1b5638bf0999efb735643ccf5f6184e9.ppt

- Количество слайдов: 30

Chapter 5 The Open Economy CHAPTER 5 The Open Economy slide 0

Chapter 5 The Open Economy CHAPTER 5 The Open Economy slide 0

In this chapter, you will learn… § accounting identities for the open economy § the small open economy model § what makes it “small” § how the trade balance and exchange rate are determined § how policies affect trade balance & exchange rate CHAPTER 5 The Open Economy slide 1

In this chapter, you will learn… § accounting identities for the open economy § the small open economy model § what makes it “small” § how the trade balance and exchange rate are determined § how policies affect trade balance & exchange rate CHAPTER 5 The Open Economy slide 1

§ Recall what we assumed so far: * In an open economy a country can spend more than its total output by borrowing from abroad. CHAPTER 5 The Open Economy slide 2

§ Recall what we assumed so far: * In an open economy a country can spend more than its total output by borrowing from abroad. CHAPTER 5 The Open Economy slide 2

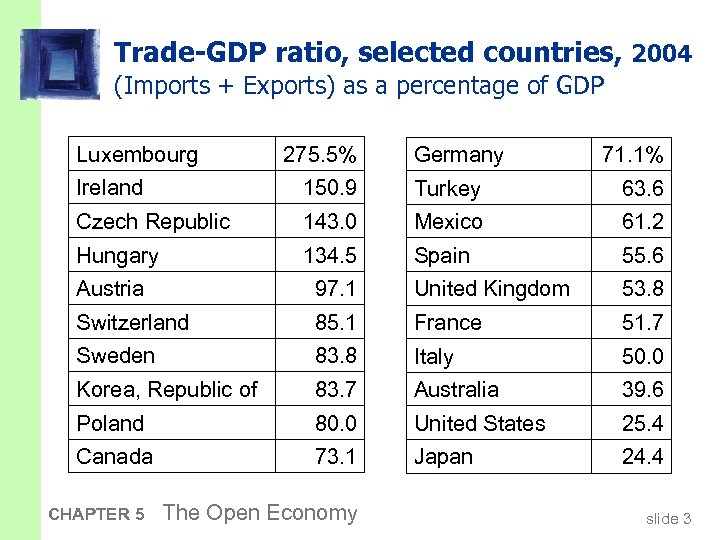

Trade-GDP ratio, selected countries, 2004 (Imports + Exports) as a percentage of GDP Luxembourg 275. 5% Germany 71. 1% Ireland 150. 9 Turkey 63. 6 Czech Republic 143. 0 Mexico 61. 2 Hungary 134. 5 Spain 55. 6 Austria 97. 1 United Kingdom 53. 8 Switzerland 85. 1 France 51. 7 Sweden 83. 8 Italy 50. 0 Korea, Republic of 83. 7 Australia 39. 6 Poland 80. 0 United States 25. 4 Canada 73. 1 Japan 24. 4 CHAPTER 5 The Open Economy slide 3

Trade-GDP ratio, selected countries, 2004 (Imports + Exports) as a percentage of GDP Luxembourg 275. 5% Germany 71. 1% Ireland 150. 9 Turkey 63. 6 Czech Republic 143. 0 Mexico 61. 2 Hungary 134. 5 Spain 55. 6 Austria 97. 1 United Kingdom 53. 8 Switzerland 85. 1 France 51. 7 Sweden 83. 8 Italy 50. 0 Korea, Republic of 83. 7 Australia 39. 6 Poland 80. 0 United States 25. 4 Canada 73. 1 Japan 24. 4 CHAPTER 5 The Open Economy slide 3

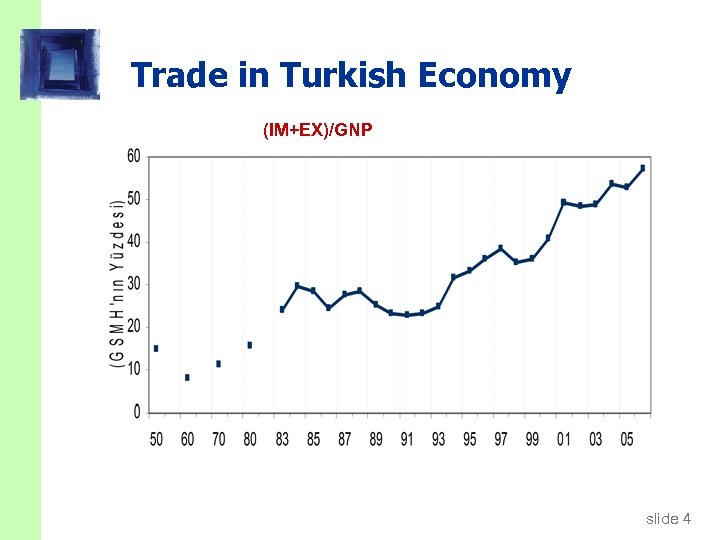

Trade in Turkish Economy (IM+EX)/GNP slide 4

Trade in Turkish Economy (IM+EX)/GNP slide 4

In an open economy, § spending need not equal output § saving need not equal investment CHAPTER 5 The Open Economy slide 5

In an open economy, § spending need not equal output § saving need not equal investment CHAPTER 5 The Open Economy slide 5

Preliminaries superscripts: d = spending on domestic goods f = spending on foreign goods EX = exports = foreign spending on domestic goods IM = imports = C f + I f + G f = spending on foreign goods NX = net exports (a. k. a. the “trade balance”) = EX – IM CHAPTER 5 The Open Economy slide 6

