7d1948382644cd7f54cfa240a6dd3ffd.ppt

- Количество слайдов: 43

Chapter 6 Assessing, Managing, and Securing Your Credit Copyright © 2012 Pearson Canada Inc. Edited by Laura Lamb, Thompson Rivers University 6 -1

Chapter 6 Assessing, Managing, and Securing Your Credit Copyright © 2012 Pearson Canada Inc. Edited by Laura Lamb, Thompson Rivers University 6 -1

Chapter Objectives • Provide a background on credit • Describe the role of credit bureaus • Explain the key characteristics of credit cards • Explain how to manage debt • Provide a background on identity theft • Describe identity theft tactics, explain how to avoid it, and how to deal with it. Copyright © 2012 Pearson Canada Inc. 1 -2

Chapter Objectives • Provide a background on credit • Describe the role of credit bureaus • Explain the key characteristics of credit cards • Explain how to manage debt • Provide a background on identity theft • Describe identity theft tactics, explain how to avoid it, and how to deal with it. Copyright © 2012 Pearson Canada Inc. 1 -2

Background on Credit What is Credit? funds provided by a creditor to a borrower that the borrower will repay with interest or fees in the future Copyright © 2012 Pearson Canada Inc. 6 -3

Background on Credit What is Credit? funds provided by a creditor to a borrower that the borrower will repay with interest or fees in the future Copyright © 2012 Pearson Canada Inc. 6 -3

Background on Credit • Types of Credit • Instalment Loan: a loan provided for specific purchases, with interest charged on the amount borrowed Copyright © 2012 Pearson Canada Inc. 6 -4

Background on Credit • Types of Credit • Instalment Loan: a loan provided for specific purchases, with interest charged on the amount borrowed Copyright © 2012 Pearson Canada Inc. 6 -4

Background on Credit (cont’d) • Revolving Open-End Credit: credit provided up to a specified maximum amount based on income, debt level, and credit history; interest is charged each month on the outstanding balance Copyright © 2012 Pearson Canada Inc. 6 -5

Background on Credit (cont’d) • Revolving Open-End Credit: credit provided up to a specified maximum amount based on income, debt level, and credit history; interest is charged each month on the outstanding balance Copyright © 2012 Pearson Canada Inc. 6 -5

Background on Credit (cont’d) What are the advantages of using Credit? What are the disadvantages of using Credit? Copyright © 2012 Pearson Canada Inc. 6 -6

Background on Credit (cont’d) What are the advantages of using Credit? What are the disadvantages of using Credit? Copyright © 2012 Pearson Canada Inc. 6 -6

Background on Credit (cont’d) • Credit History • Represents your history with credit instruments such as credit cards, retail credit cards, lines of credit, and personal loans and leases • A favourable credit history is established by paying bills in a timely manner Copyright © 2012 Pearson Canada Inc. 6 -7

Background on Credit (cont’d) • Credit History • Represents your history with credit instruments such as credit cards, retail credit cards, lines of credit, and personal loans and leases • A favourable credit history is established by paying bills in a timely manner Copyright © 2012 Pearson Canada Inc. 6 -7

Background on Credit (cont’d) • What is Credit Insurance? • Why might you want it? Copyright © 2012 Pearson Canada Inc. 6 -8

Background on Credit (cont’d) • What is Credit Insurance? • Why might you want it? Copyright © 2012 Pearson Canada Inc. 6 -8

Credit Bureaus • Credit Bureaus: reports provided by credit bureaus that document a person’s credit payment history Copyright © 2012 Pearson Canada Inc. 6 -9

Credit Bureaus • Credit Bureaus: reports provided by credit bureaus that document a person’s credit payment history Copyright © 2012 Pearson Canada Inc. 6 -9

Credit Bureaus (cont’d) • What information is on a credit report? Copyright © 2012 Pearson Canada Inc. 6 -10

Credit Bureaus (cont’d) • What information is on a credit report? Copyright © 2012 Pearson Canada Inc. 6 -10

