fb1b206b3bb766ed24d286476349887a.ppt

- Количество слайдов: 170

Chapter 4 Identifying and Adjusting for Green Features

Chapter 4 Identifying and Adjusting for Green Features

Chapter 4: Introduction • In this chapter, you will review how USPAP regards “SCOPE OF WORK” and “credible. ” • You will also recognize what to look for when inspecting the interior and exterior of a home. • Finally, you will identify data and research as they relate to adjustments and the effect of green.

Chapter 4: Introduction • In this chapter, you will review how USPAP regards “SCOPE OF WORK” and “credible. ” • You will also recognize what to look for when inspecting the interior and exterior of a home. • Finally, you will identify data and research as they relate to adjustments and the effect of green.

Chapter 4: Objectives After completing this chapter, you will be able to: • Describe SCOPE OF WORK and credible in relation to USPAP. • Recognize how to physically inspect the interior and exterior of a home, including mechanicals, electrical, plumbing, and building envelope.

Chapter 4: Objectives After completing this chapter, you will be able to: • Describe SCOPE OF WORK and credible in relation to USPAP. • Recognize how to physically inspect the interior and exterior of a home, including mechanicals, electrical, plumbing, and building envelope.

Chapter 4: Objectives (con’t) • Realize the importance of data research and data filtering. • Identify how to adjust for green features. • Define the Uniform Appraisal Dataset. • Verify and evaluate green data. • Compare cost vs. value.

Chapter 4: Objectives (con’t) • Realize the importance of data research and data filtering. • Identify how to adjust for green features. • Define the Uniform Appraisal Dataset. • Verify and evaluate green data. • Compare cost vs. value.

Chapter 4: Key Terms • AMC (Appraisal Management Company) A third party vendor who orders and receives appraisals on behalf of the lender client. The appraisal management fee negotiates turnaround time and fees with the appraisers. • Assignment Conditions above and beyond USPAP imposed by the client on the appraiser at the time the appraisal is ordered. • Concrete Siding A mixture of cellulose, concrete, and sand that forms a highly durable (estimated life span is 50 years) product. It is low maintenance and offers a high R-value.

Chapter 4: Key Terms • AMC (Appraisal Management Company) A third party vendor who orders and receives appraisals on behalf of the lender client. The appraisal management fee negotiates turnaround time and fees with the appraisers. • Assignment Conditions above and beyond USPAP imposed by the client on the appraiser at the time the appraisal is ordered. • Concrete Siding A mixture of cellulose, concrete, and sand that forms a highly durable (estimated life span is 50 years) product. It is low maintenance and offers a high R-value.

Chapter 4: Key Terms (con’t) • Credible In the context of USPAP, “worthy of belief”. • REO (Real Estate Owned) Real estate which has gone through the foreclosure process and is now bank owned. • Known Adjustments that the appraiser has developed over time. • SCOPE OF WORK RULE One of the rules in USPAP requiring an appraiser to develop and perform the scope of work necessary to produce credible results.

Chapter 4: Key Terms (con’t) • Credible In the context of USPAP, “worthy of belief”. • REO (Real Estate Owned) Real estate which has gone through the foreclosure process and is now bank owned. • Known Adjustments that the appraiser has developed over time. • SCOPE OF WORK RULE One of the rules in USPAP requiring an appraiser to develop and perform the scope of work necessary to produce credible results.

Scope of Work As an appraiser, the scope of work decision rests completely with you. The SCOPE OF WORK RULE states: • The appraiser must be prepared to demonstrate that the scope of work is sufficient to produce credible assignment results. • A lender may want a “ 2055 drive-by” and to pay a lower fee, but the appraiser is charged with developing and reporting a credible appraisal. It is your license on the line, not the lenders.

Scope of Work As an appraiser, the scope of work decision rests completely with you. The SCOPE OF WORK RULE states: • The appraiser must be prepared to demonstrate that the scope of work is sufficient to produce credible assignment results. • A lender may want a “ 2055 drive-by” and to pay a lower fee, but the appraiser is charged with developing and reporting a credible appraisal. It is your license on the line, not the lenders.

Credible Results Credible is defined in USPAP as: • Worthy of belief. Comment: Credible assignment results require support, by relevant evidence and logic, to the degree necessary for the intended use.

Credible Results Credible is defined in USPAP as: • Worthy of belief. Comment: Credible assignment results require support, by relevant evidence and logic, to the degree necessary for the intended use.

SCOPE OF WORK The SCOPE OF WORK RULE states: • For each appraisal ot appraisal review assignment, an appraiser must: 1. Identify the problem to be solved 2. Determine and perform the scope of work necessary to develop credible assignment results, and 3. Disclose the SCOPE OF WORK in the report.

SCOPE OF WORK The SCOPE OF WORK RULE states: • For each appraisal ot appraisal review assignment, an appraiser must: 1. Identify the problem to be solved 2. Determine and perform the scope of work necessary to develop credible assignment results, and 3. Disclose the SCOPE OF WORK in the report.

SCOPE OF WORK (con’t) • Comment: SCOPE OF WORK includes, but is not limited to: – The extent to which the property is identified – The extent to which tangible property is inspected – The type and extent of data researched, and – The type and extend of analyses applied to arrive at opinions or conclusions

SCOPE OF WORK (con’t) • Comment: SCOPE OF WORK includes, but is not limited to: – The extent to which the property is identified – The extent to which tangible property is inspected – The type and extent of data researched, and – The type and extend of analyses applied to arrive at opinions or conclusions

SCOPE OF WORK (con’t) • The appraiser must properly identify the problem to be solved in order to make the SCOPE OF WORK decision regarding the development process that will be required, and the knowledge and expertise necessary to complete the assignment. • An appraiser might be compelled decline an appraisal assignment for a property considered as “green, ” for which the appraiser’s knowledge and expertise is limited.

SCOPE OF WORK (con’t) • The appraiser must properly identify the problem to be solved in order to make the SCOPE OF WORK decision regarding the development process that will be required, and the knowledge and expertise necessary to complete the assignment. • An appraiser might be compelled decline an appraisal assignment for a property considered as “green, ” for which the appraiser’s knowledge and expertise is limited.

Scope of Work (con’t) • USPAP allows for an appraiser to develop the competency for the assignment during the assignment. – However, in some assignments, such as those for Fannie Mae, as an assignment condition, the appraiser must be competent at the time of accepting the assignment.

Scope of Work (con’t) • USPAP allows for an appraiser to develop the competency for the assignment during the assignment. – However, in some assignments, such as those for Fannie Mae, as an assignment condition, the appraiser must be competent at the time of accepting the assignment.

Assignment Conditions The relevant parts of the SCOPE OF WORK RULE continue with: • An appraiser must not allow assignment conditions to limit the scope of work to such a degree that the assignment results are not credible in the context of the intended use.

Assignment Conditions The relevant parts of the SCOPE OF WORK RULE continue with: • An appraiser must not allow assignment conditions to limit the scope of work to such a degree that the assignment results are not credible in the context of the intended use.

Assignment Conditions (con’t) Comment: If relevant information is not available because of assignment conditions that limit research opportunities - such as conditions that place limitations on inspection or information gathering - an appraiser must withdraw from the assignment unless the appraiser can: • Modify the assignment conditions to expand the scope of work to include gathering the information; or

Assignment Conditions (con’t) Comment: If relevant information is not available because of assignment conditions that limit research opportunities - such as conditions that place limitations on inspection or information gathering - an appraiser must withdraw from the assignment unless the appraiser can: • Modify the assignment conditions to expand the scope of work to include gathering the information; or

Assignment Conditions (con’t) • Use an extraordinary assumption about such information, if credible assignment results can still be developed. • An appraiser must not allow the intended use of an assignment or a client’s objectives to cause the assignment results to be biased.

Assignment Conditions (con’t) • Use an extraordinary assumption about such information, if credible assignment results can still be developed. • An appraiser must not allow the intended use of an assignment or a client’s objectives to cause the assignment results to be biased.

Assignment Conditions (con’t) • For example: a client requests a “normal 1004 appraisal” – when the client wishes an appraisal with an interior and exterior inspection using a standardized form and traditional valuation methods - but – the property has several significant green features which will require additional research and analysis on the part of the appraiser to properly value the property.

Assignment Conditions (con’t) • For example: a client requests a “normal 1004 appraisal” – when the client wishes an appraisal with an interior and exterior inspection using a standardized form and traditional valuation methods - but – the property has several significant green features which will require additional research and analysis on the part of the appraiser to properly value the property.

Assignment Conditions (con’t) • A common modifications to the SCOPE OF WORK is changing the requirement from an exterior only inspection appraisal report form (2055 form) to an interior and exterior inspection (1004 form). • Appraisers know - with respect to SCOPE OF WORK—it is the appraiser’s judgment as to what SCOPE OF WORK is necessary to produce credible results.

Assignment Conditions (con’t) • A common modifications to the SCOPE OF WORK is changing the requirement from an exterior only inspection appraisal report form (2055 form) to an interior and exterior inspection (1004 form). • Appraisers know - with respect to SCOPE OF WORK—it is the appraiser’s judgment as to what SCOPE OF WORK is necessary to produce credible results.

Competency Rule • The SCOPE OF WORK RULE covers not just the subject property, but the comparables and all other data used to develop the report as well. • Careful consideration of the SCOPE OF WORK RULE might cause a thoughtful appraiser to decline the assignment to appraise a green house if he or she had not received any training in green construction and features.

Competency Rule • The SCOPE OF WORK RULE covers not just the subject property, but the comparables and all other data used to develop the report as well. • Careful consideration of the SCOPE OF WORK RULE might cause a thoughtful appraiser to decline the assignment to appraise a green house if he or she had not received any training in green construction and features.

