37ff39e96beeed3c49b4e407d8594403.ppt

- Количество слайдов: 50

CHAPTER 4 Internal Analysis: Resources, Capabilities, and Activities Mc. Graw-Hill/Irwin Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

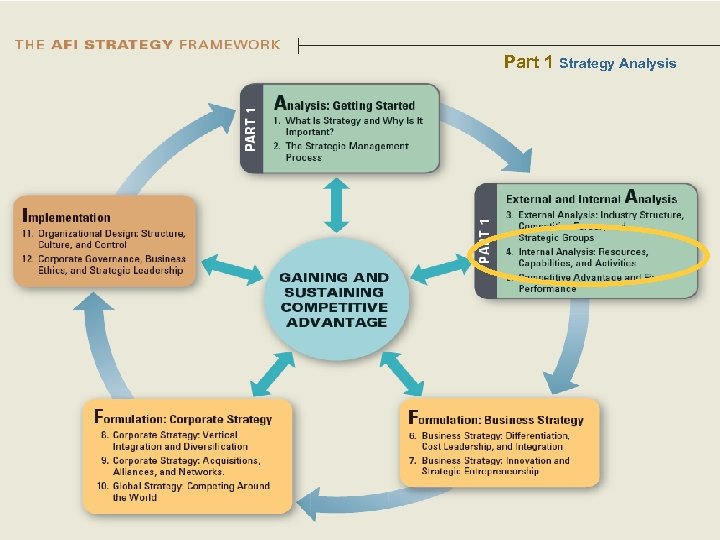

Part 1 Strategy Analysis

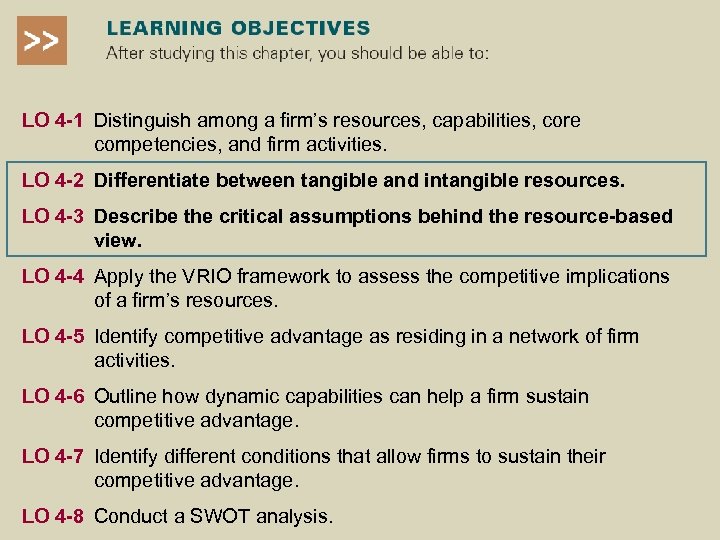

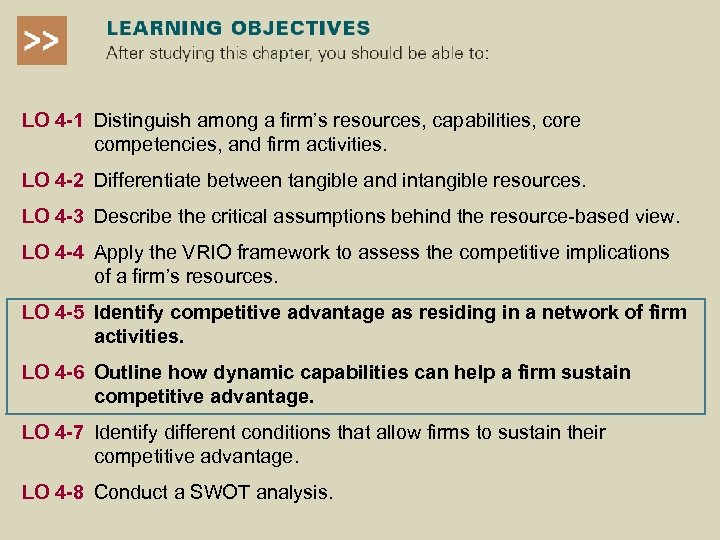

LO 4 -1 Distinguish among a firm’s resources, capabilities, core competencies, and firm activities. LO 4 -2 Differentiate between tangible and intangible resources. LO 4 -3 Describe the critical assumptions behind the resource-based view. LO 4 -4 Apply the VRIO framework to assess the competitive implications of a firm’s resources. LO 4 -5 Identify competitive advantage as residing in a network of firm activities. LO 4 -6 Outline how dynamic capabilities can help a firm sustain competitive advantage. LO 4 -7 Identify different conditions that allow firms to sustain their competitive advantage. LO 4 -8 Conduct a SWOT analysis.

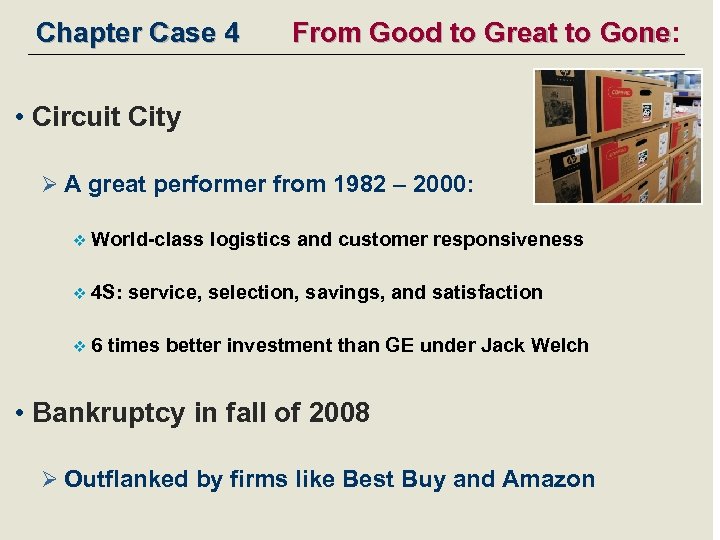

Chapter Case 4 From Good to Great to Gone: Gone • Circuit City Ø A great performer from 1982 – 2000: v World-class logistics and customer responsiveness v 4 S: service, selection, savings, and satisfaction v 6 times better investment than GE under Jack Welch • Bankruptcy in fall of 2008 Ø Outflanked by firms like Best Buy and Amazon

