batch processing and prepares all reports, the checks, and updates the general ledger

HRM Systems… differ from automated batch, sequential file systems in the following ways: – operations depts. transmit transactions to data processing via terminals – direct access files are used for storage – many processes are performed real time – real-time access to personnel files required for direct inquiries

HRM Systems… differ from automated batch, sequential file systems in the following ways: – operations depts. transmit transactions to data processing via terminals – direct access files are used for storage – many processes are performed real time – real-time access to personnel files required for direct inquiries

Reengineering Payroll • Payroll can be reengineered as a part of human resource management (HRM). • In reengineered payroll systems – operations departments transmit transactions to data processing via terminals – direct access files are used for data storage – many processes are now performed in real time.

Reengineering Payroll • Payroll can be reengineered as a part of human resource management (HRM). • In reengineered payroll systems – operations departments transmit transactions to data processing via terminals – direct access files are used for data storage – many processes are now performed in real time.

Reengineering Payroll--Before

Reengineering Payroll--Before

Reengineering Payroll--After

Reengineering Payroll--After

The Fixed Asset System (FAS) • Fixed Assets - property, plant, and equipment used in the operation of a business

The Fixed Asset System (FAS) • Fixed Assets - property, plant, and equipment used in the operation of a business

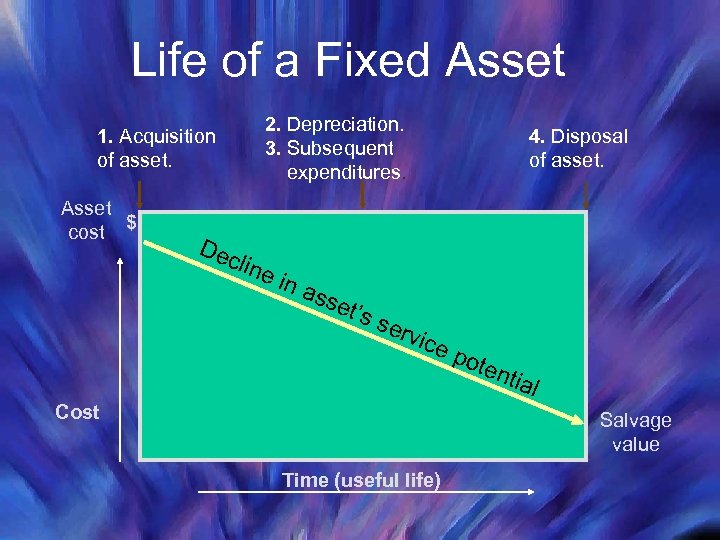

Life of a Fixed Asset 1. Acquisition of asset. Asset cost $ Dec 2. Depreciation. 3. Subsequent expenditures. line in a 4. Disposal of asset. sse t ’s s erv ice Cost pot ent ial Salvage value Time (useful life)

Life of a Fixed Asset 1. Acquisition of asset. Asset cost $ Dec 2. Depreciation. 3. Subsequent expenditures. line in a 4. Disposal of asset. sse t ’s s erv ice Cost pot ent ial Salvage value Time (useful life)

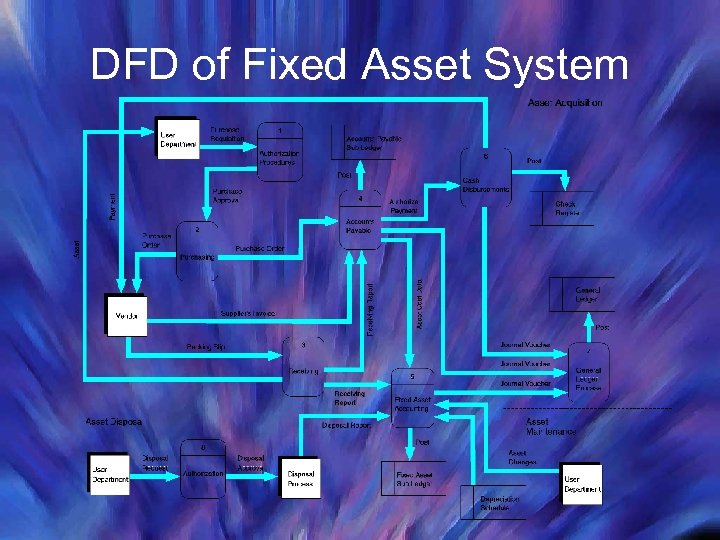

DFD of Fixed Asset System

DFD of Fixed Asset System

Objectives of the FAS • Process the acquisition of fixed assets as needed and in accordance with formal management approval and procedures • Maintain adequate accounting records of asset acquisition, cost, description, and physical location in the organization • Maintain accurate depreciation records for depreciable assets in accordance with acceptable method • Provide management with information to help it plan future fixed asset investments • Properly record the retirement and disposal of fixed assets

