38f7852436a61721237f7debf2ab9e63.ppt

- Количество слайдов: 30

Chapter 5 Accounting for Merchandising Operations Chapter 5 -1 Accounting Principles, Ninth Edition

Chapter 5 Accounting for Merchandising Operations Chapter 5 -1 Accounting Principles, Ninth Edition

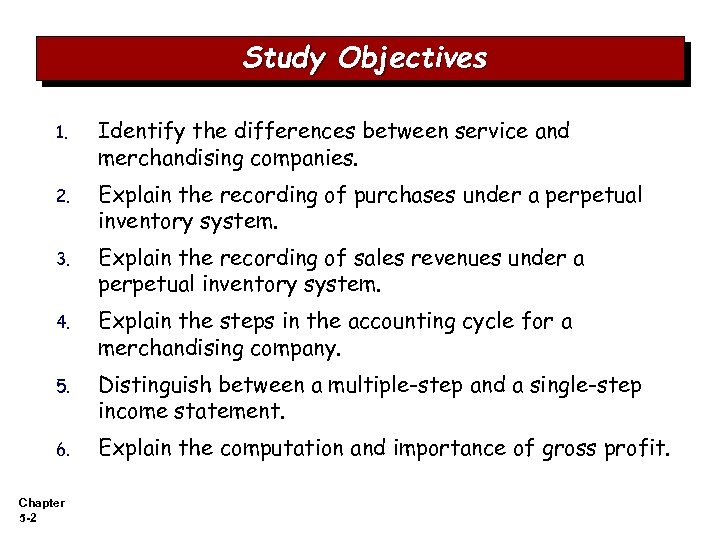

Study Objectives 1. Identify the differences between service and merchandising companies. 2. Explain the recording of purchases under a perpetual inventory system. 3. Explain the recording of sales revenues under a perpetual inventory system. 4. Explain the steps in the accounting cycle for a merchandising company. 5. Distinguish between a multiple-step and a single-step income statement. 6. Explain the computation and importance of gross profit. Chapter 5 -2

Study Objectives 1. Identify the differences between service and merchandising companies. 2. Explain the recording of purchases under a perpetual inventory system. 3. Explain the recording of sales revenues under a perpetual inventory system. 4. Explain the steps in the accounting cycle for a merchandising company. 5. Distinguish between a multiple-step and a single-step income statement. 6. Explain the computation and importance of gross profit. Chapter 5 -2

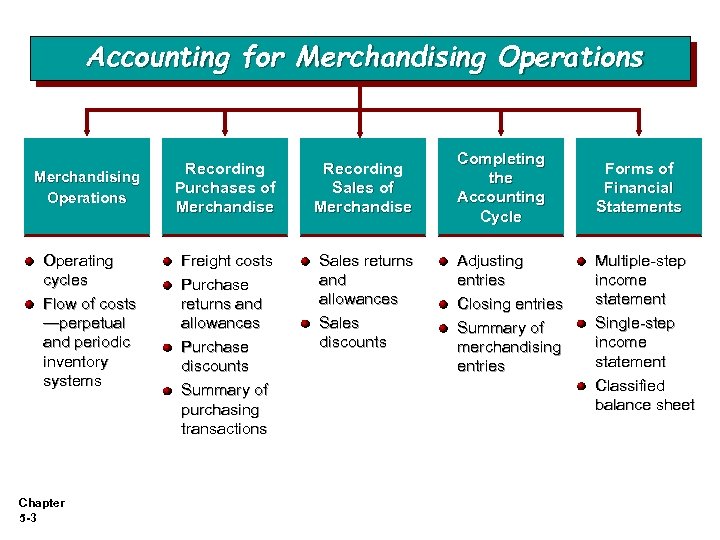

Accounting for Merchandising Operations Operating cycles Flow of costs —perpetual and periodic inventory systems Chapter 5 -3 Recording Purchases of Merchandise Recording Sales of Merchandise Freight costs Purchase returns and allowances Purchase discounts Summary of purchasing transactions Sales returns and allowances Sales discounts Completing the Accounting Cycle Adjusting entries Closing entries Summary of merchandising entries Forms of Financial Statements Multiple-step income statement Single-step income statement Classified balance sheet

Accounting for Merchandising Operations Operating cycles Flow of costs —perpetual and periodic inventory systems Chapter 5 -3 Recording Purchases of Merchandise Recording Sales of Merchandise Freight costs Purchase returns and allowances Purchase discounts Summary of purchasing transactions Sales returns and allowances Sales discounts Completing the Accounting Cycle Adjusting entries Closing entries Summary of merchandising entries Forms of Financial Statements Multiple-step income statement Single-step income statement Classified balance sheet

Merchandising Operations Merchandising Companies Buy and Sell Goods Wholesaler Retailer Consumer The primary source of revenues is referred to as sales revenue or sales. Chapter 5 -4 SO 1 Identify the differences between service and merchandising companies.

Merchandising Operations Merchandising Companies Buy and Sell Goods Wholesaler Retailer Consumer The primary source of revenues is referred to as sales revenue or sales. Chapter 5 -4 SO 1 Identify the differences between service and merchandising companies.