Chapter Case 4 Circuit City • What are the key issues in Circuit City’s demise? Ø Management distracted by other businesses v Insufficient v Laid-off investments in core competencies 3, 000 very experienced sales staff Ø Response to online retailers inadequate v Best Buy also having problems with this recently

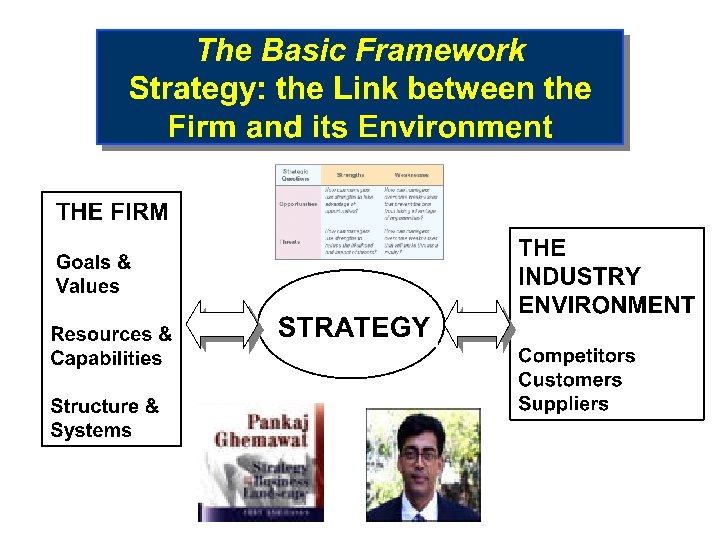

Internal Analysis: Inside the Firm • Comparing two firms in same industry: Internal focus Ø Core Competencies v Unique v Can strengths deep inside that differentiate a firm drive competitive advantage Ø Strategic Fit v Internal strengths change with the external environment

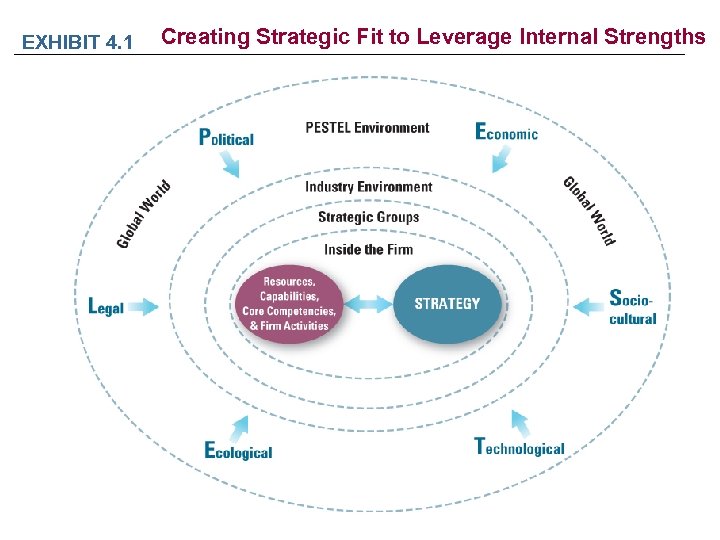

EXHIBIT 4. 1 Creating Strategic Fit to Leverage Internal Strengths

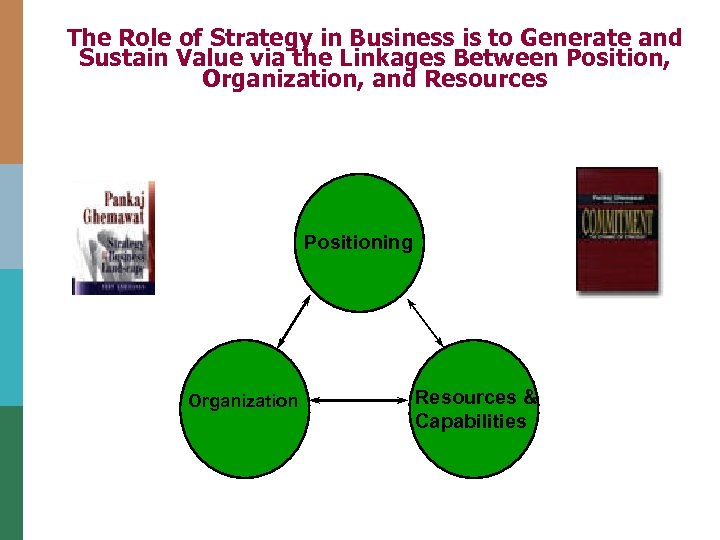

The Role of Strategy in Business is to Generate and Sustain Value via the Linkages Between Position, Organization, and Resources Positioning Organization Resources & Capabilities

Positioning • Scope of the Firm: Ø Geographic scope Ø Product-market scope: Choice of businesses (corporate portfolio analysis) Ø Product market positioning within a business Ø Vertical integration decisions 9

Organization • Structure Ø Formal definition of authority Ø Conflict resolution • Systems Ø Rules, routines, evaluation and rewards • Processes Ø Informal communication, networks, and recruitment

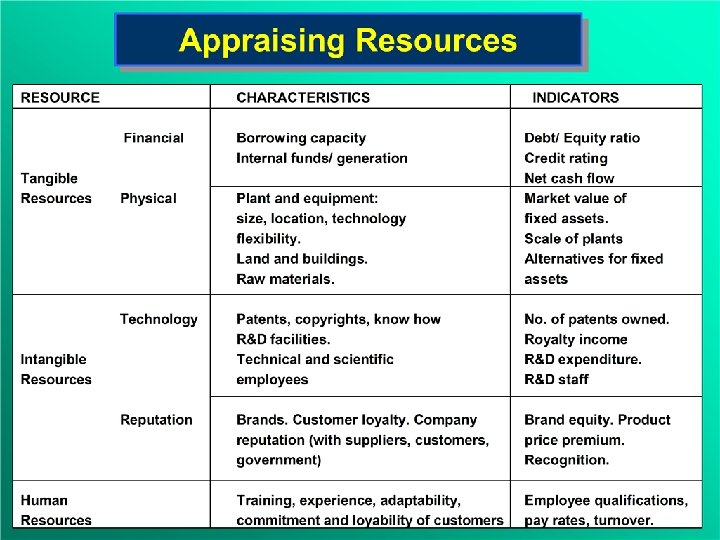

Resources and Capabilities • Tangible resources Ø e. g. , physical capital • Organizational capabilities Ø e. g. , routines and standard operating procedures • Intangible resources Ø e. g. , trademarks, “know-how” 11

