94e43de582b2900fbf90efde628202a9.ppt

- Количество слайдов: 31

Chapter 6 Merchandising Operations and Internal Control Adapted from Financial Accounting 4 e by Porter and Norton 1

Chapter 6 Merchandising Operations and Internal Control Adapted from Financial Accounting 4 e by Porter and Norton 1

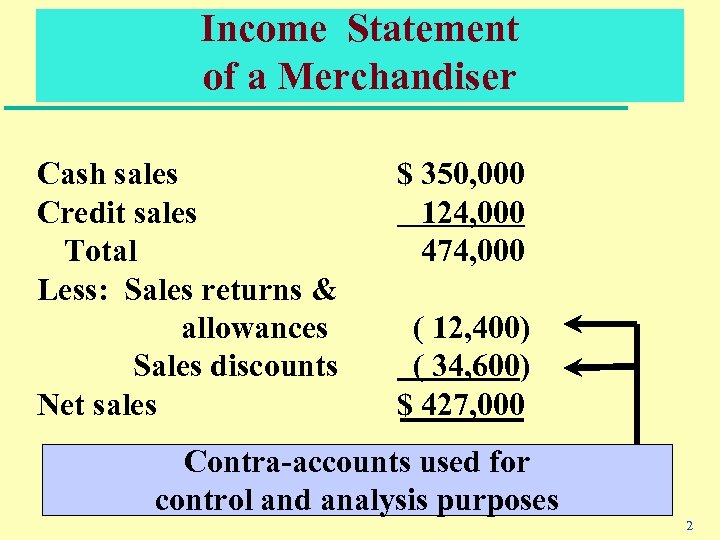

Income Statement of a Merchandiser Cash sales Credit sales Total Less: Sales returns & allowances Sales discounts Net sales $ 350, 000 124, 000 474, 000 ( 12, 400) ( 34, 600) $ 427, 000 Contra-accounts used for control and analysis purposes 2

Income Statement of a Merchandiser Cash sales Credit sales Total Less: Sales returns & allowances Sales discounts Net sales $ 350, 000 124, 000 474, 000 ( 12, 400) ( 34, 600) $ 427, 000 Contra-accounts used for control and analysis purposes 2

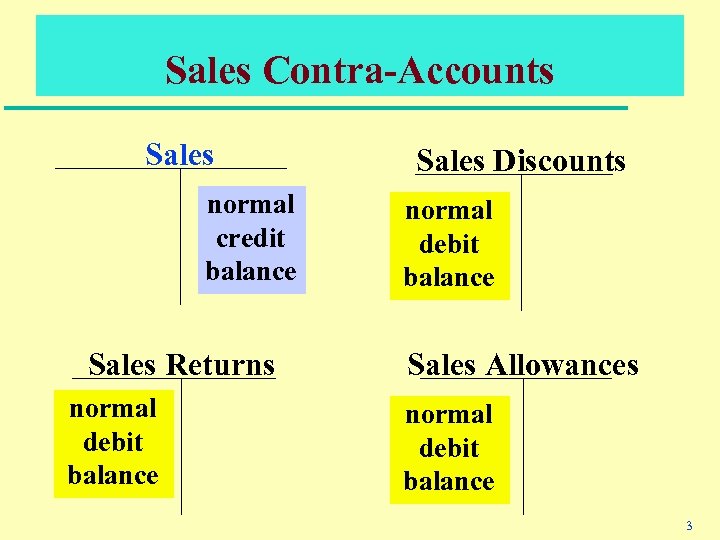

Sales Contra-Accounts Sales normal credit balance Sales Returns normal debit balance Sales Discounts normal debit balance Sales Allowances normal debit balance 3

Sales Contra-Accounts Sales normal credit balance Sales Returns normal debit balance Sales Discounts normal debit balance Sales Allowances normal debit balance 3

