d58d1bbaf7ad6b7037ec010fd6825540.ppt

- Количество слайдов: 20

Chapter 4: Money and Inflation § Continued CHAPTER 4 Money and Inflation slide 0

Chapter 4: Money and Inflation § Continued CHAPTER 4 Money and Inflation slide 0

One benefit of inflation § Nominal wages are rarely reduced, even when the equilibrium real wage falls. This hinders labor market clearing. § Sometimes the equilibrium real wage for an industry may change § Now, the firm needs to take the nominal wage as given and hire workers to a point where MPL= W/P CHAPTER 4 Money and Inflation slide 1

One benefit of inflation § Nominal wages are rarely reduced, even when the equilibrium real wage falls. This hinders labor market clearing. § Sometimes the equilibrium real wage for an industry may change § Now, the firm needs to take the nominal wage as given and hire workers to a point where MPL= W/P CHAPTER 4 Money and Inflation slide 1

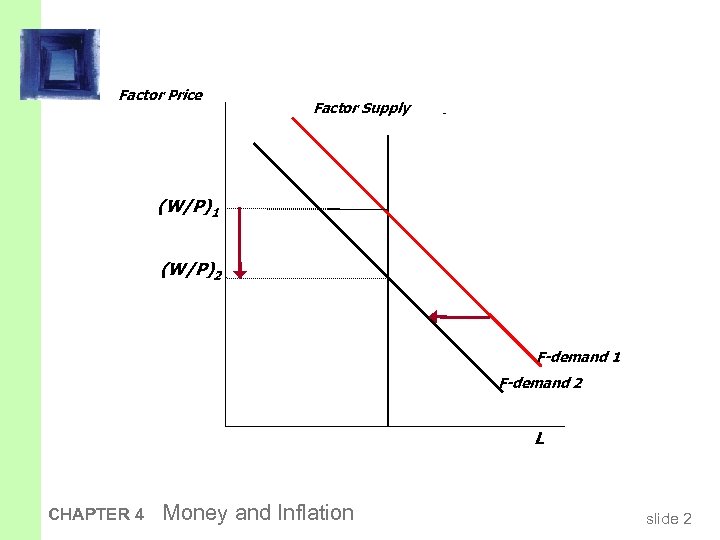

Factor Price Factor Supply (W/P)1 (W/P)2 F-demand 1 F-demand 2 L CHAPTER 4 Money and Inflation slide 2

Factor Price Factor Supply (W/P)1 (W/P)2 F-demand 1 F-demand 2 L CHAPTER 4 Money and Inflation slide 2

§ When this happens, the logical thing to do is to cut the real wage from (W /P) 1 to (W /P) 2 § If prices are fixed, this implies a reduction in nominal wages § However, this is hardly done in practice because workers feel offended. § Inflation allows the real wages to reach equilibrium levels without nominal wage cuts. § Therefore, moderate inflation improves the functioning of labor markets. CHAPTER 4 Money and Inflation slide 3

§ When this happens, the logical thing to do is to cut the real wage from (W /P) 1 to (W /P) 2 § If prices are fixed, this implies a reduction in nominal wages § However, this is hardly done in practice because workers feel offended. § Inflation allows the real wages to reach equilibrium levels without nominal wage cuts. § Therefore, moderate inflation improves the functioning of labor markets. CHAPTER 4 Money and Inflation slide 3

Hyperinflation § def: π = 50% per month § All the costs of moderate inflation described above become HUGE under hyperinflation. § Money ceases to function as a store of value, and may not serve its other functions (unit of account, medium of exchange). § People may conduct transactions with barter or a stable foreign currency. CHAPTER 4 Money and Inflation slide 4

Hyperinflation § def: π = 50% per month § All the costs of moderate inflation described above become HUGE under hyperinflation. § Money ceases to function as a store of value, and may not serve its other functions (unit of account, medium of exchange). § People may conduct transactions with barter or a stable foreign currency. CHAPTER 4 Money and Inflation slide 4

Costs of Hyperinflation -1 § Shoeleather costs: Business executives spend much more time to manage the firms’ cash that they cannot work on production and investment. § Menu costs: Prices change too fast. § Ex: German hyperinflation (1920 s) waiter announces new prices every ½ hour. § Changing relative prices: Almost impossible to do a price search when prices are changing very rapidly. § Ex: German bar: order two pitchers of beer because the price of the 2 nd one increase before you finish 1 st pitcher. CHAPTER 4 Money and Inflation slide 5

