af91a2e6c53cf791a853345eadbeb0c0.ppt

- Количество слайдов: 64

Chapter 5 Inventories and Cost of Goods Sold

Chapter 5 Inventories and Cost of Goods Sold

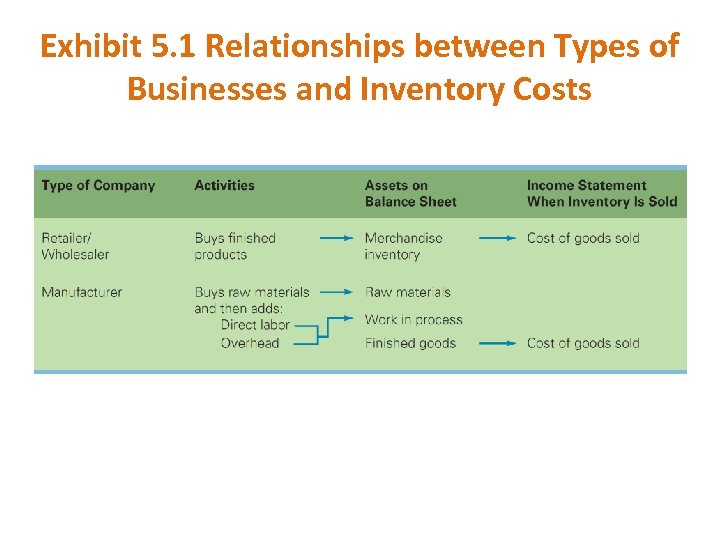

Inventory Types q Finished inventory: held by retailers and wholesalers Ø Merchandise inventory q Materials inventory: held by manufacturers Ø Raw materials Ø Work-in-progress Ø Finished goods LO 1

Inventory Types q Finished inventory: held by retailers and wholesalers Ø Merchandise inventory q Materials inventory: held by manufacturers Ø Raw materials Ø Work-in-progress Ø Finished goods LO 1

Types of Manufacturing Costs q Direct materials: also called raw Ø Ingredients materials used in making a product q Direct labor: amounts paid to workers to manufacture the product q Manufacturing overheads: all other costs that are related to the manufacturing process but cannot be directly matched to specific units of output Ø Example: depreciation supervisor of building and salary of

Types of Manufacturing Costs q Direct materials: also called raw Ø Ingredients materials used in making a product q Direct labor: amounts paid to workers to manufacture the product q Manufacturing overheads: all other costs that are related to the manufacturing process but cannot be directly matched to specific units of output Ø Example: depreciation supervisor of building and salary of

Three Forms of Inventory q Direct materials Ø The inventory of a manufacturer before the addition of any direct labor or manufacturing overhead q Work in process Ø Cost of unfinished products in company q Finished a manufacturing goods Ø A manufacturer’s inventory that ready for sale is complete and

Three Forms of Inventory q Direct materials Ø The inventory of a manufacturer before the addition of any direct labor or manufacturing overhead q Work in process Ø Cost of unfinished products in company q Finished a manufacturing goods Ø A manufacturer’s inventory that ready for sale is complete and

Exhibit 5. 1 Relationships between Types of Businesses and Inventory Costs

Exhibit 5. 1 Relationships between Types of Businesses and Inventory Costs

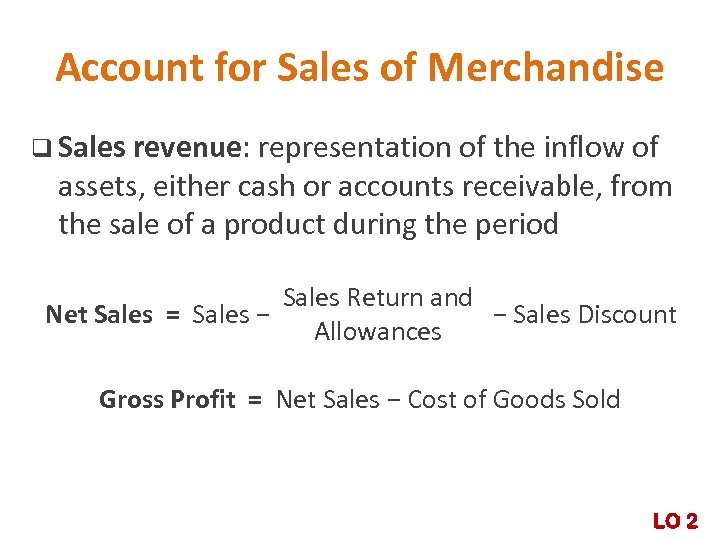

Account for Sales of Merchandise q Sales revenue: representation of the inflow of assets, either cash or accounts receivable, from the sale of a product during the period Sales Return and − Sales Discount Net Sales = Sales − Allowances Gross Profit = Net Sales − Cost of Goods Sold LO 2

Account for Sales of Merchandise q Sales revenue: representation of the inflow of assets, either cash or accounts receivable, from the sale of a product during the period Sales Return and − Sales Discount Net Sales = Sales − Allowances Gross Profit = Net Sales − Cost of Goods Sold LO 2

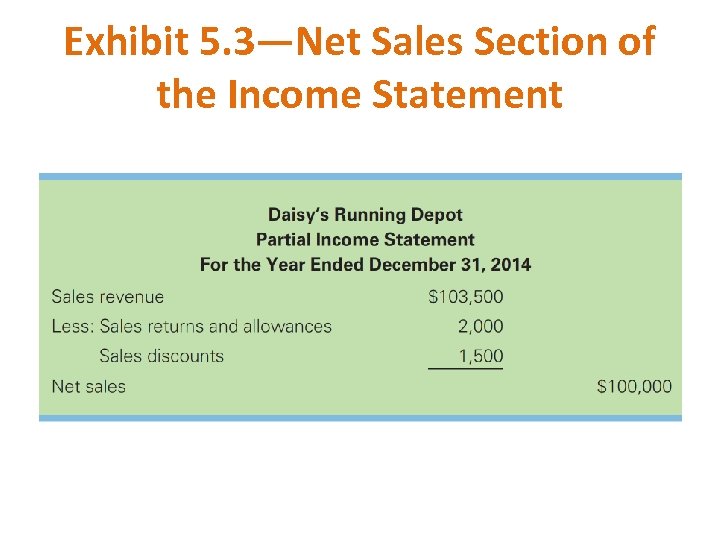

Exhibit 5. 3—Net Sales Section of the Income Statement

Exhibit 5. 3—Net Sales Section of the Income Statement

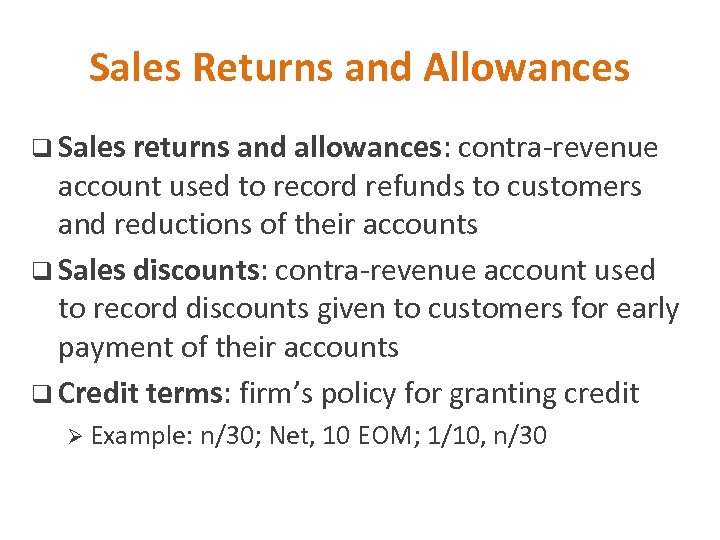

Sales Returns and Allowances q Sales returns and allowances: contra-revenue account used to record refunds to customers and reductions of their accounts q Sales discounts: contra-revenue account used to record discounts given to customers for early payment of their accounts q Credit terms: firm’s policy for granting credit Ø Example: n/30; Net, 10 EOM; 1/10, n/30

Sales Returns and Allowances q Sales returns and allowances: contra-revenue account used to record refunds to customers and reductions of their accounts q Sales discounts: contra-revenue account used to record discounts given to customers for early payment of their accounts q Credit terms: firm’s policy for granting credit Ø Example: n/30; Net, 10 EOM; 1/10, n/30

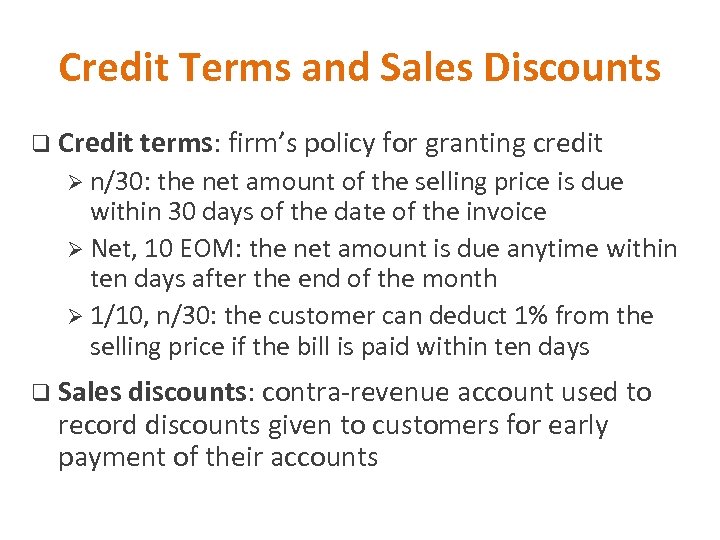

Credit Terms and Sales Discounts q Credit terms: firm’s policy for granting credit Ø n/30: the net amount of the selling price is due within 30 days of the date of the invoice Ø Net, 10 EOM: the net amount is due anytime within ten days after the end of the month Ø 1/10, n/30: the customer can deduct 1% from the selling price if the bill is paid within ten days q Sales discounts: contra-revenue account used to record discounts given to customers for early payment of their accounts

