73a36b885f32a5e0e4c7ab3eaf69e6f6.ppt

- Количество слайдов: 18

Chapter 5 Determination of Forward & Future Prices R. Srinivasan

Chapter 5 Determination of Forward & Future Prices R. Srinivasan

Introduction • Forwards contract are easier to analyse because, Futures contracts have daily settlement and Forwards contracts are settled only on maturity • Investment Vs. Consumption Assets: – Investment Asset: Are held for investment purposes by a significant number of investors (e. g. , stocks, bonds, gold, silver etc). Hence arbitrage opportunity exists. – Consumption Asset: Are consumed over a period of time (e. g. , all commodities). No arbitrage opportunity, because, manufacturers would like to hold the asset, so as not to lose a business opportunity, due to out-of-stock situation.

Introduction • Forwards contract are easier to analyse because, Futures contracts have daily settlement and Forwards contracts are settled only on maturity • Investment Vs. Consumption Assets: – Investment Asset: Are held for investment purposes by a significant number of investors (e. g. , stocks, bonds, gold, silver etc). Hence arbitrage opportunity exists. – Consumption Asset: Are consumed over a period of time (e. g. , all commodities). No arbitrage opportunity, because, manufacturers would like to hold the asset, so as not to lose a business opportunity, due to out-of-stock situation.

Short Selling • Short selling involves selling securities you do not own • Your broker borrows the securities from another client and sells them in the market in the usual way • At some stage you must buy the securities back so they can be replaced in the account of the client • Dividends and other benefits, the owner of the securities receives • If the broker runs out of shares to borrow, the investor is short-squeezed and is forced to foreclose his position immediately

Short Selling • Short selling involves selling securities you do not own • Your broker borrows the securities from another client and sells them in the market in the usual way • At some stage you must buy the securities back so they can be replaced in the account of the client • Dividends and other benefits, the owner of the securities receives • If the broker runs out of shares to borrow, the investor is short-squeezed and is forced to foreclose his position immediately

Margin Account • The investor maintains the account with the broker • Margin money can be remitted in the form of cash, marketable securities, and the broker should guarantee that the investor does not walk away from short position in case of rise in price of shares leading to a loss. • Initial Margin and additional margins are required to be maintained from time to time

Margin Account • The investor maintains the account with the broker • Margin money can be remitted in the form of cash, marketable securities, and the broker should guarantee that the investor does not walk away from short position in case of rise in price of shares leading to a loss. • Initial Margin and additional margins are required to be maintained from time to time

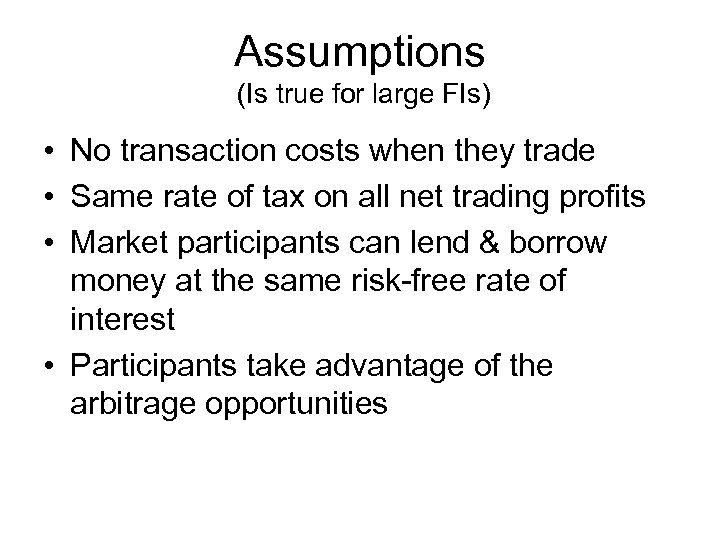

Assumptions (Is true for large FIs) • No transaction costs when they trade • Same rate of tax on all net trading profits • Market participants can lend & borrow money at the same risk-free rate of interest • Participants take advantage of the arbitrage opportunities

Assumptions (Is true for large FIs) • No transaction costs when they trade • Same rate of tax on all net trading profits • Market participants can lend & borrow money at the same risk-free rate of interest • Participants take advantage of the arbitrage opportunities

