02ec6ccfe913e28e052c225c0fabca20.ppt

- Количество слайдов: 41

Chapter 5 Discounted Cash Flow Valuation

Chapter 5 Discounted Cash Flow Valuation

Key Concepts and Skills • Know how to compute the future value of multiple cash flows • Know how to compute the present value of multiple cash flows • Know how to compute loan payments • Know how to find the interest rate on a loan • Know how loans are amortized • Understand how interest rates are quoted

Key Concepts and Skills • Know how to compute the future value of multiple cash flows • Know how to compute the present value of multiple cash flows • Know how to compute loan payments • Know how to find the interest rate on a loan • Know how loans are amortized • Understand how interest rates are quoted

Chapter Outline • Future and Present Values of Multiple Cash Flows • Annuities and Perpetuities • Comparing interest rates: The Effect of Compounding • Loan Types and Loan Amortization

Chapter Outline • Future and Present Values of Multiple Cash Flows • Annuities and Perpetuities • Comparing interest rates: The Effect of Compounding • Loan Types and Loan Amortization

Multiple Cash Flows – FV Example 1 • Suppose you invest $500 in a mutual fund today and $600 in one year. If the fund pays 9% annually, how much will you have in two years? • -500 PV 9 i 2 N Compute FV 594. 05 • -600 PV 9 i 1 N Compute FV 654. 00 • Add 1248. 05

Multiple Cash Flows – FV Example 1 • Suppose you invest $500 in a mutual fund today and $600 in one year. If the fund pays 9% annually, how much will you have in two years? • -500 PV 9 i 2 N Compute FV 594. 05 • -600 PV 9 i 1 N Compute FV 654. 00 • Add 1248. 05

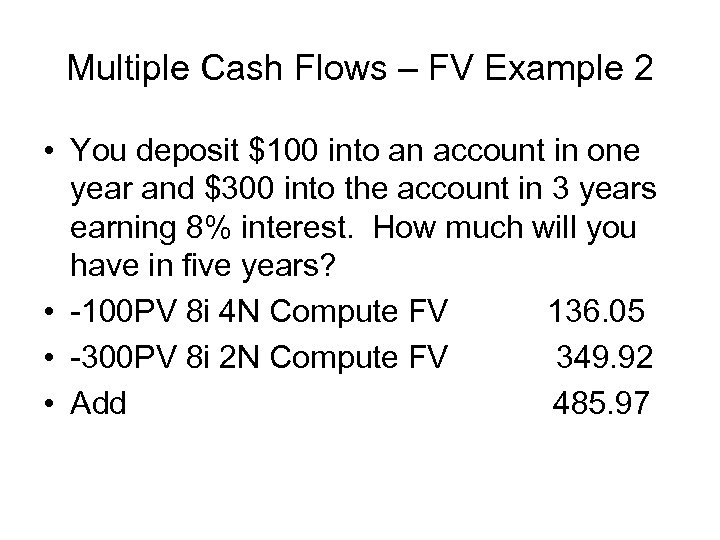

Multiple Cash Flows – FV Example 2 • You deposit $100 into an account in one year and $300 into the account in 3 years earning 8% interest. How much will you have in five years? • -100 PV 8 i 4 N Compute FV 136. 05 • -300 PV 8 i 2 N Compute FV 349. 92 • Add 485. 97

Multiple Cash Flows – FV Example 2 • You deposit $100 into an account in one year and $300 into the account in 3 years earning 8% interest. How much will you have in five years? • -100 PV 8 i 4 N Compute FV 136. 05 • -300 PV 8 i 2 N Compute FV 349. 92 • Add 485. 97

