d2ced938c1763d6866f8c7ef20409db5.ppt

- Количество слайдов: 41

Chapter 5 Financial Position and Cash Flows Prepared by: Patricia Zima, CA Mohawk College of Applied Arts and Technology Updated for IFRS by: Anupma Goel, CA Seneca College of Applied Arts and Technology

Chapter 5 Financial Position and Cash Flows Prepared by: Patricia Zima, CA Mohawk College of Applied Arts and Technology Updated for IFRS by: Anupma Goel, CA Seneca College of Applied Arts and Technology

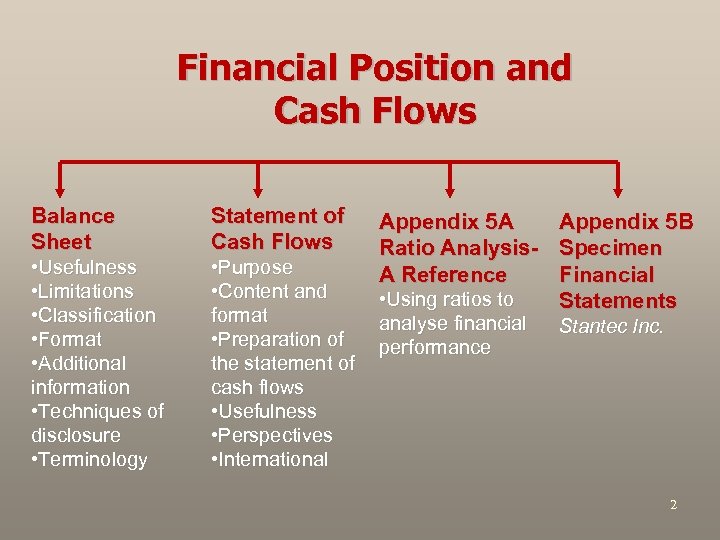

Financial Position and Cash Flows Balance Sheet Statement of Cash Flows • Usefulness • Limitations • Classification • Format • Additional information • Techniques of disclosure • Terminology • Purpose • Content and • Using ratios to format analyse financial • Preparation of performance the statement of cash flows • Usefulness • Perspectives • International Appendix 5 A Ratio Analysis. A Reference Appendix 5 B Specimen Financial Statements Stantec Inc. 2

Financial Position and Cash Flows Balance Sheet Statement of Cash Flows • Usefulness • Limitations • Classification • Format • Additional information • Techniques of disclosure • Terminology • Purpose • Content and • Using ratios to format analyse financial • Preparation of performance the statement of cash flows • Usefulness • Perspectives • International Appendix 5 A Ratio Analysis. A Reference Appendix 5 B Specimen Financial Statements Stantec Inc. 2

Section 1 Balance Sheet

Section 1 Balance Sheet

Balance Sheet: Usefulness • Also known as Statement of Financial Position • The balance sheet provides information – for evaluating the capital structure and – for computing rates of return on invested assets • It is also useful for assessing an enterprise’s – Liquidity (ability to pay current and maturing liabilities) – Solvency (ability to pay debt and related interest) – Financial flexibility (ability to respond to unexpected needs and opportunities) 4

Balance Sheet: Usefulness • Also known as Statement of Financial Position • The balance sheet provides information – for evaluating the capital structure and – for computing rates of return on invested assets • It is also useful for assessing an enterprise’s – Liquidity (ability to pay current and maturing liabilities) – Solvency (ability to pay debt and related interest) – Financial flexibility (ability to respond to unexpected needs and opportunities) 4

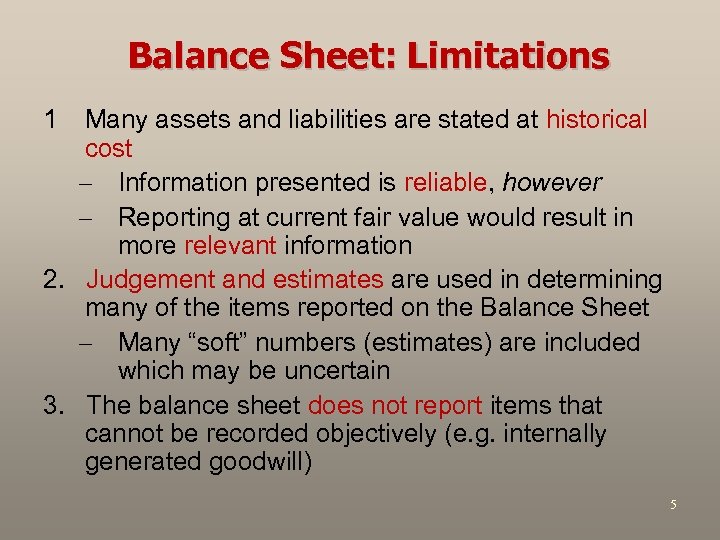

Balance Sheet: Limitations 1 Many assets and liabilities are stated at historical cost – Information presented is reliable, however – Reporting at current fair value would result in more relevant information 2. Judgement and estimates are used in determining many of the items reported on the Balance Sheet – Many “soft” numbers (estimates) are included which may be uncertain 3. The balance sheet does not report items that cannot be recorded objectively (e. g. internally generated goodwill) 5

Balance Sheet: Limitations 1 Many assets and liabilities are stated at historical cost – Information presented is reliable, however – Reporting at current fair value would result in more relevant information 2. Judgement and estimates are used in determining many of the items reported on the Balance Sheet – Many “soft” numbers (estimates) are included which may be uncertain 3. The balance sheet does not report items that cannot be recorded objectively (e. g. internally generated goodwill) 5

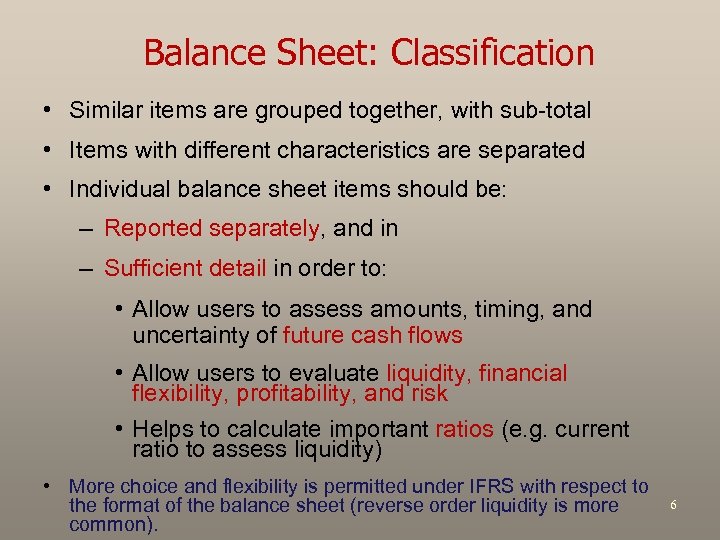

Balance Sheet: Classification • Similar items are grouped together, with sub-total • Items with different characteristics are separated • Individual balance sheet items should be: – Reported separately, and in – Sufficient detail in order to: • Allow users to assess amounts, timing, and uncertainty of future cash flows • Allow users to evaluate liquidity, financial flexibility, profitability, and risk • Helps to calculate important ratios (e. g. current ratio to assess liquidity) • More choice and flexibility is permitted under IFRS with respect to the format of the balance sheet (reverse order liquidity is more common). 6

