21d8c374ef300eda8bf1c3832bef211d.ppt

- Количество слайдов: 28

CHAPTER 5 Mc. Graw-Hill/Irwin The Time Value of Money Copyright © 2012 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

CHAPTER 5 Mc. Graw-Hill/Irwin The Time Value of Money Copyright © 2012 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Time Value of Money has a time value. It can be expressed in multiple ways: A dollar today held in savings will grow. A dollar received in a year is not worth as much as a dollar received today. 5 -2

Time Value of Money has a time value. It can be expressed in multiple ways: A dollar today held in savings will grow. A dollar received in a year is not worth as much as a dollar received today. 5 -2

Future Values Future Value: Amount to which an investment will grow after earning interest. Let r = annual interest rate Let t = # of years Simple Interest Compound Interest 5 -3

Future Values Future Value: Amount to which an investment will grow after earning interest. Let r = annual interest rate Let t = # of years Simple Interest Compound Interest 5 -3

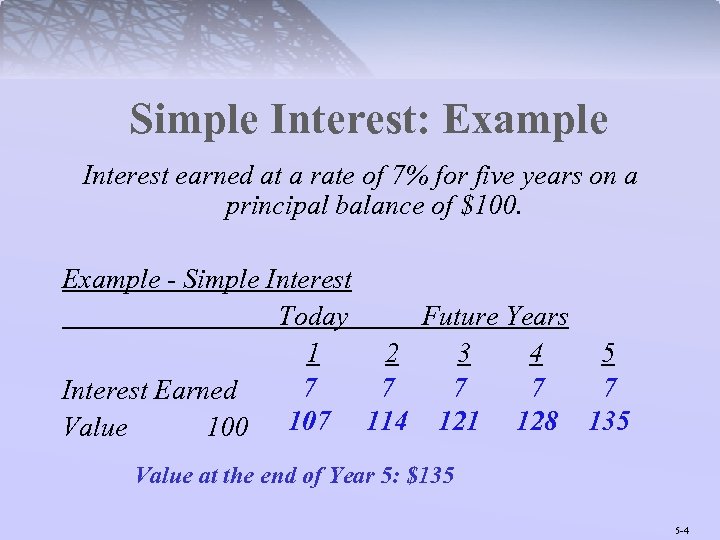

Simple Interest: Example Interest earned at a rate of 7% for five years on a principal balance of $100. Example - Simple Interest Today Future Years 1 2 3 4 5 7 7 7 Interest Earned Value 100 107 114 121 128 135 Value at the end of Year 5: $135 5 -4

Simple Interest: Example Interest earned at a rate of 7% for five years on a principal balance of $100. Example - Simple Interest Today Future Years 1 2 3 4 5 7 7 7 Interest Earned Value 100 107 114 121 128 135 Value at the end of Year 5: $135 5 -4

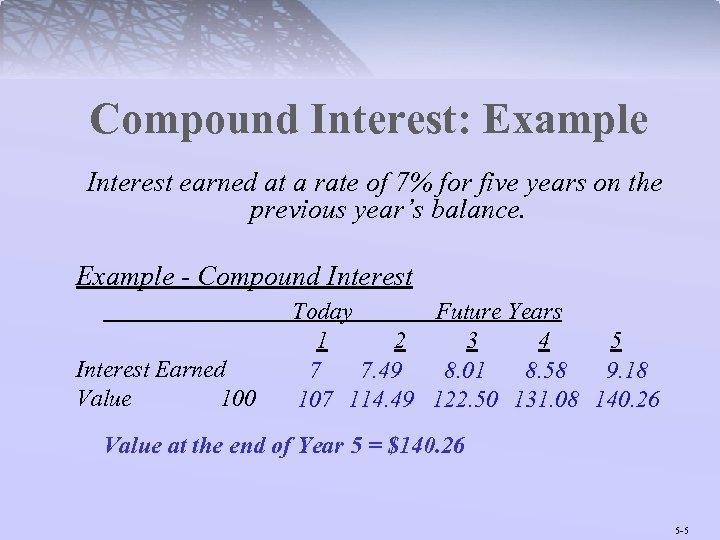

Compound Interest: Example Interest earned at a rate of 7% for five years on the previous year’s balance. Example - Compound Interest Earned Value 100 Today Future Years 1 2 3 4 5 7 7. 49 8. 01 8. 58 9. 18 107 114. 49 122. 50 131. 08 140. 26 Value at the end of Year 5 = $140. 26 5 -5