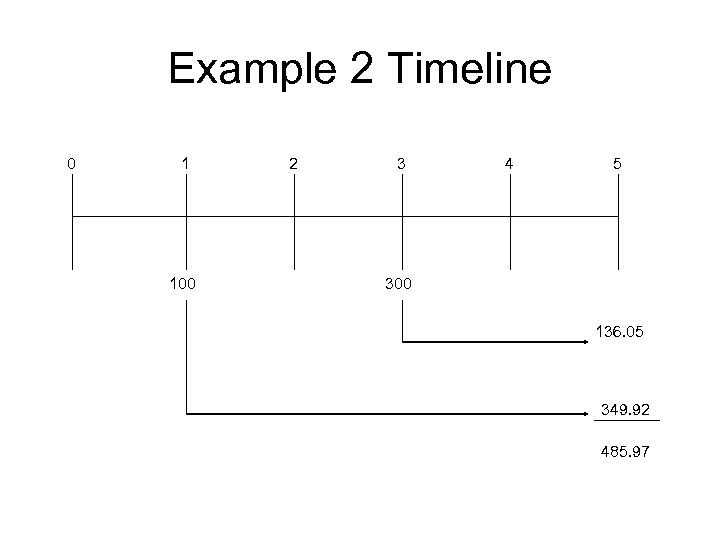

Example 2 Timeline 0 1 100 2 3 4 5 300 136. 05 349. 92 485. 97

Example 2 Timeline 0 1 100 2 3 4 5 300 136. 05 349. 92 485. 97

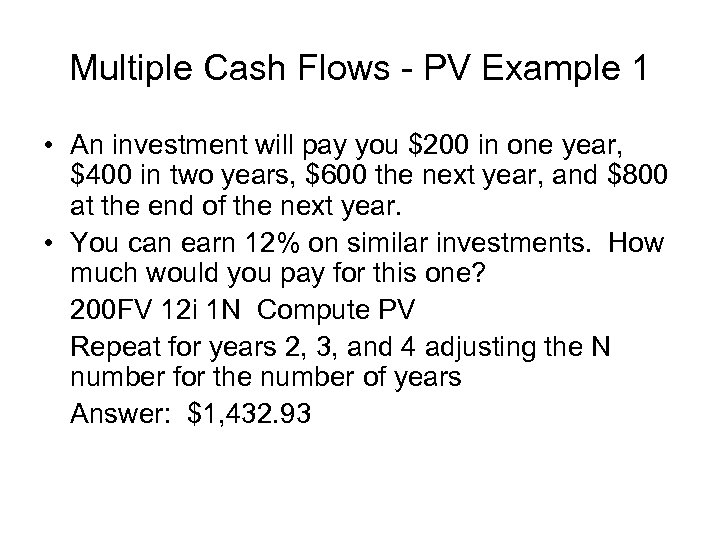

Multiple Cash Flows - PV Example 1 • An investment will pay you $200 in one year, $400 in two years, $600 the next year, and $800 at the end of the next year. • You can earn 12% on similar investments. How much would you pay for this one? 200 FV 12 i 1 N Compute PV Repeat for years 2, 3, and 4 adjusting the N number for the number of years Answer: $1, 432. 93

Multiple Cash Flows - PV Example 1 • An investment will pay you $200 in one year, $400 in two years, $600 the next year, and $800 at the end of the next year. • You can earn 12% on similar investments. How much would you pay for this one? 200 FV 12 i 1 N Compute PV Repeat for years 2, 3, and 4 adjusting the N number for the number of years Answer: $1, 432. 93

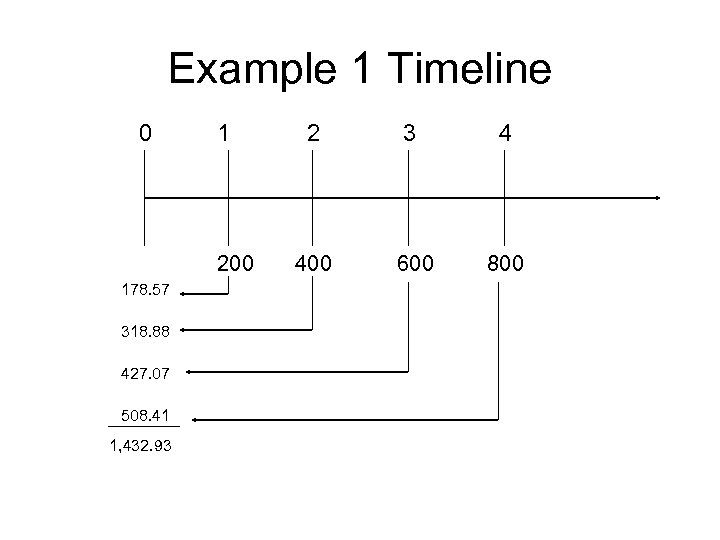

Example 1 Timeline 0 1 200 178. 57 318. 88 427. 07 508. 41 1, 432. 93 2 3 4 400 600 800

Example 1 Timeline 0 1 200 178. 57 318. 88 427. 07 508. 41 1, 432. 93 2 3 4 400 600 800

