5ccd2af826195380a30978c7b262ba10.ppt

- Количество слайдов: 73

Chapter 5 Bonds, Bond Prices and the Determination of Interest Rates Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

CONTENS 5. 1 Bonds and Present Value 5. 2 Bond Yields 5. 3 Bond Market: Supply and Demand 5. 4 Why Bonds Are Risky? 5. 5 Risk Structure of Interest Rates 5. 6 Term Structure of Interest Rates 2

5. 1 Bond Prices 1. Types of Bonds (1) Zero-coupon bonds, which promise a single future payment, such as a U. S. Treasury Bill. (2) Fixed payment loans, such as conventional mortgages. (3) Coupon Bonds, which make periodic interest payments and repay the principal at maturity. U. S. Treasury Bonds and most corporate bonds are coupon bonds. 3

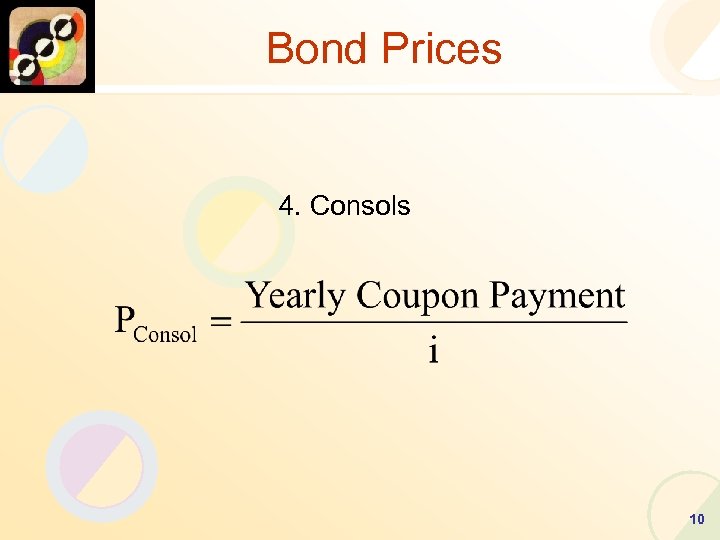

(4) Consols统一公债(由英国政府 1751 年开始发行的长期债券, which make periodic interest payments forever, never repaying the principal that was borrowed. (There aren’t many examples of these. ) 4

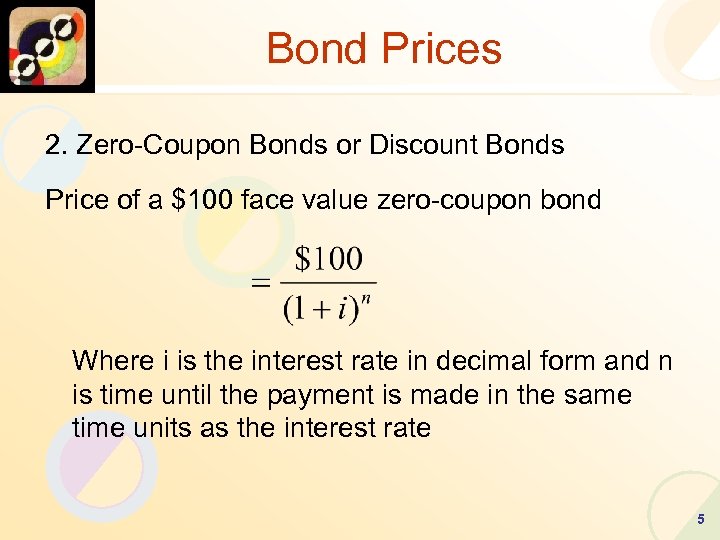

Bond Prices 2. Zero-Coupon Bonds or Discount Bonds Price of a $100 face value zero-coupon bond Where i is the interest rate in decimal form and n is time until the payment is made in the same time units as the interest rate 5

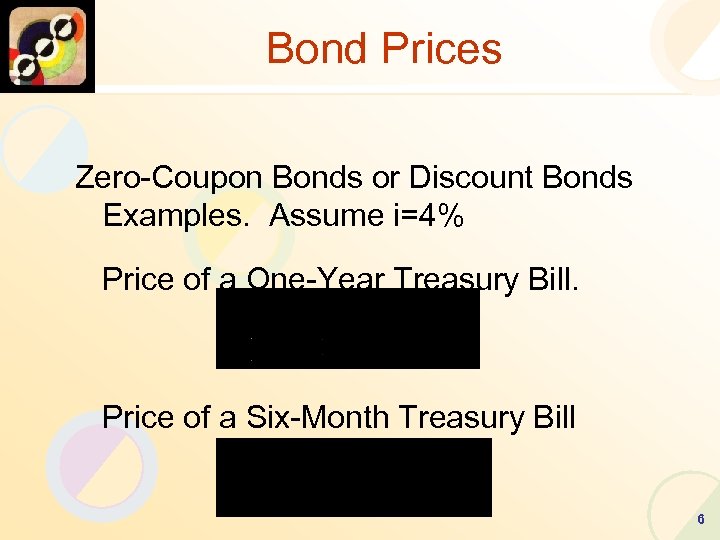

Bond Prices Zero-Coupon Bonds or Discount Bonds Examples. Assume i=4% Price of a One-Year Treasury Bill. Price of a Six-Month Treasury Bill 6

Bond Prices Zero-Coupon Bonds or Discount Bonds Given n, the price of a bond and the interest rate move in opposite directions 7