Credit Terms and Sales Discounts q Credit terms: firm’s policy for granting credit Ø n/30: the net amount of the selling price is due within 30 days of the date of the invoice Ø Net, 10 EOM: the net amount is due anytime within ten days after the end of the month Ø 1/10, n/30: the customer can deduct 1% from the selling price if the bill is paid within ten days q Sales discounts: contra-revenue account used to record discounts given to customers for early payment of their accounts

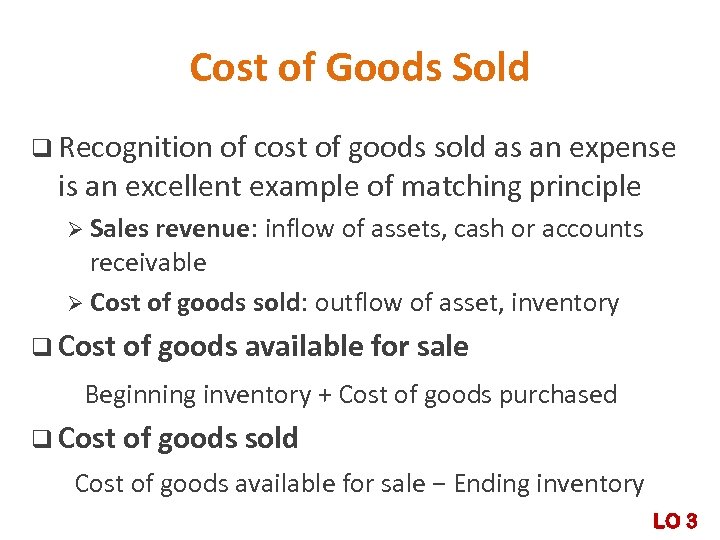

Cost of Goods Sold q Recognition of cost of goods sold as an expense is an excellent example of matching principle Ø Sales revenue: inflow of assets, cash or accounts receivable Ø Cost of goods sold: outflow of asset, inventory q Cost of goods available for sale Beginning inventory + Cost of goods purchased q Cost of goods sold Cost of goods available for sale − Ending inventory LO 3

Cost of Goods Sold q Recognition of cost of goods sold as an expense is an excellent example of matching principle Ø Sales revenue: inflow of assets, cash or accounts receivable Ø Cost of goods sold: outflow of asset, inventory q Cost of goods available for sale Beginning inventory + Cost of goods purchased q Cost of goods sold Cost of goods available for sale − Ending inventory LO 3

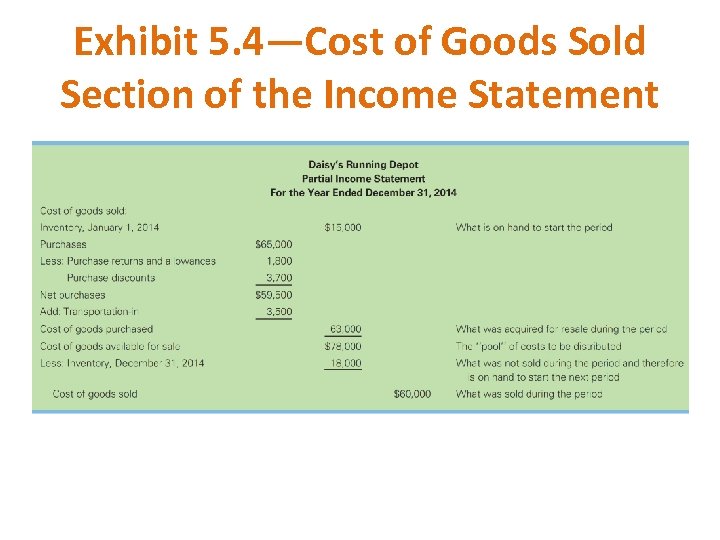

Exhibit 5. 4—Cost of Goods Sold Section of the Income Statement

Exhibit 5. 4—Cost of Goods Sold Section of the Income Statement

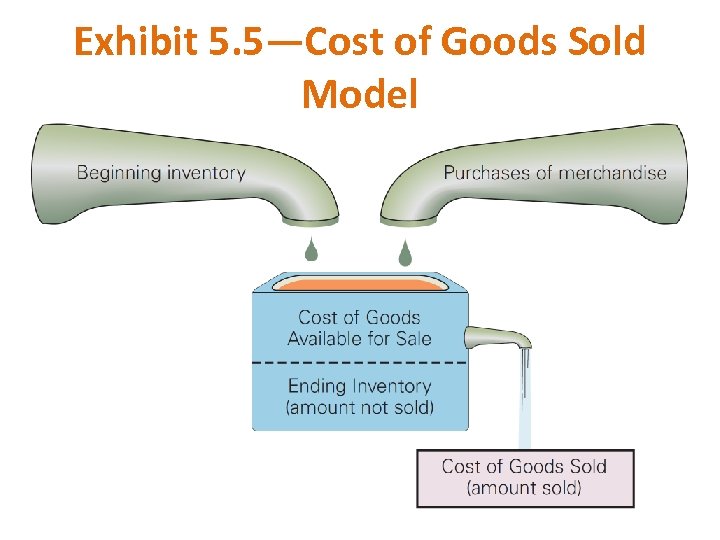

Exhibit 5. 5—Cost of Goods Sold Model

Exhibit 5. 5—Cost of Goods Sold Model

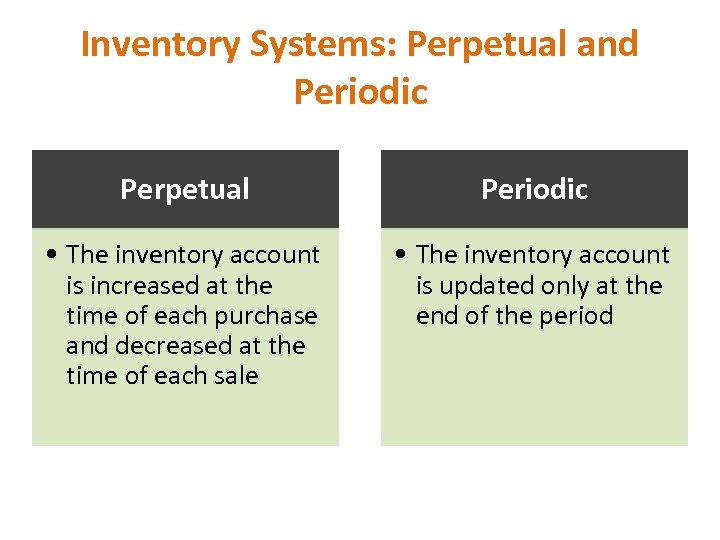

Inventory Systems: Perpetual and Periodic Perpetual Periodic • The inventory account is increased at the time of each purchase and decreased at the time of each sale • The inventory account is updated only at the end of the period

Inventory Systems: Perpetual and Periodic Perpetual Periodic • The inventory account is increased at the time of each purchase and decreased at the time of each sale • The inventory account is updated only at the end of the period

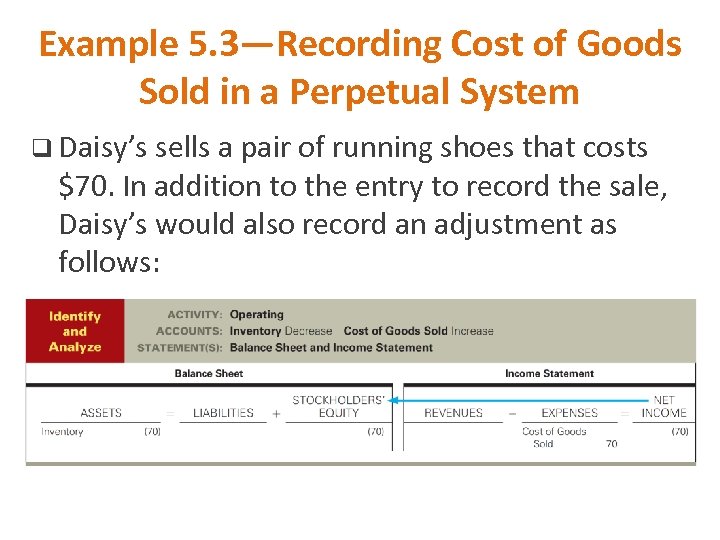

Example 5. 3—Recording Cost of Goods Sold in a Perpetual System q Daisy’s sells a pair of running shoes that costs $70. In addition to the entry to record the sale, Daisy’s would also record an adjustment as follows:

Example 5. 3—Recording Cost of Goods Sold in a Perpetual System q Daisy’s sells a pair of running shoes that costs $70. In addition to the entry to record the sale, Daisy’s would also record an adjustment as follows:

