Chapter 4.1.ppt

- Количество слайдов: 24

Chapter 4: SYSTEMS DESIGN: Process Costing 1. Introduction. Differences btw job-order and process costing 2. Overview of process costing system a. Processing departments (Introduction, Sequential and Parallel processing) b. The flow of material, labor and overhead costs c. Materials, labor and overhead cost entries d. Introduction to the case study “Double Diamond Skis” 3. Equivalent units of production a. Introduction b. Calculation of EU using weighted-average method 4. Production report – weighted-average method a. Introduction, showcase of production report b. Preparation of production report i. Step 1: Prepare a quantity schedule and compute the equivalent units ii. Step 2: Compute the total and unit costs 1. Step 3: Prepare a cost reconciliation a. Comment about rounding errors 5. A glance at operation costing 6. Practice: Review problem 7. Homework: a. Write down the lecture notes into your notebooks. b. Read and understand: Appendix 4 -A, pg-s 159 -165 c. Problems: P 4 -14, P 4 -15, P 4 -17, P 4 -19, P 4 -21, P 4 -22, P 4 -23, P 4 -24 d. Cases: C 4 -25

Chapter 4: SYSTEMS DESIGN: Process Costing 1. Introduction. Differences btw job-order and process costing 2. Overview of process costing system a. Processing departments (Introduction, Sequential and Parallel processing) b. The flow of material, labor and overhead costs c. Materials, labor and overhead cost entries d. Introduction to the case study “Double Diamond Skis” 3. Equivalent units of production a. Introduction b. Calculation of EU using weighted-average method 4. Production report – weighted-average method a. Introduction, showcase of production report b. Preparation of production report i. Step 1: Prepare a quantity schedule and compute the equivalent units ii. Step 2: Compute the total and unit costs 1. Step 3: Prepare a cost reconciliation a. Comment about rounding errors 5. A glance at operation costing 6. Practice: Review problem 7. Homework: a. Write down the lecture notes into your notebooks. b. Read and understand: Appendix 4 -A, pg-s 159 -165 c. Problems: P 4 -14, P 4 -15, P 4 -17, P 4 -19, P 4 -21, P 4 -22, P 4 -23, P 4 -24 d. Cases: C 4 -25

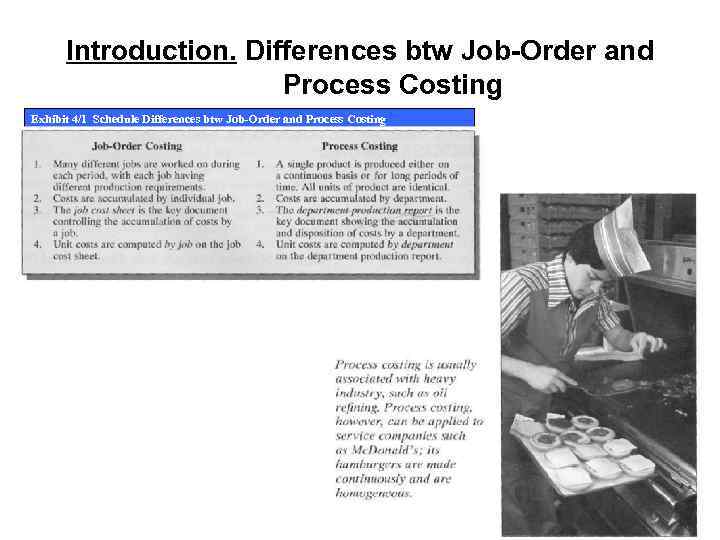

Introduction. Differences btw Job-Order and Process Costing Exhibit 4/1 Schedule Differences btw Job-Order and Process Costing

Introduction. Differences btw Job-Order and Process Costing Exhibit 4/1 Schedule Differences btw Job-Order and Process Costing

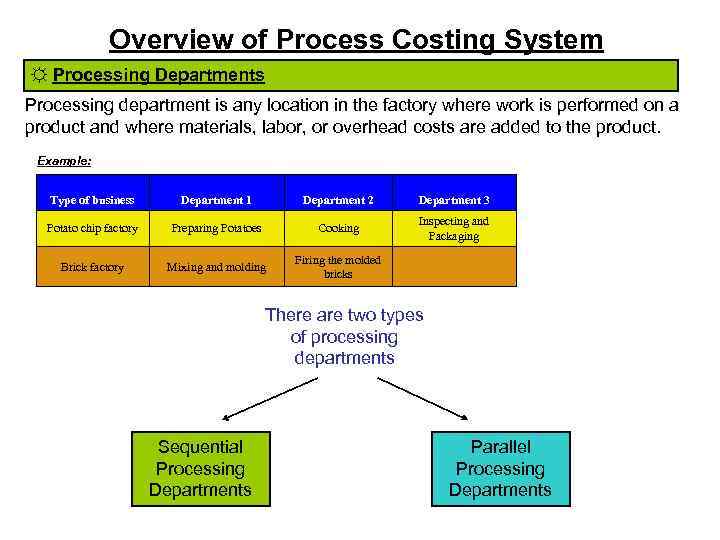

Overview of Process Costing System ☼ Processing Departments Processing department is any location in the factory where work is performed on a product and where materials, labor, or overhead costs are added to the product. Example: Type of business Department 1 Department 2 Department 3 Potato chip factory Preparing Potatoes Cooking Inspecting and Packaging Brick factory Mixing and molding Firing the molded bricks There are two types of processing departments Sequential Processing Departments Parallel Processing Departments

Overview of Process Costing System ☼ Processing Departments Processing department is any location in the factory where work is performed on a product and where materials, labor, or overhead costs are added to the product. Example: Type of business Department 1 Department 2 Department 3 Potato chip factory Preparing Potatoes Cooking Inspecting and Packaging Brick factory Mixing and molding Firing the molded bricks There are two types of processing departments Sequential Processing Departments Parallel Processing Departments

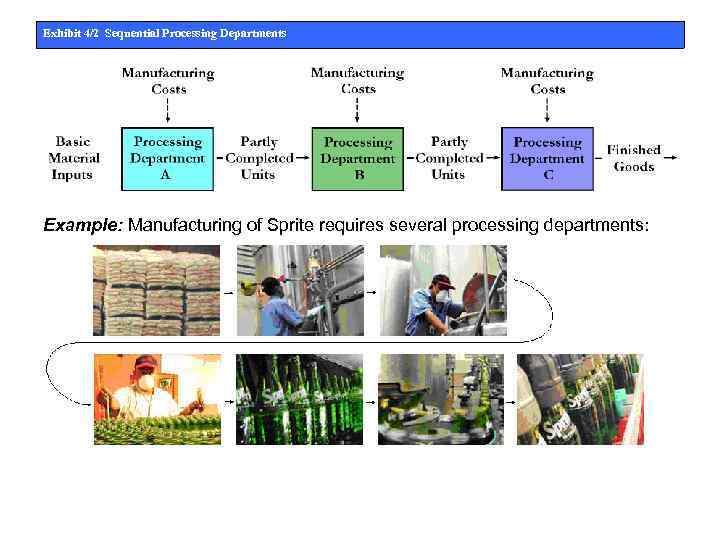

Exhibit 4/2 Sequential Processing Departments Example: Manufacturing of Sprite requires several processing departments:

