2bd63c6e404d347a09633182784d91ac.ppt

- Количество слайдов: 42

Chapter 4 Organization and Functioning of Securities Markets Questions to be answered: • What is the purpose and function of a market? • What are the characteristics that determine the quality of a market? • What is the difference between a primary and secondary capital market and how do these markets support each other?

Chapter 4 Organization and Functioning of Securities Markets Questions to be answered: • What is the purpose and function of a market? • What are the characteristics that determine the quality of a market? • What is the difference between a primary and secondary capital market and how do these markets support each other?

Chapter 4 Organization and Functioning of Securities Markets • What are the national exchanges and how are the major security markets becoming linked (what is meant by “passing the book”)? • What are the regional stock exchanges and the over-the-counter (OTC) market? • What are the alternative market-making arrangements available on the exchanges and the OCT market?

Chapter 4 Organization and Functioning of Securities Markets • What are the national exchanges and how are the major security markets becoming linked (what is meant by “passing the book”)? • What are the regional stock exchanges and the over-the-counter (OTC) market? • What are the alternative market-making arrangements available on the exchanges and the OCT market?

Chapter 4 Organization and Functioning of Securities Markets • What are the major types of orders available to investors and market makers?

Chapter 4 Organization and Functioning of Securities Markets • What are the major types of orders available to investors and market makers?

What is a market? • Brings buyers and sellers together to aid in the transfer of goods and services • Does not require a physical location • Both buyers and sellers benefit from the market

What is a market? • Brings buyers and sellers together to aid in the transfer of goods and services • Does not require a physical location • Both buyers and sellers benefit from the market

Characteristics of a Good Market • Availability of past transaction information – must be timely and accurate • Liquidity – marketability – price continuity – depth • Low Transaction costs • Rapid adjustment of prices to new information

Characteristics of a Good Market • Availability of past transaction information – must be timely and accurate • Liquidity – marketability – price continuity – depth • Low Transaction costs • Rapid adjustment of prices to new information

Organization of the Securities Market • Primary markets – Market where new securities are sold and funds go to issuing unit • Secondary markets – Market where outstanding securities are bought and sold by investors. The issuing unit does not receive any funds in a secondary market transaction

Organization of the Securities Market • Primary markets – Market where new securities are sold and funds go to issuing unit • Secondary markets – Market where outstanding securities are bought and sold by investors. The issuing unit does not receive any funds in a secondary market transaction

Government Bond Issues • 1. Treasury Bills – negotiable, non-interest bearing securities with original maturities of one year or less • 2. Treasury Notes – original maturities of 2 to 10 years • 3. Treasury Bonds – original maturities of more than 10 years

Government Bond Issues • 1. Treasury Bills – negotiable, non-interest bearing securities with original maturities of one year or less • 2. Treasury Notes – original maturities of 2 to 10 years • 3. Treasury Bonds – original maturities of more than 10 years

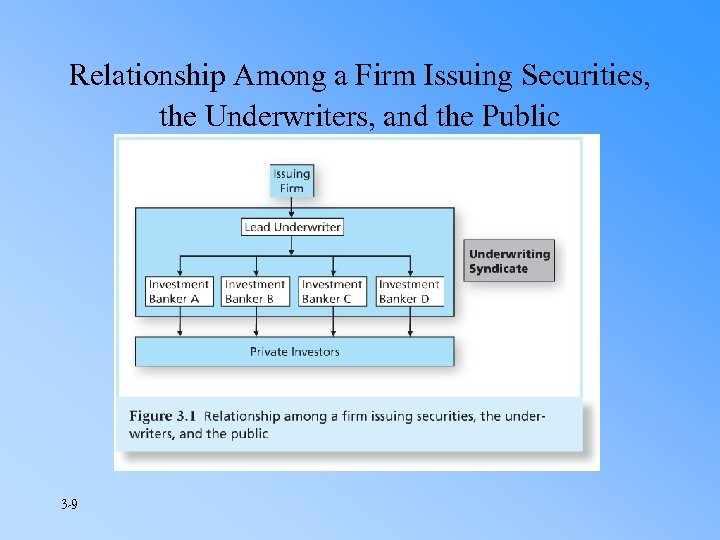

The Underwriting Function • The investment banker purchases the entire issue from the issuer and resells the security to the investing public. • The firm charges a commission for providing this service. • For municipal bonds, the underwriting function is performed by both investment banking firms and commercial banks