Compound Interest: Example Interest earned at a rate of 7% for five years on the previous year’s balance. Example - Compound Interest Earned Value 100 Today Future Years 1 2 3 4 5 7 7. 49 8. 01 8. 58 9. 18 107 114. 49 122. 50 131. 08 140. 26 Value at the end of Year 5 = $140. 26 5 -5

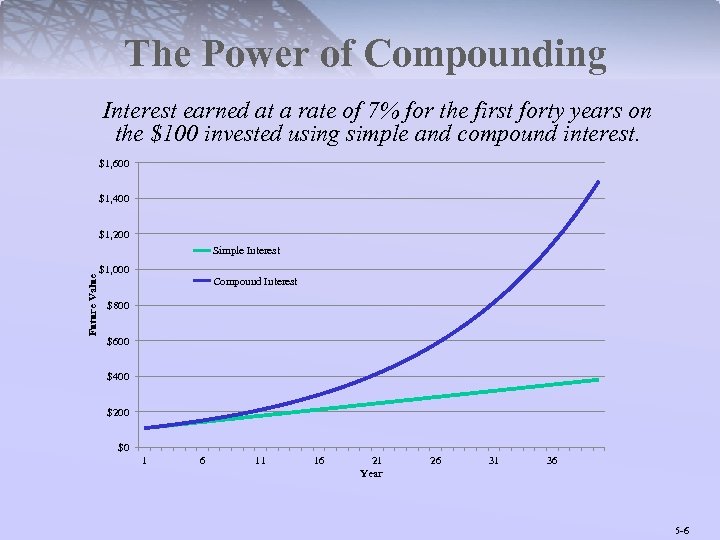

The Power of Compounding Interest earned at a rate of 7% for the first forty years on the $100 invested using simple and compound interest. $1, 600 $1, 400 $1, 200 Future Value Simple Interest $1, 000 Compound Interest $800 $600 $400 $200 $0 1 6 11 16 21 Year 26 31 36 5 -6

The Power of Compounding Interest earned at a rate of 7% for the first forty years on the $100 invested using simple and compound interest. $1, 600 $1, 400 $1, 200 Future Value Simple Interest $1, 000 Compound Interest $800 $600 $400 $200 $0 1 6 11 16 21 Year 26 31 36 5 -6

Present Value What is it? Why is it useful? 5 -7

Present Value What is it? Why is it useful? 5 -7

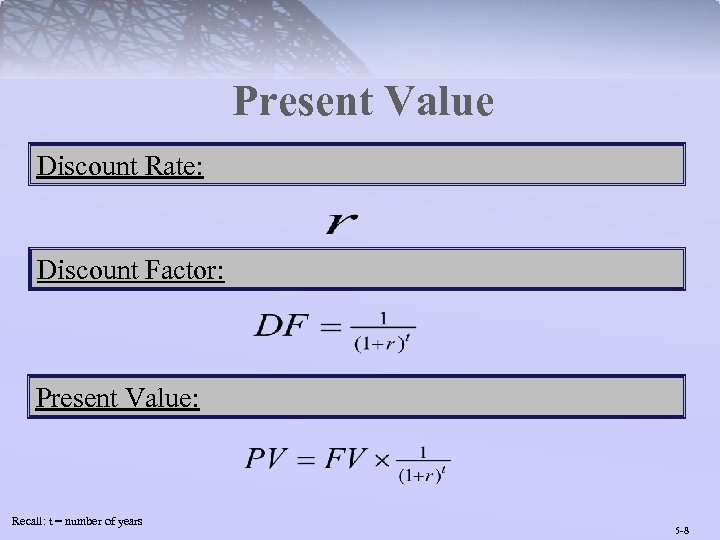

Present Value Discount Rate: Discount Factor: Present Value: Recall: t = number of years 5 -8

Present Value Discount Rate: Discount Factor: Present Value: Recall: t = number of years 5 -8