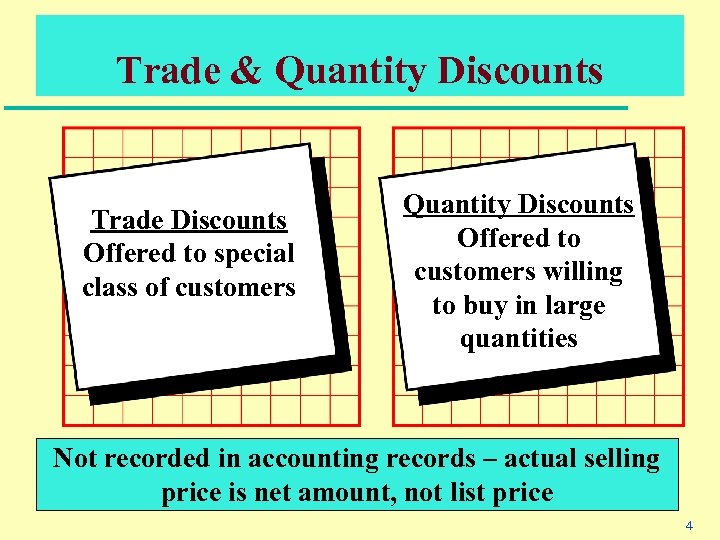

Trade & Quantity Discounts Trade Discounts Offered to special class of customers Quantity Discounts Offered to customers willing to buy in large quantities Not recorded in accounting records – actual selling price is net amount, not list price 4

Trade & Quantity Discounts Trade Discounts Offered to special class of customers Quantity Discounts Offered to customers willing to buy in large quantities Not recorded in accounting records – actual selling price is net amount, not list price 4

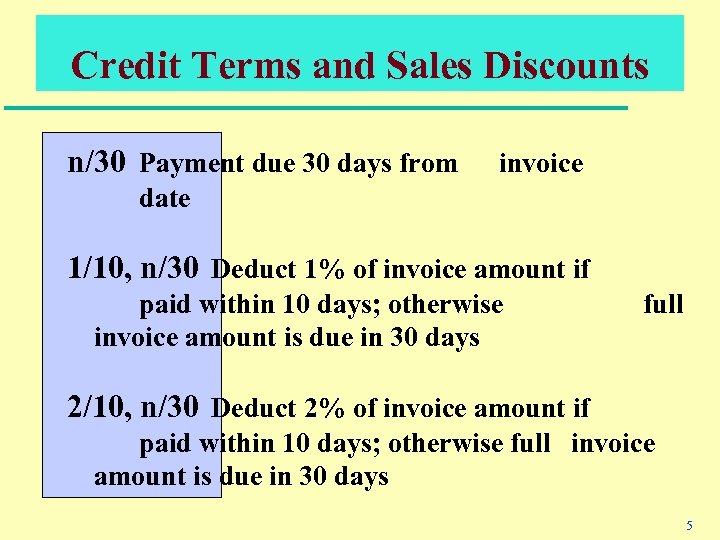

Credit Terms and Sales Discounts n/30 Payment due 30 days from invoice date 1/10, n/30 Deduct 1% of invoice amount if paid within 10 days; otherwise invoice amount is due in 30 days full 2/10, n/30 Deduct 2% of invoice amount if paid within 10 days; otherwise full invoice amount is due in 30 days 5

Credit Terms and Sales Discounts n/30 Payment due 30 days from invoice date 1/10, n/30 Deduct 1% of invoice amount if paid within 10 days; otherwise invoice amount is due in 30 days full 2/10, n/30 Deduct 2% of invoice amount if paid within 10 days; otherwise full invoice amount is due in 30 days 5

Recording Sales Discounts Cash Sales Discounts Accounts Receivable 980 20 1, 000 To record collection on account of customer who has taken 2% sales discount. ($1, 000 x 2% = $20 discount) 6

Recording Sales Discounts Cash Sales Discounts Accounts Receivable 980 20 1, 000 To record collection on account of customer who has taken 2% sales discount. ($1, 000 x 2% = $20 discount) 6

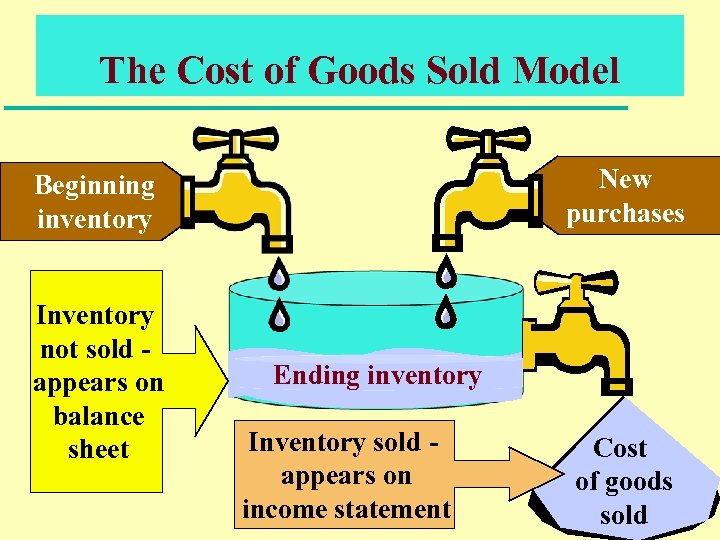

The Cost of Goods Sold Model New purchases Beginning inventory Inventory not sold appears on balance sheet Ending inventory Inventory sold appears on income statement Cost of goods sold 7