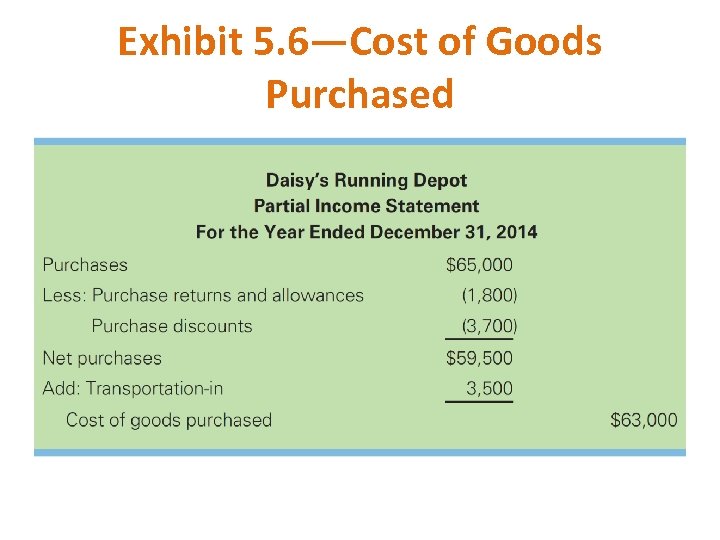

Exhibit 5. 6—Cost of Goods Purchased

Exhibit 5. 6—Cost of Goods Purchased

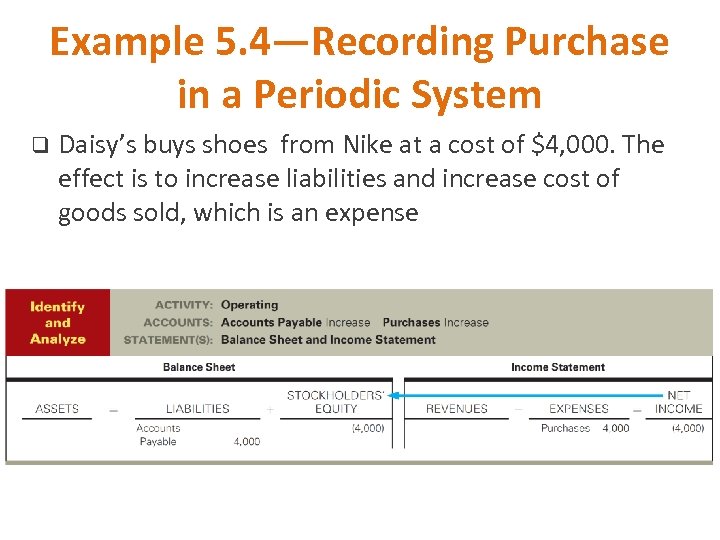

Example 5. 4—Recording Purchase in a Periodic System q Daisy’s buys shoes from Nike at a cost of $4, 000. The effect is to increase liabilities and increase cost of goods sold, which is an expense

Example 5. 4—Recording Purchase in a Periodic System q Daisy’s buys shoes from Nike at a cost of $4, 000. The effect is to increase liabilities and increase cost of goods sold, which is an expense

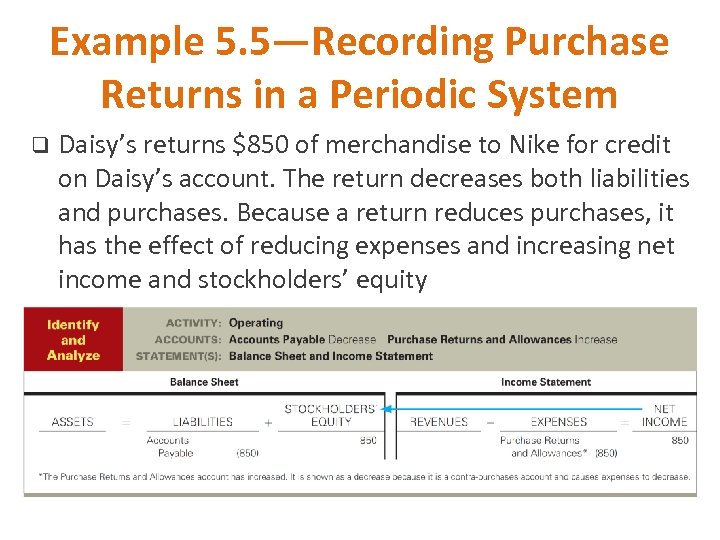

Example 5. 5—Recording Purchase Returns in a Periodic System q Daisy’s returns $850 of merchandise to Nike for credit on Daisy’s account. The return decreases both liabilities and purchases. Because a return reduces purchases, it has the effect of reducing expenses and increasing net income and stockholders’ equity

Example 5. 5—Recording Purchase Returns in a Periodic System q Daisy’s returns $850 of merchandise to Nike for credit on Daisy’s account. The return decreases both liabilities and purchases. Because a return reduces purchases, it has the effect of reducing expenses and increasing net income and stockholders’ equity

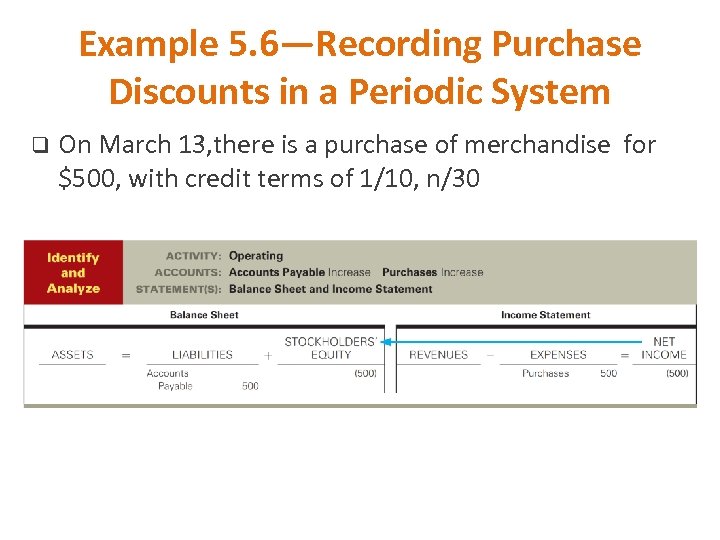

Example 5. 6—Recording Purchase Discounts in a Periodic System q On March 13, there is a purchase of merchandise for $500, with credit terms of 1/10, n/30

Example 5. 6—Recording Purchase Discounts in a Periodic System q On March 13, there is a purchase of merchandise for $500, with credit terms of 1/10, n/30

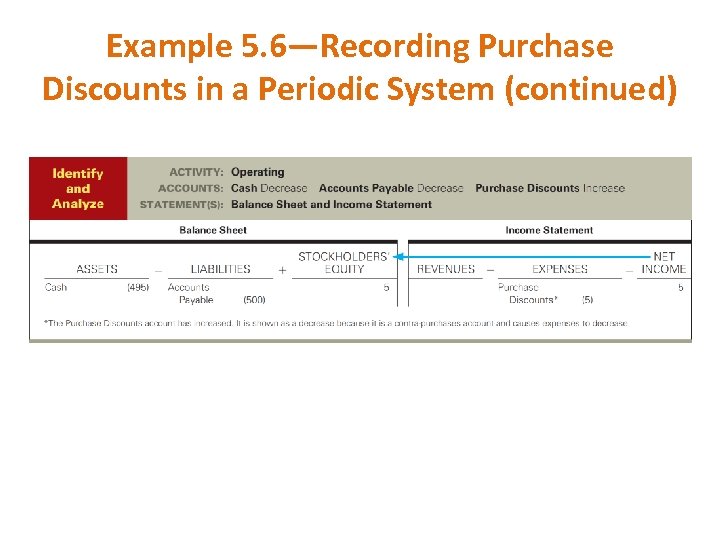

Example 5. 6—Recording Purchase Discounts in a Periodic System (continued)

Example 5. 6—Recording Purchase Discounts in a Periodic System (continued)

Purchase Discounts q A contra-purchases account used to record reductions in purchase price for early payment to a supplier

Purchase Discounts q A contra-purchases account used to record reductions in purchase price for early payment to a supplier

Shipping Terms and Transportation Costs q Cost principle: All costs necessary to prepare an asset for its intended use should be included in its cost q FOB destination point: seller incurs the transportation costs q FOB shipping point: buyer incurs the transportation costs q FOB stands for ‘‘free on board’’

Shipping Terms and Transportation Costs q Cost principle: All costs necessary to prepare an asset for its intended use should be included in its cost q FOB destination point: seller incurs the transportation costs q FOB shipping point: buyer incurs the transportation costs q FOB stands for ‘‘free on board’’

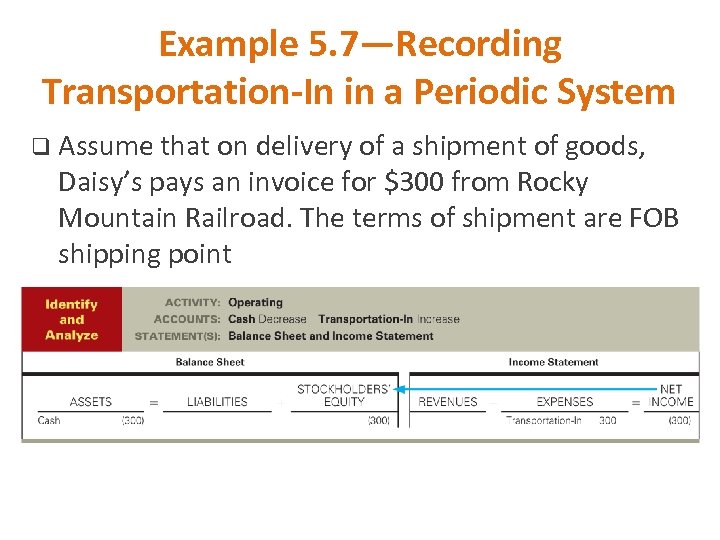

Example 5. 7—Recording Transportation-In in a Periodic System q Assume that on delivery of a shipment of goods, Daisy’s pays an invoice for $300 from Rocky Mountain Railroad. The terms of shipment are FOB shipping point

Example 5. 7—Recording Transportation-In in a Periodic System q Assume that on delivery of a shipment of goods, Daisy’s pays an invoice for $300 from Rocky Mountain Railroad. The terms of shipment are FOB shipping point