Balance Sheet: Classification • Similar items are grouped together, with sub-total • Items with different characteristics are separated • Individual balance sheet items should be: – Reported separately, and in – Sufficient detail in order to: • Allow users to assess amounts, timing, and uncertainty of future cash flows • Allow users to evaluate liquidity, financial flexibility, profitability, and risk • Helps to calculate important ratios (e. g. current ratio to assess liquidity) • More choice and flexibility is permitted under IFRS with respect to the format of the balance sheet (reverse order liquidity is more common). 6

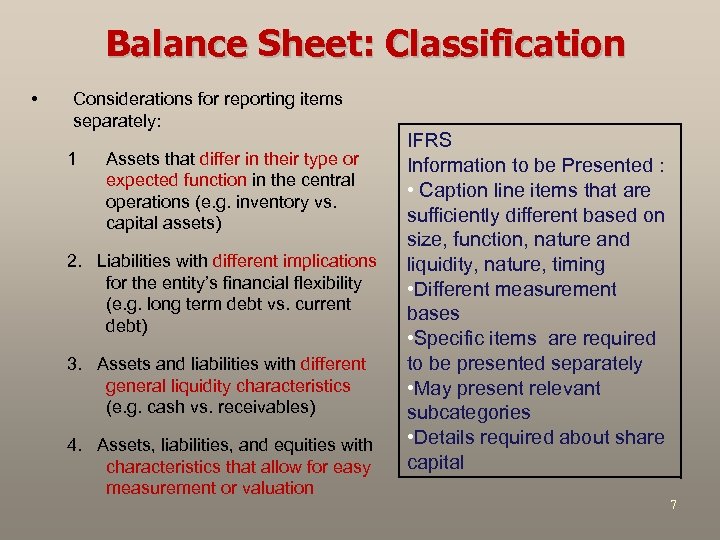

Balance Sheet: Classification • Considerations for reporting items separately: 1 Assets that differ in their type or expected function in the central operations (e. g. inventory vs. capital assets) 2. Liabilities with different implications for the entity’s financial flexibility (e. g. long term debt vs. current debt) 3. Assets and liabilities with different general liquidity characteristics (e. g. cash vs. receivables) 4. Assets, liabilities, and equities with characteristics that allow for easy measurement or valuation IFRS Information to be Presented : • Caption line items that are sufficiently different based on size, function, nature and liquidity, nature, timing • Different measurement bases • Specific items are required to be presented separately • May present relevant subcategories • Details required about share capital 7

Balance Sheet: Classification • Considerations for reporting items separately: 1 Assets that differ in their type or expected function in the central operations (e. g. inventory vs. capital assets) 2. Liabilities with different implications for the entity’s financial flexibility (e. g. long term debt vs. current debt) 3. Assets and liabilities with different general liquidity characteristics (e. g. cash vs. receivables) 4. Assets, liabilities, and equities with characteristics that allow for easy measurement or valuation IFRS Information to be Presented : • Caption line items that are sufficiently different based on size, function, nature and liquidity, nature, timing • Different measurement bases • Specific items are required to be presented separately • May present relevant subcategories • Details required about share capital 7

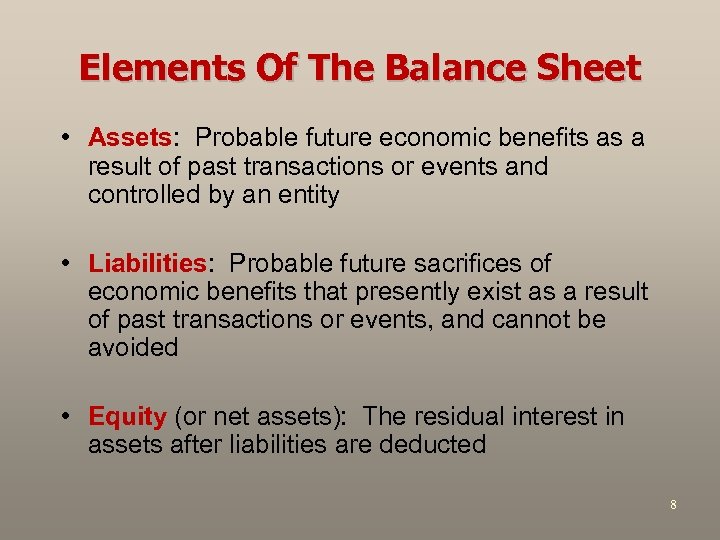

Elements Of The Balance Sheet • Assets: Probable future economic benefits as a result of past transactions or events and controlled by an entity • Liabilities: Probable future sacrifices of economic benefits that presently exist as a result of past transactions or events, and cannot be avoided • Equity (or net assets): The residual interest in assets after liabilities are deducted 8

Elements Of The Balance Sheet • Assets: Probable future economic benefits as a result of past transactions or events and controlled by an entity • Liabilities: Probable future sacrifices of economic benefits that presently exist as a result of past transactions or events, and cannot be avoided • Equity (or net assets): The residual interest in assets after liabilities are deducted 8

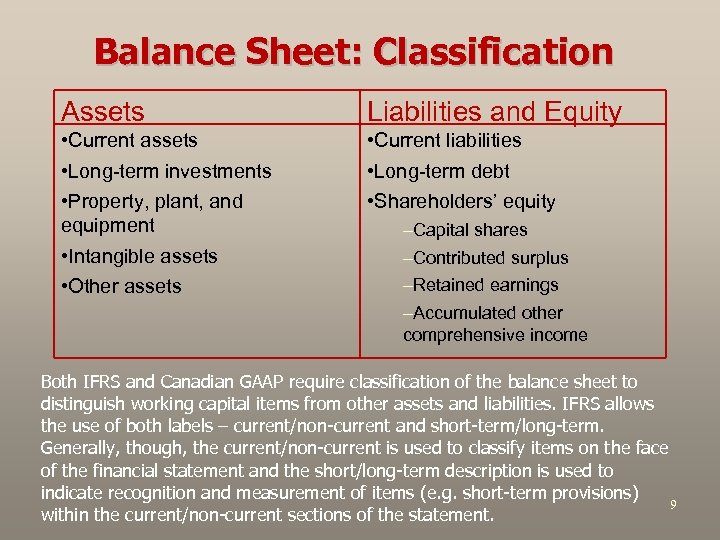

Balance Sheet: Classification Assets Liabilities and Equity • Current assets • Long-term investments • Property, plant, and equipment • Intangible assets • Other assets • Current liabilities • Long-term debt • Shareholders’ equity –Capital shares –Contributed surplus –Retained earnings –Accumulated other comprehensive income Both IFRS and Canadian GAAP require classification of the balance sheet to distinguish working capital items from other assets and liabilities. IFRS allows the use of both labels – current/non-current and short-term/long-term. Generally, though, the current/non-current is used to classify items on the face of the financial statement and the short/long-term description is used to indicate recognition and measurement of items (e. g. short-term provisions) 9 within the current/non-current sections of the statement.

