d00efb34432e7392aa35024f8ce535f6.ppt

- Количество слайдов: 14

Chapter 6: Budgeting & Budgetary Control: Learning Objectives: After studying this chapter you should: • Be aware of different approaches to the budgeting process • Know how to prepare an operating budget • Understand how budgets and variances are used to control operations • Understand the role of the balanced scorecard in linking strategy and control

Ch 6: Budgeting and Budgetary Control: When the organization’s plan for the future is expressed in dollars it is called a budget. A budget may be: part of the organizational planning process; a standard against which the organization is controlled; a target, at which the organization is aiming. Budgets may be prepared: incrementally (previous year + % increase) “zero based” (a fundamental rethinking every year) based on previous year, but with challenges to the major assumptions

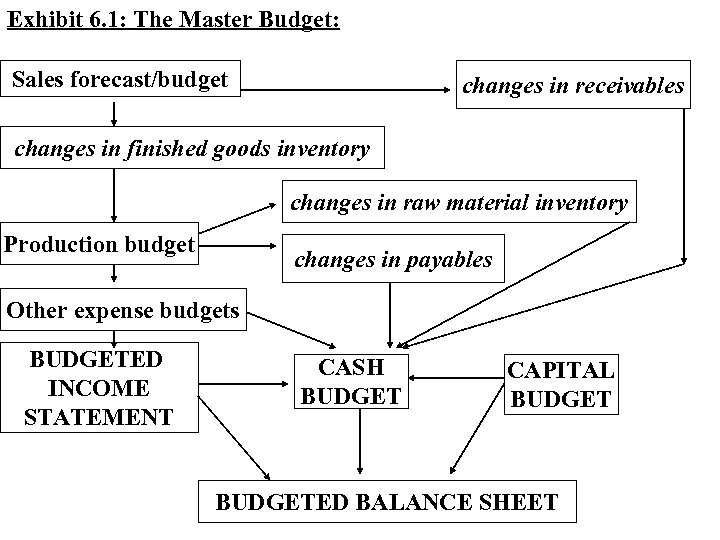

Exhibit 6. 1: The Master Budget: Sales forecast/budget changes in receivables changes in finished goods inventory changes in raw material inventory Production budget changes in payables Other expense budgets BUDGETED INCOME STATEMENT CASH BUDGET CAPITAL BUDGETED BALANCE SHEET

Sales Forecasting: The budget normally starts with a sales forecast because sales is usually the “limiting factor”. A sales forecast may be prepared by: professional forecasters (e. g. econometricians); sales/marketing staff; a committee of informed personnel. Useful information in preparing a sales forecast includes: past data and trends; macro-economic factors; knowledge of customer preferences; knowledge of technological change; knowledge of competitors’ plans.

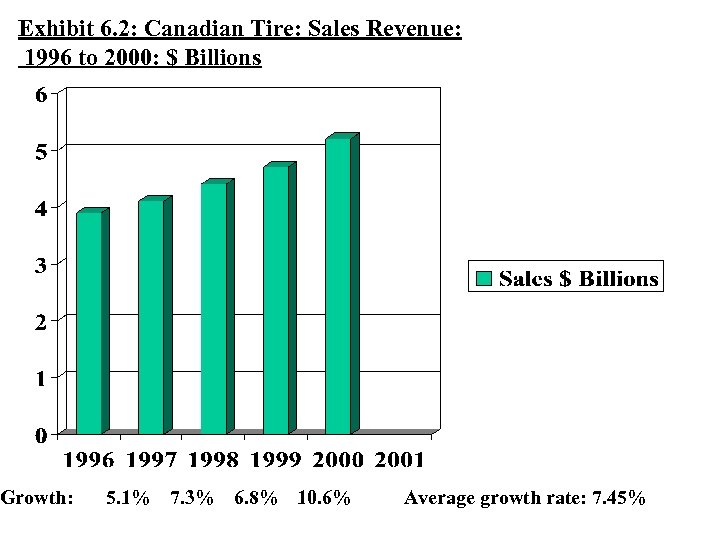

Exhibit 6. 2: Canadian Tire: Sales Revenue: 1996 to 2000: $ Billions Growth: 5. 1% 7. 3% 6. 8% 10. 6% Average growth rate: 7. 45%

Production Forecasting: In a “just-in-time” environment production exactly equals sales. Inventory of finished product allows sales and production are uncoupled, and may be different amounts, enabling smoothing of cyclical demand (e. g Christmas cards). – + = production increase of inventory decrease of inventory sales Labour forecasting: This is generally a function of production plans and labour needs in non-production areas.

