e11f92d369f6250bfe1b4321a7690f7a.ppt

- Количество слайдов: 24

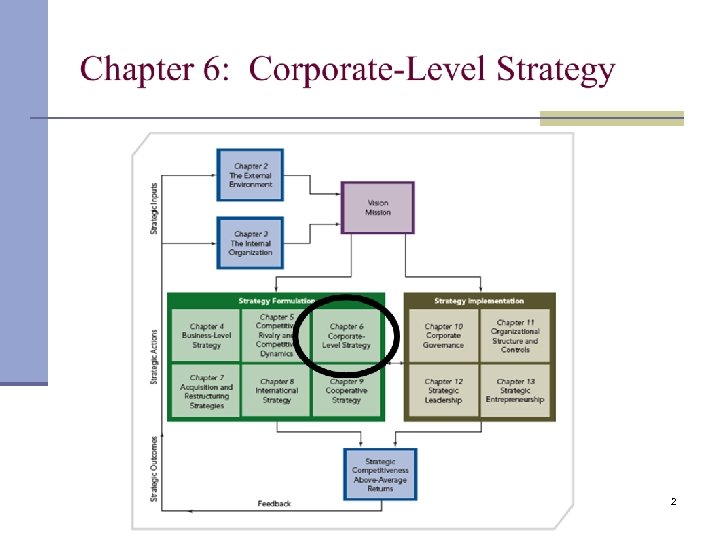

Chapter 6: Corporate-Level Strategy n Overview: n Define and discuss corporate-level strategy n Different levels and types of diversification n Three primary reasons firms diversify n Value creation: related diversification strategy n Value creation: unrelated diversification strategy n Incentives and resources encouraging diversification n Management motives for overdiversification 1

Chapter 6: Corporate-Level Strategy n Overview: n Define and discuss corporate-level strategy n Different levels and types of diversification n Three primary reasons firms diversify n Value creation: related diversification strategy n Value creation: unrelated diversification strategy n Incentives and resources encouraging diversification n Management motives for overdiversification 1

2

2

Introduction n Business-level Strategy n An integrated and coordinated set of commitments and actions the firm uses to gain competitive advantage by exploiting core competencies in specific product markets n Corporate-level Strategy n Specifies actions a firm takes to gain a competitive advantage by selecting and managing a group of different businesses competing in different product markets n n Expected to help firm earn above-average returns Value ultimately determined by degree to which “the businesses in the portfolio are worth more under the management of the company then they would be under any other ownership” 3

Introduction n Business-level Strategy n An integrated and coordinated set of commitments and actions the firm uses to gain competitive advantage by exploiting core competencies in specific product markets n Corporate-level Strategy n Specifies actions a firm takes to gain a competitive advantage by selecting and managing a group of different businesses competing in different product markets n n Expected to help firm earn above-average returns Value ultimately determined by degree to which “the businesses in the portfolio are worth more under the management of the company then they would be under any other ownership” 3

Introduction n Corporate-level strategy concerns: n The scope of the markets and industries the firm competes in n How the firm manages their portfolio of businesses n Mode of entry into new businesses n n Internal development, acquisitions/merger, joint venture/strategic alliance Level and type of diversification Capturing synergies between business units Allocating corporate resources n Product diversification is the primary form of corporate- level strategy n Diversification is often looked at as a growth strategy 4

Introduction n Corporate-level strategy concerns: n The scope of the markets and industries the firm competes in n How the firm manages their portfolio of businesses n Mode of entry into new businesses n n Internal development, acquisitions/merger, joint venture/strategic alliance Level and type of diversification Capturing synergies between business units Allocating corporate resources n Product diversification is the primary form of corporate- level strategy n Diversification is often looked at as a growth strategy 4