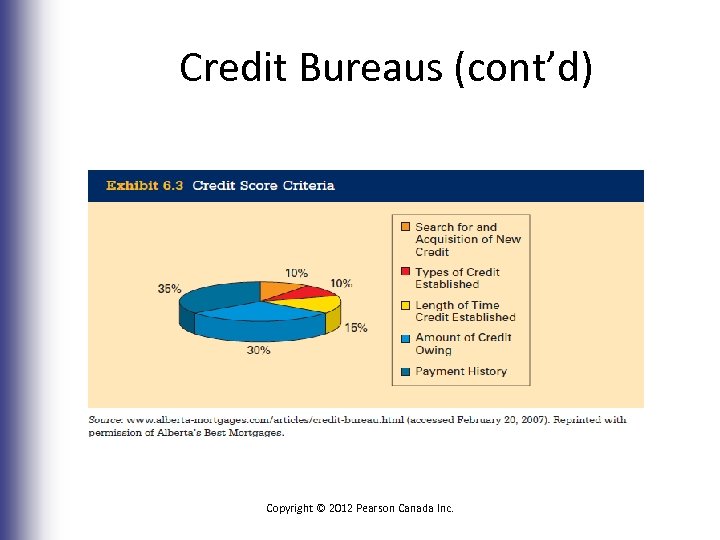

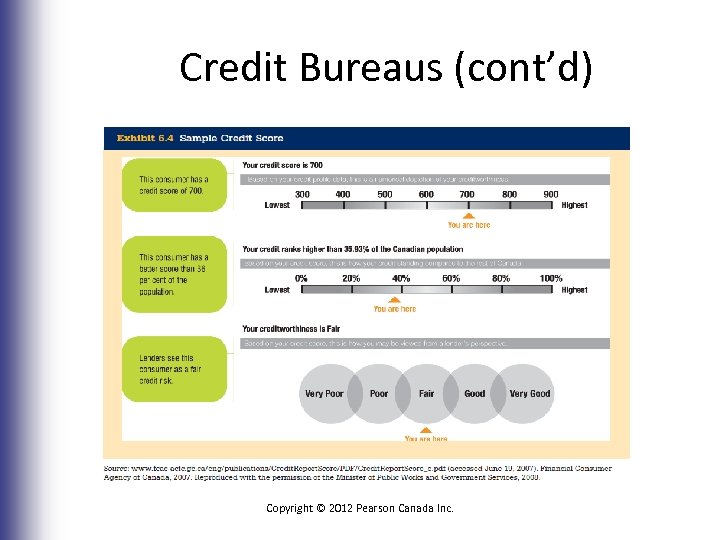

Credit Bureaus (cont’d) • What is a credit score? • A rating that indicates a person’s creditworthiness • Creditors rely on this score to help determine whether or not to extend a loan • Can affect the interest rate quoted on the loan you request What factors affect your credit score? Copyright © 2012 Pearson Canada Inc. 6 -11

Credit Bureaus (cont’d) • What is a credit score? • A rating that indicates a person’s creditworthiness • Creditors rely on this score to help determine whether or not to extend a loan • Can affect the interest rate quoted on the loan you request What factors affect your credit score? Copyright © 2012 Pearson Canada Inc. 6 -11

Credit Bureaus (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -12

Credit Bureaus (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -12

Credit Bureaus (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -13

Credit Bureaus (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -13

Credit Bureaus (cont’d) • Interpreting Credit Scores • Range from 300 to 900, with 600 or higher being considered a good score • Each financial institution sets its own criteria to determine whether to extend credit • Acceptable credit score may vary with the type of credit Copyright © 2012 Pearson Canada Inc. 6 -14

Credit Bureaus (cont’d) • Interpreting Credit Scores • Range from 300 to 900, with 600 or higher being considered a good score • Each financial institution sets its own criteria to determine whether to extend credit • Acceptable credit score may vary with the type of credit Copyright © 2012 Pearson Canada Inc. 6 -14

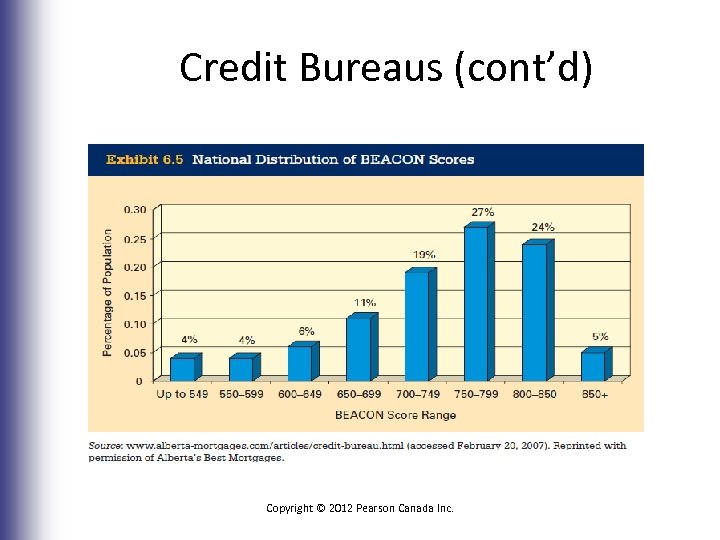

Credit Bureaus (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -15

Credit Bureaus (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -15

Credit Bureaus (cont’d) • Why might you want to review your credit report? Copyright © 2012 Pearson Canada Inc. 6 -16

