2d9fc057c4590aeea28aa5b158f29645.ppt

- Количество слайдов: 54

Chapter 5: returning to labor, capital, land & technical skills • How important are these factors in the cost of production? • What are key variations spatially • How does scale affect our view of these issues? • Going beyond the text: the issues raised in this chapter are fundamental to consideration of economic activity for the rest of the quarter

Labor How important is labor as a location factor for manufacturers? Lloyd & Dicken – my old textbook: Production workers 25% of value added, All labor 46% of value added What is value added? Value added = value of shipments - cost of goods sold

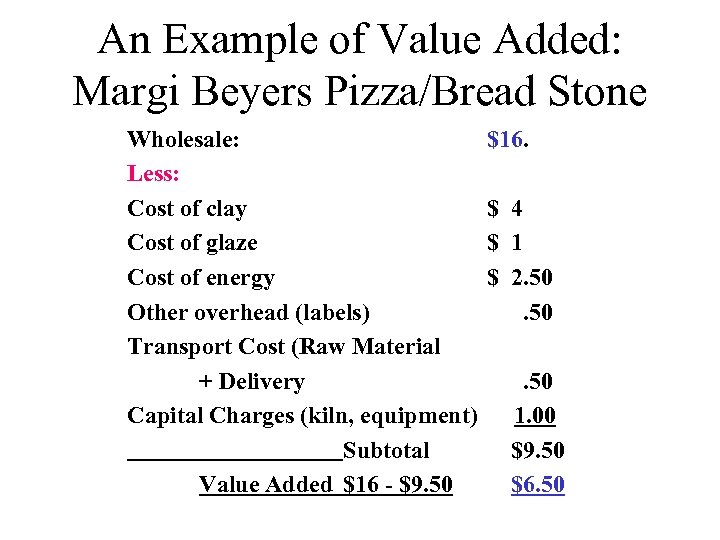

An Example of Value Added: Margi Beyers Pizza/Bread Stone Wholesale: Less: Cost of clay Cost of glaze Cost of energy Other overhead (labels) Transport Cost (Raw Material + Delivery Capital Charges (kiln, equipment) Subtotal Value Added $16 - $9. 50 $16. $ 4 $ 1 $ 2. 50. 50 1. 00 $9. 50 $6. 50

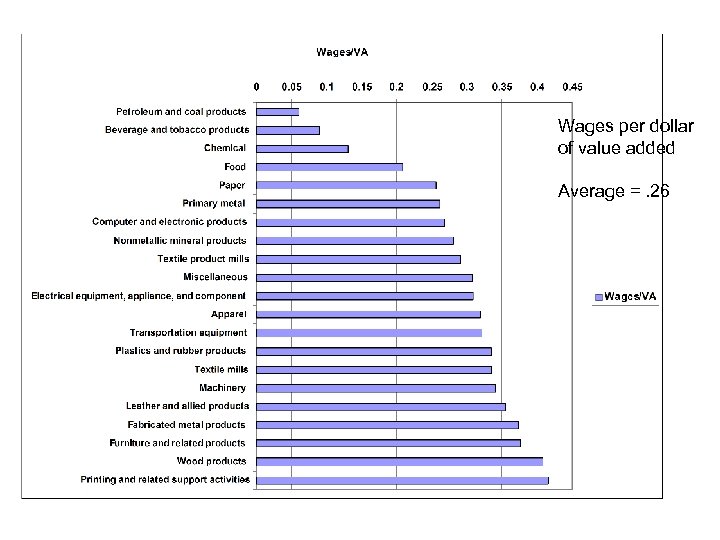

Wages per dollar of value added Average =. 26

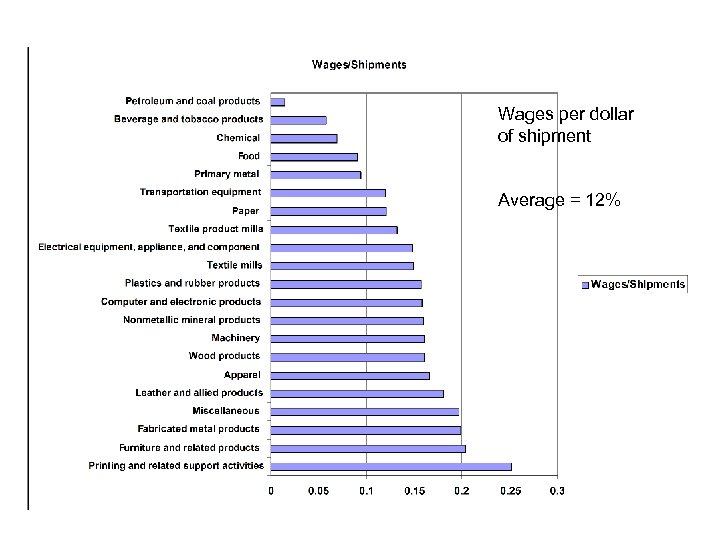

Wages per dollar of shipment Average = 12%

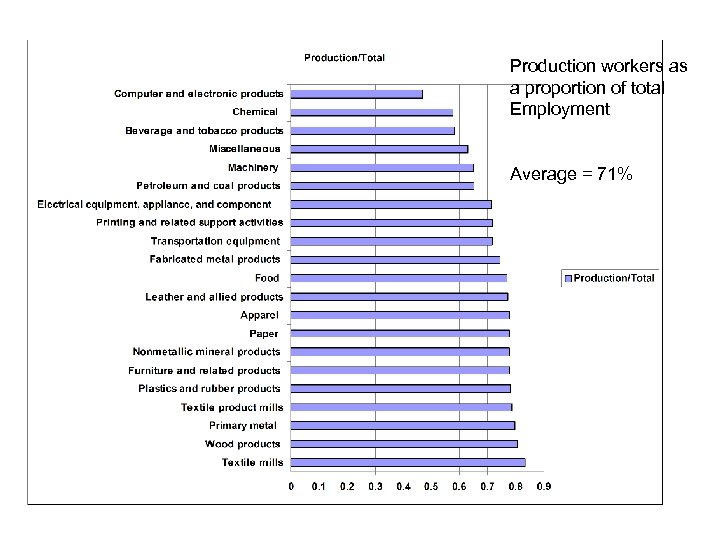

Production workers as a proportion of total Employment Average = 71%

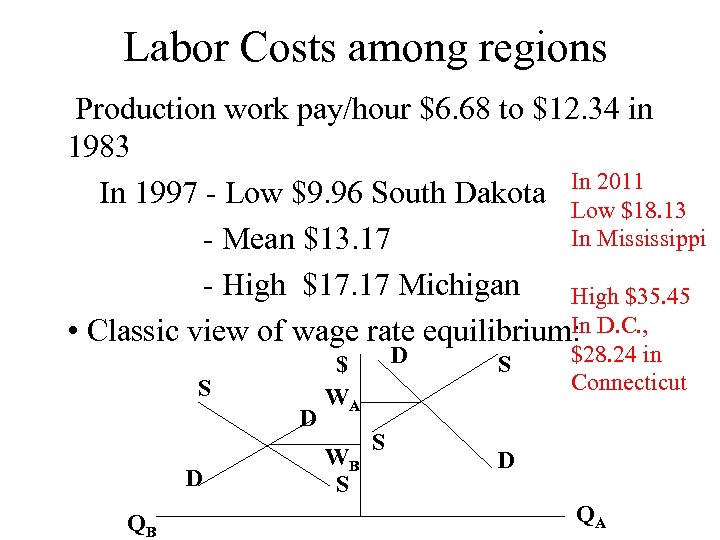

Labor Costs among regions Production work pay/hour $6. 68 to $12. 34 in 1983 In 1997 - Low $9. 96 South Dakota In 2011 Low $18. 13 In Mississippi - Mean $13. 17 - High $17. 17 Michigan High $35. 45 In • Classic view of wage rate equilibrium: D. C. , S D D QB D $ WA WB S S S $28. 24 in Connecticut D QA