Cash Forecasting: Cash forecasting is critical to organizational survival. + = Opening cash balance Total cash received Total cash available Total cash received: Cash collections from sales (Sales +/- changes in receivables) + Other cash receipts: (share issues, loans, sale of plant assets)

Cash payments: To suppliers for goods purchased (cost of goods sold +/- changes in inventory and accounts payable) To employees for labour costs To other expenses Interest & dividends Major plant asset purchases Cash available – cash payments = closing cash balance

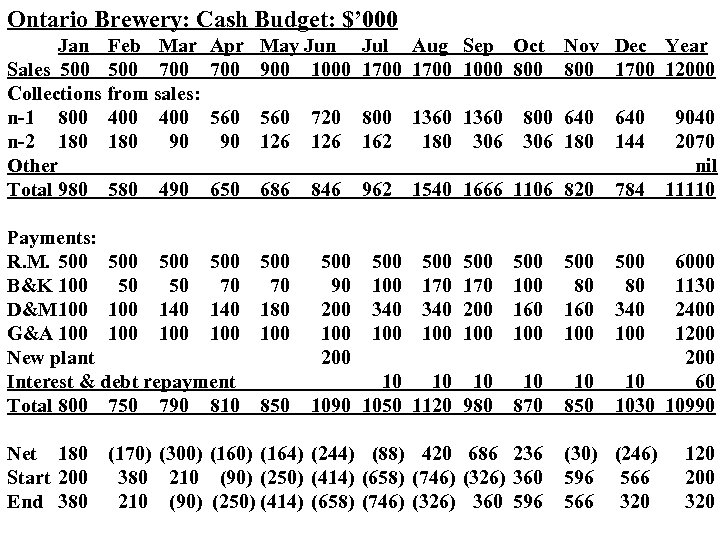

Ontario Brewery: Cash Budget: $’ 000 Jan Feb Mar Sales 500 700 Collections from sales: n-1 800 400 n-2 180 90 Other Total 980 580 490 Apr May Jun Jul Aug Sep Oct Nov Dec Year 700 900 1000 1700 1000 800 1700 12000 560 90 560 126 720 126 800 162 1360 180 306 800 640 306 180 640 144 650 686 846 962 1540 1666 1106 820 784 Payments: R. M. 500 500 B&K 100 50 50 70 D&M 100 140 G&A 100 100 New plant Interest & debt repayment Total 800 750 790 810 Net 180 Start 200 End 380 500 70 180 100 850 500 90 200 100 200 500 100 340 100 500 170 200 100 500 160 100 500 80 160 10 1090 1050 1120 980 10 870 10 850 (170) (300) (164) (244) (88) 420 686 236 380 210 (90) (250) (414) (658) (746) (326) 360 596 9040 2070 nil 11110 500 80 340 100 6000 1130 2400 1200 10 60 1030 10990 (30) (246) 596 566 320 120 200 320

Cash Budgeting: The cash budget reveals that over the year the cash increases from $200, 000 to $320, 000. However there is a cash crisis between May and August, with cash deficit rising to as much as $746, 000. If you are unaware that there will be a cash crisis you will be totally unprepared to deal with it. If you are aware you can take steps to deal with it: Possible solutions: Delay payment for the new plant until the fall; Sell short-term investments in the spring; Get a short-term bank loan from May to August. Note this is a temporary problem, so it needs a temporary solution: raising a long-term loan or issuing new shares would not be appropriate, as these are long-term solutions.

Budgetary Control: The budget will be used to control operations. Once the budget is “agreed” it represents a social contract between the parties: • The budget is accepted by the operatives as being achievable; • The budget is accepted by management as meeting their needs. Comparison of budget with the actual results will reveal the extent to which it has, or has not, been achieved. Deviations from budget should be investigated: • To reveal the responsibility area where the problem arose; • To initiate any corrective action