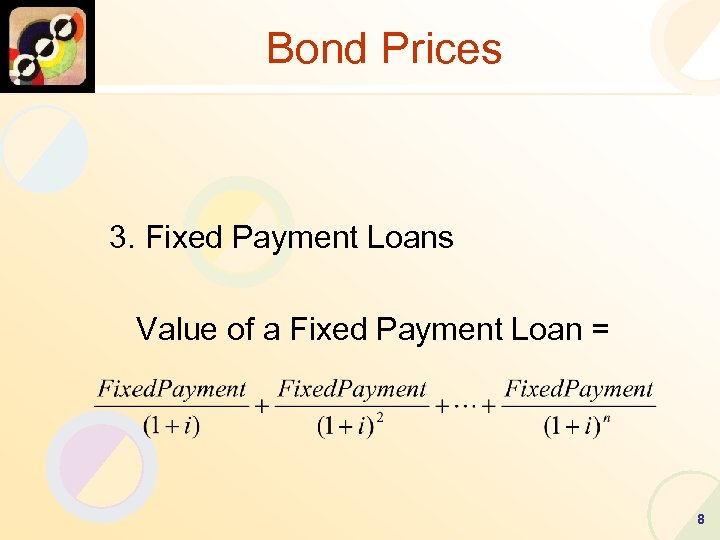

Bond Prices 3. Fixed Payment Loans Value of a Fixed Payment Loan = 8

Bond Prices Coupon Bond 9

Bond Prices 4. Consols 10

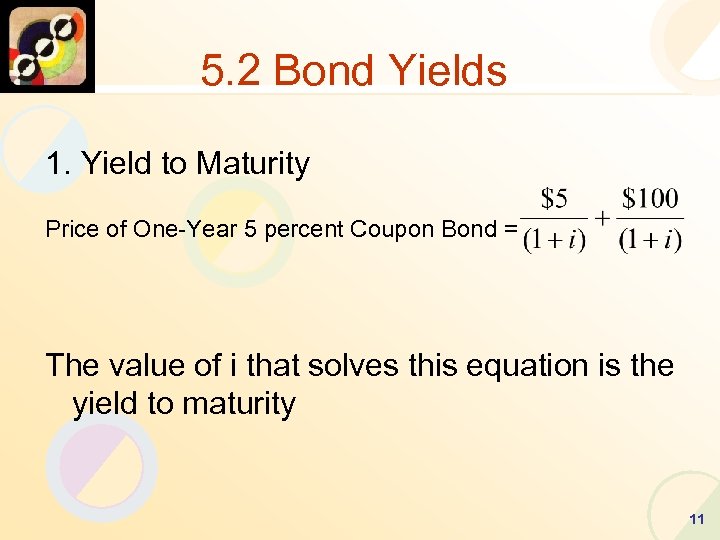

5. 2 Bond Yields 1. Yield to Maturity Price of One-Year 5 percent Coupon Bond = The value of i that solves this equation is the yield to maturity 11

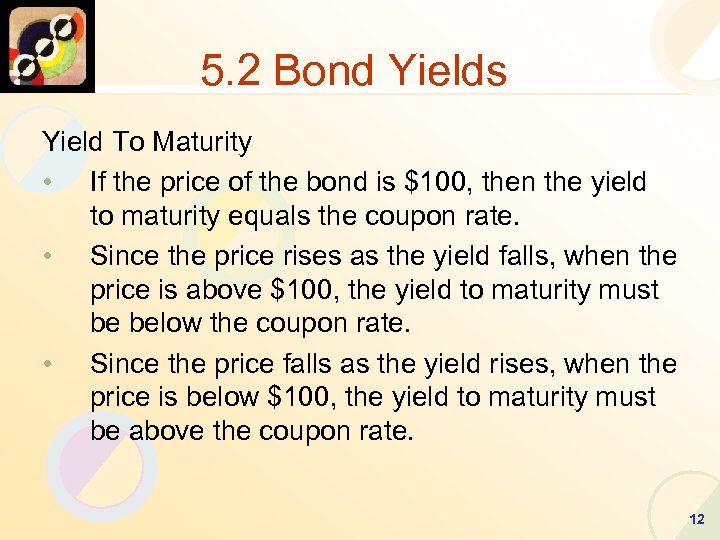

5. 2 Bond Yields Yield To Maturity • If the price of the bond is $100, then the yield to maturity equals the coupon rate. • Since the price rises as the yield falls, when the price is above $100, the yield to maturity must be below the coupon rate. • Since the price falls as the yield rises, when the price is below $100, the yield to maturity must be above the coupon rate. 12

Bond Yields: Current Yield 2. Current Yield当期收益率 13

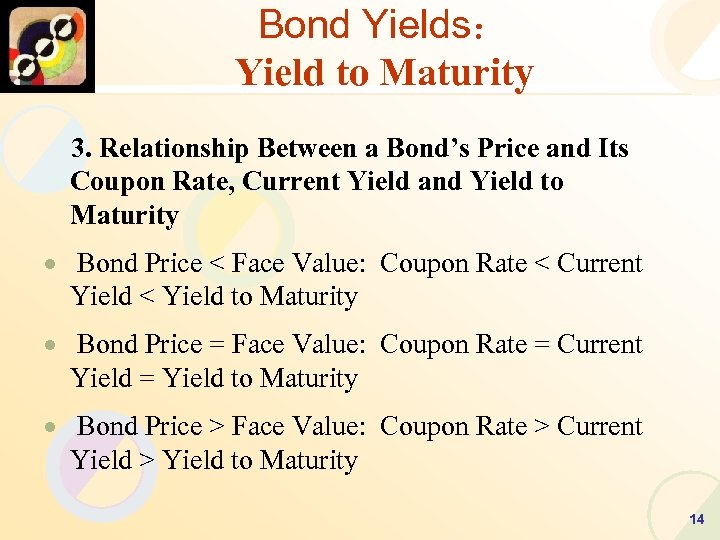

Bond Yields: Yield to Maturity 3. Relationship Between a Bond’s Price and Its Coupon Rate, Current Yield and Yield to Maturity Bond Price < Face Value: Coupon Rate < Current Yield < Yield to Maturity Bond Price = Face Value: Coupon Rate = Current Yield = Yield to Maturity Bond Price > Face Value: Coupon Rate > Current Yield > Yield to Maturity 14

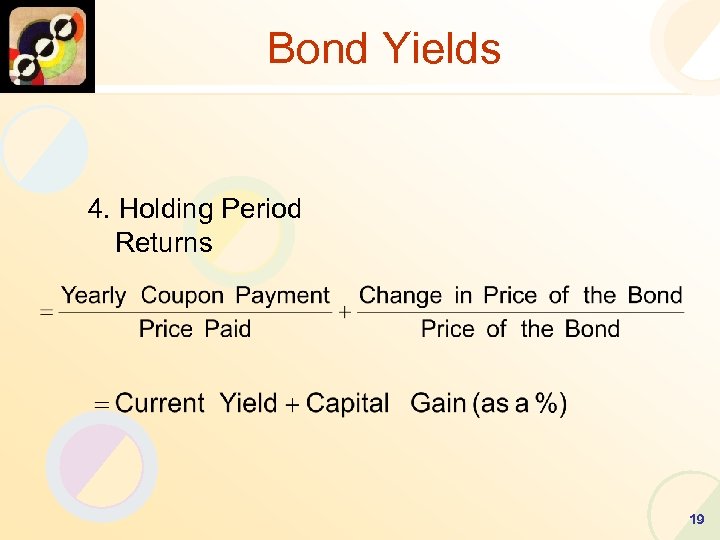

Bond Yields: Holding Period Returns 4. Holding Period Returns 持有期收益率 The holding period return – the return to holding a bond and selling it before maturity. The holding period return can differ from the yield to maturity. 15