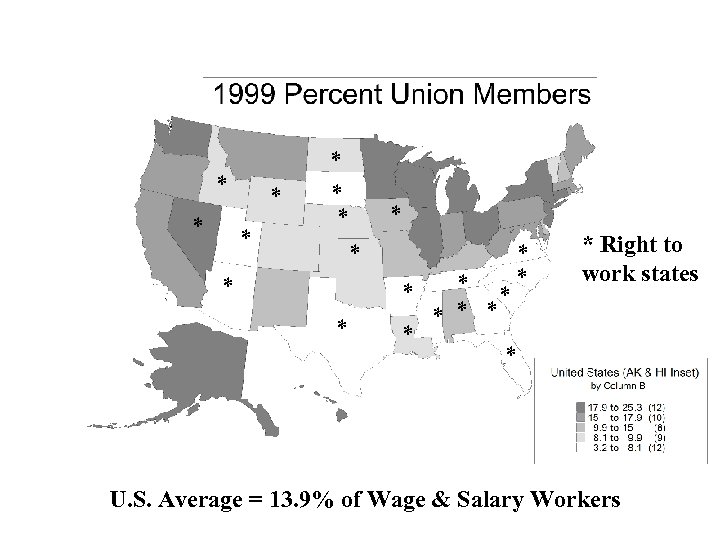

* * * * * * Right to work states * U. S. Average = 13. 9% of Wage & Salary Workers

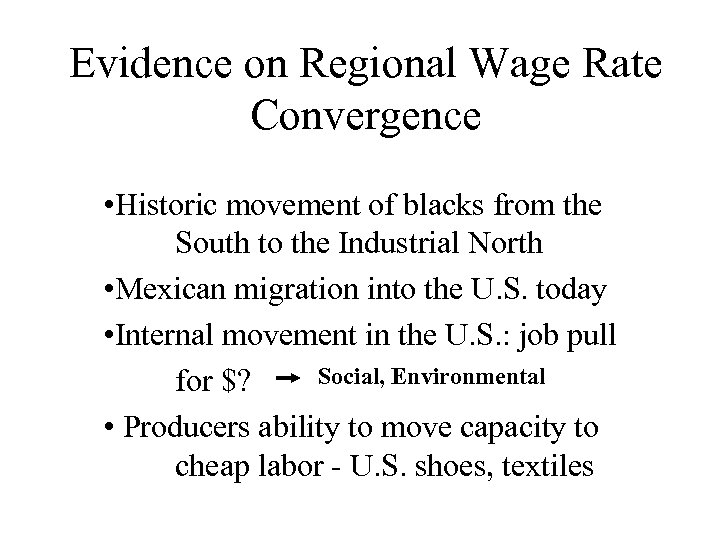

Evidence on Regional Wage Rate Convergence • Historic movement of blacks from the South to the Industrial North • Mexican migration into the U. S. today • Internal movement in the U. S. : job pull Social, Environmental for $? • Producers ability to move capacity to cheap labor - U. S. shoes, textiles

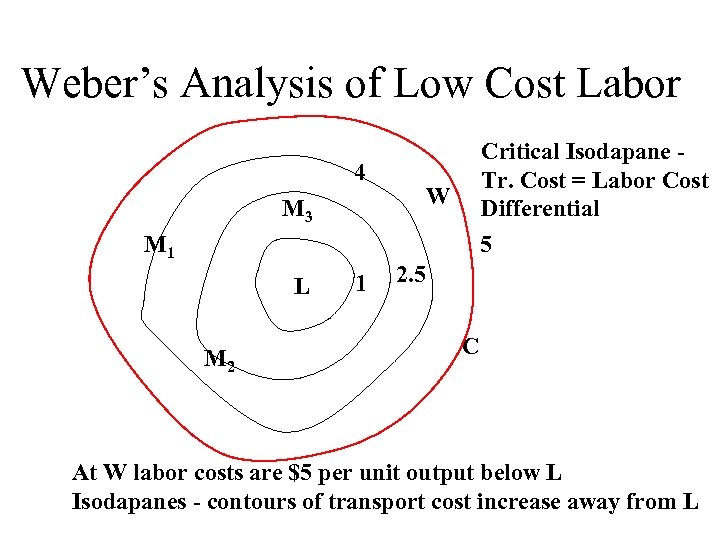

Weber’s Analysis of Low Cost Labor 4 W M 3 M 1 L M 2 1 Critical Isodapane Tr. Cost = Labor Cost Differential 5 2. 5 C At W labor costs are $5 per unit output below L Isodapanes - contours of transport cost increase away from L

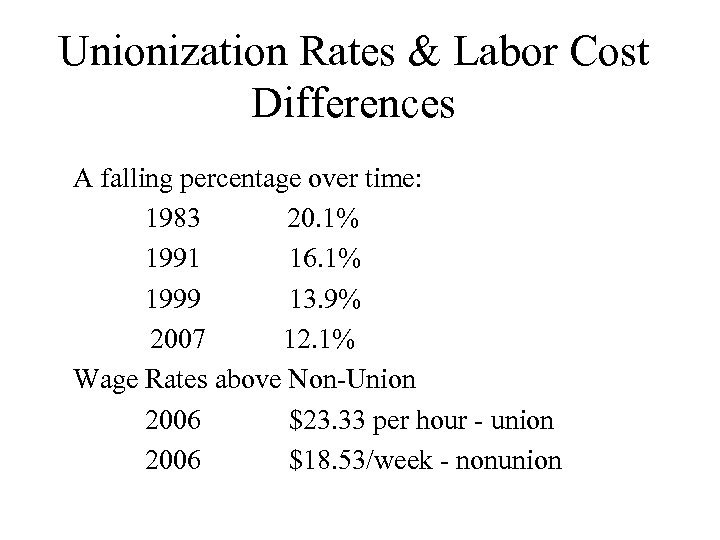

Unionization Rates & Labor Cost Differences A falling percentage over time: 1983 20. 1% 1991 16. 1% 1999 13. 9% 2007 12. 1% Wage Rates above Non-Union 2006 $23. 33 per hour - union 2006 $18. 53/week - nonunion

Labor Costs Versus Labor Productivity/Skill as a Factor in Regional Development Washington State Investment In Human Capital Study % of companies dissatisfied with employee skills: (1) Basic- ca. 35%; communication ca. 40%, problemsolving 48%, work habits - 42% (2) Educational - difficulty in finding employees: basic skills below high school: 38%, high school 56%, job related specialized skills 86%, liberal arts degree 59%, advanced degree 67%. (3) Key needs - in Training Programs, and in types of training provided.

Local Examples of Labor Force Programs • Washington State Workforce Board • Puget Sound Regional Council Prosperity Partnership • Work. Source Oregon • Idaho Workforce Development Training Program

Geographer’s New Views of Labor and Regional Advantage • Storper’s vision of “untraded interdependencies” as regional assets • Economic Sociology: - Institutionalism; embeddedness; structure and social reproduction; networks; other key factors?