Costs of Hyperinflation -1 § Shoeleather costs: Business executives spend much more time to manage the firms’ cash that they cannot work on production and investment. § Menu costs: Prices change too fast. § Ex: German hyperinflation (1920 s) waiter announces new prices every ½ hour. § Changing relative prices: Almost impossible to do a price search when prices are changing very rapidly. § Ex: German bar: order two pitchers of beer because the price of the 2 nd one increase before you finish 1 st pitcher. CHAPTER 4 Money and Inflation slide 5

Costs of Hyperinflation -2 § Tax systems: The real value of our tax payment ↓ by the time government receives it. § Overall inconvenience: Imagine carrying a bag of money to the grocery store. CHAPTER 4 Money and Inflation slide 6

Costs of Hyperinflation -2 § Tax systems: The real value of our tax payment ↓ by the time government receives it. § Overall inconvenience: Imagine carrying a bag of money to the grocery store. CHAPTER 4 Money and Inflation slide 6

What causes hyperinflation? § Hyperinflation is caused by excessive money supply growth: § When the central bank prints money, the price level rises. § If it prints money rapidly enough, the result is hyperinflation. CHAPTER 4 Money and Inflation slide 7

What causes hyperinflation? § Hyperinflation is caused by excessive money supply growth: § When the central bank prints money, the price level rises. § If it prints money rapidly enough, the result is hyperinflation. CHAPTER 4 Money and Inflation slide 7

Aside: “Money printing” § “Money printing” is a technical term that refers to an increase in money supply § Central banks usually increase the money supply through “open market operations” § An “open market purchase” is the central banks purchase of bonds from public § In exchange for bonds, CB gives money to public and the money supply increases CHAPTER 4 Money and Inflation slide 8

Aside: “Money printing” § “Money printing” is a technical term that refers to an increase in money supply § Central banks usually increase the money supply through “open market operations” § An “open market purchase” is the central banks purchase of bonds from public § In exchange for bonds, CB gives money to public and the money supply increases CHAPTER 4 Money and Inflation slide 8

§ Literally printing money through the printing press is also done to replace old currency with new ones. § Because the old currency is replaced with new currency, money supply does not change due to “money printing” via the printing press. § Printing money via printing press is under the autority of the Government (Treasury department) CHAPTER 4 Money and Inflation slide 9

§ Literally printing money through the printing press is also done to replace old currency with new ones. § Because the old currency is replaced with new currency, money supply does not change due to “money printing” via the printing press. § Printing money via printing press is under the autority of the Government (Treasury department) CHAPTER 4 Money and Inflation slide 9

A few examples of hyperinflation money growth (%) inflation (%) Israel, 1983 -85 295 275 Poland, 1989 -90 344 400 Brazil, 1987 -94 1350 1323 Argentina, 1988 -90 1264 1912 Peru, 1988 -90 2974 3849 Nicaragua, 1987 -91 4991 5261 Bolivia, 1984 -85 4208 6515 CHAPTER 4 Money and Inflation slide 10

A few examples of hyperinflation money growth (%) inflation (%) Israel, 1983 -85 295 275 Poland, 1989 -90 344 400 Brazil, 1987 -94 1350 1323 Argentina, 1988 -90 1264 1912 Peru, 1988 -90 2974 3849 Nicaragua, 1987 -91 4991 5261 Bolivia, 1984 -85 4208 6515 CHAPTER 4 Money and Inflation slide 10

Why governments create hyperinflation § Hyperinflations are caused by fiscal imbalances. § G – T: Budget Deficit: Three ways to finance: 1) ↑ T 2) Issue bonds 3) Print money (via printing press) § When a government cannot raise taxes or sell bonds, it must finance spending increases by printing money. CHAPTER 4 Money and Inflation slide 11

Why governments create hyperinflation § Hyperinflations are caused by fiscal imbalances. § G – T: Budget Deficit: Three ways to finance: 1) ↑ T 2) Issue bonds 3) Print money (via printing press) § When a government cannot raise taxes or sell bonds, it must finance spending increases by printing money. CHAPTER 4 Money and Inflation slide 11

§ If the government cannot get the funds via T or bonds, then it may rely on printing money which is inflationary. This starts a circular act: § Printing money → ↑ π → ↓ Real tax revenue → Deficit widens →print more money § In theory, the solution to hyperinflation is simple: stop printing money. § In the real world, this requires drastic and painful fiscal restraint. § Hyperinflations usually end with a fiscal reform. ↑ T, ↓ G CHAPTER 4 Money and Inflation slide 12