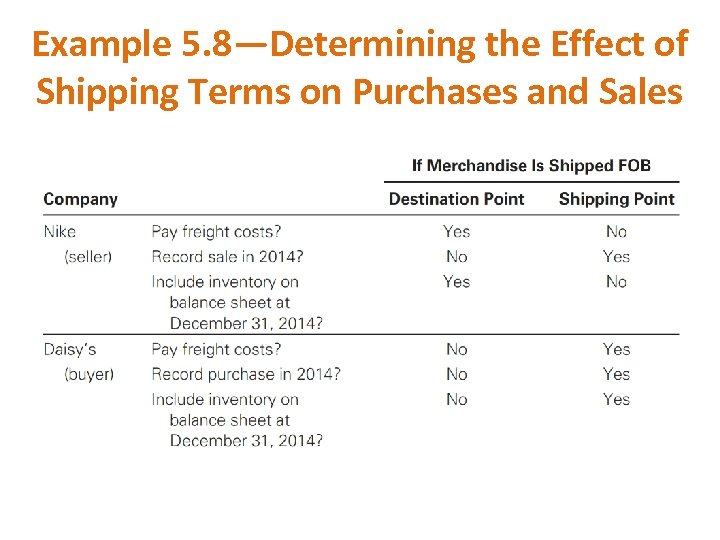

Example 5. 8—Determining the Effect of Shipping Terms on Purchases and Sales

Example 5. 8—Determining the Effect of Shipping Terms on Purchases and Sales

The Gross Profit Ratio q Important measure of profitability q Indicates a company’s ability to cover operating expenses and earn a profit q Relationship between gross profit and net sales —measured by the gross profit ratio—one of the most important measures to assess the performance of a company Gross Profit Ratio = Gross Profit Net Sales LO 4

The Gross Profit Ratio q Important measure of profitability q Indicates a company’s ability to cover operating expenses and earn a profit q Relationship between gross profit and net sales —measured by the gross profit ratio—one of the most important measures to assess the performance of a company Gross Profit Ratio = Gross Profit Net Sales LO 4

The Ratio Analysis Model 1. 2. 3. 4. 5. How much of the sales revenue is used for the cost of the products, and thus, how much remains to cover other expenses and to earn net income? Gather the information about net sales and cost of goods sold Calculate the gross profit ratio Compare the ratio with prior years and with competitors Interpret the ratios—showing increase or decrease

The Ratio Analysis Model 1. 2. 3. 4. 5. How much of the sales revenue is used for the cost of the products, and thus, how much remains to cover other expenses and to earn net income? Gather the information about net sales and cost of goods sold Calculate the gross profit ratio Compare the ratio with prior years and with competitors Interpret the ratios—showing increase or decrease

The Business Decision Model 1. 2. 3. 4. 5. If you were an investor, would you buy stock in a company? Gather information from the financial statements and other sources Compare the company's gross profit ratio with industry averages and look at trends Buy stock or find an alternative use for the money Monitor the investment periodically

The Business Decision Model 1. 2. 3. 4. 5. If you were an investor, would you buy stock in a company? Gather information from the financial statements and other sources Compare the company's gross profit ratio with industry averages and look at trends Buy stock or find an alternative use for the money Monitor the investment periodically

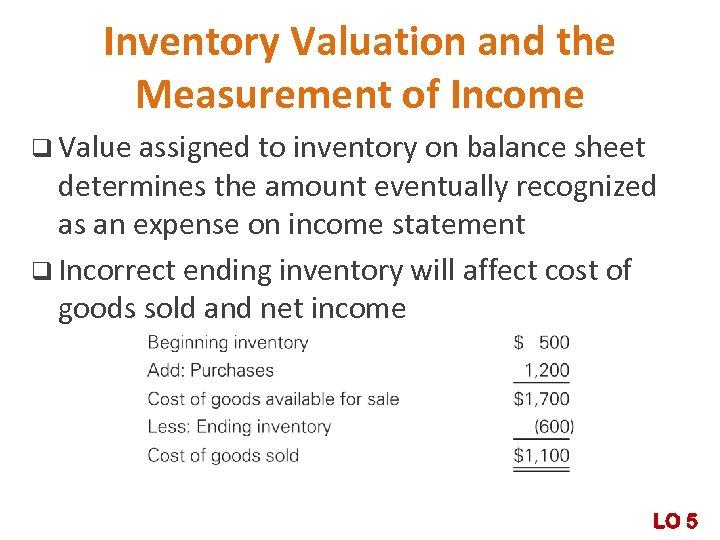

Inventory Valuation and the Measurement of Income q Value assigned to inventory on balance sheet determines the amount eventually recognized as an expense on income statement q Incorrect ending inventory will affect cost of goods sold and net income LO 5

Inventory Valuation and the Measurement of Income q Value assigned to inventory on balance sheet determines the amount eventually recognized as an expense on income statement q Incorrect ending inventory will affect cost of goods sold and net income LO 5

Inventory Costs q Cost: price paid or consideration given to acquire an asset Ø Includes expenditures directly or indirectly incurred in bringing to its existing condition and location q Examples: Freight costs incurred to bring inventory to the place of business Ø Cost of insurance when inventory is in transit Ø Cost of storing inventory before it is ready to be sold Ø Taxes paid—excise and sales taxes Ø

Inventory Costs q Cost: price paid or consideration given to acquire an asset Ø Includes expenditures directly or indirectly incurred in bringing to its existing condition and location q Examples: Freight costs incurred to bring inventory to the place of business Ø Cost of insurance when inventory is in transit Ø Cost of storing inventory before it is ready to be sold Ø Taxes paid—excise and sales taxes Ø

Inventory Costing Methods with a Periodic System Specific Identification Weighted Average First-in, First-out (FIFO) Last-in, First-out (LIFO) LO 6

Inventory Costing Methods with a Periodic System Specific Identification Weighted Average First-in, First-out (FIFO) Last-in, First-out (LIFO) LO 6

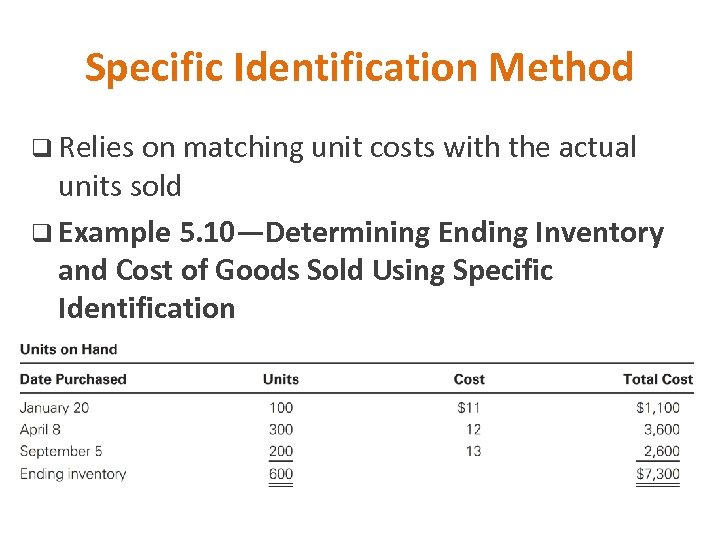

Specific Identification Method q Relies on matching unit costs with the actual units sold q Example 5. 10—Determining Ending Inventory and Cost of Goods Sold Using Specific Identification

Specific Identification Method q Relies on matching unit costs with the actual units sold q Example 5. 10—Determining Ending Inventory and Cost of Goods Sold Using Specific Identification

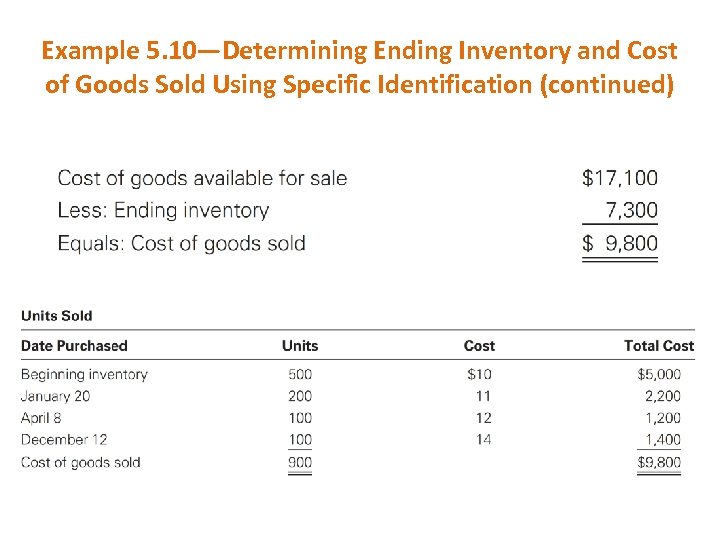

Example 5. 10—Determining Ending Inventory and Cost of Goods Sold Using Specific Identification (continued)

Example 5. 10—Determining Ending Inventory and Cost of Goods Sold Using Specific Identification (continued)

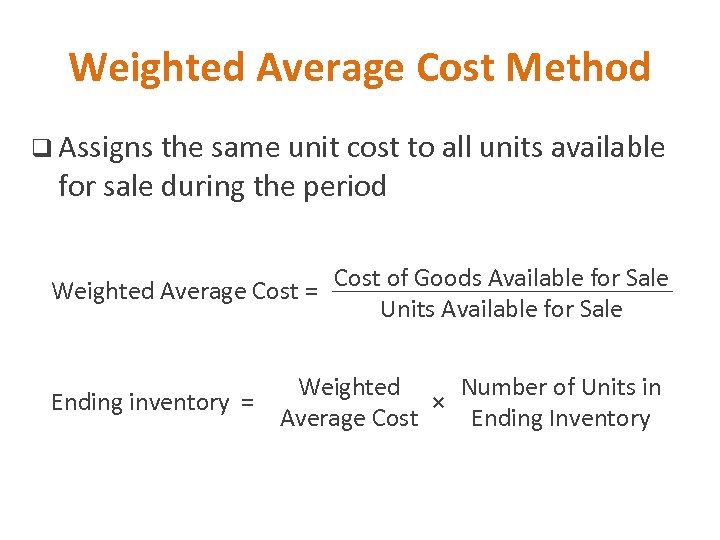

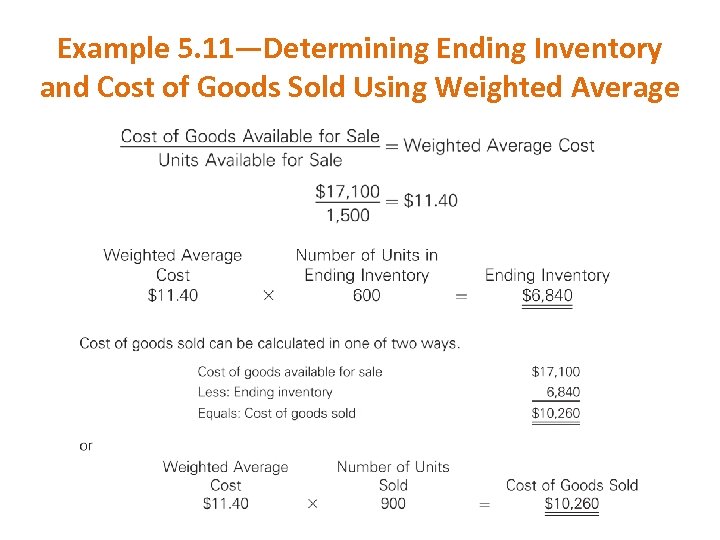

Weighted Average Cost Method q Assigns the same unit cost to all units available for sale during the period Weighted Average Cost = Cost of Goods Available for Sale Units Available for Sale Weighted Number of Units in Ending inventory = × Average Cost Ending Inventory

