26032b44d67725ffc336638c73f92339.ppt

- Количество слайдов: 50

CHAPTER 6 Business Strategy: Differentiation, Cost Leadership, and Integration Mc. Graw-Hill/Irwin Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

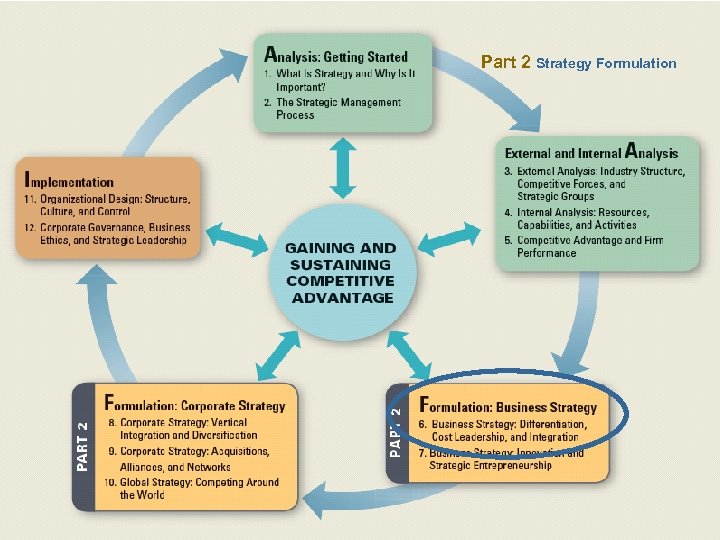

Part 2 Strategy Formulation

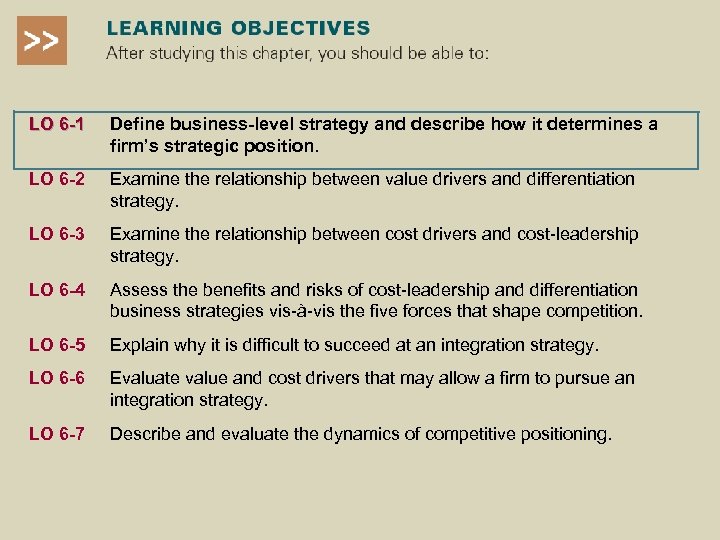

LO 6 -1 Define business-level strategy and describe how it determines a firm’s strategic position. LO 6 -2 Examine the relationship between value drivers and differentiation strategy. LO 6 -3 Examine the relationship between cost drivers and cost-leadership strategy. LO 6 -4 Assess the benefits and risks of cost-leadership and differentiation business strategies vis-à-vis the five forces that shape competition. LO 6 -5 Explain why it is difficult to succeed at an integration strategy. LO 6 -6 Evaluate value and cost drivers that may allow a firm to pursue an integration strategy. LO 6 -7 Describe and evaluate the dynamics of competitive positioning.

Chapter Case 6 Trimming Fat at Whole Foods Market • Whole Foods…Business Strategy Revitalization Ø Started as small natural-foods store 1980 Ø Became market leader; differentiation through organics and quality v Competitive advantage through 2008 • CEO John Mackey: Refocused Mission, Reduced Costs

Business Strategy and Competitive Advantage • A business-level strategy is an integrated and coordinated set of commitments and actions designed to provide value to customers and gain a competitive advantage by utilizing core competencies in specific individual product markets.

Business-Level Strategy: How to Compete for Advantage? • Answer the “Who, What, Why, and How” Ø Who - which customer segments to serve? Ø What needs, wishes, desires will we satisfy? Ø Why do we want to satisfy them? Ø How will we satisfy customers’ needs? • Details actions managers take in quest for competitive advantage Ø Single product or group of similar products