§ If the government cannot get the funds via T or bonds, then it may rely on printing money which is inflationary. This starts a circular act: § Printing money → ↑ π → ↓ Real tax revenue → Deficit widens →print more money § In theory, the solution to hyperinflation is simple: stop printing money. § In the real world, this requires drastic and painful fiscal restraint. § Hyperinflations usually end with a fiscal reform. ↑ T, ↓ G CHAPTER 4 Money and Inflation slide 12

The Classical Dichotomy Real variables: Measured in physical units – quantities and relative prices, for example: § quantity of output produced § real wage: output earned per hour of work § real interest rate: output earned in the future by lending one unit of output today CHAPTER 4 Money and Inflation slide 13

The Classical Dichotomy Real variables: Measured in physical units – quantities and relative prices, for example: § quantity of output produced § real wage: output earned per hour of work § real interest rate: output earned in the future by lending one unit of output today CHAPTER 4 Money and Inflation slide 13

§ Nominal variables: Measured in money units, e. g. , § nominal wage: Dollars per hour of work. § nominal interest rate: Dollars earned in future by lending one dollar today. § the price level: The amount of dollars needed to buy a representative basket of goods. CHAPTER 4 Money and Inflation slide 14

§ Nominal variables: Measured in money units, e. g. , § nominal wage: Dollars per hour of work. § nominal interest rate: Dollars earned in future by lending one dollar today. § the price level: The amount of dollars needed to buy a representative basket of goods. CHAPTER 4 Money and Inflation slide 14

§ In chapter 3, we have seen real variables: Real GDP, W/P: all in physical units. § In this chapter, we have seen nominal variables: Money and inflation. § In chapter 3, we have produced and allocated income without any money. § This separation between the real and the nominal side of the economy is called: Classical Dichotomy. CHAPTER 4 Money and Inflation slide 15

§ In chapter 3, we have seen real variables: Real GDP, W/P: all in physical units. § In this chapter, we have seen nominal variables: Money and inflation. § In chapter 3, we have produced and allocated income without any money. § This separation between the real and the nominal side of the economy is called: Classical Dichotomy. CHAPTER 4 Money and Inflation slide 15

Neutrality of Money § Recall the quantity theory: § ∆M has no impact on ∆Y. The irrelevance of money to real variables is called money neutrality. CHAPTER 4 Money and Inflation slide 16

Neutrality of Money § Recall the quantity theory: § ∆M has no impact on ∆Y. The irrelevance of money to real variables is called money neutrality. CHAPTER 4 Money and Inflation slide 16

Conclusions § Classical dichotomy: theoretical separation of real and nominal variables in the classical model, which implies nominal variables do not affect real variables. § Neutrality of money: Changes in the money supply do not affect real variables. In the real world, money is approximately neutral in the long run. CHAPTER 4 Money and Inflation slide 17

Conclusions § Classical dichotomy: theoretical separation of real and nominal variables in the classical model, which implies nominal variables do not affect real variables. § Neutrality of money: Changes in the money supply do not affect real variables. In the real world, money is approximately neutral in the long run. CHAPTER 4 Money and Inflation slide 17

End of chapter problem 10 § Suppose consumption depends on the level of real money balances. § Show that if real money balances depend on the nominal interest rate, an increase in the rate of M growth affects C, I, and r. § Does i adjust one for one to expected inflation? CHAPTER 4 Money and Inflation slide 18

End of chapter problem 10 § Suppose consumption depends on the level of real money balances. § Show that if real money balances depend on the nominal interest rate, an increase in the rate of M growth affects C, I, and r. § Does i adjust one for one to expected inflation? CHAPTER 4 Money and Inflation slide 18

§ C=C(M/P) and (M/P)d =L(i) § M(up) P (up) Inflation (up) i (up) (M/P)d (down) C (down) S=Y-C-G (up) r (down) § i=r + π e (down) (up) CHAPTER 4 Money and Inflation slide 19

§ C=C(M/P) and (M/P)d =L(i) § M(up) P (up) Inflation (up) i (up) (M/P)d (down) C (down) S=Y-C-G (up) r (down) § i=r + π e (down) (up) CHAPTER 4 Money and Inflation slide 19