Competency Rule (con’t) This leads us to the COMPETENCY RULEin USPAP which states: • An appraiser must: (1) be competent to perform the assignment; (2) acquire the necessary competency to perform the assignment; or (3) decline or withdraw from the assignment.

Competency Rule (con’t) This leads us to the COMPETENCY RULEin USPAP which states: • An appraiser must: (1) be competent to perform the assignment; (2) acquire the necessary competency to perform the assignment; or (3) decline or withdraw from the assignment.

Competency Rule (con’t) • Being Competent • The appraiser must determine, prior to accepting an assignment, that he or she can perform the assignment competently. Competency requires: • The ability to properly identify the problem to be addressed • The knowledge and experience to complete the assignment competently • Recognition of, and compliance with, laws and regulations that apply to the appraiser or to the assignment

Competency Rule (con’t) • Being Competent • The appraiser must determine, prior to accepting an assignment, that he or she can perform the assignment competently. Competency requires: • The ability to properly identify the problem to be addressed • The knowledge and experience to complete the assignment competently • Recognition of, and compliance with, laws and regulations that apply to the appraiser or to the assignment

Competency Rule (con’t) • Comment: Competency may apply to factors such as, but not limited to, an appraiser’s familiarity with a specific type of property or asset, a market, a geographic area, an intended use, specific laws and regulations, or an analytical method. • If such a factor is necessary for an appraiser to develop credible assignment results, the appraiser is responsible for having the competency to address that factor or following the steps outlined below to satisfy this COMPETENCY RULE.

Competency Rule (con’t) • Comment: Competency may apply to factors such as, but not limited to, an appraiser’s familiarity with a specific type of property or asset, a market, a geographic area, an intended use, specific laws and regulations, or an analytical method. • If such a factor is necessary for an appraiser to develop credible assignment results, the appraiser is responsible for having the competency to address that factor or following the steps outlined below to satisfy this COMPETENCY RULE.

Competency in Appraising Green • Green construction constitutes a specific type of property. • USPAP gives the appraiser leeway to obtain competency. • According to USPAP, the steps an appraiser must take if it is determined that competency is an issue, prior to accepting any assignments, are:

Competency in Appraising Green • Green construction constitutes a specific type of property. • USPAP gives the appraiser leeway to obtain competency. • According to USPAP, the steps an appraiser must take if it is determined that competency is an issue, prior to accepting any assignments, are:

Competency is Appraising Green (con’t) 1. Disclose the lack of knowledge and/or experience to the client before accepting the assignment 2. Take all steps necessary and appropriate to complete the assignment competently 3. Describe, in the report, the lack of knowledge and/or experience and the steps taken to complete the assignment competently.

Competency is Appraising Green (con’t) 1. Disclose the lack of knowledge and/or experience to the client before accepting the assignment 2. Take all steps necessary and appropriate to complete the assignment competently 3. Describe, in the report, the lack of knowledge and/or experience and the steps taken to complete the assignment competently.

Competency is Appraising Green (con’t) • This would apply in a situation where new construction is rare, green construction is rare, or the property has a high level of green features. • For example, an appraiser with limited experience in green appraisal would find the appraisal of a property of a Platinum level LEED property challenging. Minimally, such an appraiser would need to affiliate himself with an appraiser who has more experience.

Competency is Appraising Green (con’t) • This would apply in a situation where new construction is rare, green construction is rare, or the property has a high level of green features. • For example, an appraiser with limited experience in green appraisal would find the appraisal of a property of a Platinum level LEED property challenging. Minimally, such an appraiser would need to affiliate himself with an appraiser who has more experience.

Fannie Mae • As mentioned earlier - Fannie Mae and other users of Fannie Mae reports do not allow this leeway for competency. • Appraisers who accept assignments for Fannie Mae where they do not have competency are violating Fannie Mae’s guidelines for appraisers.

Fannie Mae • As mentioned earlier - Fannie Mae and other users of Fannie Mae reports do not allow this leeway for competency. • Appraisers who accept assignments for Fannie Mae where they do not have competency are violating Fannie Mae’s guidelines for appraisers.

Fannie Mae (con’t) • In the Appraiser’s Certification, which is part of every Fannie Mae form (used by Freddie FHA, VA, and portfolio lenders) #11 reads: • I have knowledge and experience in appraising this type of property in this market area.

Fannie Mae (con’t) • In the Appraiser’s Certification, which is part of every Fannie Mae form (used by Freddie FHA, VA, and portfolio lenders) #11 reads: • I have knowledge and experience in appraising this type of property in this market area.

Fannie Mae (con’t) • If an appraiser does not have knowledge and experience in appraising green homes, Fannie Mae is quite clear: He should decline the assignment. • From Fannie Mae’s viewpoint, competency needs to be obtained before accepting the assignment.

Fannie Mae (con’t) • If an appraiser does not have knowledge and experience in appraising green homes, Fannie Mae is quite clear: He should decline the assignment. • From Fannie Mae’s viewpoint, competency needs to be obtained before accepting the assignment.

AMC’s • Most working appraisers are aware of the increase in “traveling appraisers” meaning AMCs (Appraisal Management Companies). • Real estate agents are also well aware of this problem. In 2011, NAR reported that 16 percent of contracts taken failed to close, and estimated that 9 percent of total failed transactions were due to low appraisals. Source http: //www. realtor. org

AMC’s • Most working appraisers are aware of the increase in “traveling appraisers” meaning AMCs (Appraisal Management Companies). • Real estate agents are also well aware of this problem. In 2011, NAR reported that 16 percent of contracts taken failed to close, and estimated that 9 percent of total failed transactions were due to low appraisals. Source http: //www. realtor. org

AMC’s (con’t) • Agents are understandably frustrated when appraisers are given assignments outside their area of geographic competence. Agents often report that “traveling” appraisers: – Ask for comps (because they do not belong to the local MLS). – Request that someone meet them at the house (because they do not have a lock box key). – May even ask the agent to provide public tax records.

AMC’s (con’t) • Agents are understandably frustrated when appraisers are given assignments outside their area of geographic competence. Agents often report that “traveling” appraisers: – Ask for comps (because they do not belong to the local MLS). – Request that someone meet them at the house (because they do not have a lock box key). – May even ask the agent to provide public tax records.

AMC’s (con’t) • Agents and homeowners are similarly frustrated when a property to be appraised has several green features that may be either ignored or misunderstood by the appraiser. • An agent who lists a property with green construction, or green retrofitted features will want an appraiser who recognizes these features and knows how to adjust for them.

AMC’s (con’t) • Agents and homeowners are similarly frustrated when a property to be appraised has several green features that may be either ignored or misunderstood by the appraiser. • An agent who lists a property with green construction, or green retrofitted features will want an appraiser who recognizes these features and knows how to adjust for them.

Physical Inspection • Appraisers need to be prepared for new, or almost new, construction (green from the ground up) as well as older homes with green features. • It is always your job as an appraiser to delve in and discover what is really in a house.

Physical Inspection • Appraisers need to be prepared for new, or almost new, construction (green from the ground up) as well as older homes with green features. • It is always your job as an appraiser to delve in and discover what is really in a house.

Physical Inspection • The first step in appraising for green is the physical inspection of the house. • Create a system for taking notes and recording information. • Since 2010 Fannie Mae requires interior photos (with permission) of the kitchen, living areas and baths. – A photo jogs your memory, and proves what was there when you inspected the home.

Physical Inspection • The first step in appraising for green is the physical inspection of the house. • Create a system for taking notes and recording information. • Since 2010 Fannie Mae requires interior photos (with permission) of the kitchen, living areas and baths. – A photo jogs your memory, and proves what was there when you inspected the home.

Exterior Inspection • On your first trip around the exterior of the house, in addition to what you have looked for in the past, look for energy efficient items. • Although this isn’t a complete list, you should look for items like: • • • Solar panels Photo voltaic shingles Cisterns or rain barrels Solar powered lighting for walk ways and sidewalks Permeable surfaces for driveways Green landscaping Windmills Skylights and other day lighting Passive solar design Other design features, including positioning of the house Concrete siding

Exterior Inspection • On your first trip around the exterior of the house, in addition to what you have looked for in the past, look for energy efficient items. • Although this isn’t a complete list, you should look for items like: • • • Solar panels Photo voltaic shingles Cisterns or rain barrels Solar powered lighting for walk ways and sidewalks Permeable surfaces for driveways Green landscaping Windmills Skylights and other day lighting Passive solar design Other design features, including positioning of the house Concrete siding

Interior Inspection • As you enter the home for the interior inspection, you will, of course, be noting condition, layout, materials used, functionality, etc. • While order doesn’t matter - many appraisers start in the basement and work their way upstairs, while others inspect the first floor first, and then continue.

Interior Inspection • As you enter the home for the interior inspection, you will, of course, be noting condition, layout, materials used, functionality, etc. • While order doesn’t matter - many appraisers start in the basement and work their way upstairs, while others inspect the first floor first, and then continue.

Interior Inspection (con’t) Let’s take a look at some of the important key features of a home you’ll want to appraise. You will be focusing on: • Mechanicals • Electrical and other power sources • Plumbing • Building envelope

Interior Inspection (con’t) Let’s take a look at some of the important key features of a home you’ll want to appraise. You will be focusing on: • Mechanicals • Electrical and other power sources • Plumbing • Building envelope

Mechanical Systems • Some of the systems, mechanicals, and appliances you want to evaluate include: – Radon mitigation systems (for indoor air quality) – Fireplaces, woodstoves, and gas heaters (for indoor air quality) – Appliances (ENERGY STAR, age, condition, warranties)

Mechanical Systems • Some of the systems, mechanicals, and appliances you want to evaluate include: – Radon mitigation systems (for indoor air quality) – Fireplaces, woodstoves, and gas heaters (for indoor air quality) – Appliances (ENERGY STAR, age, condition, warranties)

Mechanical Systems (con’t) Questions to ask include: • Are the mechanical systems located inside or outside? • Are the occupants of the house protected from any potential issues with the mechanical systems? • Are there any signs of mechanical failure? • Do the systems appear to be safe and adequate and properly vented? • If the appraisal is for a sale, do warranties convey with the real estate?