Preliminaries superscripts: d = spending on domestic goods f = spending on foreign goods EX = exports = foreign spending on domestic goods IM = imports = C f + I f + G f = spending on foreign goods NX = net exports (a. k. a. the “trade balance”) = EX – IM CHAPTER 5 The Open Economy slide 6

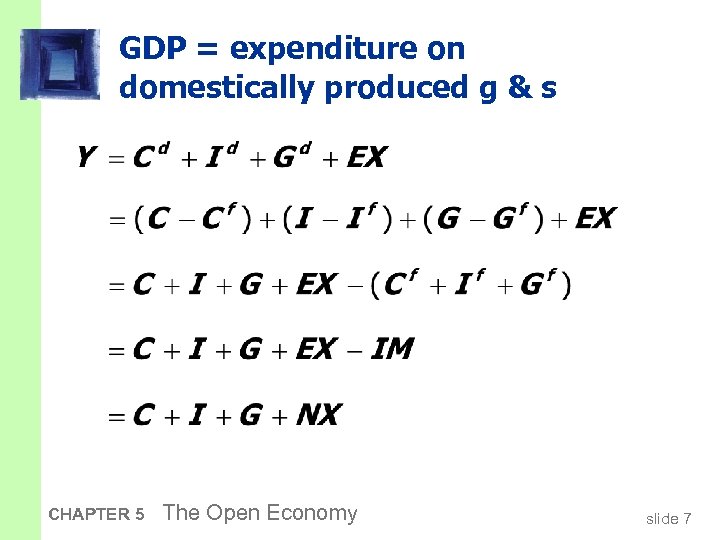

GDP = expenditure on domestically produced g & s CHAPTER 5 The Open Economy slide 7

GDP = expenditure on domestically produced g & s CHAPTER 5 The Open Economy slide 7

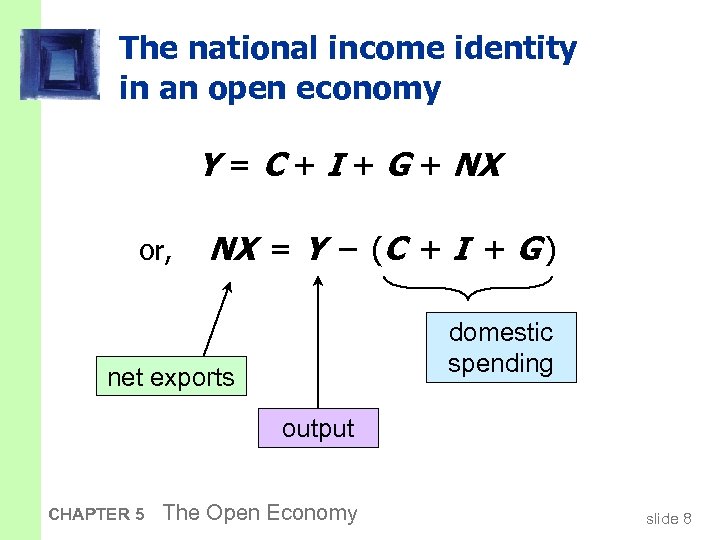

The national income identity in an open economy Y = C + I + G + NX or, NX = Y – (C + I + G ) domestic spending net exports output CHAPTER 5 The Open Economy slide 8

The national income identity in an open economy Y = C + I + G + NX or, NX = Y – (C + I + G ) domestic spending net exports output CHAPTER 5 The Open Economy slide 8

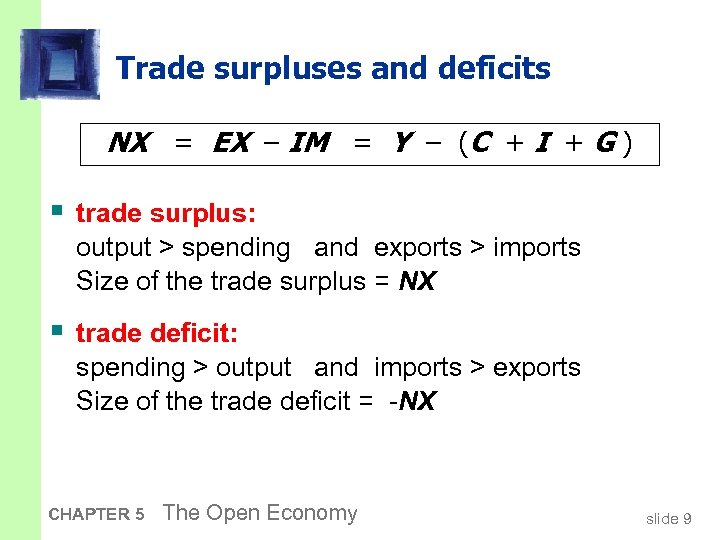

Trade surpluses and deficits NX = EX – IM = Y – (C + I + G ) § trade surplus: output > spending and exports > imports Size of the trade surplus = NX § trade deficit: spending > output and imports > exports Size of the trade deficit = -NX CHAPTER 5 The Open Economy slide 9

Trade surpluses and deficits NX = EX – IM = Y – (C + I + G ) § trade surplus: output > spending and exports > imports Size of the trade surplus = NX § trade deficit: spending > output and imports > exports Size of the trade deficit = -NX CHAPTER 5 The Open Economy slide 9