The Cost of Goods Sold Model New purchases Beginning inventory Inventory not sold appears on balance sheet Ending inventory Inventory sold appears on income statement Cost of goods sold 7

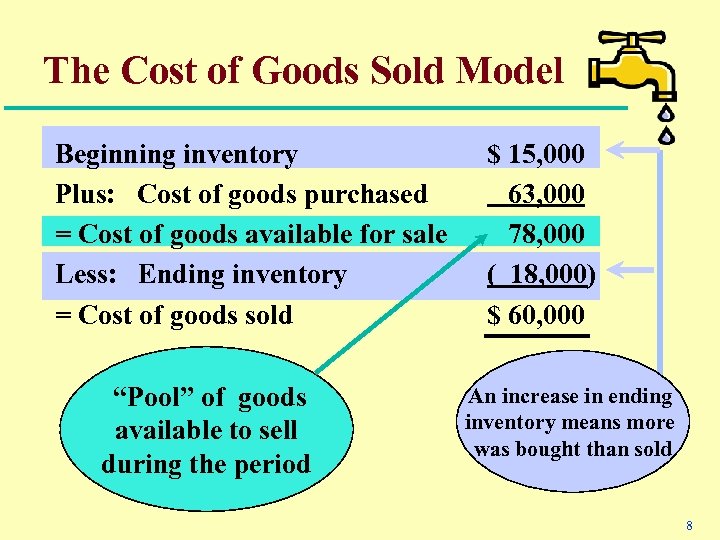

The Cost of Goods Sold Model Beginning inventory Plus: Cost of goods purchased = Cost of goods available for sale Less: Ending inventory = Cost of goods sold “Pool” of goods available to sell during the period $ 15, 000 63, 000 78, 000 ( 18, 000) $ 60, 000 An increase in ending inventory means more was bought than sold 8

The Cost of Goods Sold Model Beginning inventory Plus: Cost of goods purchased = Cost of goods available for sale Less: Ending inventory = Cost of goods sold “Pool” of goods available to sell during the period $ 15, 000 63, 000 78, 000 ( 18, 000) $ 60, 000 An increase in ending inventory means more was bought than sold 8

Perpetual Inventory Systems Inventory records are updated after each purchase or sale u Point of sale terminals have improved ability of mass merchandisers to maintain perpetual systems 9

Perpetual Inventory Systems Inventory records are updated after each purchase or sale u Point of sale terminals have improved ability of mass merchandisers to maintain perpetual systems 9

Periodic Inventory Systems Inventory records are updated periodically based on physical inventory counts u Reduces record-keeping but also decreases ability to track theft, breakage, etc. and prepare interim financial statements 10

Periodic Inventory Systems Inventory records are updated periodically based on physical inventory counts u Reduces record-keeping but also decreases ability to track theft, breakage, etc. and prepare interim financial statements 10

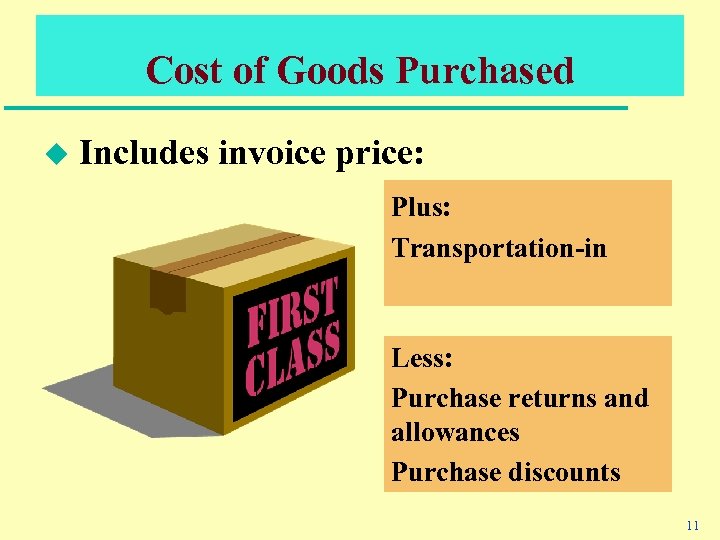

Cost of Goods Purchased u Includes invoice price: Plus: Transportation-in Less: Purchase returns and allowances Purchase discounts 11