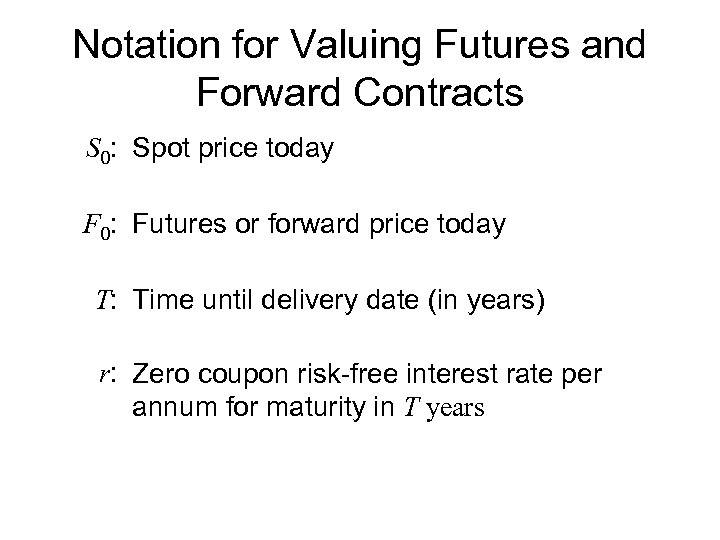

Notation for Valuing Futures and Forward Contracts S 0: Spot price today F 0: Futures or forward price today T: Time until delivery date (in years) r: Zero coupon risk-free interest rate per annum for maturity in T years

Notation for Valuing Futures and Forward Contracts S 0: Spot price today F 0: Futures or forward price today T: Time until delivery date (in years) r: Zero coupon risk-free interest rate per annum for maturity in T years

Forward price of an Investment Asset • It is easier to value an investment asset without any intermediate income (e. g. , non -dividend paying stocks, zero-coupon bonds) • Analysis of Kidder Peabody (BS 5. 1, page 125)

Forward price of an Investment Asset • It is easier to value an investment asset without any intermediate income (e. g. , non -dividend paying stocks, zero-coupon bonds) • Analysis of Kidder Peabody (BS 5. 1, page 125)

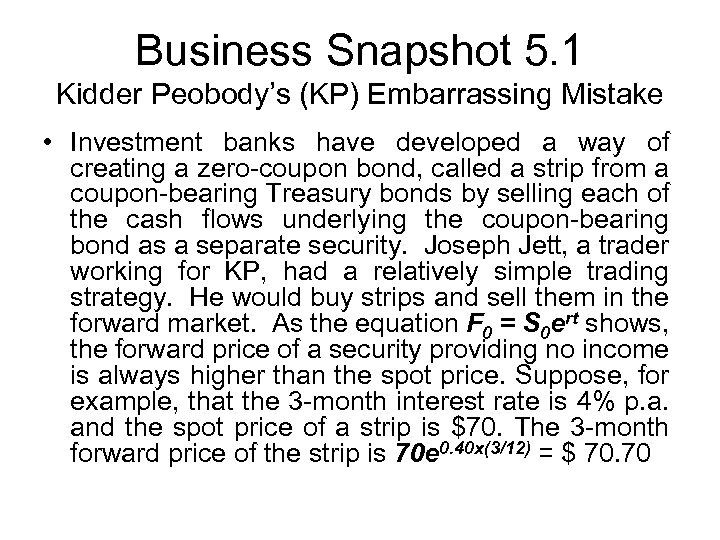

Business Snapshot 5. 1 Kidder Peobody’s (KP) Embarrassing Mistake • Investment banks have developed a way of creating a zero-coupon bond, called a strip from a coupon-bearing Treasury bonds by selling each of the cash flows underlying the coupon-bearing bond as a separate security. Joseph Jett, a trader working for KP, had a relatively simple trading strategy. He would buy strips and sell them in the forward market. As the equation F 0 = S 0 ert shows, the forward price of a security providing no income is always higher than the spot price. Suppose, for example, that the 3 -month interest rate is 4% p. a. and the spot price of a strip is $70. The 3 -month forward price of the strip is 70 e 0. 40 x(3/12) = $ 70. 70

Business Snapshot 5. 1 Kidder Peobody’s (KP) Embarrassing Mistake • Investment banks have developed a way of creating a zero-coupon bond, called a strip from a coupon-bearing Treasury bonds by selling each of the cash flows underlying the coupon-bearing bond as a separate security. Joseph Jett, a trader working for KP, had a relatively simple trading strategy. He would buy strips and sell them in the forward market. As the equation F 0 = S 0 ert shows, the forward price of a security providing no income is always higher than the spot price. Suppose, for example, that the 3 -month interest rate is 4% p. a. and the spot price of a strip is $70. The 3 -month forward price of the strip is 70 e 0. 40 x(3/12) = $ 70. 70