The Underwriting Function • The investment banker purchases the entire issue from the issuer and resells the security to the investing public. • The firm charges a commission for providing this service. • For municipal bonds, the underwriting function is performed by both investment banking firms and commercial banks

Relationship Among a Firm Issuing Securities, the Underwriters, and the Public 3 -9

Relationship Among a Firm Issuing Securities, the Underwriters, and the Public 3 -9

Investment Banking • Firm commitment – investment bank purchases securities from the issuing company and then resells them to the public. • Shelf Registration – SEC Rule 415: Allows firms to register securities and gradually sell them to the public for two years 3 -10

Investment Banking • Firm commitment – investment bank purchases securities from the issuing company and then resells them to the public. • Shelf Registration – SEC Rule 415: Allows firms to register securities and gradually sell them to the public for two years 3 -10

Corporate Bond and Stock Issues New issues are divided into two groups 1. Seasoned new issues - new shares offered by firms that already have stock outstanding 2. Initial public offerings (IPOs) - a firm selling its common stock to the public for the first time

Corporate Bond and Stock Issues New issues are divided into two groups 1. Seasoned new issues - new shares offered by firms that already have stock outstanding 2. Initial public offerings (IPOs) - a firm selling its common stock to the public for the first time

Underwriting Relationships with Investment Bankers 1. Negotiated – Most common – Full services of underwriter 2. Competitive bids – Corporation specifies securities offered – Lower costs – Reduced services of underwriter 3. Best-efforts – Investment banker acts as broker

Underwriting Relationships with Investment Bankers 1. Negotiated – Most common – Full services of underwriter 2. Competitive bids – Corporation specifies securities offered – Lower costs – Reduced services of underwriter 3. Best-efforts – Investment banker acts as broker

Introduction of Rule 415 • Allows firms to register securities and sell them piecemeal over the next two years • Referred to as shelf registrations • Great flexibility • Reduces registration fees and expenses • Allows requesting competitive bids from several investment banking firms • Mostly used for bond sales

Introduction of Rule 415 • Allows firms to register securities and sell them piecemeal over the next two years • Referred to as shelf registrations • Great flexibility • Reduces registration fees and expenses • Allows requesting competitive bids from several investment banking firms • Mostly used for bond sales

Private Placements and Rule 144 A • Firms sells to a small group of institutional investors without extensive registration • Lower issuing costs than public offering

Private Placements and Rule 144 A • Firms sells to a small group of institutional investors without extensive registration • Lower issuing costs than public offering

Why Secondary Financial Markets Are Important • Provides liquidity to investors who acquire securities in the primary market • Results in lower required returns than if issuers had to compensate for lower liquidity • Helps determine market pricing for new issues

Why Secondary Financial Markets Are Important • Provides liquidity to investors who acquire securities in the primary market • Results in lower required returns than if issuers had to compensate for lower liquidity • Helps determine market pricing for new issues

Secondary Bond Market • Secondary market for U. S. government and municipal bonds – U. S. government bonds traded by bond dealers – Banks and investment firms make up municipal market makers • Secondary corporate bond market – Traded through an OTC market

Secondary Bond Market • Secondary market for U. S. government and municipal bonds – U. S. government bonds traded by bond dealers – Banks and investment firms make up municipal market makers • Secondary corporate bond market – Traded through an OTC market

Secondary Equity Markets 1. Major national stock exchanges – New York, American, Tokyo, and London stock exchanges 2. Regional stock exchanges – Chicago, San Francisco, Boston, Osaka, Nagoya, Dublin, Cincinnati 3. Over-the-counter (OTC) market – Stocks not listed on organized exchange