Bond Yields Examples: 10 year bond (Face value=$100) and a 6% coupon rate. Sold one year later. 16

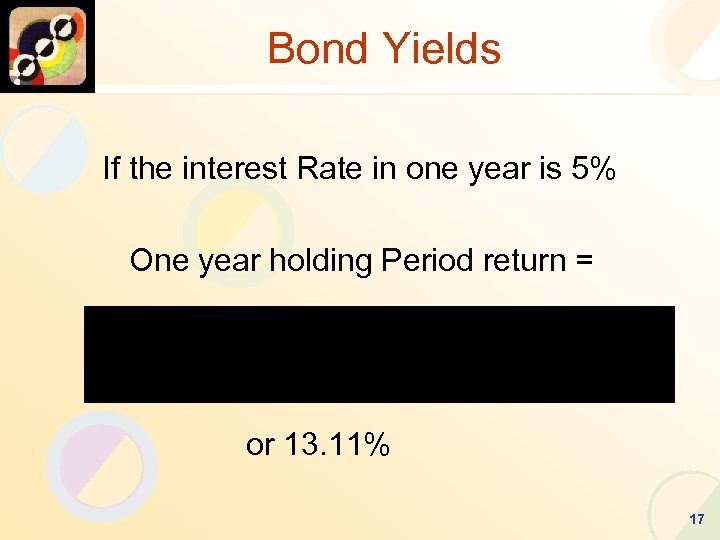

Bond Yields If the interest Rate in one year is 5% One year holding Period return = or 13. 11% 17

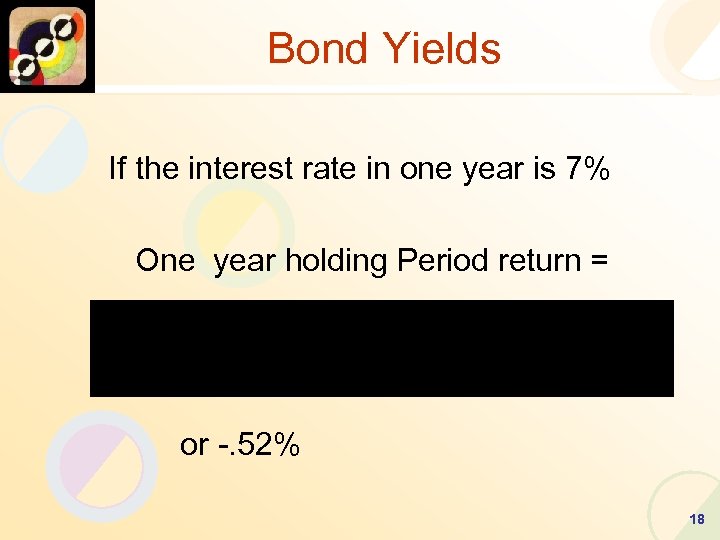

Bond Yields If the interest rate in one year is 7% One year holding Period return = or -. 52% 18

Bond Yields 4. Holding Period Returns 19

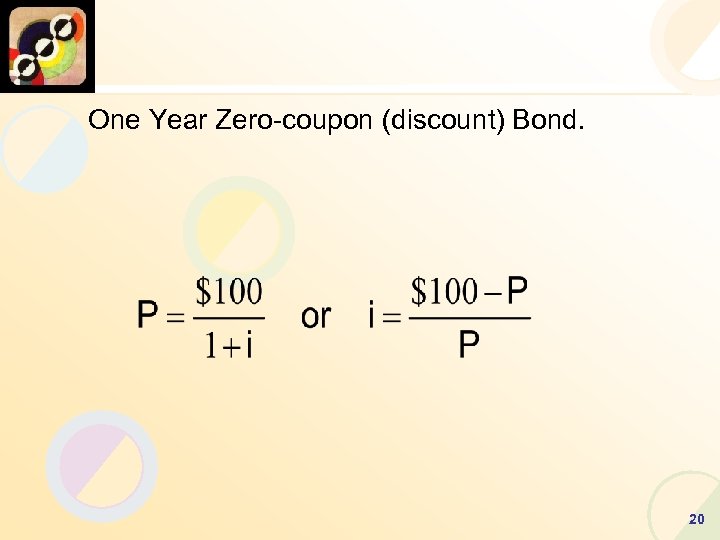

One Year Zero-coupon (discount) Bond. 20

5. 3 Bond Market:Supply and Demand 1. Bond Supply • The Bond supply curve is the relationship between the price and the quantity of bonds people are willing to sell, all other things being equal. 21

Bond Market and Interest Rates Bond Supply • From the point of view of investors, the higher the price, the more tempting it is to sell a bond they currently hold. • From the point of view of companies seeking finance for new projects, the higher the price at which they can sell bonds, the more advantageous it is to do so. 22

Bond Market and Interest Rates Bond Supply For a $100 one-year zero-coupon bond, the supply will be higher at $95 than it will be at $90, all other things being equal. 23

Bond Market and Interest Rates 2. Bond Demand • The bond demand curve is the relationship between the price and quantity of bonds that investors demand, all other things being equal. As the price falls, the reward for holding the bond rises, so the demand goes up 24

Bond Market and Interest Rates Bond Demand • The lower the price potential bondholders must pay for a fixed-dollar payment on a future date, the more likely they are to buy a bond • The zero-coupon bond promising to pay $100 in one year will be more attractive at $90 than it will at $95, all other things being equal. 25