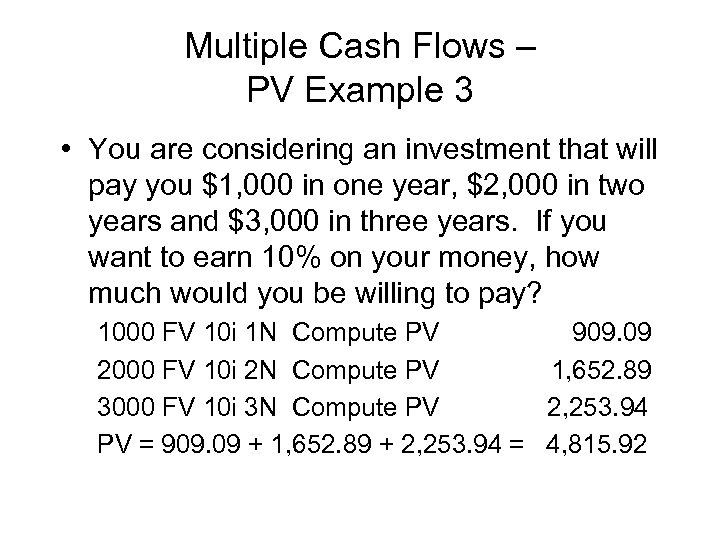

Multiple Cash Flows – PV Example 3 • You are considering an investment that will pay you $1, 000 in one year, $2, 000 in two years and $3, 000 in three years. If you want to earn 10% on your money, how much would you be willing to pay? 1000 FV 10 i 1 N Compute PV 909. 09 2000 FV 10 i 2 N Compute PV 1, 652. 89 3000 FV 10 i 3 N Compute PV 2, 253. 94 PV = 909. 09 + 1, 652. 89 + 2, 253. 94 = 4, 815. 92

Multiple Cash Flows – PV Example 3 • You are considering an investment that will pay you $1, 000 in one year, $2, 000 in two years and $3, 000 in three years. If you want to earn 10% on your money, how much would you be willing to pay? 1000 FV 10 i 1 N Compute PV 909. 09 2000 FV 10 i 2 N Compute PV 1, 652. 89 3000 FV 10 i 3 N Compute PV 2, 253. 94 PV = 909. 09 + 1, 652. 89 + 2, 253. 94 = 4, 815. 92

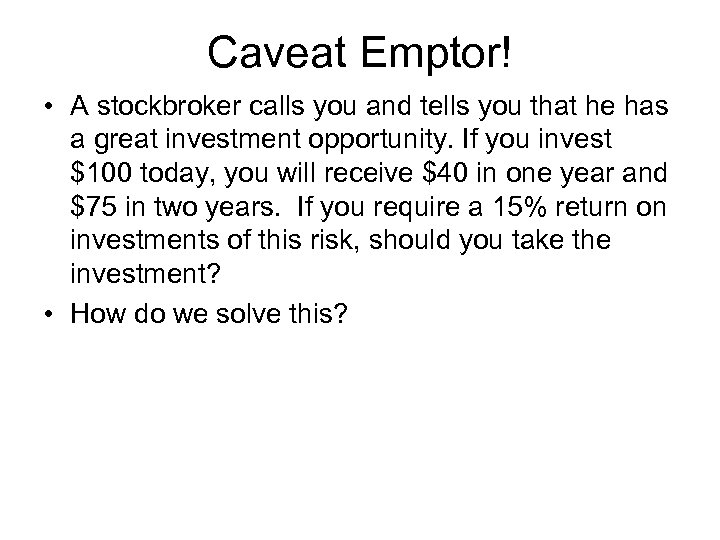

Caveat Emptor! • A stockbroker calls you and tells you that he has a great investment opportunity. If you invest $100 today, you will receive $40 in one year and $75 in two years. If you require a 15% return on investments of this risk, should you take the investment? • How do we solve this?

Caveat Emptor! • A stockbroker calls you and tells you that he has a great investment opportunity. If you invest $100 today, you will receive $40 in one year and $75 in two years. If you require a 15% return on investments of this risk, should you take the investment? • How do we solve this?

