e58434871290c63f6c324e5912e971ef.ppt

- Количество слайдов: 42

Chapter 4 Market Demand And Elasticity © 2006 Thomson Learning/South-Western

Chapter 4 Market Demand And Elasticity © 2006 Thomson Learning/South-Western

Market Demand Curves n n 2 Market demand: total quantity of good or service demanded by all potential buyers. Market demand curve shows relationship between the total quantity demanded of a single good or service and its price, holding all other factors constant.

Market Demand Curves n n 2 Market demand: total quantity of good or service demanded by all potential buyers. Market demand curve shows relationship between the total quantity demanded of a single good or service and its price, holding all other factors constant.

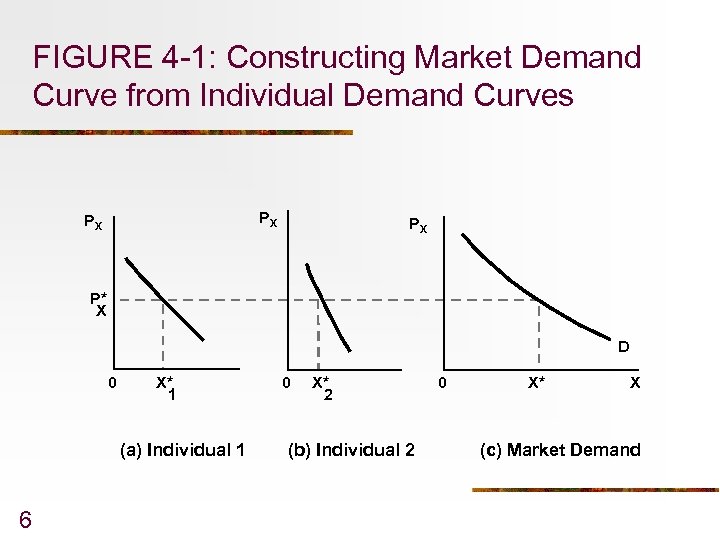

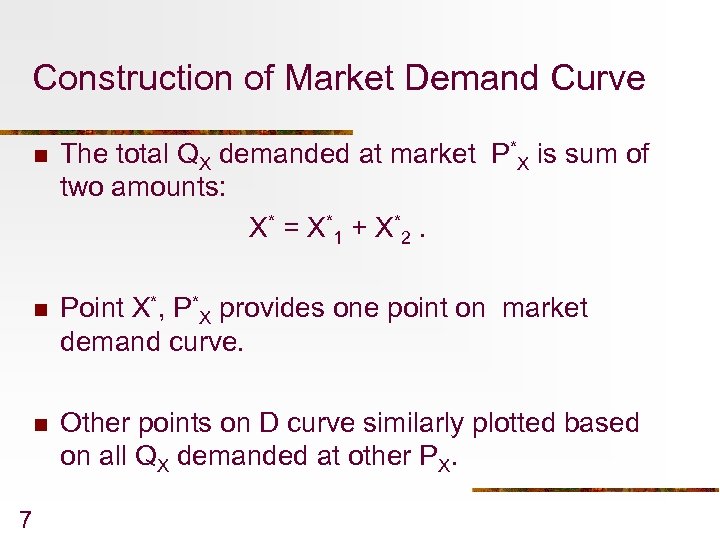

Constructing the Market Demand Curve n n We construct a market demand curve (D) by horizontally summing the all individual consumers’ demand for the good or service. Fig. 4 -1: Assume market consists of only two buyers n 3 At any given price, such as P*X, individual 1 demands X*1 and individual 2 demands X*2.

Constructing the Market Demand Curve n n We construct a market demand curve (D) by horizontally summing the all individual consumers’ demand for the good or service. Fig. 4 -1: Assume market consists of only two buyers n 3 At any given price, such as P*X, individual 1 demands X*1 and individual 2 demands X*2.

FIGURE 4 -1: Constructing a Market Demand Curve from Individual Demand Curves PX P* X 0 X* 1 (a) Individual 1 4

FIGURE 4 -1: Constructing a Market Demand Curve from Individual Demand Curves PX P* X 0 X* 1 (a) Individual 1 4

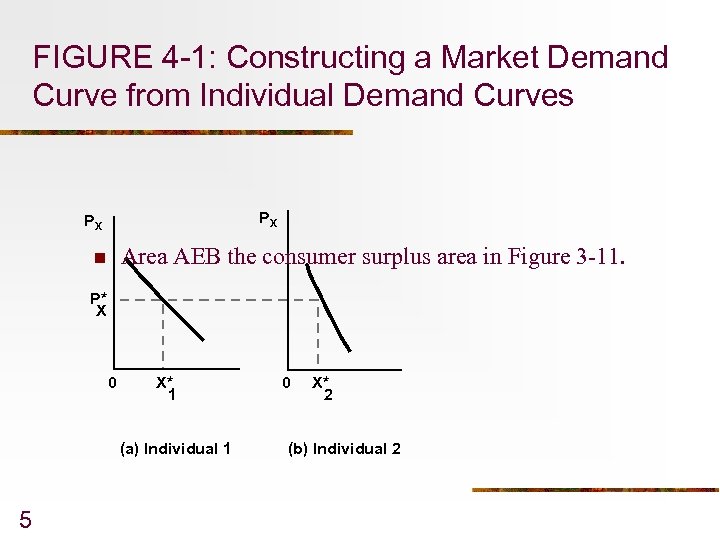

FIGURE 4 -1: Constructing a Market Demand Curve from Individual Demand Curves PX PX Area AEB the consumer surplus area in Figure 3 -11. n P* X 0 X* 1 (a) Individual 1 5 0 X* 2 (b) Individual 2

