cff0070e0c613fa7bfbbc1eae8e1c64e.ppt

- Количество слайдов: 14

Chapter 5 Bond Management 1

A. The term structure of interest rates ---Term to Maturity vs. YTM • (A) The expectation theory, Fisher 1896 If Arbitrage buy long-term bond yield P If Arbitrage sell long-term bond yield P 2

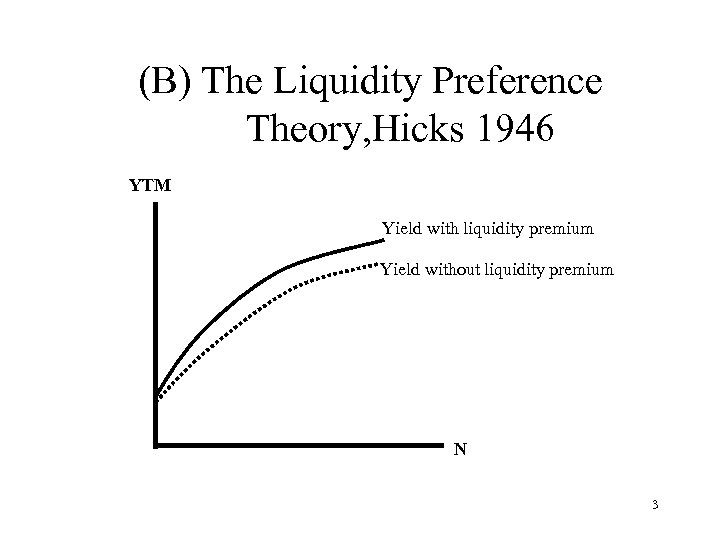

(B) The Liquidity Preference Theory, Hicks 1946 YTM Yield with liquidity premium Yield without liquidity premium N 3