Secondary Equity Markets 1. Major national stock exchanges – New York, American, Tokyo, and London stock exchanges 2. Regional stock exchanges – Chicago, San Francisco, Boston, Osaka, Nagoya, Dublin, Cincinnati 3. Over-the-counter (OTC) market – Stocks not listed on organized exchange

Trading Systems • Pure auction market – Buyers and sellers are matched by a broker at a central location – Price-driven market • Dealer market – Dealers provide liquidity by buying and selling shares – Dealers may compete against other dealers

Trading Systems • Pure auction market – Buyers and sellers are matched by a broker at a central location – Price-driven market • Dealer market – Dealers provide liquidity by buying and selling shares – Dealers may compete against other dealers

Call Versus Continuous Markets • Call markets trade individual stocks at specified times to gather all orders and determine a single price to satisfy the most orders • In a continuous market, trades occur at any time the market is open

Call Versus Continuous Markets • Call markets trade individual stocks at specified times to gather all orders and determine a single price to satisfy the most orders • In a continuous market, trades occur at any time the market is open

National Stock Exchanges • Large number of listed securities • Prestige of firms listed • Wide geographic dispersion of listed firms • Diverse clientele of buyers and sellers

National Stock Exchanges • Large number of listed securities • Prestige of firms listed • Wide geographic dispersion of listed firms • Diverse clientele of buyers and sellers

Dhaka Stock Exchange (DSE) • Chittagong Stock Exchange

Dhaka Stock Exchange (DSE) • Chittagong Stock Exchange

Important Stock Exchange in the world • American Stock Exchange (AMEX) • Tokyo Stock Exchange (TSE) • London Stock Exchange (LSE)

Important Stock Exchange in the world • American Stock Exchange (AMEX) • Tokyo Stock Exchange (TSE) • London Stock Exchange (LSE)

Over-the-Counter (OTC) Market • Not a formal organization • Largest segment of the U. S. secondary market • Unlisted stocks and listed stocks (third market) • Lenient requirements for listing on OTC • 5, 000 issues actively traded on NASDAQ NMS (National Association of Securities Dealers Automated Quotations National Market System) • 1, 000 issues on NASDAQ apart from NMS • 1, 000 issues not on NASDAQ

Over-the-Counter (OTC) Market • Not a formal organization • Largest segment of the U. S. secondary market • Unlisted stocks and listed stocks (third market) • Lenient requirements for listing on OTC • 5, 000 issues actively traded on NASDAQ NMS (National Association of Securities Dealers Automated Quotations National Market System) • 1, 000 issues on NASDAQ apart from NMS • 1, 000 issues not on NASDAQ

Operation of the OTC • Any stock may be traded as long as it has a willing market maker to act a dealer • OTC is a negotiated market

Operation of the OTC • Any stock may be traded as long as it has a willing market maker to act a dealer • OTC is a negotiated market

Third Market • OTC trading of shares listed on an exchange • Mostly well known stocks – GM, IBM, AT&T, Xerox • Competes with trades on exchange • May be open when exchange is closed or trading suspended

Third Market • OTC trading of shares listed on an exchange • Mostly well known stocks – GM, IBM, AT&T, Xerox • Competes with trades on exchange • May be open when exchange is closed or trading suspended

Fourth Market • Direct trading of securities between two parties with no broker intermediary • Usually both parties are institutions • Can save transaction costs • No data are available regarding its specific size and growth

Fourth Market • Direct trading of securities between two parties with no broker intermediary • Usually both parties are institutions • Can save transaction costs • No data are available regarding its specific size and growth

Detailed Analysis of Exchange Markets • Exchange Membership • Major Types of Orders • Exchange Market Makers

Detailed Analysis of Exchange Markets • Exchange Membership • Major Types of Orders • Exchange Market Makers

Exchange Membership • Specialist • Commission brokers – Employees of a member firm who buy or sell for the customers of the firm • Floor brokers – Independent members of an exchange who act as broker for other members • Registered traders – Use their membership to buy and sell for their own accounts