Balance Sheet: Classification Assets Liabilities and Equity • Current assets • Long-term investments • Property, plant, and equipment • Intangible assets • Other assets • Current liabilities • Long-term debt • Shareholders’ equity –Capital shares –Contributed surplus –Retained earnings –Accumulated other comprehensive income Both IFRS and Canadian GAAP require classification of the balance sheet to distinguish working capital items from other assets and liabilities. IFRS allows the use of both labels – current/non-current and short-term/long-term. Generally, though, the current/non-current is used to classify items on the face of the financial statement and the short/long-term description is used to indicate recognition and measurement of items (e. g. short-term provisions) 9 within the current/non-current sections of the statement.

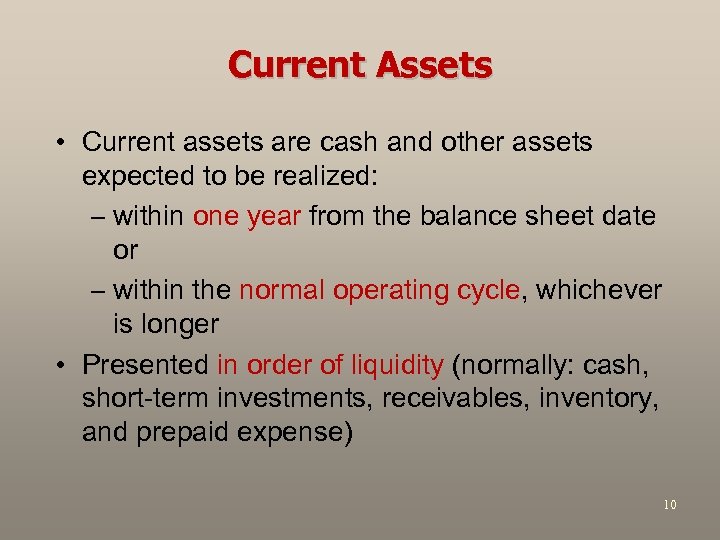

Current Assets • Current assets are cash and other assets expected to be realized: – within one year from the balance sheet date or – within the normal operating cycle, whichever is longer • Presented in order of liquidity (normally: cash, short-term investments, receivables, inventory, and prepaid expense) 10

Current Assets • Current assets are cash and other assets expected to be realized: – within one year from the balance sheet date or – within the normal operating cycle, whichever is longer • Presented in order of liquidity (normally: cash, short-term investments, receivables, inventory, and prepaid expense) 10

Current Assets–Cash • Often includes cash and cash equivalents • Defined as: Cash, demand deposits, short-term liquid investments convertible to a known cash amount, and not subject to material value changes • Any known restrictions to cash must be disclosed 11

Current Assets–Cash • Often includes cash and cash equivalents • Defined as: Cash, demand deposits, short-term liquid investments convertible to a known cash amount, and not subject to material value changes • Any known restrictions to cash must be disclosed 11

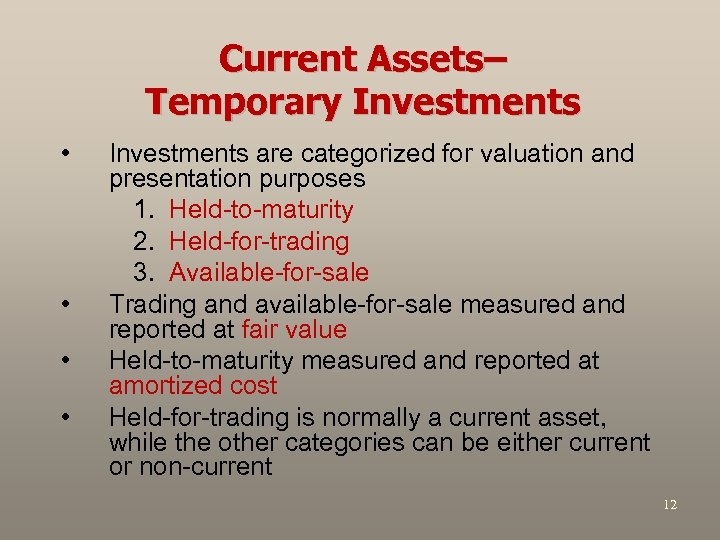

Current Assets– Temporary Investments • • Investments are categorized for valuation and presentation purposes 1. Held-to-maturity 2. Held-for-trading 3. Available-for-sale Trading and available-for-sale measured and reported at fair value Held-to-maturity measured and reported at amortized cost Held-for-trading is normally a current asset, while the other categories can be either current or non-current 12

Current Assets– Temporary Investments • • Investments are categorized for valuation and presentation purposes 1. Held-to-maturity 2. Held-for-trading 3. Available-for-sale Trading and available-for-sale measured and reported at fair value Held-to-maturity measured and reported at amortized cost Held-for-trading is normally a current asset, while the other categories can be either current or non-current 12

Current Assets–Receivables • • • Amounts should be reported separately based on the nature of their origin: 1. Ordinary trade accounts 2. Amounts owing by related parties 3. Other (substantial) unusual items Separate disclosure required for: 1. Anticipated losses (uncollectibles) 2. Amount and nature of nontrade receivables 3. Receivables pledged as collateral Accounts receivable valued at net realizable value 13

Current Assets–Receivables • • • Amounts should be reported separately based on the nature of their origin: 1. Ordinary trade accounts 2. Amounts owing by related parties 3. Other (substantial) unusual items Separate disclosure required for: 1. Anticipated losses (uncollectibles) 2. Amount and nature of nontrade receivables 3. Receivables pledged as collateral Accounts receivable valued at net realizable value 13

Current Assets–Inventories • • • Valuation basis (lower of cost and net realizable value) disclosed Cost flow assumption method (e. g. FIFO, weighted average) must be disclosed Manufacturing enterprise will disclose completion stage of inventories: 1. Raw materials 2. Work in progress 3. Finished goods 14

Current Assets–Inventories • • • Valuation basis (lower of cost and net realizable value) disclosed Cost flow assumption method (e. g. FIFO, weighted average) must be disclosed Manufacturing enterprise will disclose completion stage of inventories: 1. Raw materials 2. Work in progress 3. Finished goods 14

Current Assets– Prepaid Expenses • Defined as: expenditures already made for benefits to be received within one year or the operating cycle (whichever is longer) • Most common examples include: – Insurance – Rent – Advertising – Supplies • Current practice is to report some prepaid amounts where the benefit extends beyond one year (or operating cycle) 15

Current Assets– Prepaid Expenses • Defined as: expenditures already made for benefits to be received within one year or the operating cycle (whichever is longer) • Most common examples include: – Insurance – Rent – Advertising – Supplies • Current practice is to report some prepaid amounts where the benefit extends beyond one year (or operating cycle) 15

Long-Term Investments • Long-term investments normally consist of one of the following: – Debt securities – Equity securities – Sinking funds, tangible assets held as investments, other • Investments are intended to be held for an extended period of time • Valuation Securities: • Fair value if available for sale • Amortized cost if held to maturity • Equity method if significant influence 16

Long-Term Investments • Long-term investments normally consist of one of the following: – Debt securities – Equity securities – Sinking funds, tangible assets held as investments, other • Investments are intended to be held for an extended period of time • Valuation Securities: • Fair value if available for sale • Amortized cost if held to maturity • Equity method if significant influence 16