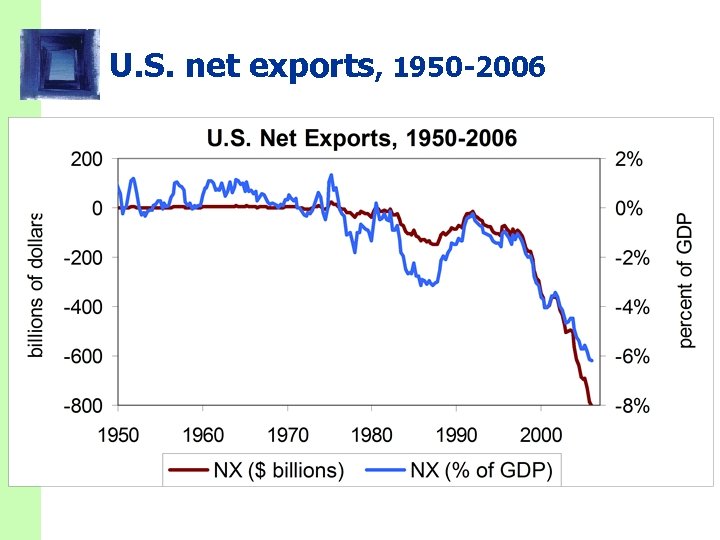

U. S. net exports, 1950 -2006

U. S. net exports, 1950 -2006

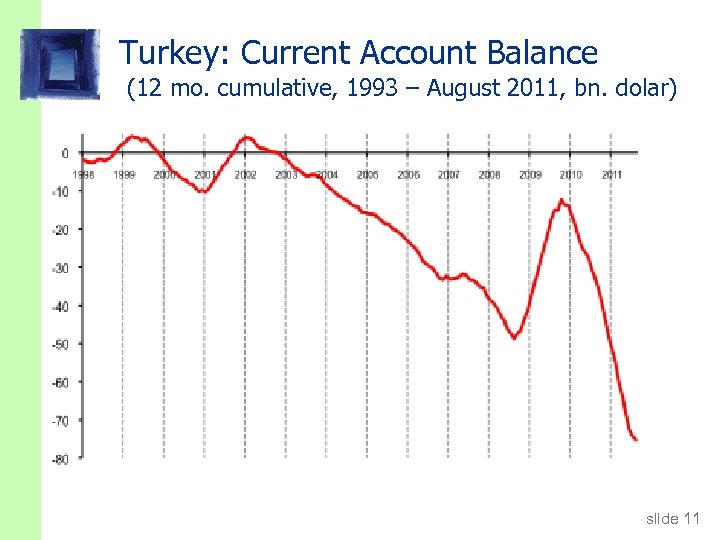

Turkey: Current Account Balance (12 mo. cumulative, 1993 – August 2011, bn. dolar) slide 11

Turkey: Current Account Balance (12 mo. cumulative, 1993 – August 2011, bn. dolar) slide 11

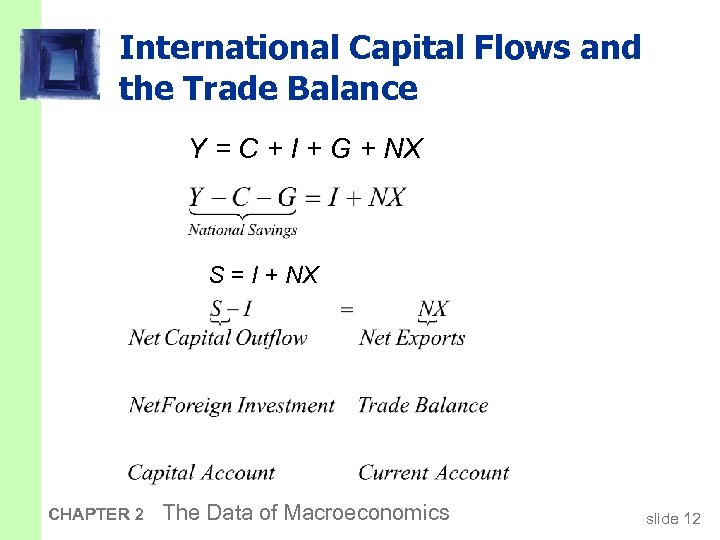

International Capital Flows and the Trade Balance Y = C + I + G + NX S = I + NX CHAPTER 2 The Data of Macroeconomics slide 12

International Capital Flows and the Trade Balance Y = C + I + G + NX S = I + NX CHAPTER 2 The Data of Macroeconomics slide 12

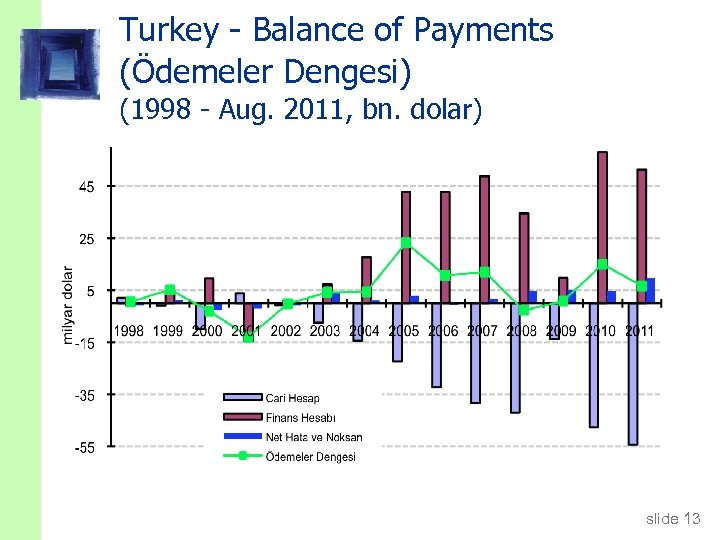

Turkey - Balance of Payments (Ödemeler Dengesi) (1998 - Aug. 2011, bn. dolar) slide 13