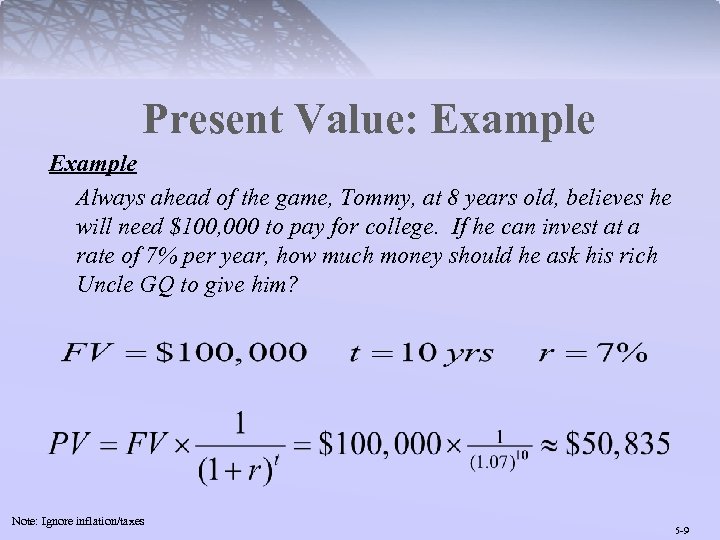

Present Value: Example Always ahead of the game, Tommy, at 8 years old, believes he will need $100, 000 to pay for college. If he can invest at a rate of 7% per year, how much money should he ask his rich Uncle GQ to give him? Note: Ignore inflation/taxes 5 -9

Present Value: Example Always ahead of the game, Tommy, at 8 years old, believes he will need $100, 000 to pay for college. If he can invest at a rate of 7% per year, how much money should he ask his rich Uncle GQ to give him? Note: Ignore inflation/taxes 5 -9

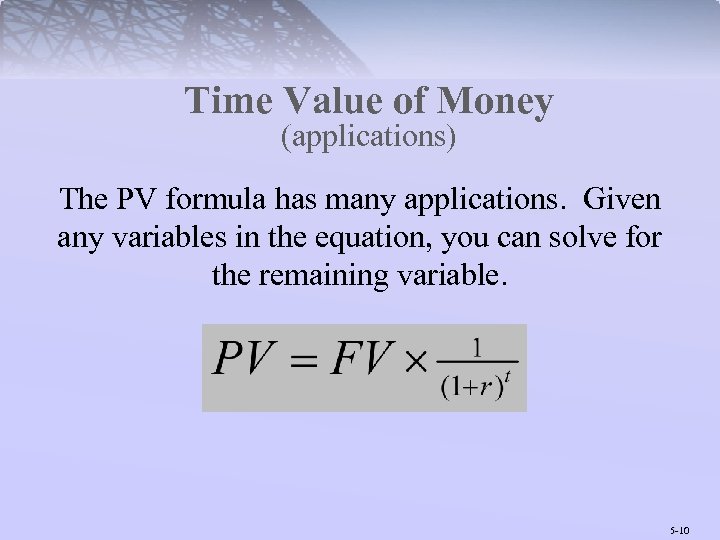

Time Value of Money (applications) The PV formula has many applications. Given any variables in the equation, you can solve for the remaining variable. 5 -10

Time Value of Money (applications) The PV formula has many applications. Given any variables in the equation, you can solve for the remaining variable. 5 -10

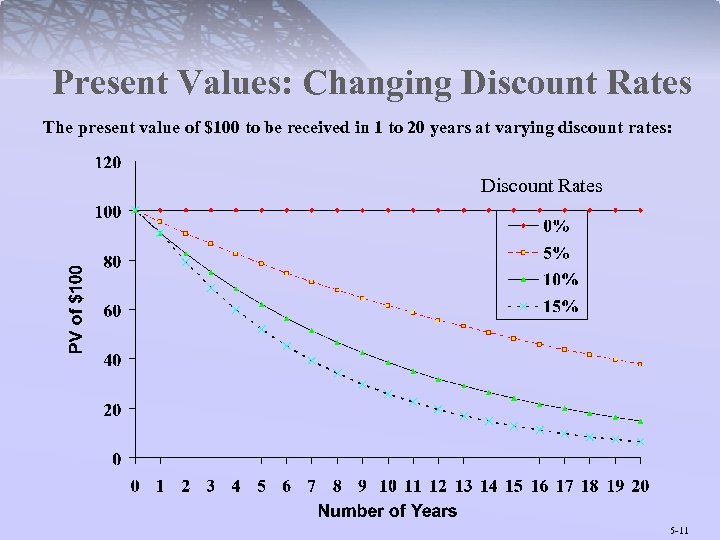

Present Values: Changing Discount Rates The present value of $100 to be received in 1 to 20 years at varying discount rates: Discount Rates 5 -11

Present Values: Changing Discount Rates The present value of $100 to be received in 1 to 20 years at varying discount rates: Discount Rates 5 -11