Credit Bureaus (cont’d) • Why might you want to review your credit report? Copyright © 2012 Pearson Canada Inc. 6 -16

Credit Cards The easiest way to establish credit is to get a credit card. Why? 1. Establish a good credit history 2. Create credit capacity 3. Eliminate the need for carrying cash 4. Provide a method for payment when cash is not an option Copyright © 2012 Pearson Canada Inc. 6 -17

Credit Cards The easiest way to establish credit is to get a credit card. Why? 1. Establish a good credit history 2. Create credit capacity 3. Eliminate the need for carrying cash 4. Provide a method for payment when cash is not an option Copyright © 2012 Pearson Canada Inc. 6 -17

Credit Cards (cont’d) 5. Earn additional benefits 6. Receive free financing until the due date on your credit card statement 7. Keep track of your spending by providing you with a consolidated list of the purchases you made Copyright © 2012 Pearson Canada Inc. 6 -18

Credit Cards (cont’d) 5. Earn additional benefits 6. Receive free financing until the due date on your credit card statement 7. Keep track of your spending by providing you with a consolidated list of the purchases you made Copyright © 2012 Pearson Canada Inc. 6 -18

Credit Cards (cont’d) • Types of Credit Cards • Master. Card, Visa, and American Express are the most popular • Credit card company receives a percentage of the payments made to merchants Copyright © 2012 Pearson Canada Inc. 6 -19

Credit Cards (cont’d) • Types of Credit Cards • Master. Card, Visa, and American Express are the most popular • Credit card company receives a percentage of the payments made to merchants Copyright © 2012 Pearson Canada Inc. 6 -19

Credit Cards (cont’d) • Prestige Credit Cards • Prestige Cards: credit cards, such as gold cards or platinum cards, issued by a financial institution to individuals who have an exceptional credit standing • Provide extra benefits • Travel insurance, insurance on rental cars, special warranties on purchases • Usually charge an annual fee Copyright © 2012 Pearson Canada Inc. 6 -20

Credit Cards (cont’d) • Prestige Credit Cards • Prestige Cards: credit cards, such as gold cards or platinum cards, issued by a financial institution to individuals who have an exceptional credit standing • Provide extra benefits • Travel insurance, insurance on rental cars, special warranties on purchases • Usually charge an annual fee Copyright © 2012 Pearson Canada Inc. 6 -20

Credit Cards (cont’d) • Specialized Credit Cards • Retail (or proprietary) Credit Card: a credit card that is honored only by a specific retail establishment • Interest rate charged is normally higher than that charged on standard or prestige cards Copyright © 2012 Pearson Canada Inc. 6 -21

Credit Cards (cont’d) • Specialized Credit Cards • Retail (or proprietary) Credit Card: a credit card that is honored only by a specific retail establishment • Interest rate charged is normally higher than that charged on standard or prestige cards Copyright © 2012 Pearson Canada Inc. 6 -21

Credit Cards (cont’d) Characteristics of credit cards: • Credit Limit • Specifies the maximum amount of credit allowed • Overdraft Protection option Copyright © 2012 Pearson Canada Inc. 6 -22

Credit Cards (cont’d) Characteristics of credit cards: • Credit Limit • Specifies the maximum amount of credit allowed • Overdraft Protection option Copyright © 2012 Pearson Canada Inc. 6 -22

Credit Cards (cont’d) • Annual Fee • Incentives to Use the Card (e. g. , points) • Grace Period • period between time of purchase and when payment is due (usually about 20 days) Copyright © 2012 Pearson Canada Inc. 6 -23

Credit Cards (cont’d) • Annual Fee • Incentives to Use the Card (e. g. , points) • Grace Period • period between time of purchase and when payment is due (usually about 20 days) Copyright © 2012 Pearson Canada Inc. 6 -23

Credit Cards (cont’d) • Cash Advances/Convenience Cheques • Usually charge high interest plus a transaction fee at the time of the transaction (i. e. no grace period) • Extremely costly source of financing and should be used only as a last resort Copyright © 2012 Pearson Canada Inc. 6 -24

