Chapter 6

Chapter 6

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Net Present Value

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

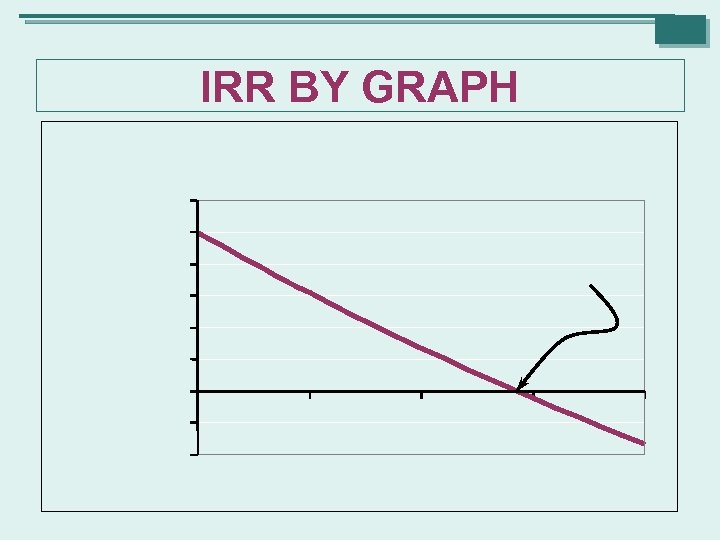

IRR BY GRAPH

IRR BY GRAPH

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria

Other Investment Criteria Book Rate of Return = Book Income / Book Assets

Other Investment Criteria Book Rate of Return = Book Income / Book Assets

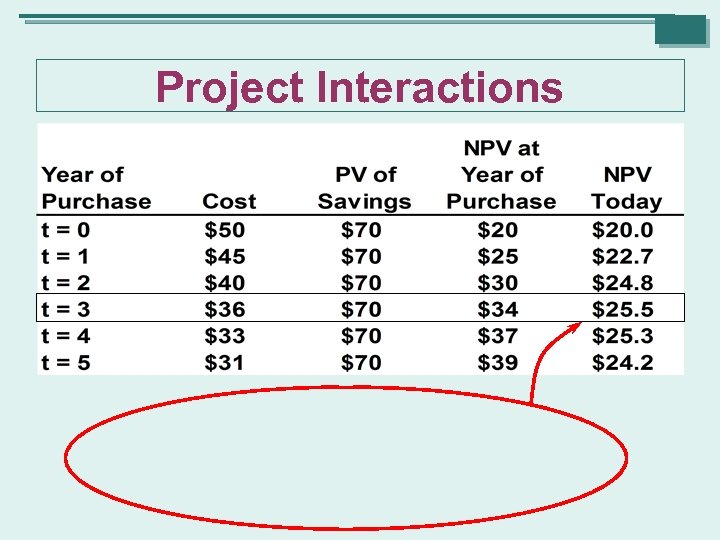

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

Project Interactions

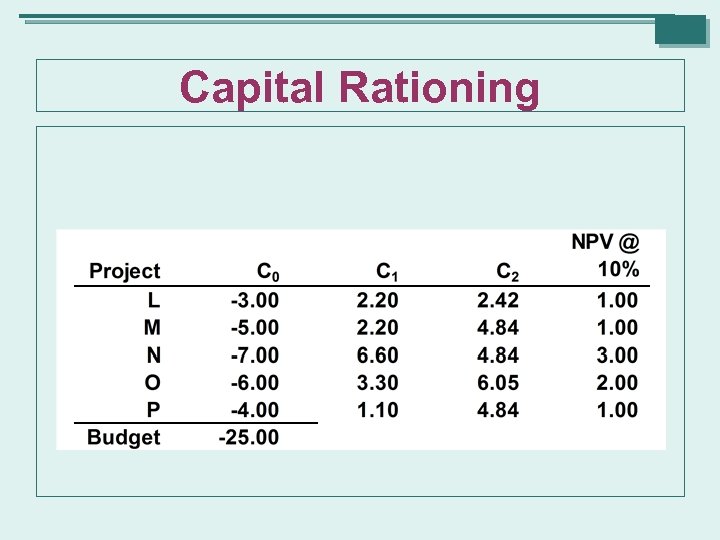

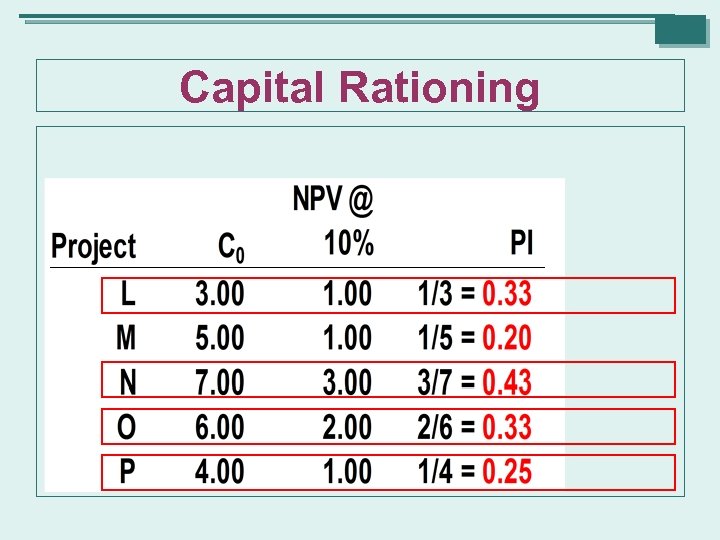

Capital Rationing

Capital Rationing

Capital Rationing How is this done?

Capital Rationing How is this done?

Capital Rationing

Capital Rationing

Capital Rationing

Capital Rationing

Capital Rationing

Capital Rationing

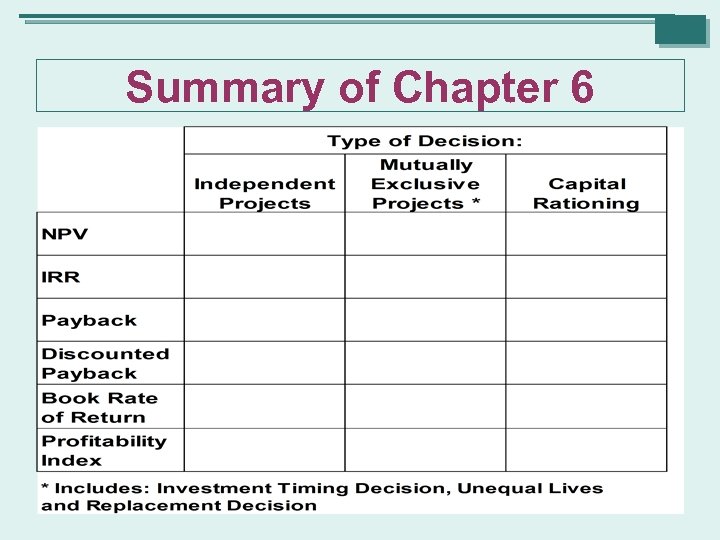

Summary of Chapter 6

Summary of Chapter 6

Summary of Chapter 6

Summary of Chapter 6

Summary of Chapter 6 NPV should always be used when evaluating project acceptability!

Summary of Chapter 6 NPV should always be used when evaluating project acceptability!