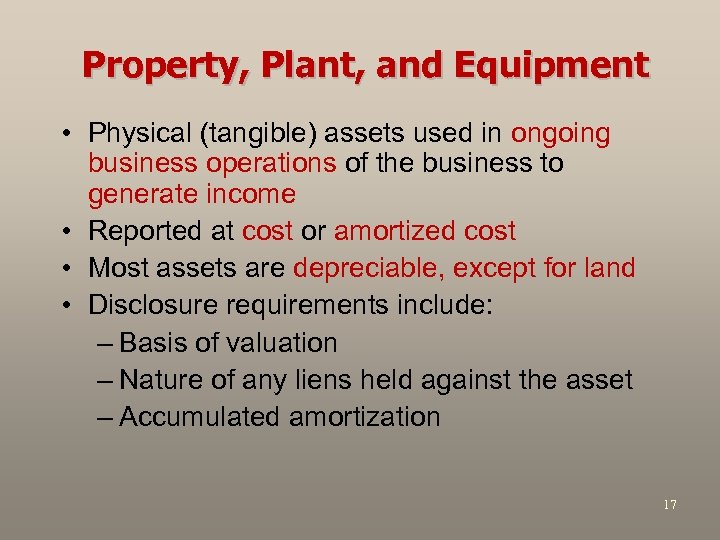

Property, Plant, and Equipment • Physical (tangible) assets used in ongoing business operations of the business to generate income • Reported at cost or amortized cost • Most assets are depreciable, except for land • Disclosure requirements include: – Basis of valuation – Nature of any liens held against the asset – Accumulated amortization 17

Property, Plant, and Equipment • Physical (tangible) assets used in ongoing business operations of the business to generate income • Reported at cost or amortized cost • Most assets are depreciable, except for land • Disclosure requirements include: – Basis of valuation – Nature of any liens held against the asset – Accumulated amortization 17

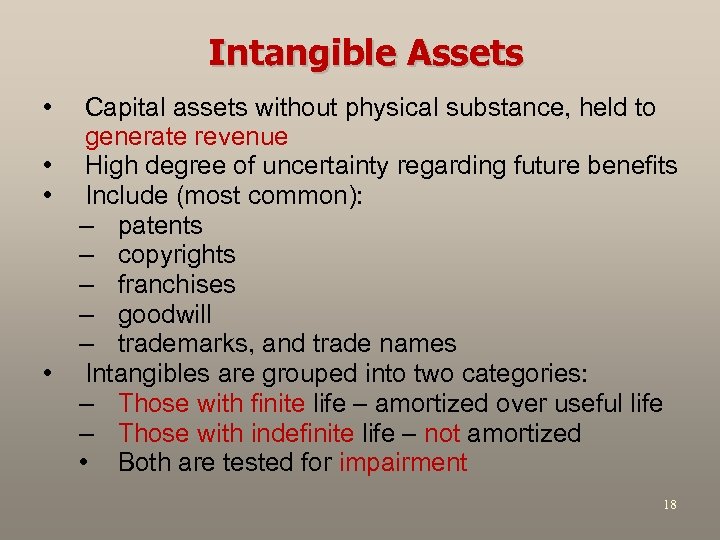

Intangible Assets • • Capital assets without physical substance, held to generate revenue High degree of uncertainty regarding future benefits Include (most common): – patents – copyrights – franchises – goodwill – trademarks, and trade names Intangibles are grouped into two categories: – Those with finite life – amortized over useful life – Those with indefinite life – not amortized • Both are tested for impairment 18

Intangible Assets • • Capital assets without physical substance, held to generate revenue High degree of uncertainty regarding future benefits Include (most common): – patents – copyrights – franchises – goodwill – trademarks, and trade names Intangibles are grouped into two categories: – Those with finite life – amortized over useful life – Those with indefinite life – not amortized • Both are tested for impairment 18

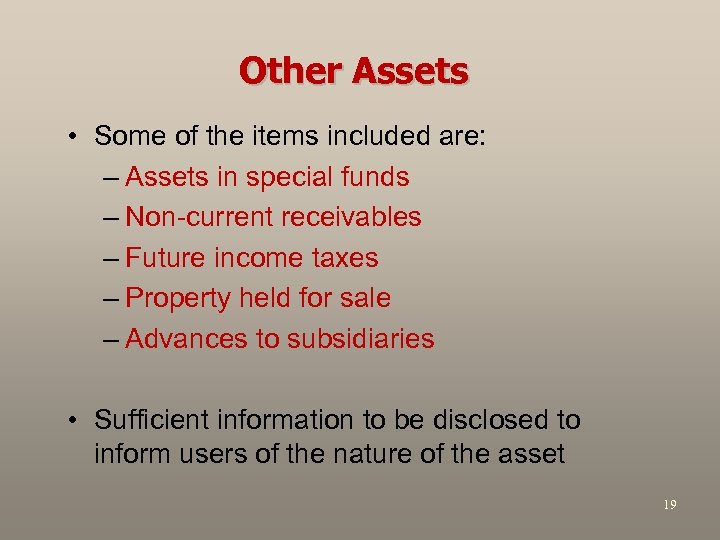

Other Assets • Some of the items included are: – Assets in special funds – Non-current receivables – Future income taxes – Property held for sale – Advances to subsidiaries • Sufficient information to be disclosed to inform users of the nature of the asset 19

Other Assets • Some of the items included are: – Assets in special funds – Non-current receivables – Future income taxes – Property held for sale – Advances to subsidiaries • Sufficient information to be disclosed to inform users of the nature of the asset 19

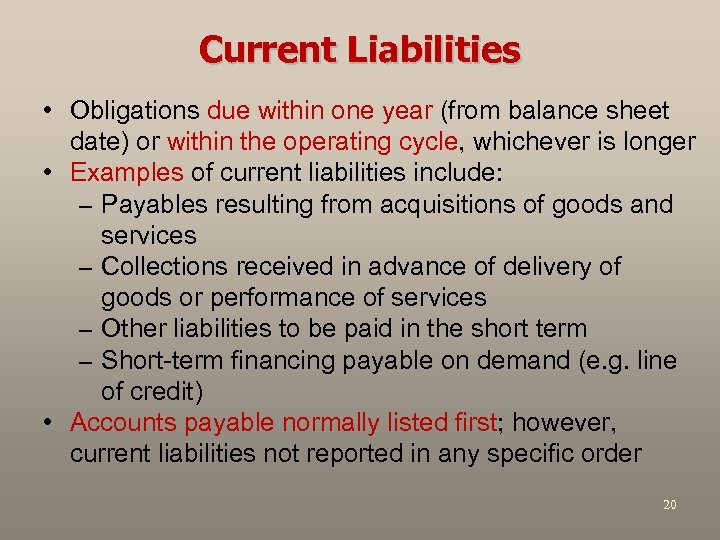

Current Liabilities • Obligations due within one year (from balance sheet date) or within the operating cycle, whichever is longer • Examples of current liabilities include: – Payables resulting from acquisitions of goods and services – Collections received in advance of delivery of goods or performance of services – Other liabilities to be paid in the short term – Short-term financing payable on demand (e. g. line of credit) • Accounts payable normally listed first; however, current liabilities not reported in any specific order 20