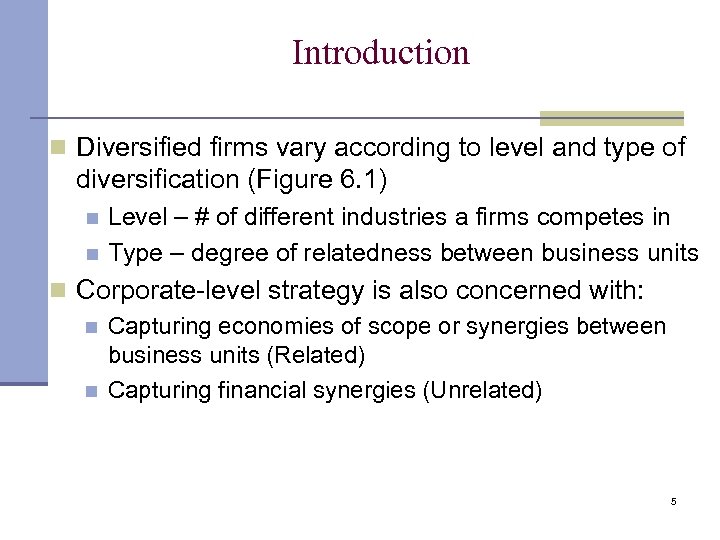

Introduction n Diversified firms vary according to level and type of diversification (Figure 6. 1) n n Level – # of different industries a firms competes in Type – degree of relatedness between business units n Corporate-level strategy is also concerned with: n Capturing economies of scope or synergies between business units (Related) n Capturing financial synergies (Unrelated) 5

Introduction n Diversified firms vary according to level and type of diversification (Figure 6. 1) n n Level – # of different industries a firms competes in Type – degree of relatedness between business units n Corporate-level strategy is also concerned with: n Capturing economies of scope or synergies between business units (Related) n Capturing financial synergies (Unrelated) 5

Levels and Types of Diversification 6

Levels and Types of Diversification 6

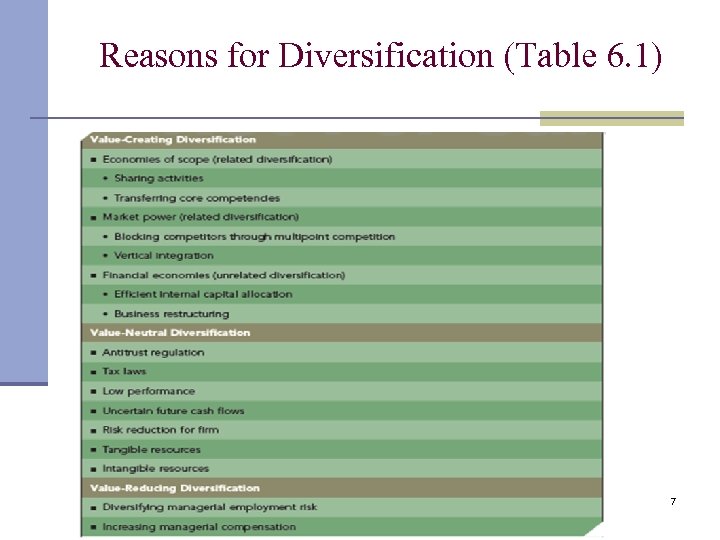

Reasons for Diversification (Table 6. 1) 7

Reasons for Diversification (Table 6. 1) 7

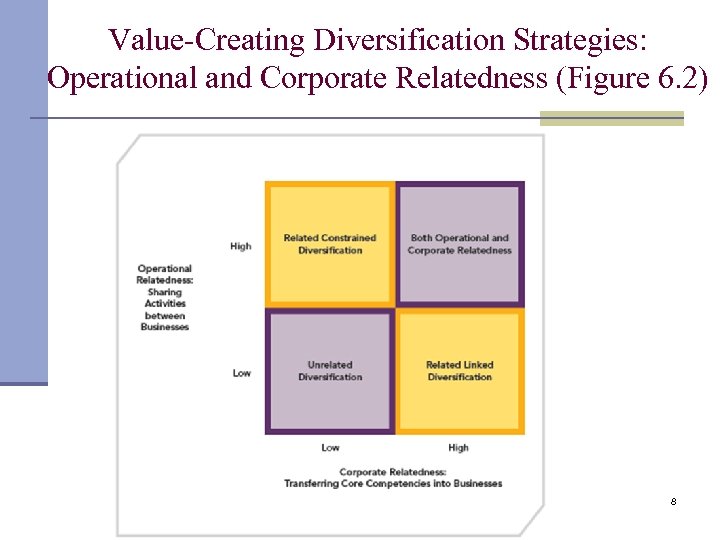

Value-Creating Diversification Strategies: Operational and Corporate Relatedness (Figure 6. 2) 8

