ccd2447c1ee0b4fe6455d4008a501e60.ppt

- Количество слайдов: 41

CHAPTER 5 Externalities Mc. Graw-Hill/Irwin Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

CHAPTER 5 Externalities Mc. Graw-Hill/Irwin Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Externalities o Externality – An activity on one entity that affects the welfare of another entity in a way that is outside the market mechanism. o Externalities cause market price to diverge from social cost, brining about an inefficient allocation of resources. o Externalities cause market price to diverge from social cost, bringing about an inefficient allocation of resources. o Example: Bart’s factory and Lisa’s fishing. 25 -

Externalities o Externality – An activity on one entity that affects the welfare of another entity in a way that is outside the market mechanism. o Externalities cause market price to diverge from social cost, brining about an inefficient allocation of resources. o Externalities cause market price to diverge from social cost, bringing about an inefficient allocation of resources. o Example: Bart’s factory and Lisa’s fishing. 25 -

Not Externalities o Not an Externality: An activity on one entity that affects the welfare of another entity in a way that is inside the market mechanism. o Example: Two business competitive industries’ prices. 35 -

Not Externalities o Not an Externality: An activity on one entity that affects the welfare of another entity in a way that is inside the market mechanism. o Example: Two business competitive industries’ prices. 35 -

The Nature of Externalities o o o Privately-owned versus commonly-owned resources. Externalities can be produced by consumers as well as firms. Externalities are reciprocal (mutual) in nature. Externalities can be positive; e. g. general knowledge. Public goods can be viewed as a special kind of externality. 45 -

The Nature of Externalities o o o Privately-owned versus commonly-owned resources. Externalities can be produced by consumers as well as firms. Externalities are reciprocal (mutual) in nature. Externalities can be positive; e. g. general knowledge. Public goods can be viewed as a special kind of externality. 45 -

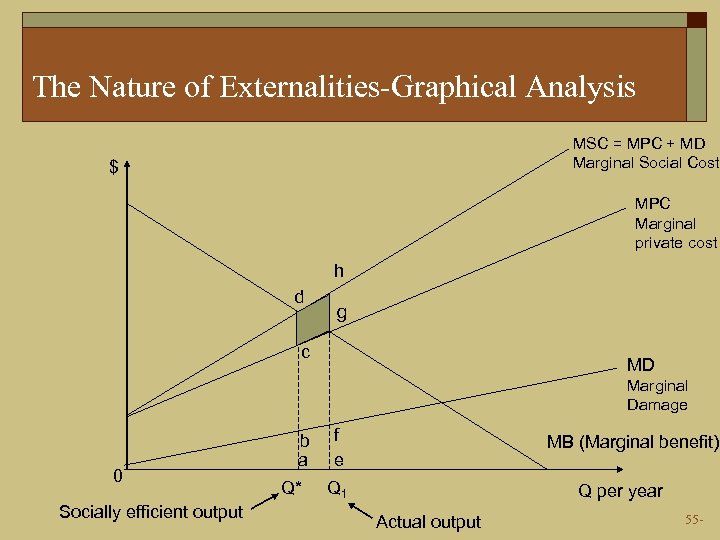

The Nature of Externalities-Graphical Analysis MSC = MPC + MD Marginal Social Cost $ MPC Marginal private cost h d g c MD Marginal Damage 0 Socially efficient output b a Q* f e MB (Marginal benefit) Q 1 Q per year Actual output 55 -

The Nature of Externalities-Graphical Analysis MSC = MPC + MD Marginal Social Cost $ MPC Marginal private cost h d g c MD Marginal Damage 0 Socially efficient output b a Q* f e MB (Marginal benefit) Q 1 Q per year Actual output 55 -

What Pollutants Do Harm? o Empirical Evidence: What is the effect of pollution on health? o What activities produce pollutants? o What is the value of the damage done? o Empirical Evidence: The effect of air pollution on housing values. 65 -