Weighted Average Cost Method q Assigns the same unit cost to all units available for sale during the period Weighted Average Cost = Cost of Goods Available for Sale Units Available for Sale Weighted Number of Units in Ending inventory = × Average Cost Ending Inventory

Example 5. 11—Determining Ending Inventory and Cost of Goods Sold Using Weighted Average

Example 5. 11—Determining Ending Inventory and Cost of Goods Sold Using Weighted Average

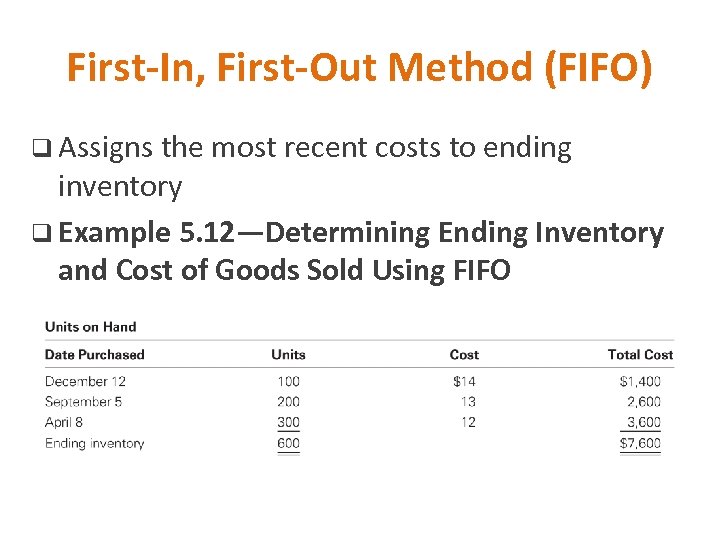

First-In, First-Out Method (FIFO) q Assigns the most recent costs to ending inventory q Example 5. 12—Determining Ending Inventory and Cost of Goods Sold Using FIFO

First-In, First-Out Method (FIFO) q Assigns the most recent costs to ending inventory q Example 5. 12—Determining Ending Inventory and Cost of Goods Sold Using FIFO

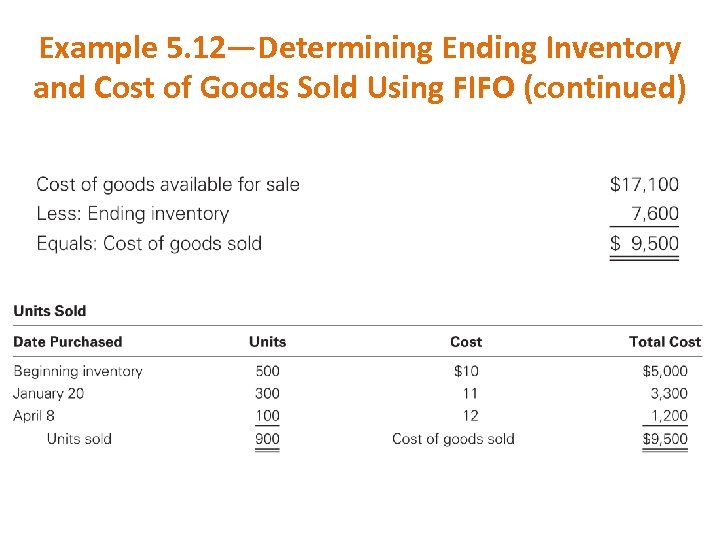

Example 5. 12—Determining Ending Inventory and Cost of Goods Sold Using FIFO (continued)

Example 5. 12—Determining Ending Inventory and Cost of Goods Sold Using FIFO (continued)

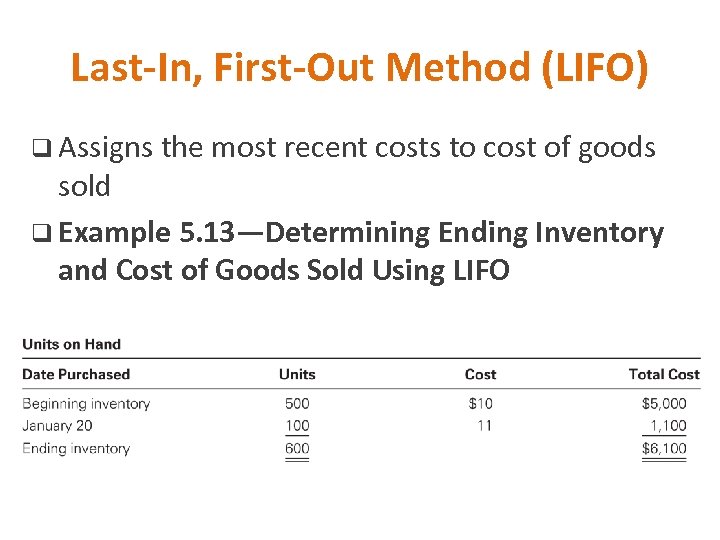

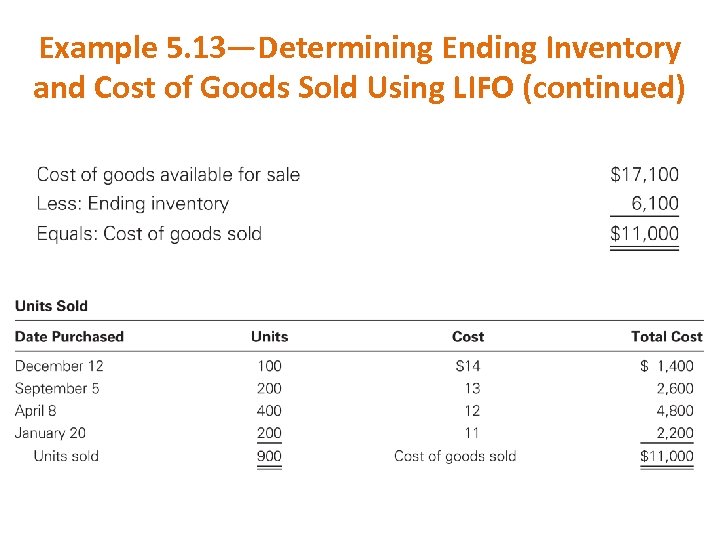

Last-In, First-Out Method (LIFO) q Assigns the most recent costs to cost of goods sold q Example 5. 13—Determining Ending Inventory and Cost of Goods Sold Using LIFO

Last-In, First-Out Method (LIFO) q Assigns the most recent costs to cost of goods sold q Example 5. 13—Determining Ending Inventory and Cost of Goods Sold Using LIFO

Example 5. 13—Determining Ending Inventory and Cost of Goods Sold Using LIFO (continued)

Example 5. 13—Determining Ending Inventory and Cost of Goods Sold Using LIFO (continued)

Selecting an Inventory Costing Method q The choice of an inventory method will impact cost of goods sold and thus net income q A company should choose the method that results in the most accurate measure of net income for the period q The primary determinant in selecting an inventory costing method should be the ability of the method to accurately reflect the net income of the period LO 7

Selecting an Inventory Costing Method q The choice of an inventory method will impact cost of goods sold and thus net income q A company should choose the method that results in the most accurate measure of net income for the period q The primary determinant in selecting an inventory costing method should be the ability of the method to accurately reflect the net income of the period LO 7

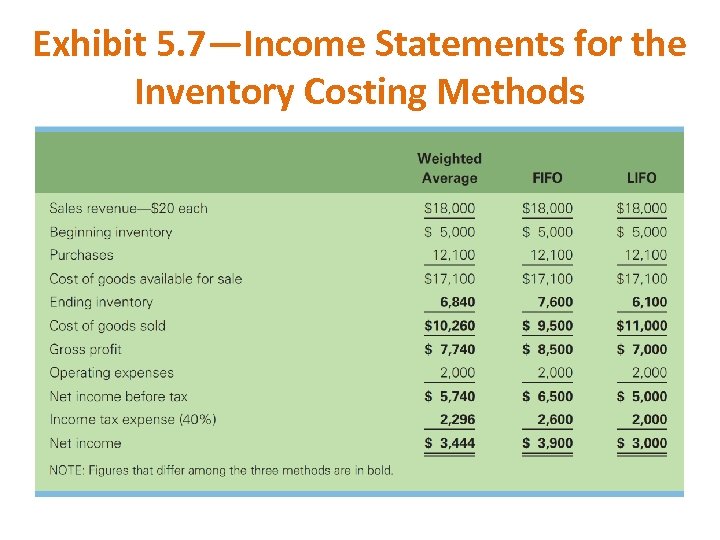

Exhibit 5. 7—Income Statements for the Inventory Costing Methods

Exhibit 5. 7—Income Statements for the Inventory Costing Methods

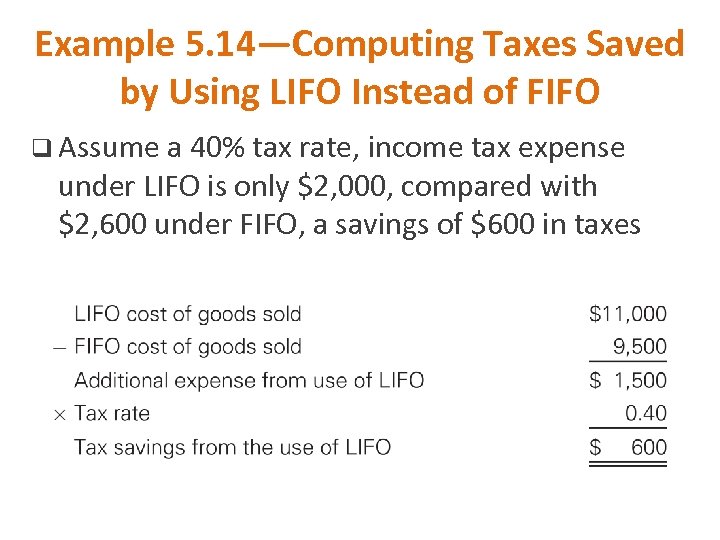

Example 5. 14—Computing Taxes Saved by Using LIFO Instead of FIFO q Assume a 40% tax rate, income tax expense under LIFO is only $2, 000, compared with $2, 600 under FIFO, a savings of $600 in taxes