Thomas Friedman – NYT Reporter • Advocate of globalization, but also the need for labor force development here in the U. S. in the face of this trend • His recent book was on the NYT best-seller list • He editorialize for support for an ex-M. I. T. president-headed report called “Rising Above the Gathering Storm. ” Link: www. nationalacademies. org

Friedman’s Ten Flatteners: • Outsourcing • Offshoring • Open- Sourcing • Insourcing • Supply Chaining • In-forming (search engines) • The Internet • Fall of the Berlin Wall • Netscape’s Public Offering • Work Flow Software • The Steroids (Digital, Mobile, Personal and Virtual) He argues together they have allowed unparalleled collaboration

Friedman Concludes about the U. S. : • Clearly, offshoring business services is intimately tied to other ongoing forms of restructuring • It provides challenges and opportunities for advanced economies as well as developing countries • There are significant research opportunities • There also many policy challenges

Capital Sources: Startup versus Later in Firm Life Startup: Personal Sources, “mattress money, ” “Business Angels, ” Venture capital, IPO’s, and business loans After Startup: Internal retention of profit, (further) stock offerings reliance on formal capital markets Selling out, being acquired to obtain capital for expansion

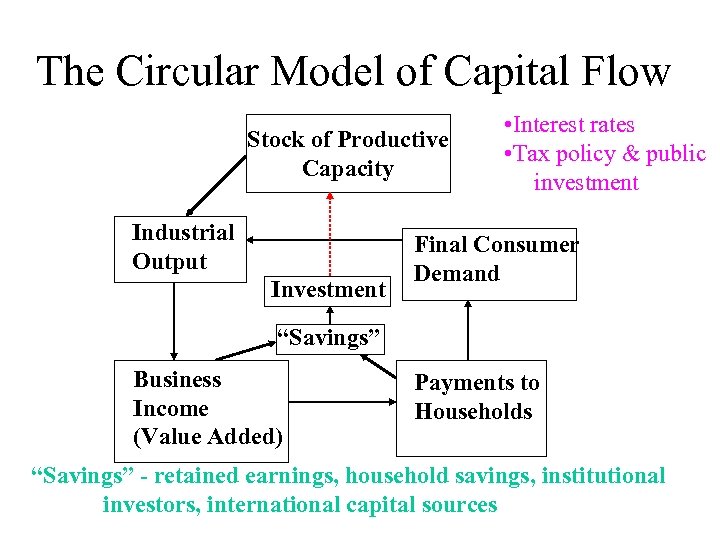

The Circular Model of Capital Flow Stock of Productive Capacity Industrial Output Investment • Interest rates • Tax policy & public investment Final Consumer Demand “Savings” Business Income (Value Added) Payments to Households “Savings” - retained earnings, household savings, institutional investors, international capital sources