What Pollutants Do Harm? o Empirical Evidence: What is the effect of pollution on health? o What activities produce pollutants? o What is the value of the damage done? o Empirical Evidence: The effect of air pollution on housing values. 65 -

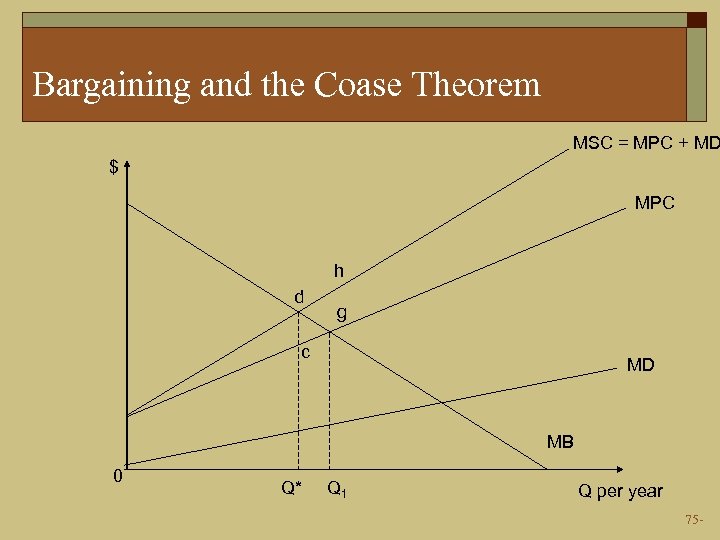

Bargaining and the Coase Theorem MSC = MPC + MD $ MPC h d g c MD MB 0 Q* Q 1 Q per year 75 -

Bargaining and the Coase Theorem MSC = MPC + MD $ MPC h d g c MD MB 0 Q* Q 1 Q per year 75 -

The Coase Theorem o Coase Theorem – Provided that transaction casts are negligible, an efficient solution to an externality problem is achieved as long as someone is assigned property rights, independent of who is assigned those rights. Thus no government intervention is required to deal with externalities. o Coase Theorem indicates that private parties may bargain toward the efficient output if property rights are established. However, bargaining costs must be low and source of the externalities easily identified. 85 -

The Coase Theorem o Coase Theorem – Provided that transaction casts are negligible, an efficient solution to an externality problem is achieved as long as someone is assigned property rights, independent of who is assigned those rights. Thus no government intervention is required to deal with externalities. o Coase Theorem indicates that private parties may bargain toward the efficient output if property rights are established. However, bargaining costs must be low and source of the externalities easily identified. 85 -

The Coase Theorem o Assumptions necessary for Coase Theorem to work include: n The costs to the parties of bargaining are low. n The owners of resources can identify the source of damages to their property and legally prevent damages. 95 -

The Coase Theorem o Assumptions necessary for Coase Theorem to work include: n The costs to the parties of bargaining are low. n The owners of resources can identify the source of damages to their property and legally prevent damages. 95 -

Other Private Solutions o Mergers: One business buys another or a third business buys the two. o Social conventions: Certain social conventions can be viewed as attempts to force people to take into account the externalities they generate. “Before you undertake some activity, take into account its external marginal benefit and cost. ” 105 -

Other Private Solutions o Mergers: One business buys another or a third business buys the two. o Social conventions: Certain social conventions can be viewed as attempts to force people to take into account the externalities they generate. “Before you undertake some activity, take into account its external marginal benefit and cost. ” 105 -

