2501e37f1aee6c70f6102e2b67a5da80.ppt

- Количество слайдов: 146

Chapter 5. Calculation Problem Areas 1

Chapter 5. Section 1. Introduction Learning Objective Understand address those difficult aspects of rent calculation where errors are most likely to occur 2

Introduction • In this session, we will focus on the errorprone components of income and rent determination – Identified in HUD’s Policy Development and Research report, “Quality Control for Rental Assistance Subsidies Determinations” – Emphasized in RIM reviews 3

Introduction • Purpose of the chapter – Identify common errors – Examine reasons for errors – Practice the more difficult calculations • We will not cover every facet of rent calculation 4

Introduction • Review of problem areas: – Employment income – Training program income – The earned income disallowance (EID) – Assets and asset income – Public housing rent calculation 5

References • Appendix A – Web Addresses (page A-1) – Training Program Income Notice (page A-5 through A-24) • Appendix B – Regulation Excerpts (page B-1 through B-20) – PH Occupancy Guidebook Excerpts (page B 21 through B-75) 6

Chapter 5. Section 2. Employment Income 7

Employment Income • PD&R report found a 68% error rate for families with earned income (employment income) – 88% for families with more than 1 source of earned income – Employment income is single strongest predictor of errors in rent calculation 8

Employment Income • Annual income from employment includes full amount, before payroll deductions, of: – Wages and salaries – Overtime pay, commissions, fees, tips and bonuses – Other compensation for personal services 9

Employment Income • Reported income will usually be in amounts over a period of time that are less than annual (hourly, weekly, bi-weekly, semi-monthly, etc. ) – Hourly/full time: rate X 2080 – Weekly: amount X 52 – Semi-monthly: amount X 24 – Bi-weekly: amount X 26 – Monthly: amount X 12 10

Verification Issues • Most errors are caused by lack of adequate verification • Either PHAs do not obtain third-party employment verification, or the verification is received but not used – Rent calculated using pay stubs – File not documented as to why third party was not available 11

Verification Issues • Learning Activity 5 -1: (Page 5 -5) • Paystubs vs. Employer Statement? • Purpose: Discrepancy Awareness – Part 1: Calculate annual income using paystubs (page 5 -5 through 5 -8) – Part 2: Re-calculate (page 5 -8) using thirdparty verification completed by employer (page 5 -9) – Part 3: Group discussion 12

Unreported and Underreported Income • Some families fail to report or underreport employment income – One common form of underreporting: reporting net earnings, not gross • Use UIV to identify unreported employment • Inform applicants and tenants of UIV sources to be checked – Encourages more accurate reporting 13

Sporadic Income • Temporary, nonrecurring, or sporadic income (including gifts) is not included in annual income • Sporadic income is income that is neither reliable nor periodic 14

Sporadic Income Example • Daniel Morgan – receives Social Security Disability plus works as handyman occasionally • Claims only worked a couple times last year (no documentation) • Answer the three questions. 15

Answer: Sporadic Income • Does this fit description of sporadic income? – Yes, his earnings fit the category of nonrecurring, sporadic income • How do you handle his working income? – Don’t include in annual income – Tell Mr. Morgan he must report any regular work or steady jobs he takes • What type of documentation should the PHA have in Daniel’s file to support its decision? – Note in file explaining situation and its decision – UIV documentation if PHA has access 16

Seasonal Employment • People in some occupations regularly work less than 12 months per year – School employees – Agricultural workers – Construction trades • There are 2 acceptable calculation methods 17

Seasonal Employment • Method 1: Annualize current income – Conduct interim reexam when income changes • Method 2: Calculate anticipated income from all known sources for the entire year – No interim reexam – History of income from past years is needed • Not useful when future income source is “unknown” or “none” 18

Seasonal Employment: Example • Marcy Walsh is currently employed as a tile setter with ABC Construction, earning $1000 per month • For the last 4 years, she has worked this job for 6 months per year during the construction season • During the other 6 months of each year, she works part-time at Domino’s Pizza, earning $400 per month 19

Calculation: Sample Method 1 • Multiply current income ($1000/month) times 12 months – $12, 000 per year • When the construction season ends, conduct an interim reexam – Multiply income from Domino’s ($400/month) times 12 months – $4800 per year 20

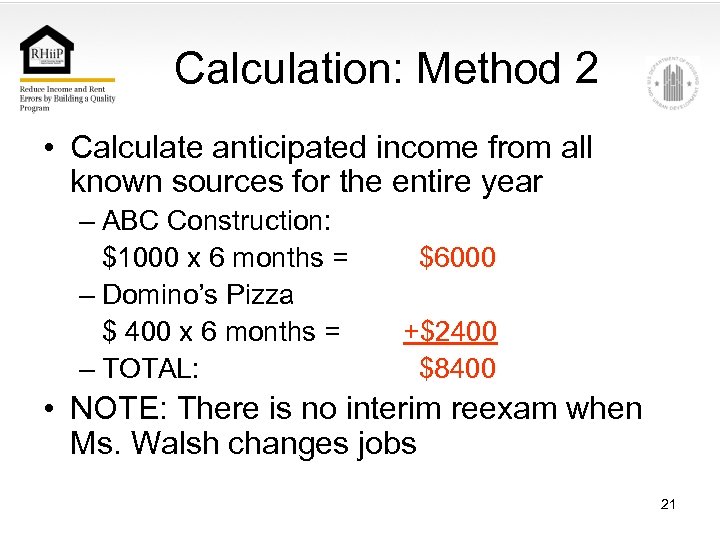

Calculation: Method 2 • Calculate anticipated income from all known sources for the entire year – ABC Construction: $1000 x 6 months = – Domino’s Pizza $ 400 x 6 months = – TOTAL: $6000 +$2400 $8400 • NOTE: There is no interim reexam when Ms. Walsh changes jobs 21

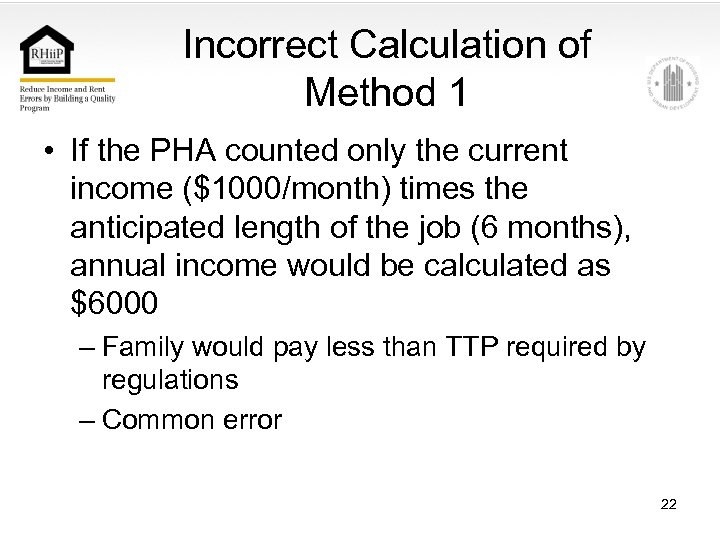

Incorrect Calculation of Method 1 • If the PHA counted only the current income ($1000/month) times the anticipated length of the job (6 months), annual income would be calculated as $6000 – Family would pay less than TTP required by regulations – Common error 22

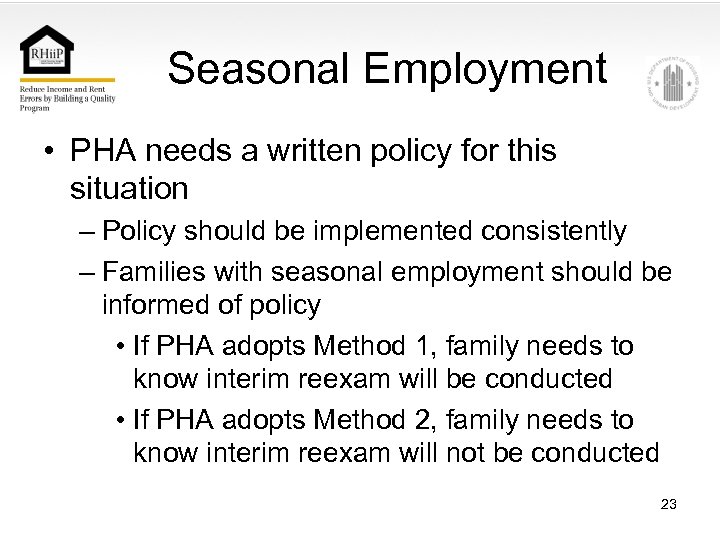

Seasonal Employment • PHA needs a written policy for this situation – Policy should be implemented consistently – Families with seasonal employment should be informed of policy • If PHA adopts Method 1, family needs to know interim reexam will be conducted • If PHA adopts Method 2, family needs to know interim reexam will not be conducted 23

Chapter 5. Section 3. Training Program Income See Appendix for Training Program Income Notice (A-5) and CFR (B-15) 24

Training Program Income • HUD-Funded Training Program v. Exclude all amounts received under the training program 25

HUD-Funded Training The head of a tenant family receives $500 mo. in TANF. She enrolls in a HUD-funded training program operated by the PHA. TANF benefits stop. She receives $600 mo. while in the training program. Upon completion, she receives a job at the PHA earning $700 per month. What monthly income is counted during training? None What is counted after completion? $700 (All) How long is income excluded? During training only 26

Other Training Program Income • 5. 609(c)(8)(v) – Exclude all incremental earnings and benefits resulting from participation in a qualifying State or local employment training program • includes programs not affiliated with a local government • no specific employment training programs cited 27

Training Program Income • To qualify, an employment training program must have clearly defined goals and objectives. • PHAs may adopt written policies that establish standards for these programs. 28

Training Program Income • Training may include – Occupational classroom training – Subsidized on-the-job training – Basic education 29

Training Program Income Incremental income: Increase in total amount of welfare, benefits, and earnings of family member after enrollment in training program as compared to income before enrollment Only the incremental increase is excluded. 30

Training Program Income • 5. 609(c)(8)(v) – Exclude incremental earnings and benefits only while the family member participates in the employment training program 31

Example of Other Training Program Income A family head receives $400 per month in TANF. He then enrolls in a qualified State employment training program and receives $550 per month in training income. TANF benefits stop. What income is counted? $400 - the extra $150 is not counted How long will income be excluded? While he remains in the training program 32

Training Program Income Issues • When new employment is reported, PHA needs to determine whether employment is part of a training program • Notice PIH 2001 -15 identified frequent errors in this component – Recommends educating tenants on eligible types of training programs • Check data-gathering forms for questions 33

Chapter 5. Section 4. Earned Income Disallowance See Appendix A for Website Address For FAQs on EID 34

Earned Income Disallowance • Effective 10/01/99 • Final Rule – Effective date 4/28/00 • Regulations: 24 CFR 960. 255 35

EID • The EID calls for the exclusion of increases in income attributable to new employment or increased earnings over income received prior to qualifying for the disallowance. • To qualify for the EID, a family must be receiving assistance under the PH program. – Applicant families are not eligible for the EID 36

EID Qualifications • Family must experience an increase in annual income as a result of one of the following 3 events. . . 37