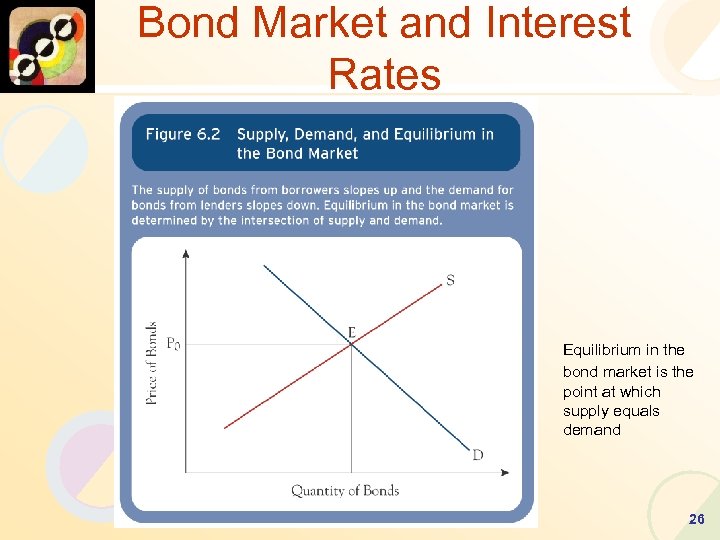

Bond Market and Interest Rates Equilibrium in the bond market is the point at which supply equals demand 26

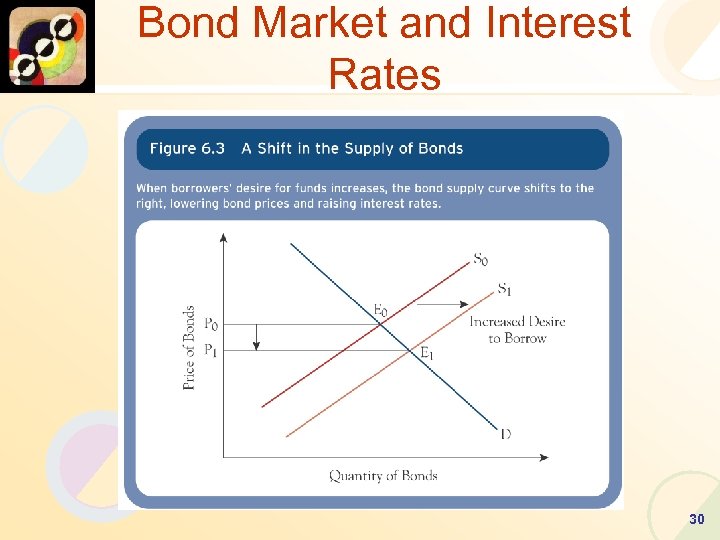

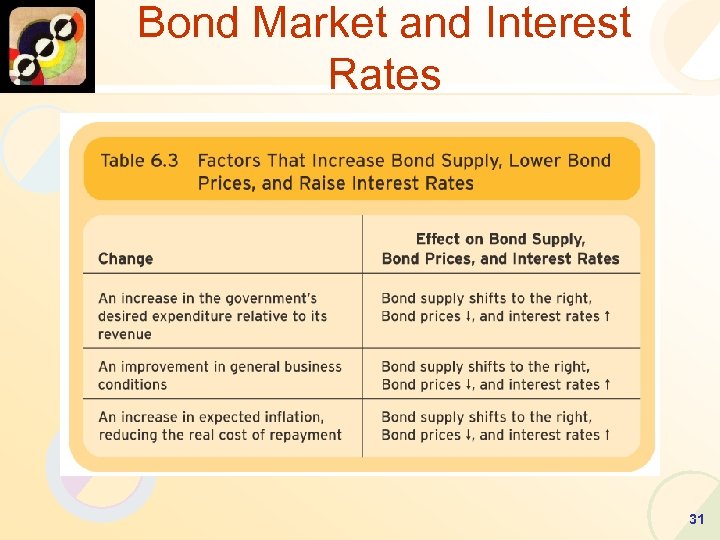

Bond Market and Interest Rates 3. Factors that shift Bond Supply • Any increase in the government’s borrowing needs increases the quantity of bonds outstanding, shifting the bond supply curve to the right. • This reduces price and increases the interest rate on the bond. 27

Bond Market and Interest Rates Factors that shift Bond Supply • (1) As business conditions improve, the bond supply curve shifts to the right. • (2 )This reduces price and increases the interest rate on the bond. 28

Bond Market and Interest Rates Factors that shift Bond Supply • (3)An increase in expected inflation shifts the bond supply curve to the right. • (4)This reduces price and increases the interest rate on the bond. 29

Bond Market and Interest Rates 30

Bond Market and Interest Rates 31

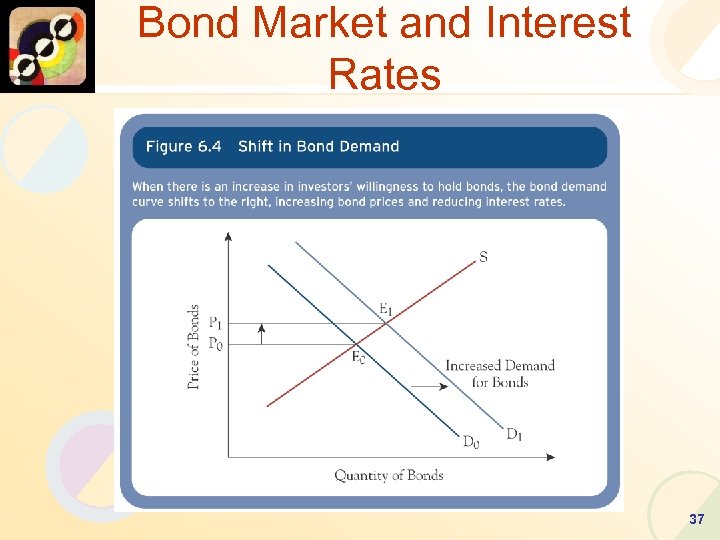

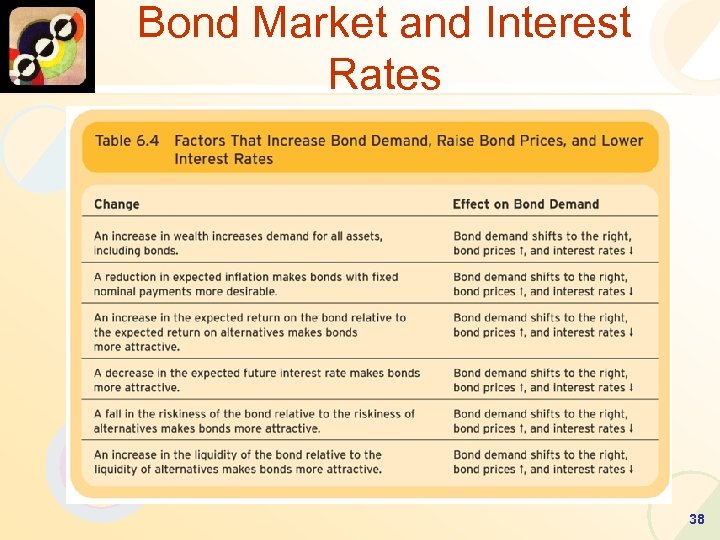

Bond Market and Interest Rates 4. Factors that shift Bond Demand • (1) An increases in wealth shift the demand for bonds to the right. This will happen as the economy grows during an expansion. • (2) This will increase Bond Prices and lower yields. 32