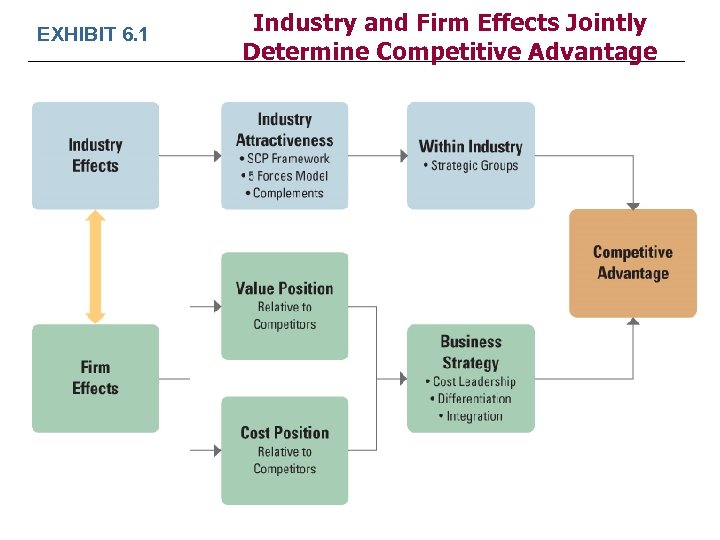

EXHIBIT 6. 1 Industry and Firm Effects Jointly Determine Competitive Advantage

Business Strategy and Competitive Advantage • Two fundamental questions: Ø How do you generate advantage? Ø How do you sustain advantage? • Key idea for sustainability is “barriers to imitation. ” Ø How long will it be before the first rival imitates the first mover? Ø How fast does new imitation occur once it starts? v These two factors determine appropriability.

Business Strategy and Competitive Advantage • Does market share generate competitive advantage? Ø The computer industry is an excellent example of the lack of correspondence between market share and profit rates. IBM was a clear market leader in terms of market share but had only mediocre economic performance relative to its rivals. High market share is no guarantee of high rates of profitability.

Business Strategy and Competitive Advantage • Does market share generate competitive advantage? Ø Perhaps high market share causes high profit rates. Ø But it could equally well be that there is a third factor (e. g. , good service capabilities at Caterpillar), unobserved by us, that causes both high profitability and high market share. v In this case, we would see a correlation between profitability and market share but no causal explanation.

Business Strategy and Competitive Advantage • When can market share work to generate and sustain an advantage? Ø Scale economies combined with high exit costs may make market share a defensible advantage.

Sustainable Competitive Advantage • Costly Duplication due to: Ø Historical Conditions; Ø Uncertainty; Ø Social Complexity; and Ø Property Rights Protection.

Business Strategy and Competitive Advantage • An organization’s knowledge or expertise can lead to sustainable advantage if: Ø The knowledge is tacit rather than articulable; Tacit Knowledge: “We know more than we can tell. ” v Tacit Skills: Riding a bike, swimming, “learning by doing, ” which is critical for maintaining a manufacturing base v Ø The knowledge is not observable in use; Ø The knowledge is (socially) complex, rather than simple.

Strategic Position • Determined by Firm’s Business-Level Strategy Ø Two primary competitive levers: Value (V) v Cost (C) v • Economic Value Created: (V-C) Ø The greater (V-C) = Competitive Advantage • Strategic Position Based on: Ø Value creation Ø Cost

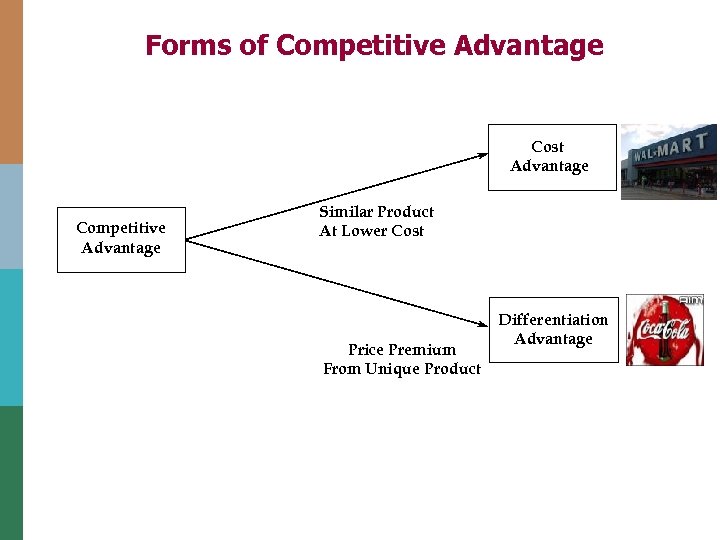

Forms of Competitive Advantage Cost Advantage Competitive Advantage Similar Product At Lower Cost Price Premium From Unique Product Differentiation Advantage

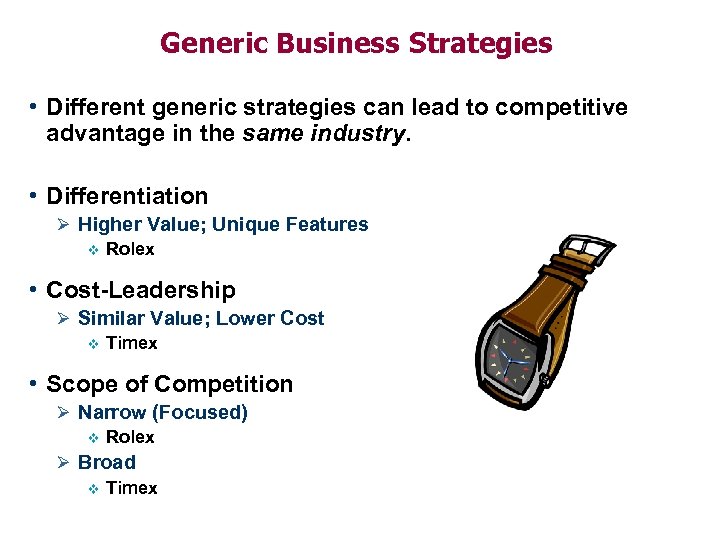

Generic Business Strategies • Different generic strategies can lead to competitive advantage in the same industry. • Differentiation Ø Higher Value; Unique Features v Rolex • Cost-Leadership Ø Similar Value; Lower Cost v Timex • Scope of Competition Ø Narrow (Focused) v Rolex Ø Broad v Timex