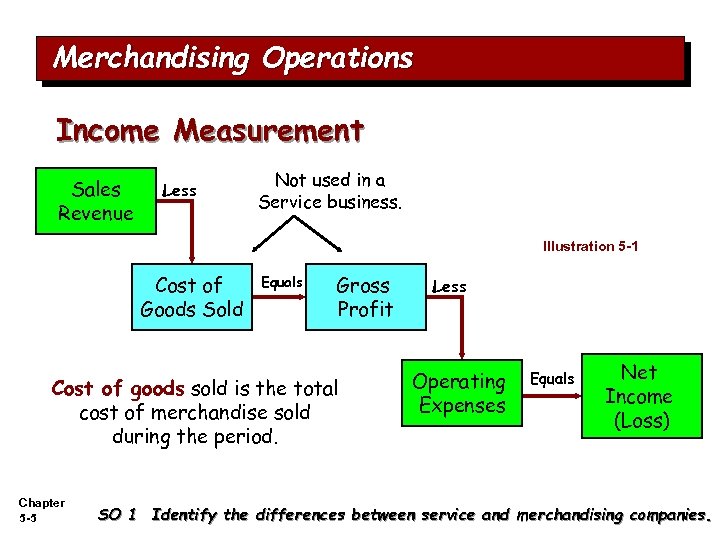

Merchandising Operations Income Measurement Sales Revenue Less Not used in a Service business. Illustration 5 -1 Cost of Goods Sold Equals Gross Profit Cost of goods sold is the total cost of merchandise sold during the period. Chapter 5 -5 Less Operating Expenses Equals Net Income (Loss) SO 1 Identify the differences between service and merchandising companies.

Merchandising Operations Income Measurement Sales Revenue Less Not used in a Service business. Illustration 5 -1 Cost of Goods Sold Equals Gross Profit Cost of goods sold is the total cost of merchandise sold during the period. Chapter 5 -5 Less Operating Expenses Equals Net Income (Loss) SO 1 Identify the differences between service and merchandising companies.

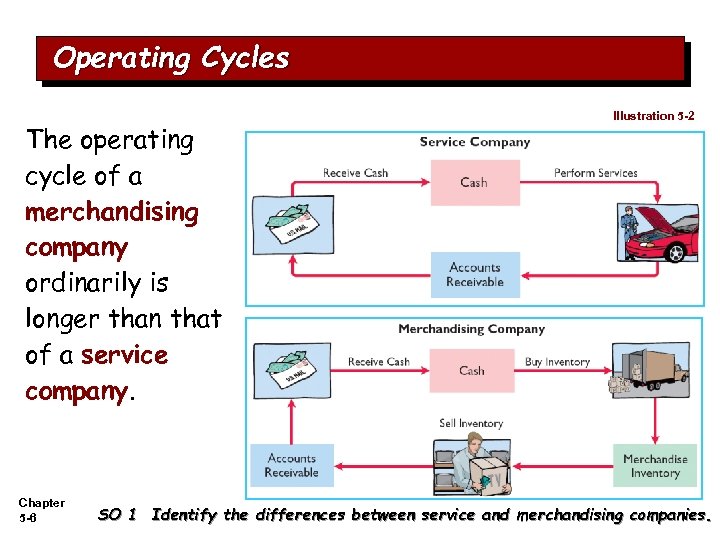

Operating Cycles The operating cycle of a merchandising company ordinarily is longer than that of a service company. Chapter 5 -6 Illustration 5 -2 SO 1 Identify the differences between service and merchandising companies.

Operating Cycles The operating cycle of a merchandising company ordinarily is longer than that of a service company. Chapter 5 -6 Illustration 5 -2 SO 1 Identify the differences between service and merchandising companies.

Flow of Costs Perpetual System Features: 1. Purchases increase Merchandise Inventory. 2. Freight costs, Purchase Returns and Allowances and Purchase Discounts are included in Merchandise Inventory. 3. Cost of Goods Sold is increased and Merchandise Inventory is decreased for each sale. 4. Physical count done to verify Merchandise Inventory balance. The perpetual inventory system provides a continuous record of Merchandise Inventory and Cost of Goods Sold. Chapter 5 -7 SO 1 Identify the differences between service and merchandising companies.

Flow of Costs Perpetual System Features: 1. Purchases increase Merchandise Inventory. 2. Freight costs, Purchase Returns and Allowances and Purchase Discounts are included in Merchandise Inventory. 3. Cost of Goods Sold is increased and Merchandise Inventory is decreased for each sale. 4. Physical count done to verify Merchandise Inventory balance. The perpetual inventory system provides a continuous record of Merchandise Inventory and Cost of Goods Sold. Chapter 5 -7 SO 1 Identify the differences between service and merchandising companies.

Flow of Costs Periodic System Features: 1. Purchases of merchandise increase Purchases. 2. Ending Inventory determined by physical count. 3. Calculation of Cost of Goods Sold: Beginning inventory Add: Purchases, net Goods available for sale Less: Ending inventory Cost of goods sold Chapter 5 -8 $ 100, 000 800, 000 900, 000 125, 000 $ 775, 000 SO 1 Identify the differences between service and merchandising companies.

Flow of Costs Periodic System Features: 1. Purchases of merchandise increase Purchases. 2. Ending Inventory determined by physical count. 3. Calculation of Cost of Goods Sold: Beginning inventory Add: Purchases, net Goods available for sale Less: Ending inventory Cost of goods sold Chapter 5 -8 $ 100, 000 800, 000 900, 000 125, 000 $ 775, 000 SO 1 Identify the differences between service and merchandising companies.