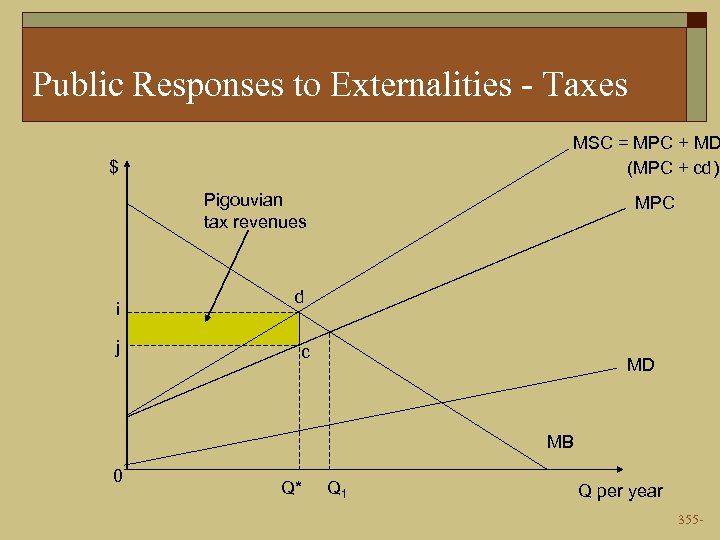

Public Solutions o Tax o A Pigouvian tax is a tax levied on pollution in an amount equal to the marginal social damage at the efficient level. Referred to A. C. Pigou in 1930 s. o Such tax gives the producer a private incentive to pollute the efficient amount. 115 -

Public Solutions o Tax o A Pigouvian tax is a tax levied on pollution in an amount equal to the marginal social damage at the efficient level. Referred to A. C. Pigou in 1930 s. o Such tax gives the producer a private incentive to pollute the efficient amount. 115 -

Tax 125 -

Tax 125 -

Key Questions · Why is the government allowed to collect taxes? · How does the government acquire money to operate on a federal, state and local level? · What are three major types of taxes? How are they different? · What are the principles of a governmental tax system? 135 -

Key Questions · Why is the government allowed to collect taxes? · How does the government acquire money to operate on a federal, state and local level? · What are three major types of taxes? How are they different? · What are the principles of a governmental tax system? 135 -

Why taxes? o To redistribute wealth o To run the country/government o To build and upkeep infrastructure o To reduce imports o To serve the government’s debt o To stop undesirable habits 145 -

Why taxes? o To redistribute wealth o To run the country/government o To build and upkeep infrastructure o To reduce imports o To serve the government’s debt o To stop undesirable habits 145 -

Principles of Taxes o Taxes is the biggest revenues for governments. o A government has to lay its tax system on certain bases or principles. 155 -

Principles of Taxes o Taxes is the biggest revenues for governments. o A government has to lay its tax system on certain bases or principles. 155 -

1. Taxes must be equal o This means that people in the same circumstances must pay the same amount. 165 -

1. Taxes must be equal o This means that people in the same circumstances must pay the same amount. 165 -

2. Taxes must be Certain o This means people know in advance what they will have to pay. o Your tax bill does not depend on the government's spending habits for the year. So you do not get a surprise at the end of the year. 175 -

2. Taxes must be Certain o This means people know in advance what they will have to pay. o Your tax bill does not depend on the government's spending habits for the year. So you do not get a surprise at the end of the year. 175 -

3. Taxes must be economical to collect o This means it cannot cost more to collect than it brings in. 185 -

3. Taxes must be economical to collect o This means it cannot cost more to collect than it brings in. 185 -

4. Taxes must be convenient to collect o Neither the tax office or the tax payer wants hassle collecting the tax. o For example, the tax workers pay called Pay As You Earn (PAYE) is collected by your employer. 195 -

4. Taxes must be convenient to collect o Neither the tax office or the tax payer wants hassle collecting the tax. o For example, the tax workers pay called Pay As You Earn (PAYE) is collected by your employer. 195 -

Canons of taxation Taxes must follow the principles of: 1. Equity 2. Certainty 3. Convenience 4. Economical to collect 205 -

Canons of taxation Taxes must follow the principles of: 1. Equity 2. Certainty 3. Convenience 4. Economical to collect 205 -