Value-Creating Diversification Strategies: Operational and Corporate Relatedness (Figure 6. 2) 8

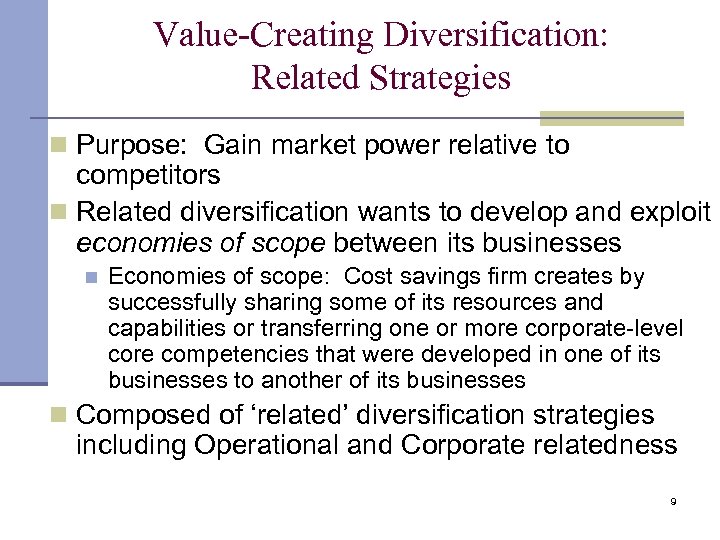

Value-Creating Diversification: Related Strategies n Purpose: Gain market power relative to competitors n Related diversification wants to develop and exploit economies of scope between its businesses n Economies of scope: Cost savings firm creates by successfully sharing some of its resources and capabilities or transferring one or more corporate-level core competencies that were developed in one of its businesses to another of its businesses n Composed of ‘related’ diversification strategies including Operational and Corporate relatedness 9

Value-Creating Diversification: Related Strategies n Purpose: Gain market power relative to competitors n Related diversification wants to develop and exploit economies of scope between its businesses n Economies of scope: Cost savings firm creates by successfully sharing some of its resources and capabilities or transferring one or more corporate-level core competencies that were developed in one of its businesses to another of its businesses n Composed of ‘related’ diversification strategies including Operational and Corporate relatedness 9

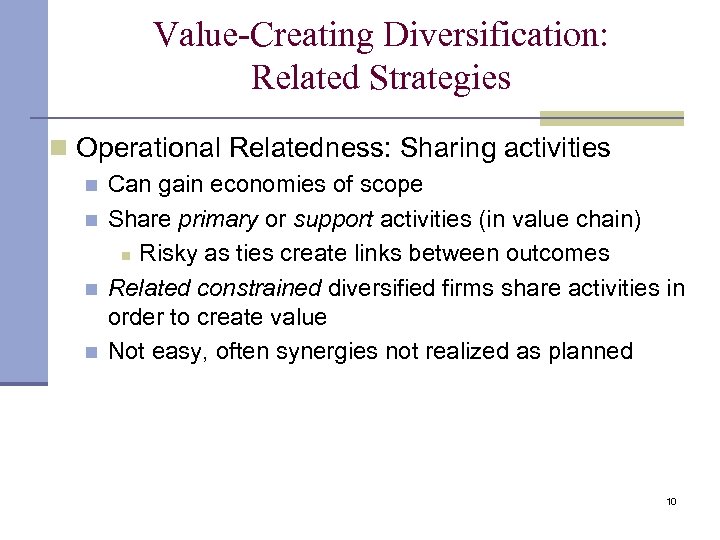

Value-Creating Diversification: Related Strategies n Operational Relatedness: Sharing activities n n Can gain economies of scope Share primary or support activities (in value chain) n Risky as ties create links between outcomes Related constrained diversified firms share activities in order to create value Not easy, often synergies not realized as planned 10

Value-Creating Diversification: Related Strategies n Operational Relatedness: Sharing activities n n Can gain economies of scope Share primary or support activities (in value chain) n Risky as ties create links between outcomes Related constrained diversified firms share activities in order to create value Not easy, often synergies not realized as planned 10