Example 5. 14—Computing Taxes Saved by Using LIFO Instead of FIFO q Assume a 40% tax rate, income tax expense under LIFO is only $2, 000, compared with $2, 600 under FIFO, a savings of $600 in taxes

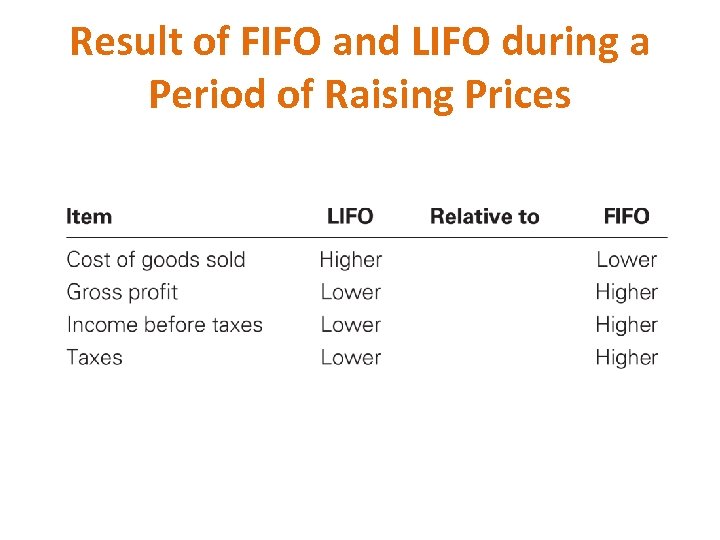

Result of FIFO and LIFO during a Period of Raising Prices

Result of FIFO and LIFO during a Period of Raising Prices

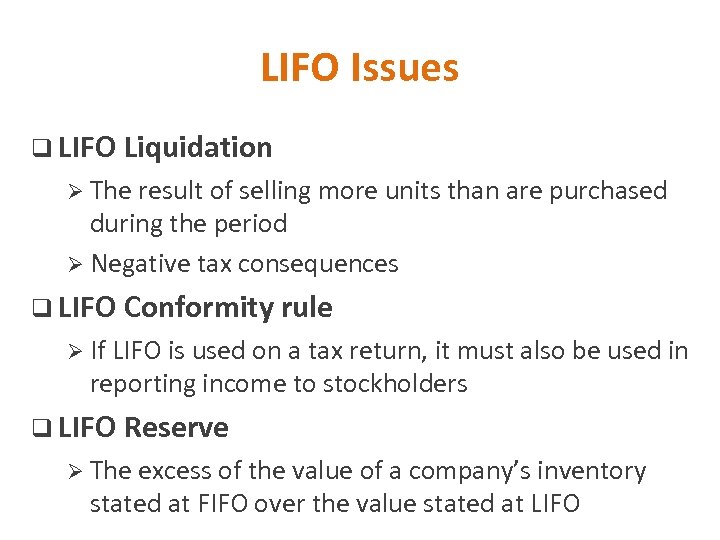

LIFO Issues q LIFO Liquidation Ø The result of selling more units than are purchased during the period Ø Negative tax consequences q LIFO Conformity rule Ø If LIFO is used on a tax return, it must also be used in reporting income to stockholders q LIFO Reserve Ø The excess of the value of a company’s inventory stated at FIFO over the value stated at LIFO

LIFO Issues q LIFO Liquidation Ø The result of selling more units than are purchased during the period Ø Negative tax consequences q LIFO Conformity rule Ø If LIFO is used on a tax return, it must also be used in reporting income to stockholders q LIFO Reserve Ø The excess of the value of a company’s inventory stated at FIFO over the value stated at LIFO

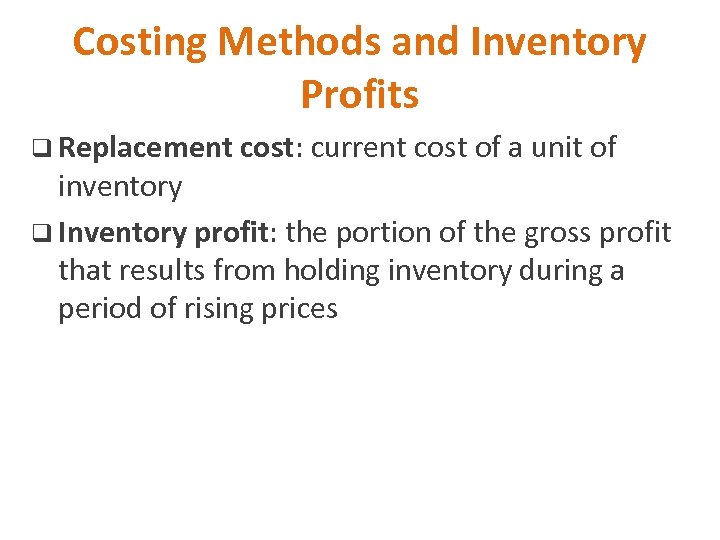

Costing Methods and Inventory Profits q Replacement cost: current cost of a unit of inventory q Inventory profit: the portion of the gross profit that results from holding inventory during a period of rising prices

Costing Methods and Inventory Profits q Replacement cost: current cost of a unit of inventory q Inventory profit: the portion of the gross profit that results from holding inventory during a period of rising prices

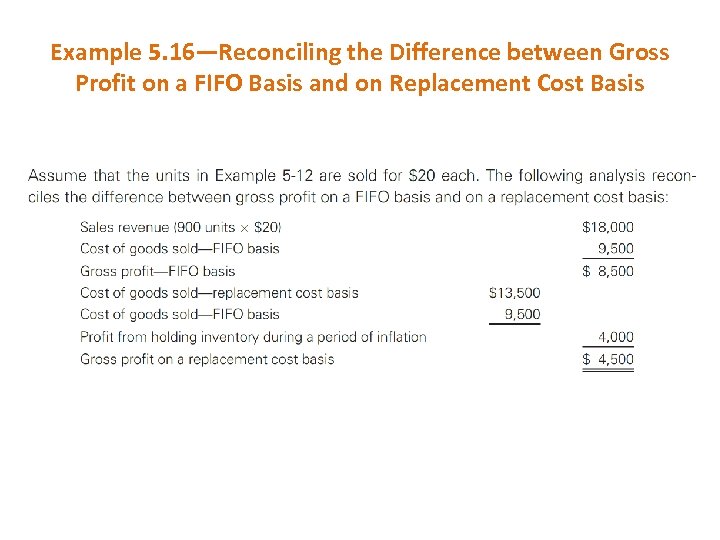

Example 5. 16—Reconciling the Difference between Gross Profit on a FIFO Basis and on Replacement Cost Basis

Example 5. 16—Reconciling the Difference between Gross Profit on a FIFO Basis and on Replacement Cost Basis

Inventory Valuation in Other Countries q Valuing inventory differ around the world Ø GAAP in the United States allows LIFO Ø IASB strictly prohibits the use of LIFO q Survival of LIFO is not only a matter of convergence with international standards Ø LIFO allows companies with rising inventory costs to report lower income

Inventory Valuation in Other Countries q Valuing inventory differ around the world Ø GAAP in the United States allows LIFO Ø IASB strictly prohibits the use of LIFO q Survival of LIFO is not only a matter of convergence with international standards Ø LIFO allows companies with rising inventory costs to report lower income

Inventory Errors q If ending inventory is overstated, cost of goods sold will be understated and thus net income for the period overstated Ø The opposite effects will occur when ending inventory is understated q Different types of inventory errors Ø Mathematical errors Ø Physical count of inventory at year-end Ø Cutoff problems—in-transit—at year-end LO 8

Inventory Errors q If ending inventory is overstated, cost of goods sold will be understated and thus net income for the period overstated Ø The opposite effects will occur when ending inventory is understated q Different types of inventory errors Ø Mathematical errors Ø Physical count of inventory at year-end Ø Cutoff problems—in-transit—at year-end LO 8