EXHIBIT 6. 2 Strategic Position and Competitive Scope: Generic Business Strategies

LO 6 -1 Define business-level strategy and describe how it determines a firm’s strategic position. LO 6 -2 Examine the relationship between value drivers and differentiation strategy. LO 6 -3 Examine the relationship between cost drivers and cost-leadership strategy. LO 6 -4 Assess the benefits and risks of cost-leadership and differentiation business strategies vis-à-vis the five forces that shape competition. LO 6 -5 Explain why it is difficult to succeed at an integration strategy. LO 6 -6 Evaluate value and cost drivers that may allow a firm to pursue an integration strategy. LO 6 -7 Describe and evaluate the dynamics of competitive positioning.

Differentiation Advantage • Differentiation Advantage, a concept developed by economist Joan Robinson, occurs when a firm is able to obtain from its differentiation a price premium in the market which exceeds the cost of providing differentiation.

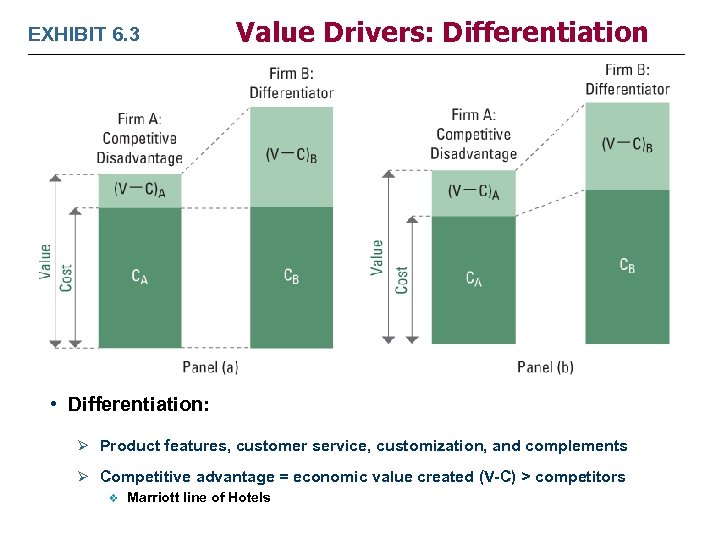

EXHIBIT 6. 3 Value Drivers: Differentiation • Differentiation: Ø Product features, customer service, customization, and complements Ø Competitive advantage = economic value created (V-C) > competitors v Marriott line of Hotels

STRATEGY HIGHLIGHT 6. 1 Toyota: From “Perfect Recall” to “Recall Nightmare” • Toyota’s strategic challenges…. Ø Launched Lexus 1989 v Luxury car segment dominated by Mercedes-Benz, BMW, Cadillac Ø LS 400 line required recall a little over a year after launch v Turned threat into opportunity to establish reputation for superior customer service v Two years after launch Lexus ranked first on quality and customer satisfaction by J. D. Powers Ø 2010 Toyota has largest recall in automotive history v Needed to exhibit superior customer responsiveness again v 8 million vehicles recalled was much more challenging 1– 25