Exchange Membership • Specialist • Commission brokers – Employees of a member firm who buy or sell for the customers of the firm • Floor brokers – Independent members of an exchange who act as broker for other members • Registered traders – Use their membership to buy and sell for their own accounts

Major Types of Orders • Market orders – Buy or sell at the best current price – Provides immediate liquidity • Limit orders – Order specifies the buy or sell price – Time specifications for order may vary • Instantaneous - “fill or kill”, part of a day, a full day, several days, a week, a month, or good until canceled (GTC)

Major Types of Orders • Market orders – Buy or sell at the best current price – Provides immediate liquidity • Limit orders – Order specifies the buy or sell price – Time specifications for order may vary • Instantaneous - “fill or kill”, part of a day, a full day, several days, a week, a month, or good until canceled (GTC)

Major Types of Orders • Short sales – Sell overpriced stock that you don’t own and purchase it back later (at a lower price) – Borrow the stock from another investor (through your broker) – Can only be made on an uptick trade – Must pay any dividends to lender – Margin requirements apply

Major Types of Orders • Short sales – Sell overpriced stock that you don’t own and purchase it back later (at a lower price) – Borrow the stock from another investor (through your broker) – Can only be made on an uptick trade – Must pay any dividends to lender – Margin requirements apply

Major Types of Orders • Special Orders – Stop loss • Conditional order to sell stock if it drops to a given price • Does not guarantee price you will get upon sale • Market disruptions cancel such orders – Stop buy order • Investor who sold short may want to limit loss if stock increases in price

Major Types of Orders • Special Orders – Stop loss • Conditional order to sell stock if it drops to a given price • Does not guarantee price you will get upon sale • Market disruptions cancel such orders – Stop buy order • Investor who sold short may want to limit loss if stock increases in price