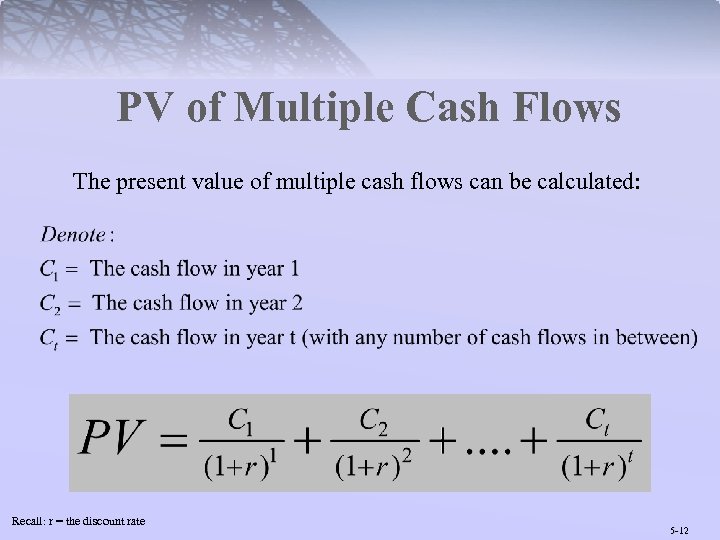

PV of Multiple Cash Flows The present value of multiple cash flows can be calculated: Recall: r = the discount rate 5 -12

PV of Multiple Cash Flows The present value of multiple cash flows can be calculated: Recall: r = the discount rate 5 -12

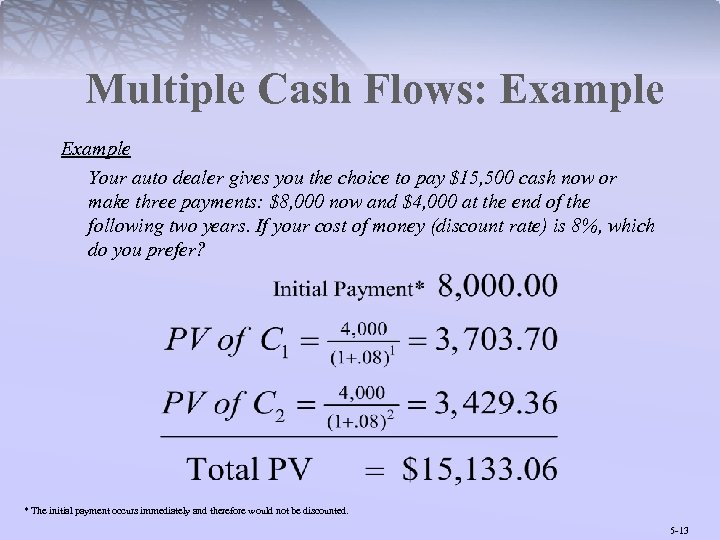

Multiple Cash Flows: Example Your auto dealer gives you the choice to pay $15, 500 cash now or make three payments: $8, 000 now and $4, 000 at the end of the following two years. If your cost of money (discount rate) is 8%, which do you prefer? * The initial payment occurs immediately and therefore would not be discounted. 5 -13

Multiple Cash Flows: Example Your auto dealer gives you the choice to pay $15, 500 cash now or make three payments: $8, 000 now and $4, 000 at the end of the following two years. If your cost of money (discount rate) is 8%, which do you prefer? * The initial payment occurs immediately and therefore would not be discounted. 5 -13

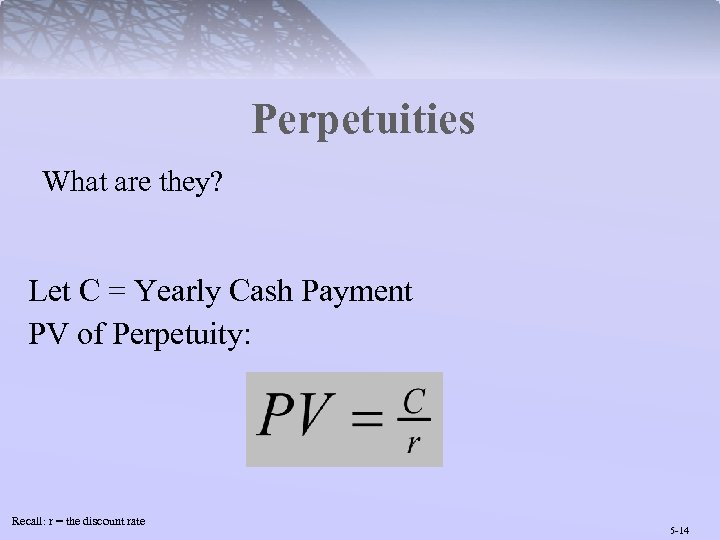

Perpetuities What are they? Let C = Yearly Cash Payment PV of Perpetuity: Recall: r = the discount rate 5 -14