Exhibit 4/2 Sequential Processing Departments Example: Manufacturing of Sprite requires several processing departments:

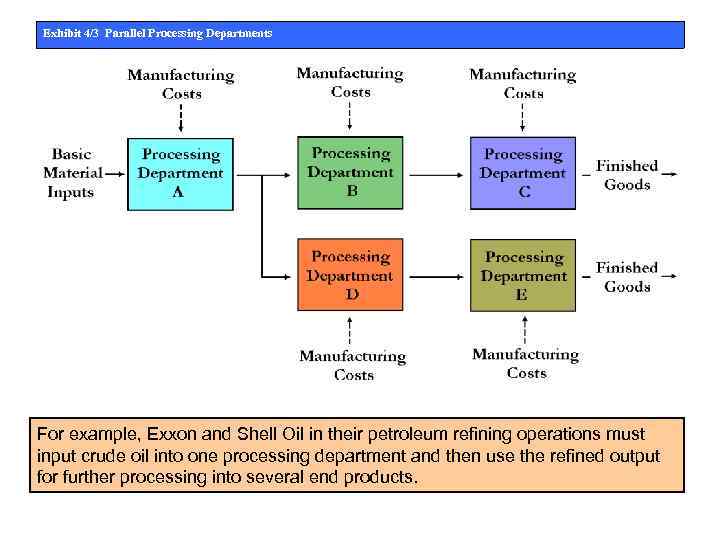

Exhibit 4/3 Parallel Processing Departments For example, Exxon and Shell Oil in their petroleum refining operations must input crude oil into one processing department and then use the refined output for further processing into several end products.

Exhibit 4/3 Parallel Processing Departments For example, Exxon and Shell Oil in their petroleum refining operations must input crude oil into one processing department and then use the refined output for further processing into several end products.

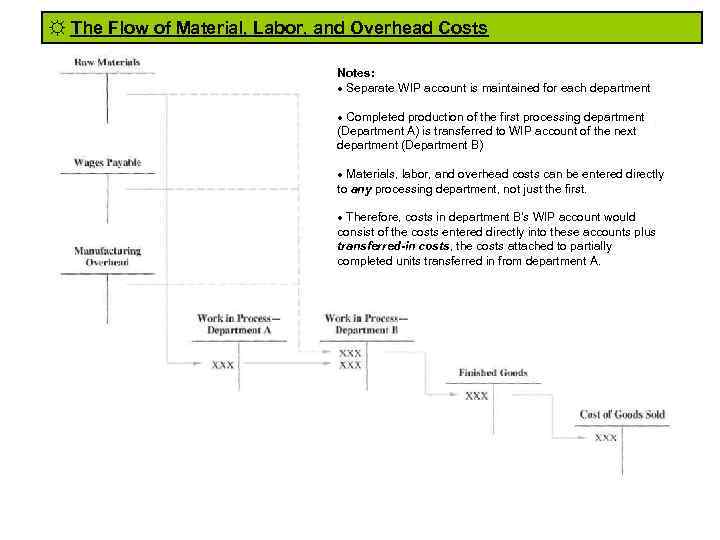

☼ The Flow of Material, Labor, and Overhead Costs Notes: Separate WIP account is maintained for each department Completed production of the first processing department (Department A) is transferred to WIP account of the next department (Department B) Materials, labor, and overhead costs can be entered directly to any processing department, not just the first. Therefore, costs in department B’s WIP account would consist of the costs entered directly into these accounts plus transferred-in costs, the costs attached to partially completed units transferred in from department A.

☼ The Flow of Material, Labor, and Overhead Costs Notes: Separate WIP account is maintained for each department Completed production of the first processing department (Department A) is transferred to WIP account of the next department (Department B) Materials, labor, and overhead costs can be entered directly to any processing department, not just the first. Therefore, costs in department B’s WIP account would consist of the costs entered directly into these accounts plus transferred-in costs, the costs attached to partially completed units transferred in from department A.

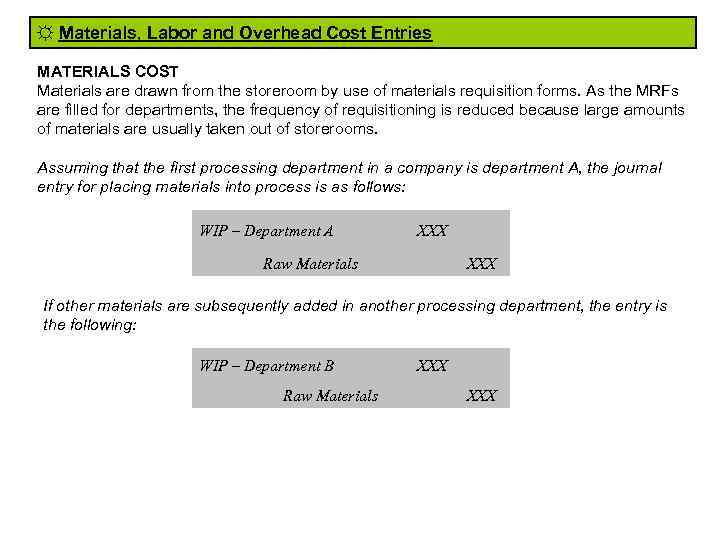

☼ Materials, Labor and Overhead Cost Entries MATERIALS COST Materials are drawn from the storeroom by use of materials requisition forms. As the MRFs are filled for departments, the frequency of requisitioning is reduced because large amounts of materials are usually taken out of storerooms. Assuming that the first processing department in a company is department A, the journal entry for placing materials into process is as follows: WIP – Department A XXX Raw Materials XXX If other materials are subsequently added in another processing department, the entry is the following: WIP – Department B Raw Materials XXX

☼ Materials, Labor and Overhead Cost Entries MATERIALS COST Materials are drawn from the storeroom by use of materials requisition forms. As the MRFs are filled for departments, the frequency of requisitioning is reduced because large amounts of materials are usually taken out of storerooms. Assuming that the first processing department in a company is department A, the journal entry for placing materials into process is as follows: WIP – Department A XXX Raw Materials XXX If other materials are subsequently added in another processing department, the entry is the following: WIP – Department B Raw Materials XXX