Credit Cards (cont’d) • Cash Advances/Convenience Cheques • Usually charge high interest plus a transaction fee at the time of the transaction (i. e. no grace period) • Extremely costly source of financing and should be used only as a last resort Copyright © 2012 Pearson Canada Inc. 6 -24

Credit Cards (cont’d) • Financing • Paying only a portion of the credit card bill monthly • 20 and 30% interest • Finance Charge: the interest and fees you must pay as a result of using credit Copyright © 2012 Pearson Canada Inc. 6 -25

Credit Cards (cont’d) • Financing • Paying only a portion of the credit card bill monthly • 20 and 30% interest • Finance Charge: the interest and fees you must pay as a result of using credit Copyright © 2012 Pearson Canada Inc. 6 -25

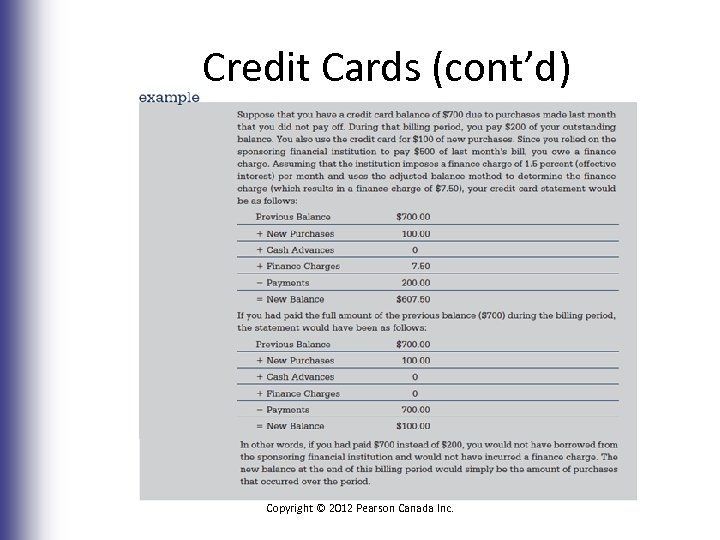

Credit Cards (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -26

Credit Cards (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -26

Credit Cards (cont’d) • Comparing Credit Cards • Factors to consider: • Acceptance by Merchants • Annual Fee • Interest Rate • Watch for “teaser rates” Copyright © 2012 Pearson Canada Inc. 6 -27

Credit Cards (cont’d) • Comparing Credit Cards • Factors to consider: • Acceptance by Merchants • Annual Fee • Interest Rate • Watch for “teaser rates” Copyright © 2012 Pearson Canada Inc. 6 -27

