7b2c559b0e63e524892a236e18a490f7.ppt

- Количество слайдов: 30

Chapter 5 Accounts Receivable Management A/R Copyright 2002 by South-Western, a division of Thomson Learning TM

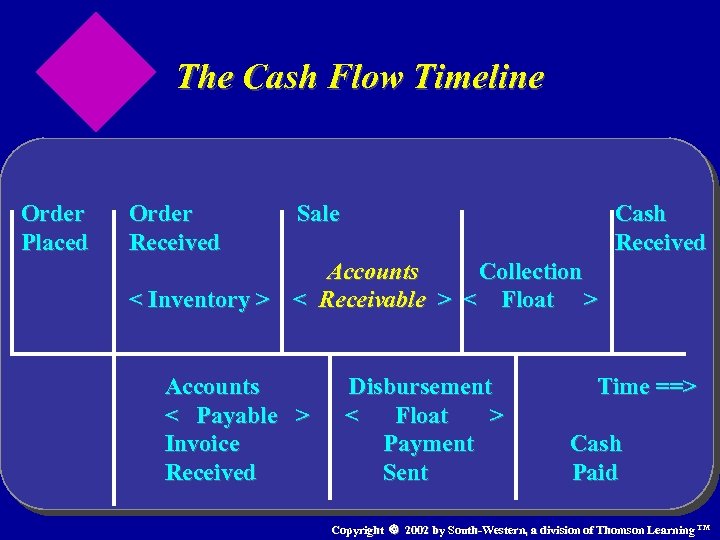

The Cash Flow Timeline Order Placed Order Received Sale Cash Received Accounts Collection < Inventory > < Receivable > < Float > Accounts < Payable > Invoice Received Disbursement < Float > Payment Sent Time ==> Cash Paid Copyright 2002 by South-Western, a division of Thomson Learning TM

Learning Objectives v Define credit policy and indicate its components v Describe the typical credit-granting sequence v Apply net present value analysis to credit extension decisions v Define credit scoring and explain limitations v List the elements in a credit rating report v Describe how receivables management can benefit from EDI Copyright 2002 by South-Western, a division of Thomson Learning TM

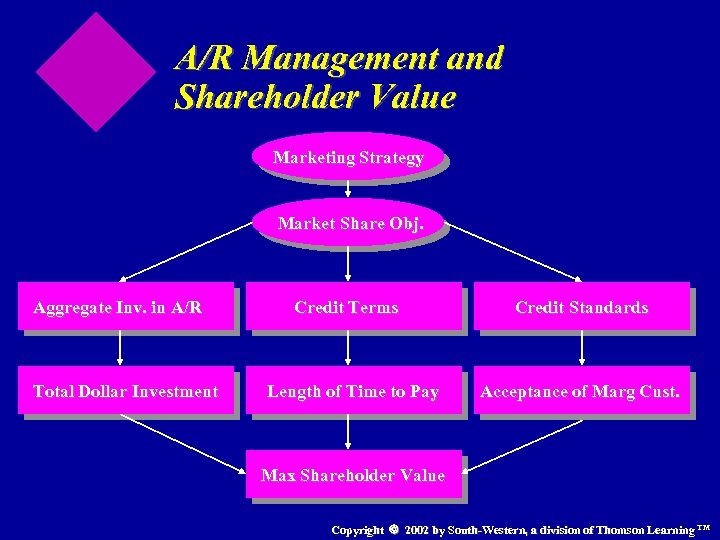

Trade Credit and Shareholder Value v Trade credit arises when goods sold under delayed payment terms v Traced to Romans due to obstacles faced in transferring money through various trading areas v Credit terms are taken for granted today v Value can be added by managing three areas: – aggregate investment in receivables – credit terms – credit standards v Over-investing in receivables can be costly v. . . but, if credit terms are not competitive, then lost sales can be costly Copyright 2002 by South-Western, a division of Thomson Learning TM

Conclusion v Minimize bad debts and outstanding receivables v Maintain financial flexibility v Optimize mix of company assets v Convert receivables to cash in a timely manner v Analyze customer risk v Respond to customer needs Copyright 2002 by South-Western, a division of Thomson Learning TM

A/R Management and Shareholder Value Marketing Strategy Market Share Obj. Aggregate Inv. in A/R Total Dollar Investment Credit Terms Length of Time to Pay Credit Standards Acceptance of Marg Cust. Max Shareholder Value Copyright 2002 by South-Western, a division of Thomson Learning TM