FIGURE 4 -1: Constructing a Market Demand Curve from Individual Demand Curves PX PX Area AEB the consumer surplus area in Figure 3 -11. n P* X 0 X* 1 (a) Individual 1 5 0 X* 2 (b) Individual 2

FIGURE 4 -1: Constructing Market Demand Curve from Individual Demand Curves PX PX PX P* X D 0 X* 1 (a) Individual 1 6 0 X* 2 (b) Individual 2 0 X* X (c) Market Demand

FIGURE 4 -1: Constructing Market Demand Curve from Individual Demand Curves PX PX PX P* X D 0 X* 1 (a) Individual 1 6 0 X* 2 (b) Individual 2 0 X* X (c) Market Demand

Construction of Market Demand Curve n n Point X*, P*X provides one point on market demand curve. n 7 The total QX demanded at market P*X is sum of two amounts: X * = X *1 + X *2. Other points on D curve similarly plotted based on all QX demanded at other PX.

Construction of Market Demand Curve n n Point X*, P*X provides one point on market demand curve. n 7 The total QX demanded at market P*X is sum of two amounts: X * = X *1 + X *2. Other points on D curve similarly plotted based on all QX demanded at other PX.

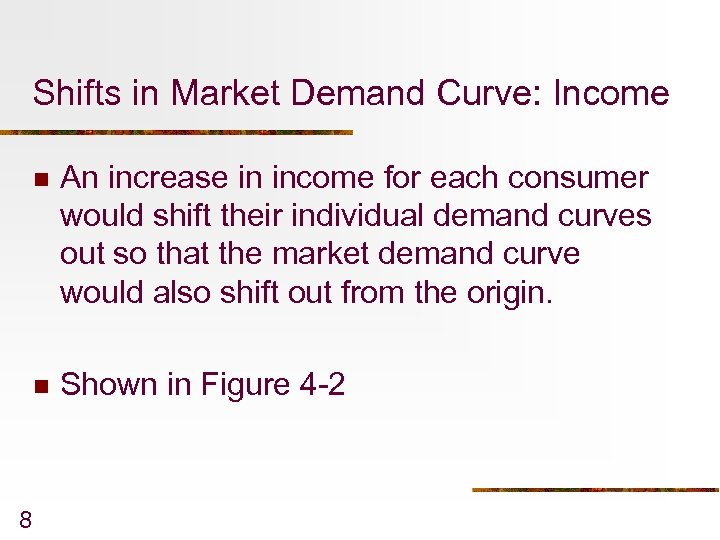

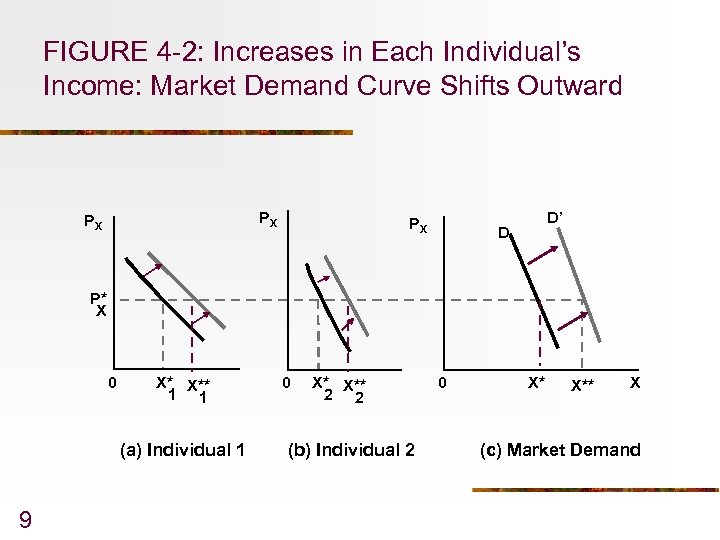

Shifts in Market Demand Curve: Income n n 8 An increase in income for each consumer would shift their individual demand curves out so that the market demand curve would also shift out from the origin. Shown in Figure 4 -2

Shifts in Market Demand Curve: Income n n 8 An increase in income for each consumer would shift their individual demand curves out so that the market demand curve would also shift out from the origin. Shown in Figure 4 -2

FIGURE 4 -2: Increases in Each Individual’s Income: Market Demand Curve Shifts Outward PX PX PX D’ D P* X 0 X* X** 1 1 (a) Individual 1 9 0 X* X** 2 2 (b) Individual 2 0 X* X** X (c) Market Demand

FIGURE 4 -2: Increases in Each Individual’s Income: Market Demand Curve Shifts Outward PX PX PX D’ D P* X 0 X* X** 1 1 (a) Individual 1 9 0 X* X** 2 2 (b) Individual 2 0 X* X** X (c) Market Demand

Shifts in Market Demand Curve: Income n Some events result in ambiguous demand curve outcomes: n n 10 If one consumer’s demand curve shifts out while another’s shifts in, the net effect depends on the size of the relative shifts. Income increases for pizza lovers would increase market demand for pizza, so long as pizza is normal good.

Shifts in Market Demand Curve: Income n Some events result in ambiguous demand curve outcomes: n n 10 If one consumer’s demand curve shifts out while another’s shifts in, the net effect depends on the size of the relative shifts. Income increases for pizza lovers would increase market demand for pizza, so long as pizza is normal good.

