abe2eb35aa18970c47710c9ee4266a05.ppt

- Количество слайдов: 27

Chapter 5 Risk & Return

Chapter 5 Risk & Return

Chapter 5: Objectives • Inflation and rates of return • How to measure risk (variance, standard deviation, beta) • How to reduce risk (diversification) • How to price risk (security market line, Capital Asset Pricing Model)

Chapter 5: Objectives • Inflation and rates of return • How to measure risk (variance, standard deviation, beta) • How to reduce risk (diversification) • How to price risk (security market line, Capital Asset Pricing Model)

Inflation, Rates of Return, and the Fisher Effect Interest Rates

Inflation, Rates of Return, and the Fisher Effect Interest Rates

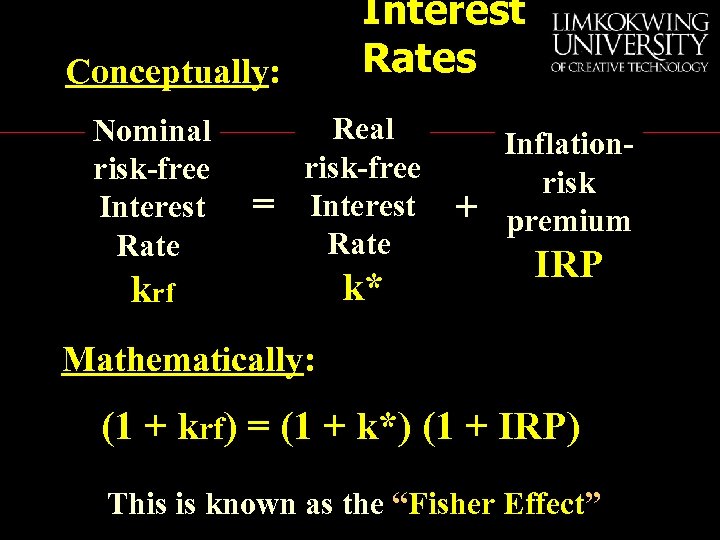

Interest Rates Conceptually: Nominal risk-free Interest Rate = Real risk-free Interest Rate krf k* + Inflationrisk premium IRP Mathematically: (1 + krf) = (1 + k*) (1 + IRP) This is known as the “Fisher Effect”

Interest Rates Conceptually: Nominal risk-free Interest Rate = Real risk-free Interest Rate krf k* + Inflationrisk premium IRP Mathematically: (1 + krf) = (1 + k*) (1 + IRP) This is known as the “Fisher Effect”

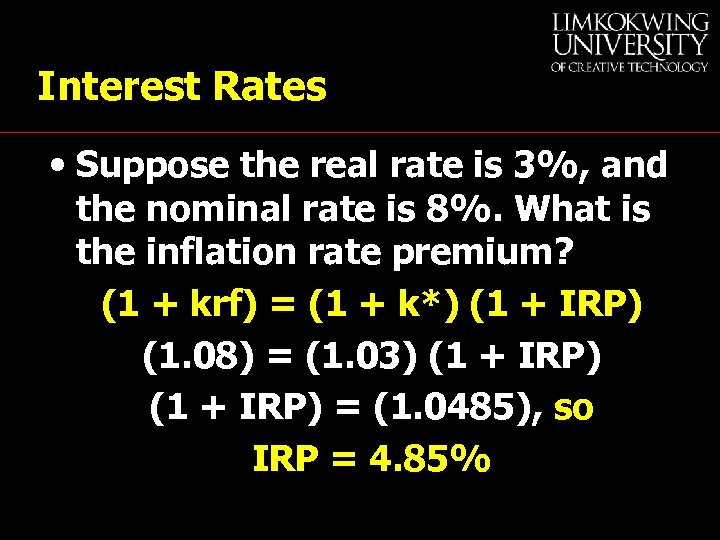

Interest Rates • Suppose the real rate is 3%, and the nominal rate is 8%. What is the inflation rate premium? (1 + krf) = (1 + k*) (1 + IRP) (1. 08) = (1. 03) (1 + IRP) = (1. 0485), so IRP = 4. 85%

Interest Rates • Suppose the real rate is 3%, and the nominal rate is 8%. What is the inflation rate premium? (1 + krf) = (1 + k*) (1 + IRP) (1. 08) = (1. 03) (1 + IRP) = (1. 0485), so IRP = 4. 85%

