d1fc245d68d7cad27dbf60ad5ec6eb81.ppt

- Количество слайдов: 29

Chapter 5 -1 No Taxation Without Representation

Chapter 5 -1 No Taxation Without Representation

LG: Students will be able to explain the Proclamation Line of 1763, analyze why Britain began to enact harsher trade laws and taxes, understand cause and effect relationships as it relates to the reaction of the colonists, and identify those individuals and groups that began to rebel against British policy. EQ: Why does conflict develop?

LG: Students will be able to explain the Proclamation Line of 1763, analyze why Britain began to enact harsher trade laws and taxes, understand cause and effect relationships as it relates to the reaction of the colonists, and identify those individuals and groups that began to rebel against British policy. EQ: Why does conflict develop?

During the 1750 s, fur traders from Great Britain living in the colonies began to cross the Appalachian Mountains. (Ohio River Valley) The land settled belonged to French. Great Britain and France both claimed the land, but this eventually led to war

During the 1750 s, fur traders from Great Britain living in the colonies began to cross the Appalachian Mountains. (Ohio River Valley) The land settled belonged to French. Great Britain and France both claimed the land, but this eventually led to war

The French and Indian War Great Britain Wins the War 1760 - British attack French fort in Quebec ▪ French lost control and the war War ended in 1763 ▪ Great Britain controlled land east of the Mississippi River and Canada

The French and Indian War Great Britain Wins the War 1760 - British attack French fort in Quebec ▪ French lost control and the war War ended in 1763 ▪ Great Britain controlled land east of the Mississippi River and Canada

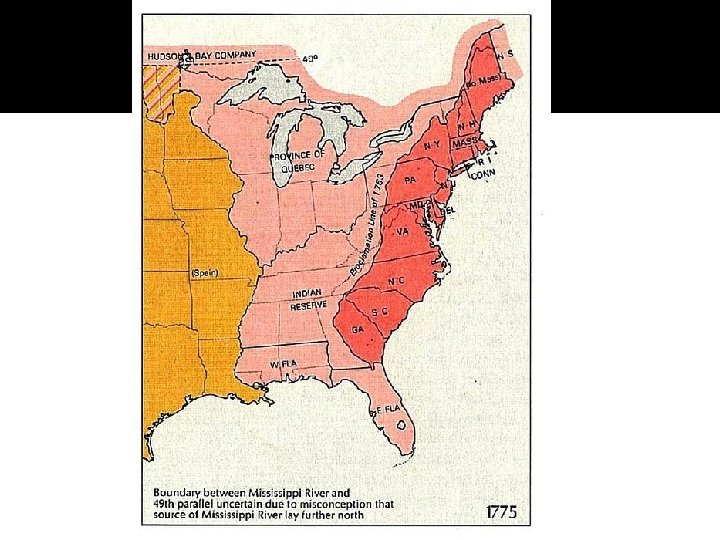

Dealing with Great Britain After the war, King George III issued the Proclamation of 1763 Prohibited colonists from moving west of the Appalachian Mountains on Native American land Passed for two reasons 1) Wanted to keep the peace between natives 2) Wanted to keep colonists close to coast where British control was stronger ▪ Thought people would not follow their laws or buy British goods ▪ Great Britain did not want to lose money and sent 10, 00 troops Colonists did not follow the Proclamation and settled out west anyway

Dealing with Great Britain After the war, King George III issued the Proclamation of 1763 Prohibited colonists from moving west of the Appalachian Mountains on Native American land Passed for two reasons 1) Wanted to keep the peace between natives 2) Wanted to keep colonists close to coast where British control was stronger ▪ Thought people would not follow their laws or buy British goods ▪ Great Britain did not want to lose money and sent 10, 00 troops Colonists did not follow the Proclamation and settled out west anyway