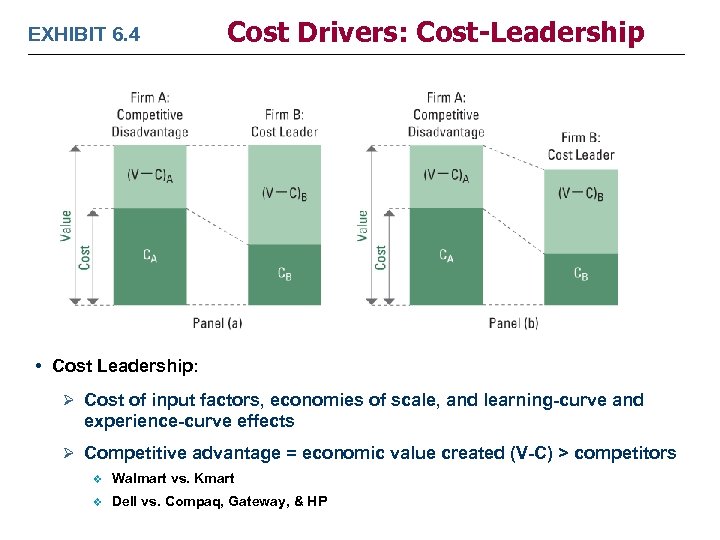

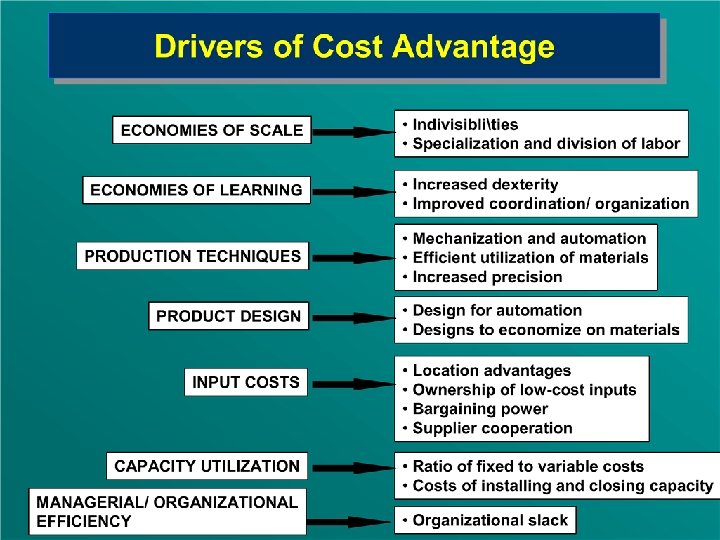

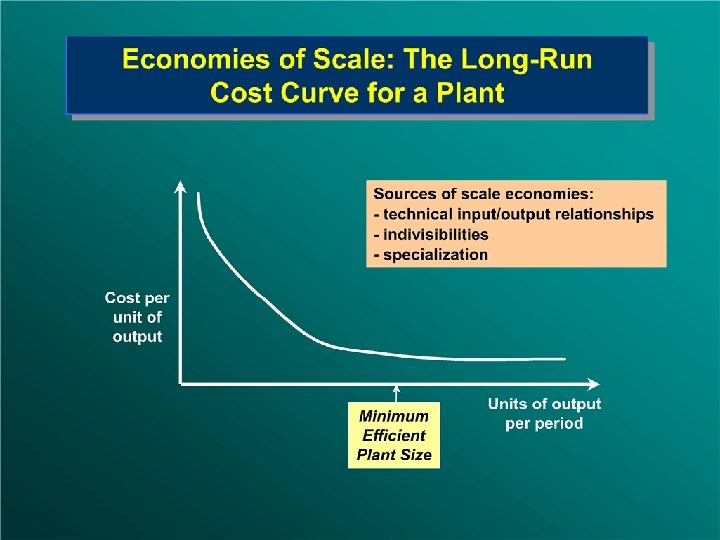

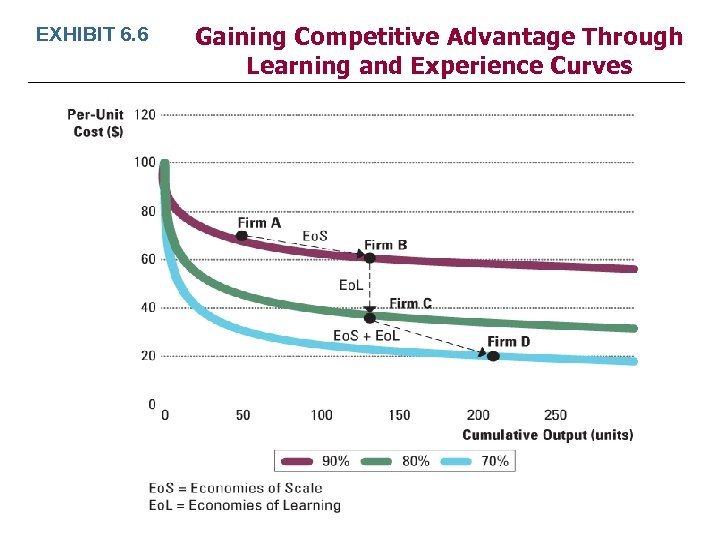

EXHIBIT 6. 4 Cost Drivers: Cost-Leadership • Cost Leadership: Ø Cost of input factors, economies of scale, and learning-curve and experience-curve effects Ø Competitive advantage = economic value created (V-C) > competitors v Walmart vs. Kmart v Dell vs. Compaq, Gateway, & HP

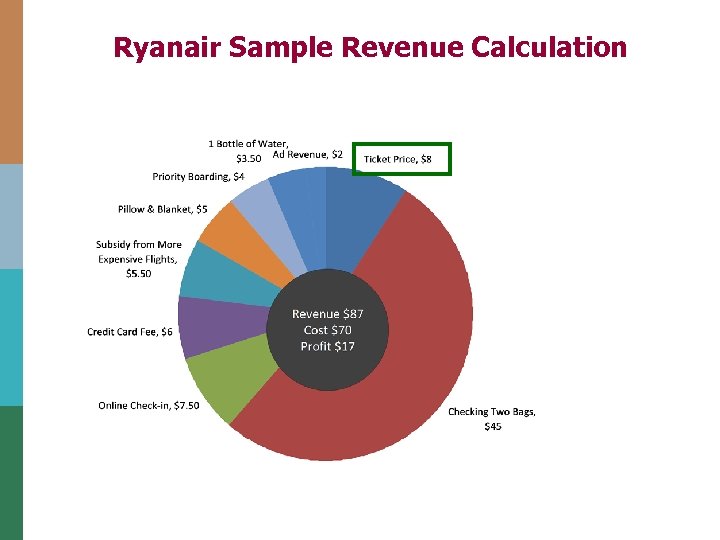

STRATEGY HIGHLIGHT 6. 2 Ryanair: Lower Cost than the Low-Cost Leader! • The “Southwest Airlines of Europe” Ø “Lowest-cost airline in the world” v No window shades on older planes, seats don’t recline, etc. v Fares as low as $8 v Numerous fees and surcharges: pillows, blankets, check-in, etc. v 20+% of revenues flow from ancillary services 1– 27