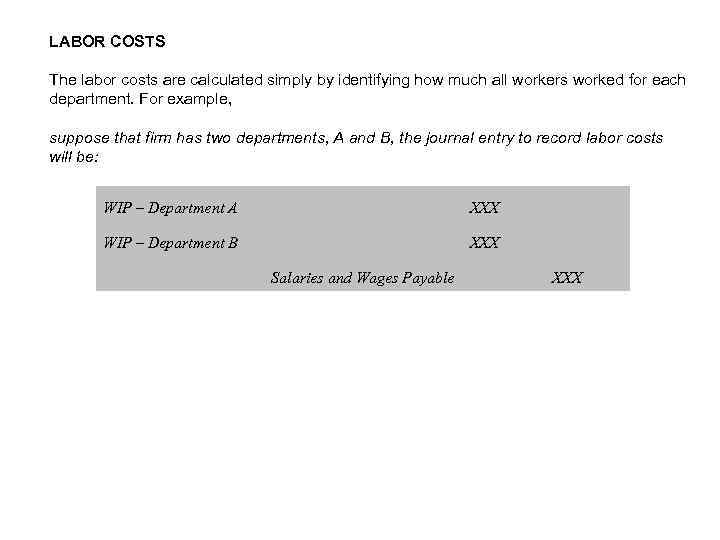

LABOR COSTS The labor costs are calculated simply by identifying how much all workers worked for each department. For example, suppose that firm has two departments, A and B, the journal entry to record labor costs will be: WIP – Department A XXX WIP – Department B XXX Salaries and Wages Payable XXX

LABOR COSTS The labor costs are calculated simply by identifying how much all workers worked for each department. For example, suppose that firm has two departments, A and B, the journal entry to record labor costs will be: WIP – Department A XXX WIP – Department B XXX Salaries and Wages Payable XXX

OVERHEAD COSTS How we compute overhead costs: 1. Products are charged with actual overhead costs rather than with applied overhead costs. 2. Overhead costs in each department are simply added directly to the department’s WIP account either as these costs are incurred or at specified intervals. 3. No under- or overapplied overhead. Why is it possible to use actual overhead costs in a process costing system when it is not possible under job-order costing? Under job-order costing: a. jobs tend to be heterogeneous b. require different inputs and times to complete c. at one time, there are several jobs under the process d. each job has different output requirements Under process costing: a. homogeneous units flow continuously through a department b. thus, it is possible to charge units with department’s actual overhead costs as these costs are incurred

OVERHEAD COSTS How we compute overhead costs: 1. Products are charged with actual overhead costs rather than with applied overhead costs. 2. Overhead costs in each department are simply added directly to the department’s WIP account either as these costs are incurred or at specified intervals. 3. No under- or overapplied overhead. Why is it possible to use actual overhead costs in a process costing system when it is not possible under job-order costing? Under job-order costing: a. jobs tend to be heterogeneous b. require different inputs and times to complete c. at one time, there are several jobs under the process d. each job has different output requirements Under process costing: a. homogeneous units flow continuously through a department b. thus, it is possible to charge units with department’s actual overhead costs as these costs are incurred

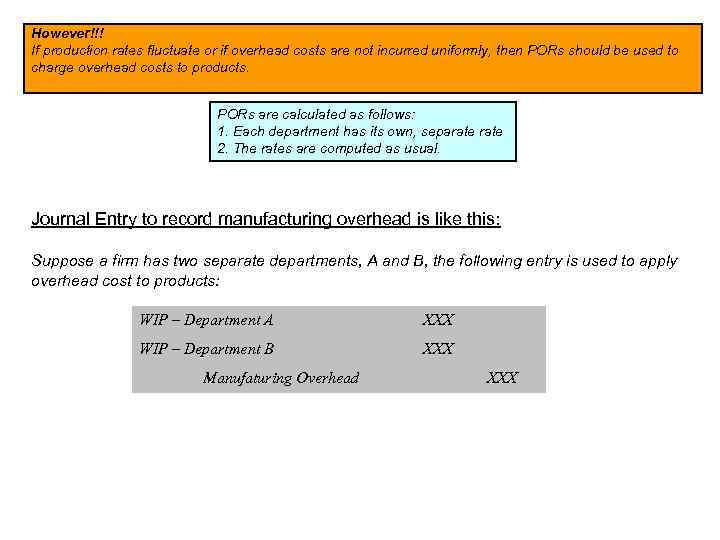

However!!! If production rates fluctuate or if overhead costs are not incurred uniformly, then PORs should be used to charge overhead costs to products. PORs are calculated as follows: 1. Each department has its own, separate 2. The rates are computed as usual. Journal Entry to record manufacturing overhead is like this: Suppose a firm has two separate departments, A and B, the following entry is used to apply overhead cost to products: WIP – Department A XXX WIP – Department B XXX Manufaturing Overhead XXX

However!!! If production rates fluctuate or if overhead costs are not incurred uniformly, then PORs should be used to charge overhead costs to products. PORs are calculated as follows: 1. Each department has its own, separate 2. The rates are computed as usual. Journal Entry to record manufacturing overhead is like this: Suppose a firm has two separate departments, A and B, the following entry is used to apply overhead cost to products: WIP – Department A XXX WIP – Department B XXX Manufaturing Overhead XXX

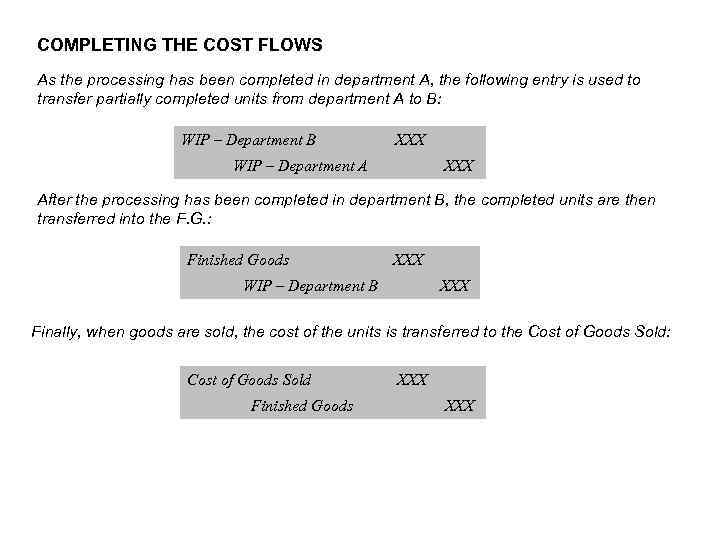

COMPLETING THE COST FLOWS As the processing has been completed in department A, the following entry is used to transfer partially completed units from department A to B: WIP – Department B XXX WIP – Department A XXX After the processing has been completed in department B, the completed units are then transferred into the F. G. : Finished Goods XXX WIP – Department B XXX Finally, when goods are sold, the cost of the units is transferred to the Cost of Goods Sold: Cost of Goods Sold Finished Goods XXX

COMPLETING THE COST FLOWS As the processing has been completed in department A, the following entry is used to transfer partially completed units from department A to B: WIP – Department B XXX WIP – Department A XXX After the processing has been completed in department B, the completed units are then transferred into the F. G. : Finished Goods XXX WIP – Department B XXX Finally, when goods are sold, the cost of the units is transferred to the Cost of Goods Sold: Cost of Goods Sold Finished Goods XXX