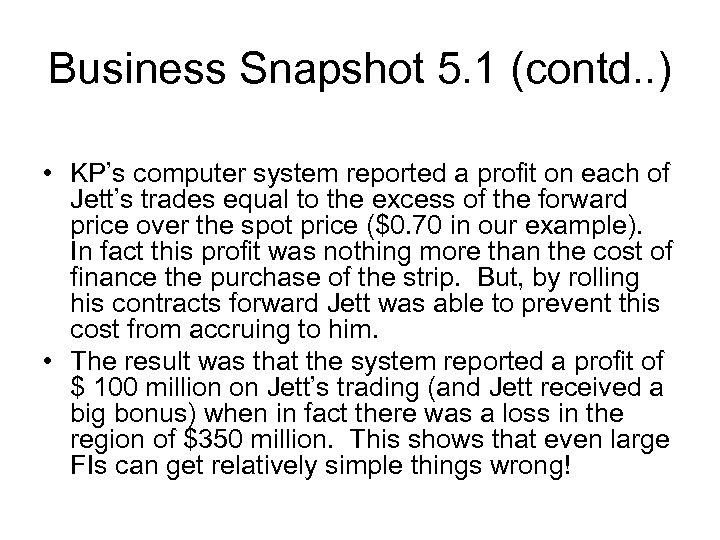

Business Snapshot 5. 1 (contd. . ) • KP’s computer system reported a profit on each of Jett’s trades equal to the excess of the forward price over the spot price ($0. 70 in our example). In fact this profit was nothing more than the cost of finance the purchase of the strip. But, by rolling his contracts forward Jett was able to prevent this cost from accruing to him. • The result was that the system reported a profit of $ 100 million on Jett’s trading (and Jett received a big bonus) when in fact there was a loss in the region of $350 million. This shows that even large FIs can get relatively simple things wrong!

Business Snapshot 5. 1 (contd. . ) • KP’s computer system reported a profit on each of Jett’s trades equal to the excess of the forward price over the spot price ($0. 70 in our example). In fact this profit was nothing more than the cost of finance the purchase of the strip. But, by rolling his contracts forward Jett was able to prevent this cost from accruing to him. • The result was that the system reported a profit of $ 100 million on Jett’s trading (and Jett received a big bonus) when in fact there was a loss in the region of $350 million. This shows that even large FIs can get relatively simple things wrong!

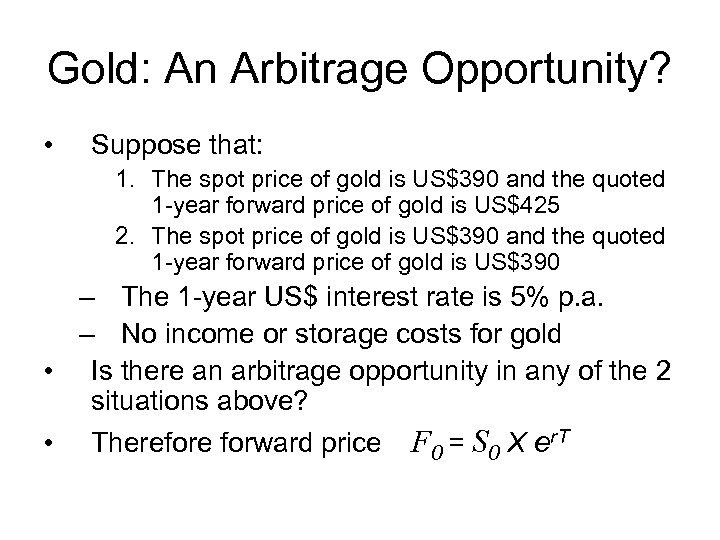

Gold: An Arbitrage Opportunity? • Suppose that: 1. The spot price of gold is US$390 and the quoted 1 -year forward price of gold is US$425 2. The spot price of gold is US$390 and the quoted 1 -year forward price of gold is US$390 – The 1 -year US$ interest rate is 5% p. a. – No income or storage costs for gold • Is there an arbitrage opportunity in any of the 2 situations above? • Therefore forward price F 0 = S 0 X er. T