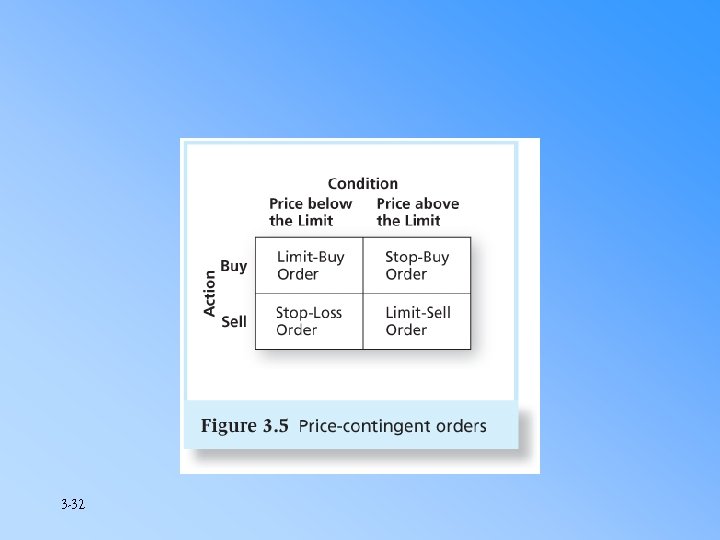

3 -32

3 -32

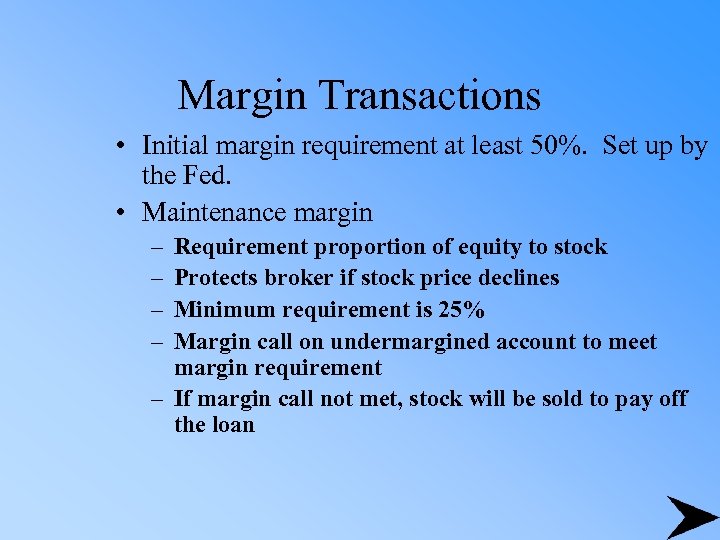

Margin Transactions • On any type order, instead of paying 100% cash, borrow a portion of the transaction, using the stock as collateral • Interest rate on margin credit may be below prime rate • Regulations limit proportion borrowed – Margin requirements are from 50% up • Changes in price affect investor’s equity

Margin Transactions • On any type order, instead of paying 100% cash, borrow a portion of the transaction, using the stock as collateral • Interest rate on margin credit may be below prime rate • Regulations limit proportion borrowed – Margin requirements are from 50% up • Changes in price affect investor’s equity

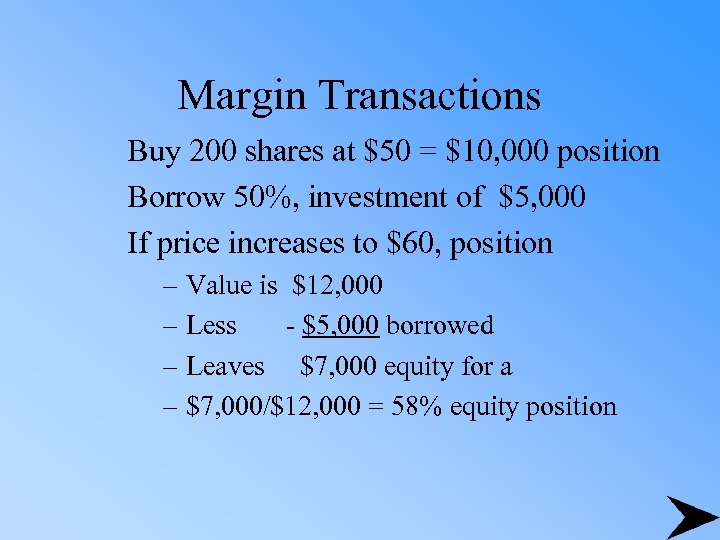

Margin Transactions Buy 200 shares at $50 = $10, 000 position Borrow 50%, investment of $5, 000 If price increases to $60, position – Value is $12, 000 – Less - $5, 000 borrowed – Leaves $7, 000 equity for a – $7, 000/$12, 000 = 58% equity position

Margin Transactions Buy 200 shares at $50 = $10, 000 position Borrow 50%, investment of $5, 000 If price increases to $60, position – Value is $12, 000 – Less - $5, 000 borrowed – Leaves $7, 000 equity for a – $7, 000/$12, 000 = 58% equity position

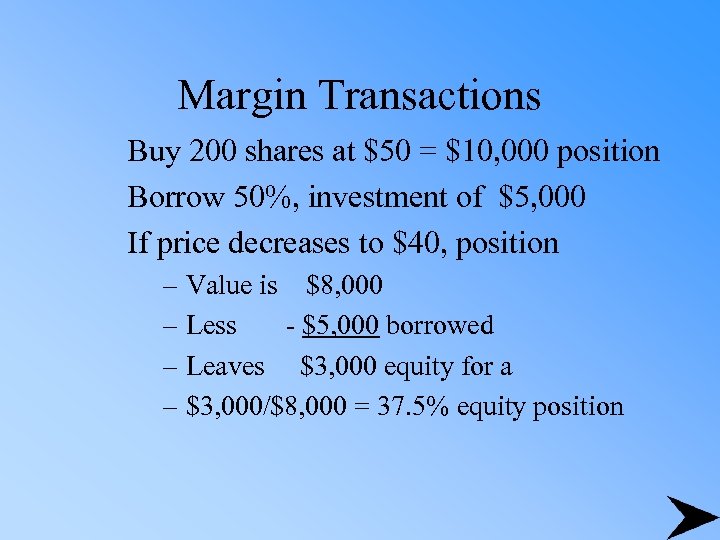

Margin Transactions Buy 200 shares at $50 = $10, 000 position Borrow 50%, investment of $5, 000 If price decreases to $40, position – Value is $8, 000 – Less - $5, 000 borrowed – Leaves $3, 000 equity for a – $3, 000/$8, 000 = 37. 5% equity position