Qualifications 1. Employment by a family member who – Was “previously unemployed”* for one or more years prior to employment * definition includes a person who has earned not more than could be earned working 10 hrs/week, 50 wks/year, at established minimum wage OR…. . . 38

Earned Income Disallowance 2. Increased earnings by a family member: – Whose increased earnings occurred during* member’s participation in an: • • economic self-sufficiency program job-training program * The increase in earnings must occur while the individual is enrolled in the program. 39

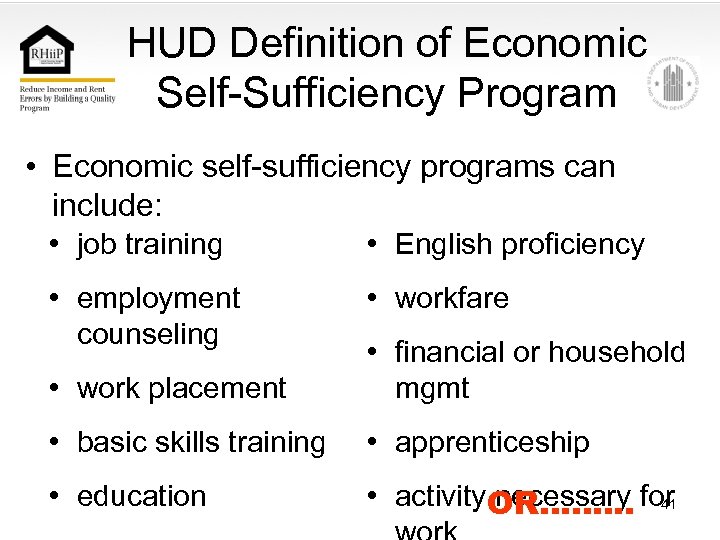

HUD Definition of Economic Self-Sufficiency Program • Any program designed to encourage, assist, train or facilitate economic independence of assisted families or to provide work for such families. 40

HUD Definition of Economic Self-Sufficiency Program • Economic self-sufficiency programs can include: • job training • English proficiency • employment counseling • workfare • work placement • financial or household mgmt • basic skills training • apprenticeship • education • activity. OR……. . . for necessary 41

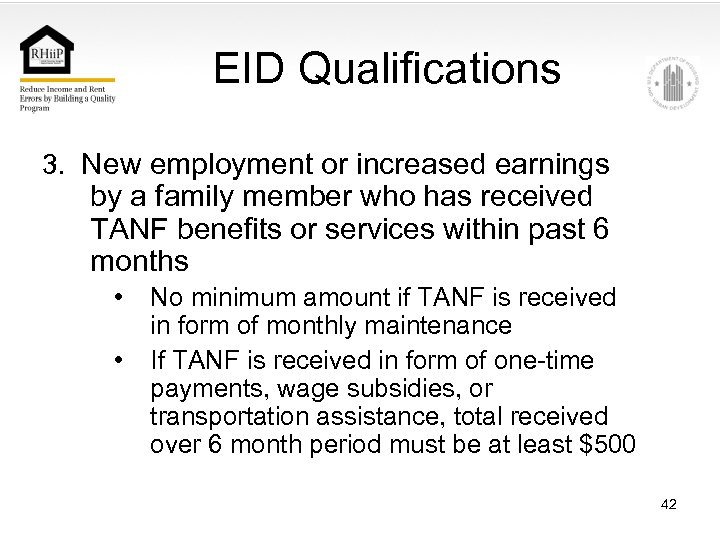

EID Qualifications 3. New employment or increased earnings by a family member who has received TANF benefits or services within past 6 months • • No minimum amount if TANF is received in form of monthly maintenance If TANF is received in form of one-time payments, wage subsidies, or transportation assistance, total received over 6 month period must be at least $500 42

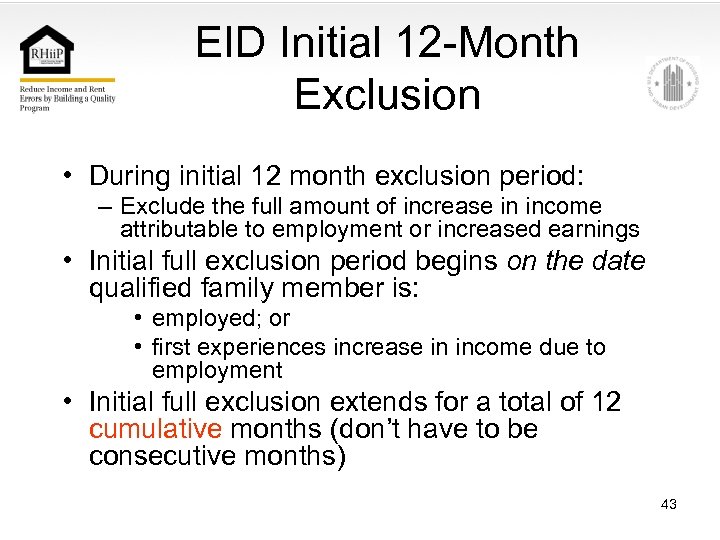

EID Initial 12 -Month Exclusion • During initial 12 month exclusion period: – Exclude the full amount of increase in income attributable to employment or increased earnings • Initial full exclusion period begins on the date qualified family member is: • employed; or • first experiences increase in income due to employment • Initial full exclusion extends for a total of 12 cumulative months (don’t have to be consecutive months) 43

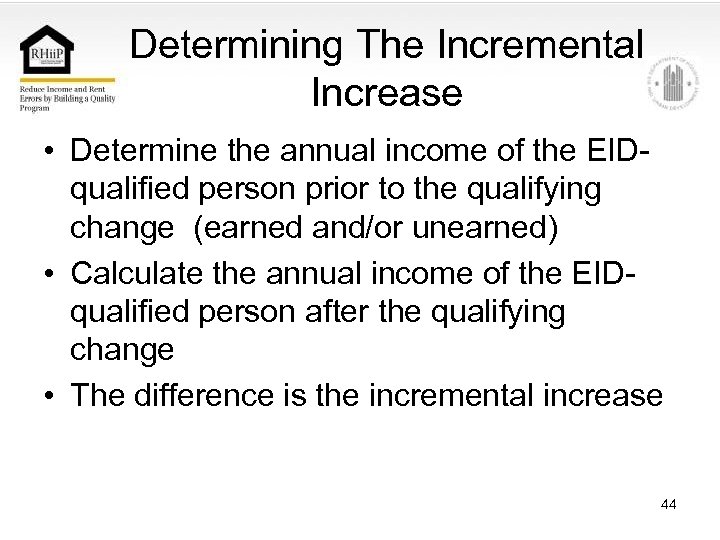

Determining The Incremental Increase • Determine the annual income of the EIDqualified person prior to the qualifying change (earned and/or unearned) • Calculate the annual income of the EIDqualified person after the qualifying change • The difference is the incremental increase 44

Example #1 • Mary Jones had $4000 in TANF benefits at the time she became employed. She is earning $12, 400 at her new job, and her TANF benefits have stopped. • How much is the incremental increase? 45

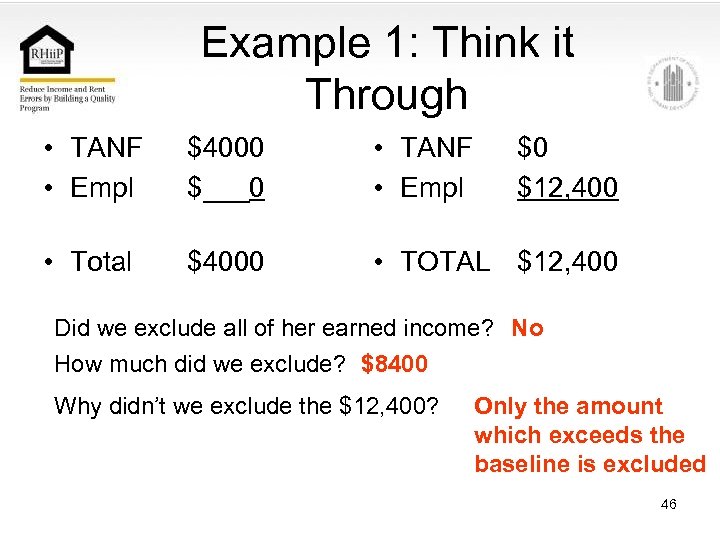

Example 1: Think it Through • TANF • Empl $4000 $___0 • TANF • Empl • Total $4000 • TOTAL $12, 400 $0 $12, 400 Did we exclude all of her earned income? No How much did we exclude? $8400 Why didn’t we exclude the $12, 400? Only the amount which exceeds the baseline is excluded 46

Example #2 • John Smith had no income at the time he became employed at $12, 400 per year. • How much is the incremental increase? 47

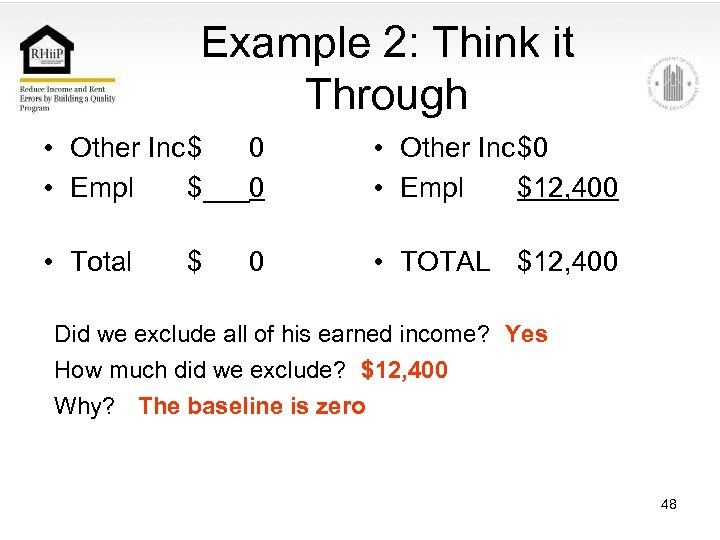

Example 2: Think it Through • Other Inc$ 0 • Empl $___0 • Other Inc$0 • Empl $12, 400 • Total • TOTAL $12, 400 $ 0 Did we exclude all of his earned income? Yes How much did we exclude? $12, 400 Why? The baseline is zero 48

EID Second 12 -Month Exclusion and Phase-In • Exclusion is reduced to 50% of the increase attributable to employment or increased earnings • Second 12 month exclusion period begins after qualified family member has received 12 cumulative months of full exclusion • Phase-in period extends for a total of 12 cumulative months (not needed to be consecutive months) 49

EID Maximum 4 Year Disallowance • 4 year lifetime maximum disallowance period – Starts at beginning of initial exclusion period and ends exactly 48 months later – No exclusion may be given after this lifetime limit has been reached 50

EID Maximum 4 Year Disallowance • EID regulations call for a maximum of 12 cumulative months for each of the two exclusion periods – Thus, an individual can “max out” after receiving the EID for only two years • 12 consecutive full-exclusion months followed by • 12 consecutive phase-in exclusion months 51