Cost of Goods Purchased u Includes invoice price: Plus: Transportation-in Less: Purchase returns and allowances Purchase discounts 11

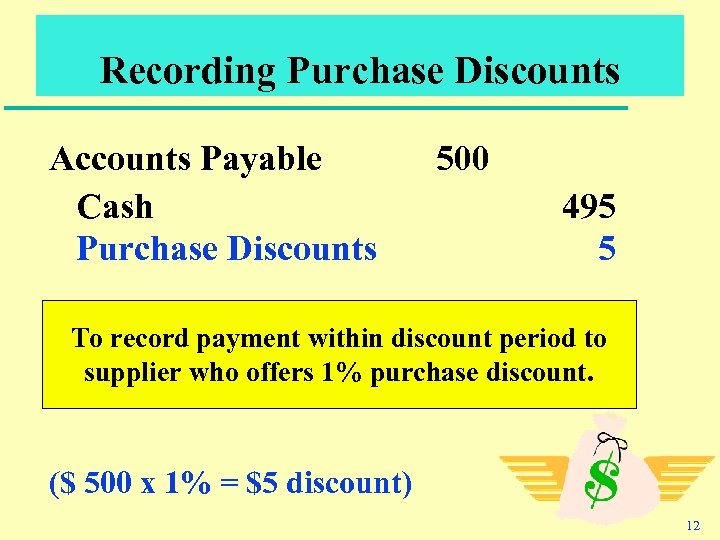

Recording Purchase Discounts Accounts Payable Cash Purchase Discounts 500 495 5 To record payment within discount period to supplier who offers 1% purchase discount. ($ 500 x 1% = $5 discount) 12

Recording Purchase Discounts Accounts Payable Cash Purchase Discounts 500 495 5 To record payment within discount period to supplier who offers 1% purchase discount. ($ 500 x 1% = $5 discount) 12

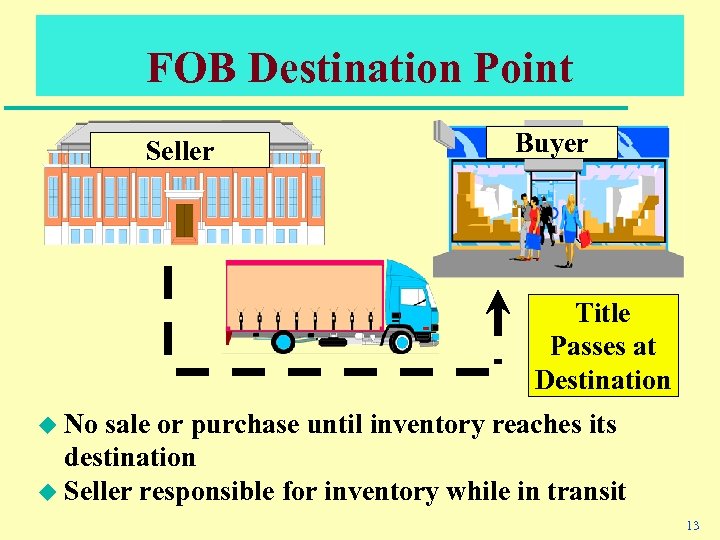

FOB Destination Point Seller Buyer Title Passes at Destination u No sale or purchase until inventory reaches its destination u Seller responsible for inventory while in transit 13

FOB Destination Point Seller Buyer Title Passes at Destination u No sale or purchase until inventory reaches its destination u Seller responsible for inventory while in transit 13