Perpetuities What are they? Let C = Yearly Cash Payment PV of Perpetuity: Recall: r = the discount rate 5 -14

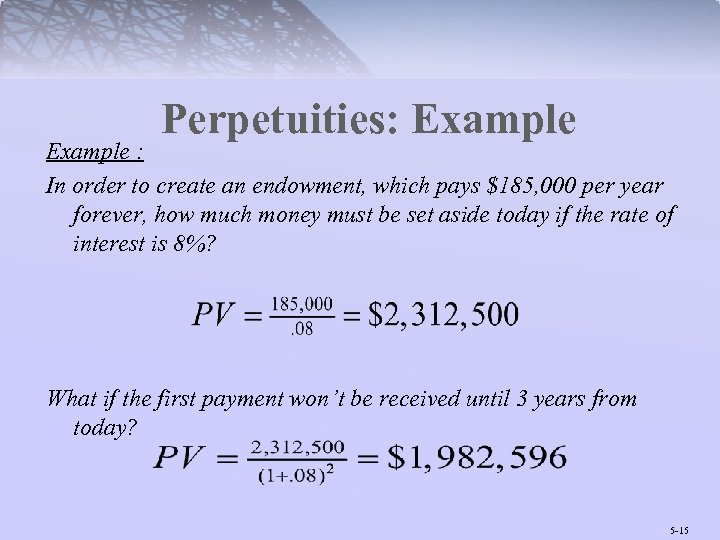

Perpetuities: Example : In order to create an endowment, which pays $185, 000 per year forever, how much money must be set aside today if the rate of interest is 8%? What if the first payment won’t be received until 3 years from today? 5 -15

Perpetuities: Example : In order to create an endowment, which pays $185, 000 per year forever, how much money must be set aside today if the rate of interest is 8%? What if the first payment won’t be received until 3 years from today? 5 -15

Annuities What are they? Annuities are equally-spaced, level streams of cash flows lasting for a limited period of time. Why are they useful? 5 -16

Annuities What are they? Annuities are equally-spaced, level streams of cash flows lasting for a limited period of time. Why are they useful? 5 -16

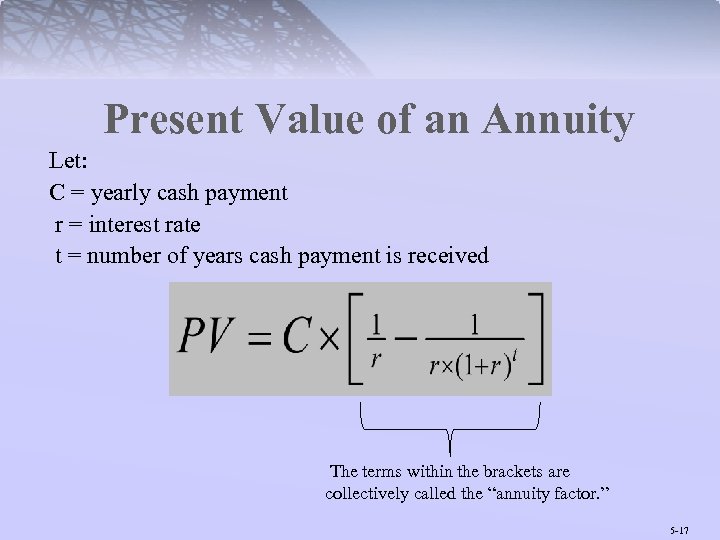

Present Value of an Annuity Let: C = yearly cash payment r = interest rate t = number of years cash payment is received The terms within the brackets are collectively called the “annuity factor. ” 5 -17

Present Value of an Annuity Let: C = yearly cash payment r = interest rate t = number of years cash payment is received The terms within the brackets are collectively called the “annuity factor. ” 5 -17