Bond Market and Interest Rates Factors that shift Bond Demand • (3) A fall in expected inflation shifts the bond demand curve to the right, increasing demand at each price and lowering the yield and increasing the Bond’s price. 33

Bond Market and Interest Rates Factors that shift Bond Demand • (4)If the return on bonds rises relative to the return on alternative investments, the demand for bonds will rise. • (5)This will increase bond prices and lower yields. 34

Bond Market and Interest Rates Factors that shift Bond Demand • (6)If a bond becomes less risky relative to alternative investments, the demand for the bond shifts to the right. 35

Bond Market and Interest Rates Factors that shift Bond Demand • (7)When a bond becomes more liquid relative to alternatives, the demand curve shifts to the right. 36

Bond Market and Interest Rates 37

Bond Market and Interest Rates 38

5. 3 Bonds and Risk 1. Sources of Bond Risk • (1)Default Risk • (2)Inflation Risk • (3) Interest-Rate Risk 39

Bond Ratings and Risk 2. Bond Ratings • Moody’s and Standard and Poor’s (1)Ratings Groups • Investment Grade • Non-Investment – Speculative Grade • Highly Speculative 40

Bond Ratings and Risk (2) Commercial Paper Ratings • Moody’s and Standard and Poor’s Rating Groups • Investment • Speculative • Default 41

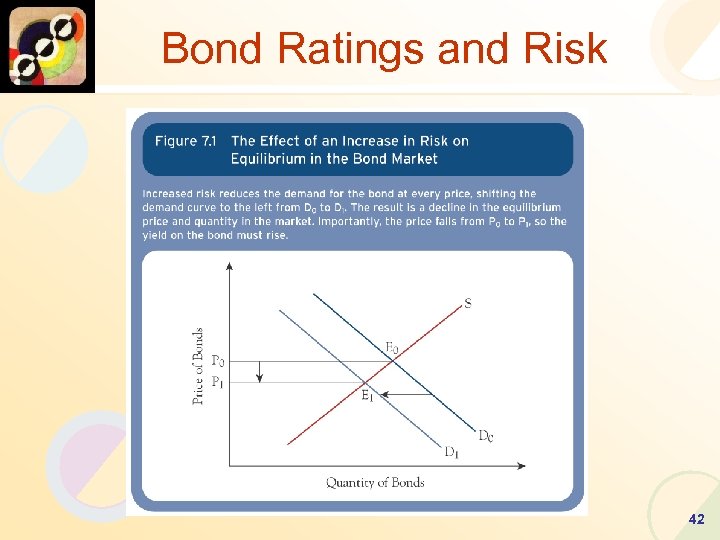

Bond Ratings and Risk 42

5. 5 Risk Structure of Interest Rates • 众多的市场利率可分为两大类 • 一类是期限相同的不同债券,利率有差别;另一 类是不同期限的同种债券,利率也可能会有差别 • 第一类期限相同债券的不同利率之间的关系,称 为利率的风险结构(Risk Structure of Interest Rate) 。 • 第二类其它条件相同、不同期限的债券,期限与 利率之间的关系称为利率的期限结构(Term Structure of Interest Rate)。 43

1. Bond Ratings and Risk Increased Risk reduces Bond Demand. The resulting shift to the left causes a decline in equilibrium price and an increase in the bond yield. Risk spread (premium) Bond Yield = U. S. Treasury Yield + Default Risk Premium 44

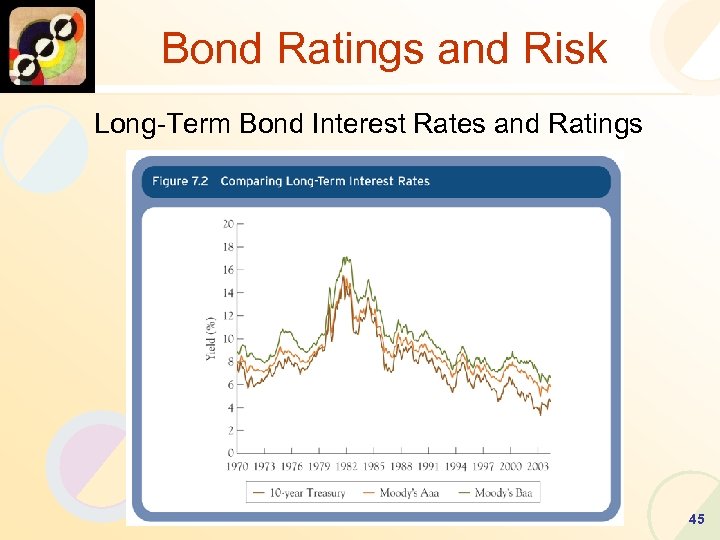

Bond Ratings and Risk Long-Term Bond Interest Rates and Ratings 45

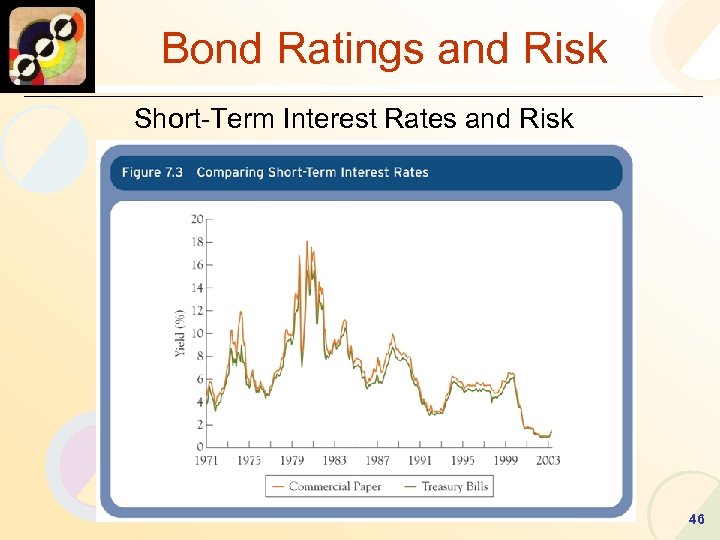

Bond Ratings and Risk Short-Term Interest Rates and Risk 46

2. Tax Status and Bond Prices Coupon Payments on Municipal Bonds are exempt from Federal Tax Payments. Tax-Exempt Bond Yield = (Taxable Bond Yield) x (1 - Tax Rate). 47