Types of Taxes · regressive tax · proportional tax 215 -

Types of Taxes · regressive tax · proportional tax 215 -

Regressive Taxes · Defined as a tax that takes a larger share from higher incomes. · Regressive taxes do not follow the ability to pay principal. That is, people who make more money should pay more taxes. · Sales tax is an example of a regressive tax. Some consumers may pay a higher percentage of tax compared to individuals that earn more money. · Social Security tax is another example of a regressive tax. Residents that make less money will pay a higher percentage of their income toward Social Security. · Regressive tax based on percentage of income is higher in lower income individuals. 225 -

Regressive Taxes · Defined as a tax that takes a larger share from higher incomes. · Regressive taxes do not follow the ability to pay principal. That is, people who make more money should pay more taxes. · Sales tax is an example of a regressive tax. Some consumers may pay a higher percentage of tax compared to individuals that earn more money. · Social Security tax is another example of a regressive tax. Residents that make less money will pay a higher percentage of their income toward Social Security. · Regressive tax based on percentage of income is higher in lower income individuals. 225 -

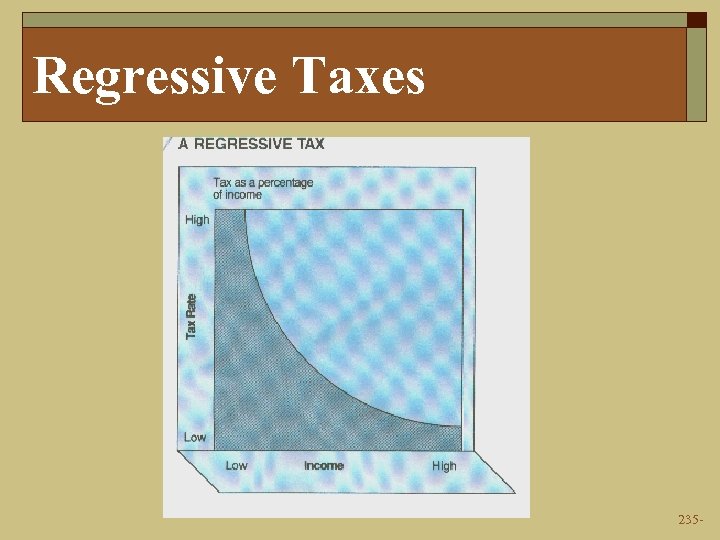

Regressive Taxes 235 -

Regressive Taxes 235 -

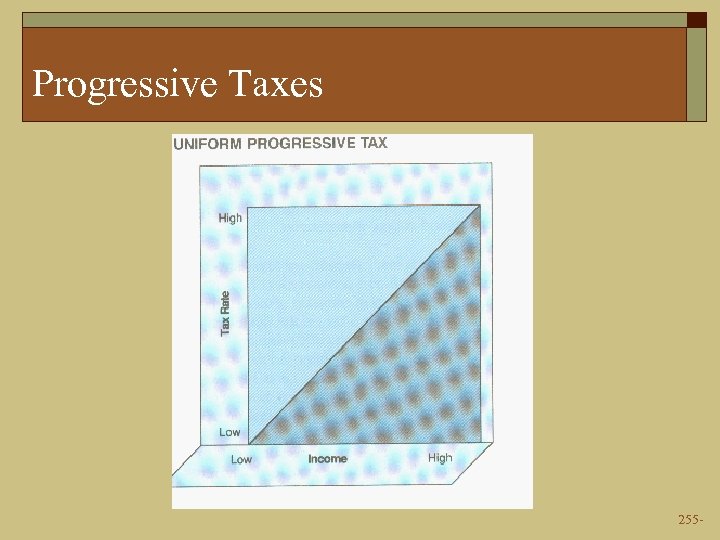

Progressive Taxes · Progressive taxes are based on the ability to pay principal. · Taxpayers at higher income levels pay larger proportions of their incomes in taxes than people at lower levels. · Federal income tax is based on a progressive tax. · The more money individuals make the more money they are asked to pay in taxes. 245 -

Progressive Taxes · Progressive taxes are based on the ability to pay principal. · Taxpayers at higher income levels pay larger proportions of their incomes in taxes than people at lower levels. · Federal income tax is based on a progressive tax. · The more money individuals make the more money they are asked to pay in taxes. 245 -