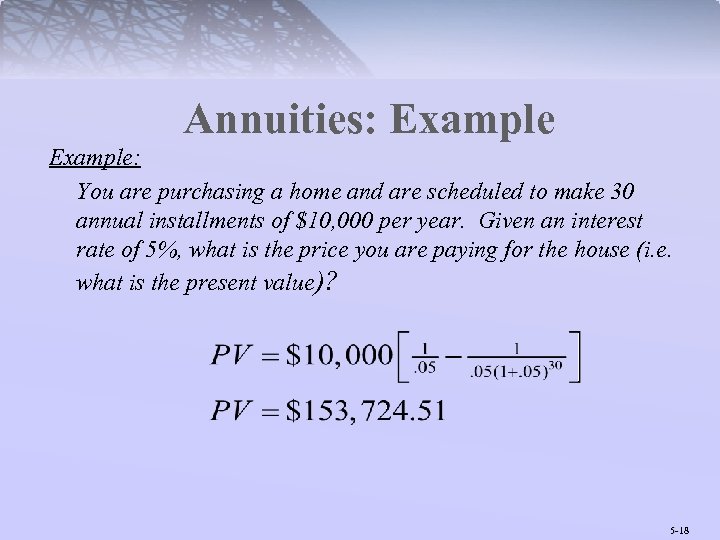

Annuities: Example: You are purchasing a home and are scheduled to make 30 annual installments of $10, 000 per year. Given an interest rate of 5%, what is the price you are paying for the house (i. e. what is the present value)? 5 -18

Annuities: Example: You are purchasing a home and are scheduled to make 30 annual installments of $10, 000 per year. Given an interest rate of 5%, what is the price you are paying for the house (i. e. what is the present value)? 5 -18

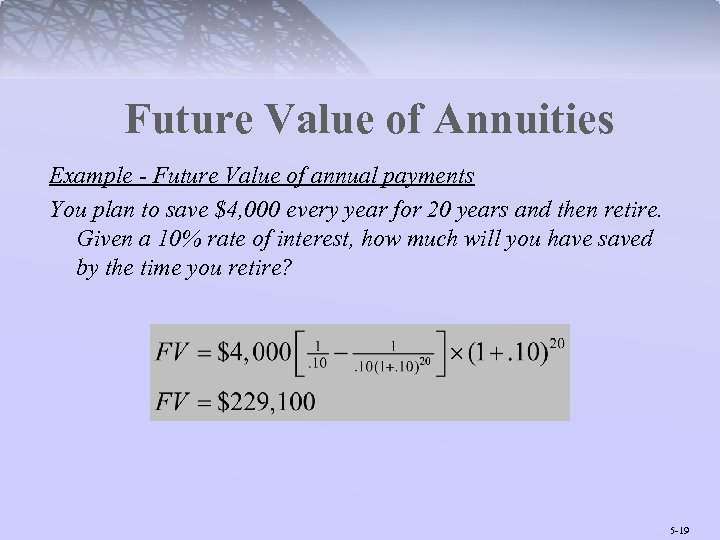

Future Value of Annuities Example - Future Value of annual payments You plan to save $4, 000 every year for 20 years and then retire. Given a 10% rate of interest, how much will you have saved by the time you retire? 5 -19

Future Value of Annuities Example - Future Value of annual payments You plan to save $4, 000 every year for 20 years and then retire. Given a 10% rate of interest, how much will you have saved by the time you retire? 5 -19

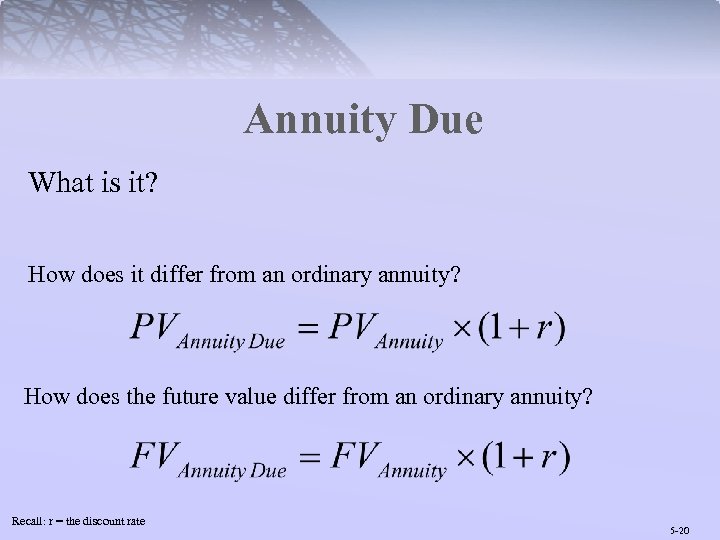

Annuity Due What is it? How does it differ from an ordinary annuity? How does the future value differ from an ordinary annuity? Recall: r = the discount rate 5 -20