Shifts in Market Demand Curve: Income n If only people who don’t like pizza enjoyed income increases, the market demand curve for pizza would not change. n Changes in prices of related goods-substitutes or complements--will also shift individual and market demand curves. 11

Shifts in Market Demand Curve: Income n If only people who don’t like pizza enjoyed income increases, the market demand curve for pizza would not change. n Changes in prices of related goods-substitutes or complements--will also shift individual and market demand curves. 11

Shifts in Market Demand Curve: Related Goods n If goods X and Y are substitutes, an increase in PY will increase DX. Similarly, a decrease in PY will decrease DX. n If goods X and Y are complements, an increase in PY will decrease DX. A decrease in PY will increase DX. 12

Shifts in Market Demand Curve: Related Goods n If goods X and Y are substitutes, an increase in PY will increase DX. Similarly, a decrease in PY will decrease DX. n If goods X and Y are complements, an increase in PY will decrease DX. A decrease in PY will increase DX. 12

Elasticity n Elasticity: measures percentage change in one variable brought about by a 1 percent change in some other variable. n Because it’s measured in percentages, units cancel out-- elasticity is a unit-less measure of responsiveness. 13

Elasticity n Elasticity: measures percentage change in one variable brought about by a 1 percent change in some other variable. n Because it’s measured in percentages, units cancel out-- elasticity is a unit-less measure of responsiveness. 13

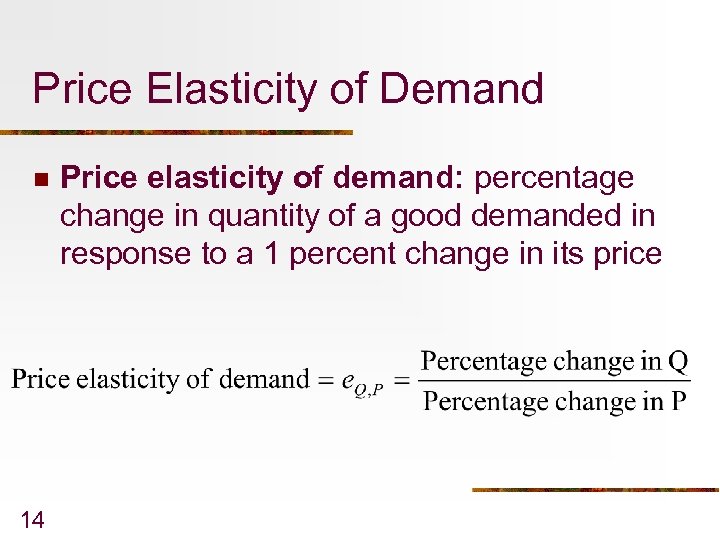

Price Elasticity of Demand n 14 Price elasticity of demand: percentage change in quantity of a good demanded in response to a 1 percent change in its price

Price Elasticity of Demand n 14 Price elasticity of demand: percentage change in quantity of a good demanded in response to a 1 percent change in its price

Price Elasticity of Demand n n n 15 Price elasticity of demand records how QX changes (in percentage terms) given a percentage change in PX. On typical demand curve, P and Q move oppositely: e. Q, P will be negative. For example, if e. Q, P = -2, a 1 percent increase in price leads to a 2 percent decrease in quantity demanded.

Price Elasticity of Demand n n n 15 Price elasticity of demand records how QX changes (in percentage terms) given a percentage change in PX. On typical demand curve, P and Q move oppositely: e. Q, P will be negative. For example, if e. Q, P = -2, a 1 percent increase in price leads to a 2 percent decrease in quantity demanded.

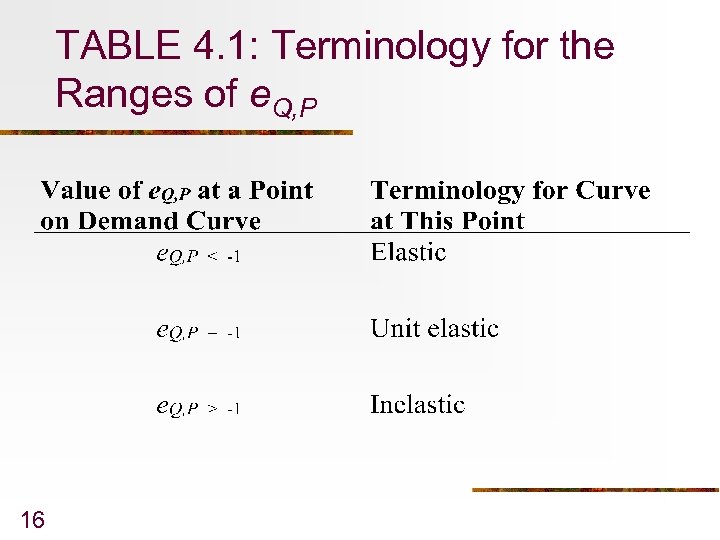

TABLE 4. 1: Terminology for the Ranges of e. Q, P 16

TABLE 4. 1: Terminology for the Ranges of e. Q, P 16

Price Elasticity: Substitutes Effect n n 17 Goods that have many close substitutes are strongly affected by price changes, so their market demand curve is likely to be relatively elastic (flat). Goods with few close substitutes will likely be relatively inelastic (demand curve will be more steep).

Price Elasticity: Substitutes Effect n n 17 Goods that have many close substitutes are strongly affected by price changes, so their market demand curve is likely to be relatively elastic (flat). Goods with few close substitutes will likely be relatively inelastic (demand curve will be more steep).