Ryanair Sample Revenue Calculation

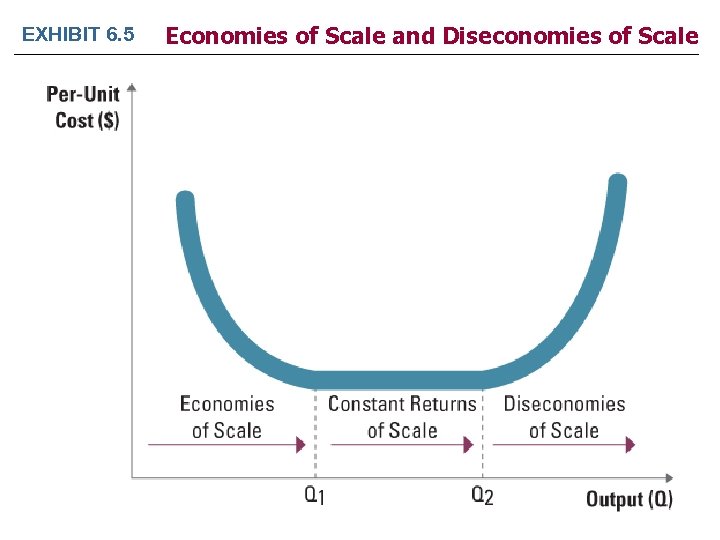

EXHIBIT 6. 5 Economies of Scale and Diseconomies of Scale

31

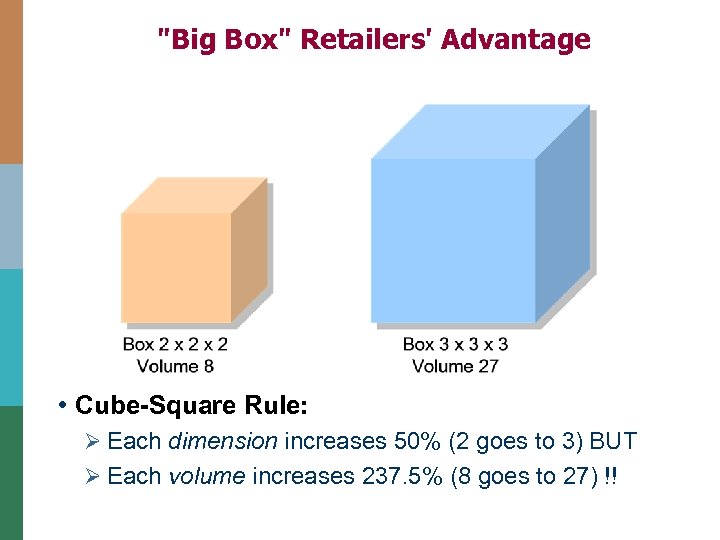

"Big Box" Retailers' Advantage • Cube-Square Rule: Ø Each dimension increases 50% (2 goes to 3) BUT Ø Each volume increases 237. 5% (8 goes to 27) !!

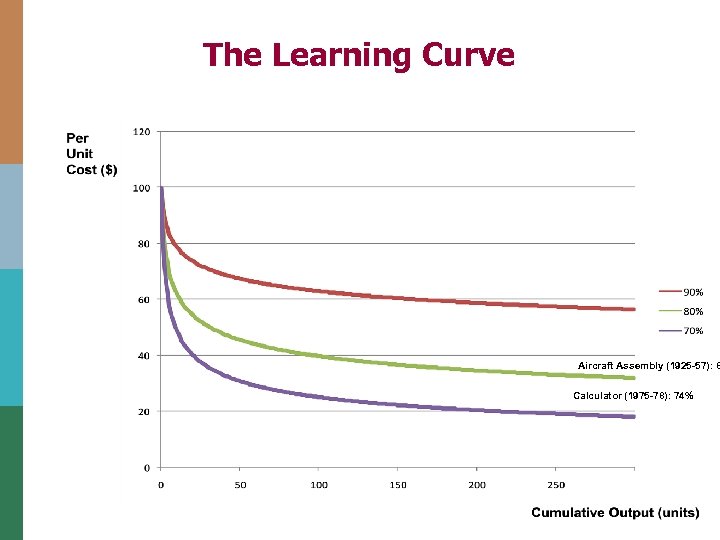

The Learning Curve Aircraft Assembly (1925 -57): 8 Calculator (1975 -78): 74%

EXHIBIT 6. 6 Gaining Competitive Advantage Through Learning and Experience Curves

Limits of “Learning Curve” Advantages Ø Copying and reverse engineering of products; Ø Hiring a competitor’s employees; Ø Purchasing the know-how from consultants; Ø Obtaining the know-how from customers; and Ø Experience advantages are often nullified by innovations.