Annuity Due What is it? How does it differ from an ordinary annuity? How does the future value differ from an ordinary annuity? Recall: r = the discount rate 5 -20

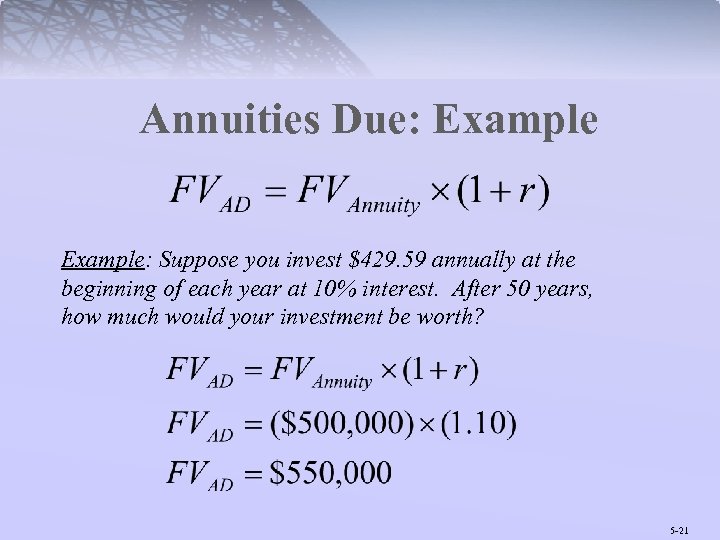

Annuities Due: Example: Suppose you invest $429. 59 annually at the beginning of each year at 10% interest. After 50 years, how much would your investment be worth? 5 -21

Annuities Due: Example: Suppose you invest $429. 59 annually at the beginning of each year at 10% interest. After 50 years, how much would your investment be worth? 5 -21

Interest Rates: EAR & APR What is EAR? What is APR? How do they differ? 5 -22

Interest Rates: EAR & APR What is EAR? What is APR? How do they differ? 5 -22

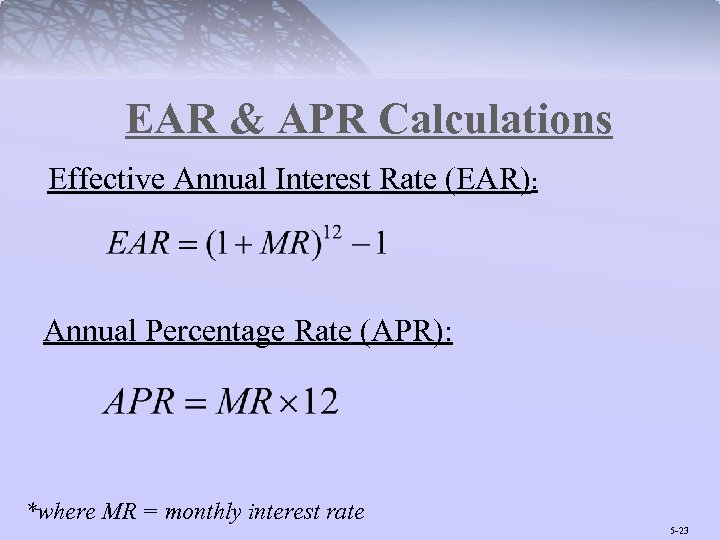

EAR & APR Calculations Effective Annual Interest Rate (EAR): Annual Percentage Rate (APR): *where MR = monthly interest rate 5 -23

EAR & APR Calculations Effective Annual Interest Rate (EAR): Annual Percentage Rate (APR): *where MR = monthly interest rate 5 -23