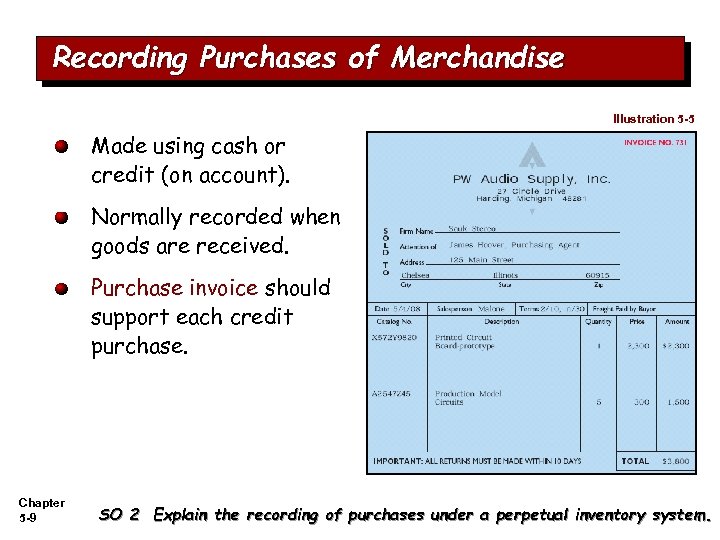

Recording Purchases of Merchandise Illustration 5 -5 Made using cash or credit (on account). Normally recorded when goods are received. Purchase invoice should support each credit purchase. Chapter 5 -9 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Illustration 5 -5 Made using cash or credit (on account). Normally recorded when goods are received. Purchase invoice should support each credit purchase. Chapter 5 -9 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Under the perpetual inventory system, companies record in the Merchandise Inventory account the purchase of goods they intend to sell. Illustration: At May 4 th , (Ahmed) Company Purchases goods from (Ali) Company by $3800 The entry in Ahmed Books is: May 4 Merchandise inventory Accounts payable Chapter 5 -10 3, 800 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Under the perpetual inventory system, companies record in the Merchandise Inventory account the purchase of goods they intend to sell. Illustration: At May 4 th , (Ahmed) Company Purchases goods from (Ali) Company by $3800 The entry in Ahmed Books is: May 4 Merchandise inventory Accounts payable Chapter 5 -10 3, 800 SO 2 Explain the recording of purchases under a perpetual inventory system.

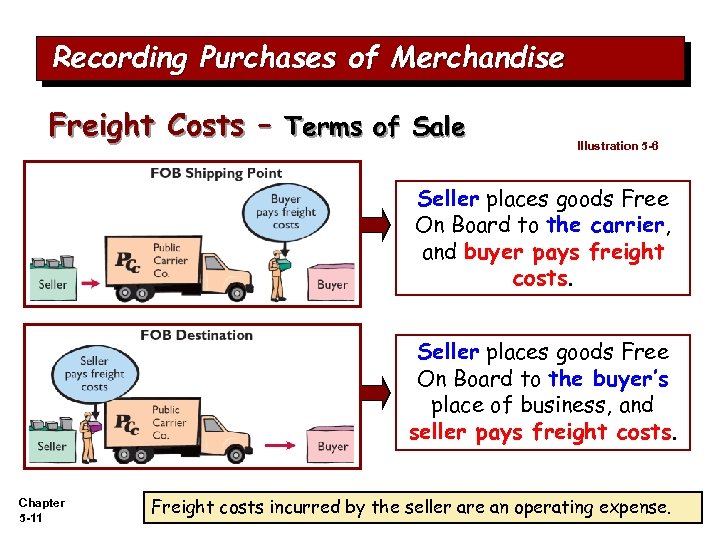

Recording Purchases of Merchandise Freight Costs – Terms of Sale Illustration 5 -6 Seller places goods Free On Board to the carrier, and buyer pays freight costs. Seller places goods Free On Board to the buyer’s place of business, and seller pays freight costs. Chapter 5 -11 Freight costs incurred by the seller are an operating expense.

Recording Purchases of Merchandise Freight Costs – Terms of Sale Illustration 5 -6 Seller places goods Free On Board to the carrier, and buyer pays freight costs. Seller places goods Free On Board to the buyer’s place of business, and seller pays freight costs. Chapter 5 -11 Freight costs incurred by the seller are an operating expense.

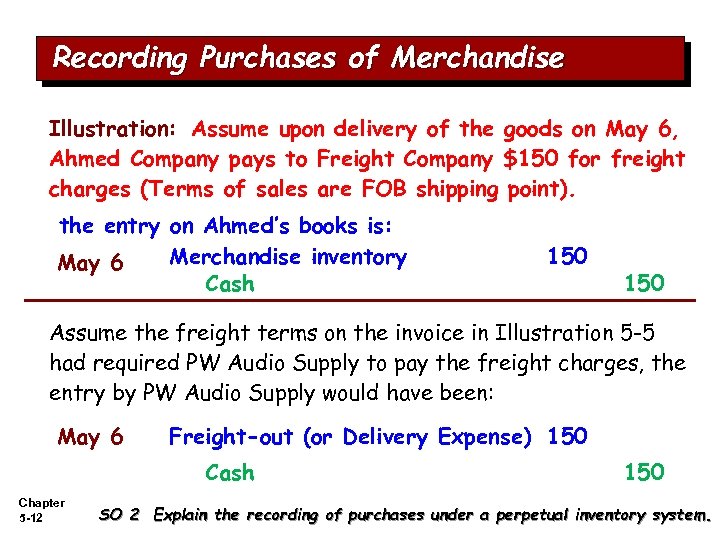

Recording Purchases of Merchandise Illustration: Assume upon delivery of the goods on May 6, Ahmed Company pays to Freight Company $150 for freight charges (Terms of sales are FOB shipping point). the entry on Ahmed’s books is: Merchandise inventory May 6 Cash 150 Assume the freight terms on the invoice in Illustration 5 -5 had required PW Audio Supply to pay the freight charges, the entry by PW Audio Supply would have been: May 6 Freight-out (or Delivery Expense) 150 Cash Chapter 5 -12 150 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Illustration: Assume upon delivery of the goods on May 6, Ahmed Company pays to Freight Company $150 for freight charges (Terms of sales are FOB shipping point). the entry on Ahmed’s books is: Merchandise inventory May 6 Cash 150 Assume the freight terms on the invoice in Illustration 5 -5 had required PW Audio Supply to pay the freight charges, the entry by PW Audio Supply would have been: May 6 Freight-out (or Delivery Expense) 150 Cash Chapter 5 -12 150 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Assume the freight terms on the invoice had required Ali Company to pay the freight charges. On the Ahmed’s book: NO entry Chapter 5 -13 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Assume the freight terms on the invoice had required Ali Company to pay the freight charges. On the Ahmed’s book: NO entry Chapter 5 -13 SO 2 Explain the recording of purchases under a perpetual inventory system.