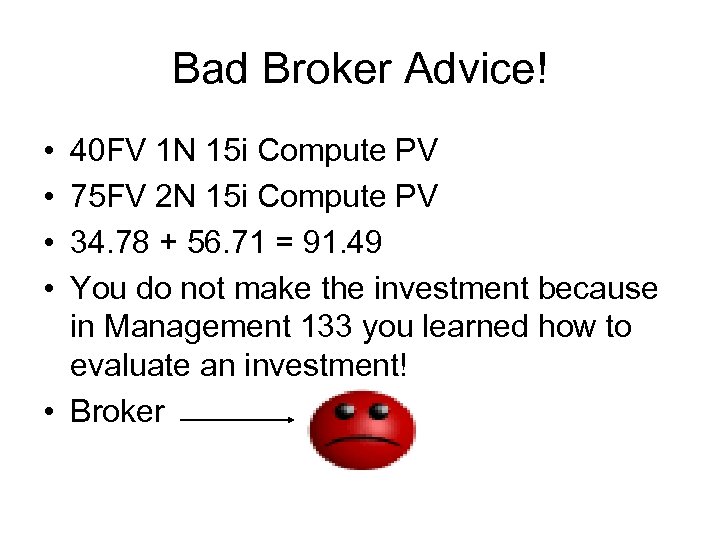

Bad Broker Advice! • • 40 FV 1 N 15 i Compute PV 75 FV 2 N 15 i Compute PV 34. 78 + 56. 71 = 91. 49 You do not make the investment because in Management 133 you learned how to evaluate an investment! • Broker

Bad Broker Advice! • • 40 FV 1 N 15 i Compute PV 75 FV 2 N 15 i Compute PV 34. 78 + 56. 71 = 91. 49 You do not make the investment because in Management 133 you learned how to evaluate an investment! • Broker

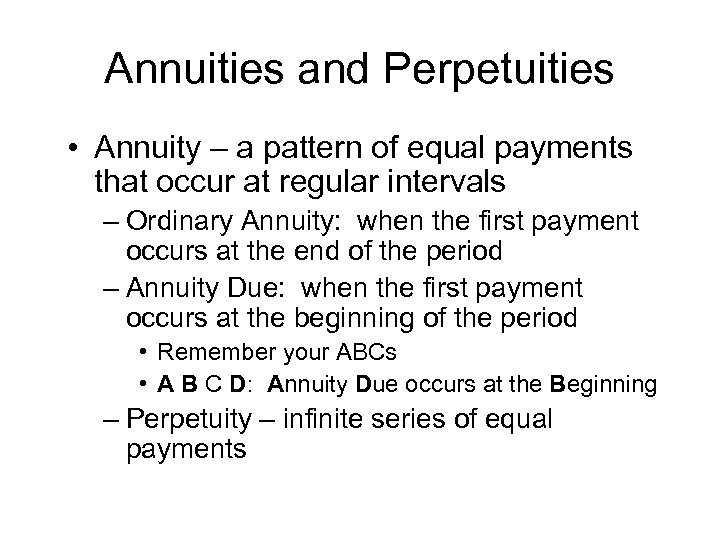

Annuities and Perpetuities • Annuity – a pattern of equal payments that occur at regular intervals – Ordinary Annuity: when the first payment occurs at the end of the period – Annuity Due: when the first payment occurs at the beginning of the period • Remember your ABCs • A B C D: Annuity Due occurs at the Beginning – Perpetuity – infinite series of equal payments

Annuities and Perpetuities • Annuity – a pattern of equal payments that occur at regular intervals – Ordinary Annuity: when the first payment occurs at the end of the period – Annuity Due: when the first payment occurs at the beginning of the period • Remember your ABCs • A B C D: Annuity Due occurs at the Beginning – Perpetuity – infinite series of equal payments

Annuities and the Calculator • You can use the PMT key on the calculator for the equal payment • The sign convention still holds • Ordinary annuity versus annuity due – You can switch your calculator between the two types by using the 2 nd BGN 2 nd Set on the TI BA-II Plus – If you see “BGN” or “Begin” in the display of your calculator, you have it set for an annuity due – Most problems are ordinary annuities

Annuities and the Calculator • You can use the PMT key on the calculator for the equal payment • The sign convention still holds • Ordinary annuity versus annuity due – You can switch your calculator between the two types by using the 2 nd BGN 2 nd Set on the TI BA-II Plus – If you see “BGN” or “Begin” in the display of your calculator, you have it set for an annuity due – Most problems are ordinary annuities

Annuity – Lottery Example • Congratulations! You won $10 million in the lottery. The money is paid in equal annual installments of $333, 333. 33 over 30 years. If the discount rate is 5%, how much is the sweepstakes actually worth today? – PV = 333, 333. 33[1 – 1/1. 0530] /. 05 = 5, 124, 150. 29 – 333, 333. 33 PMT 5 i 30 N Compute PV