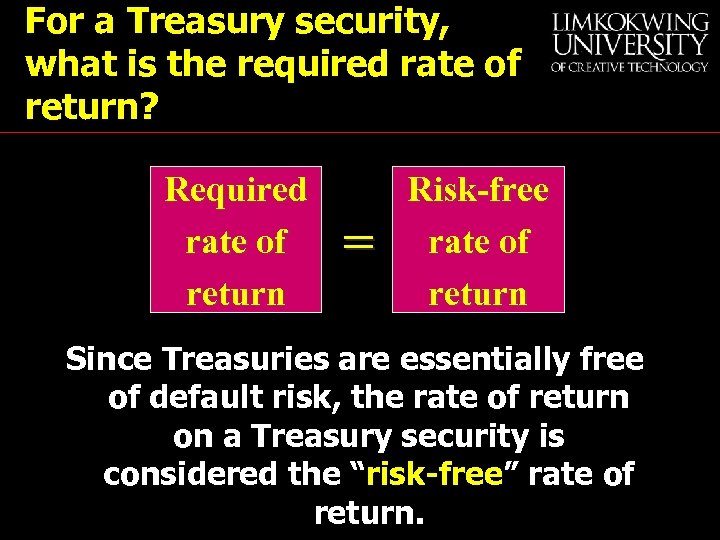

For a Treasury security, what is the required rate of return? Required rate of return = Risk-free rate of return Since Treasuries are essentially free of default risk, the rate of return on a Treasury security is considered the “risk-free” rate of return.

For a Treasury security, what is the required rate of return? Required rate of return = Risk-free rate of return Since Treasuries are essentially free of default risk, the rate of return on a Treasury security is considered the “risk-free” rate of return.

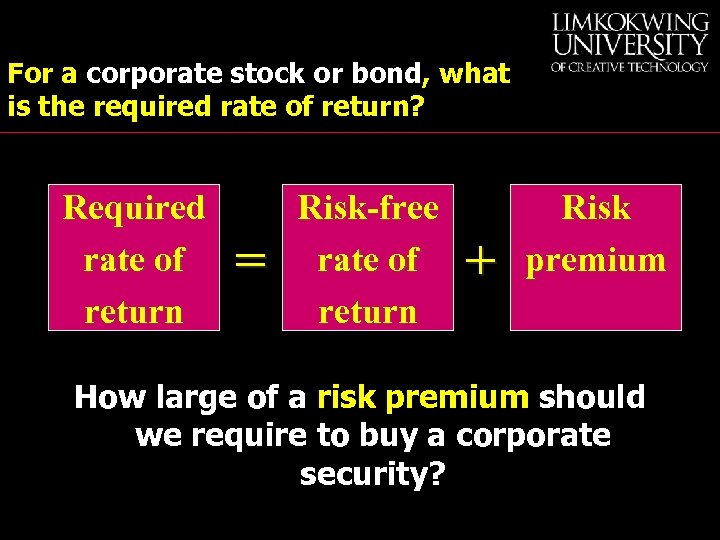

For a corporate stock or bond, what is the required rate of return? Required rate of return = Risk-free rate of return + Risk premium How large of a risk premium should we require to buy a corporate security?

For a corporate stock or bond, what is the required rate of return? Required rate of return = Risk-free rate of return + Risk premium How large of a risk premium should we require to buy a corporate security?

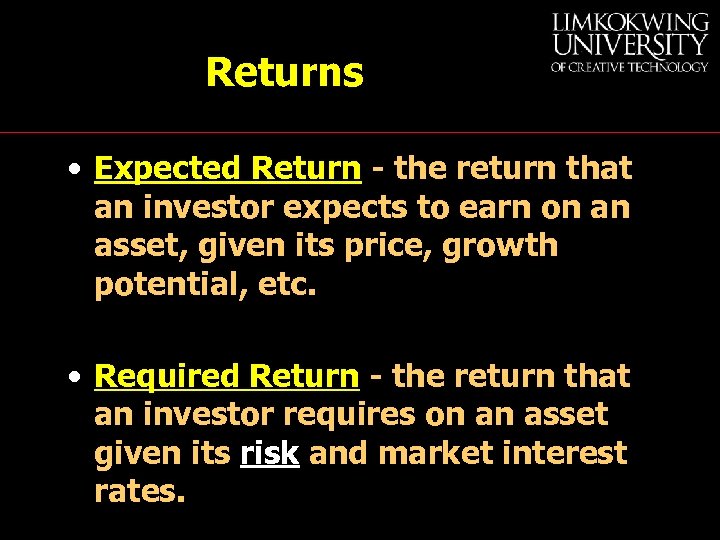

Returns • Expected Return - the return that an investor expects to earn on an asset, given its price, growth potential, etc. • Required Return - the return that an investor requires on an asset given its risk and market interest rates.