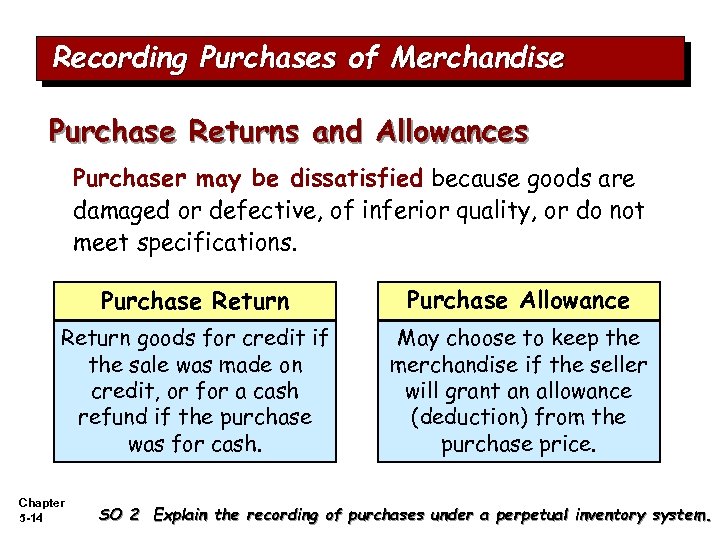

Recording Purchases of Merchandise Purchase Returns and Allowances Purchaser may be dissatisfied because goods are damaged or defective, of inferior quality, or do not meet specifications. Purchase Return Purchase Allowance Return goods for credit if the sale was made on credit, or for a cash refund if the purchase was for cash. May choose to keep the merchandise if the seller will grant an allowance (deduction) from the purchase price. Chapter 5 -14 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Purchase Returns and Allowances Purchaser may be dissatisfied because goods are damaged or defective, of inferior quality, or do not meet specifications. Purchase Return Purchase Allowance Return goods for credit if the sale was made on credit, or for a cash refund if the purchase was for cash. May choose to keep the merchandise if the seller will grant an allowance (deduction) from the purchase price. Chapter 5 -14 SO 2 Explain the recording of purchases under a perpetual inventory system.

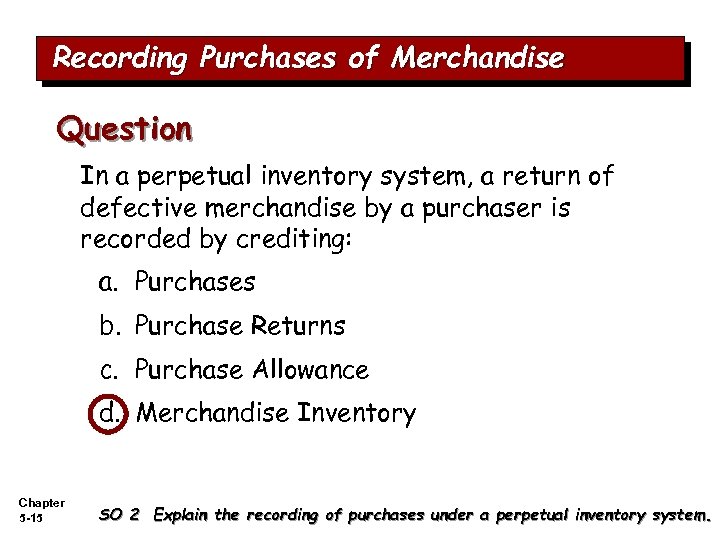

Recording Purchases of Merchandise Question In a perpetual inventory system, a return of defective merchandise by a purchaser is recorded by crediting: a. Purchases b. Purchase Returns c. Purchase Allowance d. Merchandise Inventory Chapter 5 -15 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Question In a perpetual inventory system, a return of defective merchandise by a purchaser is recorded by crediting: a. Purchases b. Purchase Returns c. Purchase Allowance d. Merchandise Inventory Chapter 5 -15 SO 2 Explain the recording of purchases under a perpetual inventory system.

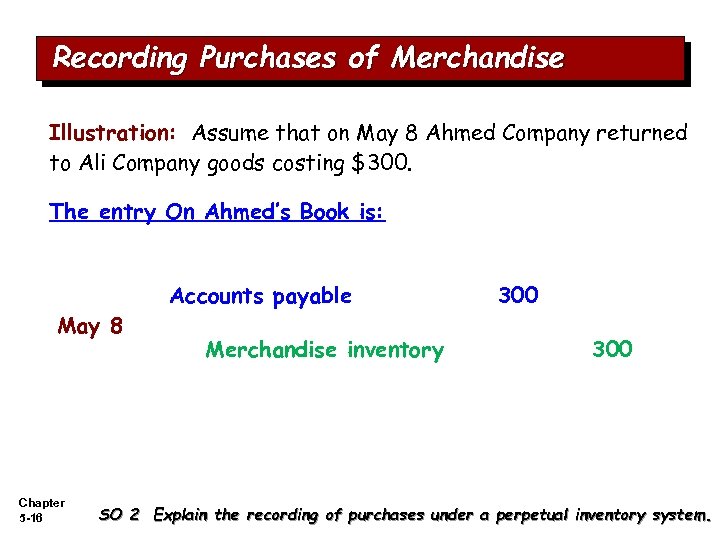

Recording Purchases of Merchandise Illustration: Assume that on May 8 Ahmed Company returned to Ali Company goods costing $300. The entry On Ahmed’s Book is: May 8 Chapter 5 -16 Accounts payable Merchandise inventory 300 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Illustration: Assume that on May 8 Ahmed Company returned to Ali Company goods costing $300. The entry On Ahmed’s Book is: May 8 Chapter 5 -16 Accounts payable Merchandise inventory 300 SO 2 Explain the recording of purchases under a perpetual inventory system.