Progressive Taxes 255 -

Progressive Taxes 255 -

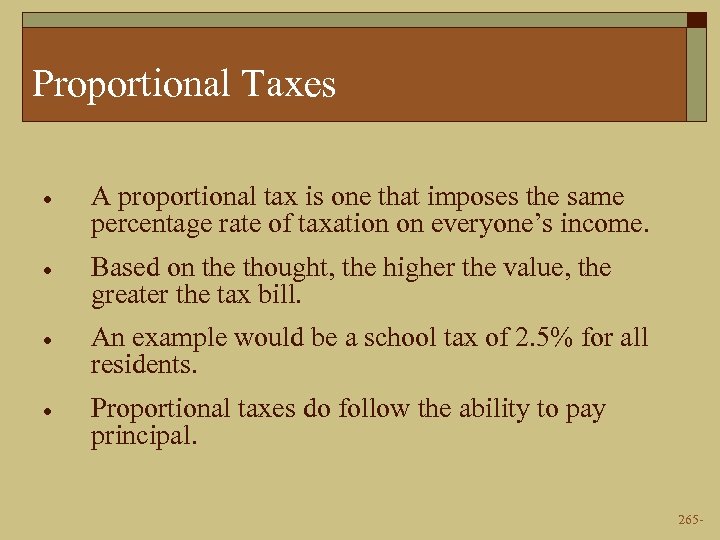

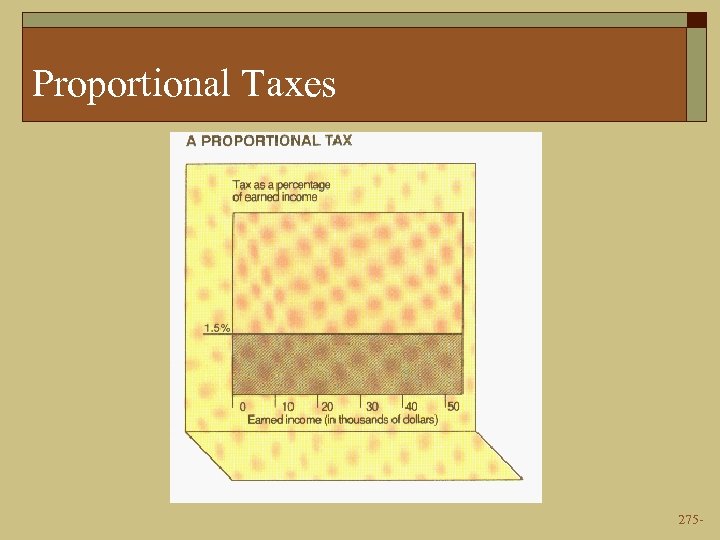

Proportional Taxes · A proportional tax is one that imposes the same percentage rate of taxation on everyone’s income. · Based on the thought, the higher the value, the greater the tax bill. · An example would be a school tax of 2. 5% for all residents. · Proportional taxes do follow the ability to pay principal. 265 -

Proportional Taxes · A proportional tax is one that imposes the same percentage rate of taxation on everyone’s income. · Based on the thought, the higher the value, the greater the tax bill. · An example would be a school tax of 2. 5% for all residents. · Proportional taxes do follow the ability to pay principal. 265 -

Proportional Taxes 275 -

Proportional Taxes 275 -

Direct or Indirect Tax o PAYE direct tax o VAT Indirect tax What is the difference? o Direct Tax, with this type of tax you have no choice, but to pay. For example; income tax. o Indirect Tax, you only pay this type of tax, if you take a certain action. For example, you buy goods so you pay value added tax (VAT). 285 -

Direct or Indirect Tax o PAYE direct tax o VAT Indirect tax What is the difference? o Direct Tax, with this type of tax you have no choice, but to pay. For example; income tax. o Indirect Tax, you only pay this type of tax, if you take a certain action. For example, you buy goods so you pay value added tax (VAT). 285 -

