a62dfe67167eb97b267e4a7e8d80ebd7.ppt

- Количество слайдов: 40

Chapter 4 Comparative Advantage and Factor Endowments

Chapter 4 Comparative Advantage and Factor Endowments

Learning Objectives • Explain the Heckscher-Ohlin Trade Model. • PPC (Production Possibility Curve) • Predict the impacts on different factors of production of trade-opening. • Predict the impacts on trade and production of a change in factor endowments. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -2

Learning Objectives • Explain the Heckscher-Ohlin Trade Model. • PPC (Production Possibility Curve) • Predict the impacts on different factors of production of trade-opening. • Predict the impacts on trade and production of a change in factor endowments. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -2

Learning Objectives (cont. ) • Illustrate the product cycle for a product as it becomes standardized in its production. • Wage Inequality Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -3

Learning Objectives (cont. ) • Illustrate the product cycle for a product as it becomes standardized in its production. • Wage Inequality Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -3

Modern Trade Theory • Adam Smith and David Ricardo assumed that each country would have its own technology, climate, and resources, and that these differences would give rise to productivity differences (and thus differences in comparative advantage) • In the 20 th century, several economists developed more detailed explanations of trade in which comparative advantage of a country depends on it’s endowments of inputs (factors of production) to produce goods Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -4

Modern Trade Theory • Adam Smith and David Ricardo assumed that each country would have its own technology, climate, and resources, and that these differences would give rise to productivity differences (and thus differences in comparative advantage) • In the 20 th century, several economists developed more detailed explanations of trade in which comparative advantage of a country depends on it’s endowments of inputs (factors of production) to produce goods Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -4

Heckscher-Ohlin (HO) Trade Model • The HO model states that a country’s factors of production (a country’s endowments of inputs) are used to make each good give rise to productivity differences between countries – Factor abundance versus factor scarcity: When a country enjoys a relative abundance of a factor, the factor’s relative cost is less than in countries where the factor is relatively scarce – A country’s comparative advantage lies in the production of goods that use relatively abundant factors Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -5

Heckscher-Ohlin (HO) Trade Model • The HO model states that a country’s factors of production (a country’s endowments of inputs) are used to make each good give rise to productivity differences between countries – Factor abundance versus factor scarcity: When a country enjoys a relative abundance of a factor, the factor’s relative cost is less than in countries where the factor is relatively scarce – A country’s comparative advantage lies in the production of goods that use relatively abundant factors Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -5

Key assumptions • As in the Ricardian model 2 goods, 2 countries. • Ricardian model assumed that each country faced a constant set of tradeoffs (e. g. , 2 loaves of bread for 3 tons of steel in the U. S. ) because of only one homogeneous input: labor • The HO model assumes: (1) multiple inputs— labour, capital, land, etc. —and (2) heterogeneity in the quality of inputs, i. e. skilled and unskilled labour. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -6

Key assumptions • As in the Ricardian model 2 goods, 2 countries. • Ricardian model assumed that each country faced a constant set of tradeoffs (e. g. , 2 loaves of bread for 3 tons of steel in the U. S. ) because of only one homogeneous input: labor • The HO model assumes: (1) multiple inputs— labour, capital, land, etc. —and (2) heterogeneity in the quality of inputs, i. e. skilled and unskilled labour. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -6