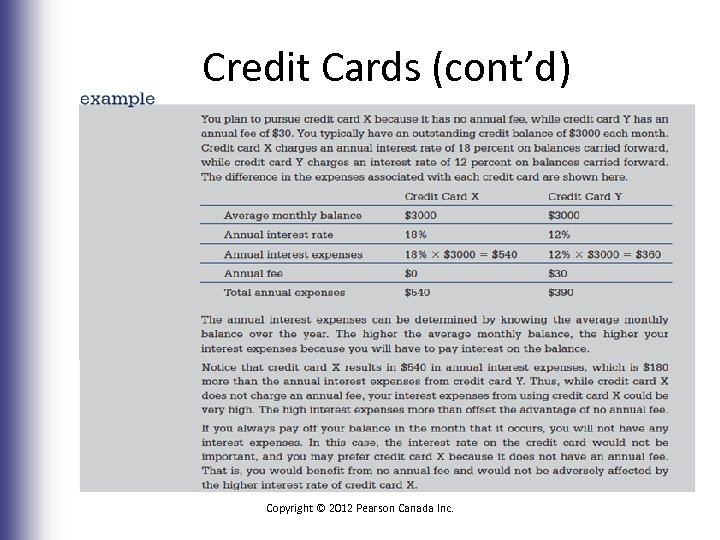

Credit Cards (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -28

Credit Cards (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -28

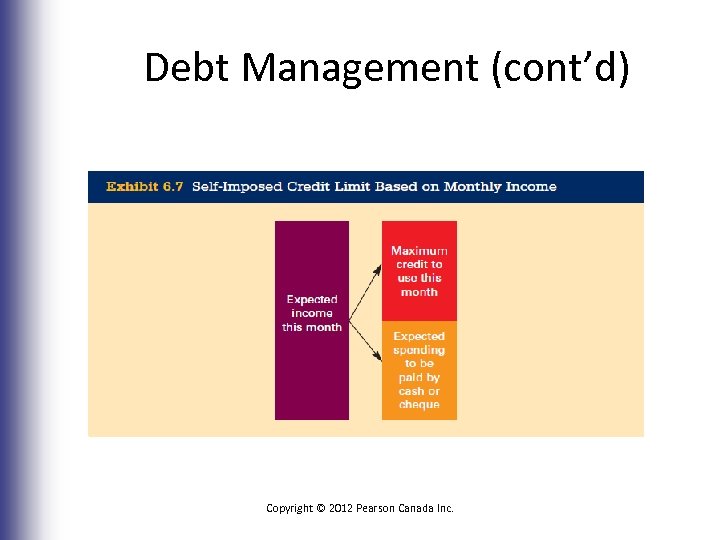

Debt Management (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -29

Debt Management (cont’d) Copyright © 2012 Pearson Canada Inc. 6 -29

Debt Management (cont’d) • Review personal financial statements • Personal balance sheet • Personal cash flow statement Copyright © 2012 Pearson Canada Inc. 6 -30

Debt Management (cont’d) • Review personal financial statements • Personal balance sheet • Personal cash flow statement Copyright © 2012 Pearson Canada Inc. 6 -30

Debt Management(cont’d) • Consumer Proposal • Consumer proposal: an offer made by a debtor to his or her creditors to modify his or her payments • Creditors have up to 45 days to object • Proposal can be made in cases where individual debt is less than $250 000, not including your home mortgage • Removed from your credit bureau report once the consumer proposal terms have been met Copyright © 2012 Pearson Canada Inc. 6 -31

Debt Management(cont’d) • Consumer Proposal • Consumer proposal: an offer made by a debtor to his or her creditors to modify his or her payments • Creditors have up to 45 days to object • Proposal can be made in cases where individual debt is less than $250 000, not including your home mortgage • Removed from your credit bureau report once the consumer proposal terms have been met Copyright © 2012 Pearson Canada Inc. 6 -31

Debt Management(cont’d) • Bankruptcy • Individuals can file for bankruptcy when they become insolvent • Insolvent: a person who owes at least $1000 and is unable to pay his or her debts as they come due • Property is given to a trustee in bankruptcy • Trustee in bankruptcy: a person licensed to administer consumer proposals and bankruptcies and manage assets held in trust Copyright © 2012 Pearson Canada Inc. 6 -32

Debt Management(cont’d) • Bankruptcy • Individuals can file for bankruptcy when they become insolvent • Insolvent: a person who owes at least $1000 and is unable to pay his or her debts as they come due • Property is given to a trustee in bankruptcy • Trustee in bankruptcy: a person licensed to administer consumer proposals and bankruptcies and manage assets held in trust Copyright © 2012 Pearson Canada Inc. 6 -32

Debt Management(cont’d) • Unsecured creditors will not be able to take legal steps to recover their debts from you • Trustee in bankruptcy will sell your assets and distribute the money obtained to your creditors on a pro rata basis • Certain assets are exempt from bankruptcy • Spouse or common-law partner is not affected by your personal bankruptcy • Bankruptcy is a last option Copyright © 2012 Pearson Canada Inc. 6 -33

Debt Management(cont’d) • Unsecured creditors will not be able to take legal steps to recover their debts from you • Trustee in bankruptcy will sell your assets and distribute the money obtained to your creditors on a pro rata basis • Certain assets are exempt from bankruptcy • Spouse or common-law partner is not affected by your personal bankruptcy • Bankruptcy is a last option Copyright © 2012 Pearson Canada Inc. 6 -33

Debt Management(cont’d) • Avoid Credit Repair Services • You can often fix any credit mistakes yourself, without paying for the services of a credit repair agency Copyright © 2012 Pearson Canada Inc. 6 -34

Debt Management(cont’d) • Avoid Credit Repair Services • You can often fix any credit mistakes yourself, without paying for the services of a credit repair agency Copyright © 2012 Pearson Canada Inc. 6 -34

Identity Theft: A Threat to Your Credit • Identity theft: occurs when an individual uses personal, identifying information unique to you (e. g. , your Social Insurance Number) without your permission for their personal gain • Goal may be to acquire money or goods or to establish a new identity for criminal purposes Copyright © 2012 Pearson Canada Inc. 6 -35