Margin Transactions Buy 200 shares at $50 = $10, 000 position Borrow 50%, investment of $5, 000 If price decreases to $40, position – Value is $8, 000 – Less - $5, 000 borrowed – Leaves $3, 000 equity for a – $3, 000/$8, 000 = 37. 5% equity position

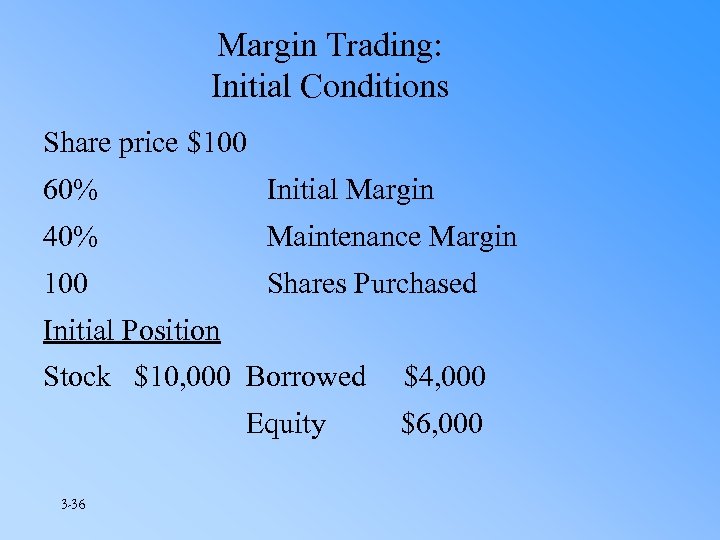

Margin Trading: Initial Conditions Share price $100 60% Initial Margin 40% Maintenance Margin 100 Shares Purchased Initial Position Stock $10, 000 Borrowed Equity 3 -36 $4, 000 $6, 000

Margin Trading: Initial Conditions Share price $100 60% Initial Margin 40% Maintenance Margin 100 Shares Purchased Initial Position Stock $10, 000 Borrowed Equity 3 -36 $4, 000 $6, 000

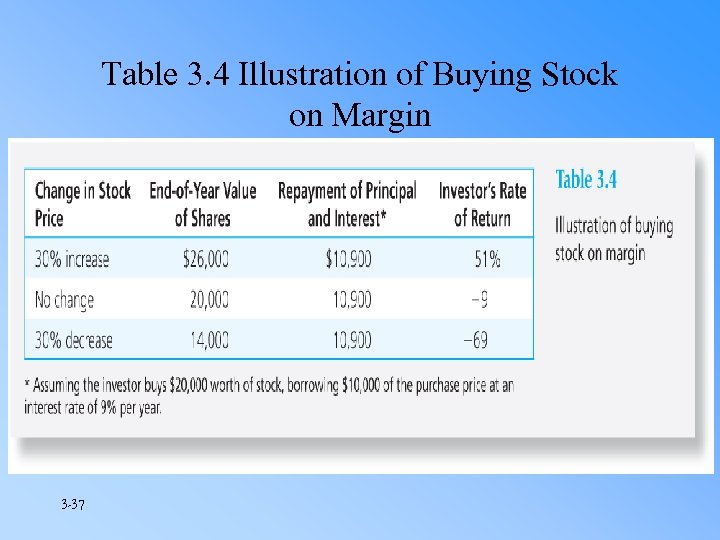

Table 3. 4 Illustration of Buying Stock on Margin 3 -37

Table 3. 4 Illustration of Buying Stock on Margin 3 -37

Margin Transactions • Initial margin requirement at least 50%. Set up by the Fed. • Maintenance margin – – Requirement proportion of equity to stock Protects broker if stock price declines Minimum requirement is 25% Margin call on undermargined account to meet margin requirement – If margin call not met, stock will be sold to pay off the loan