Current Liabilities • Obligations due within one year (from balance sheet date) or within the operating cycle, whichever is longer • Examples of current liabilities include: – Payables resulting from acquisitions of goods and services – Collections received in advance of delivery of goods or performance of services – Other liabilities to be paid in the short term – Short-term financing payable on demand (e. g. line of credit) • Accounts payable normally listed first; however, current liabilities not reported in any specific order 20

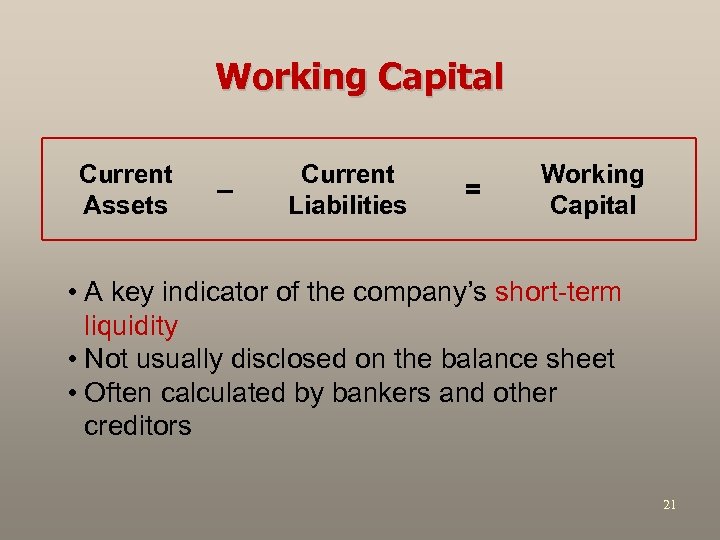

Working Capital Current Assets – Current Liabilities = Working Capital • A key indicator of the company’s short-term liquidity • Not usually disclosed on the balance sheet • Often calculated by bankers and other creditors 21

Working Capital Current Assets – Current Liabilities = Working Capital • A key indicator of the company’s short-term liquidity • Not usually disclosed on the balance sheet • Often calculated by bankers and other creditors 21

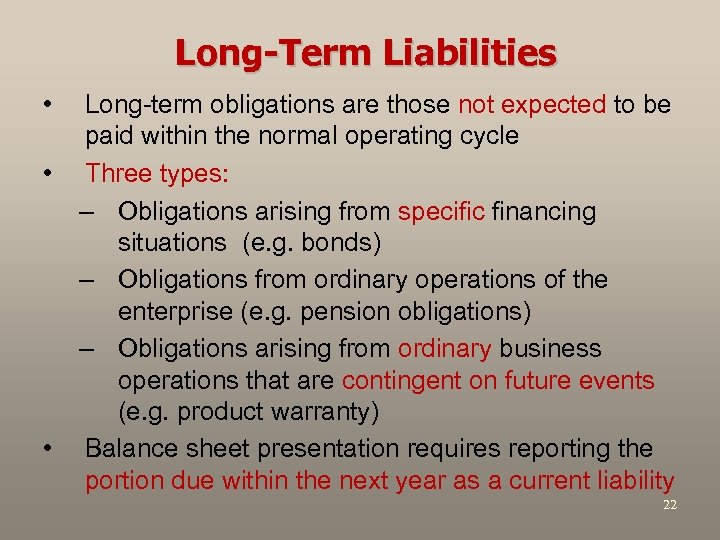

Long-Term Liabilities • • • Long-term obligations are those not expected to be paid within the normal operating cycle Three types: – Obligations arising from specific financing situations (e. g. bonds) – Obligations from ordinary operations of the enterprise (e. g. pension obligations) – Obligations arising from ordinary business operations that are contingent on future events (e. g. product warranty) Balance sheet presentation requires reporting the portion due within the next year as a current liability 22

Long-Term Liabilities • • • Long-term obligations are those not expected to be paid within the normal operating cycle Three types: – Obligations arising from specific financing situations (e. g. bonds) – Obligations from ordinary operations of the enterprise (e. g. pension obligations) – Obligations arising from ordinary business operations that are contingent on future events (e. g. product warranty) Balance sheet presentation requires reporting the portion due within the next year as a current liability 22

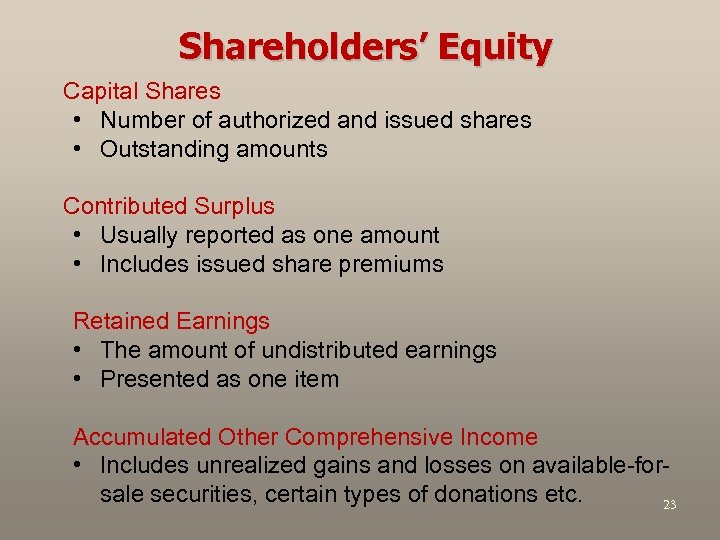

Shareholders’ Equity Capital Shares • Number of authorized and issued shares • Outstanding amounts Contributed Surplus • Usually reported as one amount • Includes issued share premiums Retained Earnings • The amount of undistributed earnings • Presented as one item Accumulated Other Comprehensive Income • Includes unrealized gains and losses on available-forsale securities, certain types of donations etc. 23

Shareholders’ Equity Capital Shares • Number of authorized and issued shares • Outstanding amounts Contributed Surplus • Usually reported as one amount • Includes issued share premiums Retained Earnings • The amount of undistributed earnings • Presented as one item Accumulated Other Comprehensive Income • Includes unrealized gains and losses on available-forsale securities, certain types of donations etc. 23

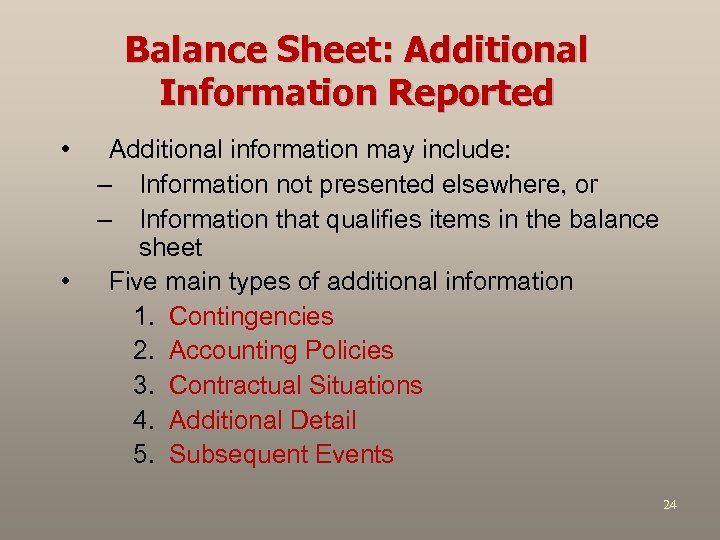

Balance Sheet: Additional Information Reported • • Additional information may include: – Information not presented elsewhere, or – Information that qualifies items in the balance sheet Five main types of additional information 1. Contingencies 2. Accounting Policies 3. Contractual Situations 4. Additional Detail 5. Subsequent Events 24