Turkey - Balance of Payments (Ödemeler Dengesi) (1998 - Aug. 2011, bn. dolar) slide 13

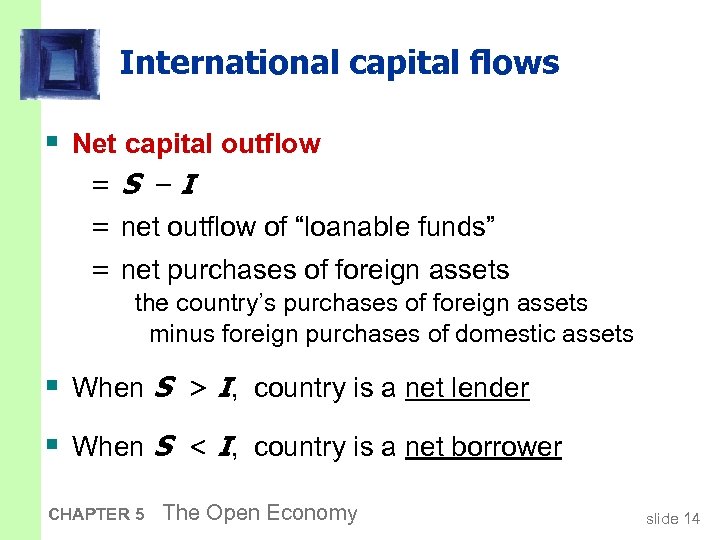

International capital flows § Net capital outflow =S –I = net outflow of “loanable funds” = net purchases of foreign assets the country’s purchases of foreign assets minus foreign purchases of domestic assets § When S > I, country is a net lender § When S < I, country is a net borrower CHAPTER 5 The Open Economy slide 14

International capital flows § Net capital outflow =S –I = net outflow of “loanable funds” = net purchases of foreign assets the country’s purchases of foreign assets minus foreign purchases of domestic assets § When S > I, country is a net lender § When S < I, country is a net borrower CHAPTER 5 The Open Economy slide 14

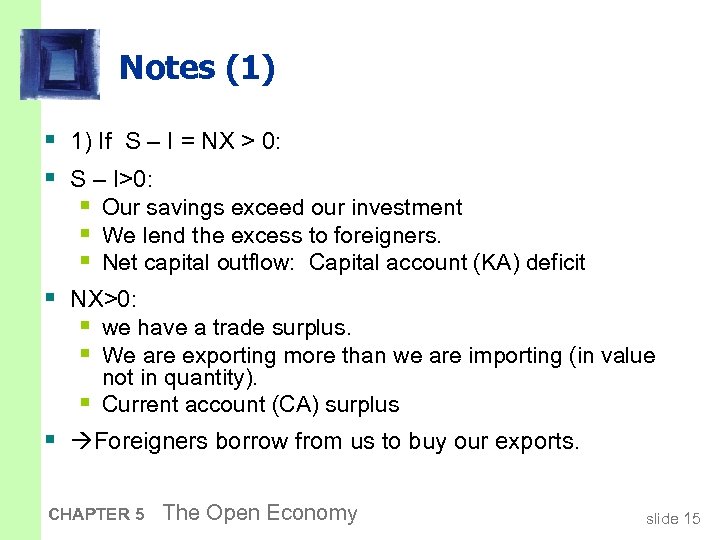

Notes (1) § 1) If S – I = NX > 0: § S – I>0: § Our savings exceed our investment § We lend the excess to foreigners. § Net capital outflow: Capital account (KA) deficit § NX>0: § we have a trade surplus. § We are exporting more than we are importing (in value § not in quantity). Current account (CA) surplus § Foreigners borrow from us to buy our exports. CHAPTER 5 The Open Economy slide 15

Notes (1) § 1) If S – I = NX > 0: § S – I>0: § Our savings exceed our investment § We lend the excess to foreigners. § Net capital outflow: Capital account (KA) deficit § NX>0: § we have a trade surplus. § We are exporting more than we are importing (in value § not in quantity). Current account (CA) surplus § Foreigners borrow from us to buy our exports. CHAPTER 5 The Open Economy slide 15

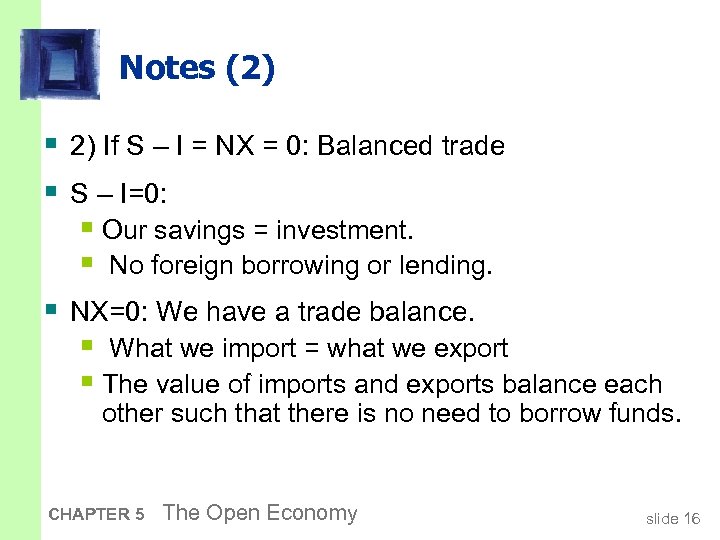

Notes (2) § 2) If S – I = NX = 0: Balanced trade § S – I=0: § Our savings = investment. § No foreign borrowing or lending. § NX=0: We have a trade balance. § What we import = what we export § The value of imports and exports balance each other such that there is no need to borrow funds. CHAPTER 5 The Open Economy slide 16