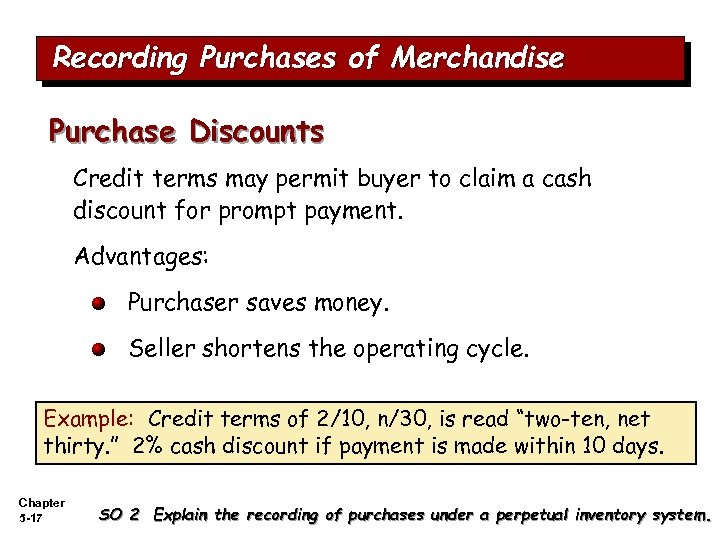

Recording Purchases of Merchandise Purchase Discounts Credit terms may permit buyer to claim a cash discount for prompt payment. Advantages: Purchaser saves money. Seller shortens the operating cycle. Example: Credit terms of 2/10, n/30, is read “two-ten, net thirty. ” 2% cash discount if payment is made within 10 days. Chapter 5 -17 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Purchase Discounts Credit terms may permit buyer to claim a cash discount for prompt payment. Advantages: Purchaser saves money. Seller shortens the operating cycle. Example: Credit terms of 2/10, n/30, is read “two-ten, net thirty. ” 2% cash discount if payment is made within 10 days. Chapter 5 -17 SO 2 Explain the recording of purchases under a perpetual inventory system.

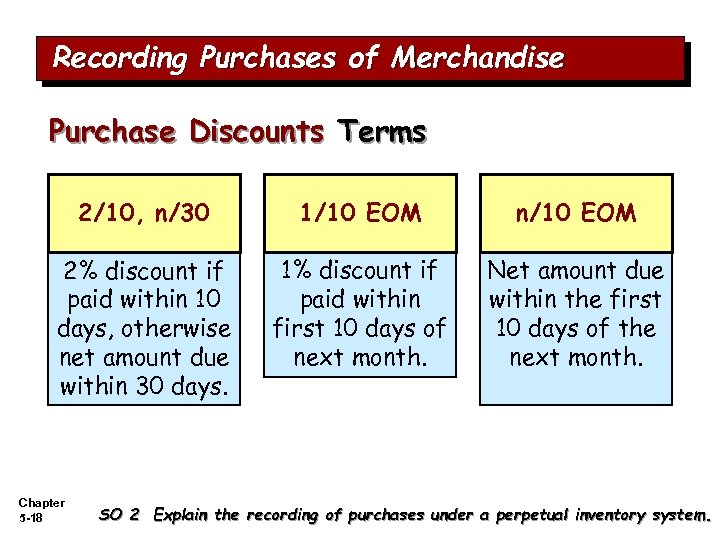

Recording Purchases of Merchandise Purchase Discounts Terms 2/10, n/30 1/10 EOM n/10 EOM 2% discount if paid within 10 days, otherwise net amount due within 30 days. 1% discount if paid within first 10 days of next month. Net amount due within the first 10 days of the next month. Chapter 5 -18 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Purchase Discounts Terms 2/10, n/30 1/10 EOM n/10 EOM 2% discount if paid within 10 days, otherwise net amount due within 30 days. 1% discount if paid within first 10 days of next month. Net amount due within the first 10 days of the next month. Chapter 5 -18 SO 2 Explain the recording of purchases under a perpetual inventory system.

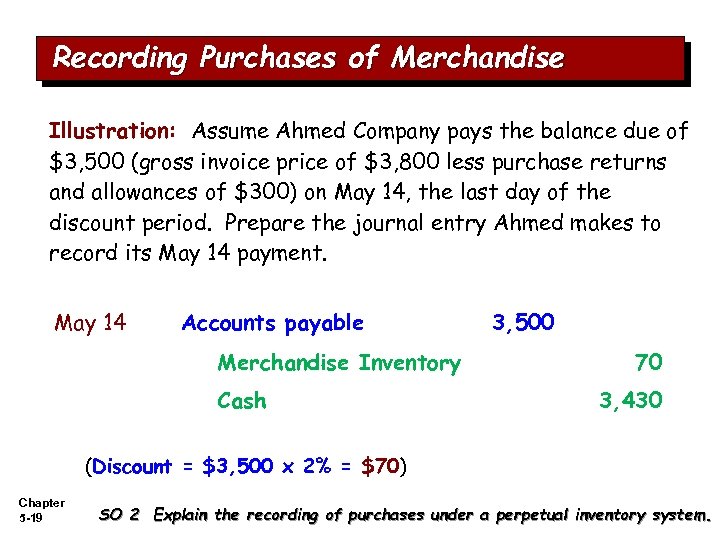

Recording Purchases of Merchandise Illustration: Assume Ahmed Company pays the balance due of $3, 500 (gross invoice price of $3, 800 less purchase returns and allowances of $300) on May 14, the last day of the discount period. Prepare the journal entry Ahmed makes to record its May 14 payment. May 14 Accounts payable Merchandise Inventory Cash 3, 500 70 3, 430 (Discount = $3, 500 x 2% = $70) Chapter 5 -19 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Illustration: Assume Ahmed Company pays the balance due of $3, 500 (gross invoice price of $3, 800 less purchase returns and allowances of $300) on May 14, the last day of the discount period. Prepare the journal entry Ahmed makes to record its May 14 payment. May 14 Accounts payable Merchandise Inventory Cash 3, 500 70 3, 430 (Discount = $3, 500 x 2% = $70) Chapter 5 -19 SO 2 Explain the recording of purchases under a perpetual inventory system.