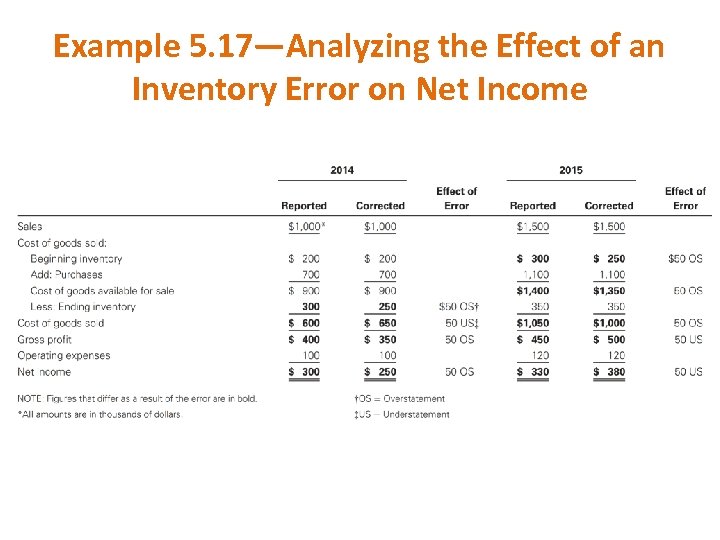

Example 5. 17—Analyzing the Effect of an Inventory Error on Net Income

Example 5. 17—Analyzing the Effect of an Inventory Error on Net Income

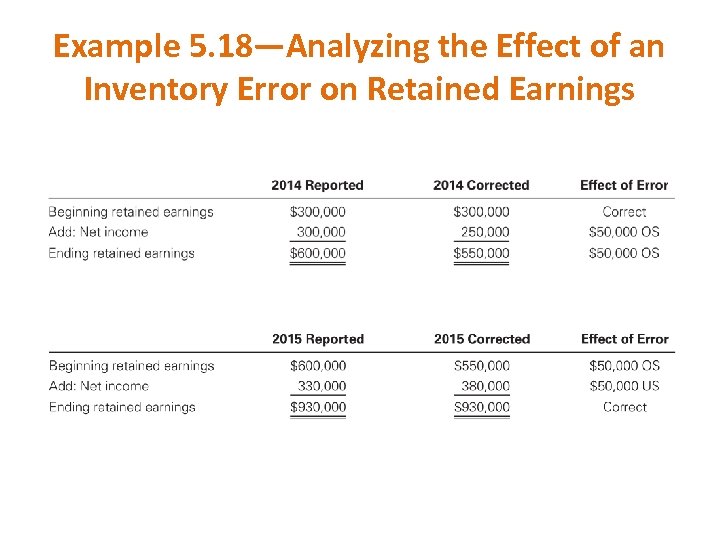

Example 5. 18—Analyzing the Effect of an Inventory Error on Retained Earnings

Example 5. 18—Analyzing the Effect of an Inventory Error on Retained Earnings

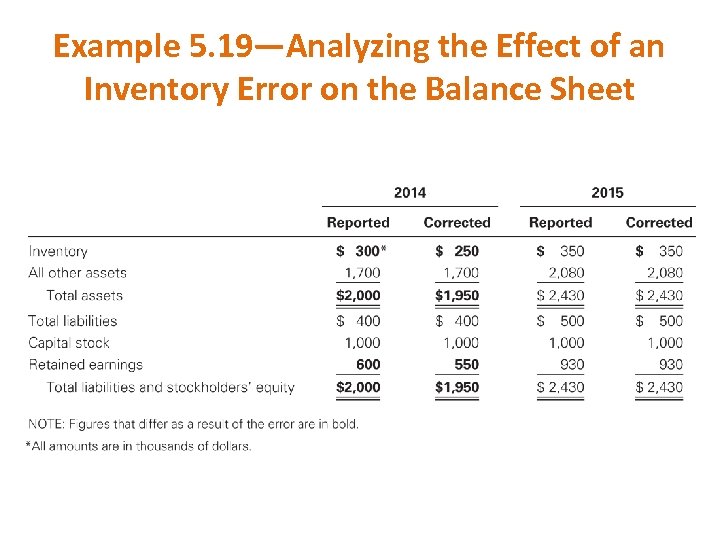

Example 5. 19—Analyzing the Effect of an Inventory Error on the Balance Sheet

Example 5. 19—Analyzing the Effect of an Inventory Error on the Balance Sheet

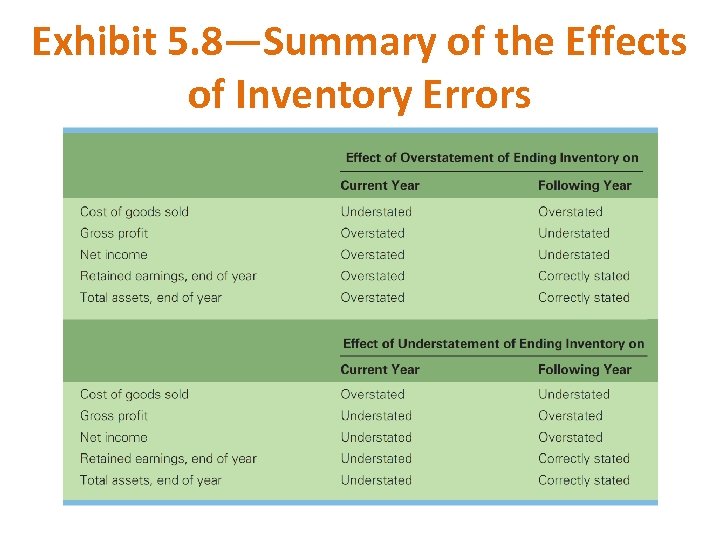

Exhibit 5. 8—Summary of the Effects of Inventory Errors

Exhibit 5. 8—Summary of the Effects of Inventory Errors

Lower-of-Cost-or Market Rule q A conservative inventory valuation approach q Require that inventory be written down at the end of the period if the market value of the inventory is less than its cost q Can be applied to: Ø Entire inventory Ø Individual items Ø Groups of items LO 9

Lower-of-Cost-or Market Rule q A conservative inventory valuation approach q Require that inventory be written down at the end of the period if the market value of the inventory is less than its cost q Can be applied to: Ø Entire inventory Ø Individual items Ø Groups of items LO 9

Lower-of-Cost-or-Market under International Standards q Required under both U. S. GAAP and IFRS q Difference: Ø U. S. GAAP • Define market value as replacement cost, subject to a maximum and a minimum amount • New amount becomes basis for future adjustments Ø IFRS • Uses net realizable value with no upper or lower limits • Write-downs of inventory can be reversed in later periods

Lower-of-Cost-or-Market under International Standards q Required under both U. S. GAAP and IFRS q Difference: Ø U. S. GAAP • Define market value as replacement cost, subject to a maximum and a minimum amount • New amount becomes basis for future adjustments Ø IFRS • Uses net realizable value with no upper or lower limits • Write-downs of inventory can be reversed in later periods

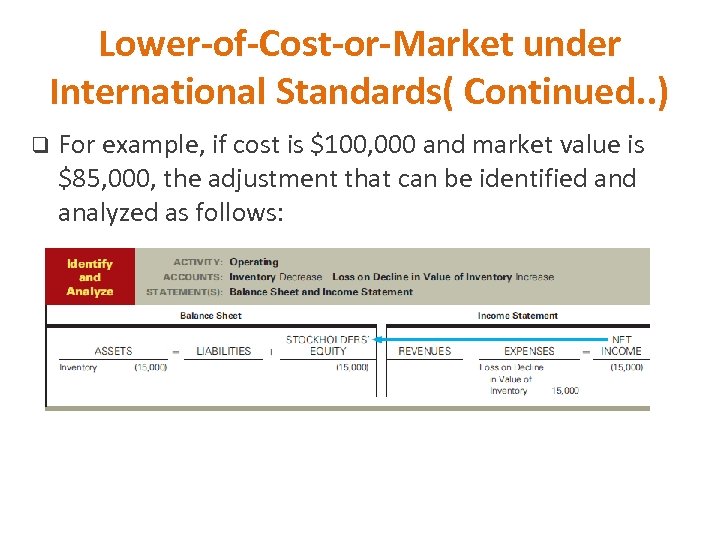

Lower-of-Cost-or-Market under International Standards( Continued. . ) q For example, if cost is $100, 000 and market value is $85, 000, the adjustment that can be identified analyzed as follows:

Lower-of-Cost-or-Market under International Standards( Continued. . ) q For example, if cost is $100, 000 and market value is $85, 000, the adjustment that can be identified analyzed as follows:

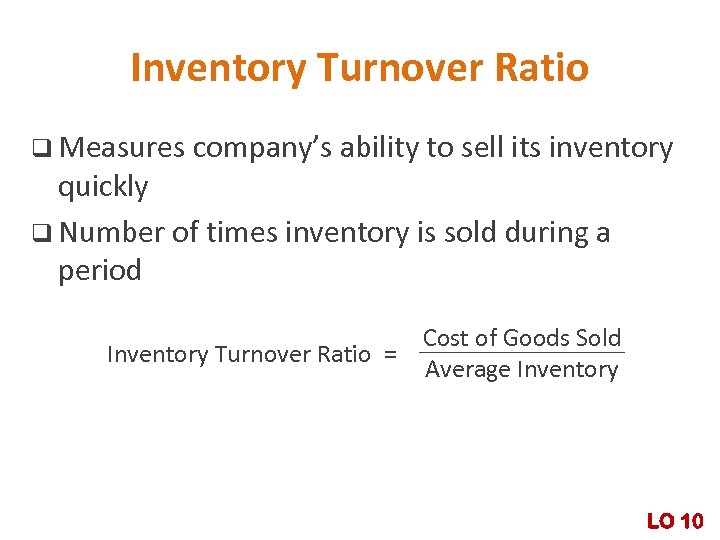

Inventory Turnover Ratio q Measures company’s ability to sell its inventory quickly q Number of times inventory is sold during a period Inventory Turnover Ratio = Cost of Goods Sold Average Inventory LO 10

Inventory Turnover Ratio q Measures company’s ability to sell its inventory quickly q Number of times inventory is sold during a period Inventory Turnover Ratio = Cost of Goods Sold Average Inventory LO 10