Gold: An Arbitrage Opportunity? • Suppose that: 1. The spot price of gold is US$390 and the quoted 1 -year forward price of gold is US$425 2. The spot price of gold is US$390 and the quoted 1 -year forward price of gold is US$390 – The 1 -year US$ interest rate is 5% p. a. – No income or storage costs for gold • Is there an arbitrage opportunity in any of the 2 situations above? • Therefore forward price F 0 = S 0 X er. T

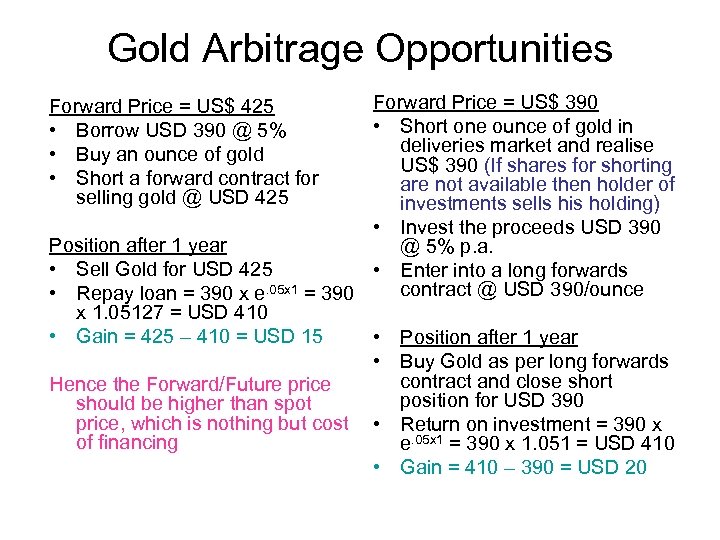

Gold Arbitrage Opportunities Forward Price = US$ 390 • Short one ounce of gold in deliveries market and realise US$ 390 (If shares for shorting are not available then holder of investments sells his holding) • Invest the proceeds USD 390 Position after 1 year @ 5% p. a. • Sell Gold for USD 425 • Enter into a long forwards contract @ USD 390/ounce • Repay loan = 390 x e. 05 x 1 = 390 x 1. 05127 = USD 410 • Gain = 425 – 410 = USD 15 • Position after 1 year • Buy Gold as per long forwards contract and close short Hence the Forward/Future price position for USD 390 should be higher than spot price, which is nothing but cost • Return on investment = 390 x of financing e. 05 x 1 = 390 x 1. 051 = USD 410 • Gain = 410 – 390 = USD 20 Forward Price = US$ 425 • Borrow USD 390 @ 5% • Buy an ounce of gold • Short a forward contract for selling gold @ USD 425

Gold Arbitrage Opportunities Forward Price = US$ 390 • Short one ounce of gold in deliveries market and realise US$ 390 (If shares for shorting are not available then holder of investments sells his holding) • Invest the proceeds USD 390 Position after 1 year @ 5% p. a. • Sell Gold for USD 425 • Enter into a long forwards contract @ USD 390/ounce • Repay loan = 390 x e. 05 x 1 = 390 x 1. 05127 = USD 410 • Gain = 425 – 410 = USD 15 • Position after 1 year • Buy Gold as per long forwards contract and close short Hence the Forward/Future price position for USD 390 should be higher than spot price, which is nothing but cost • Return on investment = 390 x of financing e. 05 x 1 = 390 x 1. 051 = USD 410 • Gain = 410 – 390 = USD 20 Forward Price = US$ 425 • Borrow USD 390 @ 5% • Buy an ounce of gold • Short a forward contract for selling gold @ USD 425