Mechanical Systems (con’t) Questions to ask include: • Are the mechanical systems located inside or outside? • Are the occupants of the house protected from any potential issues with the mechanical systems? • Are there any signs of mechanical failure? • Do the systems appear to be safe and adequate and properly vented? • If the appraisal is for a sale, do warranties convey with the real estate?

Heating and Cooling To illustrate further the level of detail an appraiser needs to provide during a green inspection, let’s review some items that would be on a heating and cooling checklist: • • Type(s) of system Type(s) of fuel Efficiency Age and condition Warranty Cost of operation (if available) Programmable thermostat(s) If duct work exists, is it sealed and insulated? • Is the foundation insulated? • Is the system zoned?

Heating and Cooling To illustrate further the level of detail an appraiser needs to provide during a green inspection, let’s review some items that would be on a heating and cooling checklist: • • Type(s) of system Type(s) of fuel Efficiency Age and condition Warranty Cost of operation (if available) Programmable thermostat(s) If duct work exists, is it sealed and insulated? • Is the foundation insulated? • Is the system zoned?

Heating and Cooling Examples • Zoning heat and air conditioning save energy, as occupants only heat and cool the rooms they are using. • Some heating systems are located outside the house. E. g. a dual fuel outside furnace that burns wood or oil.

Heating and Cooling Examples • Zoning heat and air conditioning save energy, as occupants only heat and cool the rooms they are using. • Some heating systems are located outside the house. E. g. a dual fuel outside furnace that burns wood or oil.

Geothermal Heating System According to a builder, Greg Fitzpatrick, • “I am a big fan of these systems as they are unmatched for efficiency of operation. • Geosystems are about 400 percent efficient as compared to the best LP (liquid petroleum) systems which are about 95 percent efficient. ”

Geothermal Heating System According to a builder, Greg Fitzpatrick, • “I am a big fan of these systems as they are unmatched for efficiency of operation. • Geosystems are about 400 percent efficient as compared to the best LP (liquid petroleum) systems which are about 95 percent efficient. ”

Geothermal Heating System (con’t) • When appraising green systems such as a geo-thermal system, the appraiser should ask the builder or owner the following questions: – What was the price differential between this and the best LP system? – What are the expected annual (or monthly) costs of operating this system? – How does that compare to the costs of operating the LP system?

Geothermal Heating System (con’t) • When appraising green systems such as a geo-thermal system, the appraiser should ask the builder or owner the following questions: – What was the price differential between this and the best LP system? – What are the expected annual (or monthly) costs of operating this system? – How does that compare to the costs of operating the LP system?

Hot Water Heaters Items appraisers should review related to hot water heaters include: – Type • Separate, stand alone • On demand • Off furnace – Fuel – Age, condition, warranty

Hot Water Heaters Items appraisers should review related to hot water heaters include: – Type • Separate, stand alone • On demand • Off furnace – Fuel – Age, condition, warranty

Tankless Hot Water Heaters • Gas tankless hot water heaters are more efficient overall than electric. • A square/rectangular shape is an immediate sign that it is not a conventional hot water heater.

Tankless Hot Water Heaters • Gas tankless hot water heaters are more efficient overall than electric. • A square/rectangular shape is an immediate sign that it is not a conventional hot water heater.

Tankless Hot Water Heaters (con’t) • A spigot or tap is turned on, which draws the water (indicated in blue) into the heater. • A flow sensor alerts the gas burner, which turns on the heat exchanger. • The incoming cold water circles around the heat exchanger, being heated to the preset temperature as it does.

Tankless Hot Water Heaters (con’t) • A spigot or tap is turned on, which draws the water (indicated in blue) into the heater. • A flow sensor alerts the gas burner, which turns on the heat exchanger. • The incoming cold water circles around the heat exchanger, being heated to the preset temperature as it does.

Tankless Hot Water Heaters (con’t) • As an appraiser, it’s important to note if a home has a standard water heater or a tankless one, since it provides an excellent cost savings to the consumer. *See next slide for anticipated cost savings. • Later in the chapter, we’ll discuss how to make adjustments based on energy savings.

Tankless Hot Water Heaters (con’t) • As an appraiser, it’s important to note if a home has a standard water heater or a tankless one, since it provides an excellent cost savings to the consumer. *See next slide for anticipated cost savings. • Later in the chapter, we’ll discuss how to make adjustments based on energy savings.

Tankless hot water heaters • Photo courtesy of Energystar. gov

Tankless hot water heaters • Photo courtesy of Energystar. gov

Plumbing Here are some considerations when appraising plumbing fixtures: – Dual flow toilets – Low flow showerheads – Provisions to catch and reuse grey water (if any) – Provisions to catch and use rainwater (if any)

Plumbing Here are some considerations when appraising plumbing fixtures: – Dual flow toilets – Low flow showerheads – Provisions to catch and reuse grey water (if any) – Provisions to catch and use rainwater (if any)

Plumbing (con’t) • One way to date remodeling efforts is the color and style of fixtures. • Today’s fixtures, especially toilets, tend to be lower, smaller, and if they are “dual flush” systems, have two buttons on the top of the tank, one for a full flush and one for a limited flush.

Plumbing (con’t) • One way to date remodeling efforts is the color and style of fixtures. • Today’s fixtures, especially toilets, tend to be lower, smaller, and if they are “dual flush” systems, have two buttons on the top of the tank, one for a full flush and one for a limited flush.

Flexible Tubing • A new plumbing trend seen in construction is the use of flexible tubing instead of pipes for supply lines. • This system does not have shut-offs located under the plumbing fixtures; instead, a special tool is used to shut the water supply off at the source.

Flexible Tubing • A new plumbing trend seen in construction is the use of flexible tubing instead of pipes for supply lines. • This system does not have shut-offs located under the plumbing fixtures; instead, a special tool is used to shut the water supply off at the source.

Power Sources When evaluating electrical systems and power sources, including solar panels, consider the following: • Is there adequate amperage? • If it’s a remodeled older home, is all of the old wiring disconnected and removed? • If solar panels are in place, is the homeowner selling power back to the electric company?

Power Sources When evaluating electrical systems and power sources, including solar panels, consider the following: • Is there adequate amperage? • If it’s a remodeled older home, is all of the old wiring disconnected and removed? • If solar panels are in place, is the homeowner selling power back to the electric company?

Power Sources (con’t) • Anything which looks unusual for a single family home should be investigated. – You find a 200 amp electrical system set up to run off a generator as well as power from the electric company. – The house is located in an area prone to electrical outages. The appraiser’s first impression was “super adequate”, but upon explanation by the owner, it makes sense.

Power Sources (con’t) • Anything which looks unusual for a single family home should be investigated. – You find a 200 amp electrical system set up to run off a generator as well as power from the electric company. – The house is located in an area prone to electrical outages. The appraiser’s first impression was “super adequate”, but upon explanation by the owner, it makes sense.

Building Envelope • The building envelope should keep moisture out, keep the inhabitants warm or cool and protect the inhabitants from infestations and noxious fumes. • To review - the building envelope is the entire building, from basement to roof. It contains the windows, walls as well as the attic and crawlspaces.

Building Envelope • The building envelope should keep moisture out, keep the inhabitants warm or cool and protect the inhabitants from infestations and noxious fumes. • To review - the building envelope is the entire building, from basement to roof. It contains the windows, walls as well as the attic and crawlspaces.

Lighting includes: – LCD or CFL light bulbs – Proper insulation around light fixtures – Skylights

Lighting includes: – LCD or CFL light bulbs – Proper insulation around light fixtures – Skylights

Lighting (con’t) Things to think about: • Are there any skylights in place and what kind? Is the glass thermal? Are they leaking? • New tubular skylights are much more energy efficient, and provide more lighting than the traditional flat window skylights. – Note: Soffit lights are notorious for leaking air.

Lighting (con’t) Things to think about: • Are there any skylights in place and what kind? Is the glass thermal? Are they leaking? • New tubular skylights are much more energy efficient, and provide more lighting than the traditional flat window skylights. – Note: Soffit lights are notorious for leaking air.

Windows Things to think about: – Original or replacement? – Number of panes (e. g. , double pane, triple pane) – Materials (e. g. , vinyl clad, wood clad) – Low thermal emissivity (low-E) – U-rating

Windows Things to think about: – Original or replacement? – Number of panes (e. g. , double pane, triple pane) – Materials (e. g. , vinyl clad, wood clad) – Low thermal emissivity (low-E) – U-rating

Windows (con’t) • Red flags for appraisers include clouded or fogged windows or sliding glass doors. – This generally indicates that the seal is broken and the window is not as effective. – When the seal is broken, it allows unheated air inside the window, and also allows condensation to build up within the window.

Windows (con’t) • Red flags for appraisers include clouded or fogged windows or sliding glass doors. – This generally indicates that the seal is broken and the window is not as effective. – When the seal is broken, it allows unheated air inside the window, and also allows condensation to build up within the window.

Windows (con’t) • The map in the next slide has sections of the United States with respect to requirements for windows and skylights and correlates the map to the level of Ufactor required. • Recall from an earlier chapter than Ufactors are the reverse of R-factors, and therefore, a lower U-factor indicates higher energy efficiency.

Windows (con’t) • The map in the next slide has sections of the United States with respect to requirements for windows and skylights and correlates the map to the level of Ufactor required. • Recall from an earlier chapter than Ufactors are the reverse of R-factors, and therefore, a lower U-factor indicates higher energy efficiency.

Windows (con’t)

Windows (con’t)

Exterior Doors Things to think about: • How old are the exterior doors? Are they insulated? • Some older homes actually used hollow core exterior doors, which provided very little protection from drafts.