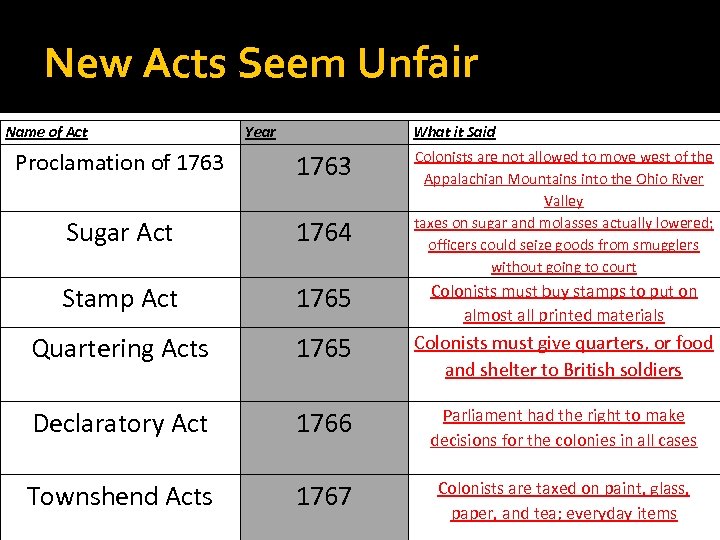

New Acts Seem Unfair Name of Act Year What it Said Colonists are not allowed to move west of the Appalachian Mountains into the Ohio River Valley taxes on sugar and molasses actually lowered; officers could seize goods from smugglers without going to court Proclamation of 1763 Sugar Act 1764 Stamp Act 1765 Colonists must buy stamps to put on almost all printed materials Quartering Acts 1765 Colonists must give quarters, or food and shelter to British soldiers Declaratory Act 1766 Parliament had the right to make decisions for the colonies in all cases Townshend Acts 1767 Colonists are taxed on paint, glass, paper, and tea; everyday items

New Acts Seem Unfair Name of Act Year What it Said Colonists are not allowed to move west of the Appalachian Mountains into the Ohio River Valley taxes on sugar and molasses actually lowered; officers could seize goods from smugglers without going to court Proclamation of 1763 Sugar Act 1764 Stamp Act 1765 Colonists must buy stamps to put on almost all printed materials Quartering Acts 1765 Colonists must give quarters, or food and shelter to British soldiers Declaratory Act 1766 Parliament had the right to make decisions for the colonies in all cases Townshend Acts 1767 Colonists are taxed on paint, glass, paper, and tea; everyday items

“No parts of (England’s colonies) can be taxed without their conscent…. every part has a right to be represented”

“No parts of (England’s colonies) can be taxed without their conscent…. every part has a right to be represented”

Paper was among the most heavily taxed goods under the Stamp Act of 1765. For a pamphlet or newspaper larger than one whole sheet, the Stamp Act imposed a duty of one shilling per page and two shillings for every advertisement. That means a 35 -page (printed on both sides) issue of a magazine with 10 advertisements would cost £ 186. 98 today, or $293. 56—on top of the newsstand price.

Paper was among the most heavily taxed goods under the Stamp Act of 1765. For a pamphlet or newspaper larger than one whole sheet, the Stamp Act imposed a duty of one shilling per page and two shillings for every advertisement. That means a 35 -page (printed on both sides) issue of a magazine with 10 advertisements would cost £ 186. 98 today, or $293. 56—on top of the newsstand price.

Nearly $300 for a magazine seems like a bargain considering colonists had to pay the equivalent of $234. 84 for a single sheet of diploma paper under the Stamp Act. Any piece of paper, skin, piece of vellum, or parchment used for a certificate of degree taken at a university or academy incurred a stamp duty of two pounds (valued £ 149. 58, or $234. 84 today).

Nearly $300 for a magazine seems like a bargain considering colonists had to pay the equivalent of $234. 84 for a single sheet of diploma paper under the Stamp Act. Any piece of paper, skin, piece of vellum, or parchment used for a certificate of degree taken at a university or academy incurred a stamp duty of two pounds (valued £ 149. 58, or $234. 84 today).