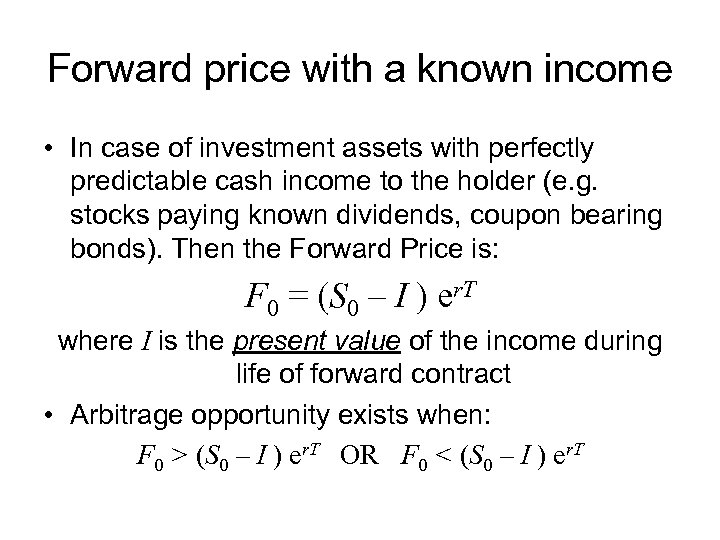

Forward price with a known income • In case of investment assets with perfectly predictable cash income to the holder (e. g. stocks paying known dividends, coupon bearing bonds). Then the Forward Price is: F 0 = (S 0 – I ) er. T where I is the present value of the income during life of forward contract • Arbitrage opportunity exists when: F 0 > (S 0 – I ) er. T OR F 0 < (S 0 – I ) er. T

Forward price with a known income • In case of investment assets with perfectly predictable cash income to the holder (e. g. stocks paying known dividends, coupon bearing bonds). Then the Forward Price is: F 0 = (S 0 – I ) er. T where I is the present value of the income during life of forward contract • Arbitrage opportunity exists when: F 0 > (S 0 – I ) er. T OR F 0 < (S 0 – I ) er. T

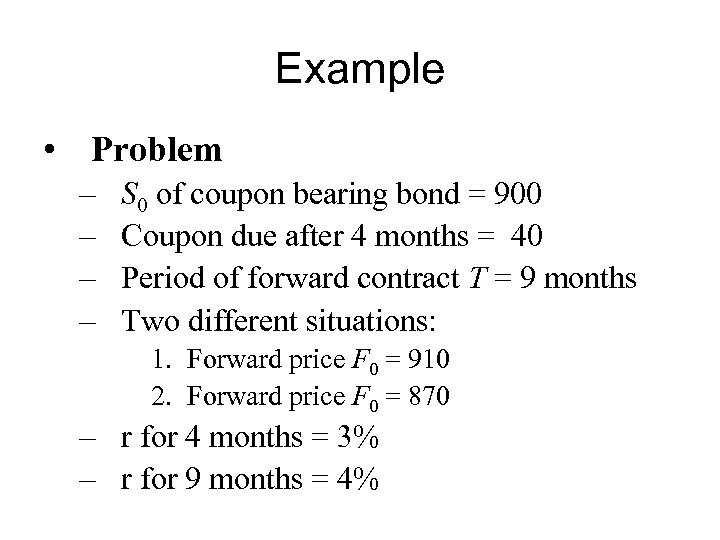

Example • Problem – – S 0 of coupon bearing bond = 900 Coupon due after 4 months = 40 Period of forward contract T = 9 months Two different situations: 1. Forward price F 0 = 910 2. Forward price F 0 = 870 – r for 4 months = 3% – r for 9 months = 4%

Example • Problem – – S 0 of coupon bearing bond = 900 Coupon due after 4 months = 40 Period of forward contract T = 9 months Two different situations: 1. Forward price F 0 = 910 2. Forward price F 0 = 870 – r for 4 months = 3% – r for 9 months = 4%