Exterior Doors Things to think about: • How old are the exterior doors? Are they insulated? • Some older homes actually used hollow core exterior doors, which provided very little protection from drafts.

Walls The interior walls will likely be one of the following: • Plaster (found in older homes) • Drywall (sometimes called gypsum board or sheetrock) • Paneling, including solid wood paneling

Walls The interior walls will likely be one of the following: • Plaster (found in older homes) • Drywall (sometimes called gypsum board or sheetrock) • Paneling, including solid wood paneling

Walls (con’t) • Appraisers should check for insulation behind the walls. – Note that 2 x 4 construction is still used in some places, instead of 2 x 6 (which is preferable). – The cavity depth dictates the R value; additional insulation can come from a home wrap or Styrofoam insulation under siding.

Walls (con’t) • Appraisers should check for insulation behind the walls. – Note that 2 x 4 construction is still used in some places, instead of 2 x 6 (which is preferable). – The cavity depth dictates the R value; additional insulation can come from a home wrap or Styrofoam insulation under siding.

Walls (con’t) • In older homes, you may find either triple brick or a double plank house construction. • Triple brick is what it sounds like; literally, three layers of brick. In these houses, the plaster was applied directly to the interior portion of the brick.

Walls (con’t) • In older homes, you may find either triple brick or a double plank house construction. • Triple brick is what it sounds like; literally, three layers of brick. In these houses, the plaster was applied directly to the interior portion of the brick.

Walls (con’t) • The challenge with this type of construction in an older home is that there is not a cavity to put insulation and wiring into. – Note: when you see conduit wiring running along the baseboard, it’s a good clue that the construction of the home did not include cavities for the wiring.

Walls (con’t) • The challenge with this type of construction in an older home is that there is not a cavity to put insulation and wiring into. – Note: when you see conduit wiring running along the baseboard, it’s a good clue that the construction of the home did not include cavities for the wiring.

Walls (con’t) • Double plank houses are common in certain parts of the United States, particularly where lumber was cheap and plentiful. • They literally have double planks—one set runs horizontally and one set runs vertically. • These houses have the same issues as triple brick - here is no cavity for electrical wires and insulation.

Walls (con’t) • Double plank houses are common in certain parts of the United States, particularly where lumber was cheap and plentiful. • They literally have double planks—one set runs horizontally and one set runs vertically. • These houses have the same issues as triple brick - here is no cavity for electrical wires and insulation.

Attics and Crawlspaces • Attics and crawlspaces are very important areas of homes and are not to be forgotten. • If you are doing an appraisal for FHA, they require you to do a “head and shoulders” inspection of the attic area—which is why, if you are an FHA appraiser, you probably carry a two- to three-step ladder in your vehicle.

Attics and Crawlspaces • Attics and crawlspaces are very important areas of homes and are not to be forgotten. • If you are doing an appraisal for FHA, they require you to do a “head and shoulders” inspection of the attic area—which is why, if you are an FHA appraiser, you probably carry a two- to three-step ladder in your vehicle.

Attics and Crawlspaces (con’t) • Often, you cannot discern how much insulation is present; only that it is there. • Try to pry up an attic floorboard to see if insulation is present.

Attics and Crawlspaces (con’t) • Often, you cannot discern how much insulation is present; only that it is there. • Try to pry up an attic floorboard to see if insulation is present.

Attics and Crawlspaces (con’t) – Sometimes, insulation is present, but is incorrectly installed. – In an unfinished attic, any insulation should be in the floor, not the roof. This placement could cause condensation and cause the roof sheathing to rot.

Attics and Crawlspaces (con’t) – Sometimes, insulation is present, but is incorrectly installed. – In an unfinished attic, any insulation should be in the floor, not the roof. This placement could cause condensation and cause the roof sheathing to rot.

Attics and Crawlspaces (con’t) • In older homes, there may be blown-in insulation in the walls. • Sometimes, the evidence of this is either visible “plugged” holes, or in the case of a brick house, new cleaner (whiter) mortar around bricks that were removed when insulation was blown in.

Attics and Crawlspaces (con’t) • In older homes, there may be blown-in insulation in the walls. • Sometimes, the evidence of this is either visible “plugged” holes, or in the case of a brick house, new cleaner (whiter) mortar around bricks that were removed when insulation was blown in.

Data, Adjustments, and the Effect of Green • After the physical inspection of the house, you need to sort and evaluate your research and data. • Now, we will delve into detail on the following topics: • Compiling data research • Filtering data • Verifying data • Evaluating data • Adjustments • Cost and value • Effect of green

Data, Adjustments, and the Effect of Green • After the physical inspection of the house, you need to sort and evaluate your research and data. • Now, we will delve into detail on the following topics: • Compiling data research • Filtering data • Verifying data • Evaluating data • Adjustments • Cost and value • Effect of green

Compiling Data Research • When a house is Green Certified, the builder and/or owner should be instructed to keep all pertinent information in a handy, but safe place, and share it with real estate agents, buyers, and appraisers.

Compiling Data Research • When a house is Green Certified, the builder and/or owner should be instructed to keep all pertinent information in a handy, but safe place, and share it with real estate agents, buyers, and appraisers.

Compiling Data Research (con’t) • In the real world of real estate, homeowners run the gamut from highly organized to very disorganized. • You will deal with these types of owners in regards to both new construction and in older, remodeled homes. • Often the current owner will state, “That was remodeled before we got here; I really don’t know much about it. ”

Compiling Data Research (con’t) • In the real world of real estate, homeowners run the gamut from highly organized to very disorganized. • You will deal with these types of owners in regards to both new construction and in older, remodeled homes. • Often the current owner will state, “That was remodeled before we got here; I really don’t know much about it. ”

REO – Real Estate Owned • The plethora of foreclosures in the market has made the problem of data research even more challenging. • REO properties, are a perfect example. • Even if the former owners left information in the house regarding its systems and warranties (green or otherwise), such documents may have been removed in the “trash out” - a standard part of the foreclosure process.

REO – Real Estate Owned • The plethora of foreclosures in the market has made the problem of data research even more challenging. • REO properties, are a perfect example. • Even if the former owners left information in the house regarding its systems and warranties (green or otherwise), such documents may have been removed in the “trash out” - a standard part of the foreclosure process.

REO (con’t) • Additionally, most REO lenders instruct agents that they want to sell the house “as is, where is”. • Many refuse to even turn utilities on for appraisers and other inspectors. If a buyer wants them turned on, he or she does so at his or her own expense.

REO (con’t) • Additionally, most REO lenders instruct agents that they want to sell the house “as is, where is”. • Many refuse to even turn utilities on for appraisers and other inspectors. If a buyer wants them turned on, he or she does so at his or her own expense.

Appraisal Management Companies • The next challenge regarding data research is the demand on appraisers relating to time and monetary constraints.

Appraisal Management Companies • The next challenge regarding data research is the demand on appraisers relating to time and monetary constraints.

AMC’s and HVCC • Since the implementation of the Home Valuation Code of Conduct (HVCC), most lenders have used a third party between the appraiser and the loan originator, to keep the appraiser from being influenced by the lender. • HVCC was a voluntary agreement between Fannie Mae, Freddie Mac with Andrew Cuomo. • HVCC was replaced by similar guidelines from Fannie Mae, FHA, VA, and others.

AMC’s and HVCC • Since the implementation of the Home Valuation Code of Conduct (HVCC), most lenders have used a third party between the appraiser and the loan originator, to keep the appraiser from being influenced by the lender. • HVCC was a voluntary agreement between Fannie Mae, Freddie Mac with Andrew Cuomo. • HVCC was replaced by similar guidelines from Fannie Mae, FHA, VA, and others.

AMC’s and HVCC (con’t) • Since the advent of HVCC and then the follow- up guidelines, appraisers in residential mortgage have, for the most part, been dealing with third parties, or AMCs. • The appraisal management fee negotiates turnaround time and fees with the appraisers. • According to some appraisers these companies have exerted significant pressure for quick turnaround times, as well as placing downward pressure on fees.

AMC’s and HVCC (con’t) • Since the advent of HVCC and then the follow- up guidelines, appraisers in residential mortgage have, for the most part, been dealing with third parties, or AMCs. • The appraisal management fee negotiates turnaround time and fees with the appraisers. • According to some appraisers these companies have exerted significant pressure for quick turnaround times, as well as placing downward pressure on fees.

Uniform Appraisal Dataset (UAD) • Fannie Mae introduced the Uniform Appraisal Dataset (UAD). • Among other things, the UAD quantifies quality and condition ratings from 1 through 6.

Uniform Appraisal Dataset (UAD) • Fannie Mae introduced the Uniform Appraisal Dataset (UAD). • Among other things, the UAD quantifies quality and condition ratings from 1 through 6.

UAD (con’t) • Despite assertions to the contrary by Fannie Mae, most appraisers agree that – Q 1 and C 1 correspond to excellent – Q 2 and C 2 to very good – Q 3 and C 3 to good – Q 4 and C 4 to average – Q 5 and C 5 to fair and – Q 6 and C 6 to poor

UAD (con’t) • Despite assertions to the contrary by Fannie Mae, most appraisers agree that – Q 1 and C 1 correspond to excellent – Q 2 and C 2 to very good – Q 3 and C 3 to good – Q 4 and C 4 to average – Q 5 and C 5 to fair and – Q 6 and C 6 to poor

UAD (con’t) • The UAD was introduced in 2011. • Some MLS systems began changing the required fields in the MLS, to correspond with the UAD requirements. • Most seasoned appraisers agree that MLS data is at best a mixed bag - some of it is wonderful some not and lots of it is missing. • In the case where data is incomplete or appears to be incorrect, the appraiser has to verify the data from a reliable source.