Value-Creating Diversification: Related Strategies n Corporate Relatedness: Core competency transfer n n Complex sets of resources and capabilities linking different businesses through managerial and technological knowledge, experience and expertise Two sources of value creation n Core competence can be developed in one business unit and transferred to other business units at no additional cost Intangible resources difficult for competitors to understand imitate, so immediate competitive advantage over competition can be achieved through transfer of corporate-level core competence Use related-linked diversification strategy 11

Value-Creating Diversification: Related Strategies n Corporate Relatedness: Core competency transfer n n Complex sets of resources and capabilities linking different businesses through managerial and technological knowledge, experience and expertise Two sources of value creation n Core competence can be developed in one business unit and transferred to other business units at no additional cost Intangible resources difficult for competitors to understand imitate, so immediate competitive advantage over competition can be achieved through transfer of corporate-level core competence Use related-linked diversification strategy 11

Value-Creating Diversification: Related Strategies n Market Power n Exists when a firm is able to sell its products above the existing competitive level or to reduce costs of primary and support activities below the competitive level, or both. n Can come from increasing scale or size n Market power can also be created through: n Multipoint Competition n n Exists when 2 or more diversified firms simultaneously compete in the same product or geographic markets. Vertical Integration n Exists when a company produces its own inputs (backward integration) or owns its own source of output distribution (forward integration) 12

Value-Creating Diversification: Related Strategies n Market Power n Exists when a firm is able to sell its products above the existing competitive level or to reduce costs of primary and support activities below the competitive level, or both. n Can come from increasing scale or size n Market power can also be created through: n Multipoint Competition n n Exists when 2 or more diversified firms simultaneously compete in the same product or geographic markets. Vertical Integration n Exists when a company produces its own inputs (backward integration) or owns its own source of output distribution (forward integration) 12

Value-Creating Diversification: Related Strategies Proctor and Gamble n Provides branded consumer goods products worldwide n 3 GBUs n Beauty GBU n n n Health and Well-Being GBU n n n Beauty segment Grooming segment Health Care segment Snacks, Coffee, and Pet Care segment Household Care GBU n n Fabric Care and Home Care segment Baby Care and Family Care segment 13

Value-Creating Diversification: Related Strategies Proctor and Gamble n Provides branded consumer goods products worldwide n 3 GBUs n Beauty GBU n n n Health and Well-Being GBU n n n Beauty segment Grooming segment Health Care segment Snacks, Coffee, and Pet Care segment Household Care GBU n n Fabric Care and Home Care segment Baby Care and Family Care segment 13

Value-Creating Diversification: Related Strategies Johnson and Johnson n Engages in the research and development, manufacture, and sale of various products in the health care field worldwide n 3 segments n Consumer segment n n Pharmaceutical segment n n Products for baby care, skin care, oral care, wound care, and women’s health care fields, as well as nutritional and over-the-counter pharmaceutical products Products for anti-infective, antipsychotic, cardiovascular, contraceptive, dermatology, gastrointestinal, hematology, immunology, neurology, oncology, pain management, urology, and virology Medical Devices and Diagnostics segment n Products for circulatory disease management, orthopaedic joint reconstruction and spinal care, wound care and women’s health, minimally invasive surgical, blood glucose monitoring and insulin delivery, and diagnostic products, as well as disposable contact lenses 14

Value-Creating Diversification: Related Strategies Johnson and Johnson n Engages in the research and development, manufacture, and sale of various products in the health care field worldwide n 3 segments n Consumer segment n n Pharmaceutical segment n n Products for baby care, skin care, oral care, wound care, and women’s health care fields, as well as nutritional and over-the-counter pharmaceutical products Products for anti-infective, antipsychotic, cardiovascular, contraceptive, dermatology, gastrointestinal, hematology, immunology, neurology, oncology, pain management, urology, and virology Medical Devices and Diagnostics segment n Products for circulatory disease management, orthopaedic joint reconstruction and spinal care, wound care and women’s health, minimally invasive surgical, blood glucose monitoring and insulin delivery, and diagnostic products, as well as disposable contact lenses 14