VAT Indirect tax o o This is tax one pays when they buy goods or services. The shopkeeper or service provider adds it to the cost of the goods or services. This is known as a consumer tax in some countries. In some countries, goods are priced in the shop minus this type of tax, but when the customer comes to the checkout they will be asked for the cost price plus the consumer tax. 295 -

VAT Indirect tax o o This is tax one pays when they buy goods or services. The shopkeeper or service provider adds it to the cost of the goods or services. This is known as a consumer tax in some countries. In some countries, goods are priced in the shop minus this type of tax, but when the customer comes to the checkout they will be asked for the cost price plus the consumer tax. 295 -

How does a shop calculate the amount of VAT it pays? o o The shop collects this tax on behalf of the government. The difference between the amount of VAT the producer, wholesaler or retailer charged the shopkeeper, and the amount the shopkeeper charged the customer, must be paid to the government. If the amount of VAT paid by the business exceeds the VAT charged by business, the government will repay the excess. This ensures that VAT is paid by the ultimate customer, not by the business. 305 -

How does a shop calculate the amount of VAT it pays? o o The shop collects this tax on behalf of the government. The difference between the amount of VAT the producer, wholesaler or retailer charged the shopkeeper, and the amount the shopkeeper charged the customer, must be paid to the government. If the amount of VAT paid by the business exceeds the VAT charged by business, the government will repay the excess. This ensures that VAT is paid by the ultimate customer, not by the business. 305 -

A Progressive Tax o This type of tax is devised to collect tax according to one’s wealth. o $200 is a lot of money to some people but not FOR others. o So a Progressive Tax is based on ones ability to pay. 315 -

A Progressive Tax o This type of tax is devised to collect tax according to one’s wealth. o $200 is a lot of money to some people but not FOR others. o So a Progressive Tax is based on ones ability to pay. 315 -

Pay as You Earn (PAYE) o This is the tax that employees pay, based on the amount of their salary. o In many countries, employers have to collect this tax, from their employees pay packet. o Note students are sometimes entitled to get the tax they paid on their summer job back, provided they are not working for the rest of the year. 325 -

Pay as You Earn (PAYE) o This is the tax that employees pay, based on the amount of their salary. o In many countries, employers have to collect this tax, from their employees pay packet. o Note students are sometimes entitled to get the tax they paid on their summer job back, provided they are not working for the rest of the year. 325 -

Dangers of an increase in Taxation o Disincentive effect, choose leisure rather than overtime. o Companies can move elsewhere. o Decrease the spending power and hence reduce jobs. o Rich might live out of the country for a at least half of the year. o Prevent savings for house, emergencies, etc… 335 -

Dangers of an increase in Taxation o Disincentive effect, choose leisure rather than overtime. o Companies can move elsewhere. o Decrease the spending power and hence reduce jobs. o Rich might live out of the country for a at least half of the year. o Prevent savings for house, emergencies, etc… 335 -

Difference in tax avoidance and tax evasion o Tax avoidance is where the taxpayer uses a legitimate loophole (excuse) to avoid paying tax for the government. Like buying an apartment to rent in an area, where the government has given tax concessions to encourage redevelopment. o Tax evasion is where a taxpayer does not pay the tax, they are due to pay. o Evasion is a crime, avoidance is not. 345 -

Difference in tax avoidance and tax evasion o Tax avoidance is where the taxpayer uses a legitimate loophole (excuse) to avoid paying tax for the government. Like buying an apartment to rent in an area, where the government has given tax concessions to encourage redevelopment. o Tax evasion is where a taxpayer does not pay the tax, they are due to pay. o Evasion is a crime, avoidance is not. 345 -

Public Responses to Externalities - Taxes MSC = MPC + MD (MPC + cd) $ Pigouvian tax revenues i j MPC d c MD MB 0 Q* Q 1 Q per year 355 -