UAD (con’t) • The UAD was introduced in 2011. • Some MLS systems began changing the required fields in the MLS, to correspond with the UAD requirements. • Most seasoned appraisers agree that MLS data is at best a mixed bag - some of it is wonderful some not and lots of it is missing. • In the case where data is incomplete or appears to be incorrect, the appraiser has to verify the data from a reliable source.

UAD (con’t) • If the data cannot be verified, the appraiser cannot use it and still comply with #13 in the certifications found in all Fannie Mae reports that states: • I obtained the information, estimates, and opinions furnished by other parties and expressed in this appraisal report from reliable sources that I believe to be true and correct.

UAD (con’t) • If the data cannot be verified, the appraiser cannot use it and still comply with #13 in the certifications found in all Fannie Mae reports that states: • I obtained the information, estimates, and opinions furnished by other parties and expressed in this appraisal report from reliable sources that I believe to be true and correct.

Filtering Data • Before an appraiser moves to the step of verifying data, the appraiser must first filter the data. • Most appraisers begin their search for comparables by entering specific data into the search fields of their MLS.

Filtering Data • Before an appraiser moves to the step of verifying data, the appraiser must first filter the data. • Most appraisers begin their search for comparables by entering specific data into the search fields of their MLS.

Filtering Data (con’t) • Once a list is generated, from the MLS, most appraisers evaluate the available comparables and then select those that they consider to be most comparable to the subject. In this respect, they are following #7 in their [Fannie Mae] certifications: • I selected and used comparable sales that are locationally, physically, and functionally the most similar to the subject property.

Filtering Data (con’t) • Once a list is generated, from the MLS, most appraisers evaluate the available comparables and then select those that they consider to be most comparable to the subject. In this respect, they are following #7 in their [Fannie Mae] certifications: • I selected and used comparable sales that are locationally, physically, and functionally the most similar to the subject property.

Filtering Data (con’t) • When doing an appraisal on a house with green features, it’s a great benefit to the appraiser to be able to search by green features. • Just as an MLS database allows an appraiser to search for square footage, number of bedrooms and bathrooms, school district, etc. – searchable “green” fields in the MLS allow an appraiser to hone in on home with similar green features.

Filtering Data (con’t) • When doing an appraisal on a house with green features, it’s a great benefit to the appraiser to be able to search by green features. • Just as an MLS database allows an appraiser to search for square footage, number of bedrooms and bathrooms, school district, etc. – searchable “green” fields in the MLS allow an appraiser to hone in on home with similar green features.

Filtering Data (con’t) • One of the best benefits is searchable fields for the appraiser trying to find another comparable sale which had a ground source heat pump, or solar panels, or a LEED Certification, etc. • NAR (The National Association of REALTORS®) has the Green Resource Council, which offers information to NAR members regarding green housing.

Filtering Data (con’t) • One of the best benefits is searchable fields for the appraiser trying to find another comparable sale which had a ground source heat pump, or solar panels, or a LEED Certification, etc. • NAR (The National Association of REALTORS®) has the Green Resource Council, which offers information to NAR members regarding green housing.

Verifying Data • Sources for verifying green data include: – Building permit records – Sellers – Buyers – Agents – Home inspectors

Verifying Data • Sources for verifying green data include: – Building permit records – Sellers – Buyers – Agents – Home inspectors

Verifying Data (con’t) • Verifying green data is very important, however, it is a much bigger chore if it is missing or incomplete. • It also leads to the question of whether or not the buyer knew of the particular features of a home before buying it.

Verifying Data (con’t) • Verifying green data is very important, however, it is a much bigger chore if it is missing or incomplete. • It also leads to the question of whether or not the buyer knew of the particular features of a home before buying it.

Verifying Data (con’t) • For example: If a buyer purchased a home with a HERS rating of 60, but was unaware of that feature, it can easily be argued that particular feature did not play into the buyer’s decision to buy that house.

Verifying Data (con’t) • For example: If a buyer purchased a home with a HERS rating of 60, but was unaware of that feature, it can easily be argued that particular feature did not play into the buyer’s decision to buy that house.

Verifying Data (con’t) • The newer the house, the more likely it is that building permit records are in place. • For remodeled homes, a building permit should have been obtained, and depending upon the local requirements, some of what is “code” may also be considered “green”.

Verifying Data (con’t) • The newer the house, the more likely it is that building permit records are in place. • For remodeled homes, a building permit should have been obtained, and depending upon the local requirements, some of what is “code” may also be considered “green”.

Verifying Data (con’t) • Verifying data through sellers, buyers, and agents can be tedious. • Another source may be home inspectors. Home inspectors have confidentiality requirements, but in some (rare) cases, sellers have home inspections done prior to listing the property, and then instruct their agent to upload the home inspection report to the MLS. • In these cases, if you are a member of the MLS, you are certainly entitled to review that report, and cite it in your report as a source of information.

Verifying Data (con’t) • Verifying data through sellers, buyers, and agents can be tedious. • Another source may be home inspectors. Home inspectors have confidentiality requirements, but in some (rare) cases, sellers have home inspections done prior to listing the property, and then instruct their agent to upload the home inspection report to the MLS. • In these cases, if you are a member of the MLS, you are certainly entitled to review that report, and cite it in your report as a source of information.

Verifying Data (con’t) • Remember: If you cannot verify data, you either cannot use the comparable, or you must make a huge disclaimer. • Never make any adjustment for a feature you were unable to confirm.

Verifying Data (con’t) • Remember: If you cannot verify data, you either cannot use the comparable, or you must make a huge disclaimer. • Never make any adjustment for a feature you were unable to confirm.

Evaluating Data • The next step is evaluating the data. – First part is identifying the relevant characteristics. – From there, format the data into a spreadsheet for easy analysis. • Remember: If you are relying on data to support adjustments, you have to make certain it is correct.

Evaluating Data • The next step is evaluating the data. – First part is identifying the relevant characteristics. – From there, format the data into a spreadsheet for easy analysis. • Remember: If you are relying on data to support adjustments, you have to make certain it is correct.

Adjustments • One of the first things that many appraisers are taught is: “Prepare every report as if you will have to defend it in court!” • Many appraisers today report being second-guessed.

Adjustments • One of the first things that many appraisers are taught is: “Prepare every report as if you will have to defend it in court!” • Many appraisers today report being second-guessed.

Adjustments (con’t) • What does Fannie Mae say about adjustments? – Adjust comparables to the subject. – Make positive adjustments if the comparable is inferior, and negative adjustments if the comparable is superior. – These adjustments must be made based on an analyses of this type of property, in this location (or a competing one), and made within the context of typical purchaser expectations.

Adjustments (con’t) • What does Fannie Mae say about adjustments? – Adjust comparables to the subject. – Make positive adjustments if the comparable is inferior, and negative adjustments if the comparable is superior. – These adjustments must be made based on an analyses of this type of property, in this location (or a competing one), and made within the context of typical purchaser expectations.

Adjustments (con’t) • Example #1 – Someone buying (in most markets in the United States) a house for over half a million dollars would expect major upgrades— hardwood flooring, granite countertops, etc. – However, someone buying a house for under $100, 000, in most markets in the United States, would have much lower expectations.

Adjustments (con’t) • Example #1 – Someone buying (in most markets in the United States) a house for over half a million dollars would expect major upgrades— hardwood flooring, granite countertops, etc. – However, someone buying a house for under $100, 000, in most markets in the United States, would have much lower expectations.

Adjustments (con’t) • Example #2 – Comparing an older, less expensive house to a newer house. – Many markets have housing inventory of 80120 years old where the houses have four bedrooms and one full bath. That is a typical expectation for that age and type of house. – No builder today would build a four-bedroom house with only one bathroom. People’s tastes and expectations change over time.

Adjustments (con’t) • Example #2 – Comparing an older, less expensive house to a newer house. – Many markets have housing inventory of 80120 years old where the houses have four bedrooms and one full bath. That is a typical expectation for that age and type of house. – No builder today would build a four-bedroom house with only one bathroom. People’s tastes and expectations change over time.

Adjustments (con’t) • Example #3 – At one time, having storm windows was an upgrade to a standard window with no storm or screen. – Today, all new construction uses some kind of thermal windows, usually with screens built in or included.

Adjustments (con’t) • Example #3 – At one time, having storm windows was an upgrade to a standard window with no storm or screen. – Today, all new construction uses some kind of thermal windows, usually with screens built in or included.

Adjustments (con’t) • Few adjustments are cost-based. Most are market-based. • Fannie Mae prefers that net adjustments per comparable not exceed 15 percent, and gross adjustments should not exceed 25 percent. • This is not to say that appraisal reports are not prepared and delivered with greater adjustments than these - this is what Fannie Mae prefers. For example: A truly odd house might end up requiring substantial adjustments.

Adjustments (con’t) • Few adjustments are cost-based. Most are market-based. • Fannie Mae prefers that net adjustments per comparable not exceed 15 percent, and gross adjustments should not exceed 25 percent. • This is not to say that appraisal reports are not prepared and delivered with greater adjustments than these - this is what Fannie Mae prefers. For example: A truly odd house might end up requiring substantial adjustments.

Adjustments (con’t) • www. efanniemae. com is a website that offers free subscriptions to information regarding servicing and selling of Fannie Mae loans. • Appraisers can also review Fannie Mae’s selling guide here.

Adjustments (con’t) • www. efanniemae. com is a website that offers free subscriptions to information regarding servicing and selling of Fannie Mae loans. • Appraisers can also review Fannie Mae’s selling guide here.

Making Green Adjustments • There a variety of ways an appraiser can make adjustments. • Once an appraiser makes “known adjustments”, he or she can then make adjustments for green features.

Making Green Adjustments • There a variety of ways an appraiser can make adjustments. • Once an appraiser makes “known adjustments”, he or she can then make adjustments for green features.

