Chapter 5.pptx

- Количество слайдов: 57

CHAPTER 5: PUBLIC SPENDING AND CHOICE Harold Washington College Economics 201 Spring 2015

CHAPTER 5: PUBLIC SPENDING/CHOICE The U. S. Postal Service delivers nearly 40% of the world’s mail. Nevertheless, its annual volume of delivered mail has declined by more than 20% since 2006. Economists classify the USPS as a governmentsponsored organization…in large part because of the $15 bil in support from gov’t loans it receives.

CHAPTER 5: PUBLIC SPENDING/CHOICE Why does the government sponsor the provision of certain items, such as mail delivery services, even though private firms otherwise could provide them?

CHAPTER 5: PUBLIC SPENDING/CHOICE What a Price System cannot do… So far we have honored the price system as the most efficient system around… However sometimes it fails to allocate resources where they are needed or will be most beneficial

CHAPTER 5: PUBLIC SPENDING/CHOICE These are called Market Failures Market Failure: A situation in which the market economy leads to too few or too many resources going to a specific economic activity Examples: Monopoly power, incomplete markets, missing markets, externalities

CHAPTER 5: PUBLIC SPENDING/CHOICE Externalities: Consequences of an economic activity that spill over to affect third parties. Pollution, for example, is an externality. Third parties: parties who are not directly involved in a given activity or transaction

CHAPTER 5: PUBLIC SPENDING/CHOICE For example: Negative: Steel Mill Positive: Trees outside HWC

CHAPTER 5: PUBLIC SPENDING/CHOICE For example: Negative: Steel Mill -Too much Q and too low P Positive: Trees outside HWC -Too low Q and too low P

CHAPTER 5: PUBLIC SPENDING/CHOICE Correcting externalities: Negative: -Special taxes like effluent fees charged to polluters which allows them to still pollute -Regulation…gov’t specifies a max allowable rate of pollution

CHAPTER 5: PUBLIC SPENDING/CHOICE Correcting externalities: Positive: -Gov’t financing and production -Subsidies (a negative tax) -Regulation (basic school education)

CHAPTER 5: PUBLIC SPENDING/CHOICE Other economic functions of gov’t -providing a legal system -promoting competition (reduce monopoly powers) -Provide Public Goods

CHAPTER 5: PUBLIC SPENDING/CHOICE Public Goods: Goods for which the principle of rival consumption does not apply and for which exclusion of nonpaying consumers is too costly to be feasible.

CHAPTER 5: PUBLIC SPENDING/CHOICE Public Goods: They can be jointly consumed by many individuals simultaneously at no additional cost and with no reduction in quality or quantity. Furthermore, no one who fails to help pay for the good can be denied the benefit of the good Nonrival in consumption and Nonexcludable

CHAPTER 5: PUBLIC SPENDING/CHOICE Public good differ, then, from private goods because private goods can be consumed by only one individual at a time and people can be easily excluded from enjoying their benefits.

CHAPTER 5: PUBLIC SPENDING/CHOICE Examples of public goods?

CHAPTER 5: PUBLIC SPENDING/CHOICE Examples of public goods? -Outdoor music concerts in public parks -National military defense -Lighthouse

CHAPTER 5: PUBLIC SPENDING/CHOICE The fundamental problem with public goods is that the private sector has a difficult, if not impossible, time providing them. Individuals in the private sector have little or no incentive to offer public goods because earning a profit from them is difficult.

CHAPTER 5: PUBLIC SPENDING/CHOICE Consequently, true public goods must be provided by the government. The flip side, however is not true…the government does not only provide public goods!

CHAPTER 5: PUBLIC SPENDING/CHOICE Raises the issue of the “Free Rider” problem: Individuals assume that others will pay for public goods so…they don’t have to!