Value-Creating Diversification: Related Strategies Campbell Soup Company n Engages in the manufacture and marketing of branded convenience food products worldwide n 4 segments n U. S. Soup, Sauces, and Beverages Baking and Snacking International Soup, Sauces, and Beverages n North America Foodservice n n 15

Value-Creating Diversification: Related Strategies Campbell Soup Company n Engages in the manufacture and marketing of branded convenience food products worldwide n 4 segments n U. S. Soup, Sauces, and Beverages Baking and Snacking International Soup, Sauces, and Beverages n North America Foodservice n n 15

Value-Creating Diversification: Unrelated Strategies n Creates value through two types of financial economies n Financial economies – cost savings realized through improved allocations of financial resources based on investments inside or outside firm Efficient internal capital market allocation (versus external capital market) n Restructuring of acquired assets n n Firm A buys firm B and restructures assets so it can operate more profitably, then A sells B for a profit in the external market 16

Value-Creating Diversification: Unrelated Strategies n Creates value through two types of financial economies n Financial economies – cost savings realized through improved allocations of financial resources based on investments inside or outside firm Efficient internal capital market allocation (versus external capital market) n Restructuring of acquired assets n n Firm A buys firm B and restructures assets so it can operate more profitably, then A sells B for a profit in the external market 16

Value-Creating Diversification: Unrelated Strategies United Technologies Corporation n Provides technology products and services to the building systems and aerospace industries worldwide n n n n Otis segment – elevators and escalators Carrier segment – air conditioning and refrigeration UTC Fire and Security segment. Pratt and Whitney segment - aircraft engines; parts and services Hamilton Sundstrand segment - aerospace products and aftermarket services Sikorsky segment – helicopters UTC also engages in the development and marketing of distributed generation power systems and fuel cell power plants for stationary, transportation, space, and defense applications 17

Value-Creating Diversification: Unrelated Strategies United Technologies Corporation n Provides technology products and services to the building systems and aerospace industries worldwide n n n n Otis segment – elevators and escalators Carrier segment – air conditioning and refrigeration UTC Fire and Security segment. Pratt and Whitney segment - aircraft engines; parts and services Hamilton Sundstrand segment - aerospace products and aftermarket services Sikorsky segment – helicopters UTC also engages in the development and marketing of distributed generation power systems and fuel cell power plants for stationary, transportation, space, and defense applications 17

Value-Creating Diversification: Unrelated Strategies Textron, Inc. n Operates in the aircraft, industrial, and finance industries worldwide. n 4 segments Bell – helicopters plus parts and service n Cessna – general aviation aircraft n Industrial – auto parts, food containers, hydraulics, golf carts n Finance – aircraft finance, asset-based lending, distribution finance, golf finance, resort finance n 18

Value-Creating Diversification: Unrelated Strategies Textron, Inc. n Operates in the aircraft, industrial, and finance industries worldwide. n 4 segments Bell – helicopters plus parts and service n Cessna – general aviation aircraft n Industrial – auto parts, food containers, hydraulics, golf carts n Finance – aircraft finance, asset-based lending, distribution finance, golf finance, resort finance n 18

Value-Neutral Diversification: Incentives and Resources n Value-Neutral Incentives to Diversify n Antitrust Regulation and Tax Laws n Low Performance n Uncertain Future Cash Flows n Synergy and Firm Risk Reduction n Tangible and Intangible Resources and Diversification 19

Value-Neutral Diversification: Incentives and Resources n Value-Neutral Incentives to Diversify n Antitrust Regulation and Tax Laws n Low Performance n Uncertain Future Cash Flows n Synergy and Firm Risk Reduction n Tangible and Intangible Resources and Diversification 19

Value-Reducing Diversification: Managerial Motives to Diversify n Top-level executives may diversify in order to diversity their own employment risk and to increase their own compensation, as long as profitability does not suffer excessively n n Diversification adds benefits to top-level managers but not shareholders This strategy may be held in check by governance mechanisms or concerns for one’s reputation 20

Value-Reducing Diversification: Managerial Motives to Diversify n Top-level executives may diversify in order to diversity their own employment risk and to increase their own compensation, as long as profitability does not suffer excessively n n Diversification adds benefits to top-level managers but not shareholders This strategy may be held in check by governance mechanisms or concerns for one’s reputation 20