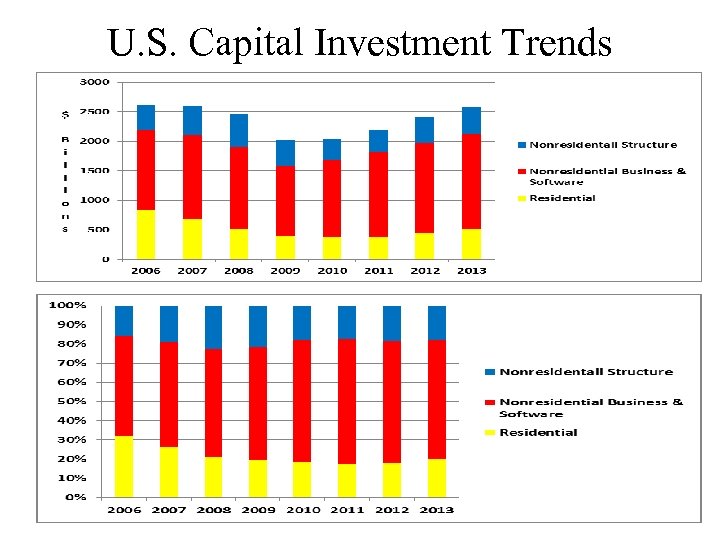

U. S. Capital Investment Trends

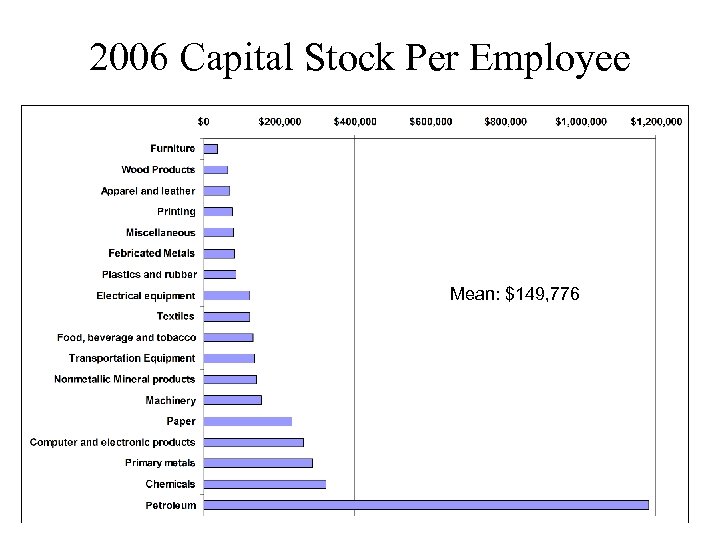

2006 Capital Stock Per Employee Mean: $149, 776

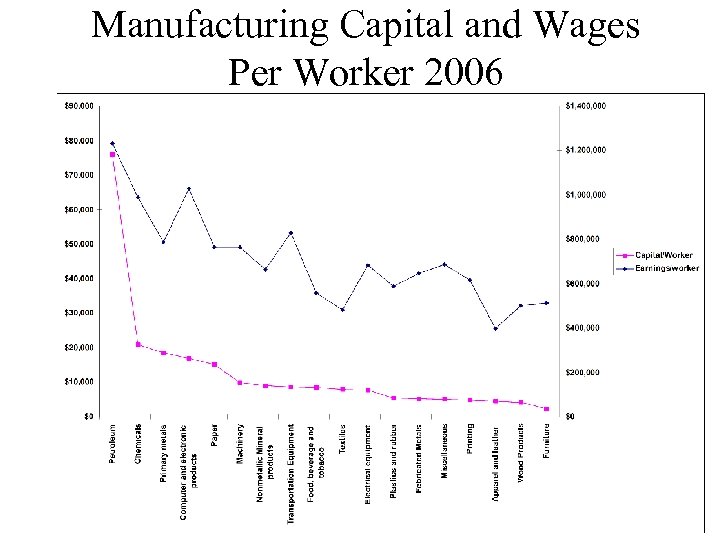

Manufacturing Capital and Wages Per Worker 2006

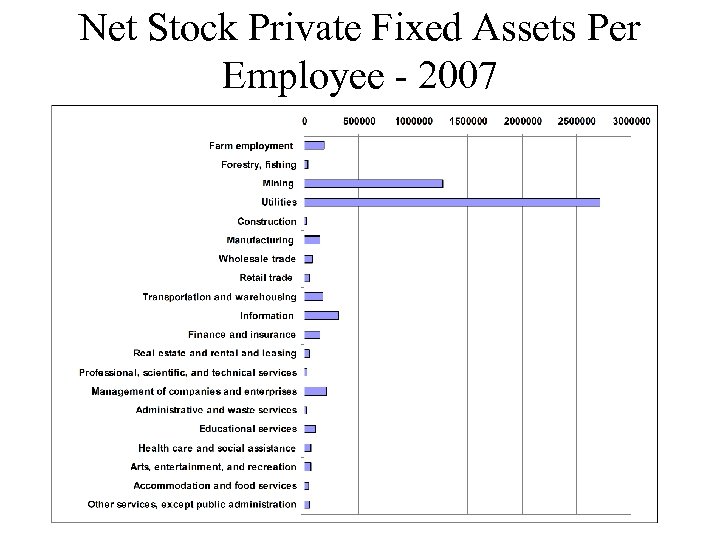

Net Stock Private Fixed Assets Per Employee - 2007

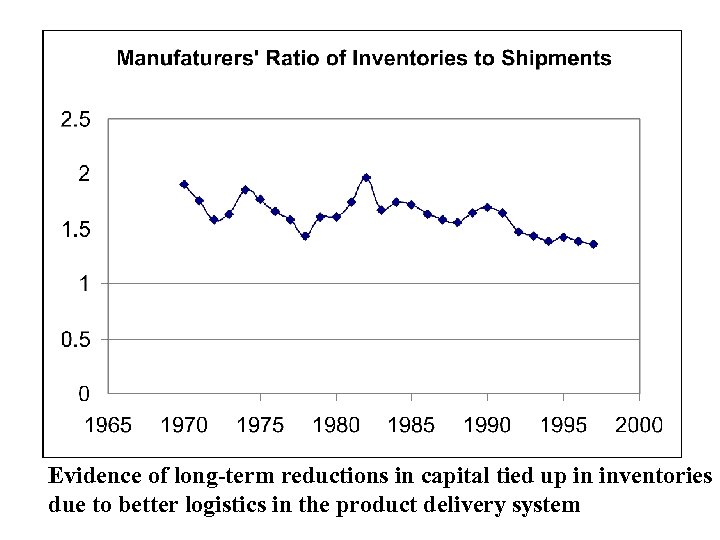

Evidence of long-term reductions in capital tied up in inventories due to better logistics in the product delivery system

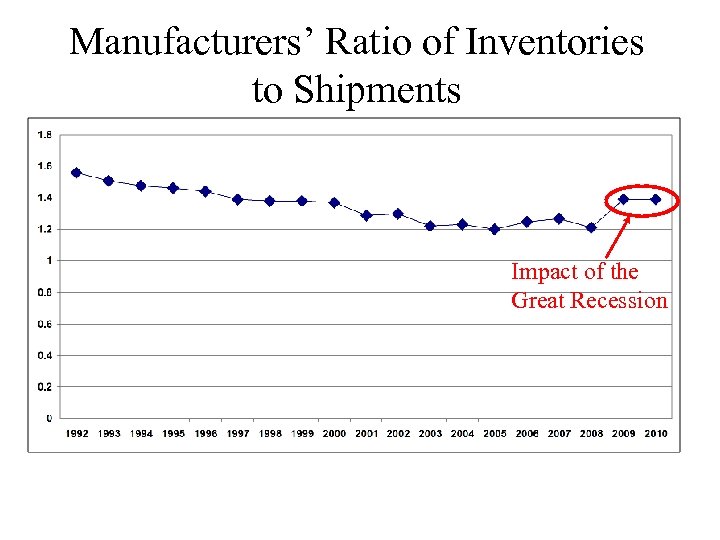

Manufacturers’ Ratio of Inventories to Shipments Impact of the Great Recession

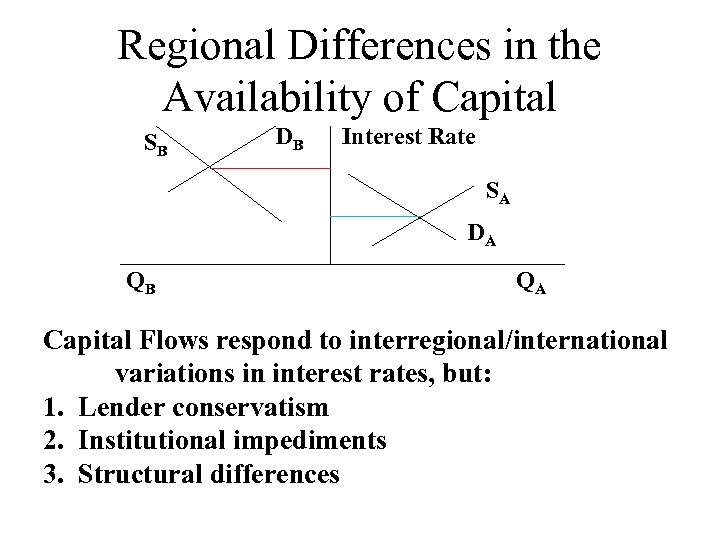

Regional Differences in the Availability of Capital SB DB Interest Rate SA DA QB QA Capital Flows respond to interregional/international variations in interest rates, but: 1. Lender conservatism 2. Institutional impediments 3. Structural differences

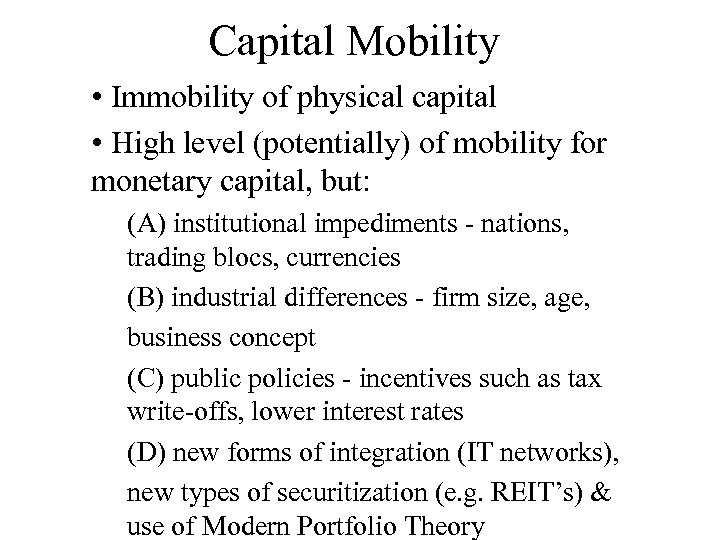

Capital Mobility • Immobility of physical capital • High level (potentially) of mobility for monetary capital, but: (A) institutional impediments - nations, trading blocs, currencies (B) industrial differences - firm size, age, business concept (C) public policies - incentives such as tax write-offs, lower interest rates (D) new forms of integration (IT networks), new types of securitization (e. g. REIT’s) & use of Modern Portfolio Theory

Spatial Variations in the Cost of Capital • Historic fragmentation of capital markets • Much more integration now, but still: A: “herding and fleeing” in commercial real estate markets B: internationalization of markets yet institutional/cultural variations in practices C: changes in investor culture: IPO’s &. com phenomena

Managerial and Technical Skills: Corporate Headquarters • The concentration of these in a few very large cities • Synergistic interactions at the top of the corporate hierarchy • Decentralization of these headquarters • Structural relationship between headquarters location and location of R&D facilities – historic geographic co-location