Notes (2) § 2) If S – I = NX = 0: Balanced trade § S – I=0: § Our savings = investment. § No foreign borrowing or lending. § NX=0: We have a trade balance. § What we import = what we export § The value of imports and exports balance each other such that there is no need to borrow funds. CHAPTER 5 The Open Economy slide 16

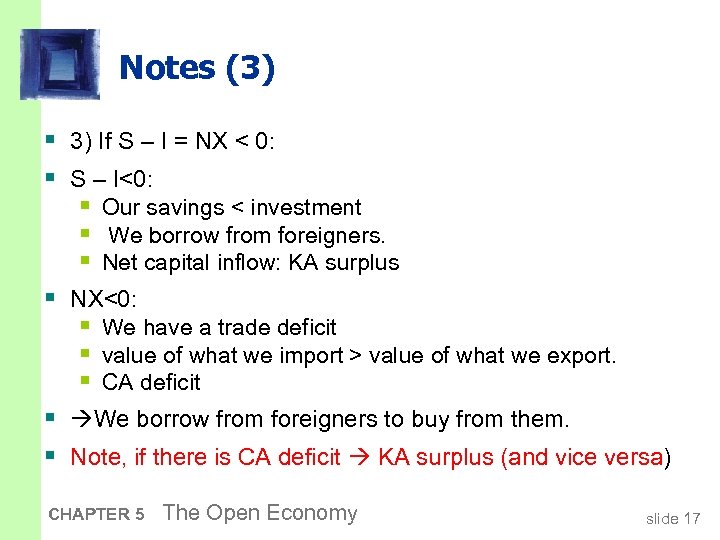

Notes (3) § 3) If S – I = NX < 0: § S – I<0: § Our savings < investment § We borrow from foreigners. § Net capital inflow: KA surplus § NX<0: § We have a trade deficit § value of what we import > value of what we export. § CA deficit § We borrow from foreigners to buy from them. § Note, if there is CA deficit KA surplus (and vice versa) CHAPTER 5 The Open Economy slide 17

Notes (3) § 3) If S – I = NX < 0: § S – I<0: § Our savings < investment § We borrow from foreigners. § Net capital inflow: KA surplus § NX<0: § We have a trade deficit § value of what we import > value of what we export. § CA deficit § We borrow from foreigners to buy from them. § Note, if there is CA deficit KA surplus (and vice versa) CHAPTER 5 The Open Economy slide 17

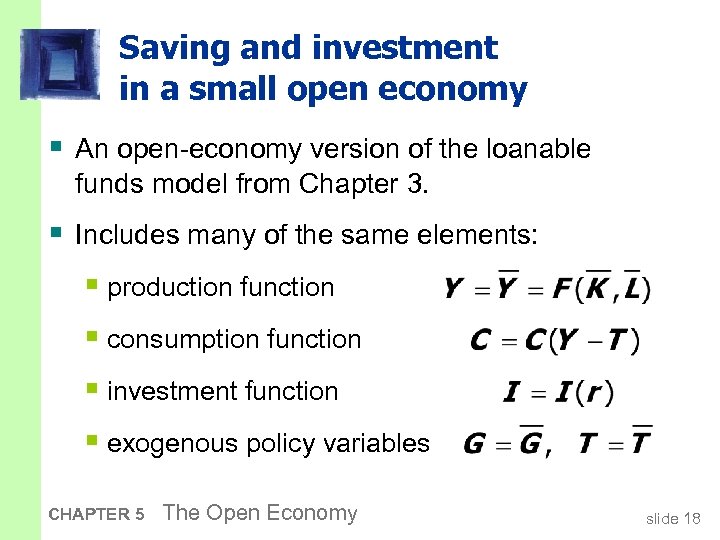

Saving and investment in a small open economy § An open-economy version of the loanable funds model from Chapter 3. § Includes many of the same elements: § production function § consumption function § investment function § exogenous policy variables CHAPTER 5 The Open Economy slide 18

Saving and investment in a small open economy § An open-economy version of the loanable funds model from Chapter 3. § Includes many of the same elements: § production function § consumption function § investment function § exogenous policy variables CHAPTER 5 The Open Economy slide 18