Trade vs. Bank Credit v Length of terms v Security v Amounts involved v Resource transferred (goods vs. money) v Extent of analysis Copyright 2002 by South-Western, a division of Thomson Learning TM

Why Extend Credit? v Financial Motive v Operating Motive v Contracting Motive v Pricing Motive v All reasons are related to market imperfections Copyright 2002 by South-Western, a division of Thomson Learning TM

Financial Motive v Potential of getting a higher price v Sellers raise capital at lower rates than customers and have cost advantages vis-a-vis banks due to: – – – similarity of customers the information gathered in the selling process lower probability of default (the goods purchased are an essential element of the buyer’s business) – seller can more easily resell product if payment is not made. Copyright 2002 by South-Western, a division of Thomson Learning TM

Operating Motive v Respond to variable and uncertain demand v Change credit terms rather than: – install extra capacity, – building or depleting inventories, – or forcing customers to wait. Copyright 2002 by South-Western, a division of Thomson Learning TM

Contracting Cost Motive v Buyer gets to inspect goods prior to payment v Seller has less theft with separation of collection and product delivery Copyright 2002 by South-Western, a division of Thomson Learning TM

Pricing Motive v Change price by changing credit terms Copyright 2002 by South-Western, a division of Thomson Learning TM

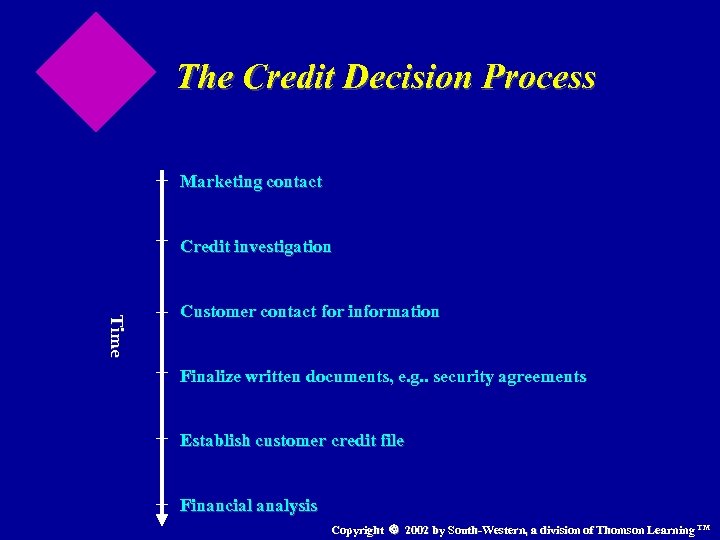

The Credit Decision Process Marketing contact Credit investigation Time Customer contact for information Finalize written documents, e. g. . security agreements Establish customer credit file Financial analysis Copyright 2002 by South-Western, a division of Thomson Learning TM

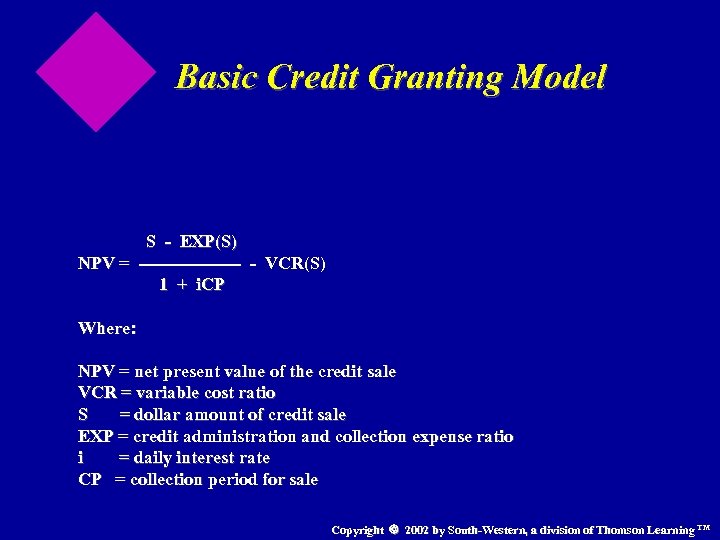

Basic Credit Granting Model S - EXP(S) NPV = --------- - VCR(S) 1 + i. CP Where: NPV = net present value of the credit sale VCR = variable cost ratio S = dollar amount of credit sale EXP = credit administration and collection expense ratio i = daily interest rate CP = collection period for sale Copyright 2002 by South-Western, a division of Thomson Learning TM