Annuity – Lottery Example • Congratulations! You won $10 million in the lottery. The money is paid in equal annual installments of $333, 333. 33 over 30 years. If the discount rate is 5%, how much is the sweepstakes actually worth today? – PV = 333, 333. 33[1 – 1/1. 0530] /. 05 = 5, 124, 150. 29 – 333, 333. 33 PMT 5 i 30 N Compute PV

Annuity vs. Annuity Due • Suppose an annuity due has five payments of $400 each with a 10% discount rate. Compute the PV of an ordinary annuity and the annuity due. • Ordinary: • 400 PMT 4 N 10 i Compute PV 1, 267. 95 • Annuity Due: • 400 PMT 5 N 10 i Compute PV 1, 667. 95 • Hint: Be sure to adjust calculator for an annuity due (begin)

Annuity vs. Annuity Due • Suppose an annuity due has five payments of $400 each with a 10% discount rate. Compute the PV of an ordinary annuity and the annuity due. • Ordinary: • 400 PMT 4 N 10 i Compute PV 1, 267. 95 • Annuity Due: • 400 PMT 5 N 10 i Compute PV 1, 667. 95 • Hint: Be sure to adjust calculator for an annuity due (begin)

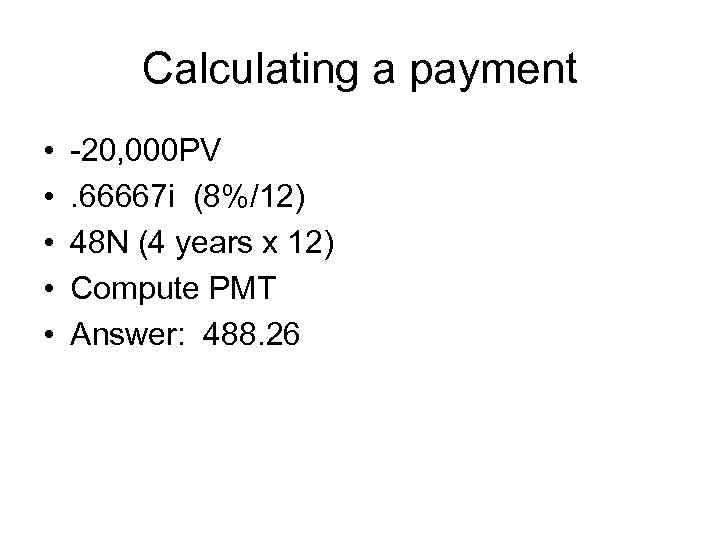

Calculating a payment • You want to borrow $20, 000 for a new car. You qualify for a four-year loan at 8% per year, compounded monthly. What is your car payment? • Try it!

Calculating a payment • You want to borrow $20, 000 for a new car. You qualify for a four-year loan at 8% per year, compounded monthly. What is your car payment? • Try it!

Calculating a payment • • • -20, 000 PV. 66667 i (8%/12) 48 N (4 years x 12) Compute PMT Answer: 488. 26

Calculating a payment • • • -20, 000 PV. 66667 i (8%/12) 48 N (4 years x 12) Compute PMT Answer: 488. 26

Finding the Number of Payments Credit Card Debt • You charged $1000 on your credit card for spring break. You can only afford to make the minimum payment of $20/month. The interest rate is 1. 5%/month. • How long will it take to pay for spring break? • Try it!

Finding the Number of Payments Credit Card Debt • You charged $1000 on your credit card for spring break. You can only afford to make the minimum payment of $20/month. The interest rate is 1. 5%/month. • How long will it take to pay for spring break? • Try it!

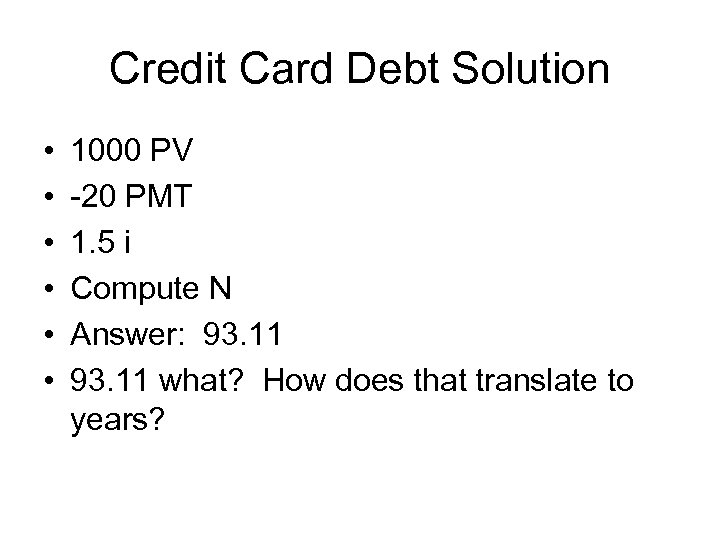

Credit Card Debt Solution • • • 1000 PV -20 PMT 1. 5 i Compute N Answer: 93. 11 what? How does that translate to years?