LO 6 -1 Define business-level strategy and describe how it determines a firm’s strategic position. LO 6 -2 Examine the relationship between value drivers and differentiation strategy. LO 6 -3 Examine the relationship between cost drivers and cost-leadership strategy. LO 6 -4 Assess the benefits and risks of cost-leadership and differentiation business strategies vis-à-vis the five forces that shape competition. LO 6 -5 Explain why it is difficult to succeed at an integration strategy. LO 6 -6 Evaluate value and cost drivers that may allow a firm to pursue an integration strategy. LO 6 -7 Describe and evaluate the dynamics of competitive positioning.

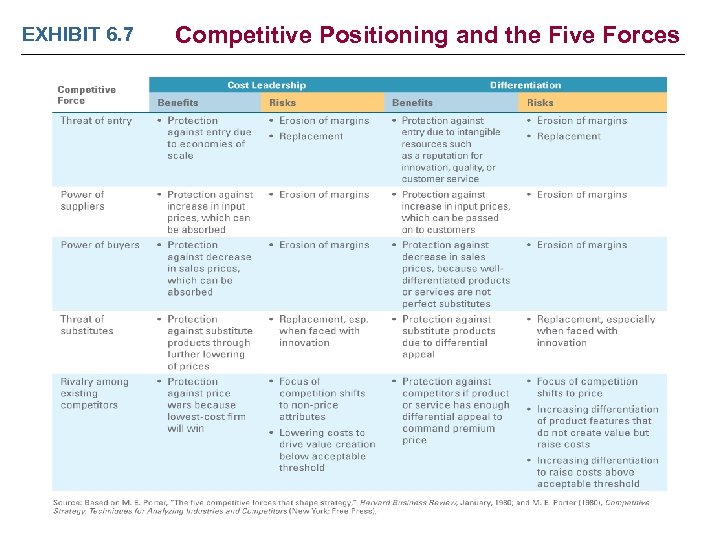

EXHIBIT 6. 7 Competitive Positioning and the Five Forces

LO 6 -1 Define business-level strategy and describe how it determines a firm’s strategic position. LO 6 -2 Examine the relationship between value drivers and differentiation strategy. LO 6 -3 Examine the relationship between cost drivers and cost-leadership strategy. LO 6 -4 Assess the benefits and risks of cost-leadership and differentiation business strategies vis-à-vis the five forces that shape competition. LO 6 -5 Explain why it is difficult to succeed at an integration strategy. LO 6 -6 Evaluate value and cost drivers that may allow a firm to pursue an integration strategy. LO 6 -7 Describe and evaluate the dynamics of competitive positioning.

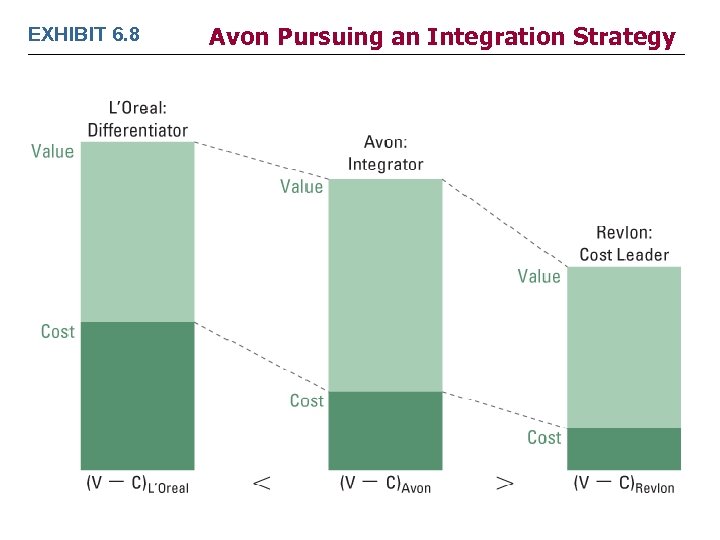

EXHIBIT 6. 8 Avon Pursuing an Integration Strategy

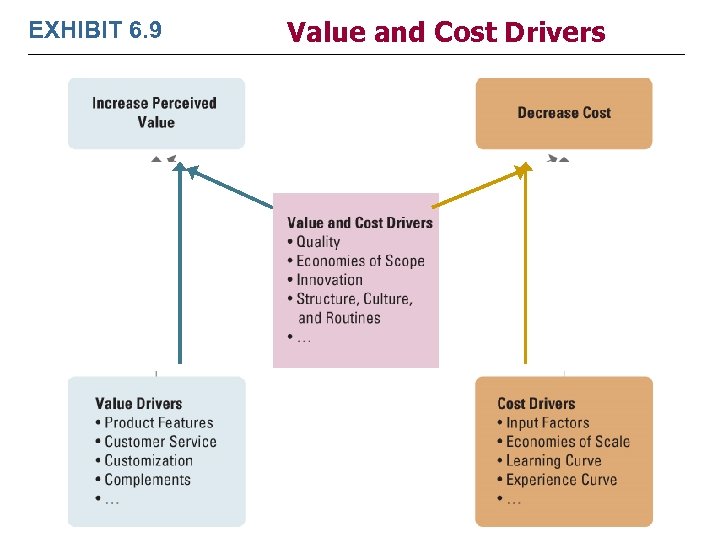

EXHIBIT 6. 9 Value and Cost Drivers

Integration Strategy – Corporate Level • Conglomerates can coordinate above the SBU level Ø Tata Group from India v 2008 bought Jaguar & Land Rover – Prestigious differentiated products v 2009 Tata Motors creates a Nano car – Lowest-priced car in the world! – Zero to 60 mph in 30 seconds – No radio or glove box – Targets bicyclists to move to cars