Balance Sheet: Additional Information Reported • • Additional information may include: – Information not presented elsewhere, or – Information that qualifies items in the balance sheet Five main types of additional information 1. Contingencies 2. Accounting Policies 3. Contractual Situations 4. Additional Detail 5. Subsequent Events 24

Balance Sheet: Techniques of Disclosure 1. Parenthetical explanations (following the items in the balance sheet) 2. Notes (to the balance sheet) 3. Cross references and contra items (where assets and liabilities may be cross referenced) 4. Supporting schedules (as for capital assets’ depreciation) 25

Balance Sheet: Techniques of Disclosure 1. Parenthetical explanations (following the items in the balance sheet) 2. Notes (to the balance sheet) 3. Cross references and contra items (where assets and liabilities may be cross referenced) 4. Supporting schedules (as for capital assets’ depreciation) 25

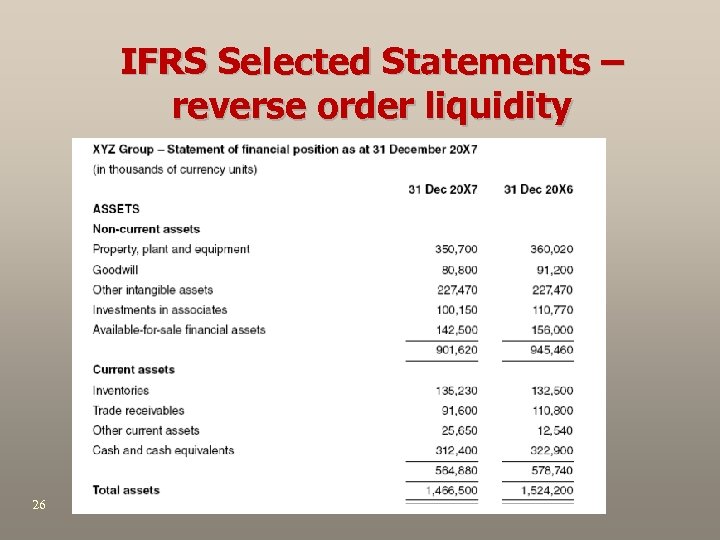

IFRS Selected Statements – reverse order liquidity 26

IFRS Selected Statements – reverse order liquidity 26

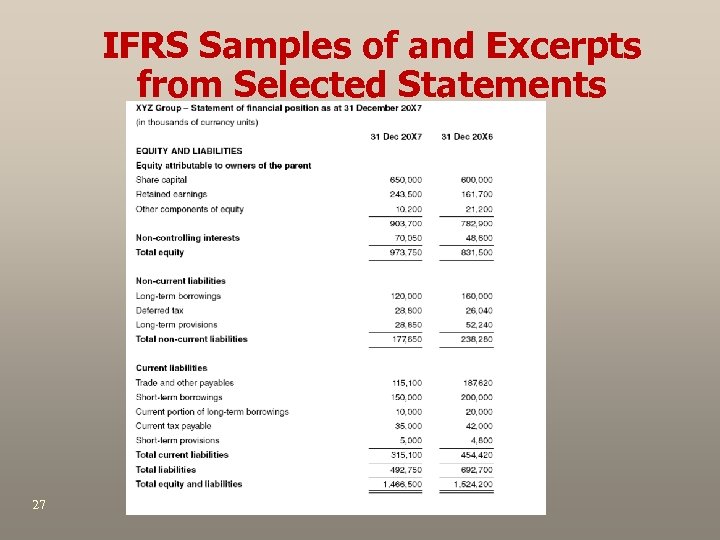

IFRS Samples of and Excerpts from Selected Statements 27

IFRS Samples of and Excerpts from Selected Statements 27

Section 2 Statement of Cash Flows

Section 2 Statement of Cash Flows

Statement of Cash Flows • To assess the firm’s ability to generate cash and cash equivalents and • To assess the firm’s cash requirements • Statement of Cash Flows shows: – Where the cash came from – What the cash was used for – What was the change in the cash balance 29

Statement of Cash Flows • To assess the firm’s ability to generate cash and cash equivalents and • To assess the firm’s cash requirements • Statement of Cash Flows shows: – Where the cash came from – What the cash was used for – What was the change in the cash balance 29

Statement of Cash Flows • Cash activities are divided into three main categories: – Operating Activities • Main revenue-producing activities – Investing Activities • Changes in long-term assets and investments – Financing Activities • Changes in equity and non-operating liabilities 30

Statement of Cash Flows • Cash activities are divided into three main categories: – Operating Activities • Main revenue-producing activities – Investing Activities • Changes in long-term assets and investments – Financing Activities • Changes in equity and non-operating liabilities 30

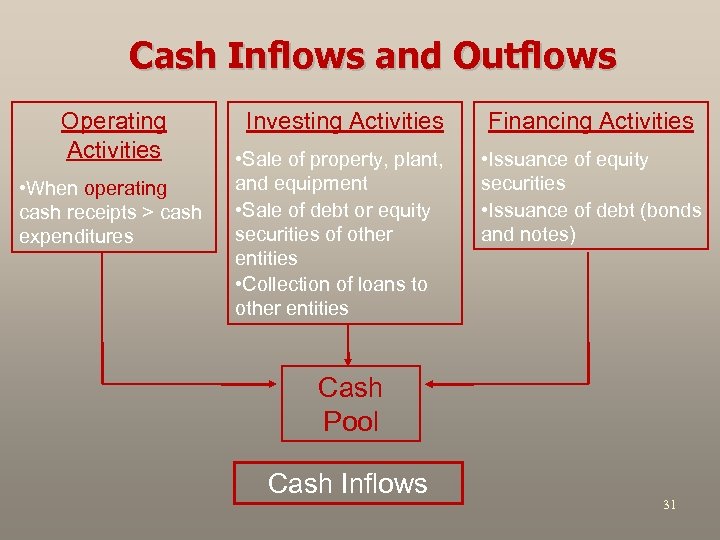

Cash Inflows and Outflows Operating Activities • When operating cash receipts > cash expenditures Investing Activities Financing Activities • Sale of property, plant, and equipment • Sale of debt or equity securities of other entities • Collection of loans to other entities • Issuance of equity securities • Issuance of debt (bonds and notes) Cash Pool Cash Inflows 31

Cash Inflows and Outflows Operating Activities • When operating cash receipts > cash expenditures Investing Activities Financing Activities • Sale of property, plant, and equipment • Sale of debt or equity securities of other entities • Collection of loans to other entities • Issuance of equity securities • Issuance of debt (bonds and notes) Cash Pool Cash Inflows 31