Returns • Expected Return - the return that an investor expects to earn on an asset, given its price, growth potential, etc. • Required Return - the return that an investor requires on an asset given its risk and market interest rates.

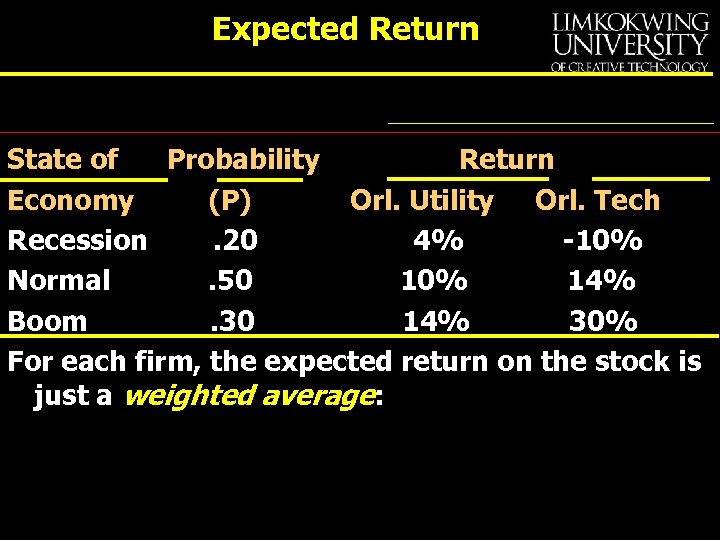

Expected Return State of Probability Return Economy (P) Orl. Utility Orl. Tech Recession. 20 4% -10% Normal. 50 10% 14% Boom. 30 14% 30% For each firm, the expected return on the stock is just a weighted average:

Expected Return State of Probability Return Economy (P) Orl. Utility Orl. Tech Recession. 20 4% -10% Normal. 50 10% 14% Boom. 30 14% 30% For each firm, the expected return on the stock is just a weighted average:

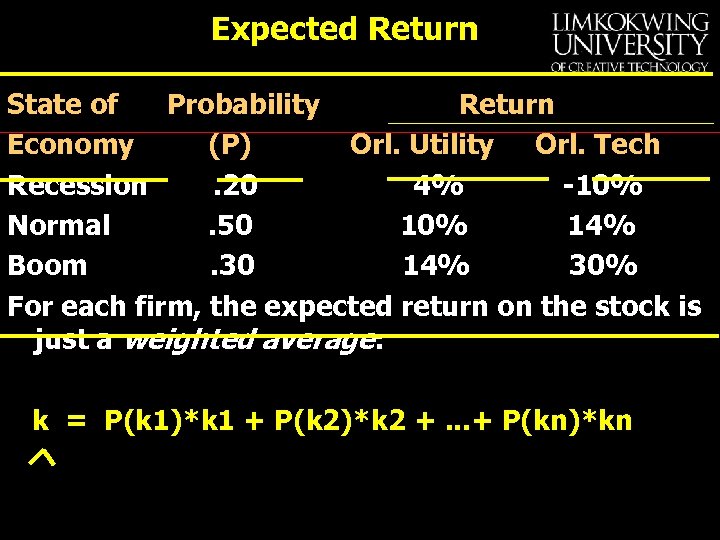

Expected Return State of Probability Return Economy (P) Orl. Utility Orl. Tech Recession. 20 4% -10% Normal. 50 10% 14% Boom. 30 14% 30% For each firm, the expected return on the stock is just a weighted average: k = P(k 1)*k 1 + P(k 2)*k 2 +. . . + P(kn)*kn

Expected Return State of Probability Return Economy (P) Orl. Utility Orl. Tech Recession. 20 4% -10% Normal. 50 10% 14% Boom. 30 14% 30% For each firm, the expected return on the stock is just a weighted average: k = P(k 1)*k 1 + P(k 2)*k 2 +. . . + P(kn)*kn