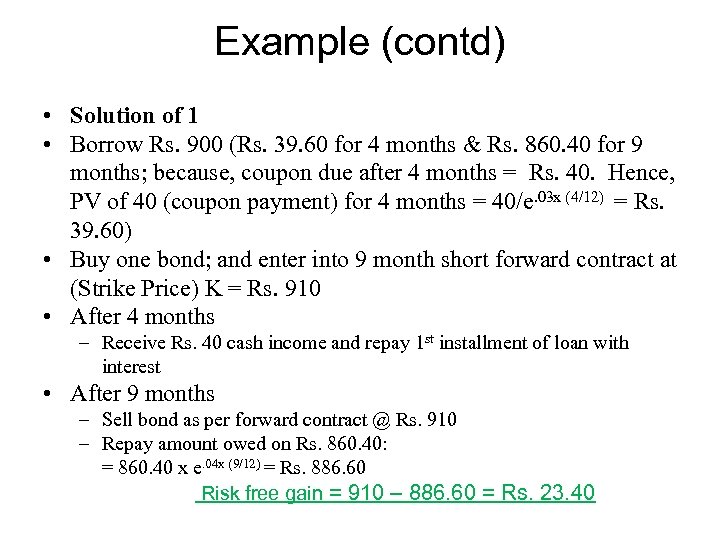

Example (contd) • Solution of 1 • Borrow Rs. 900 (Rs. 39. 60 for 4 months & Rs. 860. 40 for 9 months; because, coupon due after 4 months = Rs. 40. Hence, PV of 40 (coupon payment) for 4 months = 40/e. 03 x (4/12) = Rs. 39. 60) • Buy one bond; and enter into 9 month short forward contract at (Strike Price) K = Rs. 910 • After 4 months – Receive Rs. 40 cash income and repay 1 st installment of loan with interest • After 9 months – Sell bond as per forward contract @ Rs. 910 – Repay amount owed on Rs. 860. 40: = 860. 40 x e. 04 x (9/12) = Rs. 886. 60 Risk free gain = 910 – 886. 60 = Rs. 23. 40

Example (contd) • Solution of 1 • Borrow Rs. 900 (Rs. 39. 60 for 4 months & Rs. 860. 40 for 9 months; because, coupon due after 4 months = Rs. 40. Hence, PV of 40 (coupon payment) for 4 months = 40/e. 03 x (4/12) = Rs. 39. 60) • Buy one bond; and enter into 9 month short forward contract at (Strike Price) K = Rs. 910 • After 4 months – Receive Rs. 40 cash income and repay 1 st installment of loan with interest • After 9 months – Sell bond as per forward contract @ Rs. 910 – Repay amount owed on Rs. 860. 40: = 860. 40 x e. 04 x (9/12) = Rs. 886. 60 Risk free gain = 910 – 886. 60 = Rs. 23. 40

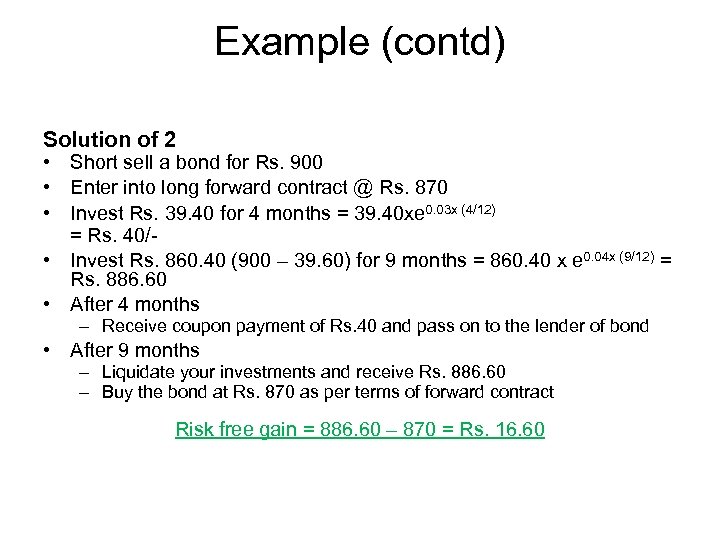

Example (contd) Solution of 2 • Short sell a bond for Rs. 900 • Enter into long forward contract @ Rs. 870 • Invest Rs. 39. 40 for 4 months = 39. 40 xe 0. 03 x (4/12) = Rs. 40/ • Invest Rs. 860. 40 (900 – 39. 60) for 9 months = 860. 40 x e 0. 04 x (9/12) = Rs. 886. 60 • After 4 months – Receive coupon payment of Rs. 40 and pass on to the lender of bond • After 9 months – Liquidate your investments and receive Rs. 886. 60 – Buy the bond at Rs. 870 as per terms of forward contract Risk free gain = 886. 60 – 870 = Rs. 16. 60

Example (contd) Solution of 2 • Short sell a bond for Rs. 900 • Enter into long forward contract @ Rs. 870 • Invest Rs. 39. 40 for 4 months = 39. 40 xe 0. 03 x (4/12) = Rs. 40/ • Invest Rs. 860. 40 (900 – 39. 60) for 9 months = 860. 40 x e 0. 04 x (9/12) = Rs. 886. 60 • After 4 months – Receive coupon payment of Rs. 40 and pass on to the lender of bond • After 9 months – Liquidate your investments and receive Rs. 886. 60 – Buy the bond at Rs. 870 as per terms of forward contract Risk free gain = 886. 60 – 870 = Rs. 16. 60