Price Elasticity and the Substitution Effect n n 18 There is also an income effect that will determine how responsive quantity demanded is to changes in price. However, since changes in the prices of most goods have a small effect on individuals’ real incomes, the income effect will likely not have as large an impact on elasticity as the substitution effect.

Price Elasticity and the Substitution Effect n n 18 There is also an income effect that will determine how responsive quantity demanded is to changes in price. However, since changes in the prices of most goods have a small effect on individuals’ real incomes, the income effect will likely not have as large an impact on elasticity as the substitution effect.

Price Elasticity and Time n For some items, substitutes can be quickly developed--such as brands of breakfast cereal. Other goods, such as heating fuel, are much less subject to being copied. n We must thus make the distinction between short-term and long-term price elasticities of demand. 19

Price Elasticity and Time n For some items, substitutes can be quickly developed--such as brands of breakfast cereal. Other goods, such as heating fuel, are much less subject to being copied. n We must thus make the distinction between short-term and long-term price elasticities of demand. 19

Price Elasticity and Total Expenditures n n Total expenditures on a good are found by multiplying the good’s price (PX) times the quantity purchased (QX). When demand is price elastic, price increases will cause total expenditures to fall. n 20 Given percentage increase in price more than counterbalanced by decrease in quantity demanded.

Price Elasticity and Total Expenditures n n Total expenditures on a good are found by multiplying the good’s price (PX) times the quantity purchased (QX). When demand is price elastic, price increases will cause total expenditures to fall. n 20 Given percentage increase in price more than counterbalanced by decrease in quantity demanded.

Price Elasticity and Total Expenditures n Suppose price elasticity of demand = -2. n n n 21 Initially people buy 1 million automobiles at $10, 000 each-- total expenditure of $10 billion. 10% price increase to $11, 000 would cause 20 percent decline in cars purchased to 800, 000 vehicles. Total expenditures after price increase would be only $8. 8 billion

Price Elasticity and Total Expenditures n Suppose price elasticity of demand = -2. n n n 21 Initially people buy 1 million automobiles at $10, 000 each-- total expenditure of $10 billion. 10% price increase to $11, 000 would cause 20 percent decline in cars purchased to 800, 000 vehicles. Total expenditures after price increase would be only $8. 8 billion

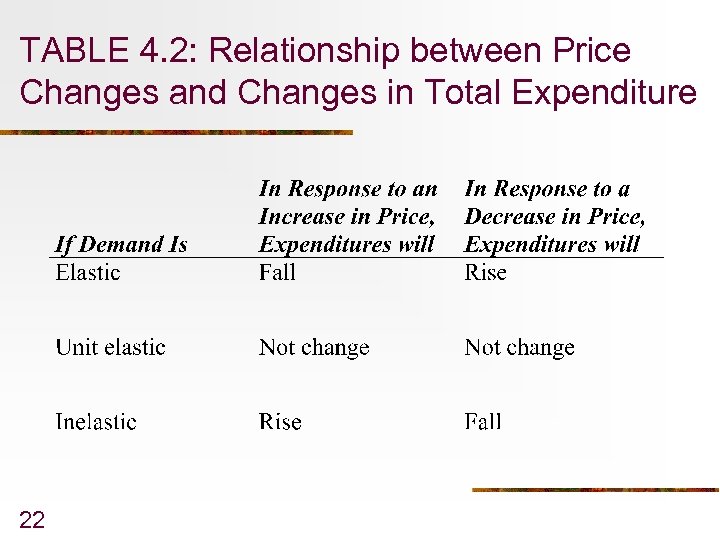

TABLE 4. 2: Relationship between Price Changes and Changes in Total Expenditure 22

TABLE 4. 2: Relationship between Price Changes and Changes in Total Expenditure 22

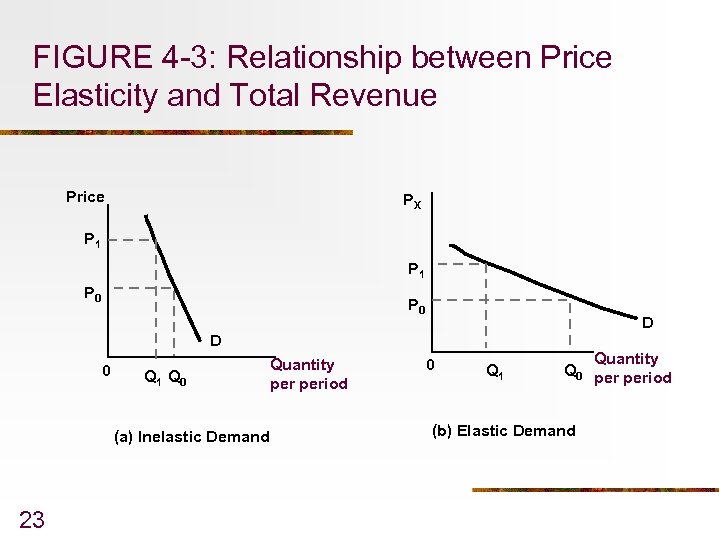

FIGURE 4 -3: Relationship between Price Elasticity and Total Revenue Price PX P 1 P 0 D D 0 Q 1 Q 0 (a) Inelastic Demand 23 Quantity period 0 Q 1 Quantity Q 0 period (b) Elastic Demand

FIGURE 4 -3: Relationship between Price Elasticity and Total Revenue Price PX P 1 P 0 D D 0 Q 1 Q 0 (a) Inelastic Demand 23 Quantity period 0 Q 1 Quantity Q 0 period (b) Elastic Demand