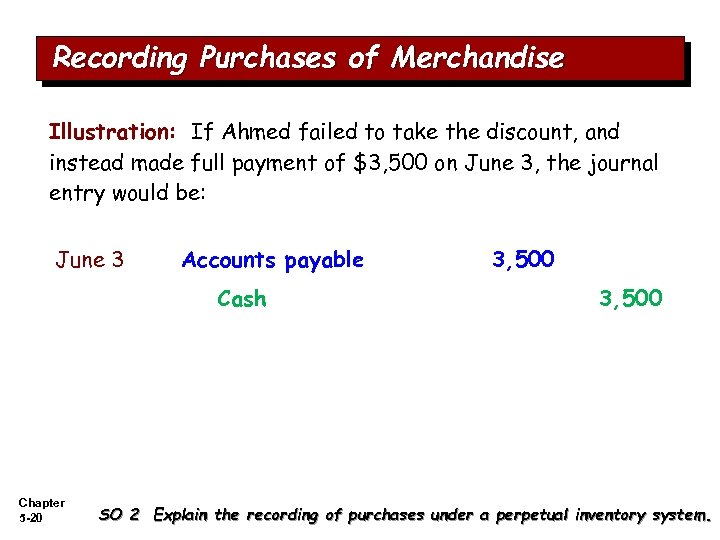

Recording Purchases of Merchandise Illustration: If Ahmed failed to take the discount, and instead made full payment of $3, 500 on June 3, the journal entry would be: June 3 Accounts payable Cash Chapter 5 -20 3, 500 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Illustration: If Ahmed failed to take the discount, and instead made full payment of $3, 500 on June 3, the journal entry would be: June 3 Accounts payable Cash Chapter 5 -20 3, 500 SO 2 Explain the recording of purchases under a perpetual inventory system.

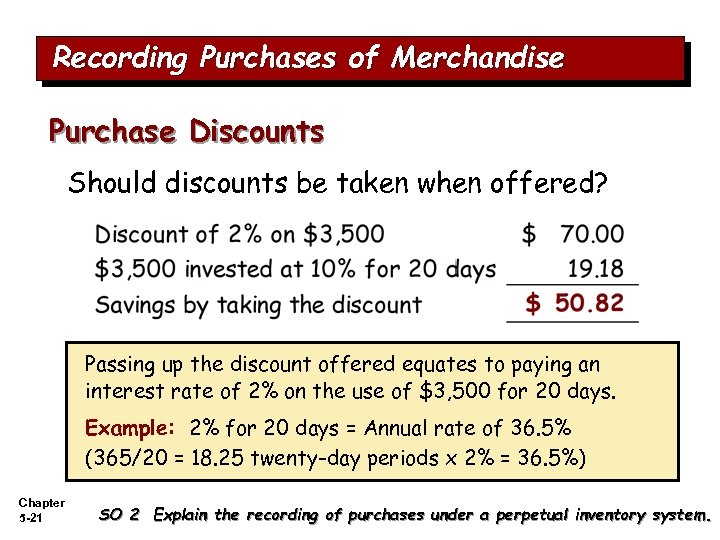

Recording Purchases of Merchandise Purchase Discounts Should discounts be taken when offered? Passing up the discount offered equates to paying an interest rate of 2% on the use of $3, 500 for 20 days. Example: 2% for 20 days = Annual rate of 36. 5% (365/20 = 18. 25 twenty-day periods x 2% = 36. 5%) Chapter 5 -21 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Purchase Discounts Should discounts be taken when offered? Passing up the discount offered equates to paying an interest rate of 2% on the use of $3, 500 for 20 days. Example: 2% for 20 days = Annual rate of 36. 5% (365/20 = 18. 25 twenty-day periods x 2% = 36. 5%) Chapter 5 -21 SO 2 Explain the recording of purchases under a perpetual inventory system.

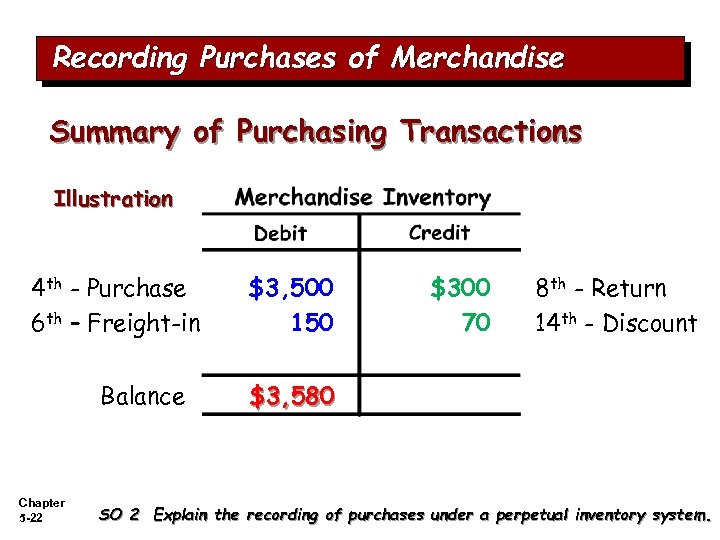

Recording Purchases of Merchandise Summary of Purchasing Transactions Illustration 4 th - Purchase 6 th – Freight-in Balance Chapter 5 -22 $3, 500 150 $300 70 8 th - Return 14 th - Discount $3, 580 SO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of Merchandise Summary of Purchasing Transactions Illustration 4 th - Purchase 6 th – Freight-in Balance Chapter 5 -22 $3, 500 150 $300 70 8 th - Return 14 th - Discount $3, 580 SO 2 Explain the recording of purchases under a perpetual inventory system.