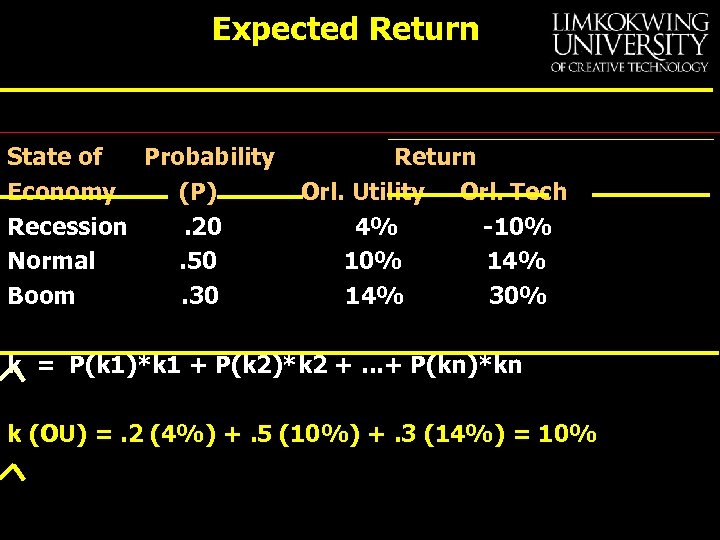

Expected Return State of Probability Economy (P) Recession. 20 Normal. 50 Boom. 30 Return Orl. Utility Orl. Tech 4% -10% 14% 30% k = P(k 1)*k 1 + P(k 2)*k 2 +. . . + P(kn)*kn k (OU) =. 2 (4%) +. 5 (10%) +. 3 (14%) = 10%

Expected Return State of Probability Economy (P) Recession. 20 Normal. 50 Boom. 30 Return Orl. Utility Orl. Tech 4% -10% 14% 30% k = P(k 1)*k 1 + P(k 2)*k 2 +. . . + P(kn)*kn k (OU) =. 2 (4%) +. 5 (10%) +. 3 (14%) = 10%

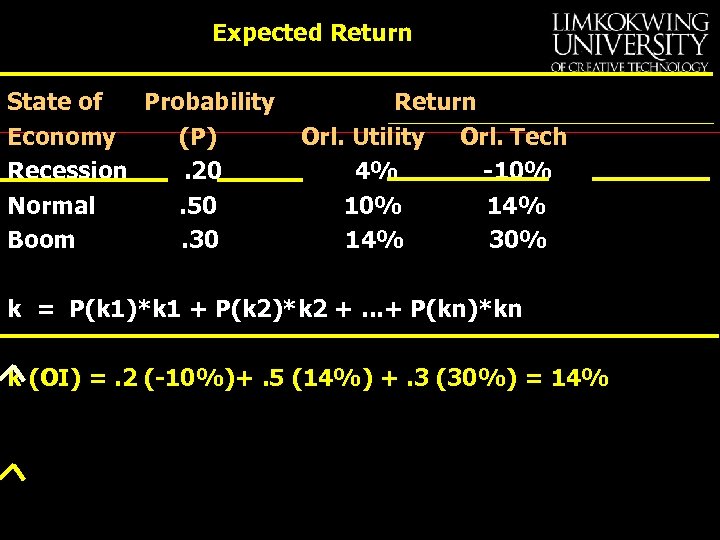

Expected Return State of Probability Economy (P) Recession. 20 Normal. 50 Boom. 30 Return Orl. Utility Orl. Tech 4% -10% 14% 30% k = P(k 1)*k 1 + P(k 2)*k 2 +. . . + P(kn)*kn k (OI) =. 2 (-10%)+. 5 (14%) +. 3 (30%) = 14%

Expected Return State of Probability Economy (P) Recession. 20 Normal. 50 Boom. 30 Return Orl. Utility Orl. Tech 4% -10% 14% 30% k = P(k 1)*k 1 + P(k 2)*k 2 +. . . + P(kn)*kn k (OI) =. 2 (-10%)+. 5 (14%) +. 3 (30%) = 14%

Based only on your expected return calculations, which stock would you prefer?

Based only on your expected return calculations, which stock would you prefer?

Have you considered RISK?

Have you considered RISK?