EID Issues • Remember, the disallowance does not apply for purposes of admission to the PH program • To ensure that every PH tenant who is eligible for EID receives it and it is calculated properly, PHA must consider: 1. How will you document – what evidence will you provide: A. That the family is a “qualified family”? B. The income exclusion in the family’s file? 52

EID Issues 2. How will you track the number of months income has been excluded and when the exclusion must end? 53

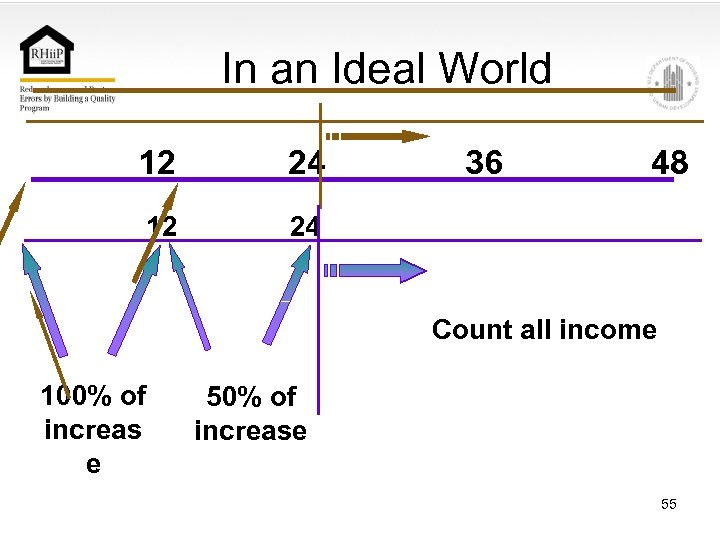

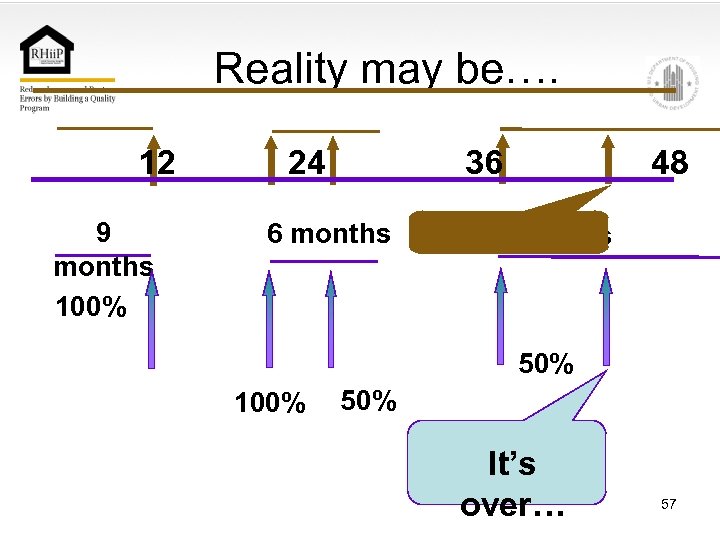

EID Issues • Tracking can be complex – In an ideal world, a person who qualifies for the EID will receive: • The full exclusion for 12 consecutive months • The phase-in exclusion for the next 12 consecutive months – Tracking would be easy 54

In an Ideal World 12 24 12 36 48 24 Count all income 100% of increas e 50% of increase 55

EID Issues • Tracking – In reality, the exclusion may stop and start more than once, making it a challenge to figure out how much to disallow when there is a break during an exclusion period. 56

Reality may be…. 12 9 months 100% 24 36 6 months 48 9 months 50% 100% 50% It’s over… 57

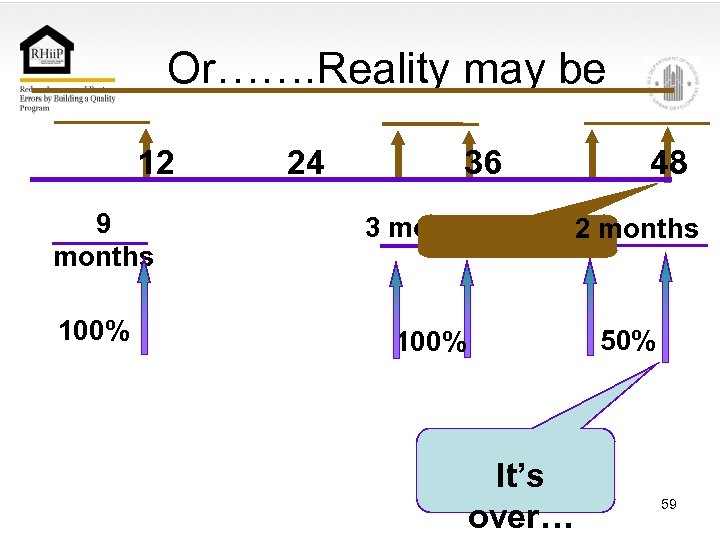

EID Issues • Tracking – Or. . . The four-year maximum may be reached before the full 12 months of phase-in (or even initial full exclusion) have been “used up. ” 58

Or……. Reality may be 12 9 months 100% 24 36 3 months 48 2 months 50% 100% It’s over… 59

EID Issues • Complexity of the regulation contributes to rent determination errors – Per HUD’s PD&R report • Difficulty in tracking exclusion periods – PHA needs standardized system 60

EID Issues • Calculation of “incremental increase” – May necessitate conducting interim reexams throughout phase-in period • Regardless of PHA’s interim policy • To simplify matters, PHA may align reexam date to coincide with the beginning of the phase-in period • Best source for answers: – RHIIP: www. hud. gov/offices/pih/programs/ph/rhiip/faq. cfm – EID: www. hud. gov/offices/pih/phr/about/ao_faq. cfm 61

Earned Income Disallowance • Learning Activity 5 -2: • EID Calculation • Read the case study • Part 1: Calculate the prequalifying income and the exclusion amount and wages for EID member • Parts 2 -4: Recalculate for changes 62

Answers: Baseline Income • Katie’s prequalifying (baseline) income is: • $5, 000 63

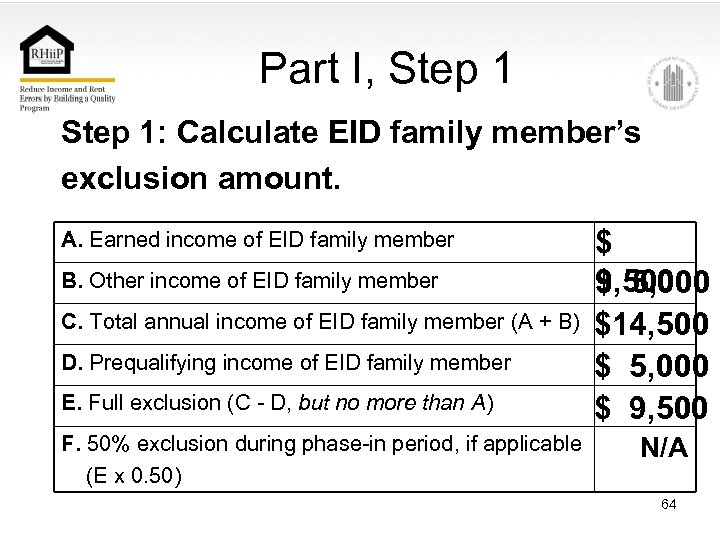

Part I, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) $ 9, 500 $ 5, 000 $14, 500 $ 5, 000 $ 9, 500 N/A 64

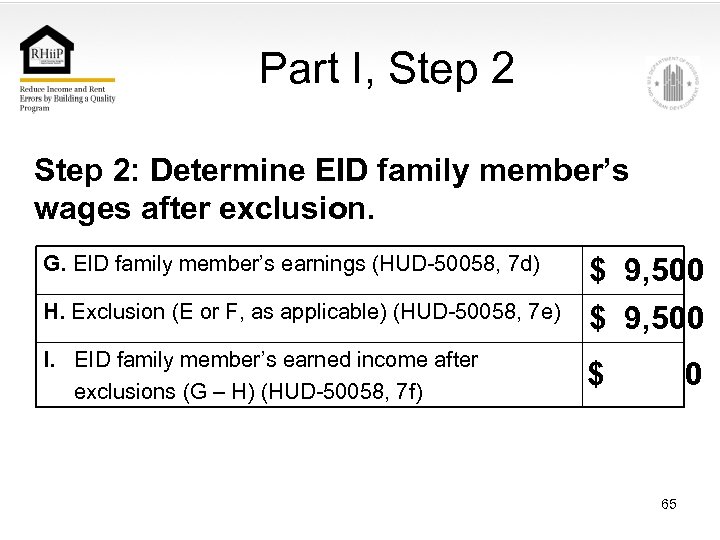

Part I, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) $ 9, 500 $ 0 65

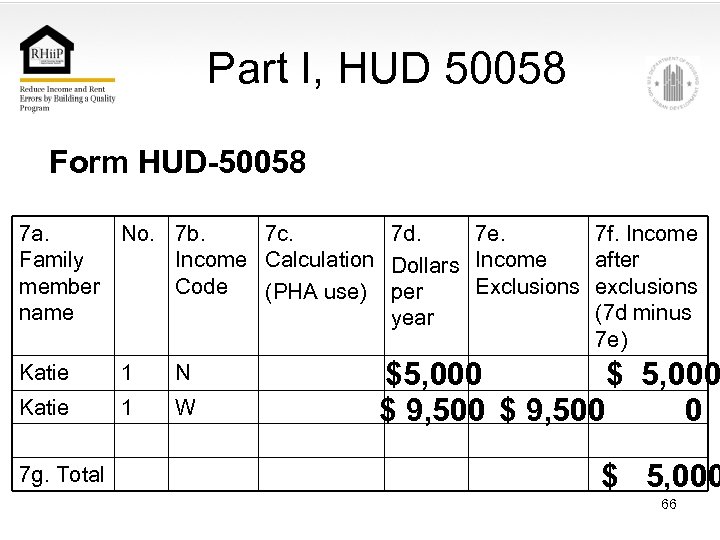

Part I, HUD 50058 Form HUD-50058 7 a. No. 7 b. 7 c. Family Income Calculation member Code (PHA use) name Katie 1 N Katie 1 W 7 g. Total 7 d. 7 e. Dollars Income Exclusions per year 7 f. Income after exclusions (7 d minus 7 e) $5, 000 $ 9, 500 0 $ 5, 000 66

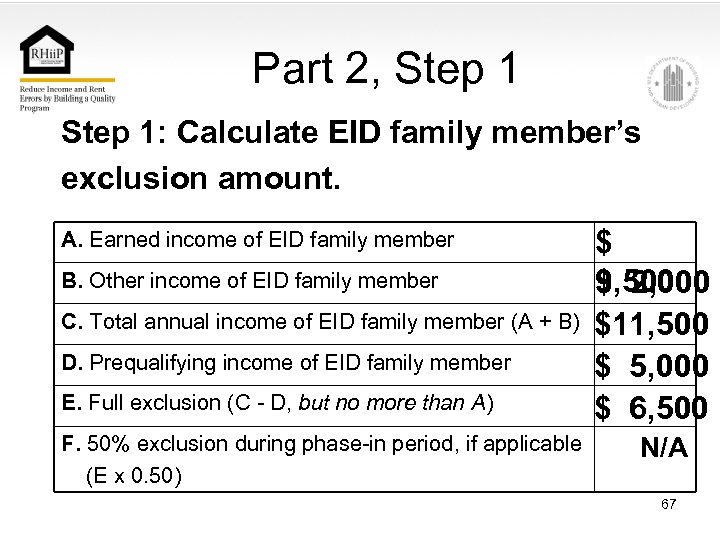

Part 2, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) $ 9, 500 $ 2, 000 $11, 500 $ 5, 000 $ 6, 500 N/A 67