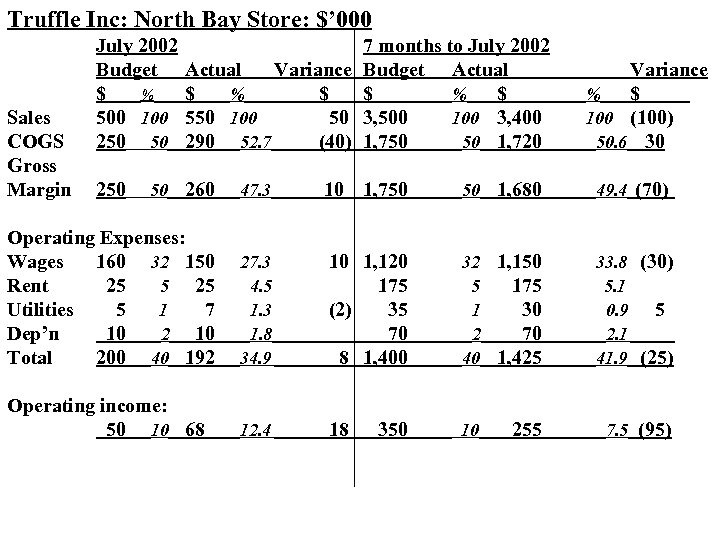

Truffle Inc: North Bay Store: $’ 000 Sales COGS Gross Margin July 2002 Budget $ % 500 100 250 50 250 7 months to July 2002 Actual Variance Budget Actual $ % $ 550 100 50 3, 500 100 3, 400 290 52. 7 (40) 1, 750 50 1, 720 Variance % $ 100 (100) 50. 6 30 50 260 47. 3 10 1, 750 50 1, 680 49. 4 (70) Operating Expenses: Wages 160 32 150 Rent 25 5 25 Utilities 5 1 7 Dep’n 10 2 10 Total 200 40 192 27. 3 4. 5 1. 3 1. 8 34. 9 10 1, 120 175 (2) 35 70 8 1, 400 32 1, 150 5 175 1 30 2 70 40 1, 425 33. 8 (30) 5. 1 0. 9 5 2. 1 41. 9 (25) Operating income: 50 10 68 12. 4 18 10 255 7. 5 (95) 350

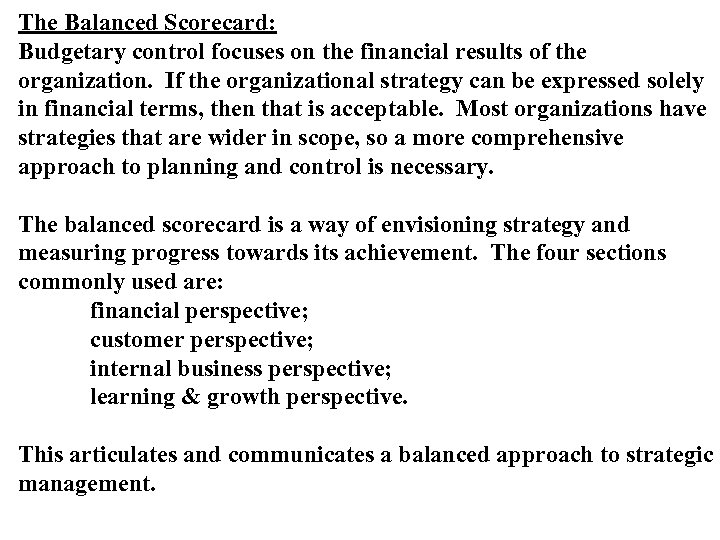

The Balanced Scorecard: Budgetary control focuses on the financial results of the organization. If the organizational strategy can be expressed solely in financial terms, then that is acceptable. Most organizations have strategies that are wider in scope, so a more comprehensive approach to planning and control is necessary. The balanced scorecard is a way of envisioning strategy and measuring progress towards its achievement. The four sections commonly used are: financial perspective; customer perspective; internal business perspective; learning & growth perspective. This articulates and communicates a balanced approach to strategic management.

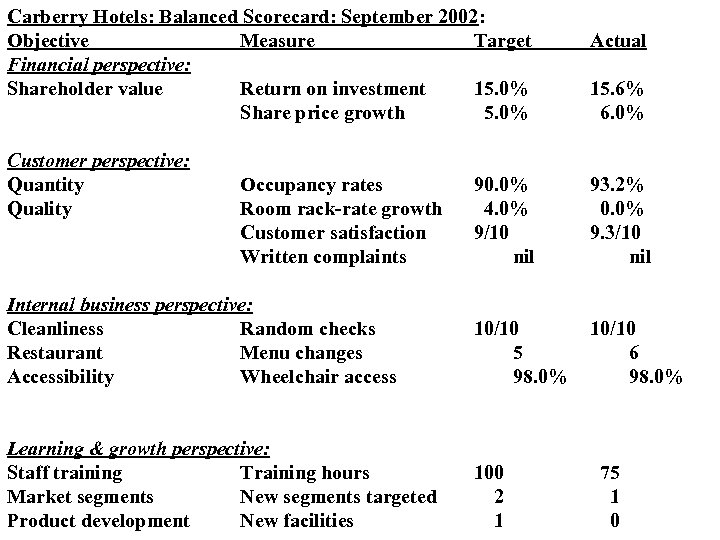

Carberry Hotels: Balanced Scorecard: September 2002: Objective Measure Target Financial perspective: Shareholder value Return on investment 15. 0% Share price growth 5. 0% Customer perspective: Quantity Quality Occupancy rates Room rack-rate growth Customer satisfaction Written complaints Actual 15. 6% 6. 0% 90. 0% 4. 0% 9/10 nil 93. 2% 0. 0% 9. 3/10 nil Internal business perspective: Cleanliness Random checks Restaurant Menu changes Accessibility Wheelchair access 10/10 5 98. 0% 10/10 6 98. 0% Learning & growth perspective: Staff training Training hours Market segments New segments targeted Product development New facilities 100 2 1 75 1 0

d00efb34432e7392aa35024f8ce535f6.ppt