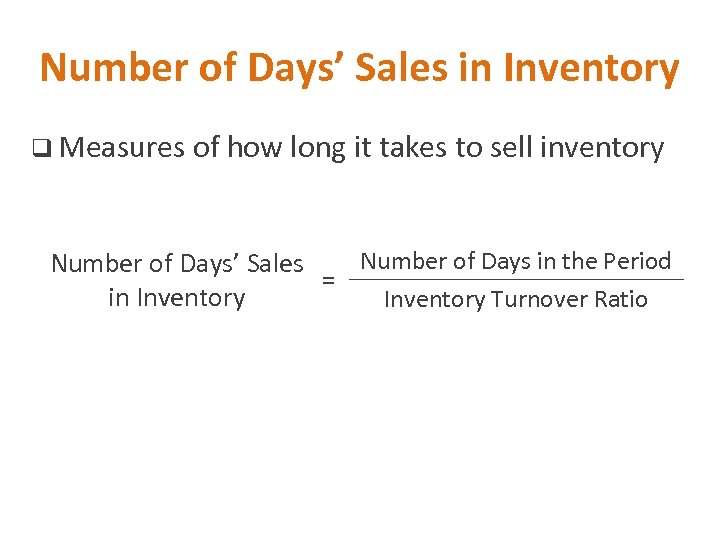

Number of Days’ Sales in Inventory q Measures of how long it takes to sell inventory Number of Days in the Period Number of Days’ Sales = in Inventory Turnover Ratio

Number of Days’ Sales in Inventory q Measures of how long it takes to sell inventory Number of Days in the Period Number of Days’ Sales = in Inventory Turnover Ratio

The Ratio Analysis Model 1. 2. 3. 4. 5. How liquid the company is? Gather cost of goods sold from the income statement and average inventory from balance sheet at the end of the two most recent years Calculate the inventory turnover ratio Compare the ratio with other ratios Interpret the ratios—measure of how long it takes to sell inventory

The Ratio Analysis Model 1. 2. 3. 4. 5. How liquid the company is? Gather cost of goods sold from the income statement and average inventory from balance sheet at the end of the two most recent years Calculate the inventory turnover ratio Compare the ratio with other ratios Interpret the ratios—measure of how long it takes to sell inventory

The Business Decision Model 1. 2. 3. 4. 5. If you were an investor, would you buy stock in the company? Gather information from the financial statements and other sources Compare trends in inventory turnover ratios, net income with industry averages Buy stock or find an alternative Monitor your decision periodically

The Business Decision Model 1. 2. 3. 4. 5. If you were an investor, would you buy stock in the company? Gather information from the financial statements and other sources Compare trends in inventory turnover ratios, net income with industry averages Buy stock or find an alternative Monitor your decision periodically

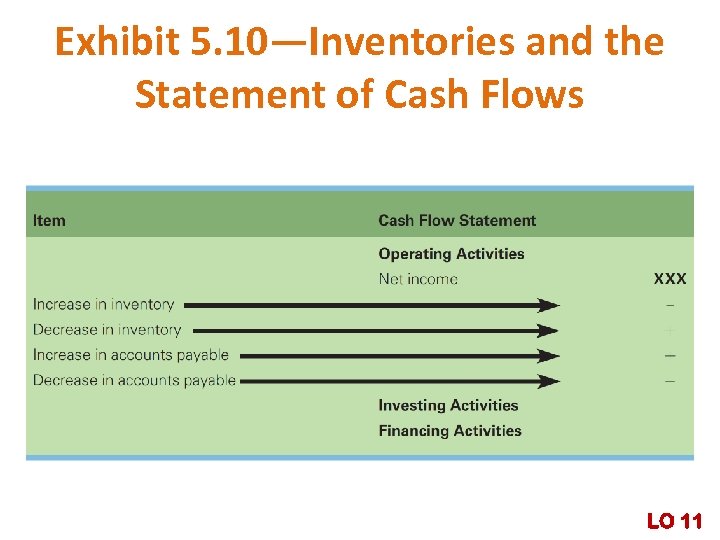

Exhibit 5. 10—Inventories and the Statement of Cash Flows LO 11

Exhibit 5. 10—Inventories and the Statement of Cash Flows LO 11

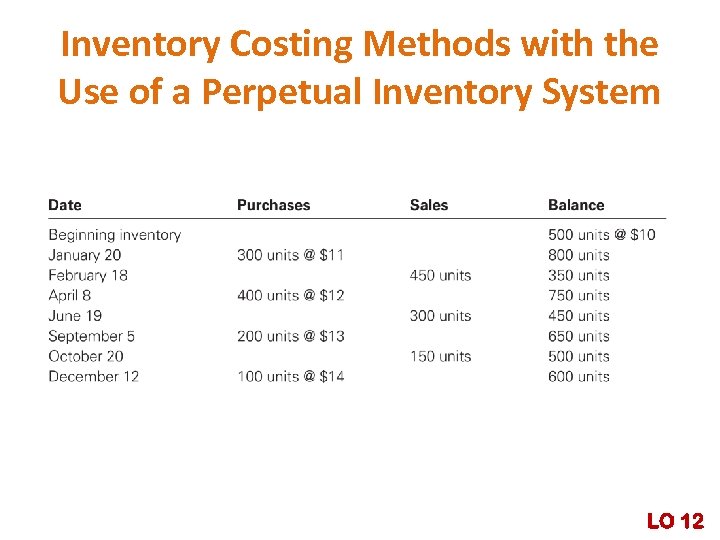

Inventory Costing Methods with the Use of a Perpetual Inventory System LO 12

Inventory Costing Methods with the Use of a Perpetual Inventory System LO 12

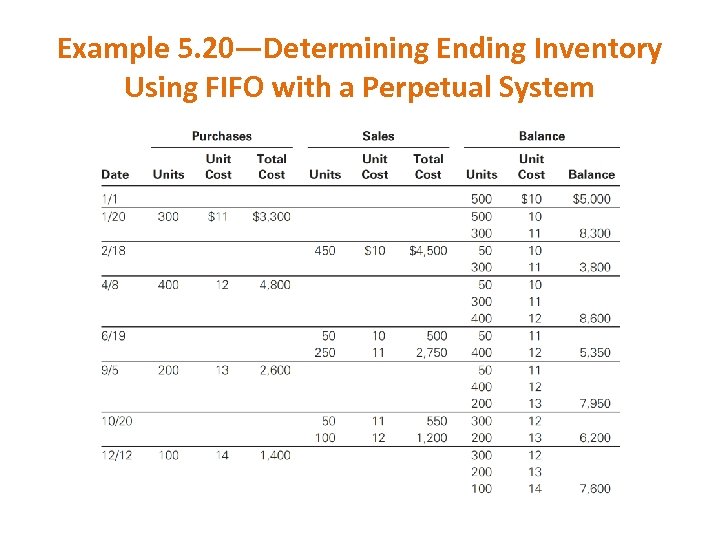

Example 5. 20—Determining Ending Inventory Using FIFO with a Perpetual System

Example 5. 20—Determining Ending Inventory Using FIFO with a Perpetual System

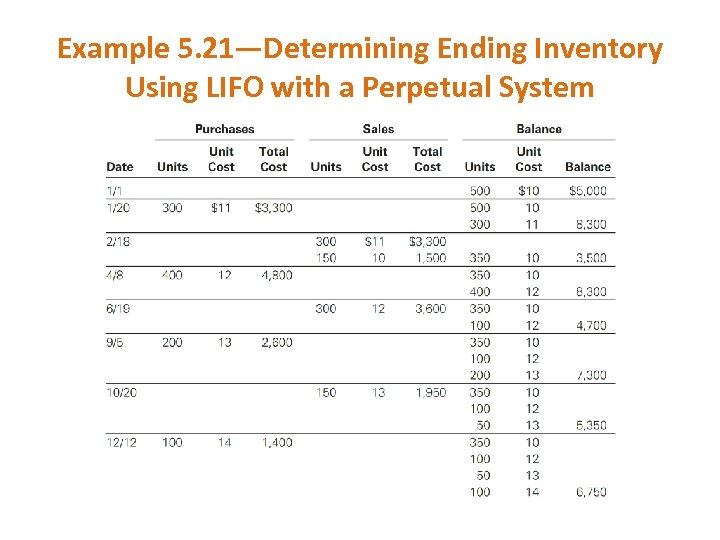

Example 5. 21—Determining Ending Inventory Using LIFO with a Perpetual System

Example 5. 21—Determining Ending Inventory Using LIFO with a Perpetual System

Moving Average q An average cost method when a weighted average cost assumption is used with a perpetual inventory system

Moving Average q An average cost method when a weighted average cost assumption is used with a perpetual inventory system

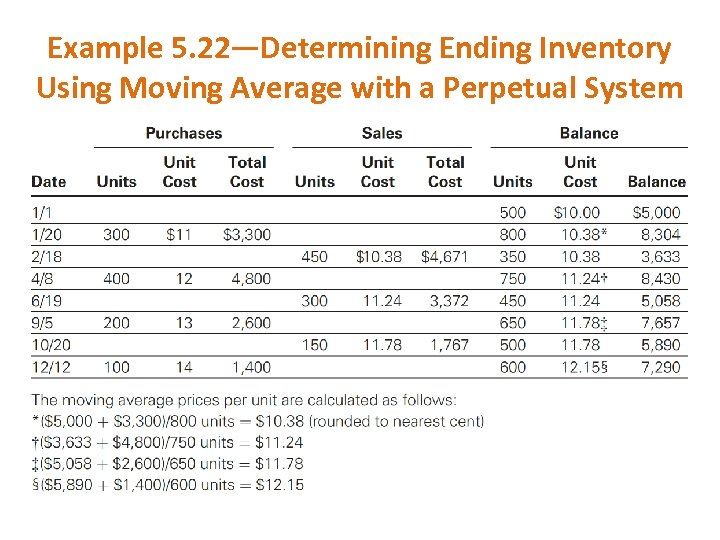

Example 5. 22—Determining Ending Inventory Using Moving Average with a Perpetual System

Example 5. 22—Determining Ending Inventory Using Moving Average with a Perpetual System

End of Chapter 5

End of Chapter 5