Demand Curves and Price Elasticity n Relationship between particular demand curve and price elasticity it exhibits can be complicated. n For some curves, elasticity remains constant everywhere (unit elastic); for others, it differs at every point along curve. n More accurate to describe elasticity at current price—specifies point on curve. 24

Demand Curves and Price Elasticity n Relationship between particular demand curve and price elasticity it exhibits can be complicated. n For some curves, elasticity remains constant everywhere (unit elastic); for others, it differs at every point along curve. n More accurate to describe elasticity at current price—specifies point on curve. 24

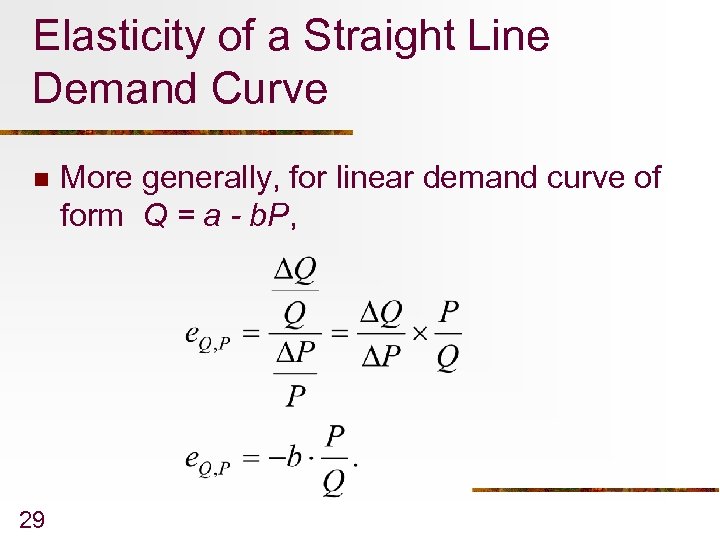

Linear Demand Curves and Price Elasticity n Price elasticity of demand changes continuously along linear demand curves. n n n 25 Demand elastic at prices above midpoint price. Demand unit elastic at midpoint price. Demand inelastic at prices below midpoint price.

Linear Demand Curves and Price Elasticity n Price elasticity of demand changes continuously along linear demand curves. n n n 25 Demand elastic at prices above midpoint price. Demand unit elastic at midpoint price. Demand inelastic at prices below midpoint price.

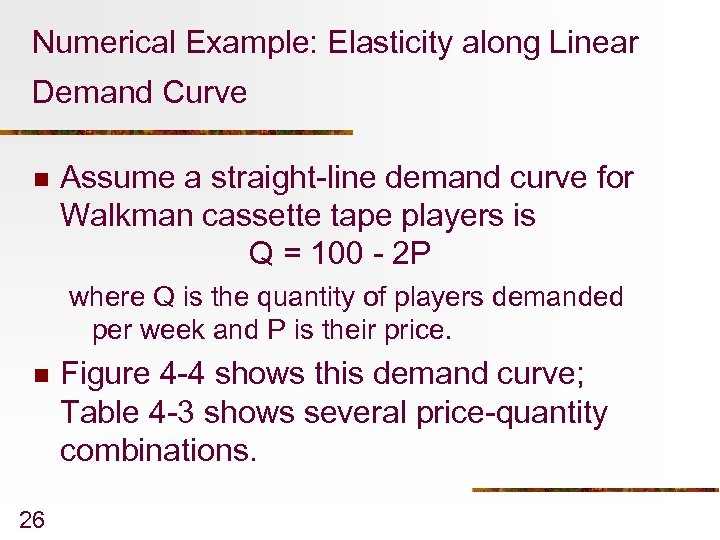

Numerical Example: Elasticity along Linear Demand Curve n Assume a straight-line demand curve for Walkman cassette tape players is Q = 100 - 2 P where Q is the quantity of players demanded per week and P is their price. n 26 Figure 4 -4 shows this demand curve; Table 4 -3 shows several price-quantity combinations.

Numerical Example: Elasticity along Linear Demand Curve n Assume a straight-line demand curve for Walkman cassette tape players is Q = 100 - 2 P where Q is the quantity of players demanded per week and P is their price. n 26 Figure 4 -4 shows this demand curve; Table 4 -3 shows several price-quantity combinations.

FIGURE 4 -4: Elasticity Varies along a Linear Demand Curve Price (dollars) 50 40 30 25 Demand 20 10 0 27 20 4050 60 80 100 Quantity of CD players per week

FIGURE 4 -4: Elasticity Varies along a Linear Demand Curve Price (dollars) 50 40 30 25 Demand 20 10 0 27 20 4050 60 80 100 Quantity of CD players per week