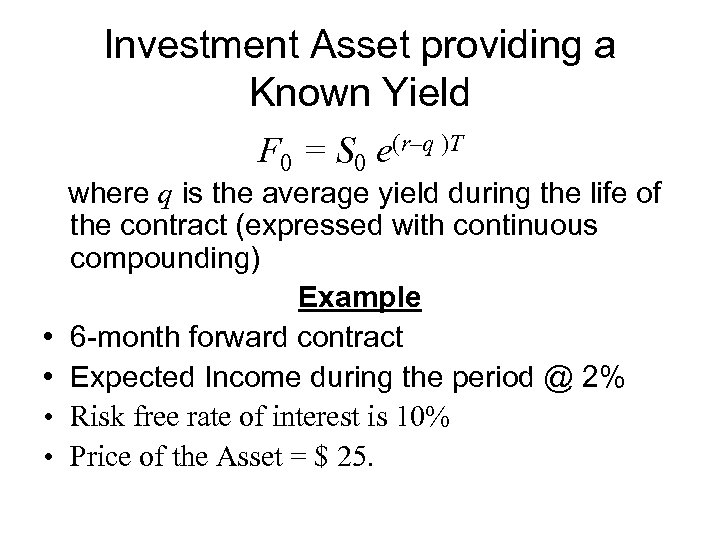

Investment Asset providing a Known Yield F 0 = S 0 e(r–q )T • • where q is the average yield during the life of the contract (expressed with continuous compounding) Example 6 -month forward contract Expected Income during the period @ 2% Risk free rate of interest is 10% Price of the Asset = $ 25.

Investment Asset providing a Known Yield F 0 = S 0 e(r–q )T • • where q is the average yield during the life of the contract (expressed with continuous compounding) Example 6 -month forward contract Expected Income during the period @ 2% Risk free rate of interest is 10% Price of the Asset = $ 25.

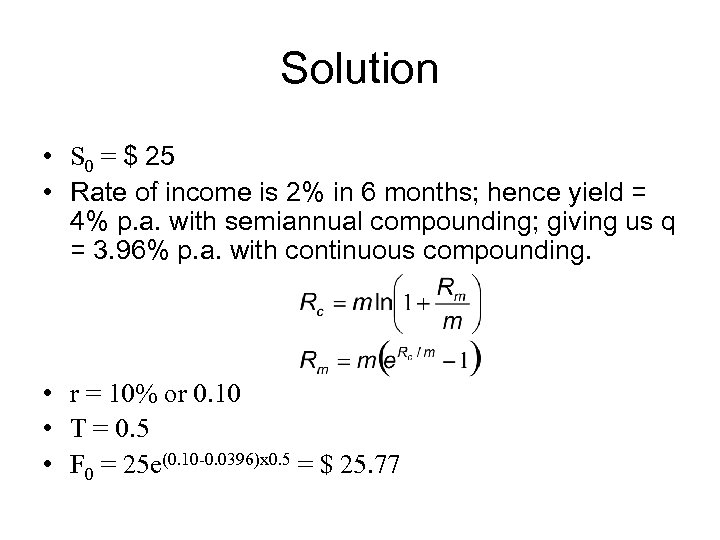

Solution • S 0 = $ 25 • Rate of income is 2% in 6 months; hence yield = 4% p. a. with semiannual compounding; giving us q = 3. 96% p. a. with continuous compounding. • r = 10% or 0. 10 • T = 0. 5 • F 0 = 25 e(0. 10 -0. 0396)x 0. 5 = $ 25. 77

Solution • S 0 = $ 25 • Rate of income is 2% in 6 months; hence yield = 4% p. a. with semiannual compounding; giving us q = 3. 96% p. a. with continuous compounding. • r = 10% or 0. 10 • T = 0. 5 • F 0 = 25 e(0. 10 -0. 0396)x 0. 5 = $ 25. 77

Forward vs Futures Prices • Forward and futures prices are usually assumed to be the same. When interest rates are uncertain, in theory they are, slightly different: • A strong positive correlation between interest rates and the asset price implies the futures price is slightly higher than the forward price • A strong negative correlation implies the reverse

Forward vs Futures Prices • Forward and futures prices are usually assumed to be the same. When interest rates are uncertain, in theory they are, slightly different: • A strong positive correlation between interest rates and the asset price implies the futures price is slightly higher than the forward price • A strong negative correlation implies the reverse