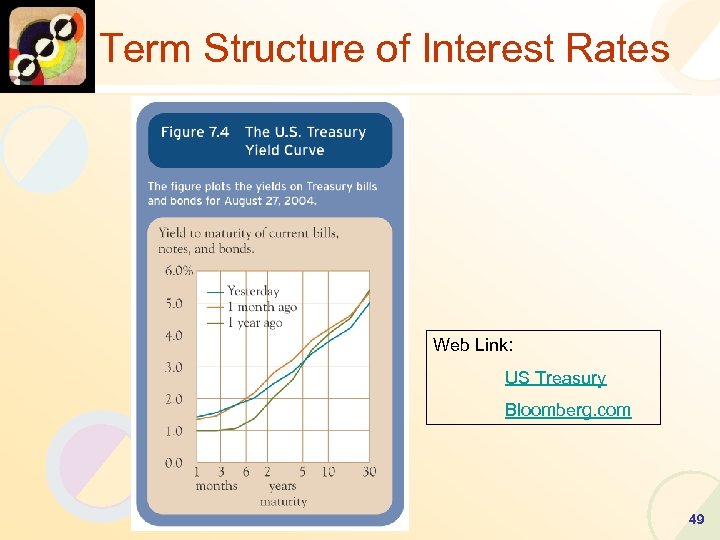

5. 6 Term Structure of Interest Rates 1. The relationship among bonds with the same risk characteristics but different maturities is called the term structure of interest rates. A plot of the term structure, with the yield to maturity on the vertical axis and the time to maturity on the horizontal axis, is called the yield curve. 48

Term Structure of Interest Rates Web Link: US Treasury Bloomberg. com 49

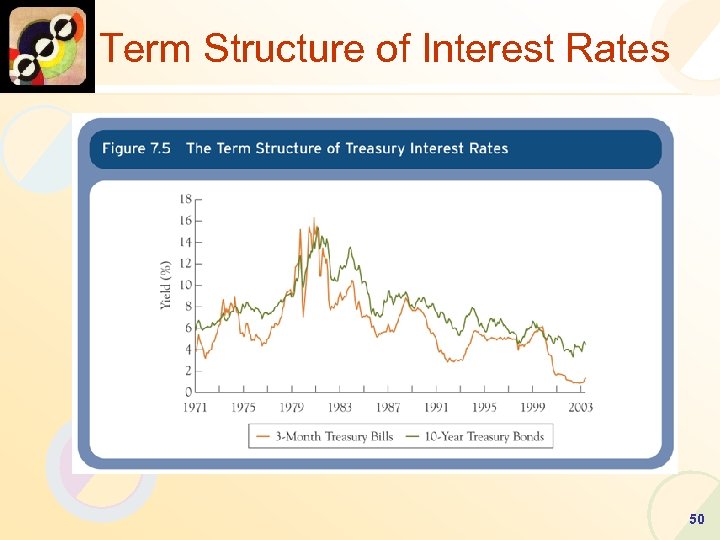

Term Structure of Interest Rates Term Structure of Treasury Interest Rates 50

Term Structure of Interest Rates 2. Term Structure “Facts” • Interest Rates of different maturities tend to move together • Yields on short-term bond are more volatile than yields on long-term bonds • Long-term yields tend to be higher than short-term yields. 51

Term Structure of Interest Rates 3. Expectations Hypothesis • Bonds of different maturities are perfect substitutes for each other. An investor with a two-year horizon. • Buy a 2 year bond or • Buy a one year bond another one year bond in one year. 52

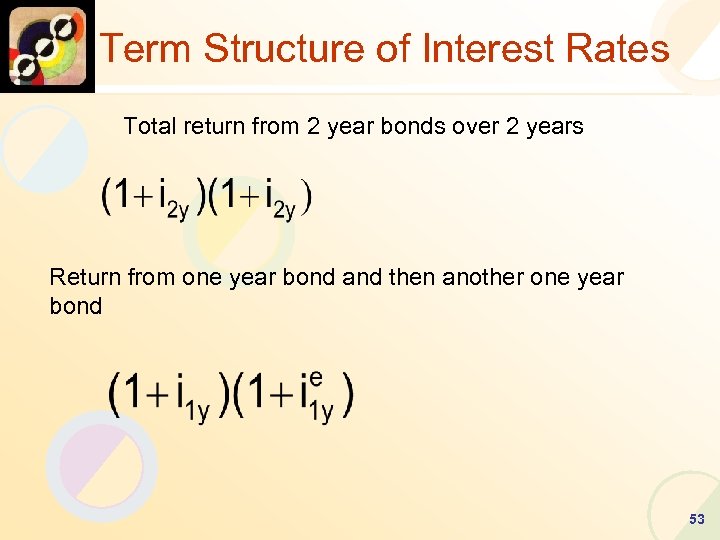

Term Structure of Interest Rates Total return from 2 year bonds over 2 years Return from one year bond and then another one year bond 53

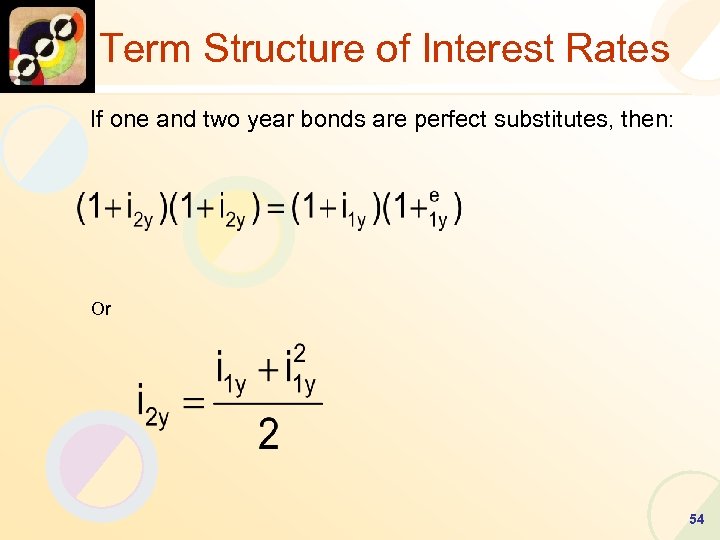

Term Structure of Interest Rates If one and two year bonds are perfect substitutes, then: Or 54