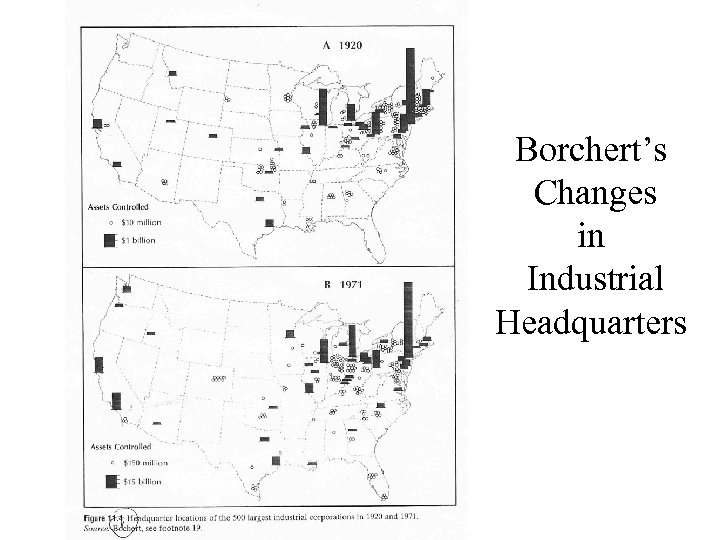

Borchert’s Changes in Industrial Headquarters

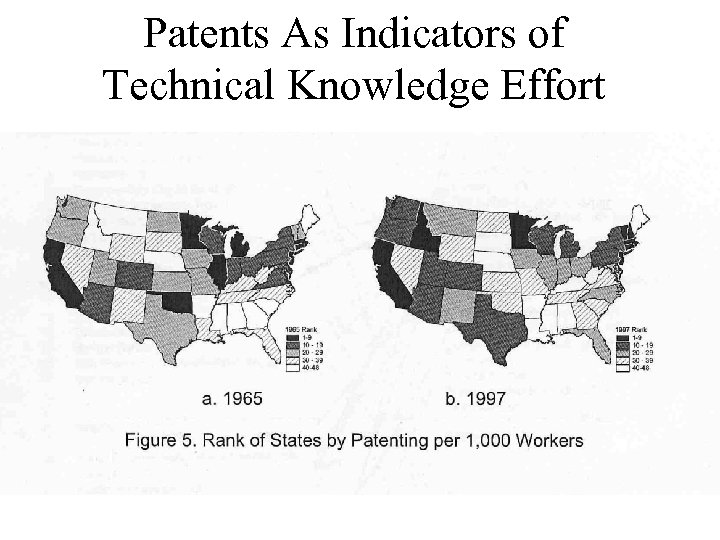

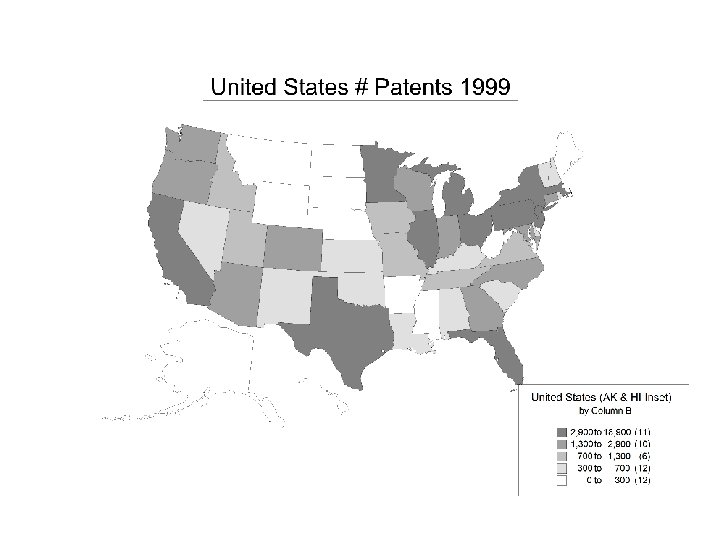

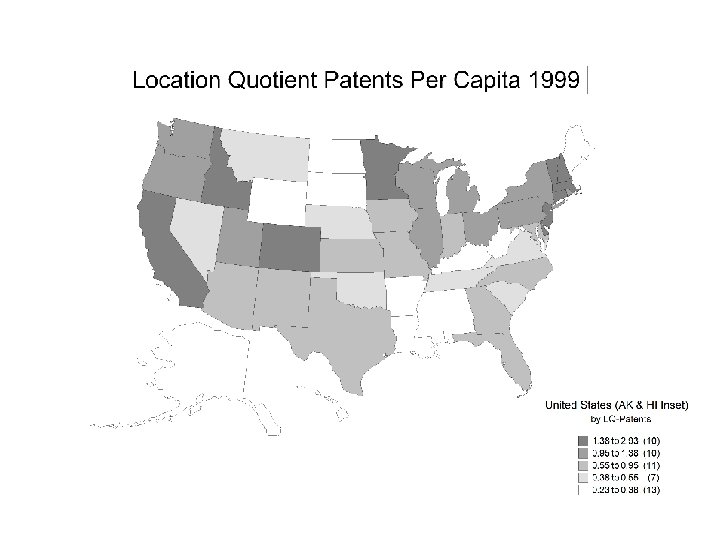

Patents As Indicators of Technical Knowledge Effort

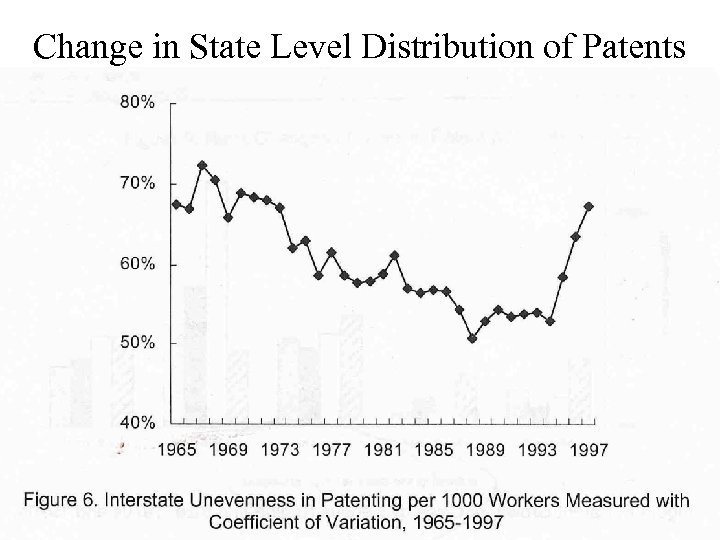

Change in State Level Distribution of Patents

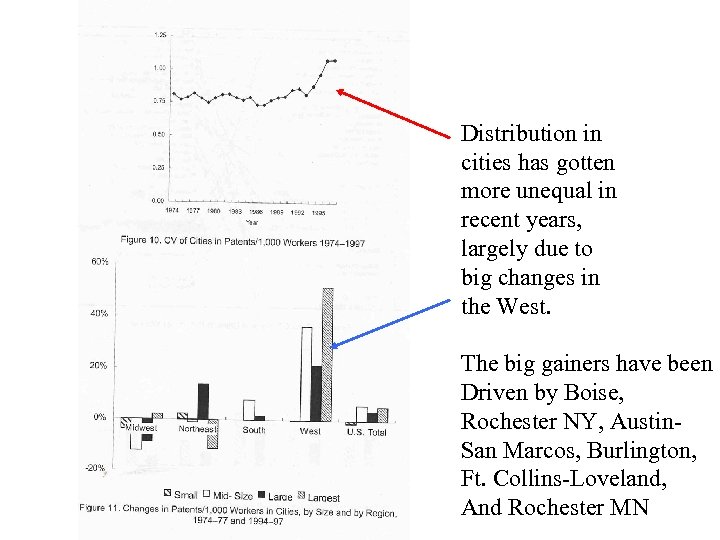

Distribution in cities has gotten more unequal in recent years, largely due to big changes in the West. The big gainers have been Driven by Boise, Rochester NY, Austin. San Marcos, Burlington, Ft. Collins-Loveland, And Rochester MN