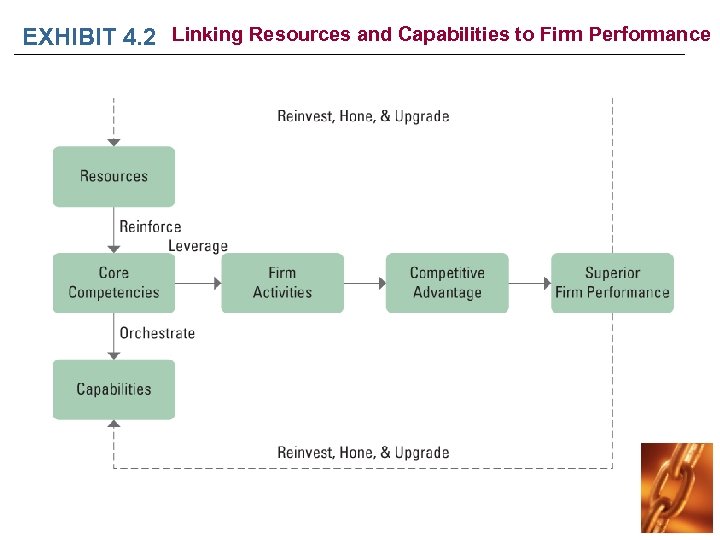

EXHIBIT 4. 2 Linking Resources and Capabilities to Firm Performance

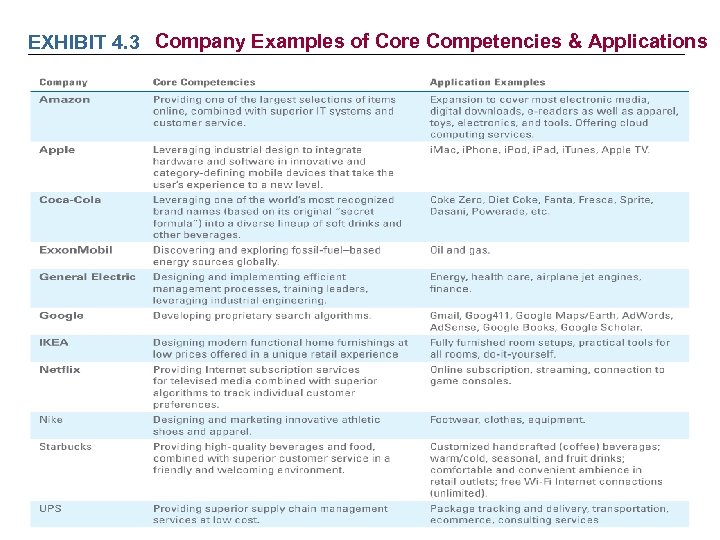

EXHIBIT 4. 3 Company Examples of Core Competencies & Applications

LO 4 -1 Distinguish among a firm’s resources, capabilities, core competencies, and firm activities. LO 4 -2 Differentiate between tangible and intangible resources. LO 4 -3 Describe the critical assumptions behind the resource-based view. LO 4 -4 Apply the VRIO framework to assess the competitive implications of a firm’s resources. LO 4 -5 Identify competitive advantage as residing in a network of firm activities. LO 4 -6 Outline how dynamic capabilities can help a firm sustain competitive advantage. LO 4 -7 Identify different conditions that allow firms to sustain their competitive advantage. LO 4 -8 Conduct a SWOT analysis.

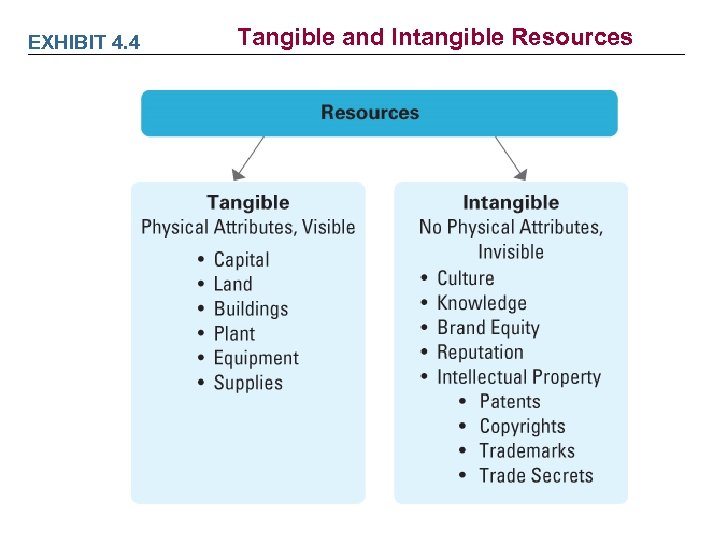

EXHIBIT 4. 4 Tangible and Intangible Resources

The Resource-based View • Google Example Ø Tangible resources valued at $5 billion Ø Intangible brand valued at over $100 billion Ø Googleplex has both tangible and intangible aspects • Competitive Advantage More Likely…. . Ø From intangible resources

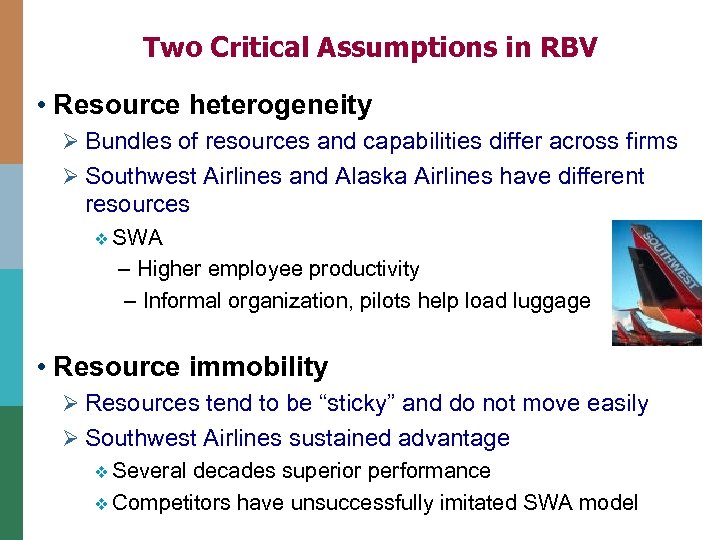

Two Critical Assumptions in RBV • Resource heterogeneity Ø Bundles of resources and capabilities differ across firms Ø Southwest Airlines and Alaska Airlines have different resources v SWA – Higher employee productivity – Informal organization, pilots help load luggage • Resource immobility Ø Resources tend to be “sticky” and do not move easily Ø Southwest Airlines sustained advantage v Several decades superior performance v Competitors have unsuccessfully imitated SWA model

