701104f4c63c70de0f474b5fe31e66b2.ppt

- Количество слайдов: 162

Chapter 6 Financial Markets, Capital Mobility, and Monetary Policy

Financial Repression: Macroeconomic Effects

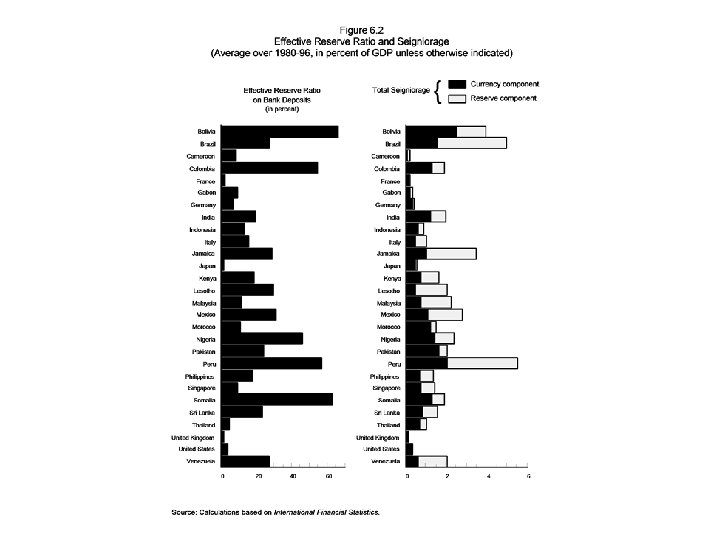

Financial Repression, the Inflation Tax, and Capital Controls

Financial Repression and Inflationary Finance

A General Public-Finance Approach

Capital Mobility: Empirical Evidence

The Magnitude of Gross Flows

Tests of Interest Parity Conditions

Tests of Monetary Autonomy

Saving-Investment Correlation

Summary

Models of Informal Credit and Foreign Exchange Markets

Models of Informal Credit Markets

Stagflationary Effects of Monetary Policy

Interest Rate Policy and Output

Models of Informal Currency Markets

Illegal Trade and Parallel Markets

Portfolio and Currency Substitution Models

Monetary Policy with Informal Financial Markets

The Analytical Framework

Changes in Monetary Policy Instruments Credit Expansion

Changes in the Administrated Interest Rate

Change in the Required Reserve Ratio

Intervention in the Parallel Foreign Exchange Market

A Simulation Model with Informal Financial Markets

Structure of the Model

Aggregate Supply

Aggregate Demand Disposible Income

Asset Accumulation and Financial Wealth

The Current Account and the Balance of Payments

The Banking System

Fiscal Deficits and Domestic Credit

Calibration of the Model

Effects of Stabilization Policies

Government Spending on Home Goods

Central Bank Credit to Commercial Banks

Increase in Lending Rates

Devaluation of the Official Exchange Rate

701104f4c63c70de0f474b5fe31e66b2.ppt