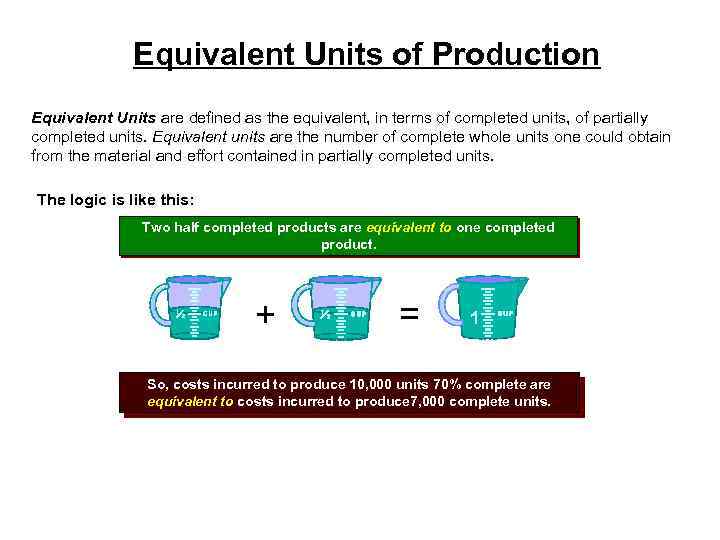

Equivalent Units of Production Equivalent Units are defined as the equivalent, in terms of completed units, of partially completed units. Equivalent units are the number of complete whole units one could obtain from the material and effort contained in partially completed units. The logic is like this: Two half completed products are equivalent to one completed product. + = 1 So, costs incurred to produce 10, 000 units 70% complete are equivalent to costs incurred to produce 7, 000 complete units.

Equivalent Units of Production Equivalent Units are defined as the equivalent, in terms of completed units, of partially completed units. Equivalent units are the number of complete whole units one could obtain from the material and effort contained in partially completed units. The logic is like this: Two half completed products are equivalent to one completed product. + = 1 So, costs incurred to produce 10, 000 units 70% complete are equivalent to costs incurred to produce 7, 000 complete units.

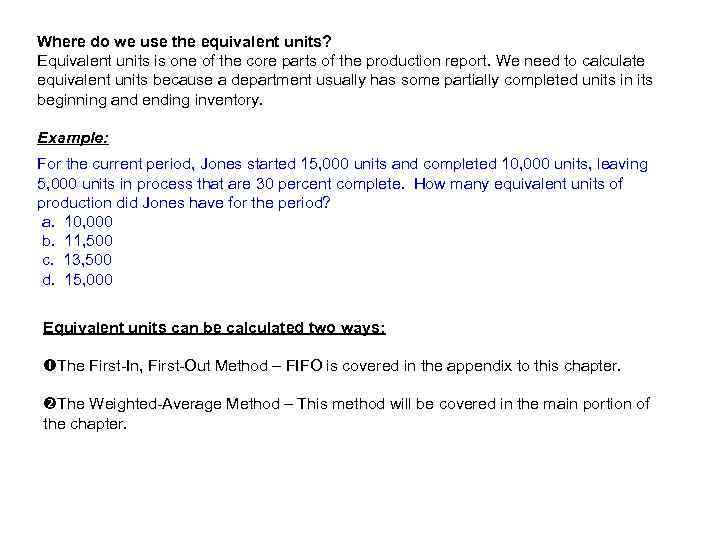

Where do we use the equivalent units? Equivalent units is one of the core parts of the production report. We need to calculate equivalent units because a department usually has some partially completed units in its beginning and ending inventory. Example: For the current period, Jones started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process that are 30 percent complete. How many equivalent units of production did Jones have for the period? a. 10, 000 b. 11, 500 c. 13, 500 d. 15, 000 Equivalent units can be calculated two ways: The First-In, First-Out Method – FIFO is covered in the appendix to this chapter. The Weighted-Average Method – This method will be covered in the main portion of the chapter.

Where do we use the equivalent units? Equivalent units is one of the core parts of the production report. We need to calculate equivalent units because a department usually has some partially completed units in its beginning and ending inventory. Example: For the current period, Jones started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process that are 30 percent complete. How many equivalent units of production did Jones have for the period? a. 10, 000 b. 11, 500 c. 13, 500 d. 15, 000 Equivalent units can be calculated two ways: The First-In, First-Out Method – FIFO is covered in the appendix to this chapter. The Weighted-Average Method – This method will be covered in the main portion of the chapter.

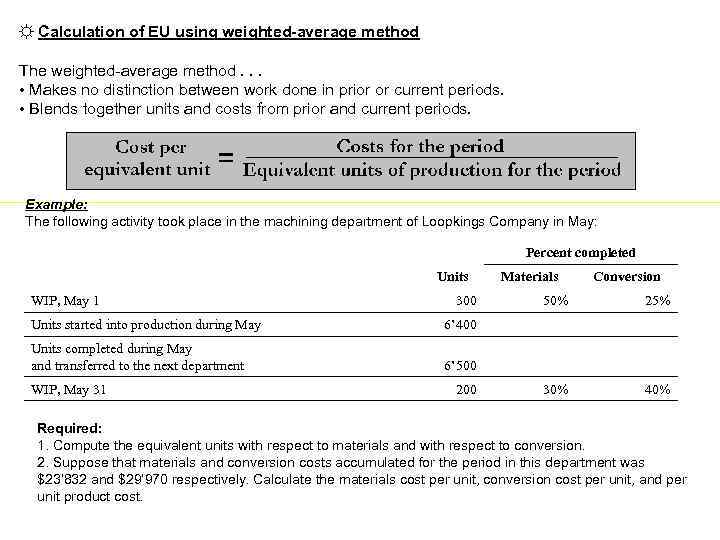

☼ Calculation of EU using weighted-average method The weighted-average method. . . • Makes no distinction between work done in prior or current periods. • Blends together units and costs from prior and current periods. Example: The following activity took place in the machining department of Loopkings Company in May: Percent completed Units WIP, May 1 300 Units started into production during May Conversion 50% 25% 30% 40% 6’ 400 Units completed during May and transferred to the next department Materials 6’ 500 WIP, May 31 200 Required: 1. Compute the equivalent units with respect to materials and with respect to conversion. 2. Suppose that materials and conversion costs accumulated for the period in this department was $23’ 832 and $29’ 970 respectively. Calculate the materials cost per unit, conversion cost per unit, and per unit product cost.

☼ Calculation of EU using weighted-average method The weighted-average method. . . • Makes no distinction between work done in prior or current periods. • Blends together units and costs from prior and current periods. Example: The following activity took place in the machining department of Loopkings Company in May: Percent completed Units WIP, May 1 300 Units started into production during May Conversion 50% 25% 30% 40% 6’ 400 Units completed during May and transferred to the next department Materials 6’ 500 WIP, May 31 200 Required: 1. Compute the equivalent units with respect to materials and with respect to conversion. 2. Suppose that materials and conversion costs accumulated for the period in this department was $23’ 832 and $29’ 970 respectively. Calculate the materials cost per unit, conversion cost per unit, and per unit product cost.