Margin Transactions • Initial margin requirement at least 50%. Set up by the Fed. • Maintenance margin – – Requirement proportion of equity to stock Protects broker if stock price declines Minimum requirement is 25% Margin call on undermargined account to meet margin requirement – If margin call not met, stock will be sold to pay off the loan

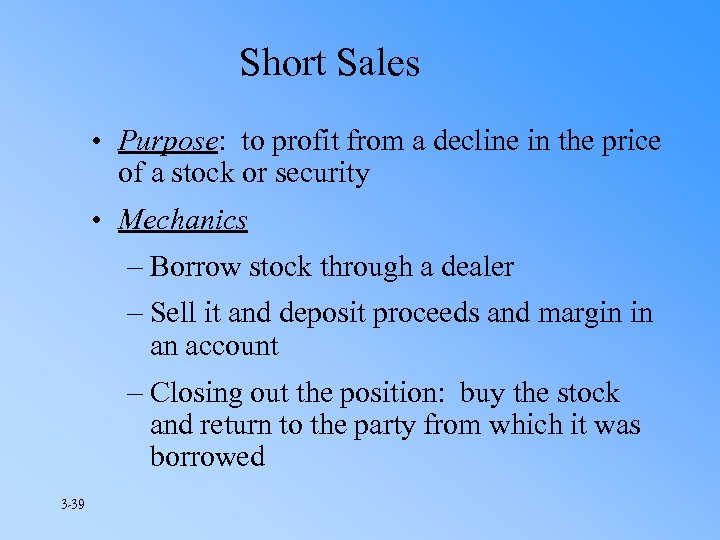

Short Sales • Purpose: to profit from a decline in the price of a stock or security • Mechanics – Borrow stock through a dealer – Sell it and deposit proceeds and margin in an account – Closing out the position: buy the stock and return to the party from which it was borrowed 3 -39

Short Sales • Purpose: to profit from a decline in the price of a stock or security • Mechanics – Borrow stock through a dealer – Sell it and deposit proceeds and margin in an account – Closing out the position: buy the stock and return to the party from which it was borrowed 3 -39

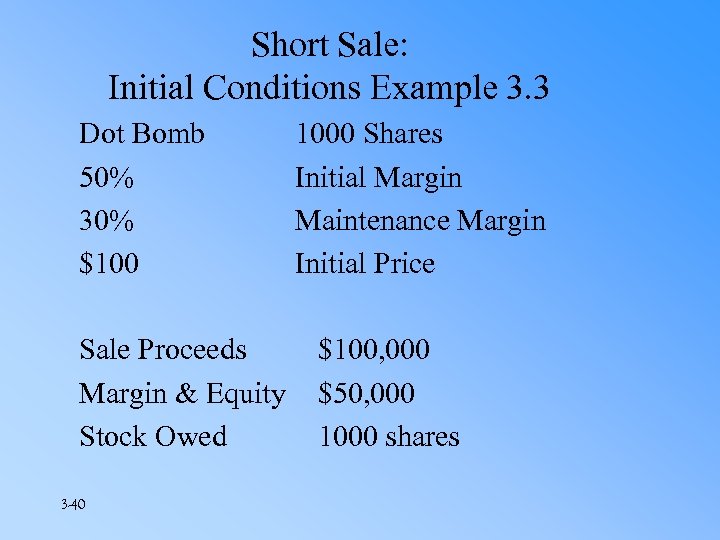

Short Sale: Initial Conditions Example 3. 3 Dot Bomb 50% 30% $100 Sale Proceeds Margin & Equity Stock Owed 3 -40 1000 Shares Initial Margin Maintenance Margin Initial Price $100, 000 $50, 000 1000 shares