Portfolio Analysis n Requires the continual evaluation of a firms portfolio of business units n This involves: n n Assessing the attractiveness of the industries the firm competes in Assessing the competitive strength of a firm's business units Checking the competitive advantage potential of sharing activities and/or transferring competencies across business units Checking the potential for capturing financial economies 21

Portfolio Analysis n Requires the continual evaluation of a firms portfolio of business units n This involves: n n Assessing the attractiveness of the industries the firm competes in Assessing the competitive strength of a firm's business units Checking the competitive advantage potential of sharing activities and/or transferring competencies across business units Checking the potential for capturing financial economies 21

Portfolio Analysis n Best Case Scenario: n All of a firm's business units compete in attractive industries and have strong competitive positions and n There ample opportunities to capture economies of scope and/or financial economies n Useful Tools for Portfolio Analysis Include: n Nine cell industry attractiveness and competitive strength matrix n BCG growth share matrix 22

Portfolio Analysis n Best Case Scenario: n All of a firm's business units compete in attractive industries and have strong competitive positions and n There ample opportunities to capture economies of scope and/or financial economies n Useful Tools for Portfolio Analysis Include: n Nine cell industry attractiveness and competitive strength matrix n BCG growth share matrix 22

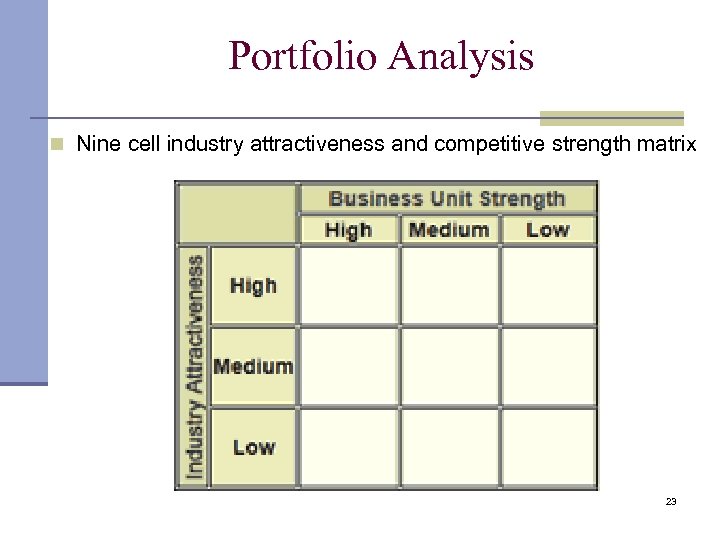

Portfolio Analysis n Nine cell industry attractiveness and competitive strength matrix 23

Portfolio Analysis n Nine cell industry attractiveness and competitive strength matrix 23

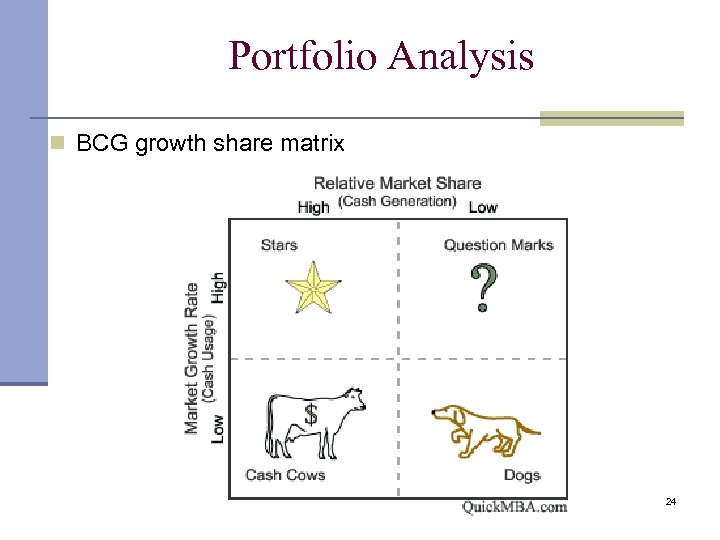

Portfolio Analysis n BCG growth share matrix 24

Portfolio Analysis n BCG growth share matrix 24