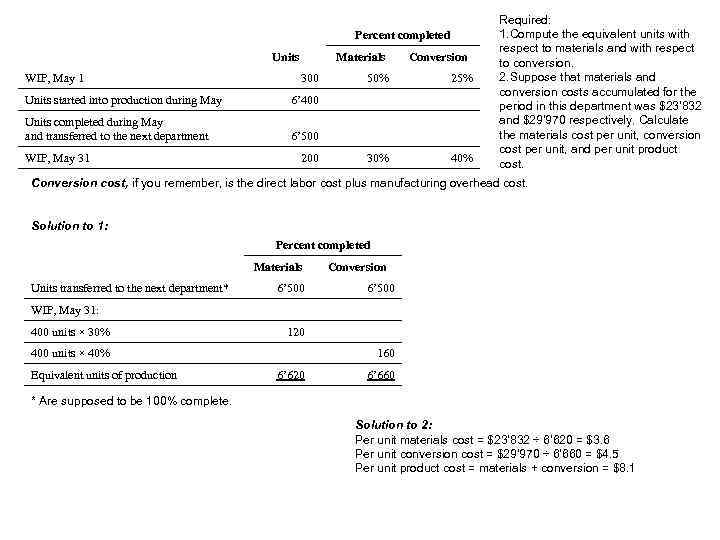

Percent completed Units WIP, May 1 Materials 300 Units started into production during May 50% 25% 30% 40% 6’ 400 Units completed during May and transferred to the next department Conversion 6’ 500 WIP, May 31 200 Required: 1. Compute the equivalent units with respect to materials and with respect to conversion. 2. Suppose that materials and conversion costs accumulated for the period in this department was $23’ 832 and $29’ 970 respectively. Calculate the materials cost per unit, conversion cost per unit, and per unit product cost. Conversion cost, if you remember, is the direct labor cost plus manufacturing overhead cost. Solution to 1: Percent completed Materials Units transferred to the next department* 6’ 500 Conversion 6’ 500 WIP, May 31: 400 units × 30% 120 400 units × 40% Equivalent units of production 160 6’ 620 6’ 660 * Are supposed to be 100% complete. Solution to 2: Per unit materials cost = $23’ 832 ÷ 6’ 620 = $3. 6 Per unit conversion cost = $29’ 970 ÷ 6’ 660 = $4. 5 Per unit product cost = materials + conversion = $8. 1

Percent completed Units WIP, May 1 Materials 300 Units started into production during May 50% 25% 30% 40% 6’ 400 Units completed during May and transferred to the next department Conversion 6’ 500 WIP, May 31 200 Required: 1. Compute the equivalent units with respect to materials and with respect to conversion. 2. Suppose that materials and conversion costs accumulated for the period in this department was $23’ 832 and $29’ 970 respectively. Calculate the materials cost per unit, conversion cost per unit, and per unit product cost. Conversion cost, if you remember, is the direct labor cost plus manufacturing overhead cost. Solution to 1: Percent completed Materials Units transferred to the next department* 6’ 500 Conversion 6’ 500 WIP, May 31: 400 units × 30% 120 400 units × 40% Equivalent units of production 160 6’ 620 6’ 660 * Are supposed to be 100% complete. Solution to 2: Per unit materials cost = $23’ 832 ÷ 6’ 620 = $3. 6 Per unit conversion cost = $29’ 970 ÷ 6’ 660 = $4. 5 Per unit product cost = materials + conversion = $8. 1

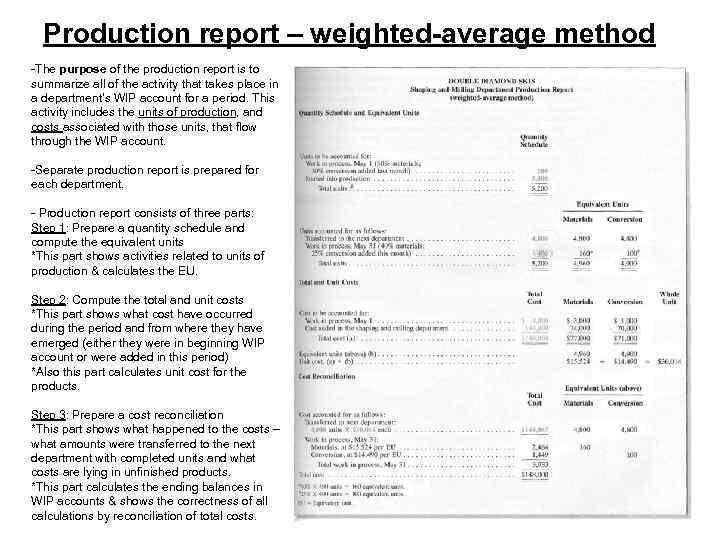

Production report – weighted-average method -The purpose of the production report is to summarize all of the activity that takes place in a department’s WIP account for a period. This activity includes the units of production, and costs associated with those units, that flow through the WIP account. -Separate production report is prepared for each department. - Production report consists of three parts: Step 1: Prepare a quantity schedule and compute the equivalent units *This part shows activities related to units of production & calculates the EU. Step 2: Compute the total and unit costs *This part shows what cost have occurred during the period and from where they have emerged (either they were in beginning WIP account or were added in this period) *Also this part calculates unit cost for the products. Step 3: Prepare a cost reconciliation *This part shows what happened to the costs – what amounts were transferred to the next department with completed units and what costs are lying in unfinished products. *This part calculates the ending balances in WIP accounts & shows the correctness of all calculations by reconciliation of total costs.

Production report – weighted-average method -The purpose of the production report is to summarize all of the activity that takes place in a department’s WIP account for a period. This activity includes the units of production, and costs associated with those units, that flow through the WIP account. -Separate production report is prepared for each department. - Production report consists of three parts: Step 1: Prepare a quantity schedule and compute the equivalent units *This part shows activities related to units of production & calculates the EU. Step 2: Compute the total and unit costs *This part shows what cost have occurred during the period and from where they have emerged (either they were in beginning WIP account or were added in this period) *Also this part calculates unit cost for the products. Step 3: Prepare a cost reconciliation *This part shows what happened to the costs – what amounts were transferred to the next department with completed units and what costs are lying in unfinished products. *This part calculates the ending balances in WIP accounts & shows the correctness of all calculations by reconciliation of total costs.