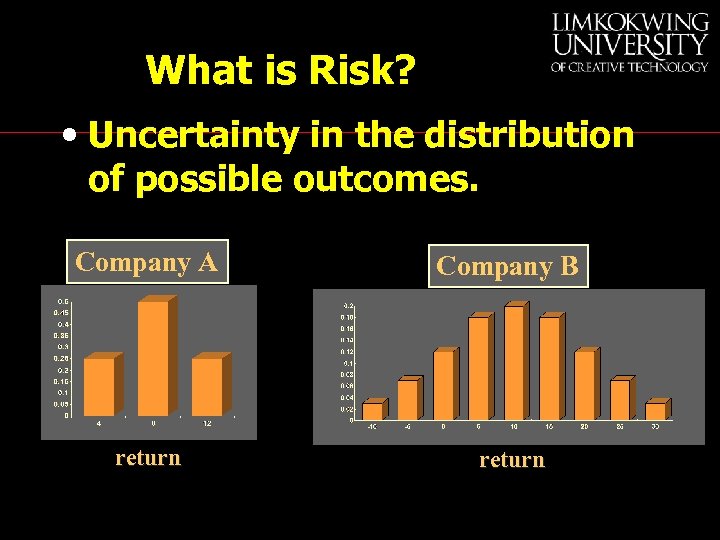

What is Risk? • The possibility that an actual return will differ from our expected return. • Uncertainty in the distribution of possible outcomes.

What is Risk? • The possibility that an actual return will differ from our expected return. • Uncertainty in the distribution of possible outcomes.

What is Risk? • Uncertainty in the distribution of possible outcomes.

What is Risk? • Uncertainty in the distribution of possible outcomes.

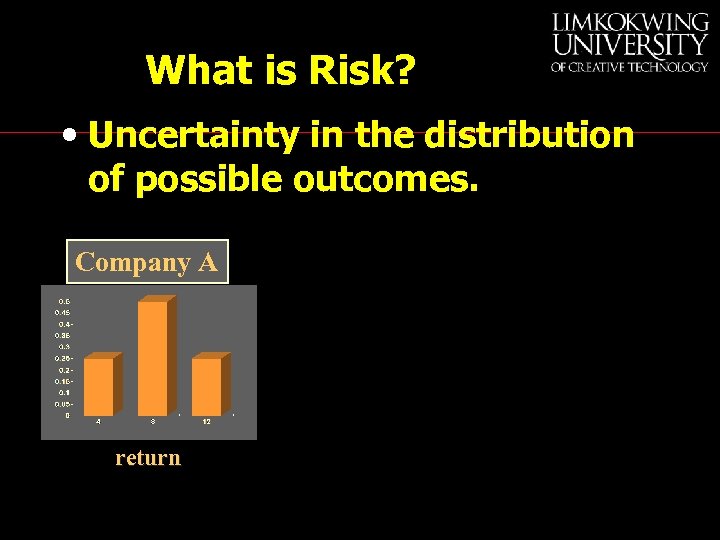

What is Risk? • Uncertainty in the distribution of possible outcomes. Company A return

What is Risk? • Uncertainty in the distribution of possible outcomes. Company A return

What is Risk? • Uncertainty in the distribution of possible outcomes. Company A Company B return

What is Risk? • Uncertainty in the distribution of possible outcomes. Company A Company B return

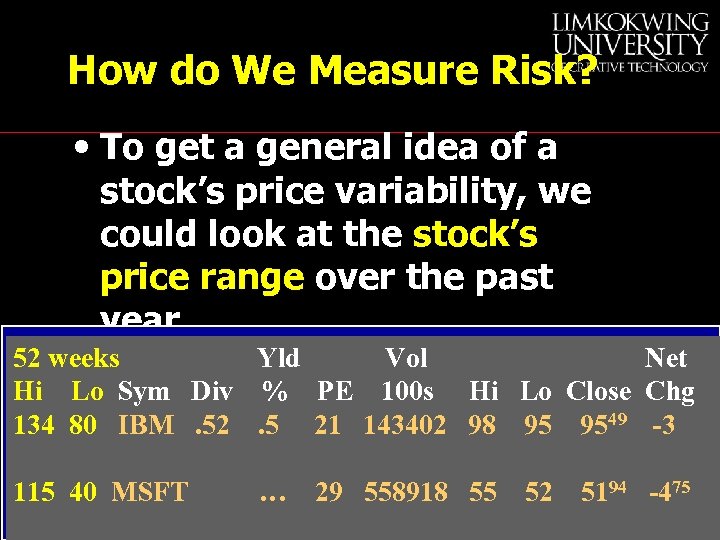

How do We Measure Risk? • To get a general idea of a stock’s price variability, we could look at the stock’s price range over the past year. 52 weeks Yld Vol Net Hi Lo Sym Div % PE 100 s Hi Lo Close Chg 134 80 IBM. 52. 5 21 143402 98 95 9549 -3 115 40 MSFT … 29 558918 55 52 5194 -475