Term Structure of Interest Rates • Or in general terms 55

Expectations Hypothesis and Term Structure Facts Explains why yield curve has different slopes: 1. When short rates expected to rise in future, average of future short rates = int is above today’s short rate: therefore yield curve is upward sloping 2. When short rates expected to stay same in future, average of future short rates are same as today’s, and yield curve is flat 3. Only when short rates expected to fall will yield curve be downward sloping 56

Expectations Hypothesis explains Fact 1 that short and long rates move together 1. Short rate rises are persistent 2. If it today, iet+1, iet+2 etc. average of future rates int 3. Therefore: it int , i. e. , short and long rates move together 57

Explains Fact 2 that yield curves tend to have steep slope when short rates are low and downward slope when short rates are high 1. When short rates are low, they are expected to rise to normal level, and long rate = average of future short rates will be well above today’s short rate: yield curve will have steep upward slope 2. When short rates are high, they will be expected to fall in future, and long rate will be below current short rate: yield curve will have downward slope 58

Doesn’t explain Fact 3 that yield curve usually has upward slope Short rates as likely to fall in future as rise, so average of future short rates will not usually be higher than current short rate: therefore, yield curve will not usually slope upward 59

Term Structure of Interest Rates Expectations Theory can not explain why long-term rates are usually above short term rates. 60

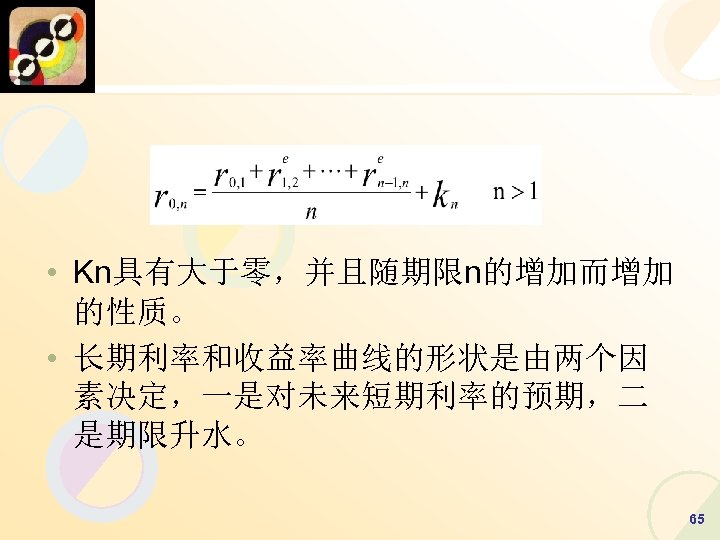

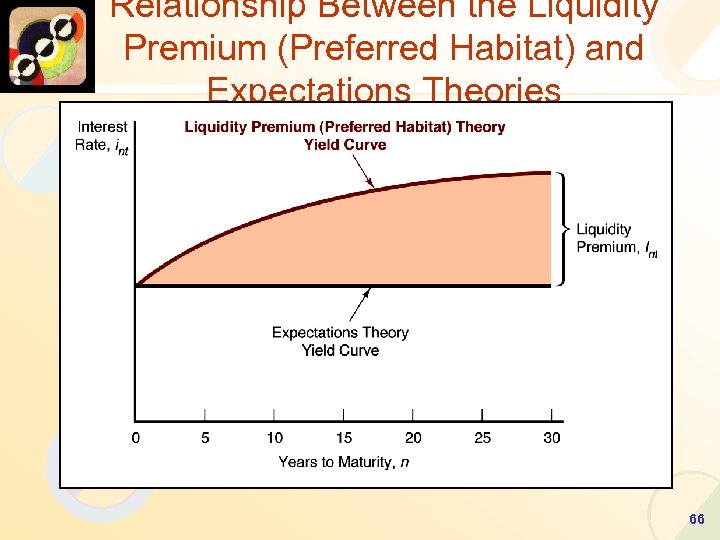

Term Structure of Interest Rates 3. Liquidity Premium (Preferred Habitat) Theories(流动性升水理论或优先置产理论) The yield curve’s upward slope is explained by the fact that long-term bonds are riskier than short-term bonds. Bondholders face both inflation and interest-rate risk. The longer the term of the bond, the greater both types of risk. 61

Liquidity Premium (Preferred Habitat) Theories Key Assumption: Bonds of different maturities are substitutes, but are not perfect substitutes Implication: Modifies Expectations Theory with features of Segmented Markets Theory Investors prefer short rather than long bonds must be paid positive liquidity (term) premium, lnt, to hold long-term bonds Results in following modification of Expectations Theory 62

4. 优先置产假说 • 优先置产假说在不同期限债券的完全可替 代和完全不可替代之间进行了折中,结论 是“不完全可替代”。 • 优先置产假说认为,为了吸引投资者购买 长期债券,必须在纯粹预期假说给定的长 期债券利率的基础上,再向投资者支付更 高的收益,这种多出来的更高的收益称为 期限升水,即必须让投资者为持有不偏好 的期限的债券而得到补偿。 63

Term Structure of Interest Rates Liquidity Premium Theory 64

• Kn具有大于零,并且随期限n的增加而增加 的性质。 • 长期利率和收益率曲线的形状是由两个因 素决定,一是对未来短期利率的预期,二 是期限升水。 65

Relationship Between the Liquidity Premium (Preferred Habitat) and Expectations Theories 66