Short Sale: Initial Conditions Example 3. 3 Dot Bomb 50% 30% $100 Sale Proceeds Margin & Equity Stock Owed 3 -40 1000 Shares Initial Margin Maintenance Margin Initial Price $100, 000 $50, 000 1000 shares

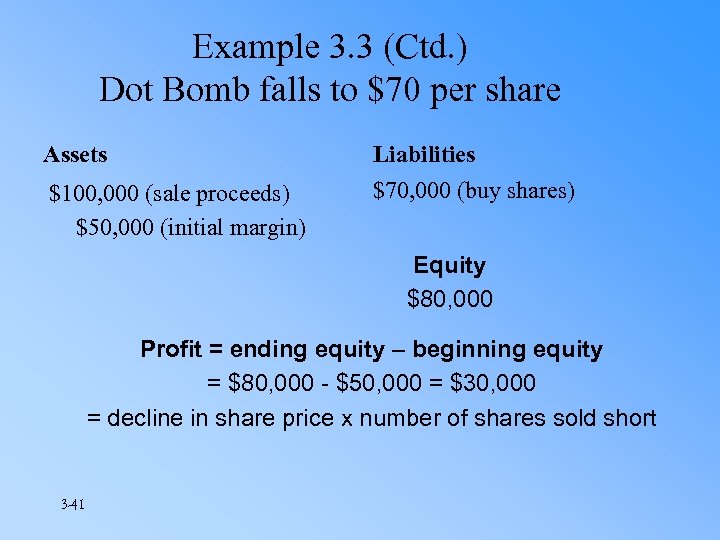

Example 3. 3 (Ctd. ) Dot Bomb falls to $70 per share Assets Liabilities $100, 000 (sale proceeds) $50, 000 (initial margin) $70, 000 (buy shares) Equity $80, 000 Profit = ending equity – beginning equity = $80, 000 - $50, 000 = $30, 000 = decline in share price x number of shares sold short 3 -41

Example 3. 3 (Ctd. ) Dot Bomb falls to $70 per share Assets Liabilities $100, 000 (sale proceeds) $50, 000 (initial margin) $70, 000 (buy shares) Equity $80, 000 Profit = ending equity – beginning equity = $80, 000 - $50, 000 = $30, 000 = decline in share price x number of shares sold short 3 -41

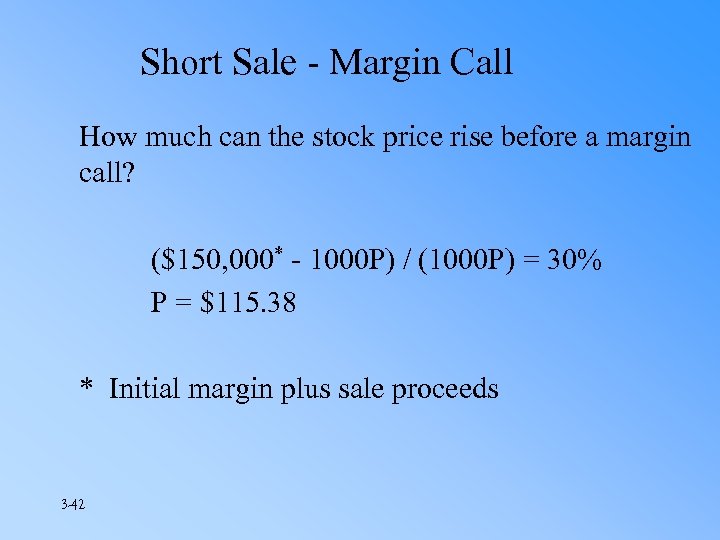

Short Sale - Margin Call How much can the stock price rise before a margin call? ($150, 000* - 1000 P) / (1000 P) = 30% P = $115. 38 * Initial margin plus sale proceeds 3 -42

Short Sale - Margin Call How much can the stock price rise before a margin call? ($150, 000* - 1000 P) / (1000 P) = 30% P = $115. 38 * Initial margin plus sale proceeds 3 -42