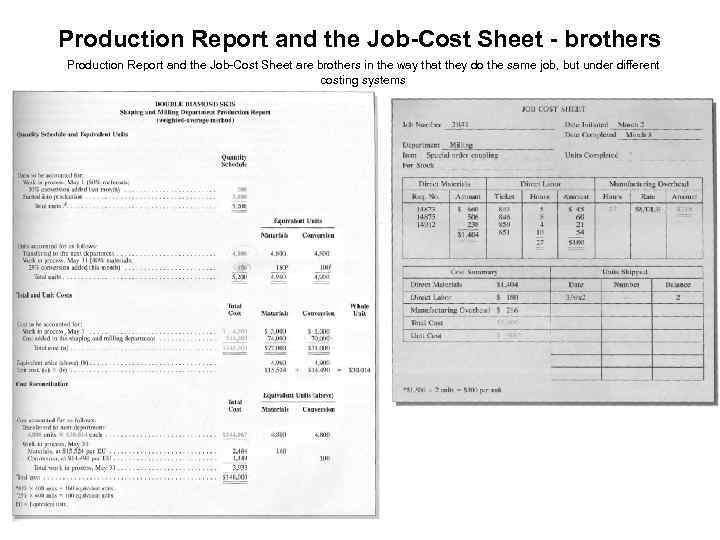

Production Report and the Job-Cost Sheet - brothers Production Report and the Job-Cost Sheet are brothers in the way that they do the same job, but under different costing systems

Production Report and the Job-Cost Sheet - brothers Production Report and the Job-Cost Sheet are brothers in the way that they do the same job, but under different costing systems

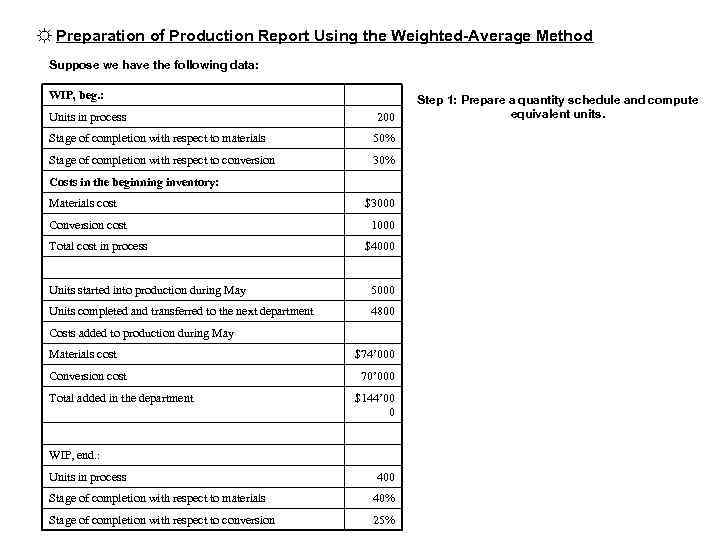

☼ Preparation of Production Report Using the Weighted-Average Method Suppose we have the following data: WIP, beg. : Units in process 200 Stage of completion with respect to materials 50% Stage of completion with respect to conversion 30% Costs in the beginning inventory: Materials cost Conversion cost Total cost in process $3000 1000 $4000 Units started into production during May 5000 Units completed and transferred to the next department 4800 Costs added to production during May Materials cost Conversion cost Total added in the department $74’ 000 70’ 000 $144’ 00 0 WIP, end. : Units in process 400 Stage of completion with respect to materials 40% Stage of completion with respect to conversion 25% Step 1: Prepare a quantity schedule and compute equivalent units.

☼ Preparation of Production Report Using the Weighted-Average Method Suppose we have the following data: WIP, beg. : Units in process 200 Stage of completion with respect to materials 50% Stage of completion with respect to conversion 30% Costs in the beginning inventory: Materials cost Conversion cost Total cost in process $3000 1000 $4000 Units started into production during May 5000 Units completed and transferred to the next department 4800 Costs added to production during May Materials cost Conversion cost Total added in the department $74’ 000 70’ 000 $144’ 00 0 WIP, end. : Units in process 400 Stage of completion with respect to materials 40% Stage of completion with respect to conversion 25% Step 1: Prepare a quantity schedule and compute equivalent units.

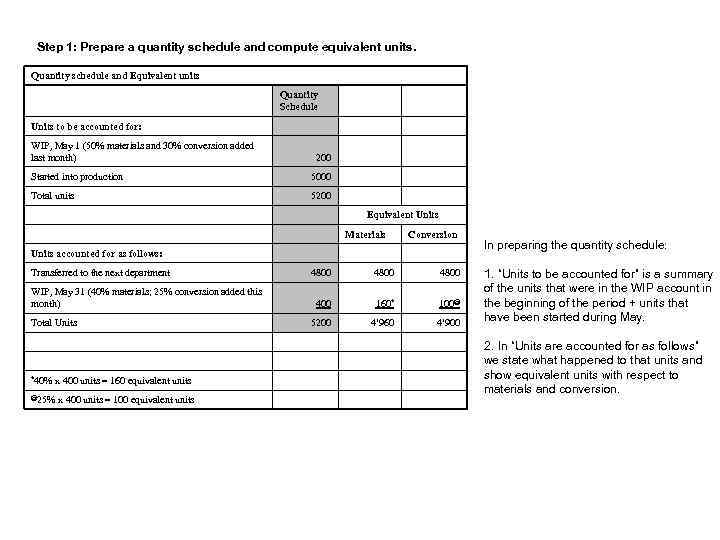

Step 1: Prepare a quantity schedule and compute equivalent units. Quantity schedule and Equivalent units Quantity Schedule Units to be accounted for: WIP, May 1 (50% materials and 30% conversion added last month) 200 Started into production 5000 Total units 5200 Equivalent Units Materials Conversion Units accounted for as follows: Transferred to the next department WIP, May 31 (40% materials; 25% conversion added this month) Total Units *40% x 400 units = 160 equivalent units @25% x 400 units = 100 equivalent units 4800 400 160* 100@ 5200 4’ 960 4’ 900 In preparing the quantity schedule: 1. “Units to be accounted for” is a summary of the units that were in the WIP account in the beginning of the period + units that have been started during May. 2. In “Units are accounted for as follows” we state what happened to that units and show equivalent units with respect to materials and conversion.

Step 1: Prepare a quantity schedule and compute equivalent units. Quantity schedule and Equivalent units Quantity Schedule Units to be accounted for: WIP, May 1 (50% materials and 30% conversion added last month) 200 Started into production 5000 Total units 5200 Equivalent Units Materials Conversion Units accounted for as follows: Transferred to the next department WIP, May 31 (40% materials; 25% conversion added this month) Total Units *40% x 400 units = 160 equivalent units @25% x 400 units = 100 equivalent units 4800 400 160* 100@ 5200 4’ 960 4’ 900 In preparing the quantity schedule: 1. “Units to be accounted for” is a summary of the units that were in the WIP account in the beginning of the period + units that have been started during May. 2. In “Units are accounted for as follows” we state what happened to that units and show equivalent units with respect to materials and conversion.