How do We Measure Risk? • To get a general idea of a stock’s price variability, we could look at the stock’s price range over the past year. 52 weeks Yld Vol Net Hi Lo Sym Div % PE 100 s Hi Lo Close Chg 134 80 IBM. 52. 5 21 143402 98 95 9549 -3 115 40 MSFT … 29 558918 55 52 5194 -475

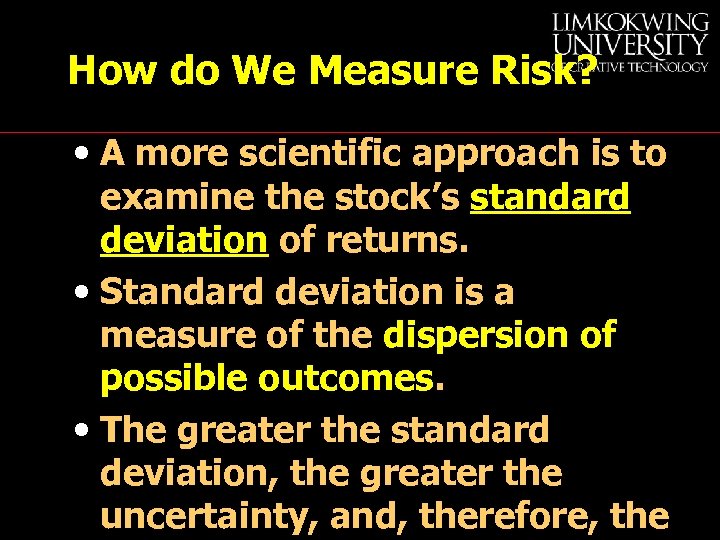

How do We Measure Risk? • A more scientific approach is to examine the stock’s standard deviation of returns. • Standard deviation is a measure of the dispersion of possible outcomes. • The greater the standard deviation, the greater the uncertainty, and, therefore, the

How do We Measure Risk? • A more scientific approach is to examine the stock’s standard deviation of returns. • Standard deviation is a measure of the dispersion of possible outcomes. • The greater the standard deviation, the greater the uncertainty, and, therefore, the

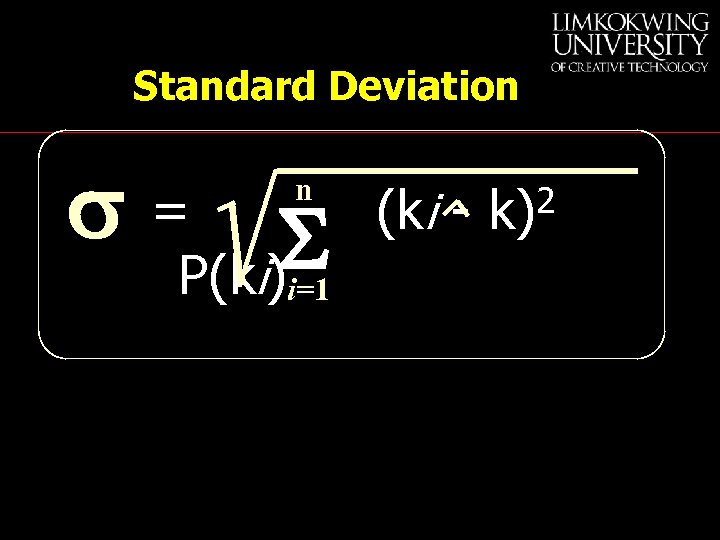

Standard Deviation s= S P(ki) n i=1 (ki - 2 k)

Standard Deviation s= S P(ki) n i=1 (ki - 2 k)