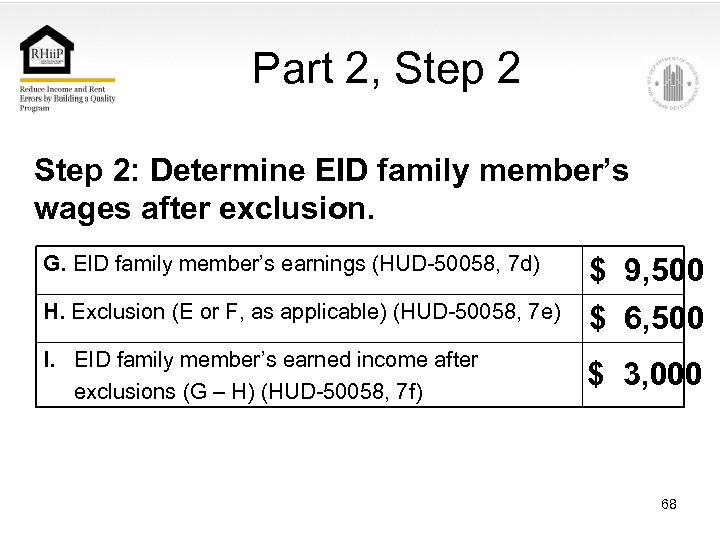

Part 2, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) $ 9, 500 $ 6, 500 $ 3, 000 68

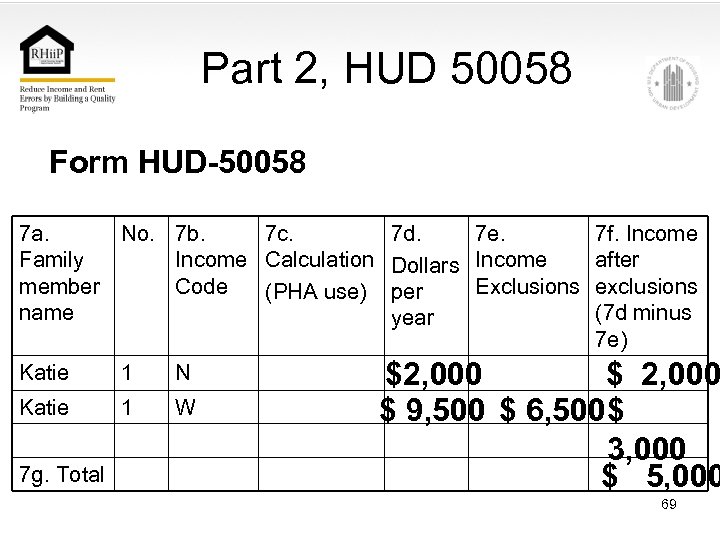

Part 2, HUD 50058 Form HUD-50058 7 a. No. 7 b. 7 c. Family Income Calculation member Code (PHA use) name Katie 1 N Katie 1 W 7 g. Total 7 d. 7 e. Dollars Income Exclusions per year 7 f. Income after exclusions (7 d minus 7 e) $2, 000 $ 9, 500 $ 6, 500$ 3, 000 $ 5, 000 69

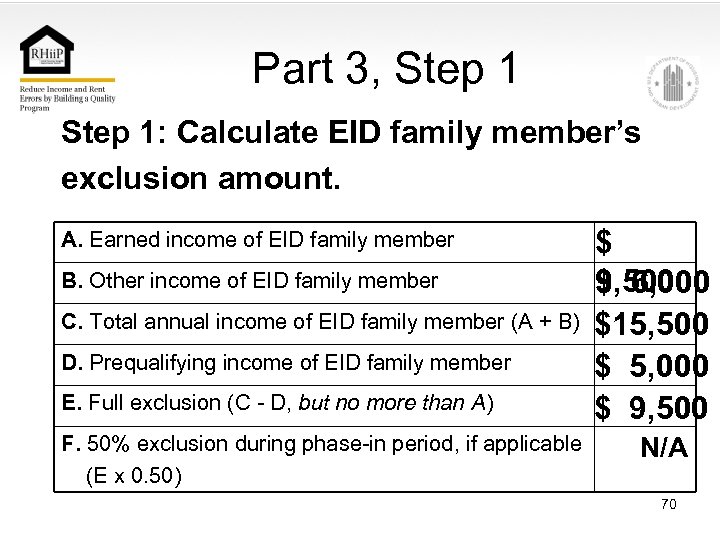

Part 3, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) $ 9, 500 $ 6, 000 $15, 500 $ 5, 000 $ 9, 500 N/A 70

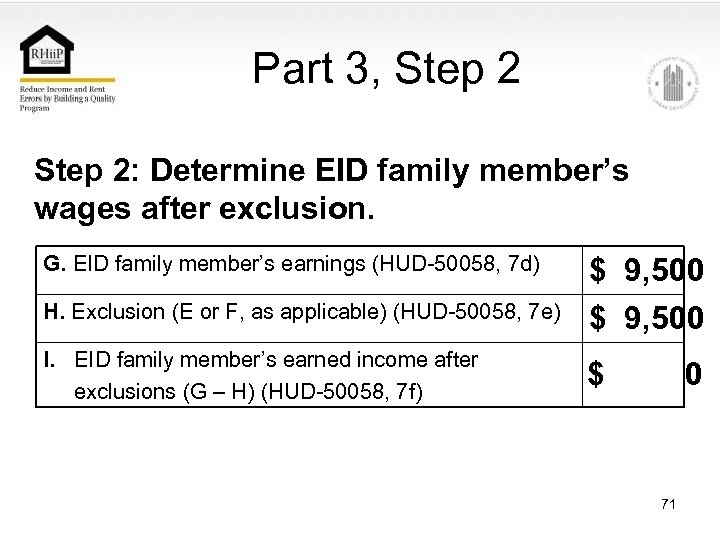

Part 3, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) $ 9, 500 $ 0 71

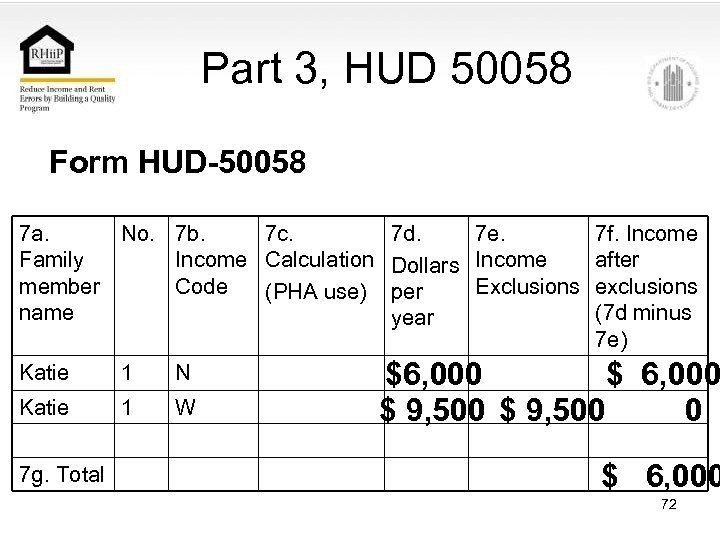

Part 3, HUD 50058 Form HUD-50058 7 a. No. 7 b. 7 c. Family Income Calculation member Code (PHA use) name Katie 1 N Katie 1 W 7 g. Total 7 d. 7 e. Dollars Income Exclusions per year 7 f. Income after exclusions (7 d minus 7 e) $6, 000 $ 9, 500 0 $ 6, 000 72

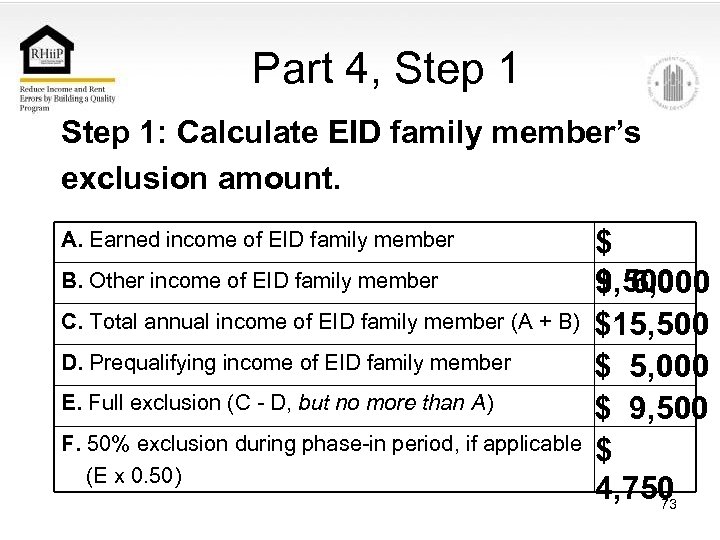

Part 4, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) $ 9, 500 $ 6, 000 $15, 500 $ 5, 000 $ 9, 500 $ 4, 750 73

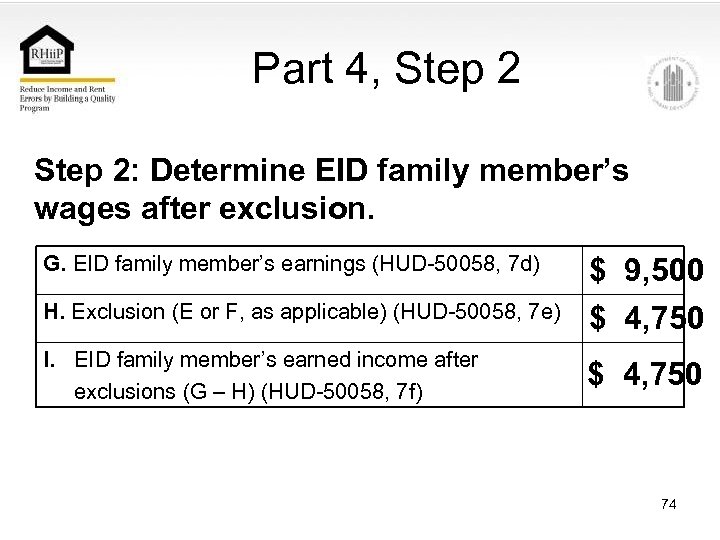

Part 4, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) $ 9, 500 $ 4, 750 74