Making Green Adjustments (con’t) For example: An appraiser can develop a discounted cash flow to take into account the savings realized by the property owner for investing in green features up front, but reaping the lower operating costs over time. An appraiser can apply a GRM to homes with green features, and identify the benefit from that aspect.

Making Green Adjustments (con’t) For example: An appraiser can develop a discounted cash flow to take into account the savings realized by the property owner for investing in green features up front, but reaping the lower operating costs over time. An appraiser can apply a GRM to homes with green features, and identify the benefit from that aspect.

Correlating Dissimilar Data A challenge to appraisers is correlating dissimilar data. • For example – you work in an area with a “Green” MLS allowing you to separate out homes which are green certified. – Your subject property is an ENERGY STAR home. It has a HERS rating of 60.

Correlating Dissimilar Data A challenge to appraisers is correlating dissimilar data. • For example – you work in an area with a “Green” MLS allowing you to separate out homes which are green certified. – Your subject property is an ENERGY STAR home. It has a HERS rating of 60.

Correlating Dissimilar Data (con’t) For comparables, you find three other homes: • One is an ENERGY STAR home, with a HERS rating of 70. • One is a home which has an NAHB Gold rating • One is a Silver Level LEED home. All four homes have green features and all have quantifiable green features, but they are not identical.

Correlating Dissimilar Data (con’t) For comparables, you find three other homes: • One is an ENERGY STAR home, with a HERS rating of 70. • One is a home which has an NAHB Gold rating • One is a Silver Level LEED home. All four homes have green features and all have quantifiable green features, but they are not identical.

Correlating Dissimilar Data (con’t) • A logical place to start is by calculating the cost paid per square foot for each house. • You want to compare this data with published cost tables for Green Construction, available from Marshall and Swift. • Their data is available for purchase in book form, or online @ http: //www. marshallswift. com/

Correlating Dissimilar Data (con’t) • A logical place to start is by calculating the cost paid per square foot for each house. • You want to compare this data with published cost tables for Green Construction, available from Marshall and Swift. • Their data is available for purchase in book form, or online @ http: //www. marshallswift. com/

Cost and Value • Once you have ascertained the costs of construction and broken out differences among the homes, you still are faced with Cost ≠ Value (cost does not equal value). • You can calculate what each comparable, and the subject, would cost to build new, but you need to compare the cost of the comparables with the price they sold for.

Cost and Value • Once you have ascertained the costs of construction and broken out differences among the homes, you still are faced with Cost ≠ Value (cost does not equal value). • You can calculate what each comparable, and the subject, would cost to build new, but you need to compare the cost of the comparables with the price they sold for.

Cost and Value (con’t) • As you are doing this, analyze the sales to determine which features are relevant characteristics, and how those relevant characteristics equated to the price paid for the home. • Unlike investor buyers, who can generally explain exactly why they bought what they bought and why they paid what they paid for it, residential buyers often insert qualitative reasons into the equation.

Cost and Value (con’t) • As you are doing this, analyze the sales to determine which features are relevant characteristics, and how those relevant characteristics equated to the price paid for the home. • Unlike investor buyers, who can generally explain exactly why they bought what they bought and why they paid what they paid for it, residential buyers often insert qualitative reasons into the equation.

Cost and Value (con’t) • To confound the situation, we know as appraisers that we are valuing for the typical purchaser, not the one in a million purchaser. • For this reason, before making energy or green adjustments, you want to make your “known” adjustments for things like square footage, garages, baths, etc.

Cost and Value (con’t) • To confound the situation, we know as appraisers that we are valuing for the typical purchaser, not the one in a million purchaser. • For this reason, before making energy or green adjustments, you want to make your “known” adjustments for things like square footage, garages, baths, etc.

The Effect of Green • Another way to consider the effect of “green” on price or valuation is to calculate the estimated savings on utility costs, and convert that to an additional capitalized savings value when an Energy Efficient Mortgage is, or would most likely be used, to finance the property in the particular market. • In other words, because the borrower is projected to pay less for energy costs, she has more in her monthly budget, which can be converted to additional capitalized saving based on how much less she has going out the door for mortgage and utilities.

The Effect of Green • Another way to consider the effect of “green” on price or valuation is to calculate the estimated savings on utility costs, and convert that to an additional capitalized savings value when an Energy Efficient Mortgage is, or would most likely be used, to finance the property in the particular market. • In other words, because the borrower is projected to pay less for energy costs, she has more in her monthly budget, which can be converted to additional capitalized saving based on how much less she has going out the door for mortgage and utilities.

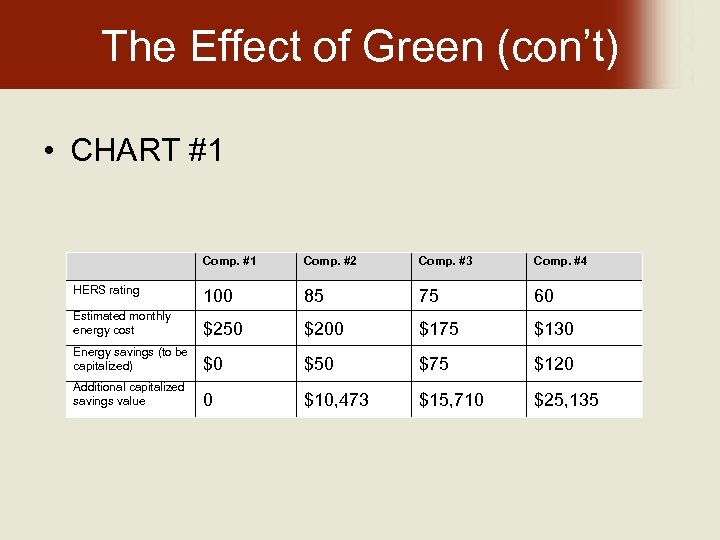

The Effect of Green (con’t) • Let’s look at an example. – From a pool of potential comparables, you identify four houses. – One is a basic, new construction without a HERS rating, and no particular “green” features. – The other three comparables have HERS ratings, and you have estimates of the savings per month based upon each HERS rating. – The borrower is considering an EEM loan at 4 percent, which is market level, with a 30 -year term. Look at the chart on the next slide:

The Effect of Green (con’t) • Let’s look at an example. – From a pool of potential comparables, you identify four houses. – One is a basic, new construction without a HERS rating, and no particular “green” features. – The other three comparables have HERS ratings, and you have estimates of the savings per month based upon each HERS rating. – The borrower is considering an EEM loan at 4 percent, which is market level, with a 30 -year term. Look at the chart on the next slide:

The Effect of Green (con’t) • CHART #1 Comp. #1 Comp. #2 Comp. #3 Comp. #4 HERS rating 100 85 75 60 Estimated monthly energy cost $250 $200 $175 $130 Energy savings (to be capitalized) $0 $50 $75 $120 Additional capitalized savings value 0 $10, 473 $15, 710 $25, 135

The Effect of Green (con’t) • CHART #1 Comp. #1 Comp. #2 Comp. #3 Comp. #4 HERS rating 100 85 75 60 Estimated monthly energy cost $250 $200 $175 $130 Energy savings (to be capitalized) $0 $50 $75 $120 Additional capitalized savings value 0 $10, 473 $15, 710 $25, 135

The Effect of Green (con’t) • The math is simple: – The amount of energy savings is entered into a financial calculator as “payment” (PMT). – 4 percent is the interest rate (i) and 30 years is the term (n). – You have converted the money to be saved into additional capitalized savings value, which is the present value (PV).

The Effect of Green (con’t) • The math is simple: – The amount of energy savings is entered into a financial calculator as “payment” (PMT). – 4 percent is the interest rate (i) and 30 years is the term (n). – You have converted the money to be saved into additional capitalized savings value, which is the present value (PV).

The Effect of Green (con’t) • Here are the calculator steps leading to the concluded additional capitalized savings value in the previous example: Energy Cost Savings (PMT) Rate (i) (entered as monthly payments) Term (n) (entered as monthly payments) Additional Capitalized Savings Value (PV) (rounded) Comp. #1 None --------- Comp. #2 $50 4% 30 $10, 473 Comp. #3 $75 4% 30 $15, 710 Comp. #4 $120 4% 30 $25, 135

The Effect of Green (con’t) • Here are the calculator steps leading to the concluded additional capitalized savings value in the previous example: Energy Cost Savings (PMT) Rate (i) (entered as monthly payments) Term (n) (entered as monthly payments) Additional Capitalized Savings Value (PV) (rounded) Comp. #1 None --------- Comp. #2 $50 4% 30 $10, 473 Comp. #3 $75 4% 30 $15, 710 Comp. #4 $120 4% 30 $25, 135

The Effect of Green (con’t) • This math can be adapted to a variety of circumstances. For example, according to the NAR 2011 Survey of Home Buyers and Home Sellers, the median anticipated tenure in a home is 15 years. • This is one of the highest levels it has ever been. Historically, the turnover time was seven to eight years.

The Effect of Green (con’t) • This math can be adapted to a variety of circumstances. For example, according to the NAR 2011 Survey of Home Buyers and Home Sellers, the median anticipated tenure in a home is 15 years. • This is one of the highest levels it has ever been. Historically, the turnover time was seven to eight years.