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Government-sponsored good A good that has been deemed socially desirable through the political process. For example museums, sports stadiums, concerts, etc… People in society may not otherwise fund such a good

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Government-inhibited Goods Through the political process, goods that have been deemed socially undesirable. Heroin, cigarettes, gambling, and cocaine are examples. The government therefore taxes, regulates, or flat out prohibits such goods

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Government-inhibited Goods Government may justify relatively high taxes on alcohol and cigarettes because they are socially undesirable

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Income Redistribution For example: -Progressive Income Tax System -Transfer Payments -Transfers in kind -Education

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Income Redistribution The income tax system in the US is a progressive system meaning the more you earn, the more you pay…sort of…

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Income Redistribution Transfer Payments: Money payments made by governments to individuals for which no services or goods are rendered in return. Examples: Social Security old-age and disability benefits, and unemployment insurance benefits

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Income Redistribution Transfers in Kind: Payments that are in the form of actual goods and services, such as food stamps, subsidized public housing, and medical care, and for which no goods are services are rendered in return

CHAPTER 5: PUBLIC SPENDING/CHOICE Political Functions of Government: -Income Redistribution In theory, public education is also a form of income redistribution by making sure that the poor have access to education

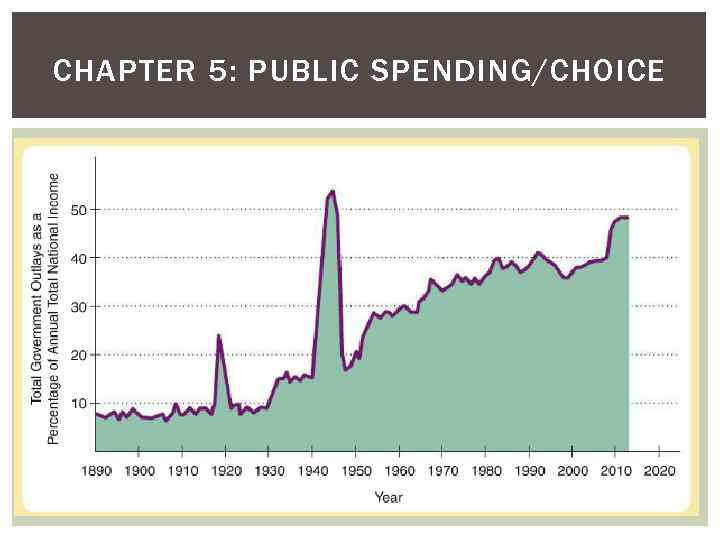

CHAPTER 5: PUBLIC SPENDING/CHOICE Public Spending and Transfer Programs Total government outlays include all government expenditures on employees, rent, electricity, and the like… Also this includes transfer payments like welfare and Social Security.

CHAPTER 5: PUBLIC SPENDING/CHOICE

CHAPTER 5: PUBLIC SPENDING/CHOICE Public Spending and Transfer Programs State government spending on the other hand is made up primarily of education, and “other” things like waste treatment, garbage collection, mosquito abatement, and the judicial system

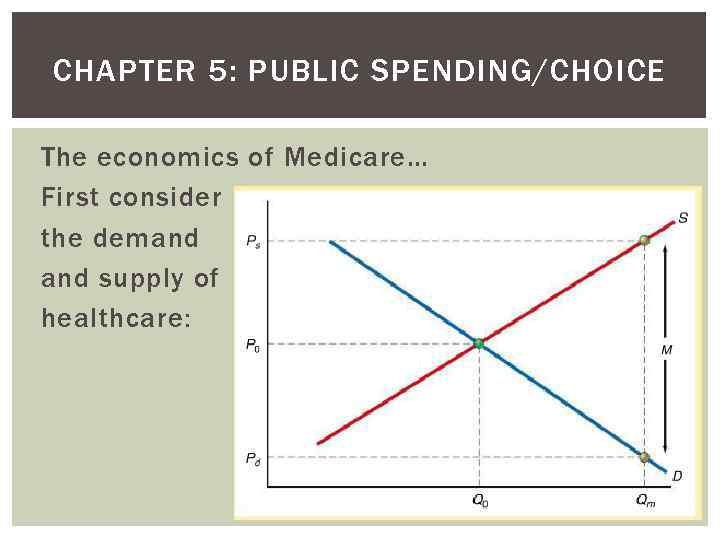

CHAPTER 5: PUBLIC SPENDING/CHOICE The economics of Medicare… First consider the demand supply of healthcare:

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: This graph is showing that despite the equilibrium price P 0 and quantity Q 0, the government decides that people need more healthcare at a lower price and offer a subsidy equal to M

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: This gives people the opportunity to consume the quantity Qm, while only paying the price Pd. Suppliers, though, will still get paid at price Ps…because the government makes up the difference with the subsidy

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: Since the founding of Medicare, many things have changed but the program has not fully adjusted to these changes: -substantially larger doctor’s salaries -private for-profit hospitals -many new procedures/tests -longer living patients

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: Every expansion of the program, including the 2004 broadening of Medicare to cover obesity as a new illness eligible for coverage and the extension of Medicare to cover patients’ prescription drug expenses beginning in 2006 has followed the same pattern.