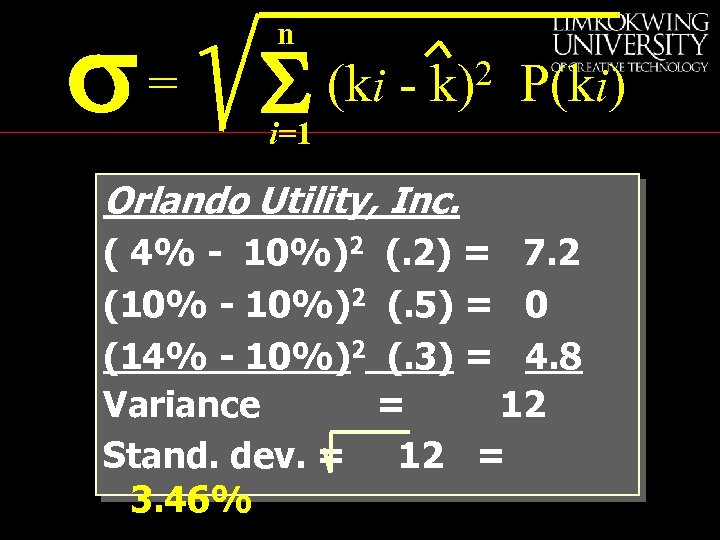

s= n S (ki - 2 k) P(ki) i=1 Orlando Utility, Inc. ( 4% - 10%)2 (. 2) = 7. 2 (10% - 10%)2 (. 5) = 0 (14% - 10%)2 (. 3) = 4. 8 Variance = 12 Stand. dev. = 12 = 3. 46%

s= n S (ki - 2 k) P(ki) i=1 Orlando Utility, Inc. ( 4% - 10%)2 (. 2) = 7. 2 (10% - 10%)2 (. 5) = 0 (14% - 10%)2 (. 3) = 4. 8 Variance = 12 Stand. dev. = 12 = 3. 46%

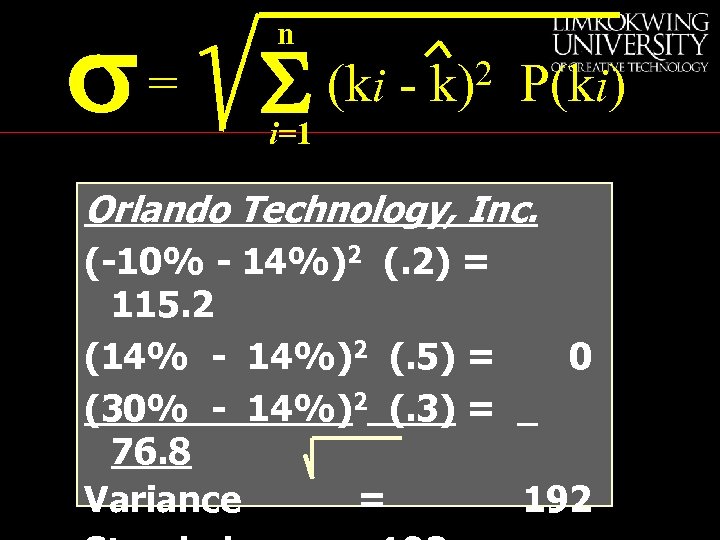

s= n S (ki - 2 k) P(ki) i=1 Orlando Technology, Inc. (-10% - 14%)2 (. 2) = 115. 2 (14% - 14%)2 (. 5) = 0 (30% - 14%)2 (. 3) = 76. 8 Variance = 192

s= n S (ki - 2 k) P(ki) i=1 Orlando Technology, Inc. (-10% - 14%)2 (. 2) = 115. 2 (14% - 14%)2 (. 5) = 0 (30% - 14%)2 (. 3) = 76. 8 Variance = 192

s= n S (ki - 2 k) P(ki) i=1 Orlando Technology, Inc. (-10% - 14%)2 (. 2) = 115. 2 (14% - 14%)2 (. 5) = 0 (30% - 14%)2 (. 3) = 76. 8 Variance = 192

s= n S (ki - 2 k) P(ki) i=1 Orlando Technology, Inc. (-10% - 14%)2 (. 2) = 115. 2 (14% - 14%)2 (. 5) = 0 (30% - 14%)2 (. 3) = 76. 8 Variance = 192

Which stock would you prefer? How would you decide?

Which stock would you prefer? How would you decide?

Summary Orlando Technology Expected Return 14% Orlando Utility 10%

Summary Orlando Technology Expected Return 14% Orlando Utility 10%

It depends on your tolerance for risk! Return Risk Remember, there’s a tradeoff

It depends on your tolerance for risk! Return Risk Remember, there’s a tradeoff