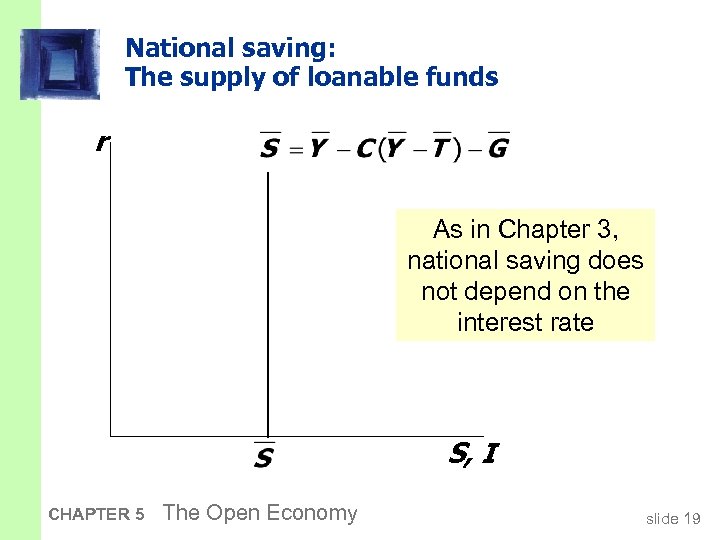

National saving: The supply of loanable funds r As in Chapter 3, national saving does not depend on the interest rate S, I CHAPTER 5 The Open Economy slide 19

National saving: The supply of loanable funds r As in Chapter 3, national saving does not depend on the interest rate S, I CHAPTER 5 The Open Economy slide 19

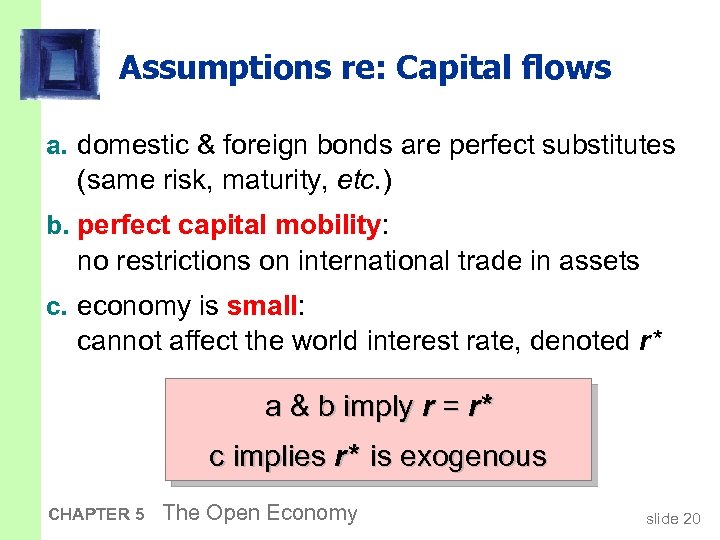

Assumptions re: Capital flows a. domestic & foreign bonds are perfect substitutes (same risk, maturity, etc. ) b. perfect capital mobility: no restrictions on international trade in assets c. economy is small: cannot affect the world interest rate, denoted r* a & b imply r = r* c implies r* is exogenous CHAPTER 5 The Open Economy slide 20

Assumptions re: Capital flows a. domestic & foreign bonds are perfect substitutes (same risk, maturity, etc. ) b. perfect capital mobility: no restrictions on international trade in assets c. economy is small: cannot affect the world interest rate, denoted r* a & b imply r = r* c implies r* is exogenous CHAPTER 5 The Open Economy slide 20

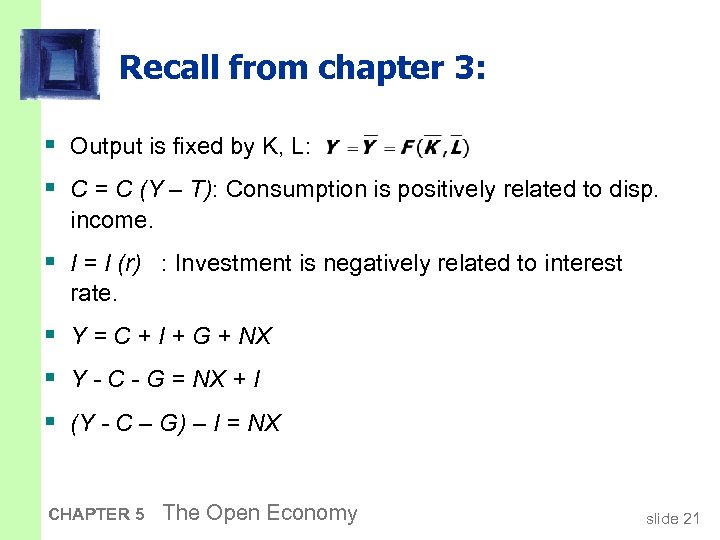

Recall from chapter 3: § Output is fixed by K, L: § C = C (Y – T): Consumption is positively related to disp. income. § I = I (r) : Investment is negatively related to interest rate. § Y = C + I + G + NX § Y - C - G = NX + I § (Y - C – G) – I = NX CHAPTER 5 The Open Economy slide 21

Recall from chapter 3: § Output is fixed by K, L: § C = C (Y – T): Consumption is positively related to disp. income. § I = I (r) : Investment is negatively related to interest rate. § Y = C + I + G + NX § Y - C - G = NX + I § (Y - C – G) – I = NX CHAPTER 5 The Open Economy slide 21