Establishing a Credit Policy v Should we extend credit? v Credit policy components v Credit-granting decision Copyright 2002 by South-Western, a division of Thomson Learning TM

Should We Extend Credit? v Follow industry practice v Extent and form of credit offer – in-house credit card – sell receivables to a factor – captive finance company? Copyright 2002 by South-Western, a division of Thomson Learning TM

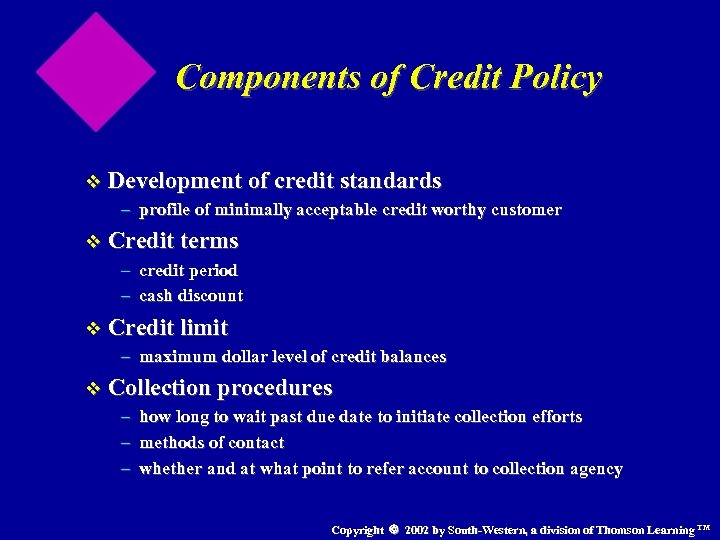

Components of Credit Policy v Development of credit standards – profile of minimally acceptable credit worthy customer v Credit terms – credit period – cash discount v Credit limit – maximum dollar level of credit balances v Collection procedures – how long to wait past due date to initiate collection efforts – methods of contact – whether and at what point to refer account to collection agency Copyright 2002 by South-Western, a division of Thomson Learning TM

Credit-Granting Decision v Development of credit standards v Gathering necessary information v Credit analysis: applying credit standards v Risk analysis Copyright 2002 by South-Western, a division of Thomson Learning TM

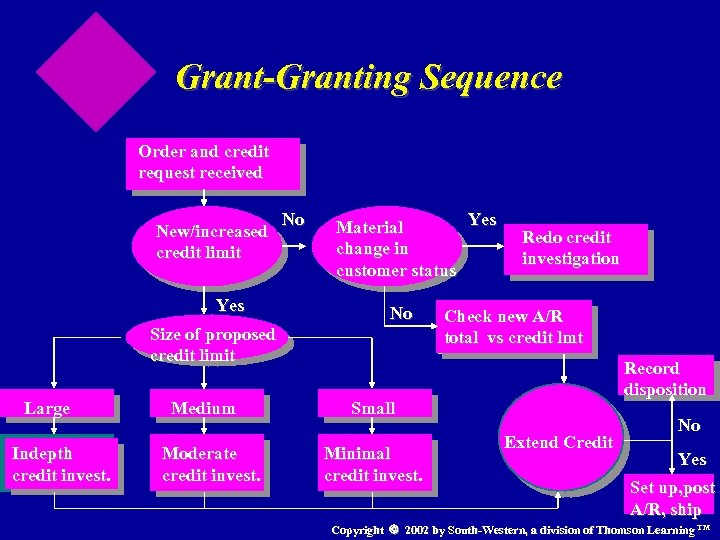

Grant-Granting Sequence Order and credit request received New/increased credit limit Yes Size of proposed credit limit Large Indepth credit invest. Medium Moderate credit invest. No Yes Material change in customer status No Redo credit investigation Check new A/R total vs credit lmt Record disposition Small Minimal credit invest. Extend Credit No Yes Set up, post A/R, ship Copyright 2002 by South-Western, a division of Thomson Learning TM