Public Responses to Externalities - Taxes MSC = MPC + MD (MPC + cd) $ Pigouvian tax revenues i j MPC d c MD MB 0 Q* Q 1 Q per year 355 -

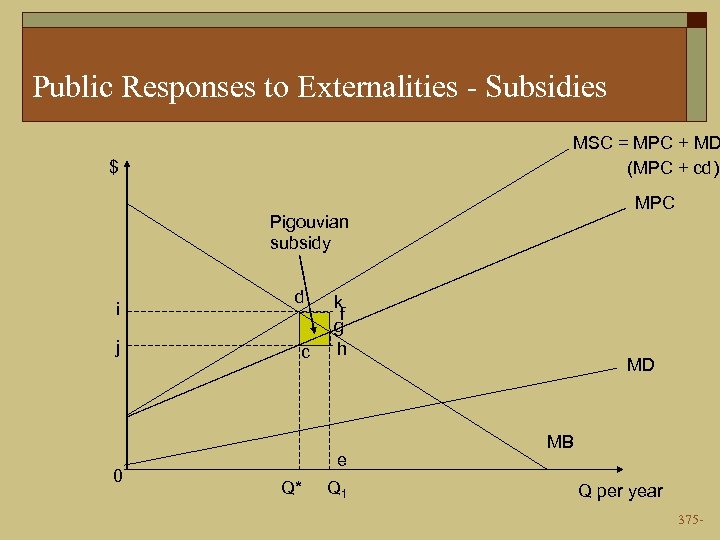

Public Solutions o Subsidy o A subsidy for pollution not produced can induce procedures to pollute at the efficient level. o However, subsidies can lead to too much production, are administratively difficult, and are regarded by some as ethically unappealing. 365 -

Public Solutions o Subsidy o A subsidy for pollution not produced can induce procedures to pollute at the efficient level. o However, subsidies can lead to too much production, are administratively difficult, and are regarded by some as ethically unappealing. 365 -

Public Responses to Externalities - Subsidies MSC = MPC + MD (MPC + cd) $ MPC Pigouvian subsidy i j 0 d c k f g h e Q* Q 1 MD MB Q per year 375 -

Public Responses to Externalities - Subsidies MSC = MPC + MD (MPC + cd) $ MPC Pigouvian subsidy i j 0 d c k f g h e Q* Q 1 MD MB Q per year 375 -

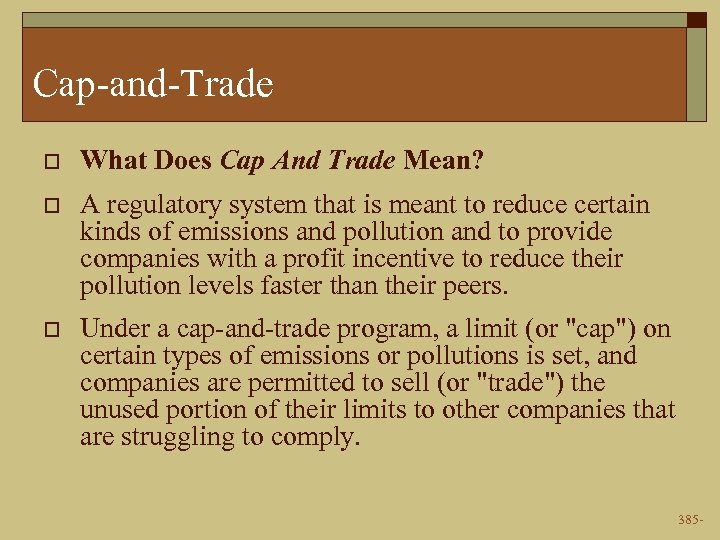

Cap-and-Trade o What Does Cap And Trade Mean? o A regulatory system that is meant to reduce certain kinds of emissions and pollution and to provide companies with a profit incentive to reduce their pollution levels faster than their peers. o Under a cap-and-trade program, a limit (or "cap") on certain types of emissions or pollutions is set, and companies are permitted to sell (or "trade") the unused portion of their limits to other companies that are struggling to comply. 385 -