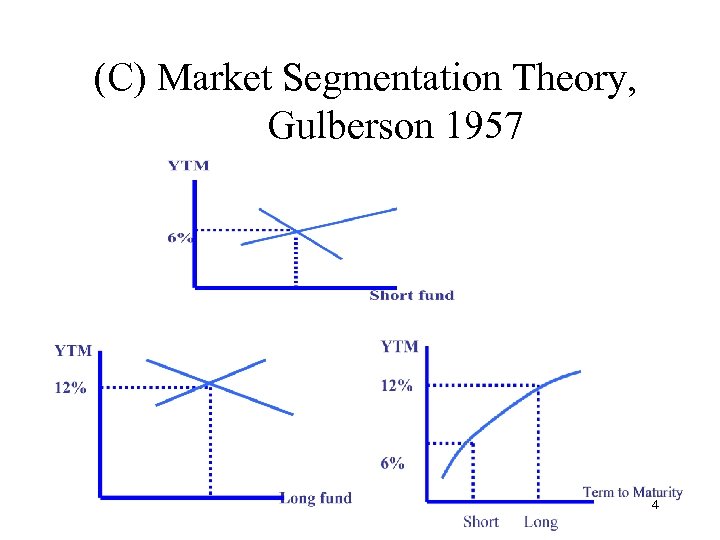

(C) Market Segmentation Theory, Gulberson 1957 4

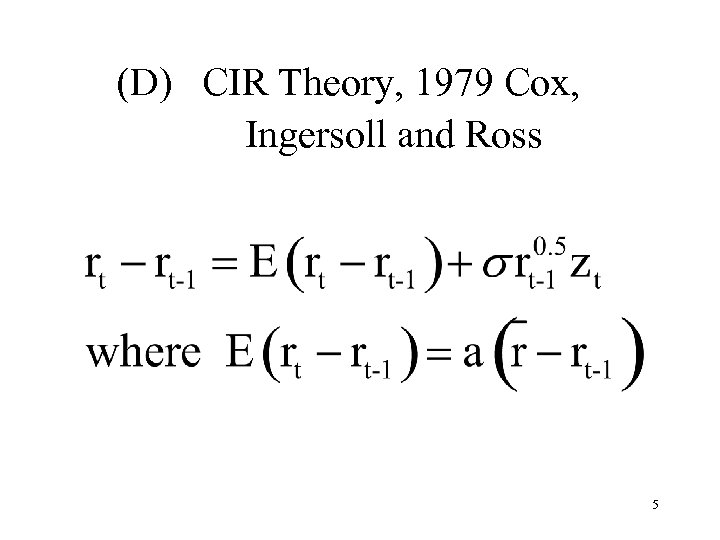

(D) CIR Theory, 1979 Cox, Ingersoll and Ross 5

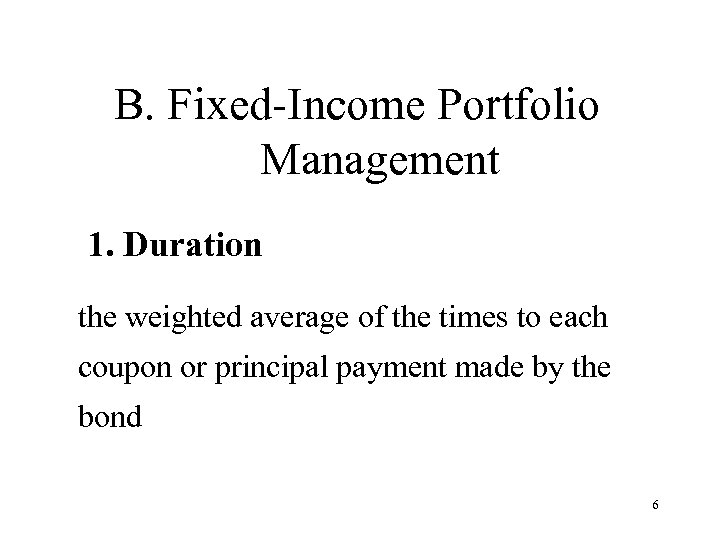

B. Fixed-Income Portfolio Management 1. Duration the weighted average of the times to each coupon or principal payment made by the bond 6

![B. Fixed-Income Portfolio Management (1) Macaulay's Duration, 1938 Macaulay (MD) MD=1 {[C 1/(1+Y)]/P 0}+2 B. Fixed-Income Portfolio Management (1) Macaulay's Duration, 1938 Macaulay (MD) MD=1 {[C 1/(1+Y)]/P 0}+2](https://present5.com/presentation/cff0070e0c613fa7bfbbc1eae8e1c64e/image-7.jpg)

B. Fixed-Income Portfolio Management (1) Macaulay's Duration, 1938 Macaulay (MD) MD=1 {[C 1/(1+Y)]/P 0}+2 {[C 2/(1+Y)2]/P 0 } +. . . +T {[(CT+F)/(1+Y) ]/P 0} = {[t. CT/(1+Y) ]+[FT/(1+Y) ]}/P 0 7

![B. Fixed-Income Portfolio Management (2) Duration vs. Interest rate sensitivity MD= ―(ΔP/P)/[ΔYTM/(1+YTM)] 8 B. Fixed-Income Portfolio Management (2) Duration vs. Interest rate sensitivity MD= ―(ΔP/P)/[ΔYTM/(1+YTM)] 8](https://present5.com/presentation/cff0070e0c613fa7bfbbc1eae8e1c64e/image-8.jpg)

B. Fixed-Income Portfolio Management (2) Duration vs. Interest rate sensitivity MD= ―(ΔP/P)/[ΔYTM/(1+YTM)] 8

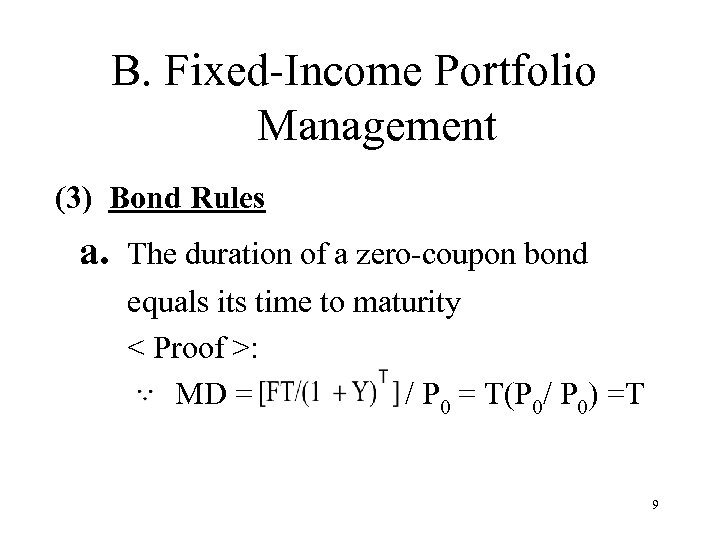

B. Fixed-Income Portfolio Management (3) Bond Rules a. The duration of a zero-coupon bond equals its time to maturity < Proof >: MD = / P 0 = T(P 0/ P 0) =T 9