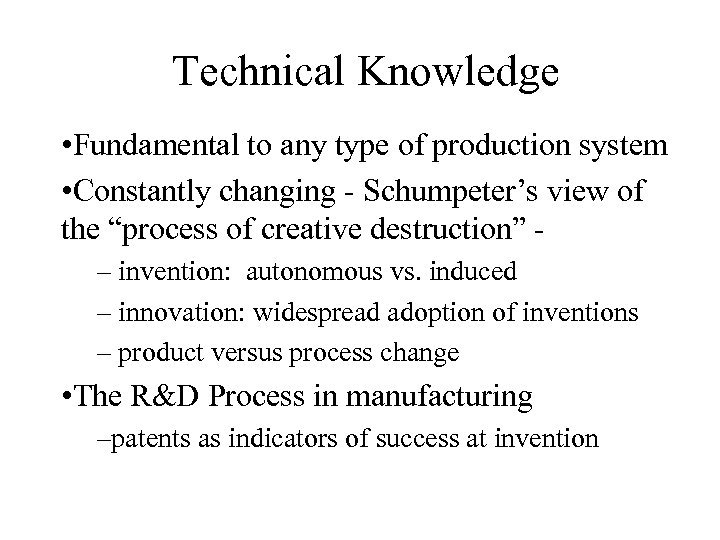

Technical Knowledge • Fundamental to any type of production system • Constantly changing - Schumpeter’s view of the “process of creative destruction” – invention: autonomous vs. induced – innovation: widespread adoption of inventions – product versus process change • The R&D Process in manufacturing –patents as indicators of success at invention

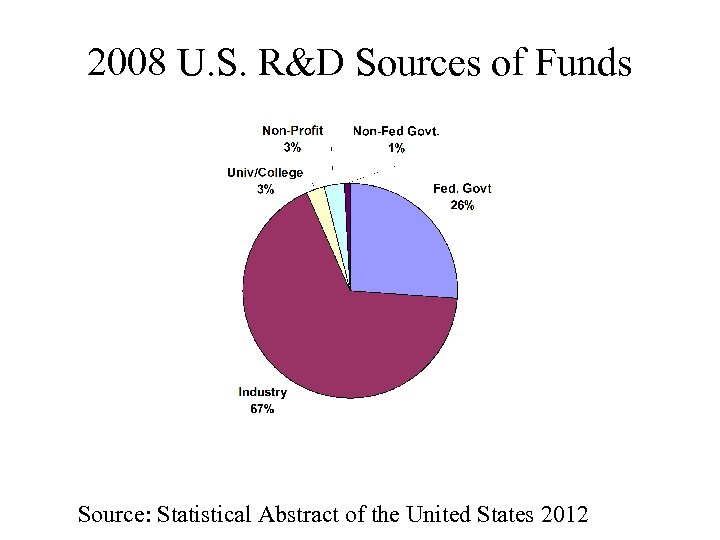

2008 U. S. R&D Sources of Funds Source: Statistical Abstract of the United States 2012

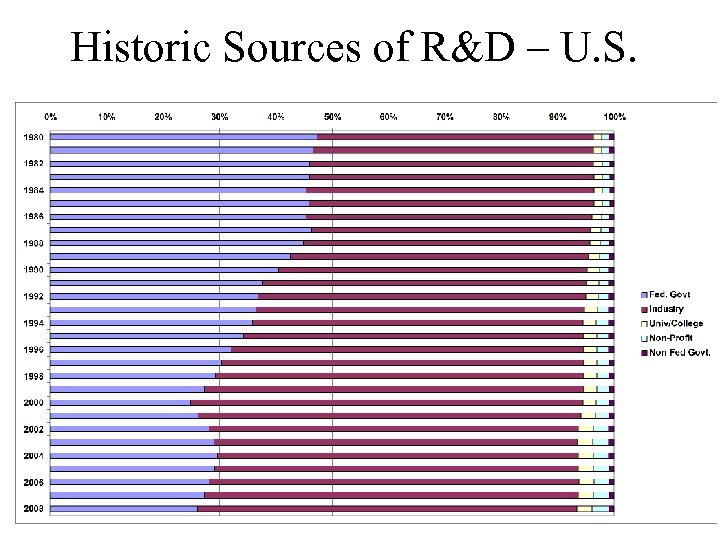

Historic Sources of R&D – U. S.

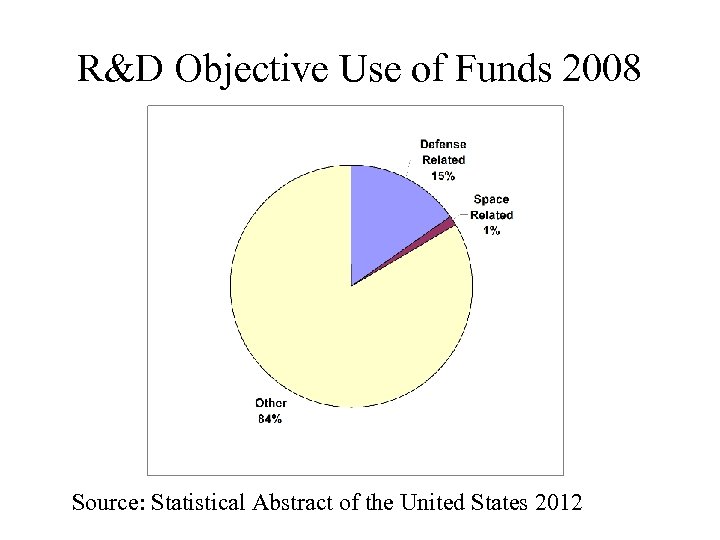

R&D Objective Use of Funds 2008 Source: Statistical Abstract of the United States 2012

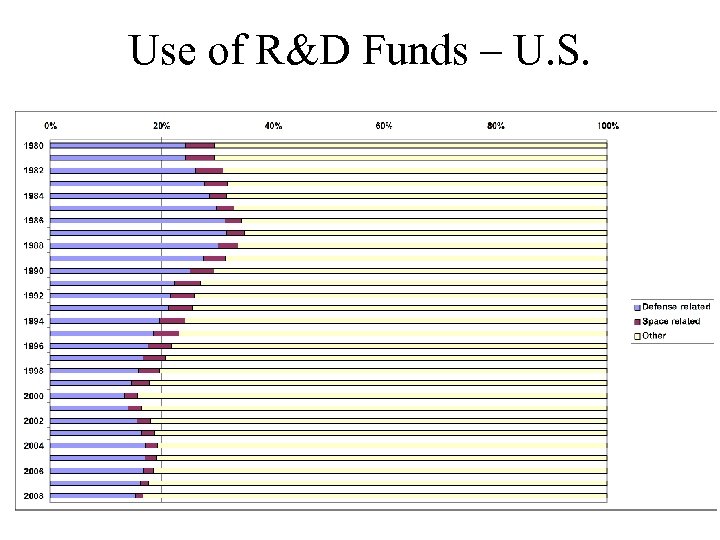

Use of R&D Funds – U. S.