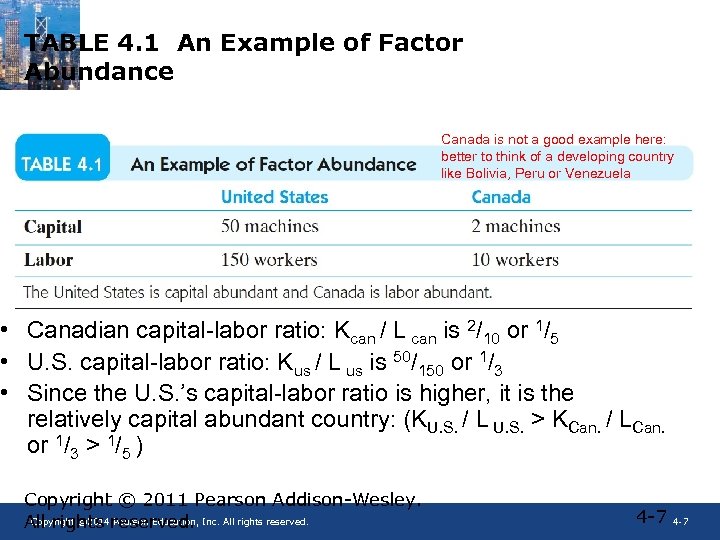

TABLE 4. 1 An Example of Factor Abundance Canada is not a good example here: better to think of a developing country like Bolivia, Peru or Venezuela • Canadian capital-labor ratio: Kcan / L can is 2/10 or 1/5 • U. S. capital-labor ratio: Kus / L us is 50/150 or 1/3 • Since the U. S. ’s capital-labor ratio is higher, it is the relatively capital abundant country: (KU. S. / L U. S. > KCan. / LCan. or 1/3 > 1/5 ) Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -7

TABLE 4. 1 An Example of Factor Abundance Canada is not a good example here: better to think of a developing country like Bolivia, Peru or Venezuela • Canadian capital-labor ratio: Kcan / L can is 2/10 or 1/5 • U. S. capital-labor ratio: Kus / L us is 50/150 or 1/3 • Since the U. S. ’s capital-labor ratio is higher, it is the relatively capital abundant country: (KU. S. / L U. S. > KCan. / LCan. or 1/3 > 1/5 ) Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -7

Implications • US is capital abundant relatively to Canada, so capital should be relatively cheap in the US and the US would have a relatively lower cost in producing capital-intensive goods> the US will have a lower opportunity cost in the production that uses relatively more capital and less labour. • US should export capital abundant goods, Canada labour abundant. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -8

Implications • US is capital abundant relatively to Canada, so capital should be relatively cheap in the US and the US would have a relatively lower cost in producing capital-intensive goods> the US will have a lower opportunity cost in the production that uses relatively more capital and less labour. • US should export capital abundant goods, Canada labour abundant. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -8

Heckscher-Ohlin (HO) Trade Model (cont. ) • The U. S. is richly endowed with a wide variety of factors: natural resources, skilled labor, and physical capital – Expectation: The U. S. will export agricultural products (particularly those requiring skilled labor and physical capital) and machinery and industrial goods (requiring physical capital and scientific and engineering skills) – Result: Major U. S. exports include grain products made with small labor and large capital inputs; and commercial aircraft made with physical capital and skilled labor. – But not all model predictions are good… Leontief found that U. S. exports were less capital-intensive than U. S. imports, even though the U. S. is the most capital-abundant country in the world: Leontief paradox. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -9

Heckscher-Ohlin (HO) Trade Model (cont. ) • The U. S. is richly endowed with a wide variety of factors: natural resources, skilled labor, and physical capital – Expectation: The U. S. will export agricultural products (particularly those requiring skilled labor and physical capital) and machinery and industrial goods (requiring physical capital and scientific and engineering skills) – Result: Major U. S. exports include grain products made with small labor and large capital inputs; and commercial aircraft made with physical capital and skilled labor. – But not all model predictions are good… Leontief found that U. S. exports were less capital-intensive than U. S. imports, even though the U. S. is the most capital-abundant country in the world: Leontief paradox. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -9