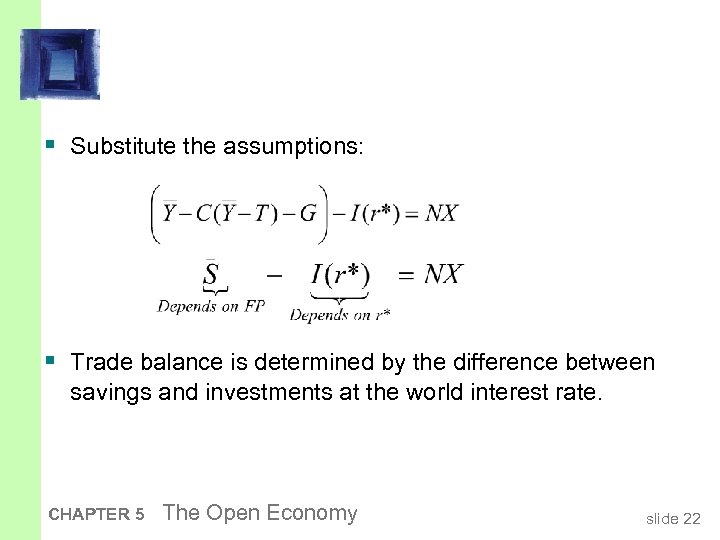

§ Substitute the assumptions: § Trade balance is determined by the difference between savings and investments at the world interest rate. CHAPTER 5 The Open Economy slide 22

§ Substitute the assumptions: § Trade balance is determined by the difference between savings and investments at the world interest rate. CHAPTER 5 The Open Economy slide 22

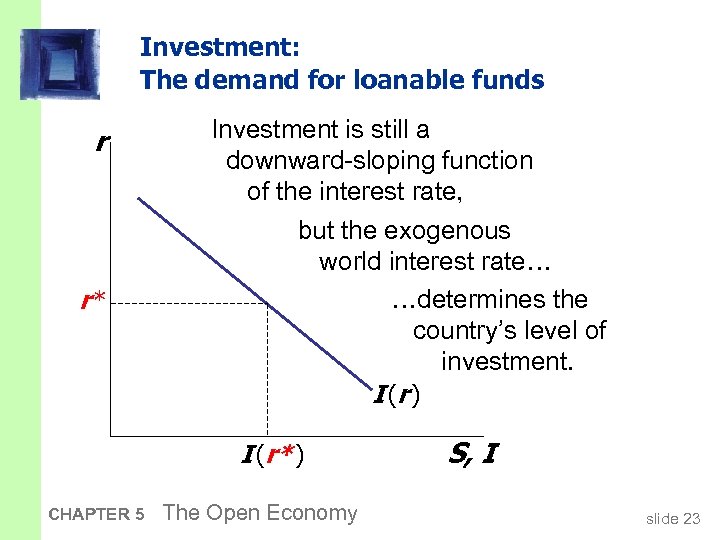

Investment: The demand for loanable funds r r* Investment is still a downward-sloping function of the interest rate, but the exogenous world interest rate… …determines the country’s level of investment. I (r ) I (r* ) CHAPTER 5 The Open Economy S, I slide 23

Investment: The demand for loanable funds r r* Investment is still a downward-sloping function of the interest rate, but the exogenous world interest rate… …determines the country’s level of investment. I (r ) I (r* ) CHAPTER 5 The Open Economy S, I slide 23

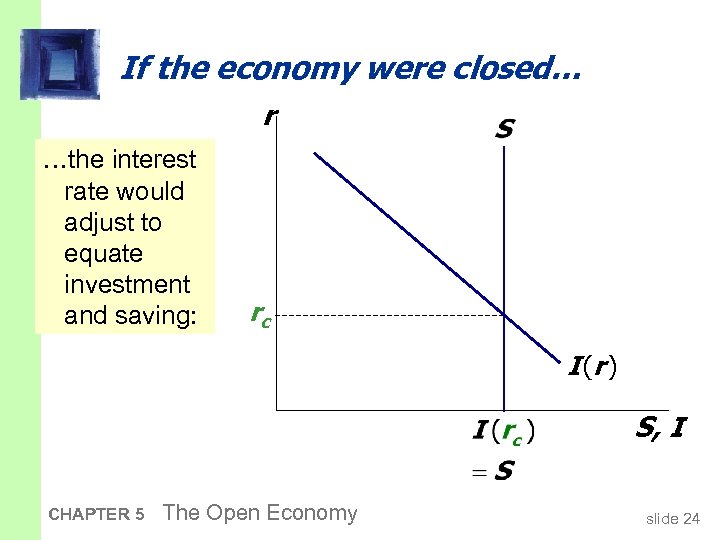

If the economy were closed… r …the interest rate would adjust to equate investment and saving: rc I (r ) S, I CHAPTER 5 The Open Economy slide 24

If the economy were closed… r …the interest rate would adjust to equate investment and saving: rc I (r ) S, I CHAPTER 5 The Open Economy slide 24

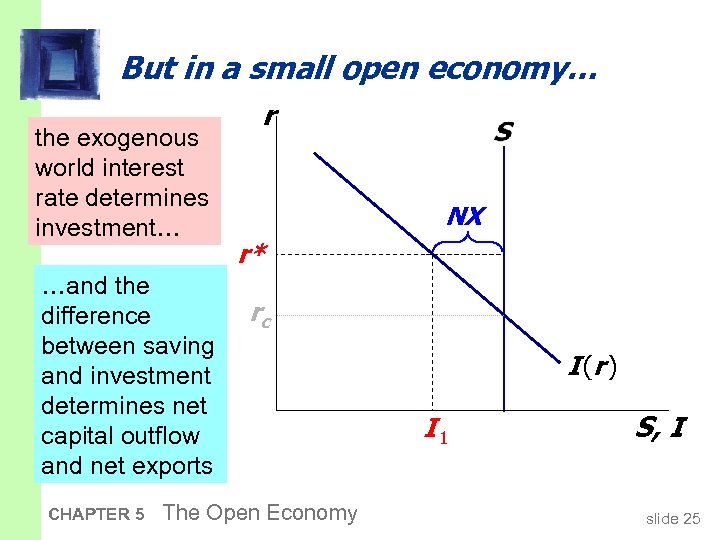

But in a small open economy… the exogenous world interest rate determines investment… …and the difference between saving and investment determines net capital outflow and net exports CHAPTER 5 r NX r* rc The Open Economy I (r ) I 1 S, I slide 25