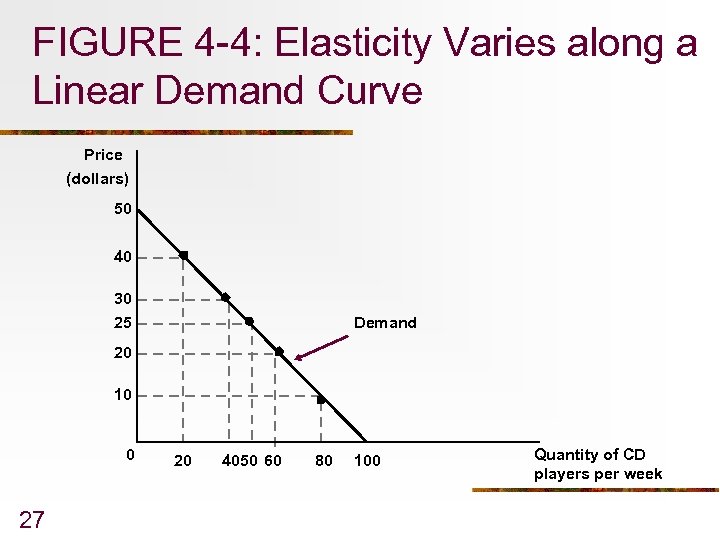

TABLE 4 -3: Price, Quantity, and Total Expenditures on Walkmans for Demand Function Q = 100 - 2 P 28

TABLE 4 -3: Price, Quantity, and Total Expenditures on Walkmans for Demand Function Q = 100 - 2 P 28

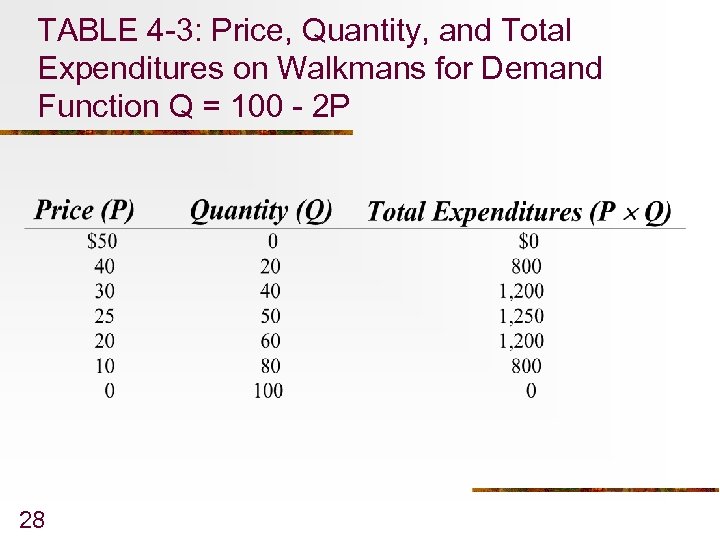

Elasticity of a Straight Line Demand Curve n 29 More generally, for linear demand curve of form Q = a - b. P,

Elasticity of a Straight Line Demand Curve n 29 More generally, for linear demand curve of form Q = a - b. P,

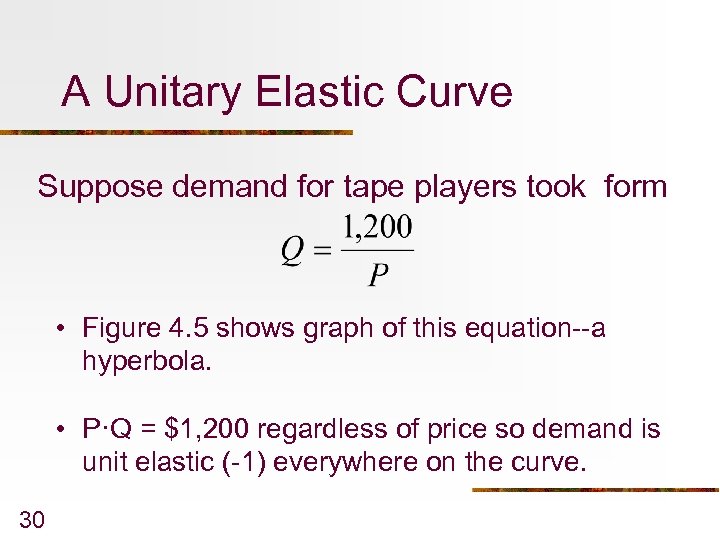

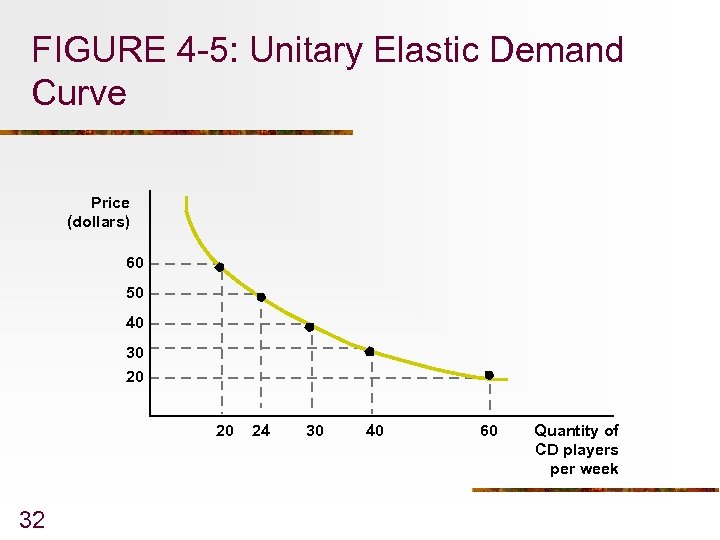

A Unitary Elastic Curve Suppose demand for tape players took form • Figure 4. 5 shows graph of this equation--a hyperbola. • P·Q = $1, 200 regardless of price so demand is unit elastic (-1) everywhere on the curve. 30

A Unitary Elastic Curve Suppose demand for tape players took form • Figure 4. 5 shows graph of this equation--a hyperbola. • P·Q = $1, 200 regardless of price so demand is unit elastic (-1) everywhere on the curve. 30