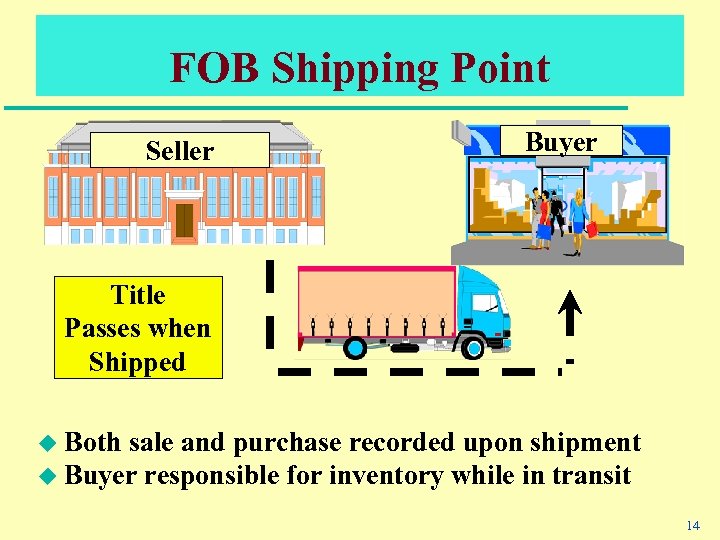

FOB Shipping Point Seller Buyer Title Passes when Shipped u Both sale and purchase recorded upon shipment u Buyer responsible for inventory while in transit 14

FOB Shipping Point Seller Buyer Title Passes when Shipped u Both sale and purchase recorded upon shipment u Buyer responsible for inventory while in transit 14

Responsibility for Internal Control Internal Auditors External Auditors Management Audit Committee of Board of Directors 15

Responsibility for Internal Control Internal Auditors External Auditors Management Audit Committee of Board of Directors 15

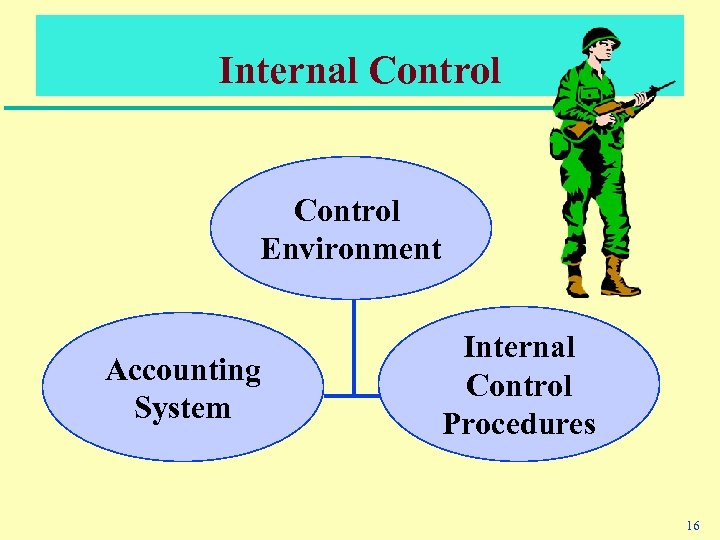

Internal Control Environment Accounting System Internal Control Procedures 16

Internal Control Environment Accounting System Internal Control Procedures 16

The Control Environment Management’s competence and operating style u u. Personnel policies and practices u. Influence of board of directors 17

The Control Environment Management’s competence and operating style u u. Personnel policies and practices u. Influence of board of directors 17

The Accounting System Methods and records used to report transactions and maintain financial information u Can be manual or automated systems or a combination of both u Use of journals is an integral part of any system 18

The Accounting System Methods and records used to report transactions and maintain financial information u Can be manual or automated systems or a combination of both u Use of journals is an integral part of any system 18

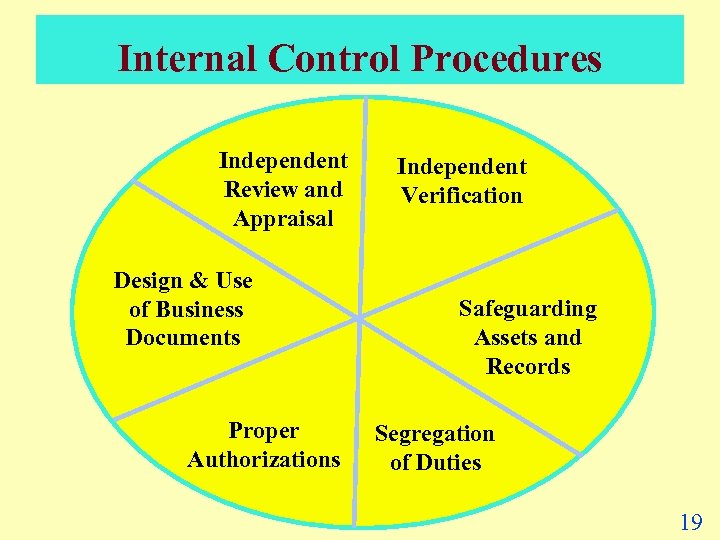

Internal Control Procedures Independent Review and Appraisal Design & Use of Business Documents Proper Authorizations Independent Verification Safeguarding Assets and Records Segregation of Duties 19