Credit Card Debt Solution • • • 1000 PV -20 PMT 1. 5 i Compute N Answer: 93. 11 what? How does that translate to years?

Finding the Number of Payments For a Personal Loan • You borrow $2000 from a friend at 5% interest rate. You agree to make annual payments of $734. 42. • How long will it take you to pay off the loan? • Try it!

Finding the Number of Payments For a Personal Loan • You borrow $2000 from a friend at 5% interest rate. You agree to make annual payments of $734. 42. • How long will it take you to pay off the loan? • Try it!

Finding the Number of Payments – Another Example • The hard way to solve this problem! – 2000 = 734. 42(1 – 1/1. 05 t) /. 05 –. 136161869 = 1 – 1/1. 05 t =. 863838131 – 1. 157624287 = 1. 05 t – t = ln(1. 157624287) / ln(1. 05)

Finding the Number of Payments – Another Example • The hard way to solve this problem! – 2000 = 734. 42(1 – 1/1. 05 t) /. 05 –. 136161869 = 1 – 1/1. 05 t =. 863838131 – 1. 157624287 = 1. 05 t – t = ln(1. 157624287) / ln(1. 05)

The Easy Solution Using Your Financial Calculator! • • • 2000 PV -734. 42 PMT 5 i Compute N Answer: Three years

The Easy Solution Using Your Financial Calculator! • • • 2000 PV -734. 42 PMT 5 i Compute N Answer: Three years

Finding the Rate • Suppose you borrow $10, 000 from your rich uncle for a trip to Hawaii! You agree to pay $207. 58 per month for 60 months. What is the monthly interest rate? – Sign convention matters!!! 60 N 10, 000 PV -207. 58 PMT CPT I/Y Answer: . 75 per month

Finding the Rate • Suppose you borrow $10, 000 from your rich uncle for a trip to Hawaii! You agree to pay $207. 58 per month for 60 months. What is the monthly interest rate? – Sign convention matters!!! 60 N 10, 000 PV -207. 58 PMT CPT I/Y Answer: . 75 per month

Future Values for Annuities • You decide you want to retire at 40, so you begin saving for your retirement by depositing $2, 000 per year in an IRA. • If the interest rate is 7. 5%, how much will you have in 40 years? • Which annuity will have produce the most amount of money for retirement, an Ordinary Annuity or an Annuity Due?

Future Values for Annuities • You decide you want to retire at 40, so you begin saving for your retirement by depositing $2, 000 per year in an IRA. • If the interest rate is 7. 5%, how much will you have in 40 years? • Which annuity will have produce the most amount of money for retirement, an Ordinary Annuity or an Annuity Due?

Annuity Solution – – – FV(Ordinary) = 454, 513. 04 FV(Due) = 488, 601. 52 2000 PMT 7. 5 i 40 N Compute FV Change calculator to BEGIN mode for Annuity Due All things being equal, the annuity due will always have the higher dollar amount because the money has a longer time to compound. – Remember, the greatest law in the universe is the law of compound interest!

Annuity Solution – – – FV(Ordinary) = 454, 513. 04 FV(Due) = 488, 601. 52 2000 PMT 7. 5 i 40 N Compute FV Change calculator to BEGIN mode for Annuity Due All things being equal, the annuity due will always have the higher dollar amount because the money has a longer time to compound. – Remember, the greatest law in the universe is the law of compound interest!

Perpetuity • A perpetuity is a annuity with an infinite life, making continual annual payments • Perpetuity formula: PV = C/r – C = Cash flow – r = return A perpetual cash flow of $500 with an 8% return would be computed as: PV = C/r = $500/. 08 = $6, 250

Perpetuity • A perpetuity is a annuity with an infinite life, making continual annual payments • Perpetuity formula: PV = C/r – C = Cash flow – r = return A perpetual cash flow of $500 with an 8% return would be computed as: PV = C/r = $500/. 08 = $6, 250

Effective Annual Rate (EAR) • This is the actual or true interest rate paid or earned (received). • The effective rate reflects the impact of compounding frequency. • If you want to compare two alternative investments with different compounding periods you must compute the EAR and use that for comparison.