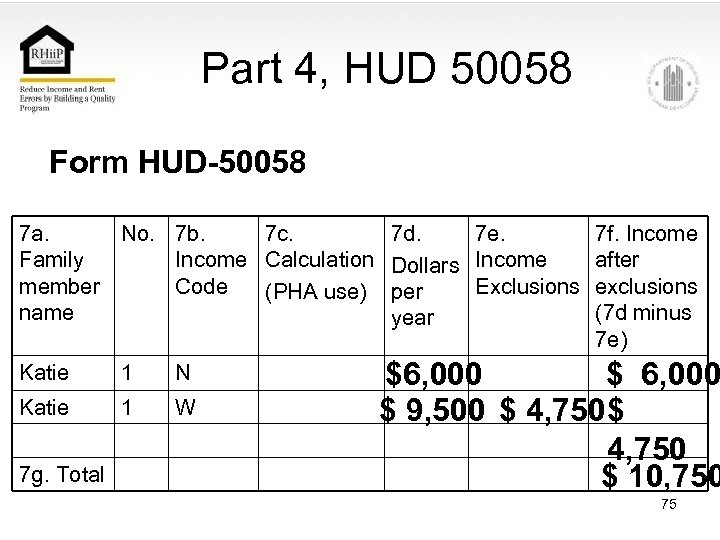

Part 4, HUD 50058 Form HUD-50058 7 a. No. 7 b. 7 c. Family Income Calculation member Code (PHA use) name Katie 1 N Katie 1 W 7 g. Total 7 d. 7 e. Dollars Income Exclusions per year 7 f. Income after exclusions (7 d minus 7 e) $6, 000 $ 9, 500 $ 4, 750 $ 10, 750 75

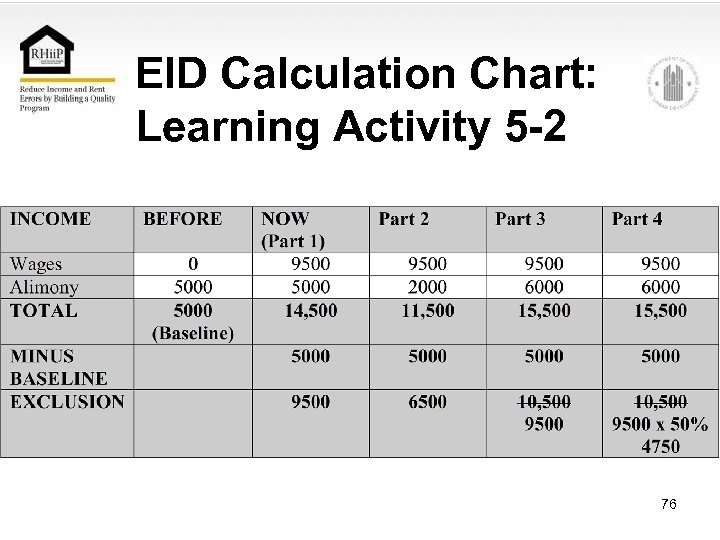

EID Calculation Chart: Learning Activity 5 -2 76

Applying the EID Rules • In this section, we’ll walk you step-by-step through an in-depth example of the complexities that can arise in the application of the EID rules. 77

Challenges for PHA Management • Since EID is a statutory requirement and a major source of rent errors, management must take seriously the responsibility of ensuring that staff can apply the EID rules correctly. • Rectifying a failure to provide this benefit when a family is entitled to it can be costly for a PHA. So can providing excess subsidy! 78

Challenges for PHA Staff • Staff may be puzzled or confused by the results of correctly applying the EID rules such as families with these circumstances: – Family who has significant increase in earned income without having any increase in rent – Family who has decreases in other income with no equivalent decreases in rent 79

Challenges for PHA Staff • Other confusing areas – Explaining to families why their rent is going up or down as a result of the EID rules – Difficulty tracking a family’s EID benefit as time passes and family circumstances change 80

Purpose of Effective Tracking System • Public housing residents must benefit only for the number of months for which they qualify • PHA does not become liable for excess subsidy 81

In-Depth Example • Franklin Family – One member will become eligible for EID and will progress through two 12 month exclusion periods – Case study will help us track the two exclusion periods as well as the 4 -year maximum benefit period • Time is divided into 4 12 -month blocks • See time lines (page 5 -35) 82

In-Depth Example • Franklin Family Scenario (page 5 -36) 83

In-Depth Example • For each scenario, we will follow these 3 steps: 1. Calculate the EID exclusion amount 2. Calculate the family member’s wages after exclusion 3. Complete Form HUD-50058 entries 84

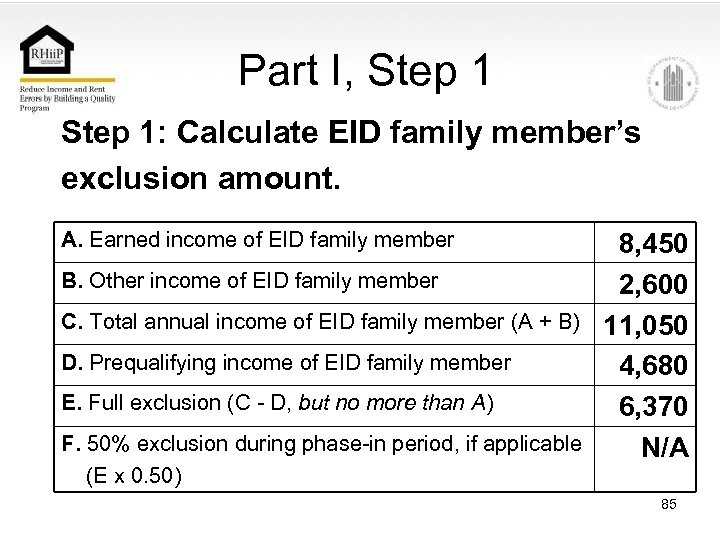

Part I, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) 8, 450 2, 600 11, 050 4, 680 6, 370 N/A 85

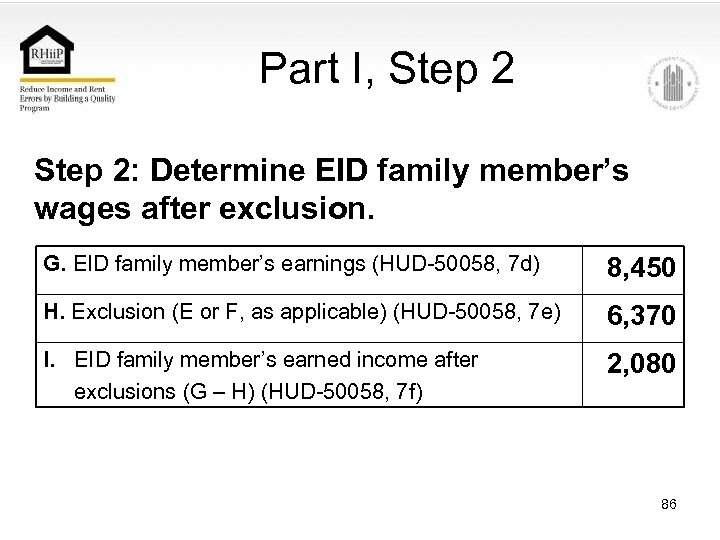

Part I, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) 8, 450 H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) 6, 370 I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) 2, 080 86

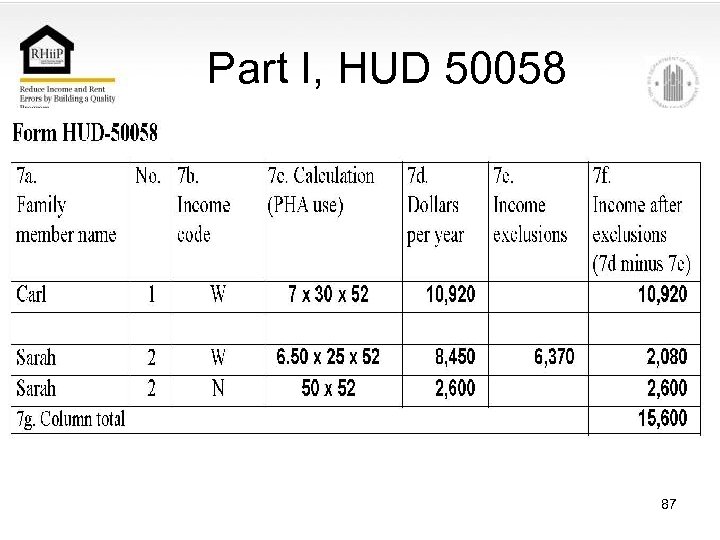

Part I, HUD 50058 87

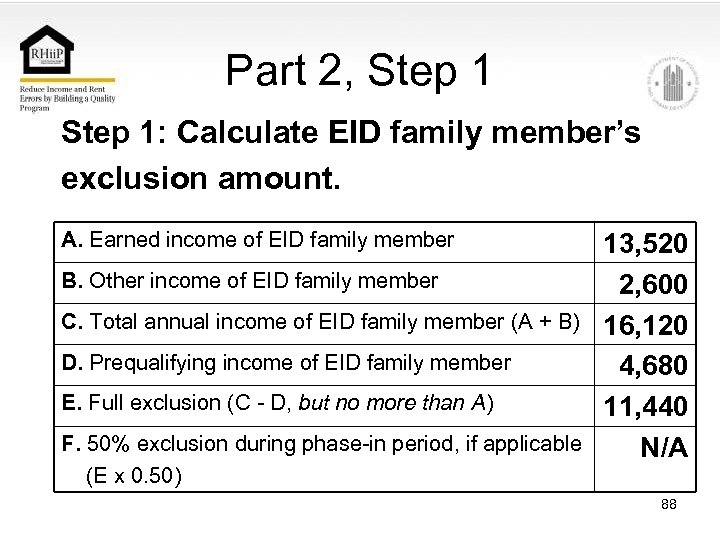

Part 2, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) 13, 520 2, 600 16, 120 4, 680 11, 440 N/A 88

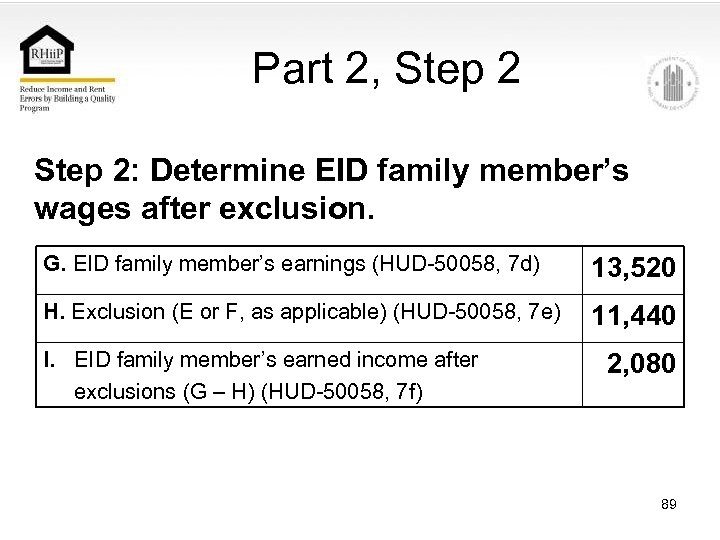

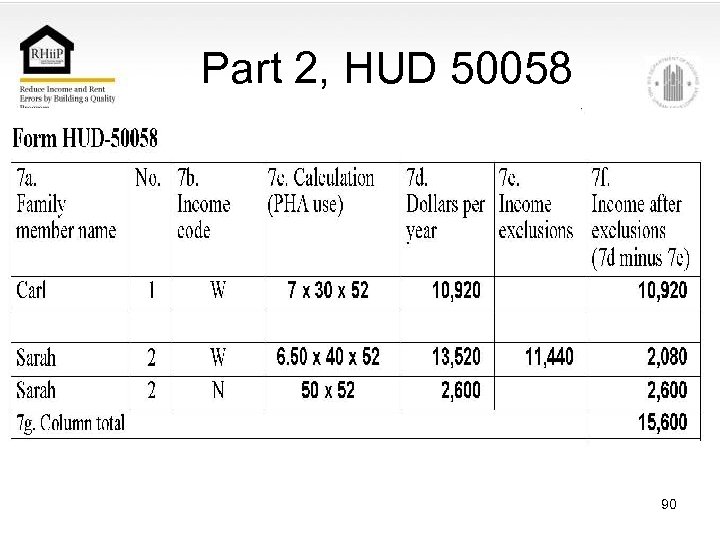

Part 2, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) 13, 520 H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) 11, 440 I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) 2, 080 89