The Effect of Green (con’t) • Let’s look at this from the perspective of a buyer who anticipates a 10 -year tenure in the home. • Any savings, therefore, in his mind, will only be those he can realize during the 10 years he occupies and owns the house. (The same thought process can be used if the energy efficient item had a remaining life of 10 years. )

The Effect of Green (con’t) • Let’s look at this from the perspective of a buyer who anticipates a 10 -year tenure in the home. • Any savings, therefore, in his mind, will only be those he can realize during the 10 years he occupies and owns the house. (The same thought process can be used if the energy efficient item had a remaining life of 10 years. )

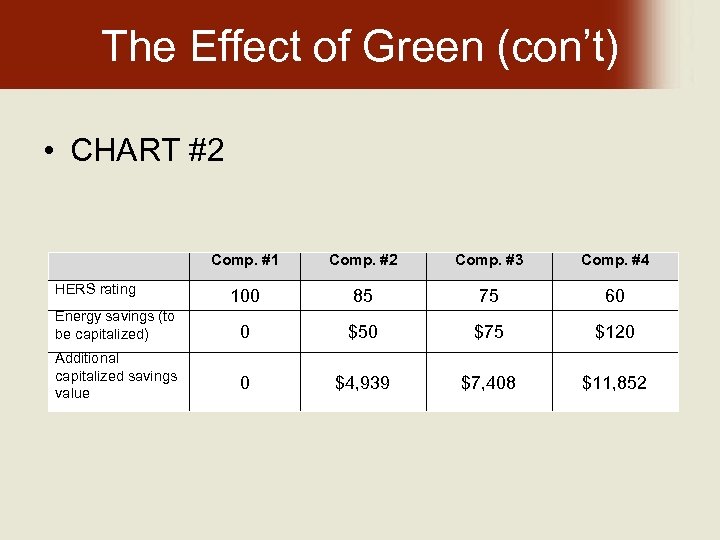

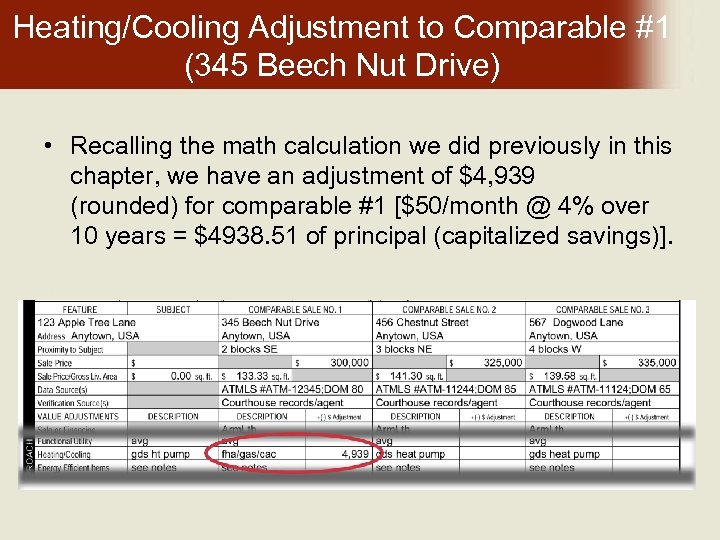

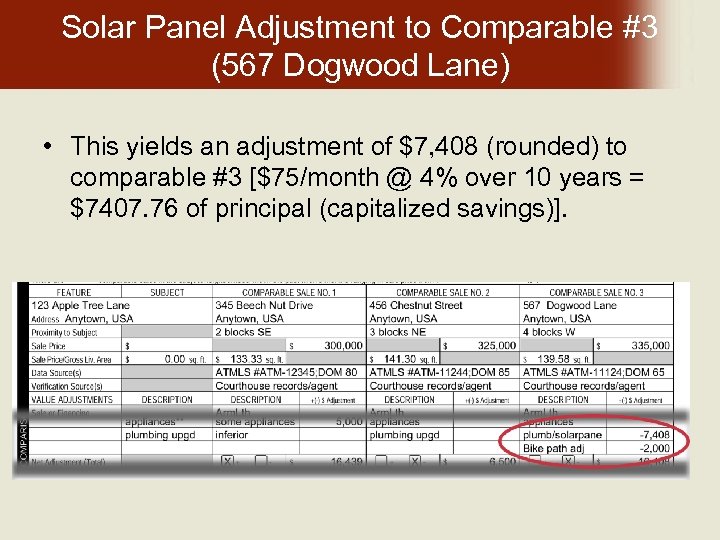

The Effect of Green (con’t) • CHART #2 Comp. #1 Comp. #2 Comp. #3 Comp. #4 100 85 75 60 Energy savings (to be capitalized) 0 $50 $75 $120 Additional capitalized savings value 0 $4, 939 $7, 408 $11, 852 HERS rating

The Effect of Green (con’t) • CHART #2 Comp. #1 Comp. #2 Comp. #3 Comp. #4 100 85 75 60 Energy savings (to be capitalized) 0 $50 $75 $120 Additional capitalized savings value 0 $4, 939 $7, 408 $11, 852 HERS rating

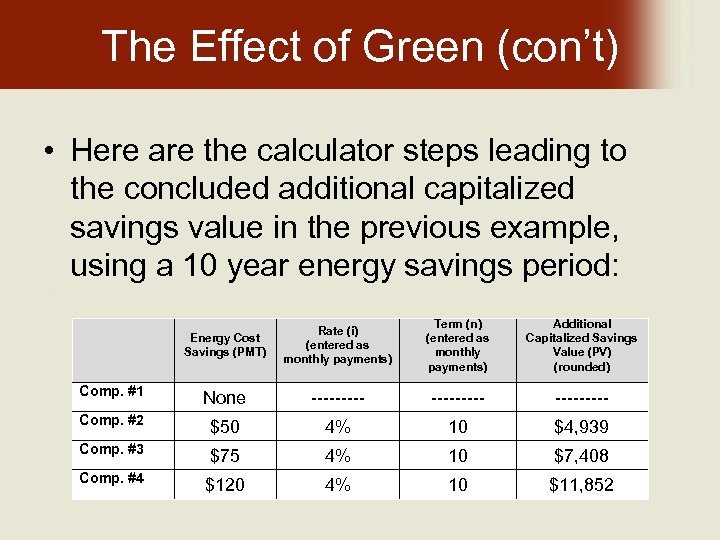

The Effect of Green (con’t) • Here are the calculator steps leading to the concluded additional capitalized savings value in the previous example, using a 10 year energy savings period: Energy Cost Savings (PMT) Rate (i) (entered as monthly payments) Term (n) (entered as monthly payments) Additional Capitalized Savings Value (PV) (rounded) Comp. #1 None --------- Comp. #2 $50 4% 10 $4, 939 Comp. #3 $75 4% 10 $7, 408 Comp. #4 $120 4% 10 $11, 852

The Effect of Green (con’t) • Here are the calculator steps leading to the concluded additional capitalized savings value in the previous example, using a 10 year energy savings period: Energy Cost Savings (PMT) Rate (i) (entered as monthly payments) Term (n) (entered as monthly payments) Additional Capitalized Savings Value (PV) (rounded) Comp. #1 None --------- Comp. #2 $50 4% 10 $4, 939 Comp. #3 $75 4% 10 $7, 408 Comp. #4 $120 4% 10 $11, 852

The Effect of Green (con’t) • An argument can also be made that whether the borrower anticipates selling within 10 years or not, he will anticipate maintenance, repairs, and possible replacement of the system, which would discount the savings from energy costs.

The Effect of Green (con’t) • An argument can also be made that whether the borrower anticipates selling within 10 years or not, he will anticipate maintenance, repairs, and possible replacement of the system, which would discount the savings from energy costs.

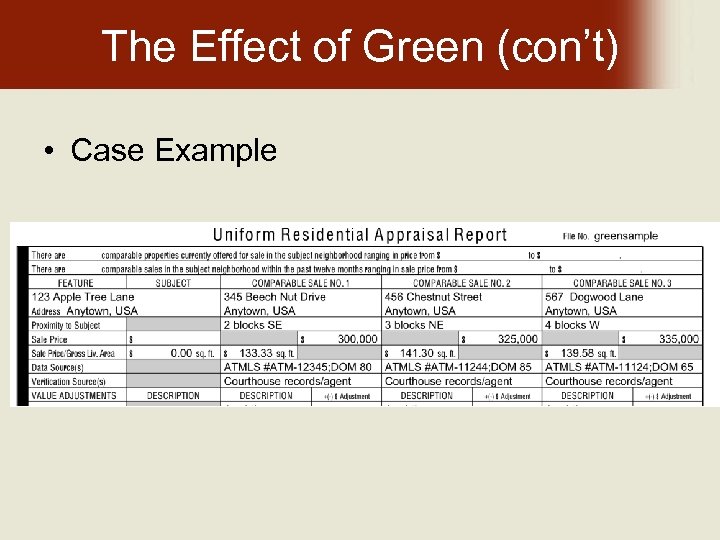

The Effect of Green (con’t) • Case Example

The Effect of Green (con’t) • Case Example

The Effect of Green (con’t) • The grid has been completed by an appraiser. The subject and three comparables are shown and “known” adjustments have been made. By known adjustments, we mean adjustments that the appraiser has developed over time. – These will be adjustments which come up over and over again, are objective, and may only need to be tested to ensure relevance to the data being used in the current assignment.

The Effect of Green (con’t) • The grid has been completed by an appraiser. The subject and three comparables are shown and “known” adjustments have been made. By known adjustments, we mean adjustments that the appraiser has developed over time. – These will be adjustments which come up over and over again, are objective, and may only need to be tested to ensure relevance to the data being used in the current assignment.

The Effect of Green (con’t) • Elements of comparison such as decoration, for example, is often based upon the judgment of the appraiser and can vary; square footage, number of baths, etc. are examples of objective data based upon direct market reactions. Let’s look more specifically at the differences and the adjustments.

The Effect of Green (con’t) • Elements of comparison such as decoration, for example, is often based upon the judgment of the appraiser and can vary; square footage, number of baths, etc. are examples of objective data based upon direct market reactions. Let’s look more specifically at the differences and the adjustments.