Effective Annual Rate (EAR) • This is the actual or true interest rate paid or earned (received). • The effective rate reflects the impact of compounding frequency. • If you want to compare two alternative investments with different compounding periods you must compute the EAR and use that for comparison.

Annual Percentage Rate • This is the annual (nominal) rate that must be disclosed to consumers on credit cards and on other loans as a result of “truth in lending” laws. • By definition APR = period rate times the number of periods per year • Consequently, to get the period rate we rearrange the APR equation: – Period rate = APR / number of periods per year

Annual Percentage Rate • This is the annual (nominal) rate that must be disclosed to consumers on credit cards and on other loans as a result of “truth in lending” laws. • By definition APR = period rate times the number of periods per year • Consequently, to get the period rate we rearrange the APR equation: – Period rate = APR / number of periods per year

Computing APRs • What is the APR if the monthly rate is. 5%? –. 5(12) = 6% • What is the APR if the semiannual rate is. 5%? –. 5(2) = 1% • What is the monthly rate if the APR is 12% with monthly compounding? – 12 / 12 = 1% – Can you divide the above APR by 2 to get the semiannual rate? NO!!! You need an APR based on semiannual compounding to find the semiannual rate.

Computing APRs • What is the APR if the monthly rate is. 5%? –. 5(12) = 6% • What is the APR if the semiannual rate is. 5%? –. 5(2) = 1% • What is the monthly rate if the APR is 12% with monthly compounding? – 12 / 12 = 1% – Can you divide the above APR by 2 to get the semiannual rate? NO!!! You need an APR based on semiannual compounding to find the semiannual rate.

Things to Remember • You ALWAYS need to make sure that the interest rate and the time period match. – If you are looking at annual periods, you need an annual rate. – If you are looking at monthly periods, you need a monthly rate. • If you have an APR based on monthly compounding, you have to use monthly periods for lump sums, or adjust the interest rate appropriately if you have payments other than monthly

Things to Remember • You ALWAYS need to make sure that the interest rate and the time period match. – If you are looking at annual periods, you need an annual rate. – If you are looking at monthly periods, you need a monthly rate. • If you have an APR based on monthly compounding, you have to use monthly periods for lump sums, or adjust the interest rate appropriately if you have payments other than monthly

Computing EARs - Example • Suppose you can earn 1% per month on $1 invested today. – What is the APR? 1(12) = 12% – How much are you effectively earning? • FV = -1 PV 1 i 12 N Compute FV = 1. 1268 • Rate = 12. 68% • Suppose if you put it in another account, you earn 3% per quarter. – What is the APR? 3(4) = 12% – How much are you effectively earning? • -1 PV 3 i 4 N Compute FV = 1. 1255 • Rate = 12. 55%

Computing EARs - Example • Suppose you can earn 1% per month on $1 invested today. – What is the APR? 1(12) = 12% – How much are you effectively earning? • FV = -1 PV 1 i 12 N Compute FV = 1. 1268 • Rate = 12. 68% • Suppose if you put it in another account, you earn 3% per quarter. – What is the APR? 3(4) = 12% – How much are you effectively earning? • -1 PV 3 i 4 N Compute FV = 1. 1255 • Rate = 12. 55%

Compounding Comparison • You are looking at two savings accounts. One pays 5. 25%, with daily compounding. The other pays 5. 3% with semiannual compounding. Which account should you use? – First account calculator sequence: – 5. 25 shift NOM%, 365 shift P/YR, shift EFF% = 5. 3899 – Second account calculator sequence: – 5. 3 shift NOM%, 2 shift P/YR, shift EFF% = 5. 3702 • Which account should you choose and why?

Compounding Comparison • You are looking at two savings accounts. One pays 5. 25%, with daily compounding. The other pays 5. 3% with semiannual compounding. Which account should you use? – First account calculator sequence: – 5. 25 shift NOM%, 365 shift P/YR, shift EFF% = 5. 3899 – Second account calculator sequence: – 5. 3 shift NOM%, 2 shift P/YR, shift EFF% = 5. 3702 • Which account should you choose and why?