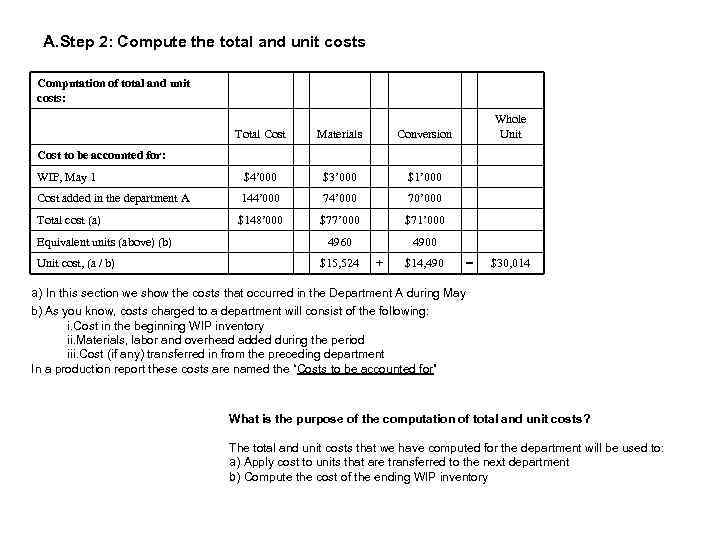

A. Step 2: Compute the total and unit costs Computation of total and unit costs: Total Cost Materials Conversion WIP, May 1 $4’ 000 $3’ 000 $1’ 000 Cost added in the department A 144’ 000 70’ 000 Total cost (a) $148’ 000 $77’ 000 $71’ 000 4960 Whole Unit 4900 Cost to be accounted for: Equivalent units (above) (b) Unit cost, (a / b) $15, 524 + $14, 490 = $30, 014 a) In this section we show the costs that occurred in the Department A during May b) As you know, costs charged to a department will consist of the following: i. Cost in the beginning WIP inventory ii. Materials, labor and overhead added during the period iii. Cost (if any) transferred in from the preceding department In a production report these costs are named the “Costs to be accounted for” What is the purpose of the computation of total and unit costs? The total and unit costs that we have computed for the department will be used to: a) Apply cost to units that are transferred to the next department b) Compute the cost of the ending WIP inventory

A. Step 2: Compute the total and unit costs Computation of total and unit costs: Total Cost Materials Conversion WIP, May 1 $4’ 000 $3’ 000 $1’ 000 Cost added in the department A 144’ 000 70’ 000 Total cost (a) $148’ 000 $77’ 000 $71’ 000 4960 Whole Unit 4900 Cost to be accounted for: Equivalent units (above) (b) Unit cost, (a / b) $15, 524 + $14, 490 = $30, 014 a) In this section we show the costs that occurred in the Department A during May b) As you know, costs charged to a department will consist of the following: i. Cost in the beginning WIP inventory ii. Materials, labor and overhead added during the period iii. Cost (if any) transferred in from the preceding department In a production report these costs are named the “Costs to be accounted for” What is the purpose of the computation of total and unit costs? The total and unit costs that we have computed for the department will be used to: a) Apply cost to units that are transferred to the next department b) Compute the cost of the ending WIP inventory

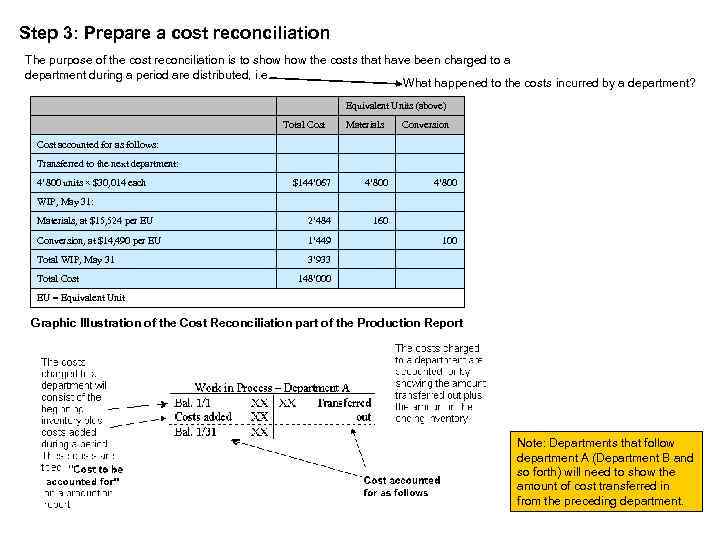

Step 3: Prepare a cost reconciliation The purpose of the cost reconciliation is to show the costs that have been charged to a department during a period are distributed, i. e. What happened to the costs incurred by a department? Equivalent Units (above) Total Cost Materials Conversion Cost accounted for as follows: Transferred to the next department: 4’ 800 units × $30, 014 each $144’ 067 4’ 800 Materials, at $15, 524 per EU 2’ 484 160 Conversion, at $14, 490 per EU 1’ 449 Total WIP, May 31 4’ 800 3’ 933 WIP, May 31: Total Cost 100 148’ 000 EU = Equivalent Unit Graphic Illustration of the Cost Reconciliation part of the Production Report Note: Departments that follow department A (Department B and so forth) will need to show the amount of cost transferred in from the preceding department.

Step 3: Prepare a cost reconciliation The purpose of the cost reconciliation is to show the costs that have been charged to a department during a period are distributed, i. e. What happened to the costs incurred by a department? Equivalent Units (above) Total Cost Materials Conversion Cost accounted for as follows: Transferred to the next department: 4’ 800 units × $30, 014 each $144’ 067 4’ 800 Materials, at $15, 524 per EU 2’ 484 160 Conversion, at $14, 490 per EU 1’ 449 Total WIP, May 31 4’ 800 3’ 933 WIP, May 31: Total Cost 100 148’ 000 EU = Equivalent Unit Graphic Illustration of the Cost Reconciliation part of the Production Report Note: Departments that follow department A (Department B and so forth) will need to show the amount of cost transferred in from the preceding department.

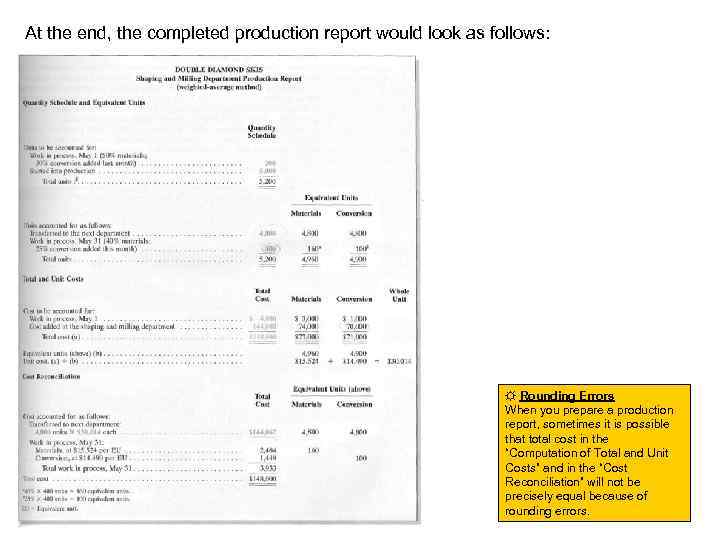

At the end, the completed production report would look as follows: ☼ Rounding Errors When you prepare a production report, sometimes it is possible that total cost in the “Computation of Total and Unit Costs” and in the “Cost Reconciliation” will not be precisely equal because of rounding errors.