LO 4 -1 Distinguish among a firm’s resources, capabilities, core competencies, and firm activities. LO 4 -2 Differentiate between tangible and intangible resources. LO 4 -3 Describe the critical assumptions behind the resource-based view. LO 4 -4 Apply the VRIO framework to assess the competitive implications of a firm’s resources. LO 4 -5 Identify competitive advantage as residing in a network of firm activities. LO 4 -6 Outline how dynamic capabilities can help a firm sustain competitive advantage. LO 4 -7 Identify different conditions that allow firms to sustain their competitive advantage. LO 4 -8 Conduct a SWOT analysis.

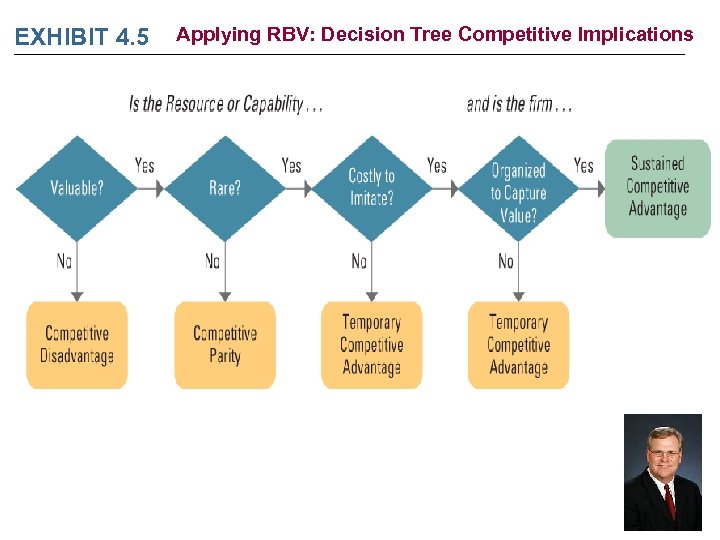

EXHIBIT 4. 5 Applying RBV: Decision Tree Competitive Implications

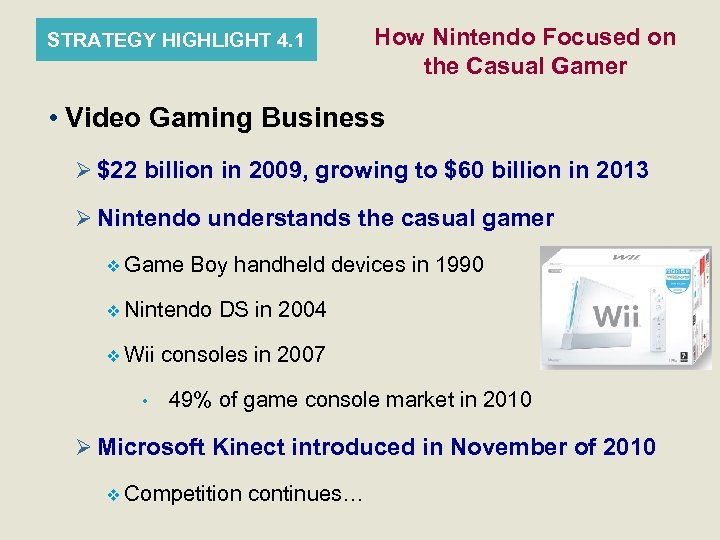

STRATEGY HIGHLIGHT 4. 1 How Nintendo Focused on the Casual Gamer • Video Gaming Business Ø $22 billion in 2009, growing to $60 billion in 2013 Ø Nintendo understands the casual gamer v Game Boy handheld devices in 1990 v Nintendo v Wii • DS in 2004 consoles in 2007 49% of game console market in 2010 Ø Microsoft Kinect introduced in November of 2010 v Competition continues… 1– 24

LO 4 -1 Distinguish among a firm’s resources, capabilities, core competencies, and firm activities. LO 4 -2 Differentiate between tangible and intangible resources. LO 4 -3 Describe the critical assumptions behind the resource-based view. LO 4 -4 Apply the VRIO framework to assess the competitive implications of a firm’s resources. LO 4 -5 Identify competitive advantage as residing in a network of firm activities. LO 4 -6 Outline how dynamic capabilities can help a firm sustain competitive advantage. LO 4 -7 Identify different conditions that allow firms to sustain their competitive advantage. LO 4 -8 Conduct a SWOT analysis.