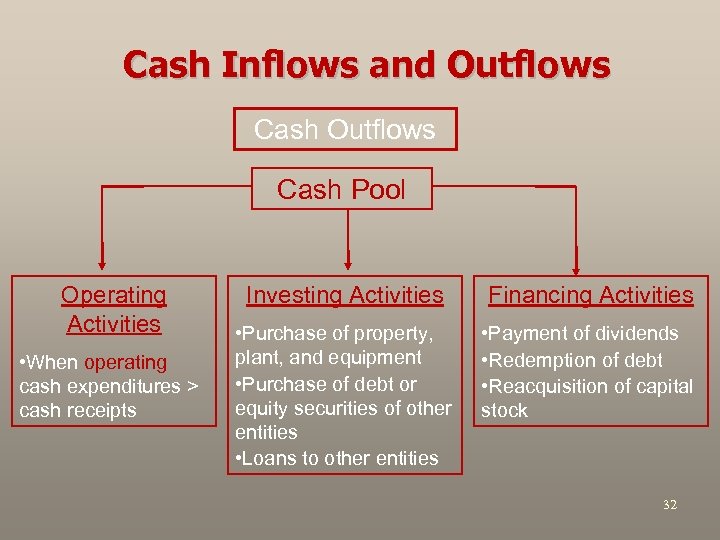

Cash Inflows and Outflows Cash Pool Operating Activities • When operating cash expenditures > cash receipts Investing Activities Financing Activities • Purchase of property, plant, and equipment • Purchase of debt or equity securities of other entities • Loans to other entities • Payment of dividends • Redemption of debt • Reacquisition of capital stock 32

Cash Inflows and Outflows Cash Pool Operating Activities • When operating cash expenditures > cash receipts Investing Activities Financing Activities • Purchase of property, plant, and equipment • Purchase of debt or equity securities of other entities • Loans to other entities • Payment of dividends • Redemption of debt • Reacquisition of capital stock 32

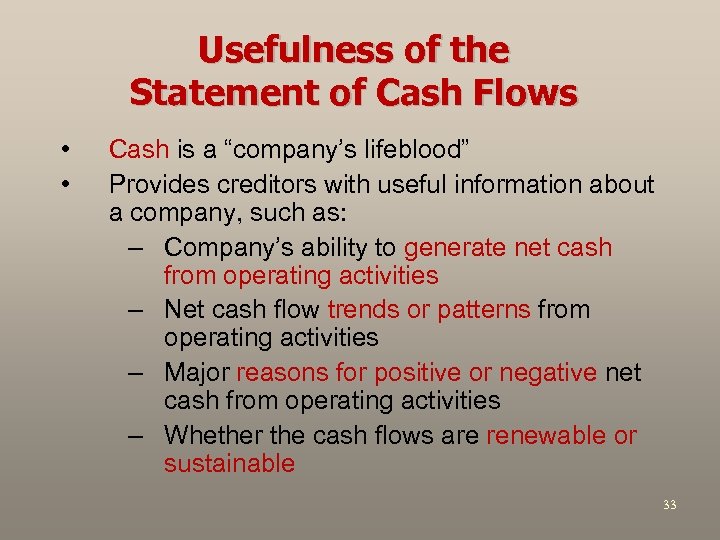

Usefulness of the Statement of Cash Flows • • Cash is a “company’s lifeblood” Provides creditors with useful information about a company, such as: – Company’s ability to generate net cash from operating activities – Net cash flow trends or patterns from operating activities – Major reasons for positive or negative net cash from operating activities – Whether the cash flows are renewable or sustainable 33

Usefulness of the Statement of Cash Flows • • Cash is a “company’s lifeblood” Provides creditors with useful information about a company, such as: – Company’s ability to generate net cash from operating activities – Net cash flow trends or patterns from operating activities – Major reasons for positive or negative net cash from operating activities – Whether the cash flows are renewable or sustainable 33

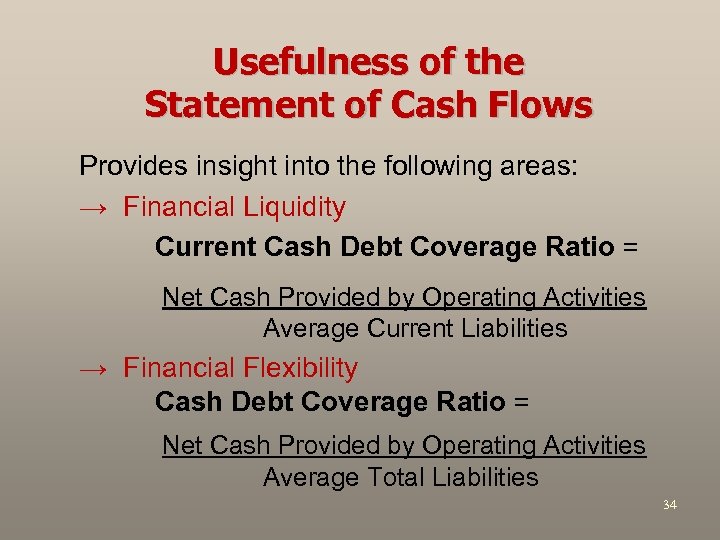

Usefulness of the Statement of Cash Flows Provides insight into the following areas: → Financial Liquidity Current Cash Debt Coverage Ratio = Net Cash Provided by Operating Activities Average Current Liabilities → Financial Flexibility Cash Debt Coverage Ratio = Net Cash Provided by Operating Activities Average Total Liabilities 34

Usefulness of the Statement of Cash Flows Provides insight into the following areas: → Financial Liquidity Current Cash Debt Coverage Ratio = Net Cash Provided by Operating Activities Average Current Liabilities → Financial Flexibility Cash Debt Coverage Ratio = Net Cash Provided by Operating Activities Average Total Liabilities 34

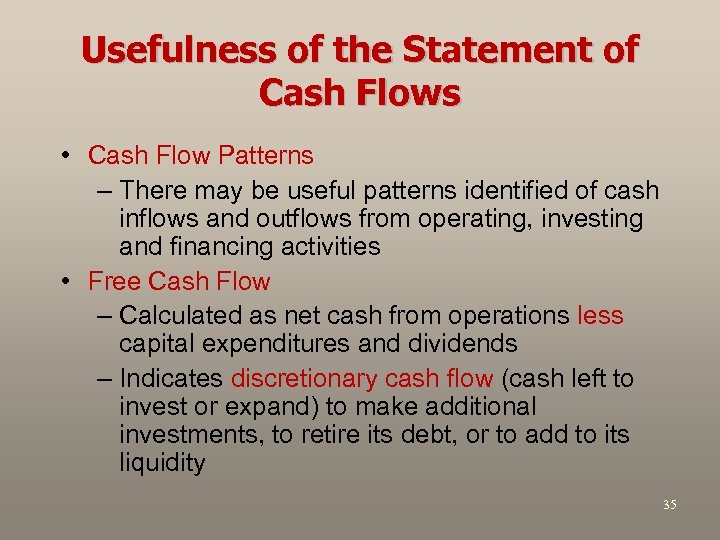

Usefulness of the Statement of Cash Flows • Cash Flow Patterns – There may be useful patterns identified of cash inflows and outflows from operating, investing and financing activities • Free Cash Flow – Calculated as net cash from operations less capital expenditures and dividends – Indicates discretionary cash flow (cash left to invest or expand) to make additional investments, to retire its debt, or to add to its liquidity 35