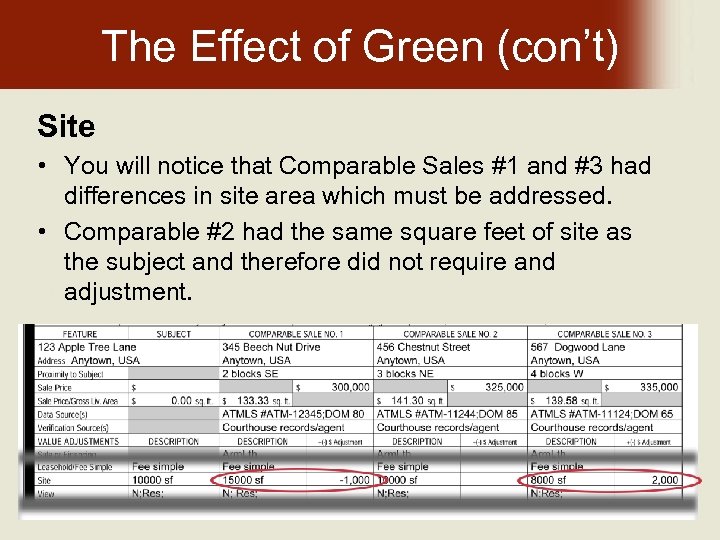

The Effect of Green (con’t) Site • You will notice that Comparable Sales #1 and #3 had differences in site area which must be addressed. • Comparable #2 had the same square feet of site as the subject and therefore did not require and adjustment.

The Effect of Green (con’t) Site • You will notice that Comparable Sales #1 and #3 had differences in site area which must be addressed. • Comparable #2 had the same square feet of site as the subject and therefore did not require and adjustment.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • This comp has 5, 000 more square feet of site area than the subject, but when the appraiser inspects the exterior of this comparable (as required by Fannie Mae), she realizes that the additional 5, 000 square feet are mostly vertical; the lot has a very steep bank on three sides.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • This comp has 5, 000 more square feet of site area than the subject, but when the appraiser inspects the exterior of this comparable (as required by Fannie Mae), she realizes that the additional 5, 000 square feet are mostly vertical; the lot has a very steep bank on three sides.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • As real estate professionals, we know that builders and subdividers will include “junk land” with other lots because it is of no value to them. • Because of the topography of this site compared to the subject, the adjustment made by the appraiser is minimal, and based entirely on the fact that these steep banks effectively keep neighboring homes from being too close.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • As real estate professionals, we know that builders and subdividers will include “junk land” with other lots because it is of no value to them. • Because of the topography of this site compared to the subject, the adjustment made by the appraiser is minimal, and based entirely on the fact that these steep banks effectively keep neighboring homes from being too close.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • The appraiser has adjusted at 20 cents per square foot for the difference in lot size between the subject and comparable #1. • The amount of this adjustment is not important; the defensibility of them is.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • The appraiser has adjusted at 20 cents per square foot for the difference in lot size between the subject and comparable #1. • The amount of this adjustment is not important; the defensibility of them is.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • The appraiser should have developed this adjustment over time by calculating how much more the typical purchaser would pay for more land. It should also be relative to other facts about the land, including topography, wetlands, etc. • This appraiser has developed the defensible opinion that 10, 000 square feet is the most common and expected lot size for this type of home, in this market. Thus, $. 20 X 5, 000 = (-)$1, 000.

Site Adjustment to Comparable #1 (345 Beech Nut Drive) • The appraiser should have developed this adjustment over time by calculating how much more the typical purchaser would pay for more land. It should also be relative to other facts about the land, including topography, wetlands, etc. • This appraiser has developed the defensible opinion that 10, 000 square feet is the most common and expected lot size for this type of home, in this market. Thus, $. 20 X 5, 000 = (-)$1, 000.

Site Adjustment to Comparable #3 (567 Dogwood Lane) • The site area of Comparable #3 is 2, 000 square foot smaller in size than the subject site and has a site adjustment of $1. 00 per sf. Why is the adjustment different from that applied to Comparable #1?

Site Adjustment to Comparable #3 (567 Dogwood Lane) • The site area of Comparable #3 is 2, 000 square foot smaller in size than the subject site and has a site adjustment of $1. 00 per sf. Why is the adjustment different from that applied to Comparable #1?

Site Adjustment to Comparable #3 (567 Dogwood Lane) • The appraiser’s opinion is that 10, 000 square feet is the typical “expected” lot size. The appraiser has data to indicate that buyers penalize smaller lots at about $1. 00 per square foot. Thus, $1. 00 x 2, 000 = (+)$2, 000

Site Adjustment to Comparable #3 (567 Dogwood Lane) • The appraiser’s opinion is that 10, 000 square feet is the typical “expected” lot size. The appraiser has data to indicate that buyers penalize smaller lots at about $1. 00 per square foot. Thus, $1. 00 x 2, 000 = (+)$2, 000

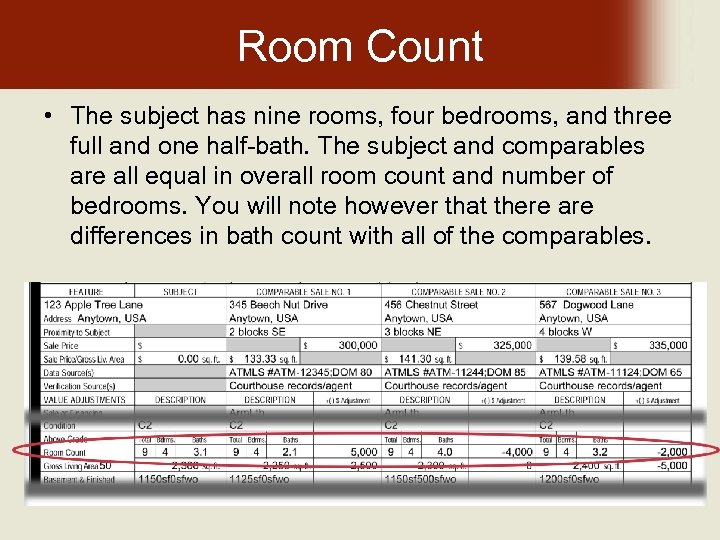

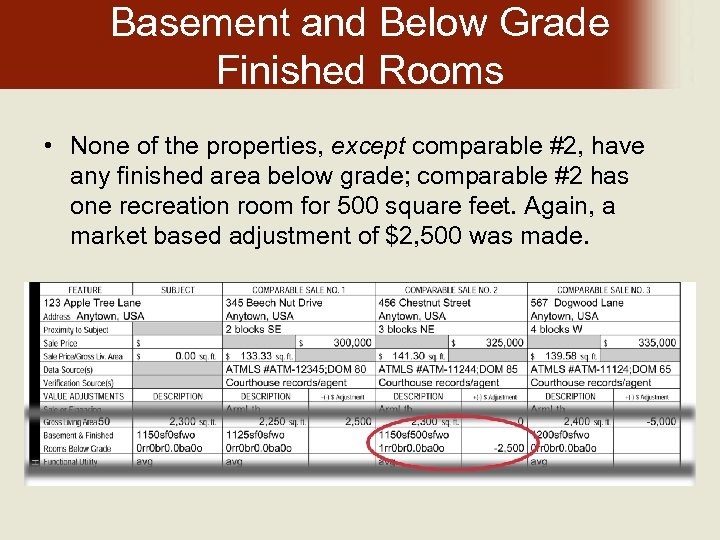

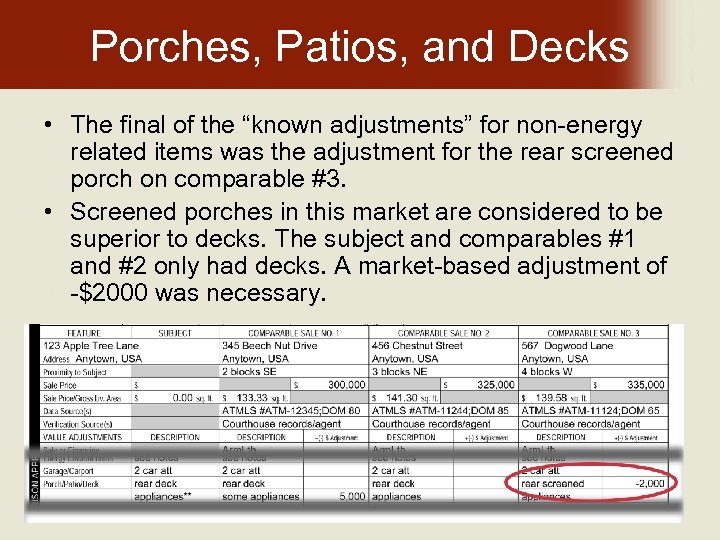

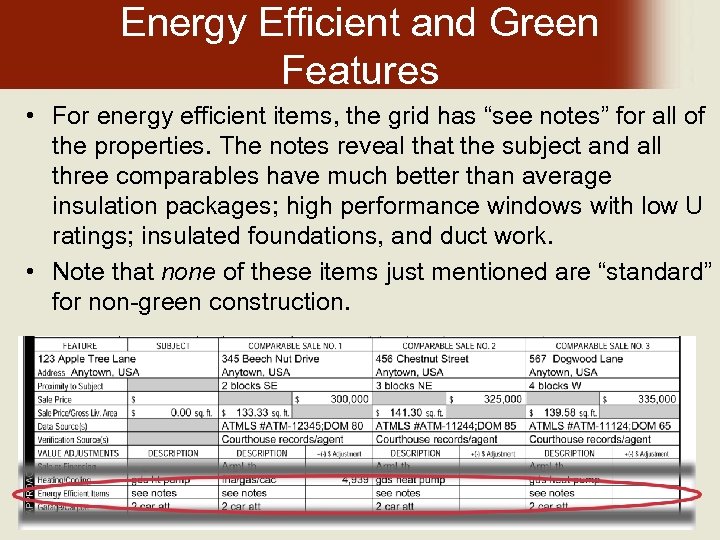

Room Count • The subject has nine rooms, four bedrooms, and three full and one half-bath. The subject and comparables are all equal in overall room count and number of bedrooms. You will note however that there are differences in bath count with all of the comparables.