Part 2, HUD 50058 90

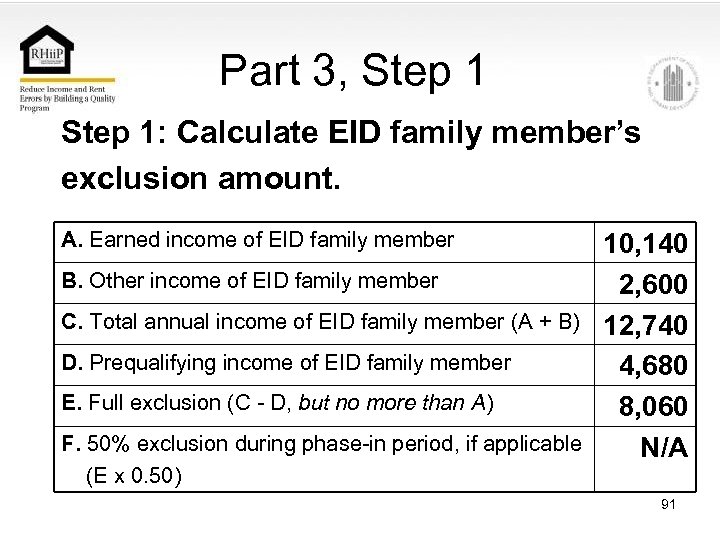

Part 3, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) 10, 140 2, 600 12, 740 4, 680 8, 060 N/A 91

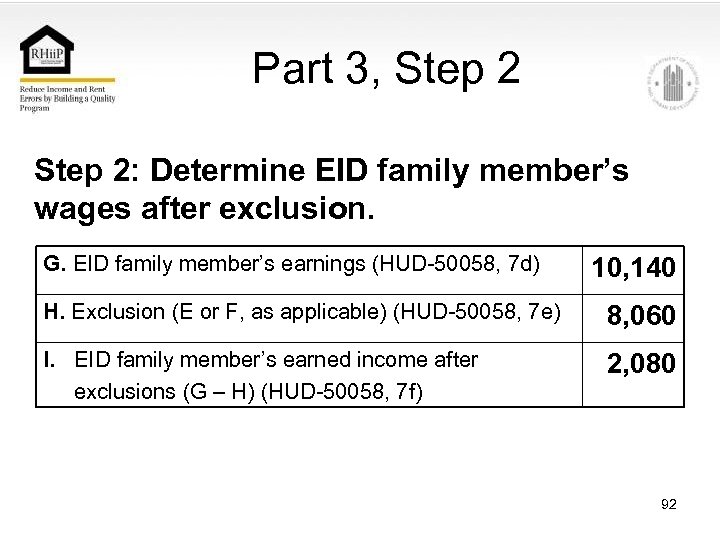

Part 3, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) 10, 140 H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) 8, 060 I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) 2, 080 92

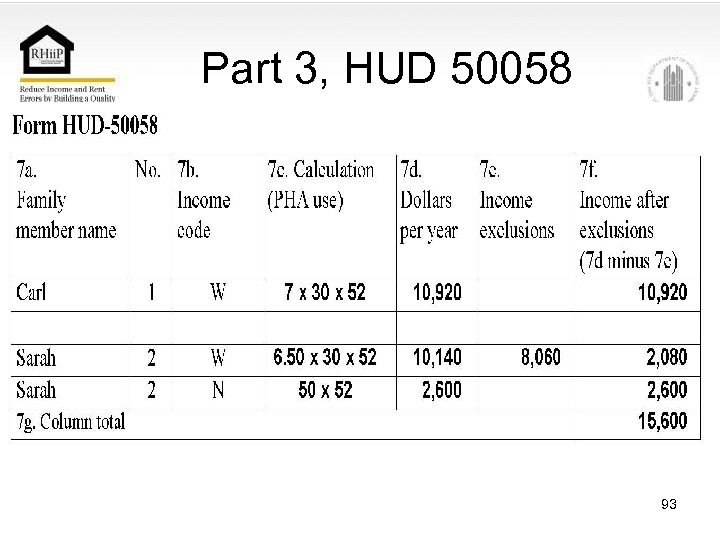

Part 3, HUD 50058 93

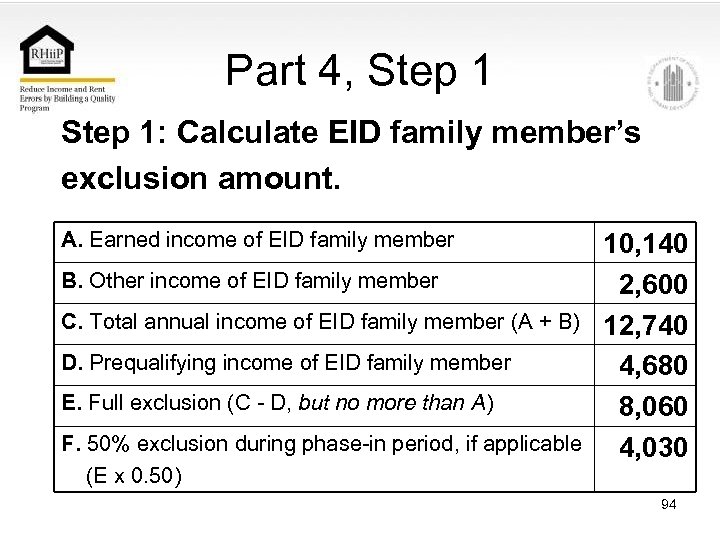

Part 4, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) 10, 140 2, 600 12, 740 4, 680 8, 060 4, 030 94

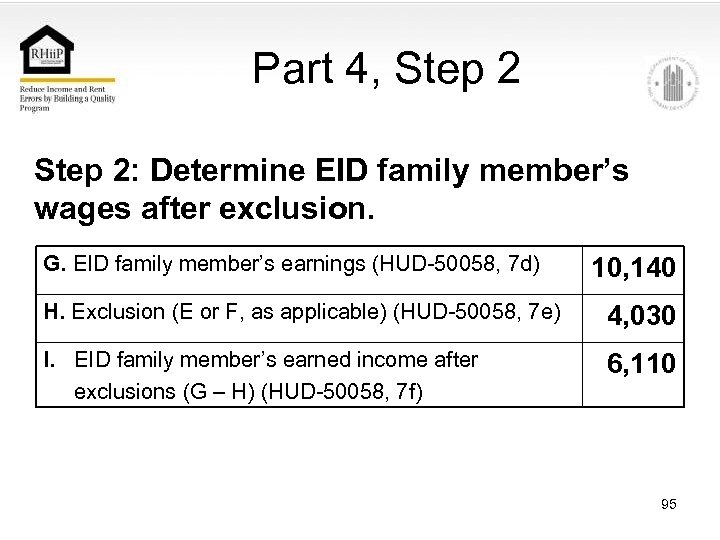

Part 4, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) 10, 140 H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) 4, 030 I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) 6, 110 95

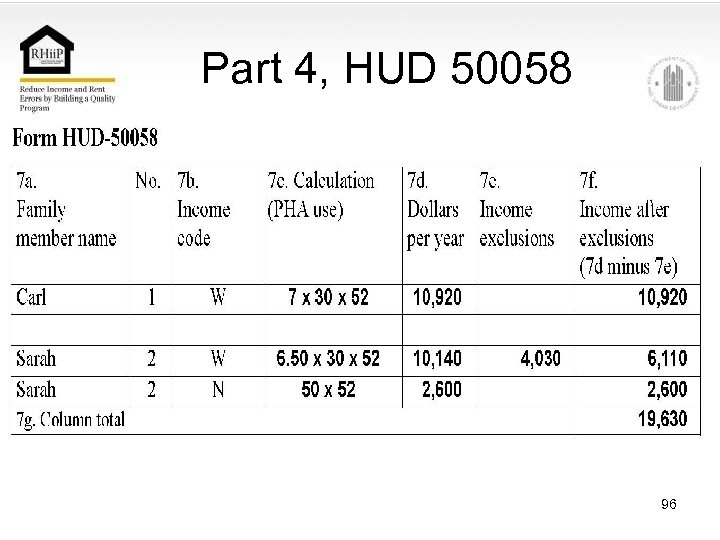

Part 4, HUD 50058 96

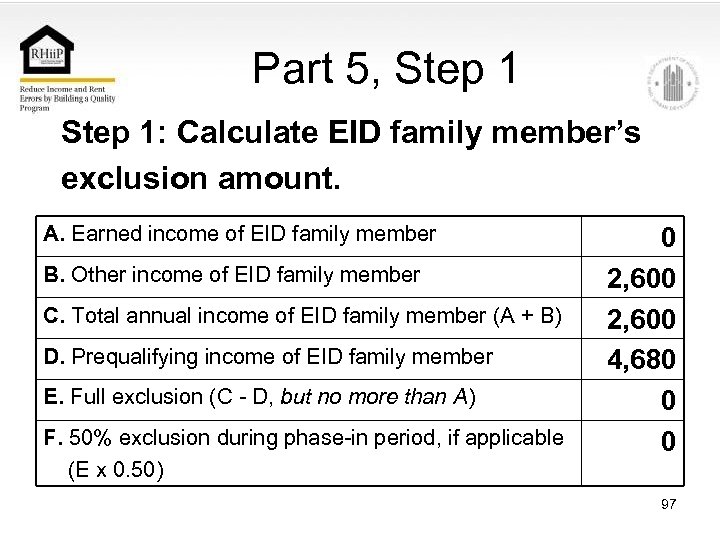

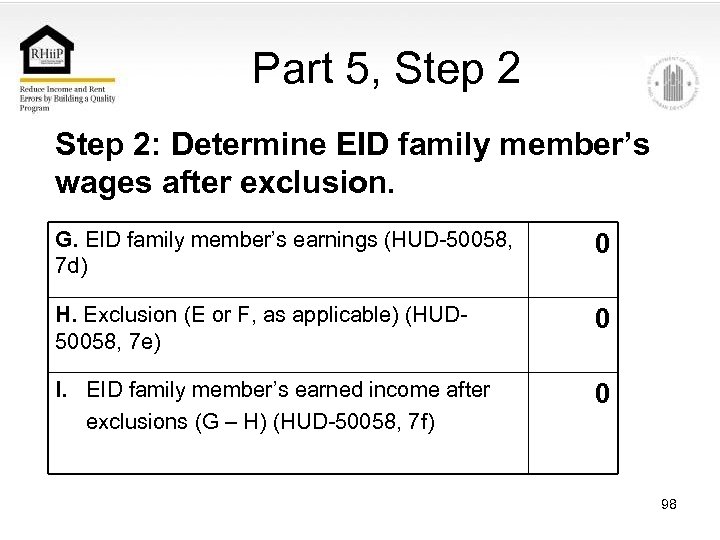

Part 5, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) 0 2, 600 4, 680 0 0 97