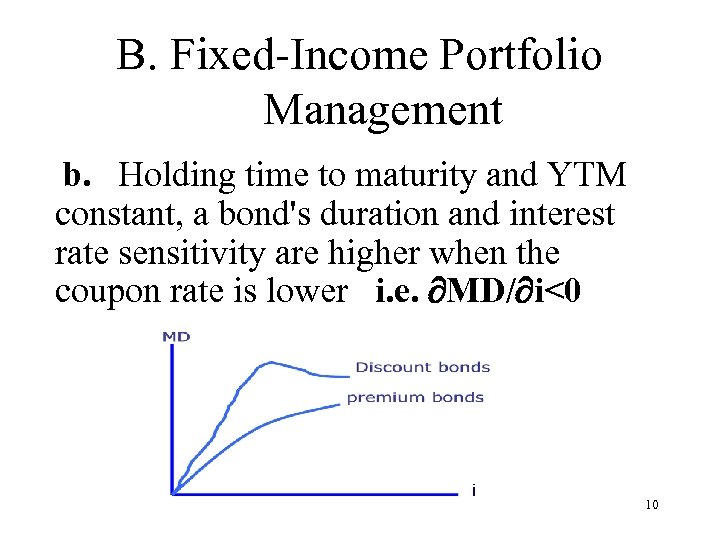

B. Fixed-Income Portfolio Management b. Holding time to maturity and YTM constant, a bond's duration and interest rate sensitivity are higher when the coupon rate is lower i. e. MD/ i<0 10

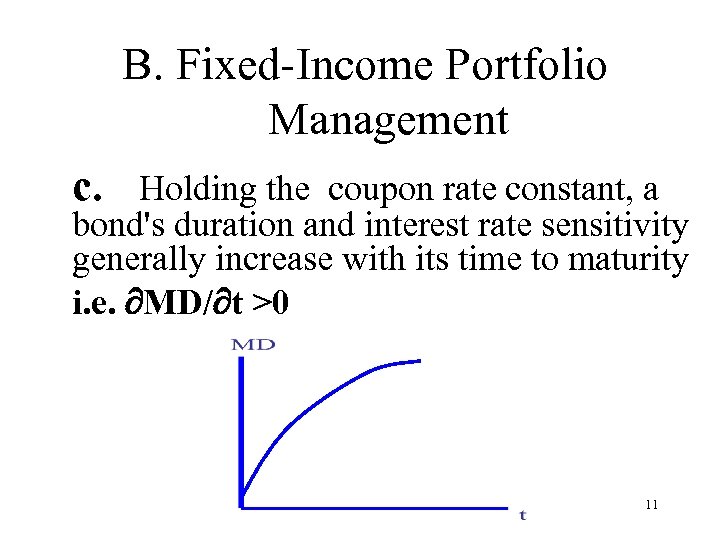

B. Fixed-Income Portfolio Management c. Holding the coupon rate constant, a bond's duration and interest rate sensitivity generally increase with its time to maturity i. e. MD/ t >0 11

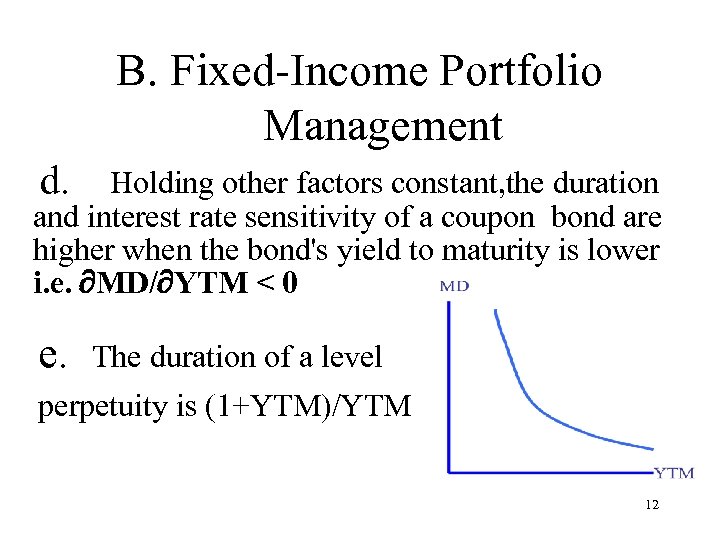

B. Fixed-Income Portfolio Management d. Holding other factors constant, the duration and interest rate sensitivity of a coupon bond are higher when the bond's yield to maturity is lower i. e. MD/ YTM < 0 e. The duration of a level perpetuity is (1+YTM)/YTM 12

B. Fixed-Income Portfolio Management 2. Immunization: strategies used by investors to shield their overall financial status from exposure to interest rate fluctuations Rebalancing portfolio As interest rates and asset durations change, a manager must rebalance the portfolio of fixed income assets continually to realign its duration with the duration of the obligation 13

![B. Fixed-Income Portfolio Management Single bond, Single payment [Immunization rule] MD of the bond B. Fixed-Income Portfolio Management Single bond, Single payment [Immunization rule] MD of the bond](https://present5.com/presentation/cff0070e0c613fa7bfbbc1eae8e1c64e/image-14.jpg)

B. Fixed-Income Portfolio Management Single bond, Single payment [Immunization rule] MD of the bond = MD of the liability Bond portfolio, Single payment [Immunization rule] Weighted Average MD of the bond portfolio = MD of the liability 14

cff0070e0c613fa7bfbbc1eae8e1c64e.ppt