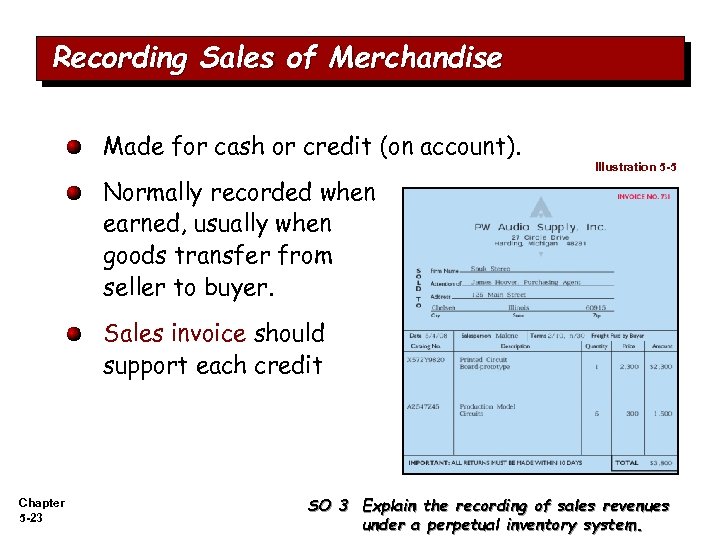

Recording Sales of Merchandise Made for cash or credit (on account). Normally recorded when earned, usually when goods transfer from seller to buyer. Sales invoice should support each credit Chapter 5 -23 Illustration 5 -5 sale. SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Made for cash or credit (on account). Normally recorded when earned, usually when goods transfer from seller to buyer. Sales invoice should support each credit Chapter 5 -23 Illustration 5 -5 sale. SO 3 Explain the recording of sales revenues under a perpetual inventory system.

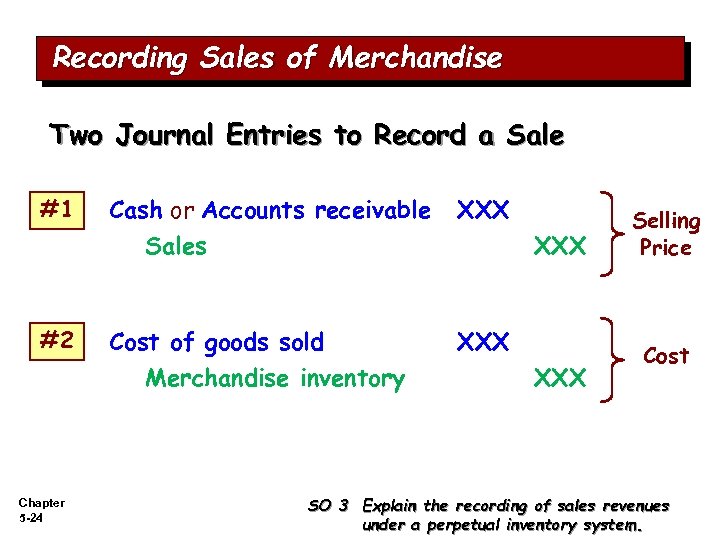

Recording Sales of Merchandise Two Journal Entries to Record a Sale #1 #2 Chapter 5 -24 Cash or Accounts receivable Sales XXX Cost of goods sold Merchandise inventory XXX XXX Selling Price Cost SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Two Journal Entries to Record a Sale #1 #2 Chapter 5 -24 Cash or Accounts receivable Sales XXX Cost of goods sold Merchandise inventory XXX XXX Selling Price Cost SO 3 Explain the recording of sales revenues under a perpetual inventory system.

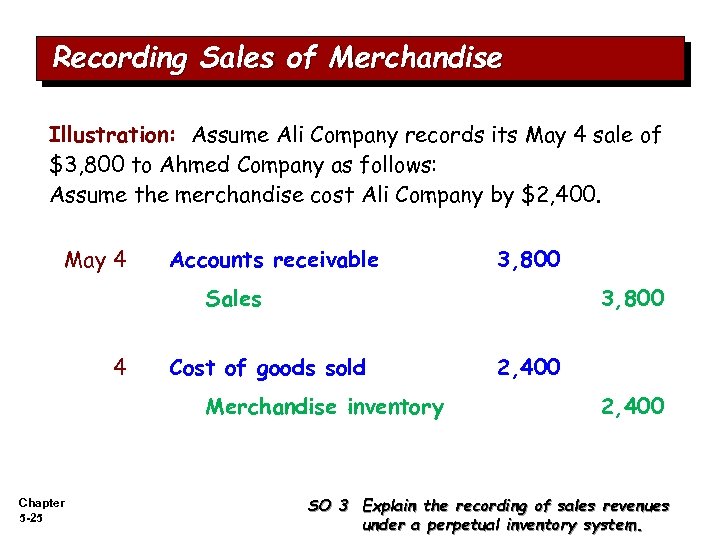

Recording Sales of Merchandise Illustration: Assume Ali Company records its May 4 sale of $3, 800 to Ahmed Company as follows: Assume the merchandise cost Ali Company by $2, 400. May 4 Accounts receivable 3, 800 Sales 4 3, 800 Cost of goods sold Merchandise inventory Chapter 5 -25 2, 400 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Illustration: Assume Ali Company records its May 4 sale of $3, 800 to Ahmed Company as follows: Assume the merchandise cost Ali Company by $2, 400. May 4 Accounts receivable 3, 800 Sales 4 3, 800 Cost of goods sold Merchandise inventory Chapter 5 -25 2, 400 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Sales Returns and Allowances “Flipside” of purchase returns and allowances. Contra-revenue account (debit). Sales not reduced (debited) because: Ø would obscure importance of sales returns and allowances as a percentage of sales. Ø could distort comparisons between total sales in different accounting periods. Chapter 5 -26 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Sales Returns and Allowances “Flipside” of purchase returns and allowances. Contra-revenue account (debit). Sales not reduced (debited) because: Ø would obscure importance of sales returns and allowances as a percentage of sales. Ø could distort comparisons between total sales in different accounting periods. Chapter 5 -26 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