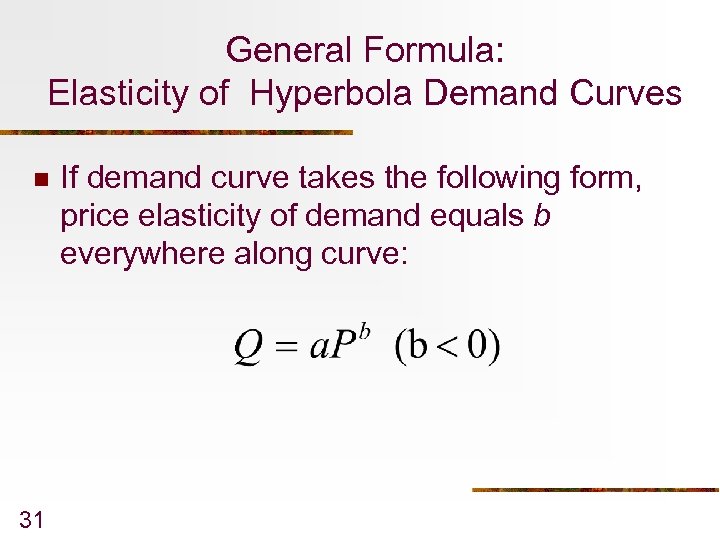

General Formula: Elasticity of Hyperbola Demand Curves n 31 If demand curve takes the following form, price elasticity of demand equals b everywhere along curve:

General Formula: Elasticity of Hyperbola Demand Curves n 31 If demand curve takes the following form, price elasticity of demand equals b everywhere along curve:

FIGURE 4 -5: Unitary Elastic Demand Curve Price (dollars) 60 50 40 30 20 20 32 24 30 40 60 Quantity of CD players per week

FIGURE 4 -5: Unitary Elastic Demand Curve Price (dollars) 60 50 40 30 20 20 32 24 30 40 60 Quantity of CD players per week

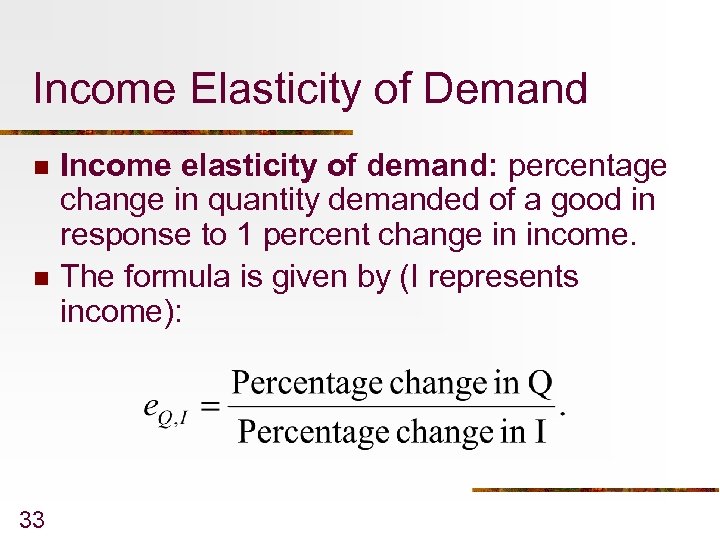

Income Elasticity of Demand n n 33 Income elasticity of demand: percentage change in quantity demanded of a good in response to 1 percent change in income. The formula is given by (I represents income):

Income Elasticity of Demand n n 33 Income elasticity of demand: percentage change in quantity demanded of a good in response to 1 percent change in income. The formula is given by (I represents income):

Income Elasticity of Demand n n n 34 Normal goods: e. Q, I positive--income increases lead to increased purchases of good. Inferior goods: e. Q, I negative e. Q, I > 1, purchase of good increases more on percentage basis than income--good is called luxury good.

Income Elasticity of Demand n n n 34 Normal goods: e. Q, I positive--income increases lead to increased purchases of good. Inferior goods: e. Q, I negative e. Q, I > 1, purchase of good increases more on percentage basis than income--good is called luxury good.

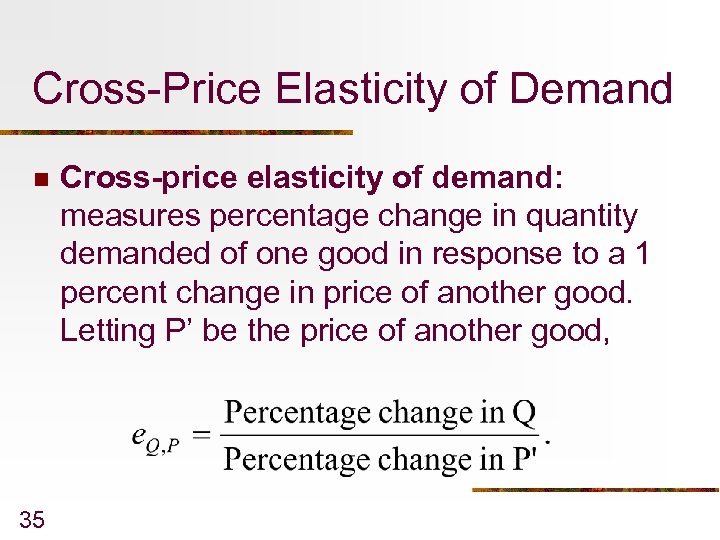

Cross-Price Elasticity of Demand n 35 Cross-price elasticity of demand: measures percentage change in quantity demanded of one good in response to a 1 percent change in price of another good. Letting P’ be the price of another good,

Cross-Price Elasticity of Demand n 35 Cross-price elasticity of demand: measures percentage change in quantity demanded of one good in response to a 1 percent change in price of another good. Letting P’ be the price of another good,

Cross-Price Elasticity of Demand n n 36 If goods are substitutes, increase in price of one good will cause buyers to purchase more of substitute: Cross-price elasticity positive. If goods are complements, increase in price of one good will cause buyers to buy less of that good as well as less of the complementary good: Cross-price elasticity negative.