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: The end result is that policy makers vastly underestimated the total cost of the Medicare program and the quantity of medical treatment that would be sought with the newly provided subsidies…

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: Today, Medicare’s cost is estimated to be about $550 billion per year and unfunded guarantees of Medicare spending in the future are estimated at more than $25 trillion.

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: These amounts do not even take into consideration the Medicaid program…a program similar to Medicare but aimed at helping lower income individuals. Medicaid costs more than $400 billion per year and is growing rapidly

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Medicare: So what is the difference between this and the eventual total socialization of the medical system in the US? Why not just make it similar to the system in the UK?

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Public Education One thing that all public education programs have in common (regardless of funding sources and schemes) is the provision of educational services to primary, secondary, and college students at prices well below those that would otherwise prevail in the marketplace for these services

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Public Education They essentially work the same way as the Medicare/Medicaid programs by subsidizing in order to get people to consume more and to get firms (schools) to offer more

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Public Education There are incentive issues to deal with, however… Since the 1960 s, various measures of the performance of US primary and secondary students have failed to increase even as public spending on education has risen

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Public Education For example, because the cost of education that faces parents/students has declined, the demand for educational services has risen… However the expenditures have often contributed relatively little to actual student learning

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Public Education Public schools also are essentially a monopoly…they do not face any real competition So parents who are unhappy with the services can complain…but there is little else to be done except move to a different school district

CHAPTER 5: PUBLIC SPENDING/CHOICE The Economics of Public Education Could the fact that the valuation of the last unit of services falls as the per-student subsidy rises help to explain why higher spending is not closely related to learning outcomes?

CHAPTER 5: PUBLIC SPENDING/CHOICE So with Medicare and public education spending in mind…and also remembering things like public goods, externalities, and government -sponsored goods… Let’s take a look at Collective Decision Making and how public sector decisions differ from private sector

CHAPTER 5: PUBLIC SPENDING/CHOICE Governments consist of individuals. No government actually thinks and acts. Instead, government actions are the result of decision making by individuals in their roles as elected representatives

CHAPTER 5: PUBLIC SPENDING/CHOICE So when considering how government works in the economic world, we must examine the incentives of people in government and specialinterest lobbyists who attempt to get government to do something… Collective Decision Making

CHAPTER 5: PUBLIC SPENDING/CHOICE Collective Decision Making: How voters politicians, and other interested parties act and how these actions influence nonmarket decisions Theory of public choice: The study of collective decision making

CHAPTER 5: PUBLIC SPENDING/CHOICE At the heart of the matter is that public and private decision making is similar in the sense that individuals in both cases will make decisions from a selfish or self-serving point of view…rational economic agents!

CHAPTER 5: PUBLIC SPENDING/CHOICE There are therefore similarities like… Opportunity costs, competition for public resources, and similarity of individuals (public and private sector people are basically the same)

CHAPTER 5: PUBLIC SPENDING/CHOICE Where they start to differ, however, is in places like… The incentives structure -What happens if Google or Apple do not perform up to their customers’ and shareholders’ expectations? -What happens if the USPS is not performing up to the highest standards?

CHAPTER 5: PUBLIC SPENDING/CHOICE Where they start to differ, however, is in places like… Government Goods and Services at zero price… Even though the consumer does not pay, there is still a price and an opportunity cost… Where are your tax dollars going? Without the direct relationship it is hard to account for

CHAPTER 5: PUBLIC SPENDING/CHOICE Where they start to differ, however, is in places like… Use of force…governments can just resort to using force to get their way… Expropriation means that if you don’t pay taxes the government will just take your wages…

CHAPTER 5: PUBLIC SPENDING/CHOICE Where they start to differ, however, is in places like… Voting vs. Spending In a political system, one person is supposed to get one vote…majority rule therefore is supposed to prevail

CHAPTER 5: PUBLIC SPENDING/CHOICE Where they start to differ, however, is in places like… Voting vs. Spending In a market system, however, proportional rule wins…meaning decisions are made based on dollars available to the decision maker

CHAPTER 5: PUBLIC SPENDING/CHOICE Where they start to differ, however, is in places like… Voting vs. Spending Despite the apparent issue of fairness, there is a higher level of efficiency with the market system

Chapter 5.pptx