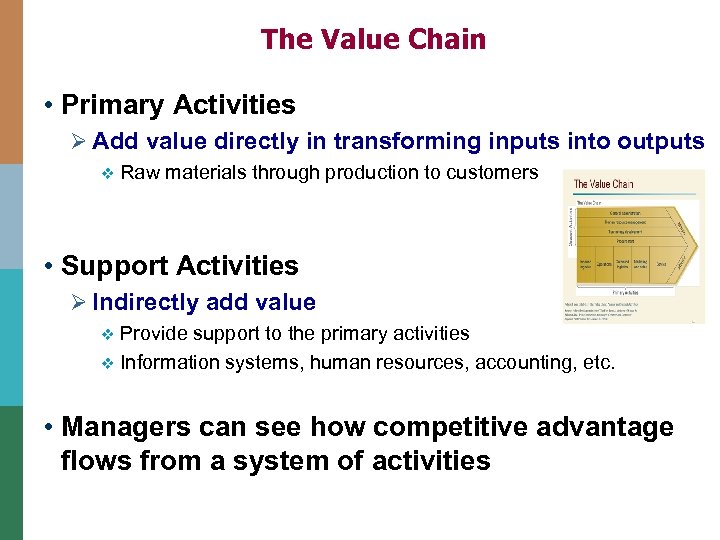

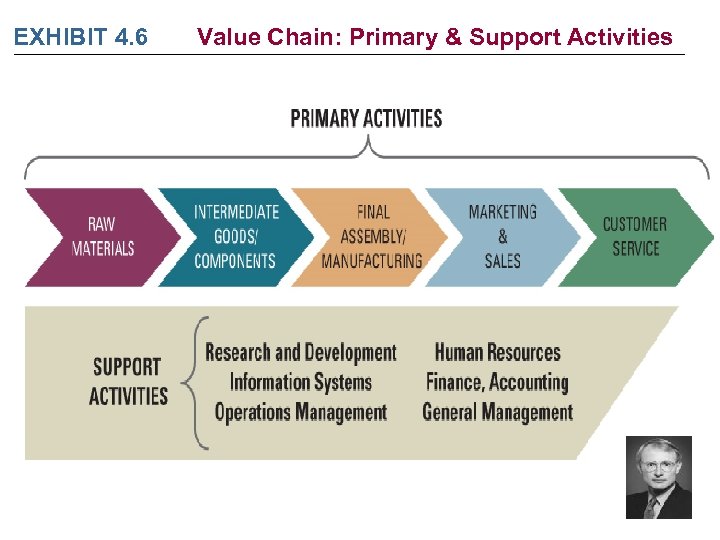

The Value Chain • Primary Activities Ø Add value directly in transforming inputs into outputs v Raw materials through production to customers • Support Activities Ø Indirectly add value Provide support to the primary activities v Information systems, human resources, accounting, etc. v • Managers can see how competitive advantage flows from a system of activities

EXHIBIT 4. 6 Value Chain: Primary & Support Activities

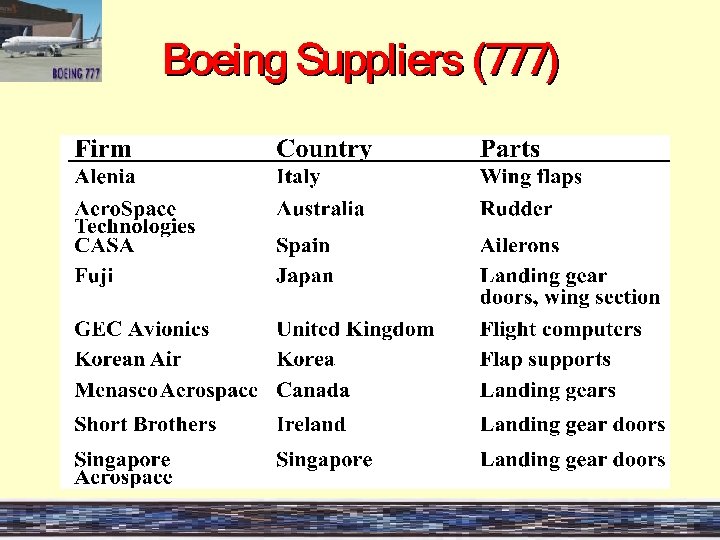

Value Chain Analysis • Outsourcing activities can have the unintended consequence of damaging the firm’s potential to evaluate continuously its key assumptions, learn, and create new capabilities and core competencies. Therefore, managers should verify that the firm does not outsource activities that stimulate the development of new capabilities and competencies.

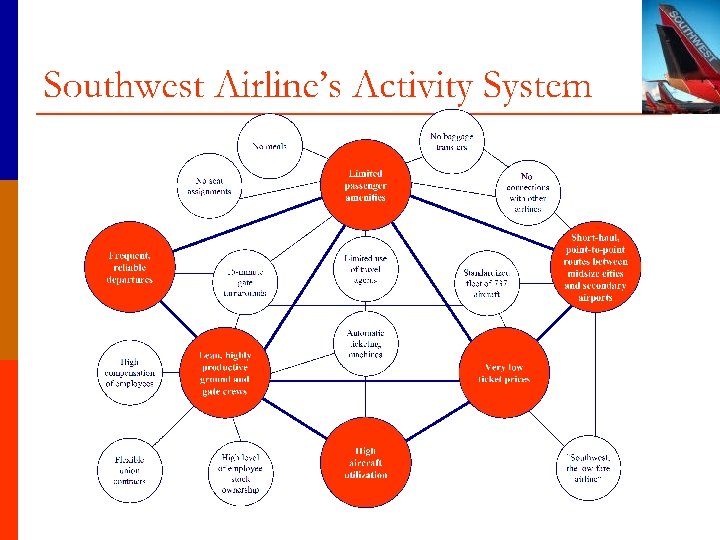

Strategic Coherence The Logic of How The Business Fits Together: • Southwest Airlines Ø Low Price Ø Short Routes • No Frills • Point-to-Point • One Aircraft -Boeing 737 • High number of Aircraft per Route • No Meals • Flexible/ Lower Staffing • American Airlines Ø Premium Price Ø Short, Long, & Int’l Ø Variety • Hub & Spoke System • Multiple Aircraft • Low number of Aircraft per Route • Meals & Service • Higher Staffing 32