Usefulness of the Statement of Cash Flows • Cash Flow Patterns – There may be useful patterns identified of cash inflows and outflows from operating, investing and financing activities • Free Cash Flow – Calculated as net cash from operations less capital expenditures and dividends – Indicates discretionary cash flow (cash left to invest or expand) to make additional investments, to retire its debt, or to add to its liquidity 35

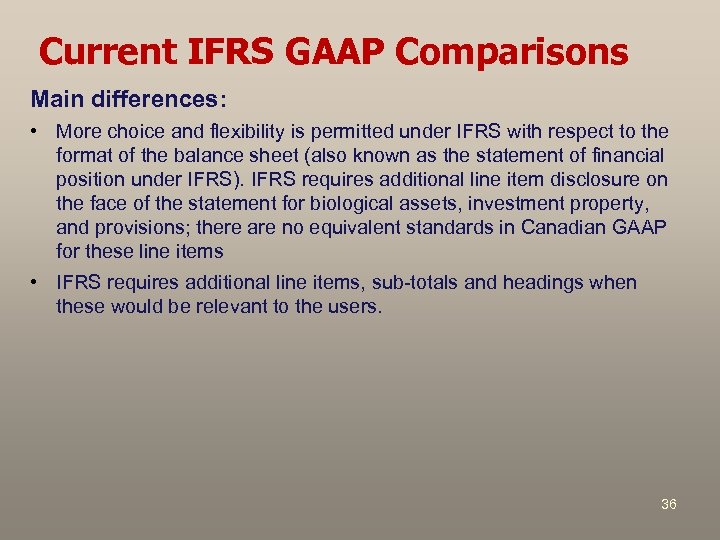

Current IFRS GAAP Comparisons Main differences: • More choice and flexibility is permitted under IFRS with respect to the format of the balance sheet (also known as the statement of financial position under IFRS). IFRS requires additional line item disclosure on the face of the statement for biological assets, investment property, and provisions; there are no equivalent standards in Canadian GAAP for these line items • IFRS requires additional line items, sub-totals and headings when these would be relevant to the users. 36

Current IFRS GAAP Comparisons Main differences: • More choice and flexibility is permitted under IFRS with respect to the format of the balance sheet (also known as the statement of financial position under IFRS). IFRS requires additional line item disclosure on the face of the statement for biological assets, investment property, and provisions; there are no equivalent standards in Canadian GAAP for these line items • IFRS requires additional line items, sub-totals and headings when these would be relevant to the users. 36

Current IFRS GAAP Comparisons Main differences: • Both IFRS and Canadian GAAP require classification of the balance sheet to distinguish working capital items from other assets and liabilities. IFRS allows the use of both labels – current/non-current and short-term/long-term. Generally, though, the current/non-current is used to classify items on the face of the financial statement and the short/long-term description is used to indicate recognition and measurement of items (e. g. short-term provisions) within the current/non-current sections of the statement. • Under IFRS, all deferred income taxes are classified as non-current. 37

Current IFRS GAAP Comparisons Main differences: • Both IFRS and Canadian GAAP require classification of the balance sheet to distinguish working capital items from other assets and liabilities. IFRS allows the use of both labels – current/non-current and short-term/long-term. Generally, though, the current/non-current is used to classify items on the face of the financial statement and the short/long-term description is used to indicate recognition and measurement of items (e. g. short-term provisions) within the current/non-current sections of the statement. • Under IFRS, all deferred income taxes are classified as non-current. 37

Current IFRS GAAP Comparisons Main differences (continued): • Under IFRS, if there is a breach of a covenant or long-term agreement that makes the liability due on demand at the balance sheet date, the loan must be classified as current. If there are renegotiations, any new agreement must be in place by the balance sheet date in order to classify the loan as noncurrent. 38

Current IFRS GAAP Comparisons Main differences (continued): • Under IFRS, if there is a breach of a covenant or long-term agreement that makes the liability due on demand at the balance sheet date, the loan must be classified as current. If there are renegotiations, any new agreement must be in place by the balance sheet date in order to classify the loan as noncurrent. 38

Current IFRS GAAP Comparisons Main differences (continued): • Under IFRS, an accounting policy choice is required to classify these cash flows in a consistent manner. These cash flows should be classified as operating, investing or financing depending on the nature of the underlying cash flows. This differs from Canadian GAAP under which these cash flows are classified as operating activities if it the item is included in the income statement; if the cash flow is not included in the income statement, it should be classified according to its nature (e. g. dividends charged to retained earnings would be classified as financing activities). 39

Current IFRS GAAP Comparisons Main differences (continued): • Under IFRS, an accounting policy choice is required to classify these cash flows in a consistent manner. These cash flows should be classified as operating, investing or financing depending on the nature of the underlying cash flows. This differs from Canadian GAAP under which these cash flows are classified as operating activities if it the item is included in the income statement; if the cash flow is not included in the income statement, it should be classified according to its nature (e. g. dividends charged to retained earnings would be classified as financing activities). 39

Looking Ahead • The IASB is involved in “Financial Statement Presentation” project which consists of three phases: 1. Phase A - What constitutes a complete set of financial statements 2. Phase B - Presentation of information on the face of the statements 3. Phase C - Interim financial reporting • The three objectives for financial statement presentation are that information should be presented in the financial statements in a manner that: – Portrays a cohesive financial picture of an entity’s activities. – Disaggregates information so that it is useful in predicting an entity’s future cash flows. – Helps users assess an entity’s liquidity and financial flexibility. 40

Looking Ahead • The IASB is involved in “Financial Statement Presentation” project which consists of three phases: 1. Phase A - What constitutes a complete set of financial statements 2. Phase B - Presentation of information on the face of the statements 3. Phase C - Interim financial reporting • The three objectives for financial statement presentation are that information should be presented in the financial statements in a manner that: – Portrays a cohesive financial picture of an entity’s activities. – Disaggregates information so that it is useful in predicting an entity’s future cash flows. – Helps users assess an entity’s liquidity and financial flexibility. 40

COPYRIGHT Copyright © 2009 John Wiley & Sons Canada, Ltd. All rights reserved. Reproduction or translation of this work beyond that permitted by Access Copyright (The Canadian Copyright Licensing Agency) is unlawful. Requests for further information should be addressed to the Permissions Department, John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his or her own use only and not for distribution or resale. The author and the publisher assume no responsibility for errors, omissions, or damages caused by the use of these programs or from the use of the information contained herein. 41

COPYRIGHT Copyright © 2009 John Wiley & Sons Canada, Ltd. All rights reserved. Reproduction or translation of this work beyond that permitted by Access Copyright (The Canadian Copyright Licensing Agency) is unlawful. Requests for further information should be addressed to the Permissions Department, John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his or her own use only and not for distribution or resale. The author and the publisher assume no responsibility for errors, omissions, or damages caused by the use of these programs or from the use of the information contained herein. 41