Part 5, Step 2: Determine EID family member’s wages after exclusion. G. EID family member’s earnings (HUD-50058, 7 d) 0 H. Exclusion (E or F, as applicable) (HUD 50058, 7 e) 0 I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) 0 98

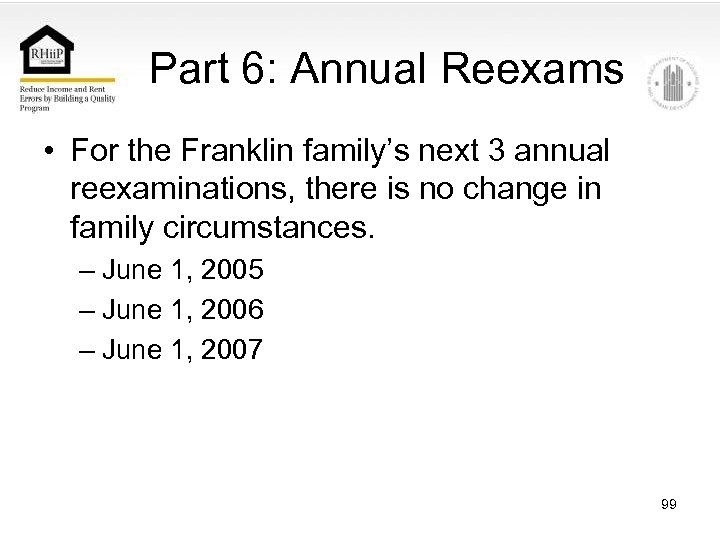

Part 6: Annual Reexams • For the Franklin family’s next 3 annual reexaminations, there is no change in family circumstances. – June 1, 2005 – June 1, 2006 – June 1, 2007 99

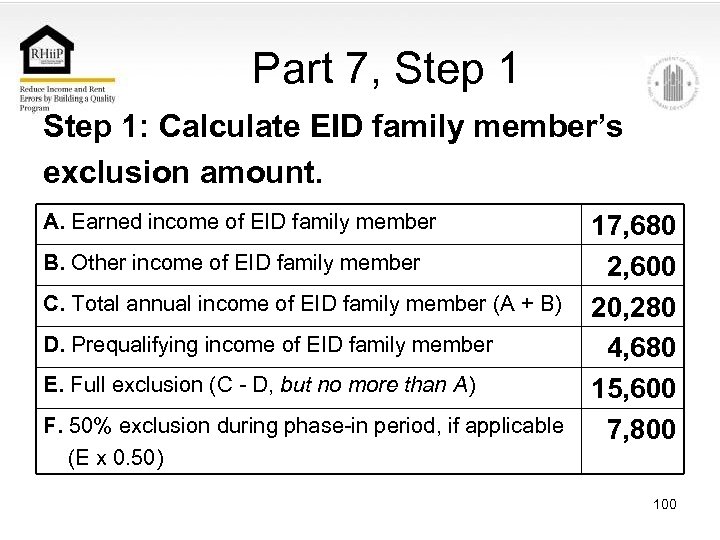

Part 7, Step 1: Calculate EID family member’s exclusion amount. A. Earned income of EID family member B. Other income of EID family member C. Total annual income of EID family member (A + B) D. Prequalifying income of EID family member E. Full exclusion (C - D, but no more than A) F. 50% exclusion during phase-in period, if applicable (E x 0. 50) 17, 680 2, 600 20, 280 4, 680 15, 600 7, 800 100

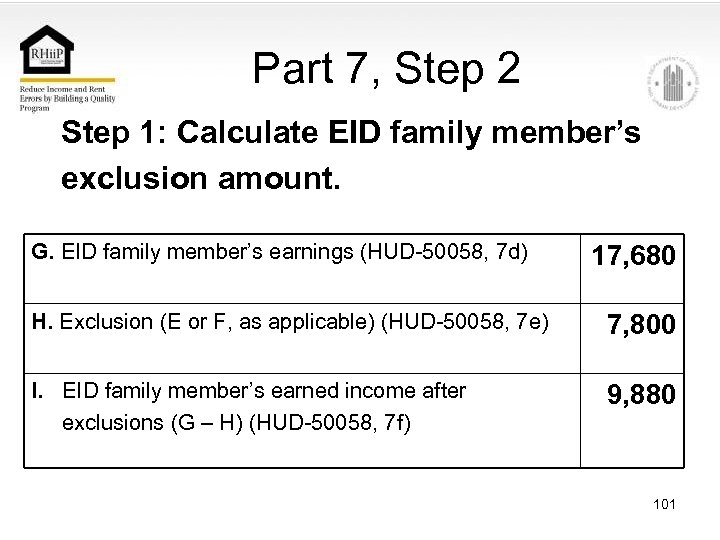

Part 7, Step 2 Step 1: Calculate EID family member’s exclusion amount. G. EID family member’s earnings (HUD-50058, 7 d) 17, 680 H. Exclusion (E or F, as applicable) (HUD-50058, 7 e) 7, 800 I. EID family member’s earned income after exclusions (G – H) (HUD-50058, 7 f) 9, 880 101

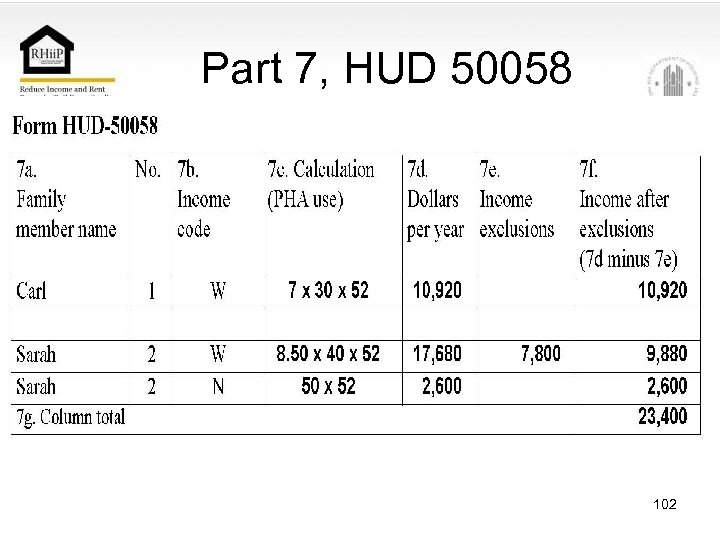

Part 7, HUD 50058 102

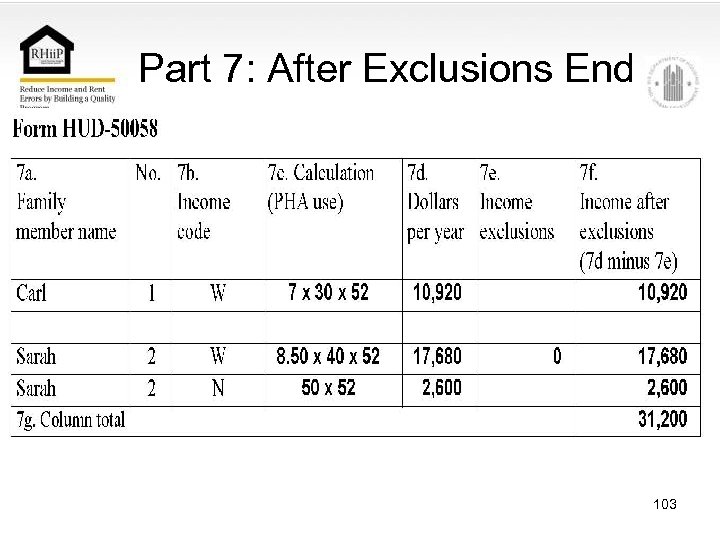

Part 7: After Exclusions End 103

Chapter 5. Section 5. Assets and Asset Income 104

Assets and Asset Income • Value of assets may affect family’s annual income • PHA must: – Identify assets – Verify market value of asset – Convert from market to cash value 105

Assets and Asset Income • To determine cash value of asset, start with the fair market value. Then subtract: – Any expenses involved in converting assets to cash: • • Broker fees Legal fees Settlement costs Penalty for early withdrawal – Any money owed on the asset, such as the mortgage balance 106

What Assets Include • Savings and checking accounts – PHAs establish policies for determining value of accounts – May elect to count current balances or average balances for a given period (2 months, 6 months, etc. ) 107

What Assets Include • • Accessible amount of trusts available to family Stock, bonds, money market funds Equity in real property, other capital investments Retirement savings accounts 108

What Assets Include • Contributions to company retirement/pension funds – Before retirement, count only amounts family can withdraw without retiring or quitting – After retirement, count regular periodic payments as income 109

What Assets Include • Assets held in the name of more than one person that allow unrestricted access • Lump sum receipts which are retained and verifiable – – Inheritances, capital gains, lottery winnings Social security & SSI lump sum payments 110

What Assets Include • Personal property held as investment – gems, jewelry – coin collections • Surrender value of life insurance policies 111

Assets Disposed of For Less Than Fair Market Value • Imputed Assets: Assets disposed of within two years prior examination or reexamination for less than fair market value 112

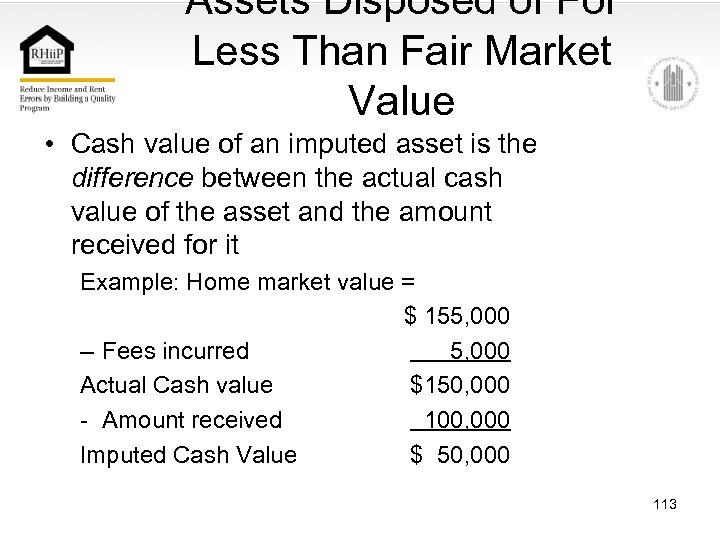

Assets Disposed of For Less Than Fair Market Value • Cash value of an imputed asset is the difference between the actual cash value of the asset and the amount received for it Example: Home market value = $ 155, 000 – Fees incurred 5, 000 Actual Cash value $150, 000 - Amount received 100, 000 Imputed Cash Value $ 50, 000 113