Under the Stamp Act, a tariff of ten shillings was added to every pair of dice sold. In today’s economy, that would leave you paying over $58 for a pair of dice. Even more harrowing, the penalty for being caught selling an illegal pair of dice (and therein bypassing the tariff) would cost you ten pounds per die—or 20 for the pair. This penalty is equivalent to over $2300 today

Under the Stamp Act, a tariff of ten shillings was added to every pair of dice sold. In today’s economy, that would leave you paying over $58 for a pair of dice. Even more harrowing, the penalty for being caught selling an illegal pair of dice (and therein bypassing the tariff) would cost you ten pounds per die—or 20 for the pair. This penalty is equivalent to over $2300 today

Each deck of playing cards sold in the colonies was charged an extra shilling (or $5. 87 today) under the Stamp Act. While that might not seem like much compared to the exorbitant duties on dice and paper, things are put into perspective when you consider that you can buy a deck of cards today for well under $5. 00—that makes the duty in excess of 100 percent of the cards’ value. Also, much like dice, the penalty for selling counterfeit cards was 20 pounds (thousands of dollars).

Each deck of playing cards sold in the colonies was charged an extra shilling (or $5. 87 today) under the Stamp Act. While that might not seem like much compared to the exorbitant duties on dice and paper, things are put into perspective when you consider that you can buy a deck of cards today for well under $5. 00—that makes the duty in excess of 100 percent of the cards’ value. Also, much like dice, the penalty for selling counterfeit cards was 20 pounds (thousands of dollars).

A stamp duty of four pence (or $1. 96—which now seems like a bargain!) was added to one-year calendars and almanacs printed in the colonies.

A stamp duty of four pence (or $1. 96—which now seems like a bargain!) was added to one-year calendars and almanacs printed in the colonies.

Under the Townshend Acts, a duty of three pence (approximately $1. 46 today) was added to every pound of tea sold in the colonies. Why was this so cheap?

Under the Townshend Acts, a duty of three pence (approximately $1. 46 today) was added to every pound of tea sold in the colonies. Why was this so cheap?

The Sugar Act of 1764 imposed a duty of 2 pounds, 19 shillings, and 9 pence, or ($350. 80) on every hundredweight (112 lbs) of foreign coffee sold in the colonies. This is even more egregious when you consider that the tariff on British coffee was a mere 7 shillings ($41. 10) per hundredweight. Foreign coffee was more than eight times more expensive than British coffee, nearly ensuring the British a monopoly on colonial coffee sales.

The Sugar Act of 1764 imposed a duty of 2 pounds, 19 shillings, and 9 pence, or ($350. 80) on every hundredweight (112 lbs) of foreign coffee sold in the colonies. This is even more egregious when you consider that the tariff on British coffee was a mere 7 shillings ($41. 10) per hundredweight. Foreign coffee was more than eight times more expensive than British coffee, nearly ensuring the British a monopoly on colonial coffee sales.

A hundredweight of foreign white sugar incurred an outrageous duty of 1 pound, 2 shillings—or nearly $130—under the Sugar Act. It actually increased the number of items taxed, but lowered the tax on sugar and molasses

A hundredweight of foreign white sugar incurred an outrageous duty of 1 pound, 2 shillings—or nearly $130—under the Sugar Act. It actually increased the number of items taxed, but lowered the tax on sugar and molasses

According to the Sugar Act, on “every ton of wine of the growth of the Madeiras, or of any other island or place from whence such wine may be lawfully imported” was placed a tariff of seven pounds ($805). That’s 14 times more than wine from continental Europe!

According to the Sugar Act, on “every ton of wine of the growth of the Madeiras, or of any other island or place from whence such wine may be lawfully imported” was placed a tariff of seven pounds ($805). That’s 14 times more than wine from continental Europe!