LO 6 -1 Define business-level strategy and describe how it determines a firm’s strategic position. LO 6 -2 Examine the relationship between value drivers and differentiation strategy. LO 6 -3 Examine the relationship between cost drivers and cost-leadership strategy. LO 6 -4 Assess the benefits and risks of cost-leadership and differentiation business strategies vis-à-vis the five forces that shape competition. LO 6 -5 Explain why it is difficult to succeed at an integration strategy. LO 6 -6 Evaluate value and cost drivers that may allow a firm to pursue an integration strategy. LO 6 -7 Describe and evaluate the dynamics of competitive positioning.

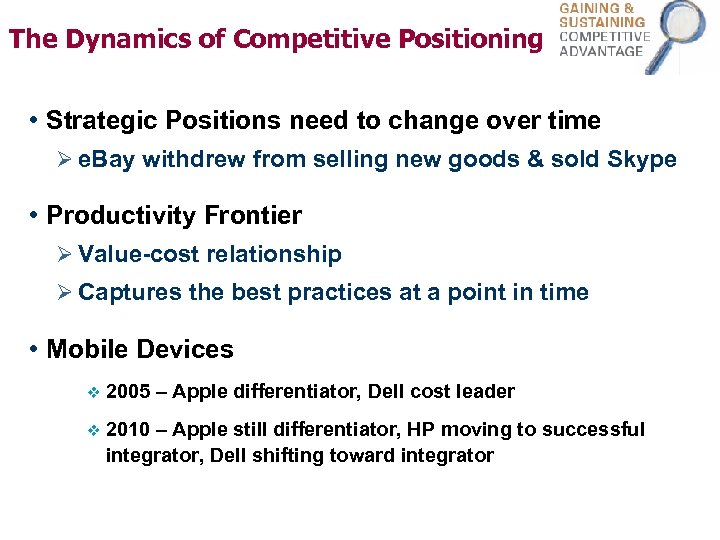

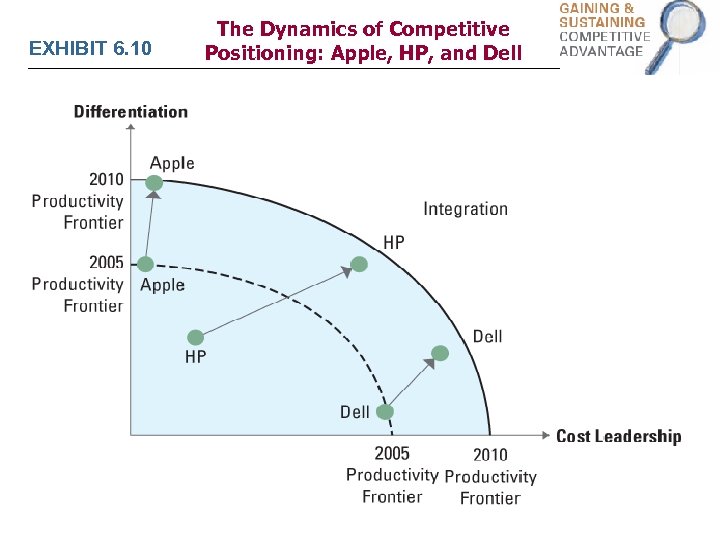

The Dynamics of Competitive Positioning • Strategic Positions need to change over time Ø e. Bay withdrew from selling new goods & sold Skype • Productivity Frontier Ø Value-cost relationship Ø Captures the best practices at a point in time • Mobile Devices v 2005 – Apple differentiator, Dell cost leader v 2010 – Apple still differentiator, HP moving to successful integrator, Dell shifting toward integrator