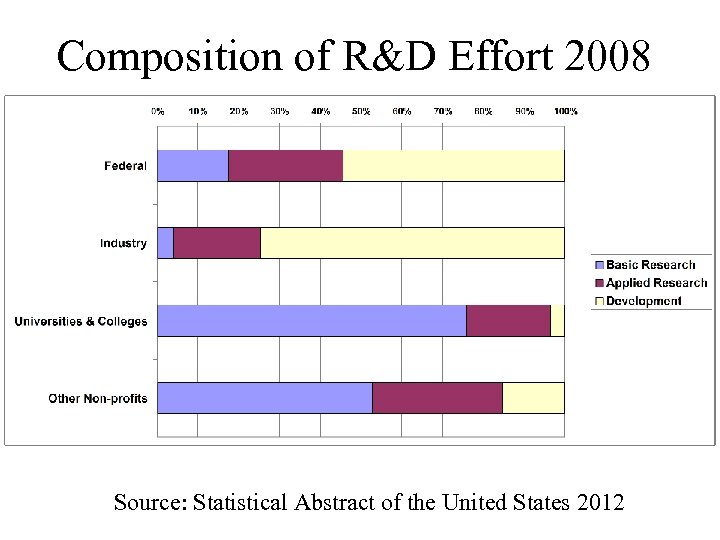

Composition of R&D Effort 2008 Source: Statistical Abstract of the United States 2012

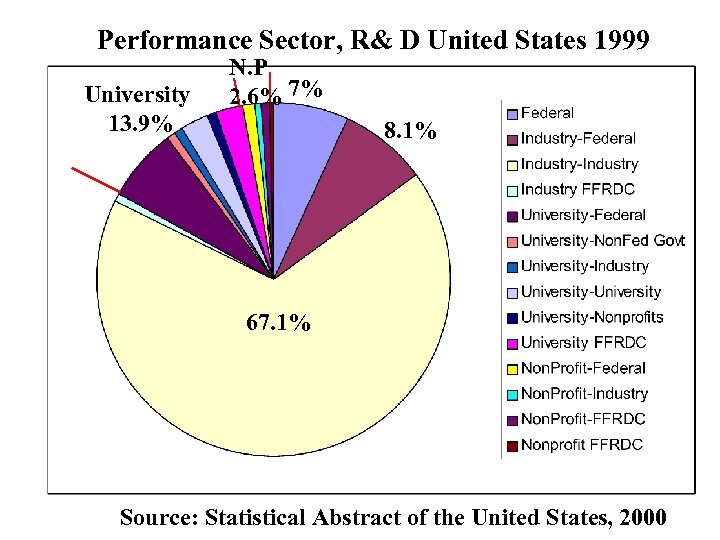

Performance Sector, R& D United States 1999 University 13. 9% N. P 2. 6% 7% 8. 1% 67. 1% Source: Statistical Abstract of the United States, 2000

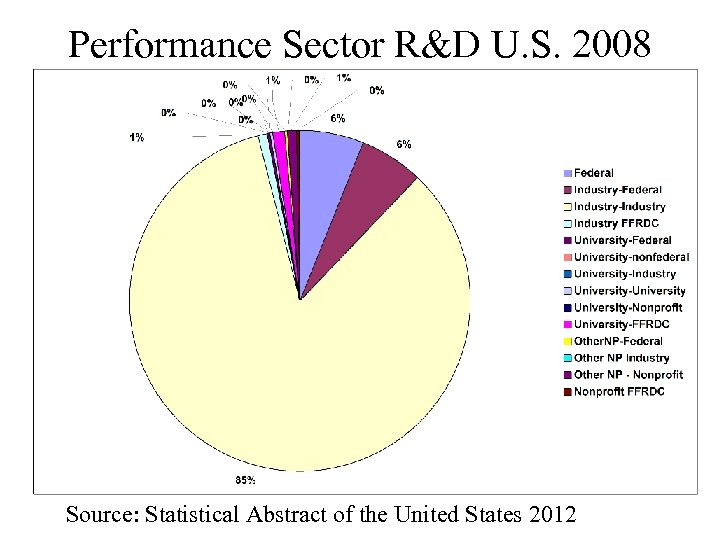

Performance Sector R&D U. S. 2008 Source: Statistical Abstract of the United States 2012

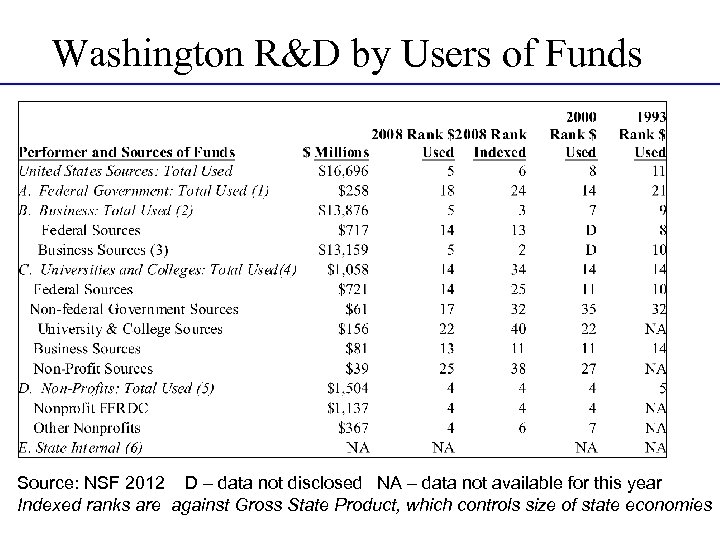

Washington R&D by Users of Funds Source: NSF 2012 D – data not disclosed NA – data not available for this year Indexed ranks are against Gross State Product, which controls size of state economies

Other Industries - $40. 9 billion Source: Statistical Abstract of the United States, 1998

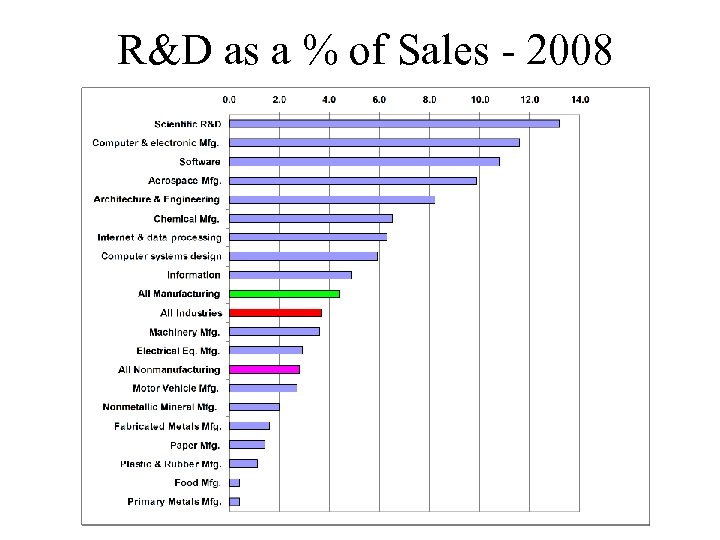

R&D as a % of Sales - 2008

Technical Knowledge Spatial Concentration of R&D activity Mobility and Availability of Technical Knowledge in Space Regional Consequences of R&D Effort Research at the UW - Impacts on local industrial development