Objectives of the FAS • Process the acquisition of fixed assets as needed and in accordance with formal management approval and procedures • Maintain adequate accounting records of asset acquisition, cost, description, and physical location in the organization • Maintain accurate depreciation records for depreciable assets in accordance with acceptable method • Provide management with information to help it plan future fixed asset investments • Properly record the retirement and disposal of fixed assets

Asset Acquisition • Generally begins with a department manager determining that an old fixed asset needs to be replaced or the need for a new fixed asset is warranted • The manager fills out a purchase requisition and may require a signature for items over a pre-specified limit. • The fixed asset department performs the record-keeping function.

Asset Acquisition • Generally begins with a department manager determining that an old fixed asset needs to be replaced or the need for a new fixed asset is warranted • The manager fills out a purchase requisition and may require a signature for items over a pre-specified limit. • The fixed asset department performs the record-keeping function.

Asset Maintenance • Involves adjusting the fixed asset subsidiary account balances as the assets depreciate over time (or deplete with usage) • Depreciation calculations are internal transactions that the fixed asset system must process based upon a depreciation schedule. • Physical improvements must also be recorded to increase the subsidiary account balance and depreciation schedule.

Asset Maintenance • Involves adjusting the fixed asset subsidiary account balances as the assets depreciate over time (or deplete with usage) • Depreciation calculations are internal transactions that the fixed asset system must process based upon a depreciation schedule. • Physical improvements must also be recorded to increase the subsidiary account balance and depreciation schedule.

Asset Disposal • At the end of the useful life or an earlier disposition of the asset, the asset must be removed from the records. • The disposal requires a disposal request and disposal report as source documents to remove the asset from the records and the depreciation schedules.

Asset Disposal • At the end of the useful life or an earlier disposition of the asset, the asset must be removed from the records. • The disposal requires a disposal request and disposal report as source documents to remove the asset from the records and the depreciation schedules.

Computer-Based Fixed Asset System--Acquisition • Acquisition - the receipt of the asset is recorded, along with information such as its useful life, depreciation methods, etc. and the ledgers are automatically updated

Computer-Based Fixed Asset System--Acquisition • Acquisition - the receipt of the asset is recorded, along with information such as its useful life, depreciation methods, etc. and the ledgers are automatically updated

Computer-Based Fixed Asset System--Maintenance • Computerized FAS will automatically: – calculate current period’s depreciation – update the accumulated depreciation and book -value fields in the subsidiary records – post the total amount of depreciation to the affected general ledger accounts • depreciation expense and accumulated depreciation – record the depreciation transaction by adding a record to the journal voucher file

Computer-Based Fixed Asset System--Maintenance • Computerized FAS will automatically: – calculate current period’s depreciation – update the accumulated depreciation and book -value fields in the subsidiary records – post the total amount of depreciation to the affected general ledger accounts • depreciation expense and accumulated depreciation – record the depreciation transaction by adding a record to the journal voucher file

Computer-Based Fixed Asset System--Disposal • Computerized FAS will automatically: – post an adjusting entry to the fixed asset control account in the general ledger – record any loss or gain associated with the disposal transaction – prepare a journal voucher record

Computer-Based Fixed Asset System--Disposal • Computerized FAS will automatically: – post an adjusting entry to the fixed asset control account in the general ledger – record any loss or gain associated with the disposal transaction – prepare a journal voucher record

Controlling the Fixed Asset System • Authorization should be formal and explicit because of high cost of PPE: – acquisitions – changes in depreciation methods • Supervision - threat of misappropriation requires constant management supervision: – theft--secure the physical location of assets – misuse--monitor on-the-job activities

Controlling the Fixed Asset System • Authorization should be formal and explicit because of high cost of PPE: – acquisitions – changes in depreciation methods • Supervision - threat of misappropriation requires constant management supervision: – theft--secure the physical location of assets – misuse--monitor on-the-job activities

Controlling the Fixed Asset System • Independent Verification Controls the internal auditor should periodically verify FAS records: – the reasonableness of factors used in decisions (useful life, discounts, budgeting model) – location, condition, and fair value of the fixed asset records in the subsidiary ledger – the programming logic for automatic calculations (depreciation)

Controlling the Fixed Asset System • Independent Verification Controls the internal auditor should periodically verify FAS records: – the reasonableness of factors used in decisions (useful life, discounts, budgeting model) – location, condition, and fair value of the fixed asset records in the subsidiary ledger – the programming logic for automatic calculations (depreciation)