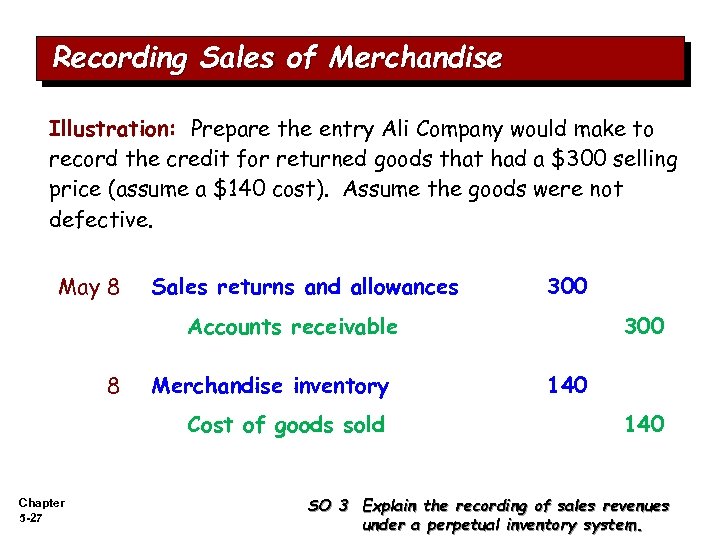

Recording Sales of Merchandise Illustration: Prepare the entry Ali Company would make to record the credit for returned goods that had a $300 selling price (assume a $140 cost). Assume the goods were not defective. May 8 Sales returns and allowances 300 Accounts receivable 8 Merchandise inventory Cost of goods sold Chapter 5 -27 300 140 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Illustration: Prepare the entry Ali Company would make to record the credit for returned goods that had a $300 selling price (assume a $140 cost). Assume the goods were not defective. May 8 Sales returns and allowances 300 Accounts receivable 8 Merchandise inventory Cost of goods sold Chapter 5 -27 300 140 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

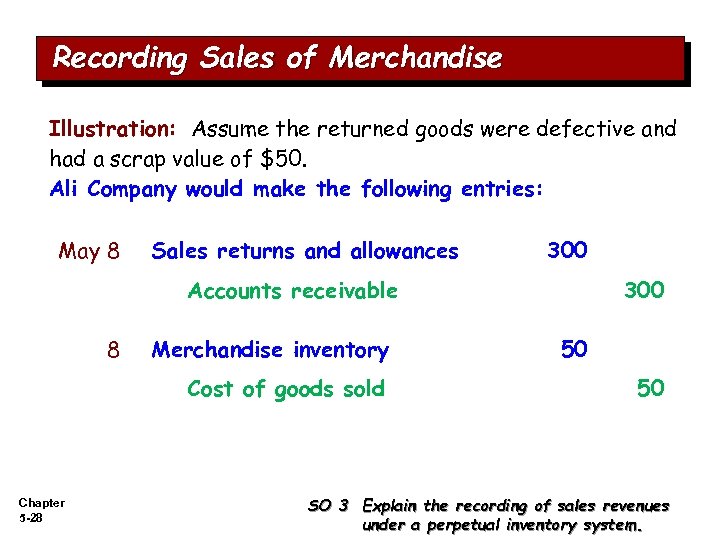

Recording Sales of Merchandise Illustration: Assume the returned goods were defective and had a scrap value of $50. Ali Company would make the following entries: May 8 Sales returns and allowances 300 Accounts receivable 8 Merchandise inventory Cost of goods sold Chapter 5 -28 300 50 50 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Illustration: Assume the returned goods were defective and had a scrap value of $50. Ali Company would make the following entries: May 8 Sales returns and allowances 300 Accounts receivable 8 Merchandise inventory Cost of goods sold Chapter 5 -28 300 50 50 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

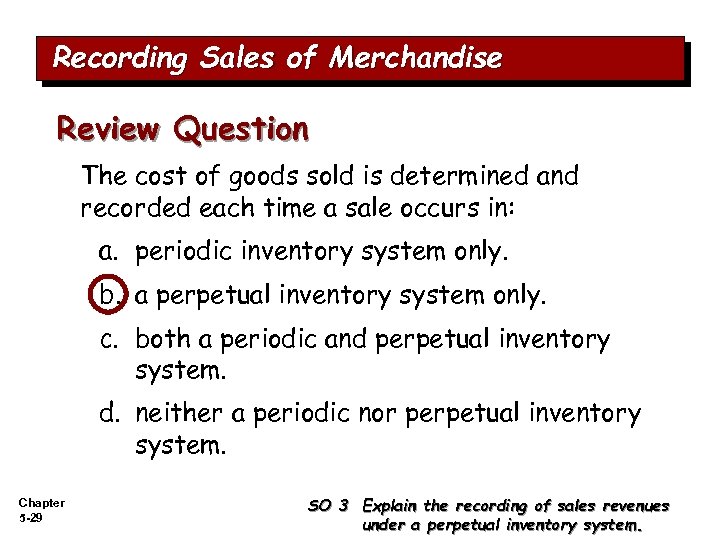

Recording Sales of Merchandise Review Question The cost of goods sold is determined and recorded each time a sale occurs in: a. periodic inventory system only. b. a perpetual inventory system only. c. both a periodic and perpetual inventory system. d. neither a periodic nor perpetual inventory system. Chapter 5 -29 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Recording Sales of Merchandise Review Question The cost of goods sold is determined and recorded each time a sale occurs in: a. periodic inventory system only. b. a perpetual inventory system only. c. both a periodic and perpetual inventory system. d. neither a periodic nor perpetual inventory system. Chapter 5 -29 SO 3 Explain the recording of sales revenues under a perpetual inventory system.

Chapter 5 -30

Chapter 5 -30