Under the Stamp Act, the paper on which you printed your license to sell wine—but, significantly, not wine and spirits—was stuck with a stamp duty of 4 pounds (or $469. 68 dollars today).

Under the Stamp Act, the paper on which you printed your license to sell wine—but, significantly, not wine and spirits—was stuck with a stamp duty of 4 pounds (or $469. 68 dollars today).

New Acts Seem Unfair Money collected from the acts went to Great Britain Colonists wanted money to help improve life in the colonies George Grenville created the writs of assistance These laws let officers go into people’s houses without permission to search for smuggled goods Also created courts where people did not receive fair trials with juries. ▪ Officers were the juries

New Acts Seem Unfair Money collected from the acts went to Great Britain Colonists wanted money to help improve life in the colonies George Grenville created the writs of assistance These laws let officers go into people’s houses without permission to search for smuggled goods Also created courts where people did not receive fair trials with juries. ▪ Officers were the juries

George Greenville “…taxing the colonies for the expense of their defense was only right and just” After all it cost them 70, 000 in 1748 and swelled to 350, 000 by 1764 JERK

George Greenville “…taxing the colonies for the expense of their defense was only right and just” After all it cost them 70, 000 in 1748 and swelled to 350, 000 by 1764 JERK

New Acts Seem Unfair Patrick Henry was responsible for the protests against the Stamp Act (1765) He persuaded burgesses in Virginia to write a resolution- a formal opinion- saying it had the sole right to tax Virginians, not Parliament Created the phrase, “No taxation without representation” ▪ Parliament did not have the right to make laws for the colonists ▪ Went against the colonial tradition of “self government”. AWESOME

New Acts Seem Unfair Patrick Henry was responsible for the protests against the Stamp Act (1765) He persuaded burgesses in Virginia to write a resolution- a formal opinion- saying it had the sole right to tax Virginians, not Parliament Created the phrase, “No taxation without representation” ▪ Parliament did not have the right to make laws for the colonists ▪ Went against the colonial tradition of “self government”. AWESOME

Colonists Protest Samuel Adams helped start an organization called the Sons of Liberty Members would protest the Stamp Act and create effigies of royal officials to burn and march through the streets (1765)

Colonists Protest Samuel Adams helped start an organization called the Sons of Liberty Members would protest the Stamp Act and create effigies of royal officials to burn and march through the streets (1765)

Colonists Protest Stamp Act Congress drafted a petition to the king and Parliament stating colonies could only be taxed by their own assemblies (1765) In March 1766, the Stamp Act was repealed, or cancelled ▪ Colonists did not trust the king or Parliament The same year Parliament passed the Declaratory Act A year later the Townshend Acts were passed which taxed all imported goods on everyday items used by the colonists they could not produce themselves. Angered the colonists even more

Colonists Protest Stamp Act Congress drafted a petition to the king and Parliament stating colonies could only be taxed by their own assemblies (1765) In March 1766, the Stamp Act was repealed, or cancelled ▪ Colonists did not trust the king or Parliament The same year Parliament passed the Declaratory Act A year later the Townshend Acts were passed which taxed all imported goods on everyday items used by the colonists they could not produce themselves. Angered the colonists even more

Colonists Protest Colonists were outraged by any laws that Parliament passed Only their own representatives had the right to tax them Colonists would boycott, like during the Stamp Act, all British goods Women also protested Women organized groups Daughters of Liberty ▪ Urged Americans to ▪ Wear homemade fabrics ▪ Produce other goods that were only before available from Great Britain Wanted the colonies to become economically independent

Colonists Protest Colonists were outraged by any laws that Parliament passed Only their own representatives had the right to tax them Colonists would boycott, like during the Stamp Act, all British goods Women also protested Women organized groups Daughters of Liberty ▪ Urged Americans to ▪ Wear homemade fabrics ▪ Produce other goods that were only before available from Great Britain Wanted the colonies to become economically independent