33

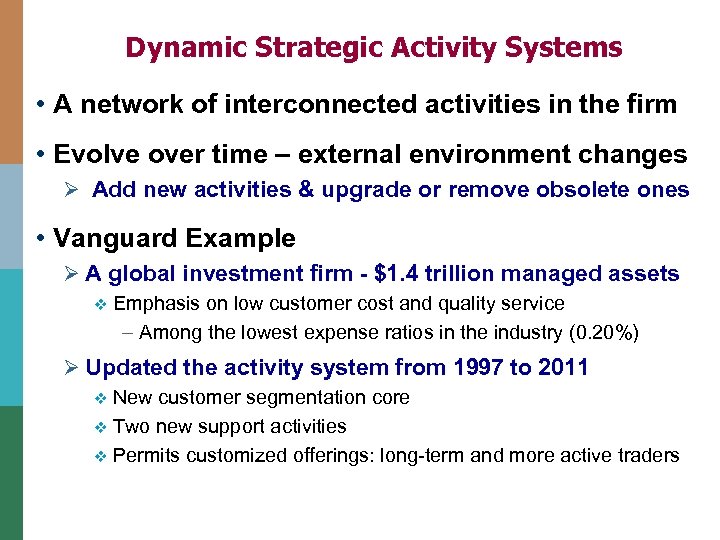

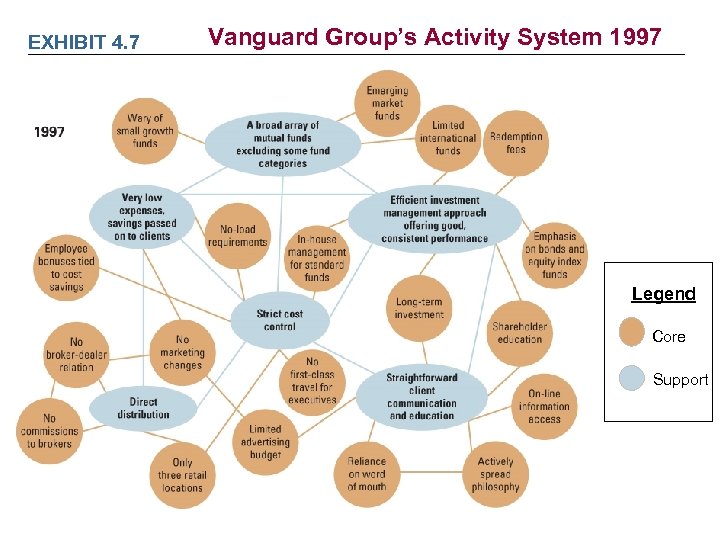

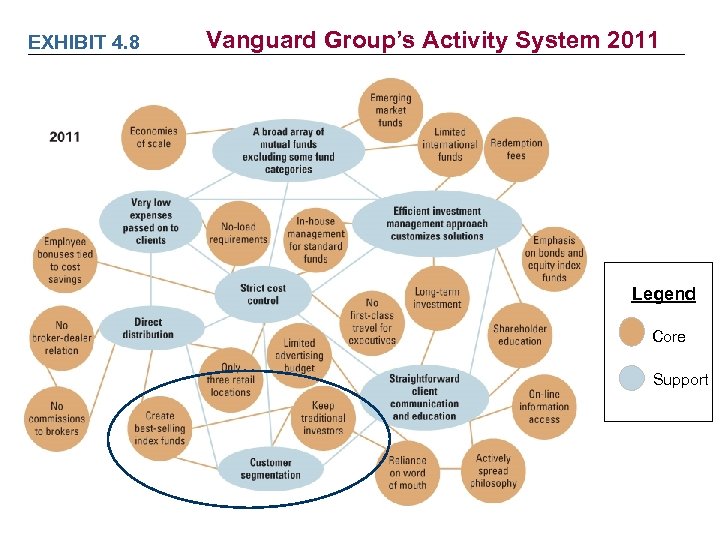

Dynamic Strategic Activity Systems • A network of interconnected activities in the firm • Evolve over time – external environment changes Ø Add new activities & upgrade or remove obsolete ones • Vanguard Example Ø A global investment firm - $1. 4 trillion managed assets v Emphasis on low customer cost and quality service – Among the lowest expense ratios in the industry (0. 20%) Ø Updated the activity system from 1997 to 2011 New customer segmentation core v Two new support activities v Permits customized offerings: long-term and more active traders v

EXHIBIT 4. 7 Vanguard Group’s Activity System 1997 Legend Core Support

EXHIBIT 4. 8 Vanguard Group’s Activity System 2011 Legend Core Support

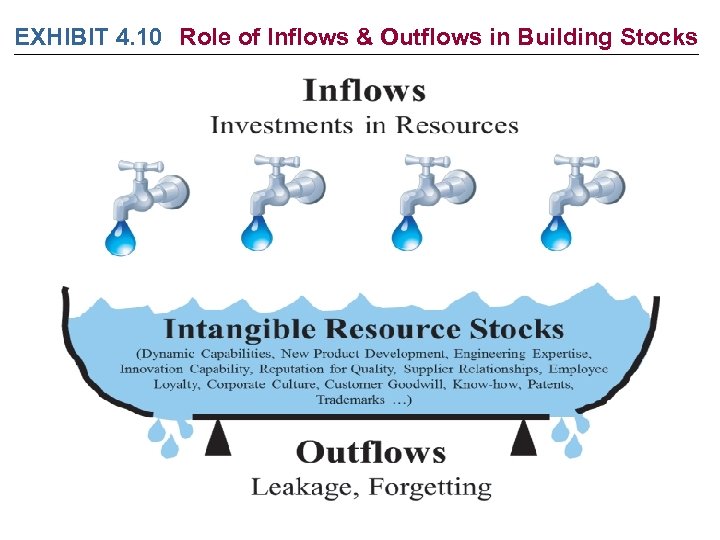

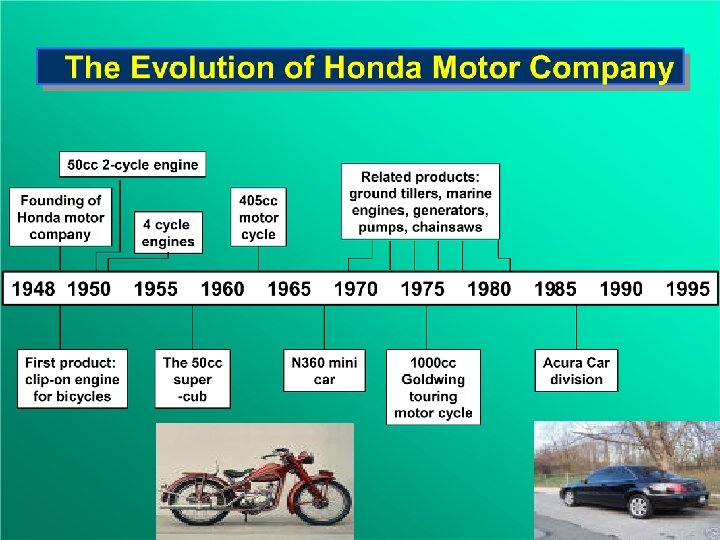

Dynamic Capabilities Perspective • A firm can modify its resource base to gain & sustain a competitive advantage Ø Advantage is gained from reconfiguring a firm’s resource base Ø Honda core competency in gas-powered engine design v Could v If decrease in value consumers move toward electric-powered cars v BYD competency in batteries would gain advantage • Dynamic capabilities are an intangible resource • Resource stocks and flows are a useful view

EXHIBIT 4. 10 Role of Inflows & Outflows in Building Stocks

STRATEGY HIGHLIGHT 4. 2 IBM’s Dynamic Strategic Fit • From mainframes to services transformation Ø In 1992, less than 8, 000 people in global services Ø In 2010, nearly 150, 000 employees there • IBM started the PC revolution…then became a misfit in the industry • Lou Gerstner joined as CEO of a nearly bankrupt IBM • Moved IBM downstream toward services and thus higher value added • Transformation of core competency: • Today, IBM is a nimble IT-services firm 1– 39