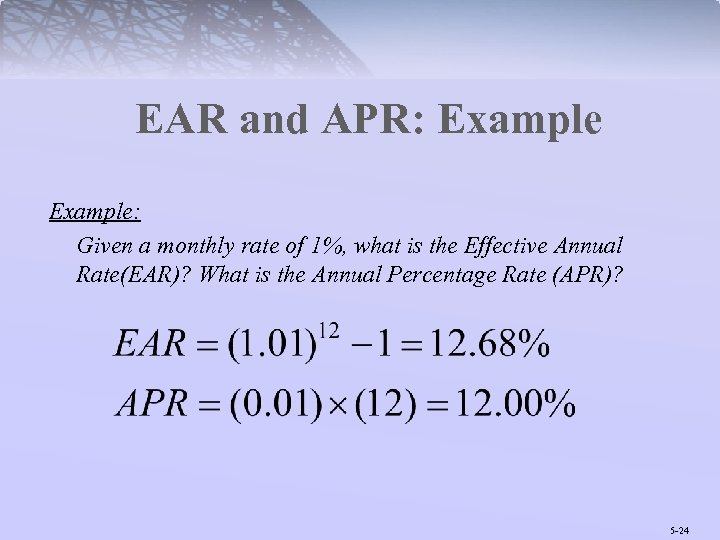

EAR and APR: Example: Given a monthly rate of 1%, what is the Effective Annual Rate(EAR)? What is the Annual Percentage Rate (APR)? 5 -24

EAR and APR: Example: Given a monthly rate of 1%, what is the Effective Annual Rate(EAR)? What is the Annual Percentage Rate (APR)? 5 -24

Inflation What is it? What determines inflation rates? What is deflation? 5 -25

Inflation What is it? What determines inflation rates? What is deflation? 5 -25

Inflation and Real Interest Exact calculation: Approximation: 5 -26

Inflation and Real Interest Exact calculation: Approximation: 5 -26

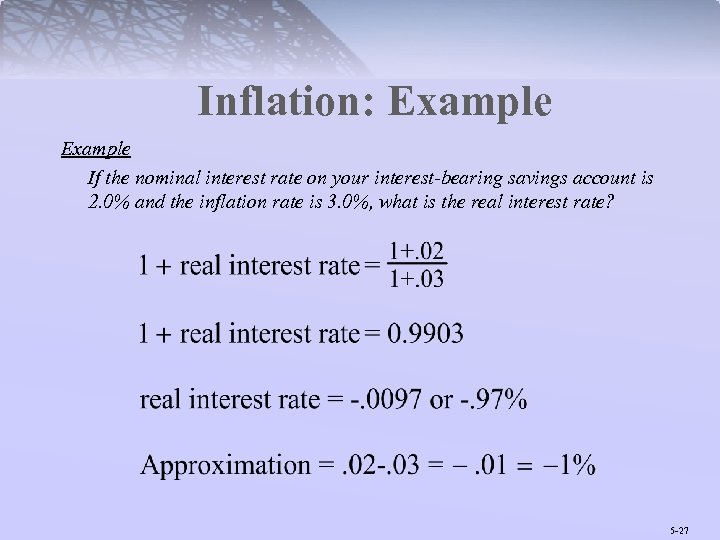

Inflation: Example If the nominal interest rate on your interest-bearing savings account is 2. 0% and the inflation rate is 3. 0%, what is the real interest rate? 5 -27

Inflation: Example If the nominal interest rate on your interest-bearing savings account is 2. 0% and the inflation rate is 3. 0%, what is the real interest rate? 5 -27

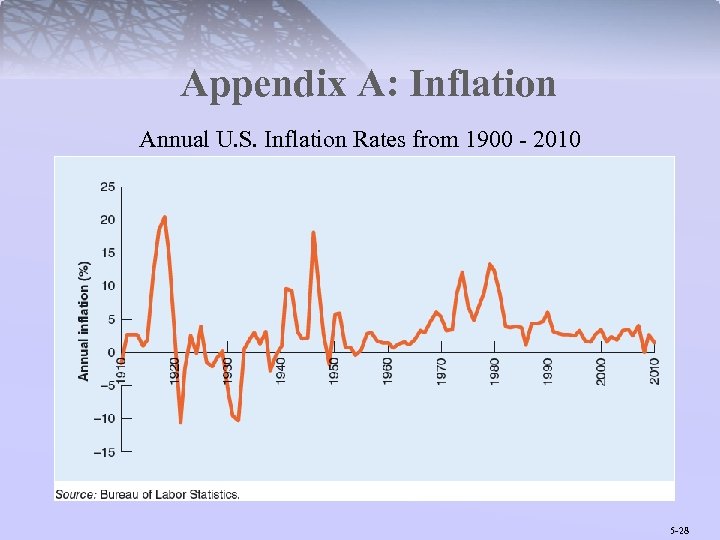

Appendix A: Inflation Annual U. S. Inflation Rates from 1900 - 2010 5 -28

Appendix A: Inflation Annual U. S. Inflation Rates from 1900 - 2010 5 -28