Cross-Price Elasticity of Demand n n 36 If goods are substitutes, increase in price of one good will cause buyers to purchase more of substitute: Cross-price elasticity positive. If goods are complements, increase in price of one good will cause buyers to buy less of that good as well as less of the complementary good: Cross-price elasticity negative.

Problems Estimating Demand Curves n First problem: how to derive estimate holding all other factors constant (the ceteris paribus assumption). n As discussed in Appendix to Chapter 1, ceteris paribus problem often solved using multiple regression analysis. 37

Problems Estimating Demand Curves n First problem: how to derive estimate holding all other factors constant (the ceteris paribus assumption). n As discussed in Appendix to Chapter 1, ceteris paribus problem often solved using multiple regression analysis. 37

Problems Estimating Demand Curves n n 38 Second problem: what is observed in the data. Data points represent quantity and price outcomes simultaneously determined by both demand supply curves. Econometric problem here is to “identify” the demand curve from equilibrium points that generated curve.

Problems Estimating Demand Curves n n 38 Second problem: what is observed in the data. Data points represent quantity and price outcomes simultaneously determined by both demand supply curves. Econometric problem here is to “identify” the demand curve from equilibrium points that generated curve.

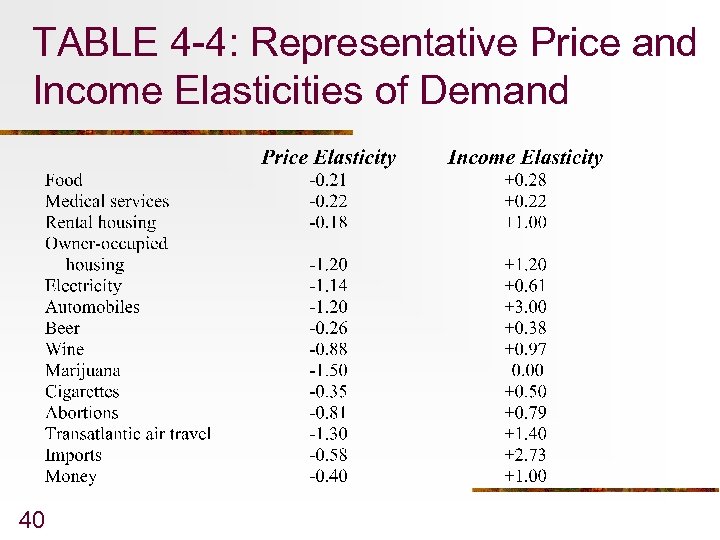

Some Elasticity Estimates n n Table 4 -4 gathers estimated income and price elasticities of demand. Note: n n 39 All estimated price elasticities are less than zero--as predicted by negatively sloped demand curve. Most price elasticity estimates indicate that goods are price inelastic.

Some Elasticity Estimates n n Table 4 -4 gathers estimated income and price elasticities of demand. Note: n n 39 All estimated price elasticities are less than zero--as predicted by negatively sloped demand curve. Most price elasticity estimates indicate that goods are price inelastic.

TABLE 4 -4: Representative Price and Income Elasticities of Demand 40

TABLE 4 -4: Representative Price and Income Elasticities of Demand 40

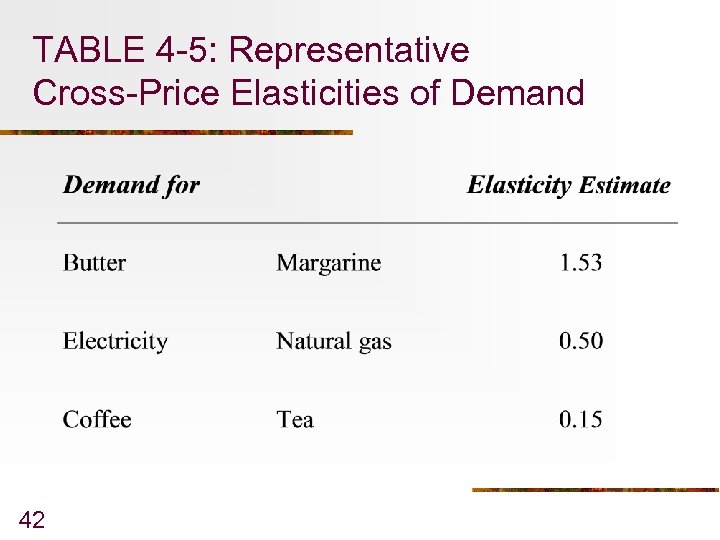

Some Cross-price Elasticity Estimates n Table 4 -5 shows cross-price elasticity estimates n All goods appear to be substitutes and have positive cross-price elasticities. 41

Some Cross-price Elasticity Estimates n Table 4 -5 shows cross-price elasticity estimates n All goods appear to be substitutes and have positive cross-price elasticities. 41

TABLE 4 -5: Representative Cross-Price Elasticities of Demand 42

TABLE 4 -5: Representative Cross-Price Elasticities of Demand 42