Computing Payments with APRs • Suppose you want to buy Plasma TV that costs $3500 and the store is willing to allow you to make monthly payments. The loan period is for 2 years and the interest rate is 16. 9% with monthly compounding. What is your monthly payment? – – Monthly rate = 16. 9 / 12 i Number of months = 2(12) = 24 N -3500 PV Compute pmt 172. 88

Computing Payments with APRs • Suppose you want to buy Plasma TV that costs $3500 and the store is willing to allow you to make monthly payments. The loan period is for 2 years and the interest rate is 16. 9% with monthly compounding. What is your monthly payment? – – Monthly rate = 16. 9 / 12 i Number of months = 2(12) = 24 N -3500 PV Compute pmt 172. 88

Future Values with Monthly Compounding • Suppose you deposit $50 per month into an account that has an APR of 9%, based on monthly compounding. How much will you have in the account in 35 years? – Monthly rate = 9/12 i – Number of months = 35(12) = 420 N – -50 PMT – Compute FV 147, 089. 22

Future Values with Monthly Compounding • Suppose you deposit $50 per month into an account that has an APR of 9%, based on monthly compounding. How much will you have in the account in 35 years? – Monthly rate = 9/12 i – Number of months = 35(12) = 420 N – -50 PMT – Compute FV 147, 089. 22

Present Value with Daily Compounding • You need $15, 000 in 3 years for a new car. If you can deposit money into an account that pays an APR of 5. 5% based on daily compounding, how much would you need to deposit? – Number of days = 3(365) = 1095 N – Daily rate = 5. 5 / 365 i – 15, 000 FV – Compute PV 12, 718. 56

Present Value with Daily Compounding • You need $15, 000 in 3 years for a new car. If you can deposit money into an account that pays an APR of 5. 5% based on daily compounding, how much would you need to deposit? – Number of days = 3(365) = 1095 N – Daily rate = 5. 5 / 365 i – 15, 000 FV – Compute PV 12, 718. 56

Quick Quiz: Part 5 • What is the definition of an APR? • What is the effective annual rate? • Which rate should you use to compare alternative investments or loans? • Which rate do you need to use in the time value of money calculations?

Quick Quiz: Part 5 • What is the definition of an APR? • What is the effective annual rate? • Which rate should you use to compare alternative investments or loans? • Which rate do you need to use in the time value of money calculations?

Discount Loans – Example • Treasury bills are examples of pure discount loans. The principal amount is repaid at some future date, without any periodic interest payments. • If a T-bill promises to repay $10, 000 in 12 months and the market interest rate is 7 percent, how much will the bill sell for in the market? – 10, 000 FV 7 i 1 N – Compute PV = 9, 345. 79

Discount Loans – Example • Treasury bills are examples of pure discount loans. The principal amount is repaid at some future date, without any periodic interest payments. • If a T-bill promises to repay $10, 000 in 12 months and the market interest rate is 7 percent, how much will the bill sell for in the market? – 10, 000 FV 7 i 1 N – Compute PV = 9, 345. 79

Interest-Only Loan - Example • Consider a 5 -year, interest only loan with a 7% interest rate. The principal amount is $10, 000. Interest is paid annually. – What would the stream of cash flows be? • Years 1 – 4: Interest payments of. 07(10, 000) = 700 • Year 5: Interest + principal = 10, 700

Interest-Only Loan - Example • Consider a 5 -year, interest only loan with a 7% interest rate. The principal amount is $10, 000. Interest is paid annually. – What would the stream of cash flows be? • Years 1 – 4: Interest payments of. 07(10, 000) = 700 • Year 5: Interest + principal = 10, 700

Amortized Loan with Fixed Payment - Example • Each payment covers the interest expense plus reduces principal • Consider a 4 -year loan with annual payments. The interest rate is 8% and the principal amount is $5000. – What is the annual payment? • -5000 PV 4 N 8 i • COMPUTE PMT = 1, 509. 60

Amortized Loan with Fixed Payment - Example • Each payment covers the interest expense plus reduces principal • Consider a 4 -year loan with annual payments. The interest rate is 8% and the principal amount is $5000. – What is the annual payment? • -5000 PV 4 N 8 i • COMPUTE PMT = 1, 509. 60

Quick Quiz • What is a pure discount loan? What is a good example of a pure discount loan? • What is an interest-only loan? What is a good example of an interest-only loan? • What is an amortized loan? What is a good example of an amortized loan?

Quick Quiz • What is a pure discount loan? What is a good example of a pure discount loan? • What is an interest-only loan? What is a good example of an interest-only loan? • What is an amortized loan? What is a good example of an amortized loan?

End of Chapter 5!

End of Chapter 5!