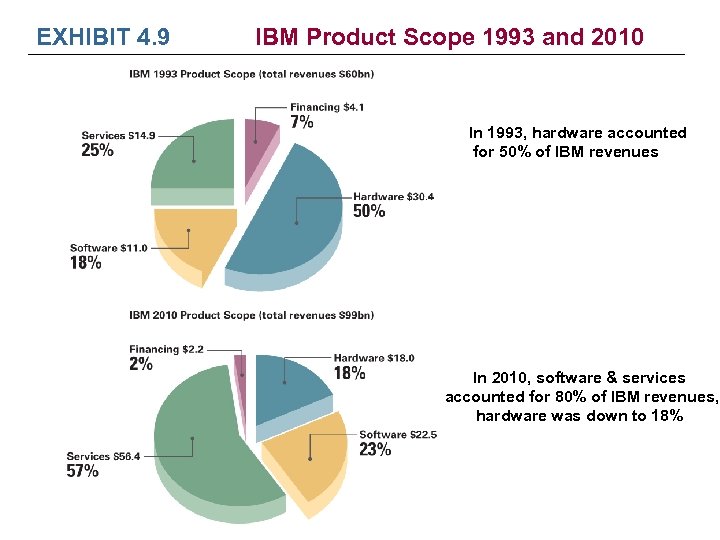

EXHIBIT 4. 9 IBM Product Scope 1993 and 2010 In 1993, hardware accounted for 50% of IBM revenues In 2010, software & services accounted for 80% of IBM revenues, hardware was down to 18%

LO 4 -1 Distinguish among a firm’s resources, capabilities, core competencies, and firm activities. LO 4 -2 Differentiate between tangible and intangible resources. LO 4 -3 Describe the critical assumptions behind the resource-based view. LO 4 -4 Apply the VRIO framework to assess the competitive implications of a firm’s resources. LO 4 -5 Identify competitive advantage as residing in a network of firm activities. LO 4 -6 Outline how dynamic capabilities can help a firm sustain competitive advantage. LO 4 -7 Identify different conditions that allow firms to sustain their competitive advantage. LO 4 -8 Conduct a SWOT analysis.

How to Protect a Competitive Advantage 1. Better Expectations of Future Values Ø Buy Resources at a low cost v Real Estate Development - highway expansion 2. Path Dependence Ø Current alternatives are limited by past decisions U. S. is the only industrial nation not on the metric system v Honda’s core competency in gas engines took decades to build v

How to Protect a Competitive Advantage 3. Causal Ambiguity Ø Cause of success or failure are not apparent v Why has Apple had such a string of successful products? – Role of Steve Jobs’ vision? – Unique talents of the Apple design team? – Timing of product introductions? 4. Social Complexity Ø Two or more systems interact creating many possibilities v A group of 3 people has 3 relationships v A group of 5 people has 12 relationships

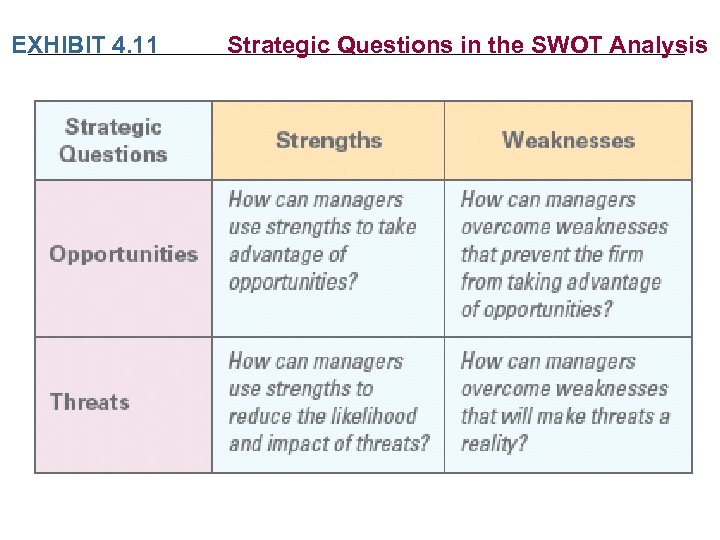

EXHIBIT 4. 11 Strategic Questions in the SWOT Analysis

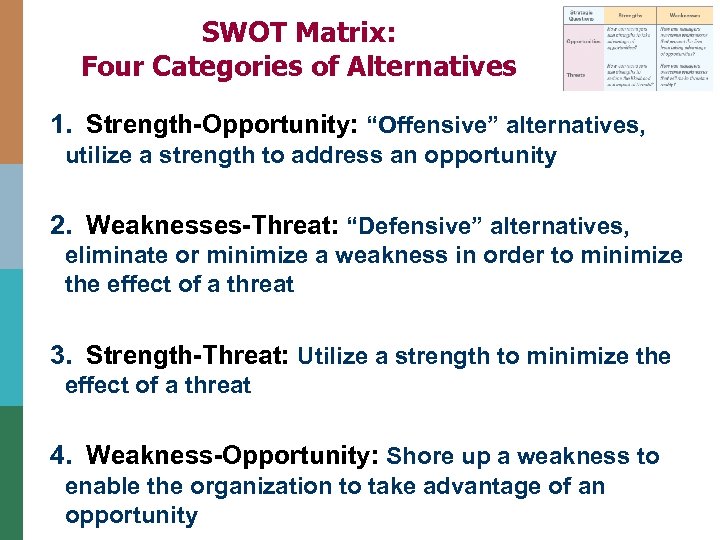

SWOT Matrix: Four Categories of Alternatives 1. Strength-Opportunity: “Offensive” alternatives, utilize a strength to address an opportunity 2. Weaknesses-Threat: “Defensive” alternatives, eliminate or minimize a weakness in order to minimize the effect of a threat 3. Strength-Threat: Utilize a strength to minimize the effect of a threat 4. Weakness-Opportunity: Shore up a weakness to enable the organization to take advantage of an opportunity