At the end, the completed production report would look as follows: ☼ Rounding Errors When you prepare a production report, sometimes it is possible that total cost in the “Computation of Total and Unit Costs” and in the “Cost Reconciliation” will not be precisely equal because of rounding errors.

A glance at Operation Costing Operation costing is a hybrid costing system that employs aspects of both job order and process costing. Uses of hybrid or operation costing system: Operation costing system is used in situations where products have some common characteristics and also some individual characteristics. Shoes, for example, have some common characteristics in that all styles involve cutting and sewing that can be done on a repetitive basis, using the same equipment and following the same basic procedure. Shoes also have individual characteristics. Some are made of expensive leathers and others may be made using inexpensive synthetic materials. In a situation such as this, where products have some common characteristics but also must be handled individually to some extent, operation costing may be used to determine product costs. Products are typically handled in batches when operation costing is in use, with each batch charged for its own specific materials. In this sense, operation costing is similar to job order costing. However, labor and overhead costs are accumulated by operation or by department, and these costs are assigned to units as in process costing. Examples of other products for which operation costing may be used include electronic equipments (such as semi conductors), textiles, clothing, and jewelry (such as rings, bracelets, and medallions). Products of this type are typically produced in batches, but they can vary considerably from model to model or from style to style in terms of the cost of raw materials inputs. Therefore, an operation costing system is well suited for providing cost data.

A glance at Operation Costing Operation costing is a hybrid costing system that employs aspects of both job order and process costing. Uses of hybrid or operation costing system: Operation costing system is used in situations where products have some common characteristics and also some individual characteristics. Shoes, for example, have some common characteristics in that all styles involve cutting and sewing that can be done on a repetitive basis, using the same equipment and following the same basic procedure. Shoes also have individual characteristics. Some are made of expensive leathers and others may be made using inexpensive synthetic materials. In a situation such as this, where products have some common characteristics but also must be handled individually to some extent, operation costing may be used to determine product costs. Products are typically handled in batches when operation costing is in use, with each batch charged for its own specific materials. In this sense, operation costing is similar to job order costing. However, labor and overhead costs are accumulated by operation or by department, and these costs are assigned to units as in process costing. Examples of other products for which operation costing may be used include electronic equipments (such as semi conductors), textiles, clothing, and jewelry (such as rings, bracelets, and medallions). Products of this type are typically produced in batches, but they can vary considerably from model to model or from style to style in terms of the cost of raw materials inputs. Therefore, an operation costing system is well suited for providing cost data.

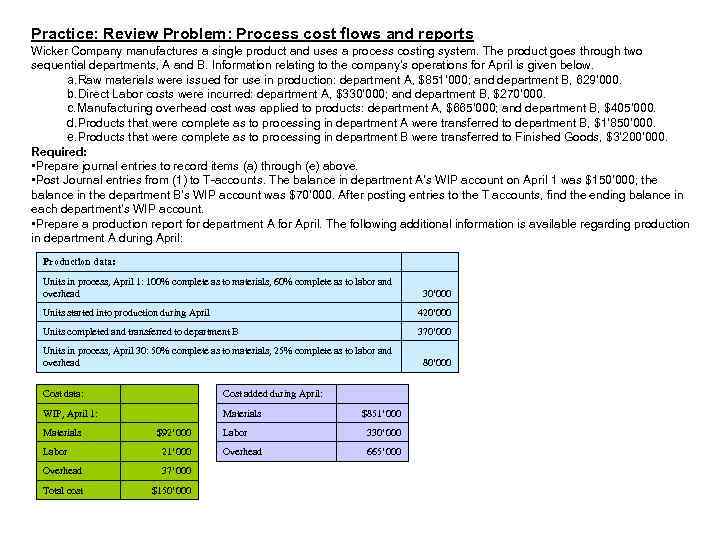

Practice: Review Problem: Process cost flows and reports Wicker Company manufactures a single product and uses a process costing system. The product goes through two sequential departments, A and B. Information relating to the company’s operations for April is given below. a. Raw materials were issued for use in production: department A, $851’ 000; and department B, 629’ 000. b. Direct Labor costs were incurred: department A, $330’ 000; and department B, $270’ 000. c. Manufacturing overhead cost was applied to products: department A, $665’ 000; and department B, $405’ 000. d. Products that were complete as to processing in department A were transferred to department B, $1’ 850’ 000. e. Products that were complete as to processing in department B were transferred to Finished Goods, $3’ 200’ 000. Required: • Prepare journal entries to record items (a) through (e) above. • Post Journal entries from (1) to T-accounts. The balance in department A’s WIP account on April 1 was $150’ 000; the balance in the department B’s WIP account was $70’ 000. After posting entries to the T accounts, find the ending balance in each department’s WIP account. • Prepare a production report for department A for April. The following additional information is available regarding production in department A during April: Production data: Units in process, April 1: 100% complete as to materials, 60% complete as to labor and overhead 30’ 000 Units started into production during April 420’ 000 Units completed and transferred to department B 370’ 000 Units in process, April 30: 50% complete as to materials, 25% complete as to labor and overhead Cost data: Cost added during April: WIP, April 1: Materials $92’ 000 Labor 21’ 000 Overhead 37’ 000 Total cost $150’ 000 $851’ 000 Labor 330’ 000 Overhead 665’ 000 80’ 000

Practice: Review Problem: Process cost flows and reports Wicker Company manufactures a single product and uses a process costing system. The product goes through two sequential departments, A and B. Information relating to the company’s operations for April is given below. a. Raw materials were issued for use in production: department A, $851’ 000; and department B, 629’ 000. b. Direct Labor costs were incurred: department A, $330’ 000; and department B, $270’ 000. c. Manufacturing overhead cost was applied to products: department A, $665’ 000; and department B, $405’ 000. d. Products that were complete as to processing in department A were transferred to department B, $1’ 850’ 000. e. Products that were complete as to processing in department B were transferred to Finished Goods, $3’ 200’ 000. Required: • Prepare journal entries to record items (a) through (e) above. • Post Journal entries from (1) to T-accounts. The balance in department A’s WIP account on April 1 was $150’ 000; the balance in the department B’s WIP account was $70’ 000. After posting entries to the T accounts, find the ending balance in each department’s WIP account. • Prepare a production report for department A for April. The following additional information is available regarding production in department A during April: Production data: Units in process, April 1: 100% complete as to materials, 60% complete as to labor and overhead 30’ 000 Units started into production during April 420’ 000 Units completed and transferred to department B 370’ 000 Units in process, April 30: 50% complete as to materials, 25% complete as to labor and overhead Cost data: Cost added during April: WIP, April 1: Materials $92’ 000 Labor 21’ 000 Overhead 37’ 000 Total cost $150’ 000 $851’ 000 Labor 330’ 000 Overhead 665’ 000 80’ 000