Assets Disposed of For Less Than Fair Market Value • PHA can establish a minimum threshold for counting assets disposed of for less than fair value • Threshold of $1, 000 would be reasonable 114

Assets Disposed of For Less Than Fair Market Value • Generally NOT considered are those assets disposed of due to: – – – divorce or separation bankruptcy foreclosure • PHA should develop applicant/tenant certification form for verifying assets disposed of for less than fair market value 115

Assets Disposed of For Less Than Fair Market Value • Learning Activity 5 -3: Assets disposed of for less than fair market value (page 5 -50) 116

Income from Assets • Market value of asset is used to determine anticipated income from asset – Formula to determine anticipated income from interest bearing accounts: Market value x interest rate = anticipated income What is the market value of a $4, 000 savings account? 117

Income from Assets • Learning Activity 5 -4: • Interest Income from Assets (page 5 -52) 118

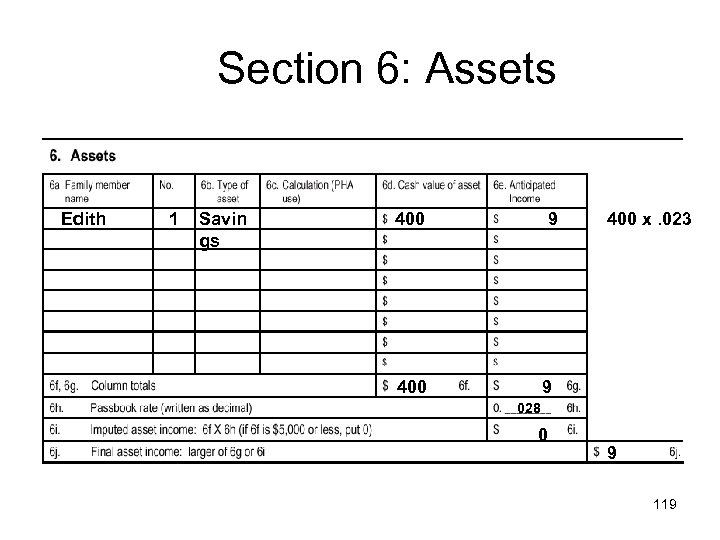

Section 6: Assets Edith 1 Savin gs 400 9 400 x. 023 9 028 0 9 119

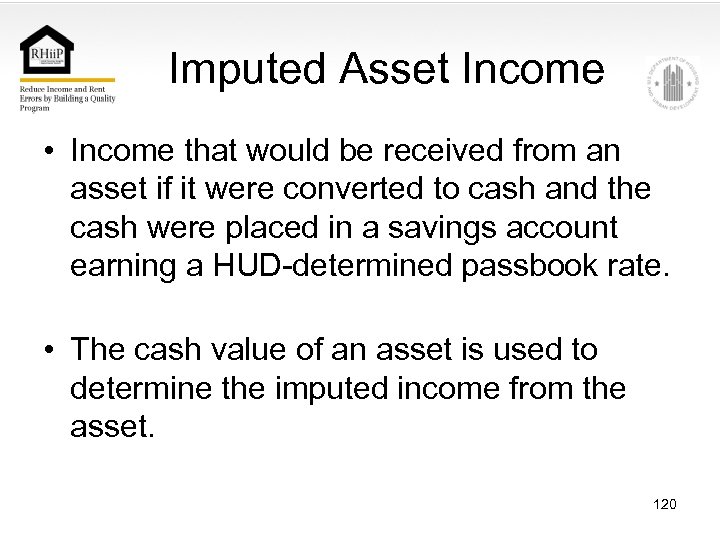

Imputed Asset Income • Income that would be received from an asset if it were converted to cash and the cash were placed in a savings account earning a HUD-determined passbook rate. • The cash value of an asset is used to determine the imputed income from the asset. 120

Imputed Asset Income • Remember, when calculating the cash value of an asset, PHAs must take into account the expenses involved in converting the asset to cash such as: – Penalties for early withdrawal – Broker or legal fees – Closing costs (for real estate) 121

Imputed Asset Income • Imputed asset incomes into play on the HUD 50058 only when the total cash value of all assets is greater than $5000. 122

Imputed Asset Income • When total cash value of all assets is $5000 or less, use the actual income from assets 123

Imputed Asset Income • If the total cash value of all assets exceeds $5, 000 must use the greater of: – actual income from assets – imputed income from assets (HUD passbook rate times total cash value of all assets) 124

Assets and Asset Income • Learning Activity 5 -5: • Assets and Asset Income (page 5 -56) 125

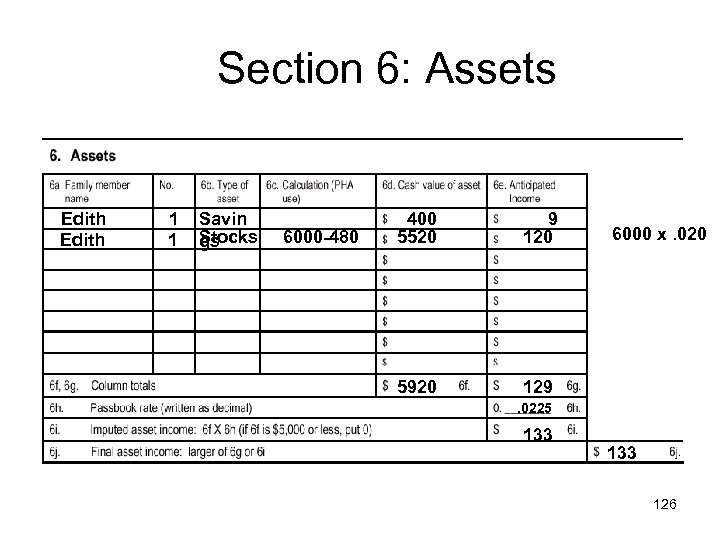

Section 6: Assets Edith 1 1 Savin Stocks gs 6000 -480 400 5520 9 120 5920 129 6000 x. 020 . 0225 133 126

What Assets Do Not Include • Necessary items of personal property such as furniture and automobiles • Assets not accessible to the family • Interest in Indian Trust lands 127

Asset Issues • Staff should know that market value is used to calculate actual income on certificate of deposits and other instruments that carry a penalty for early withdrawal – Cash value is used to determine imputed asset income only if total cash value of all assets exceeds $5000 128

Asset Issues • The actual anticipated income from an interest-bearing asset (savings account) is based on the interest rate actually paid by the bank or other institution where the account is located. – The HUD-determined passbook rate is not used to determine actual income. – The HUD-determined passbook rate is used only to determine imputed interest on assets totaling more than $5000. 129

Asset Issues • PHA staff should be reminded that: – All assets count, regardless of their value – Assets may have a cash value and produce no actual income – There is no maximum asset limit for applicants or tenants • PHA may not pass cost of asset verification to families – Bank verifications – Appraisals 130

Chapter 5. Section 6. PH Rent Calculation 131

Definitions • Tenant rent is the amount payable monthly by the family as rent to the PHA • Total tenant payment (TTP) is the amount the tenant pays toward rent plus any utility allowance • Utility reimbursement is the amount, if any, by which the utility allowance for the unit exceeds the family’s TTP – Not used for a family paying flat rent 132

Income-Based Rent • Tenant rent is the TTP minus the utility allowance • If the utility allowance exceeds the TTP, the PHA must pay the excess amount either to the family or directly to the utility supplier on behalf of the family – Must notify the family of the amount paid to the utility supplier 133

Ceiling Rents • PHAs with ceiling rents that were authorized and established before 10/1/99 were allowed to retain them until 10/1/02 • After that, PHAs were required to adjust ceiling rents to the level required for flat rents • Ceiling rents subject to: – Annual reexamination requirements – Limitation that tenant rent plus utility allowance may not exceed TTP • Tenant rent will be the lower of the TTP or the ceiling rent minus any utility allowance 134

Flat Rents • For each public housing unit, a PHA must establish a flat rent based on the market rent charged for comparable units in the unassisted rental market • PHA must use a reasonable method to determine flat rent, taking into consideration: – Location, quality, size, unit type, age of unit, amenities, housing services, maintenance and utilities provided by the PHA 135

Flat Rents • Example: if a comparable unit rents for $400 and the PHA pays utilities averaging $50 a month, PHA should use $450 as the flat rent • Flat rent encourages self-sufficiency 136

Flat Rents • PHA must maintain records that: – Document method used to determine flat rents – Show flat rents are determined in accordance with this method – Document flat rents offered to families under this method • For family that chooses flat rent, the PHA must conduct a reexamination at least once every three years • If family chooses flat rent, there is no utility allowance 137

Ceiling Rents and Flat Rents • A PHA may have ceiling rents and flat rents at the same time • Ceiling rents are a function of the formulabased rent – When the PHA establishes ceiling rents, the family is charged the lesser of the TTP or the ceiling rent • The PHA will determine the lesser, and then gives the family the choice of the “formula rent” or the flat rent 138

Family Choice of Rent • PHAs must give families choice between income-based rent and flat rent once a year • PHAs must provide families with enough information to make an informed choice, including: – PHA’s policies on switching type of rent in case of financial hardship – Dollar amount of tenant rent for family under each option 139

Family Choice of Rent • If family chooses flat rent one year, a PHA is required to provide the amount of income-based rent for the subsequent rent only under either of the following conditions: – It is the year the PHA is conducting an income reexamination – The family requests the information and submits updated income information 140

Family Choice of Rent • For a family that chooses flat rent, the PHA must conduct a reexamination of family income at least once every three years • The PHA must conduct a reexamination of family composition at least annually 141

Switching Because of Hardship • A PHA must adopt written policies for determining when payment of flat rent is a hardship for a family 142

Switching Because of Hardship • Policies must include the following situations as well as any others the PHA determines appropriate: – Family has experienced a decrease in income because of changed circumstances, including loss or reduction of employment, death in the family, or reduction in or loss of earnings or other assistance – Family has experienced an increase in expenses for medical costs, child care, transportation, education, or similar items 143

Switching Because of Hardship • A family paying flat rent may at any time request a switch due to financial hardship • If the PHA determines that the family is unable to pay flat rent because of financial hardship, PHA must immediately allow the switch to income-based rent • The PHA must make a determination within a reasonable time after the request 144

Switching Because of Hardship • When establishing policies, a PHA should indicate the time frame in which family must notify the PHA of a financial hardship and the need to switch rent options • The PHA should be able to act within 30 days – Includes verifying the financial hardship • Once a family switches to income-based rent because of financial hardship, the family must wait until its next annual reexamination to switch back 145

Learning Objective • Understand address those difficult aspects of rent calculation where errors are most likely to occur 146

2501e37f1aee6c70f6102e2b67a5da80.ppt