But in a small open economy… the exogenous world interest rate determines investment… …and the difference between saving and investment determines net capital outflow and net exports CHAPTER 5 r NX r* rc The Open Economy I (r ) I 1 S, I slide 25

Next, three experiments: 1. Fiscal policy at home 2. Fiscal policy abroad 3. An increase in investment demand CHAPTER 5 The Open Economy slide 26

Next, three experiments: 1. Fiscal policy at home 2. Fiscal policy abroad 3. An increase in investment demand CHAPTER 5 The Open Economy slide 26

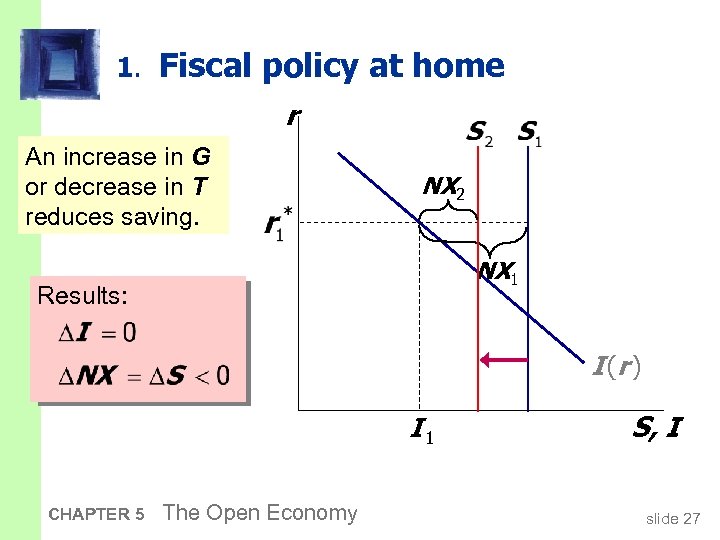

1. Fiscal policy at home r An increase in G or decrease in T reduces saving. NX 2 NX 1 Results: I (r ) I 1 CHAPTER 5 The Open Economy S, I slide 27

1. Fiscal policy at home r An increase in G or decrease in T reduces saving. NX 2 NX 1 Results: I (r ) I 1 CHAPTER 5 The Open Economy S, I slide 27

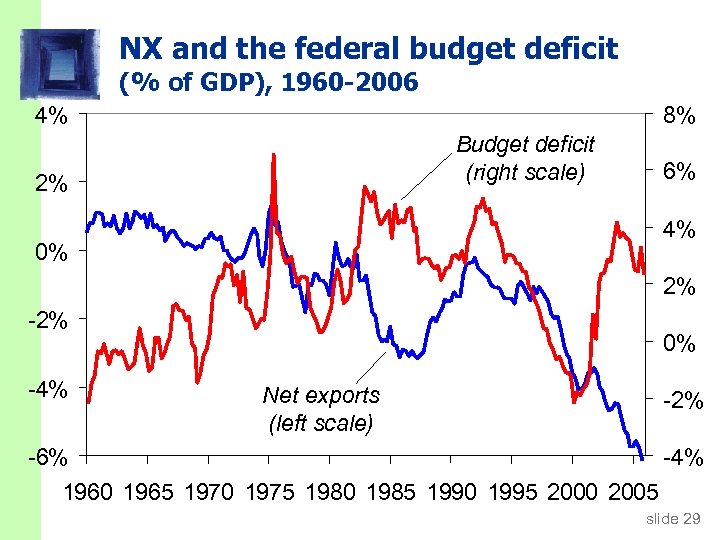

§ Note that the analysis on the previous slide applies to ANYTHING that causes a decrease in saving. § Other examples: a shift in consumer preferences regarding the tradeoff between saving and consumption, or a change in the tax laws that reduces the incentive to save. § Our model generates a prediction: the government’s budget deficit and the country’s trade balance should be negatively related. Does this prediction come true in the real world? Let’s look at the data…. CHAPTER 5 The Open Economy slide 28

§ Note that the analysis on the previous slide applies to ANYTHING that causes a decrease in saving. § Other examples: a shift in consumer preferences regarding the tradeoff between saving and consumption, or a change in the tax laws that reduces the incentive to save. § Our model generates a prediction: the government’s budget deficit and the country’s trade balance should be negatively related. Does this prediction come true in the real world? Let’s look at the data…. CHAPTER 5 The Open Economy slide 28

NX and the federal budget deficit (% of GDP), 1960 -2006 4% 8% Budget deficit (right scale) 2% 6% 4% 0% 2% -4% 0% Net exports (left scale) -2% -6% -4% 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 slide 29

NX and the federal budget deficit (% of GDP), 1960 -2006 4% 8% Budget deficit (right scale) 2% 6% 4% 0% 2% -4% 0% Net exports (left scale) -2% -6% -4% 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 slide 29