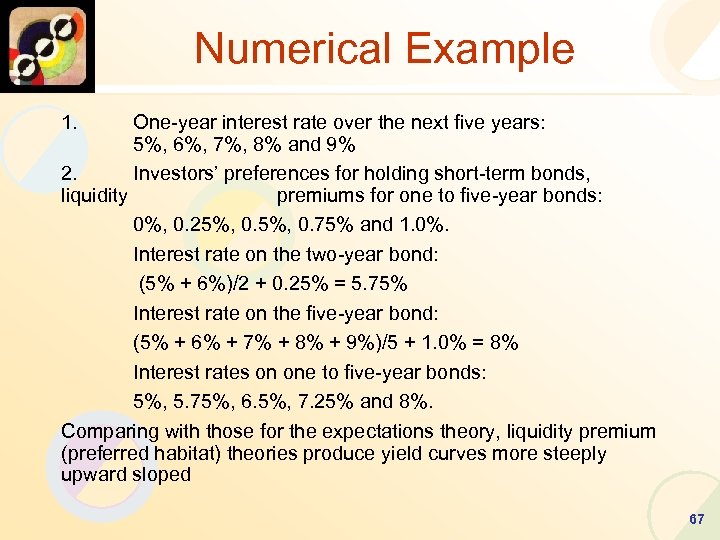

Numerical Example 1. One-year interest rate over the next five years: 5%, 6%, 7%, 8% and 9% 2. Investors’ preferences for holding short-term bonds, liquidity premiums for one to five-year bonds: 0%, 0. 25%, 0. 75% and 1. 0%. Interest rate on the two-year bond: (5% + 6%)/2 + 0. 25% = 5. 75% Interest rate on the five-year bond: (5% + 6% + 7% + 8% + 9%)/5 + 1. 0% = 8% Interest rates on one to five-year bonds: 5%, 5. 75%, 6. 5%, 7. 25% and 8%. Comparing with those for the expectations theory, liquidity premium (preferred habitat) theories produce yield curves more steeply upward sloped 67

Liquidity Premium Theories: Explains all 3 Facts Explains Fact 3 of usual upward sloped yield curve by investors’ preferences for short-term bonds Explains Fact 1 and Fact 2 using same explanations as expectations hypothesis because it has average of future short rates as determinant of long rate 68

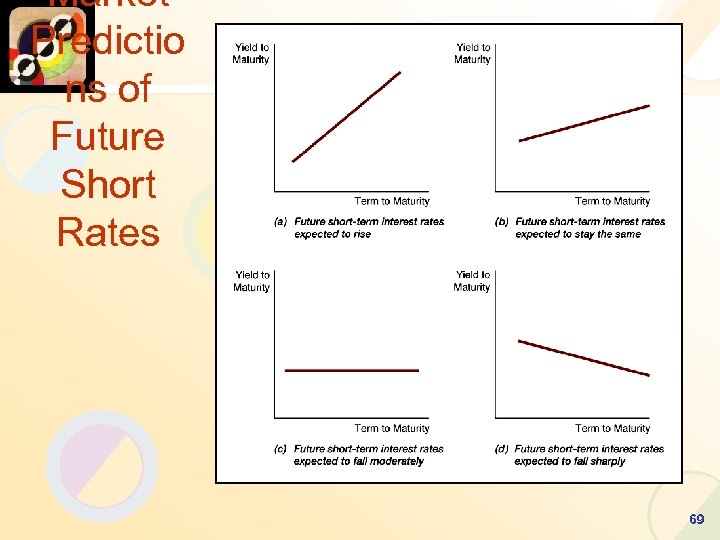

Market Predictio ns of Future Short Rates 69

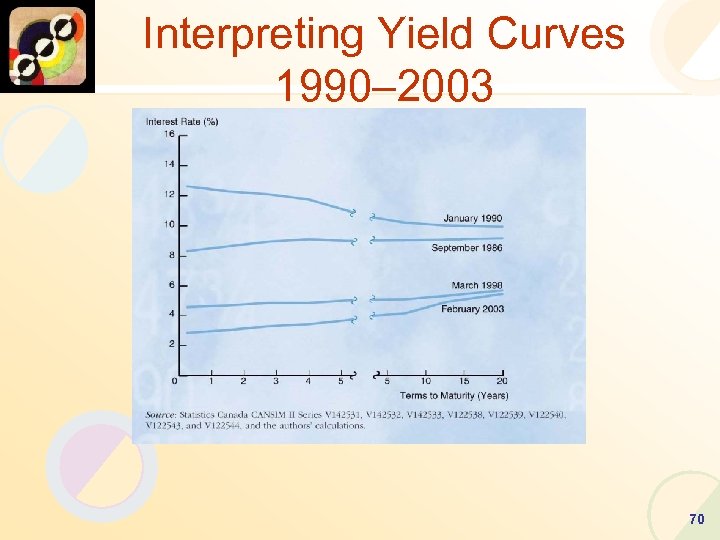

Interpreting Yield Curves 1990– 2003 70

• 优先置产假说不仅能较好地解释三个经验 事实,而且对于每一个经验事实的解释, 优先置产假说比纯粹预期假说或市场分割 理论更完善。 • 反过来,可以根据收益率曲线的形状来推 测人们对未来短期利率的预期。 71

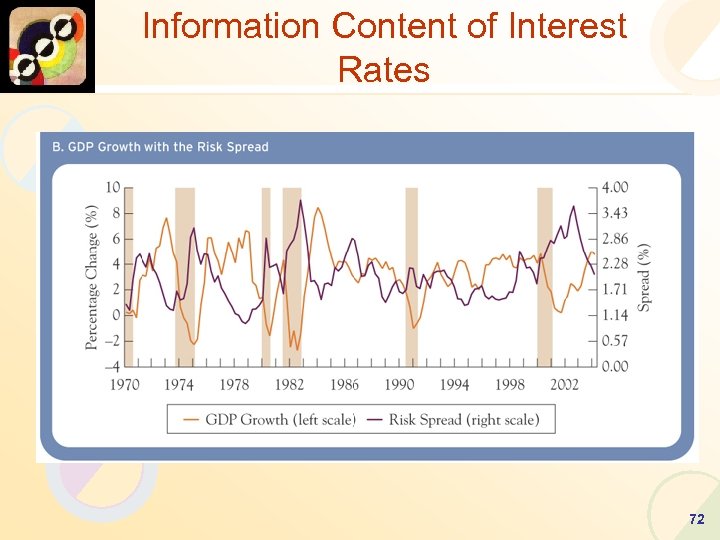

Information Content of Interest Rates 72

Chapter 5 End of Chapter Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

5ccd2af826195380a30978c7b262ba10.ppt