47

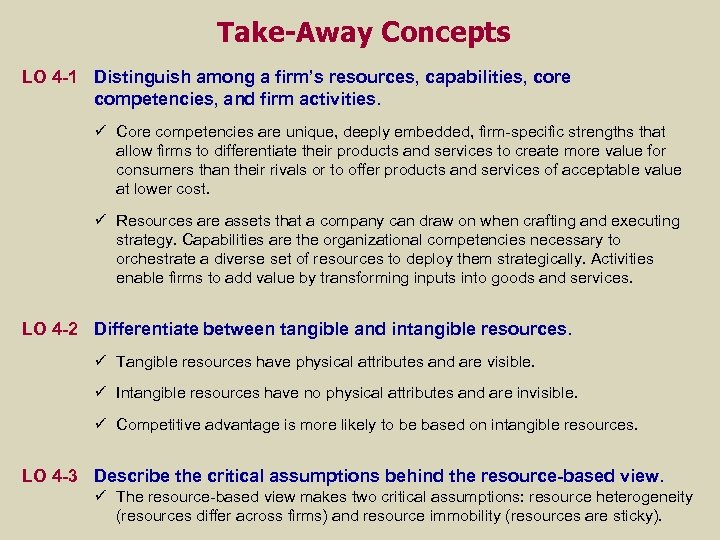

Take-Away Concepts LO 4 -1 Distinguish among a firm’s resources, capabilities, core competencies, and firm activities. ü Core competencies are unique, deeply embedded, firm-specific strengths that allow firms to differentiate their products and services to create more value for consumers than their rivals or to offer products and services of acceptable value at lower cost. ü Resources are assets that a company can draw on when crafting and executing strategy. Capabilities are the organizational competencies necessary to orchestrate a diverse set of resources to deploy them strategically. Activities enable firms to add value by transforming inputs into goods and services. LO 4 -2 Differentiate between tangible and intangible resources. ü Tangible resources have physical attributes and are visible. ü Intangible resources have no physical attributes and are invisible. ü Competitive advantage is more likely to be based on intangible resources. LO 4 -3 Describe the critical assumptions behind the resource-based view. ü The resource-based view makes two critical assumptions: resource heterogeneity (resources differ across firms) and resource immobility (resources are sticky).

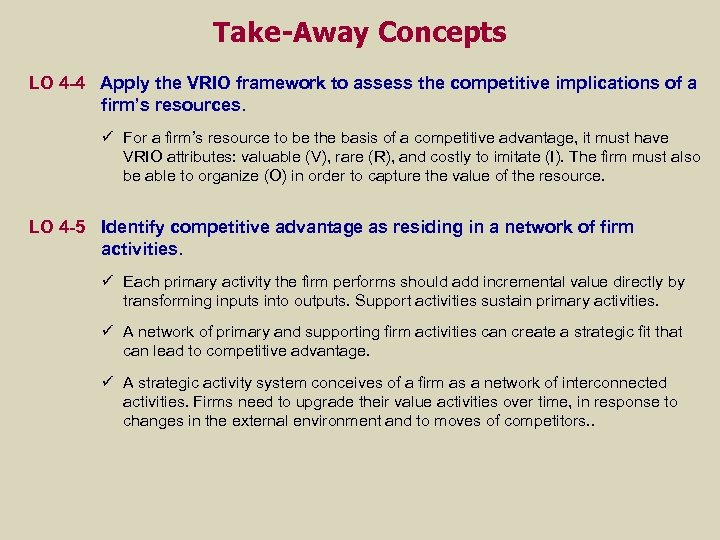

Take-Away Concepts LO 4 -4 Apply the VRIO framework to assess the competitive implications of a firm’s resources. ü For a firm’s resource to be the basis of a competitive advantage, it must have VRIO attributes: valuable (V), rare (R), and costly to imitate (I). The firm must also be able to organize (O) in order to capture the value of the resource. LO 4 -5 Identify competitive advantage as residing in a network of firm activities. ü Each primary activity the firm performs should add incremental value directly by transforming inputs into outputs. Support activities sustain primary activities. ü A network of primary and supporting firm activities can create a strategic fit that can lead to competitive advantage. ü A strategic activity system conceives of a firm as a network of interconnected activities. Firms need to upgrade their value activities over time, in response to changes in the external environment and to moves of competitors. .

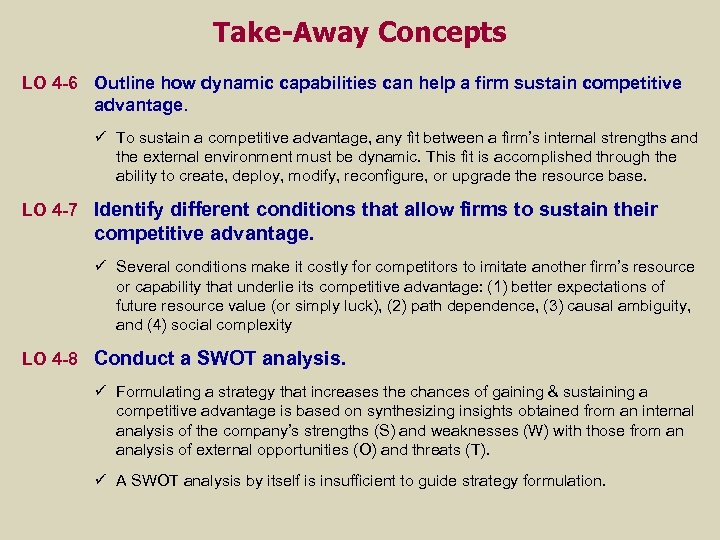

Take-Away Concepts LO 4 -6 Outline how dynamic capabilities can help a firm sustain competitive advantage. ü To sustain a competitive advantage, any fit between a firm’s internal strengths and the external environment must be dynamic. This fit is accomplished through the ability to create, deploy, modify, reconfigure, or upgrade the resource base. LO 4 -7 Identify different conditions that allow firms to sustain their competitive advantage. ü Several conditions make it costly for competitors to imitate another firm’s resource or capability that underlie its competitive advantage: (1) better expectations of future resource value (or simply luck), (2) path dependence, (3) causal ambiguity, and (4) social complexity LO 4 -8 Conduct a SWOT analysis. ü Formulating a strategy that increases the chances of gaining & sustaining a competitive advantage is based on synthesizing insights obtained from an internal analysis of the company’s strengths (S) and weaknesses (W) with those from an analysis of external opportunities (O) and threats (T). ü A SWOT analysis by itself is insufficient to guide strategy formulation.

37ff39e96beeed3c49b4e407d8594403.ppt