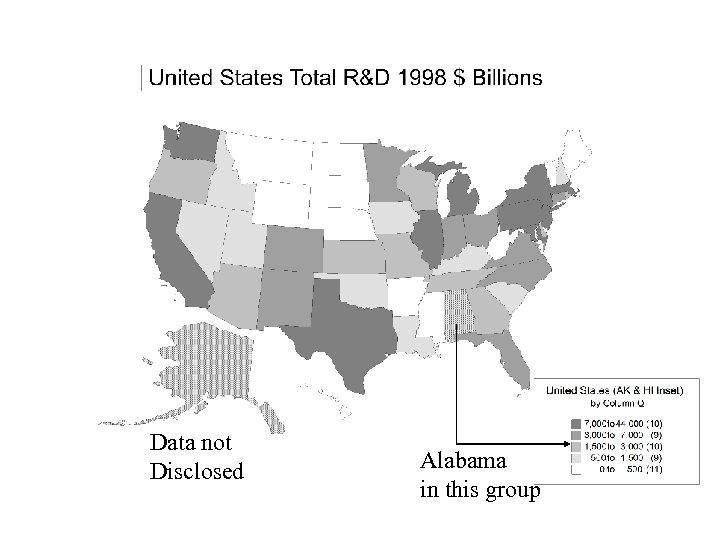

Data not Disclosed Alabama in this group

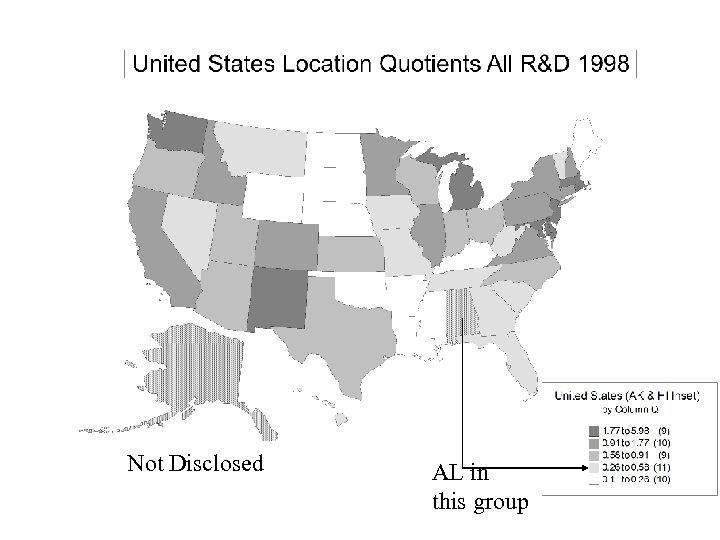

Not Disclosed AL in this group

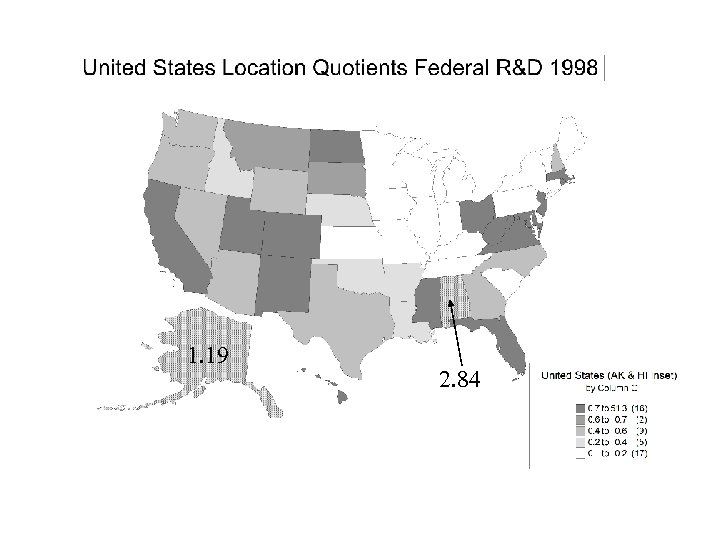

1. 19 2. 84

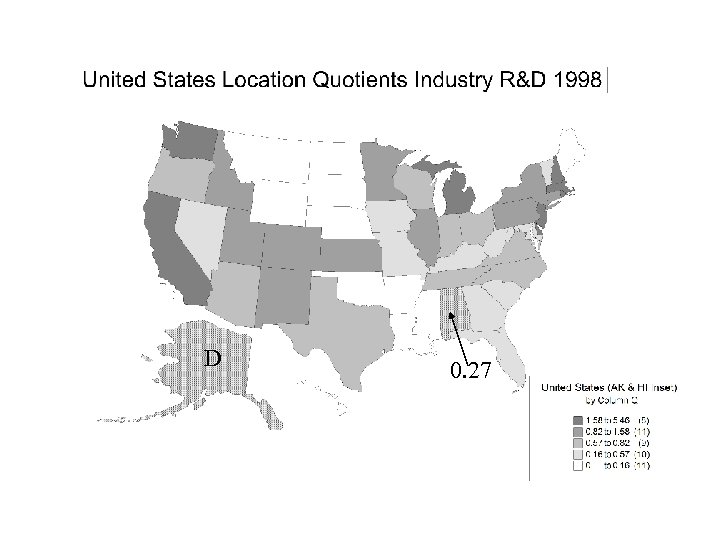

D 0. 27

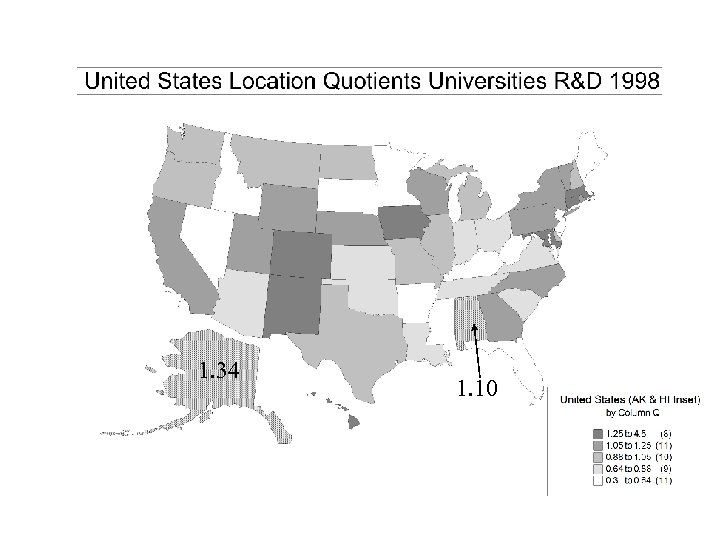

1. 34 1. 10

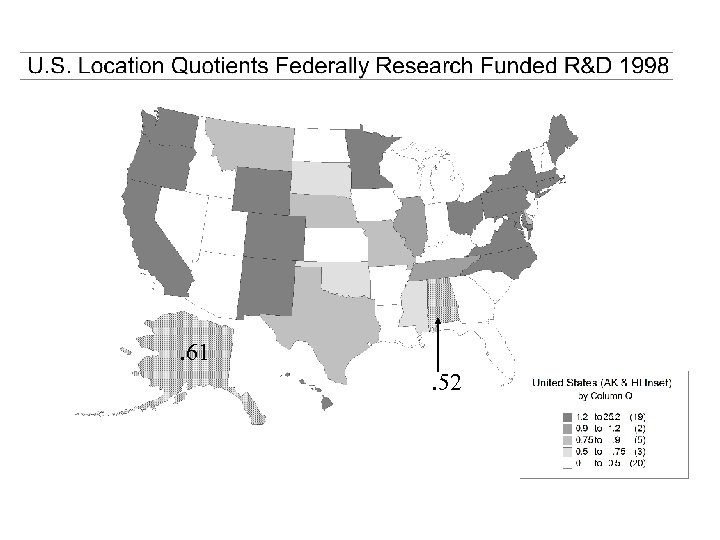

. 61. 52

2d9fc057c4590aeea28aa5b158f29645.ppt