Identity Theft: A Threat to Your Credit • Identity theft: occurs when an individual uses personal, identifying information unique to you (e. g. , your Social Insurance Number) without your permission for their personal gain • Goal may be to acquire money or goods or to establish a new identity for criminal purposes Copyright © 2012 Pearson Canada Inc. 6 -35

Identity Theft: A Threat to Your Credit (cont’d) • The Scope of Identity Theft • Go to www. phonebusters. com/english/statistics. html What is the Cost of Identity Theft? • Difficult to measure • Average individual loss due to identity theft is $1868 Copyright © 2012 Pearson Canada Inc. 6 -36

Identity Theft: A Threat to Your Credit (cont’d) • The Scope of Identity Theft • Go to www. phonebusters. com/english/statistics. html What is the Cost of Identity Theft? • Difficult to measure • Average individual loss due to identity theft is $1868 Copyright © 2012 Pearson Canada Inc. 6 -36

Identity Theft Tactics • Shoulder surfing • Dumpster diving • Skimming • Pretexting, Phishing, and Pharming Copyright © 2012 Pearson Canada Inc. 6 -37

Identity Theft Tactics • Shoulder surfing • Dumpster diving • Skimming • Pretexting, Phishing, and Pharming Copyright © 2012 Pearson Canada Inc. 6 -37

Protecting Against Identity Theft • Only give personal information over the phone, through email, or over the internet if you have initiated contact • Keep the amount of identification that you carry with you to a minimum • Invest in a paper shredder • Do not give out your SIN and do not carry it with you • Change your passwords regularly Copyright © 2012 Pearson Canada Inc. 6 -38

Protecting Against Identity Theft • Only give personal information over the phone, through email, or over the internet if you have initiated contact • Keep the amount of identification that you carry with you to a minimum • Invest in a paper shredder • Do not give out your SIN and do not carry it with you • Change your passwords regularly Copyright © 2012 Pearson Canada Inc. 6 -38

Protecting Against Identity Theft (cont’d) • Look for a closed-lock or unbroken-key icon in your web browser before entering sensitive data • Clear the cache of you browser after visiting secure sites • Be familiar with the encryption level of your web browser • Install and maintain a firewall Copyright © 2012 Pearson Canada Inc. 6 -39

Protecting Against Identity Theft (cont’d) • Look for a closed-lock or unbroken-key icon in your web browser before entering sensitive data • Clear the cache of you browser after visiting secure sites • Be familiar with the encryption level of your web browser • Install and maintain a firewall Copyright © 2012 Pearson Canada Inc. 6 -39

Protecting Against Identity Theft (cont’d) • Be suspicious of e-mails that request personal information • Be cautious about downloading files and installing programs from the internet Copyright © 2012 Pearson Canada Inc. 6 -40

Protecting Against Identity Theft (cont’d) • Be suspicious of e-mails that request personal information • Be cautious about downloading files and installing programs from the internet Copyright © 2012 Pearson Canada Inc. 6 -40

Responses to Identity Theft • Take immediate action • Take steps to undo the damage • Document the steps you take to re-establish credit • Cancel and obtain new credit cards • Have the identity theft noted on your credit report Copyright © 2012 Pearson Canada Inc. 6 -41

Responses to Identity Theft • Take immediate action • Take steps to undo the damage • Document the steps you take to re-establish credit • Cancel and obtain new credit cards • Have the identity theft noted on your credit report Copyright © 2012 Pearson Canada Inc. 6 -41

Responses to Identity Theft (cont’d) • Obtain new ABM cards • Advise the passport office if your passport has been stolen • Advise Canada Post if you feel that your mail may be being diverted • Advise you telephone, cable, and utility providers about the identity theft • Obtain a new driver’s license Copyright © 2012 Pearson Canada Inc. 6 -42

Responses to Identity Theft (cont’d) • Obtain new ABM cards • Advise the passport office if your passport has been stolen • Advise Canada Post if you feel that your mail may be being diverted • Advise you telephone, cable, and utility providers about the identity theft • Obtain a new driver’s license Copyright © 2012 Pearson Canada Inc. 6 -42

Responses to Identity Theft (cont’d) • Request that a fraud alert be placed in your file • Will enable the credit bureau to contact you if there is any attempt to establish credit in your name Copyright © 2012 Pearson Canada Inc. 6 -43

Responses to Identity Theft (cont’d) • Request that a fraud alert be placed in your file • Will enable the credit bureau to contact you if there is any attempt to establish credit in your name Copyright © 2012 Pearson Canada Inc. 6 -43