Cap-and-Trade o What Does Cap And Trade Mean? o A regulatory system that is meant to reduce certain kinds of emissions and pollution and to provide companies with a profit incentive to reduce their pollution levels faster than their peers. o Under a cap-and-trade program, a limit (or "cap") on certain types of emissions or pollutions is set, and companies are permitted to sell (or "trade") the unused portion of their limits to other companies that are struggling to comply. 385 -

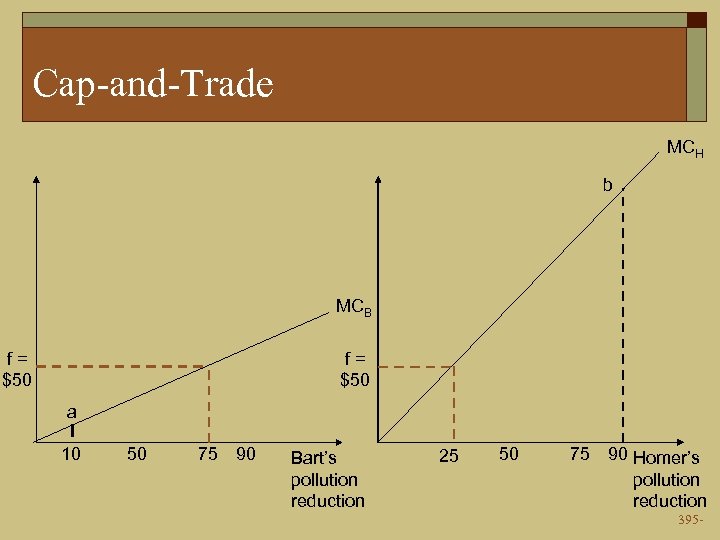

Cap-and-Trade MCH b MCB f= $50 a 10 50 75 90 Bart’s pollution reduction 25 50 75 90 Homer’s pollution reduction 395 -

Cap-and-Trade MCH b MCB f= $50 a 10 50 75 90 Bart’s pollution reduction 25 50 75 90 Homer’s pollution reduction 395 -

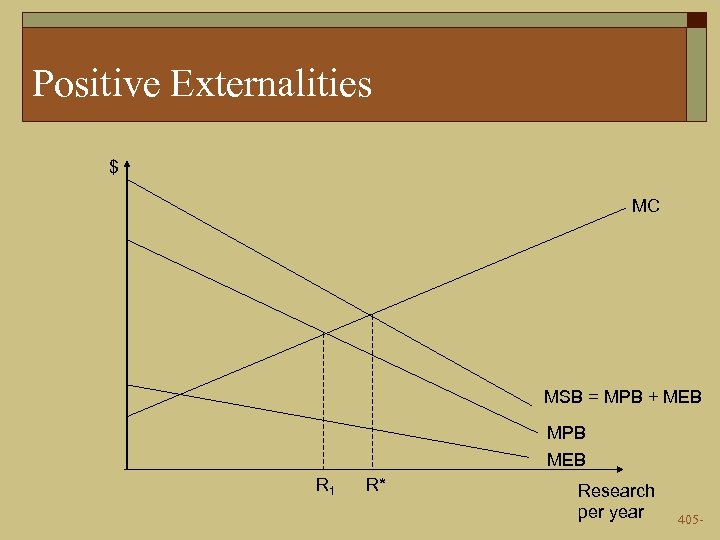

Positive Externalities $ MC MSB = MPB + MEB MPB MEB R 1 R* Research per year 405 -

Positive Externalities $ MC MSB = MPB + MEB MPB MEB R 1 R* Research per year 405 -

A Cautionary Note o Requests for subsidies n Resource extracted from taxpayers n Market does not always fail 415 -

A Cautionary Note o Requests for subsidies n Resource extracted from taxpayers n Market does not always fail 415 -