Internal Control Procedures Independent Review and Appraisal Design & Use of Business Documents Proper Authorizations Independent Verification Safeguarding Assets and Records Segregation of Duties 19

Proper Authorizations u Authority and responsibility go hand in hand LOAN APPROVED 20

Proper Authorizations u Authority and responsibility go hand in hand LOAN APPROVED 20

Segregation of duties u Separate physical custody from the accounting for assets 21

Segregation of duties u Separate physical custody from the accounting for assets 21

Independent Verification u One individual or department acts as a check on the work of another 22

Independent Verification u One individual or department acts as a check on the work of another 22

Safeguarding Assets and Records u Protect assets and accounting records from loss, theft, unauthorized use, etc. 23

Safeguarding Assets and Records u Protect assets and accounting records from loss, theft, unauthorized use, etc. 23

Independent Review and Appraisal u Provide for periodic review and appraisal of the accounting system and the people operating it. Audit Report 24

Independent Review and Appraisal u Provide for periodic review and appraisal of the accounting system and the people operating it. Audit Report 24

Design and Use of Business Documents u Capture all relevant information about a transaction and assist in proper recording and classification. u Are properly controlled 25

Design and Use of Business Documents u Capture all relevant information about a transaction and assist in proper recording and classification. u Are properly controlled 25

Limitations on Internal Control u No – – system is entirely foolproof Employees in collusion can override the best controls Cost vs. benefit tradeoff 26

Limitations on Internal Control u No – – system is entirely foolproof Employees in collusion can override the best controls Cost vs. benefit tradeoff 26

Appendix Internal Control for a Merchandising Company 27

Appendix Internal Control for a Merchandising Company 27

Controls Over Cash u All cash receipts deposited intact daily u All cash disbursements made by check te Da Payc heck r re yc Pa k c he or f e an e Do . D t ep of T u as re for John Doe Date J Dep t. of Tre asu rer 28

Controls Over Cash u All cash receipts deposited intact daily u All cash disbursements made by check te Da Payc heck r re yc Pa k c he or f e an e Do . D t ep of T u as re for John Doe Date J Dep t. of Tre asu rer 28

Controls Over Cash Received Over the Counter u Cash registers u Prenumbered customer receipts u Investigation of recurring discrepancies 29

Controls Over Cash Received Over the Counter u Cash registers u Prenumbered customer receipts u Investigation of recurring discrepancies 29

Controls Over Cash Received in the Mail u Two employees open mail u Prelist prepared u Monthly customer statements 30

Controls Over Cash Received in the Mail u Two employees open mail u Prelist prepared u Monthly customer statements 30

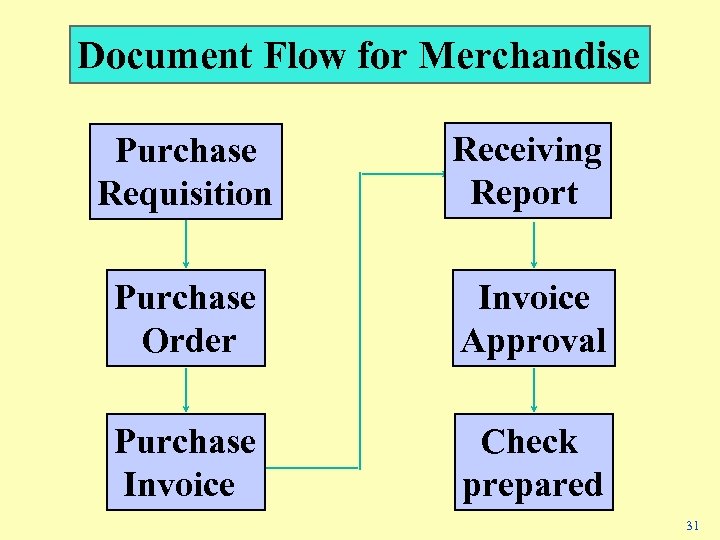

Document Flow for Merchandise Purchase Requisition Receiving Report Purchase Order Invoice Approval Purchase Invoice Check prepared 31

Document Flow for Merchandise Purchase Requisition Receiving Report Purchase Order Invoice Approval Purchase Invoice Check prepared 31