EXHIBIT 6. 10 The Dynamics of Competitive Positioning: Apple, HP, and Dell

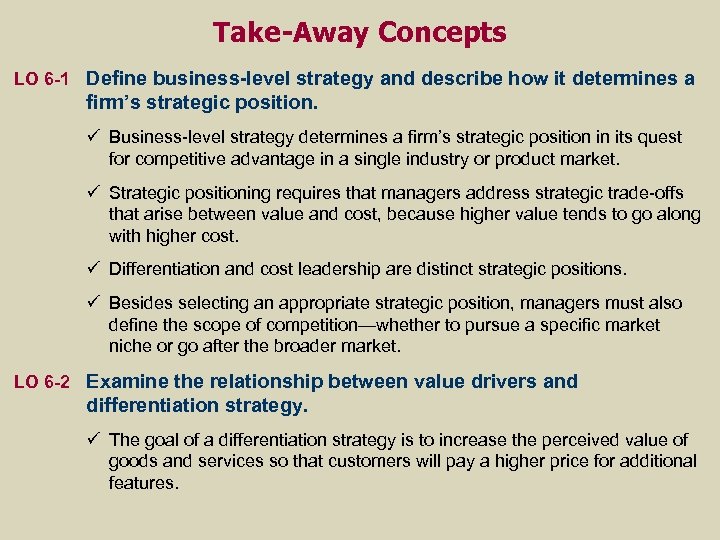

Take-Away Concepts LO 6 -1 Define business-level strategy and describe how it determines a firm’s strategic position. ü Business-level strategy determines a firm’s strategic position in its quest for competitive advantage in a single industry or product market. ü Strategic positioning requires that managers address strategic trade-offs that arise between value and cost, because higher value tends to go along with higher cost. ü Differentiation and cost leadership are distinct strategic positions. ü Besides selecting an appropriate strategic position, managers must also define the scope of competition—whether to pursue a specific market niche or go after the broader market. LO 6 -2 Examine the relationship between value drivers and differentiation strategy. ü The goal of a differentiation strategy is to increase the perceived value of goods and services so that customers will pay a higher price for additional features.

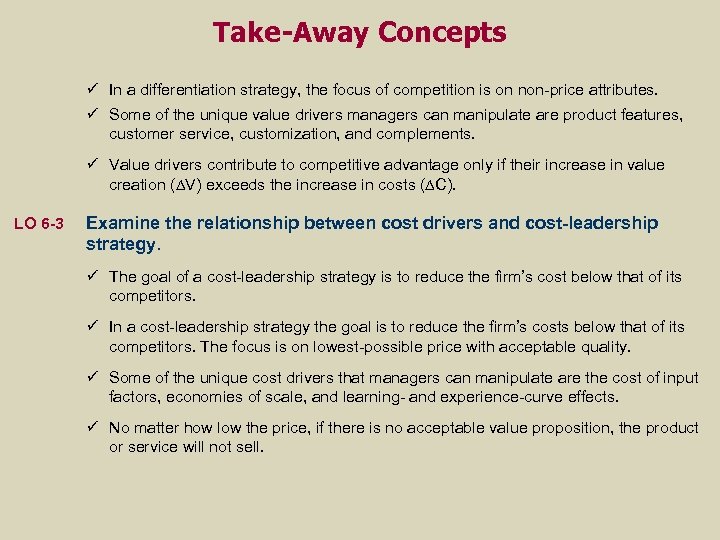

Take-Away Concepts ü In a differentiation strategy, the focus of competition is on non-price attributes. ü Some of the unique value drivers managers can manipulate are product features, customer service, customization, and complements. ü Value drivers contribute to competitive advantage only if their increase in value creation (∆V) exceeds the increase in costs (∆C). LO 6 -3 Examine the relationship between cost drivers and cost-leadership strategy. ü The goal of a cost-leadership strategy is to reduce the firm’s cost below that of its competitors. ü In a cost-leadership strategy the goal is to reduce the firm’s costs below that of its competitors. The focus is on lowest-possible price with acceptable quality. ü Some of the unique cost drivers that managers can manipulate are the cost of input factors, economies of scale, and learning- and experience-curve effects. ü No matter how low the price, if there is no acceptable value proposition, the product or service will not sell.

Take-Away Concepts LO 6 -4 Assess the benefits and risks of cost-leadership and differentiation business strategies vis-à-vis the five forces that shape competition. ü The five forces model helps managers use generic business strategies to protect themselves against the industry forces that drive down profitability. ü Differentiation and cost-leadership strategies allow firms to carve out strong strategic positions, not only to protect themselves against the five forces, but also to benefit from them in their quest for competitive advantage. ü Exhibit 6. 7 lists benefits and risks of each business strategy.

Take-Away Concepts LO 6 -5 Explain why it is difficult to succeed at an integration strategy. ü A successful integration strategy requires that trade-offs between differentiation and low cost be reconciled. ü Integration strategy often is difficult because the two distinct strategic positions require internal value chain activities that are fundamentally different from one another. ü When firms fail to resolve strategic trade-offs between differentiation and cost, they end up being stuck in the middle. They then succeed at neither strategy, leading to a competitive disadvantage. LO 6 -6 Evaluate value and cost drivers that may allow a firm to pursue an integration strategy. ü To address the trade-offs between differentiation and cost leadership at the business level, managers may leverage quality, economies of scope, innovation, and the firm’s structure, culture, and routines. ü The trade-offs between differentiation and low cost can either be addressed at the business level or at the corporate level.

Take-Away Concepts LO 6 -7 Describe and evaluate the dynamics of competitive positioning. ü Strategic positions need to change over time as the environment changes. ü Best practices determine the productivity frontier at any given time. ü Reaching the productivity frontier enhances the likelihood of obtaining a competitive advantage. ü Not reaching the productivity frontier implies competitive disadvantage if other firms are positioned at the productivity frontier.

26032b44d67725ffc336638c73f92339.ppt