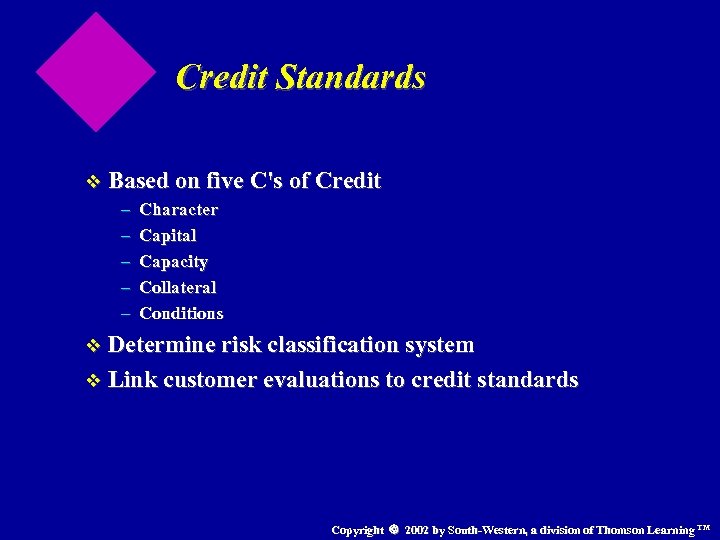

Credit Standards v Based on five C's of Credit – Character – Capital – Capacity – Collateral – Conditions v Determine risk classification system v Link customer evaluations to credit standards Copyright 2002 by South-Western, a division of Thomson Learning TM

Gathering Information v credit reporting agencies, e. g. . Dun & Bradstreet v credit interchange bureaus, NACM v bank letters v references from other suppliers v financial statements v field data gathered by sales reps Copyright 2002 by South-Western, a division of Thomson Learning TM

Credit Analysis: Applying the Standards v Nonfinancial – concerned with willingness to pay, character v Financial – ability to pay, financial ratios etc. . (other C’s of credit) v Credit scoring models – Example: Y =. 000025(INCOME) + 0. 50(PAYHIST) + 0. 25(EMPLOYMT) Copyright 2002 by South-Western, a division of Thomson Learning TM

Emergence of Expert Systems v Example of decision rule: “If gross income is equal to or grater than $20, 000 and the applicant has not been delinquent and gross income per household member is equal to or greater than $12, 000 and debt/equity ratio is equal to or greater than 30% but less than 50% and personal property is equal to or greater than $50, 000, then grant credit. ” Copyright 2002 by South-Western, a division of Thomson Learning TM

Factors Affecting Credit Terms v Competition v Operating cycle v Type of good (raw materials vs finished goods, perishables, etc. ) v Seasonality of demand v Cost v Customer type v Product profit margin Copyright 2002 by South-Western, a division of Thomson Learning TM

Survey Results v Two-thirds offered credit but no cash discount. Most popular credit period was net 30 v One-fourth offered cash discounts, 70% had 2/10, net 30 with 25% offering 1/10, net 30 v Industry influence: 80% of wholesalers vs 36% of service firms offered cash discounts v 80% of firms charged a late fee, usually 15 -20%. Copyright 2002 by South-Western, a division of Thomson Learning TM

Cash Discounts v The lower the VC, the higher the feasible discount v Based on company’s cost of funds v Consider timing effect when changing discounts v Should be based on product’s price elasticity v Higher the bad debt experience, higher the optimal discount Copyright 2002 by South-Western, a division of Thomson Learning TM

Practice of Taking Cash Discounts v 51% of firms always took cash discount v 40% sometimes v 9% take discount and pay late v Study found that 4 or 5 companies would be more profitable if cash discount was eliminated Copyright 2002 by South-Western, a division of Thomson Learning TM

A/R Management in Practice v Discounts appear to be changed to match competitors, not inflation or interest rates v The higher a firm’s contribution margin, the more likely the firm should be to offer discounts. v A price cut is thought to have more impact than instituting a cash discount v The more receivables a firm has, does not necessarily relate to use of penalty fees v The greater amount of receivables does not relate to a more active credit evaluation. Copyright 2002 by South-Western, a division of Thomson Learning TM

Receivables, Collections, and EDI v If credit approval is delayed. . . – buyers using EDI purchase orders and JIT manufacturing can encounter serious problems. – sellers can now ship within hours of receiving orders. . . thus seller must be able to handle electronically transmitted orders. v Seller may also issues electronic invoices and be paid electronically using an EDI-capable bank so that remittance data can be automatically read by seller’s A/R system v Trend is for use of data transmission to automate the cash application process Copyright 2002 by South-Western, a division of Thomson Learning TM

Summary v Investment in A/R represent significant investment v Key aspects outlined – credit policy – credit standards – credit granting sequence – credit limits – credit terms v Management of A/R is influenced by what competitors are doing not by shareholder wealth considerations v Proper use of NPV techniques can ensure that credit decisions enhance shareholder value. Copyright 2002 by South-Western, a division of Thomson Learning TM

7b2c559b0e63e524892a236e18a490f7.ppt