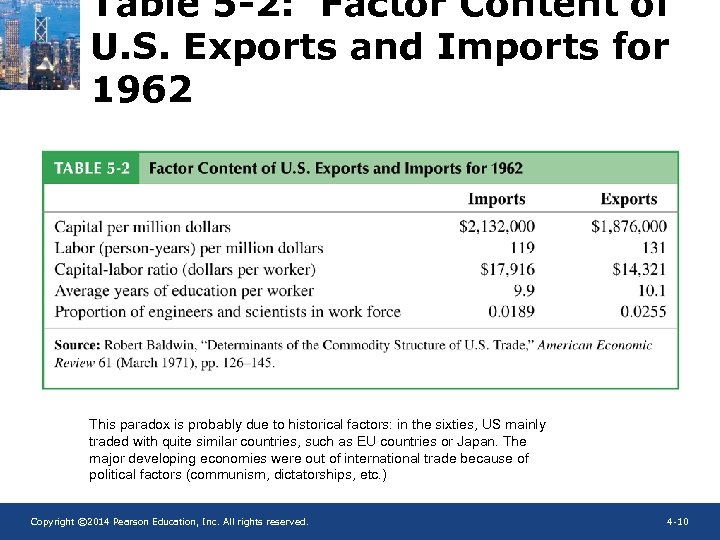

Table 5 -2: Factor Content of U. S. Exports and Imports for 1962 This paradox is probably due to historical factors: in the sixties, US mainly traded with quite similar countries, such as EU countries or Japan. The major developing economies were out of international trade because of political factors (communism, dictatorships, etc. ) Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -10

Table 5 -2: Factor Content of U. S. Exports and Imports for 1962 This paradox is probably due to historical factors: in the sixties, US mainly traded with quite similar countries, such as EU countries or Japan. The major developing economies were out of international trade because of political factors (communism, dictatorships, etc. ) Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -10

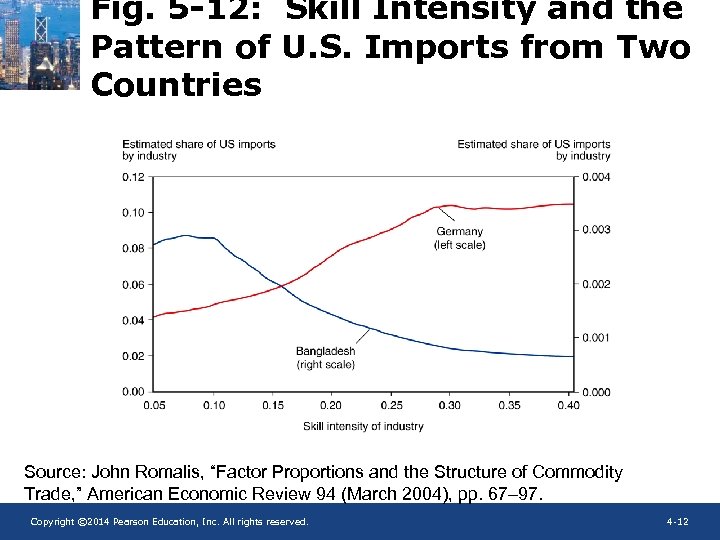

Empirical Evidence of the Heckscher-Ohlin Model • However, in general, patterns of exports between developed (high income) and developing (low/middle income) countries are in line with the HO theory. • US imports from Bangladesh are highest in lowskill-intensity industries, while US imports from Germany are highest in high- skill-intensity industries. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -11

Empirical Evidence of the Heckscher-Ohlin Model • However, in general, patterns of exports between developed (high income) and developing (low/middle income) countries are in line with the HO theory. • US imports from Bangladesh are highest in lowskill-intensity industries, while US imports from Germany are highest in high- skill-intensity industries. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -11

Fig. 5 -12: Skill Intensity and the Pattern of U. S. Imports from Two Countries Source: John Romalis, “Factor Proportions and the Structure of Commodity Trade, ” American Economic Review 94 (March 2004), pp. 67– 97. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -12

Fig. 5 -12: Skill Intensity and the Pattern of U. S. Imports from Two Countries Source: John Romalis, “Factor Proportions and the Structure of Commodity Trade, ” American Economic Review 94 (March 2004), pp. 67– 97. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -12

Gains from Trade in the HO Model • As in the Ricardian model: increase in market size <> Specialization <> gains for trade • As in the Ricardian model, there are gains for trade as, with respect to autharky, the price of the exported good rises and the one of the imported good falls in both countries. – The price of the exported good rises because foreign consumers buy the cheaper good produced from home, so increase its demand. – The price of the imported good falls as the foreign country is relatively more productive (with respect to the home country) in the good imported. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -13

Gains from Trade in the HO Model • As in the Ricardian model: increase in market size <> Specialization <> gains for trade • As in the Ricardian model, there are gains for trade as, with respect to autharky, the price of the exported good rises and the one of the imported good falls in both countries. – The price of the exported good rises because foreign consumers buy the cheaper good produced from home, so increase its demand. – The price of the imported good falls as the foreign country is relatively more productive (with respect to the home country) in the good imported. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -13

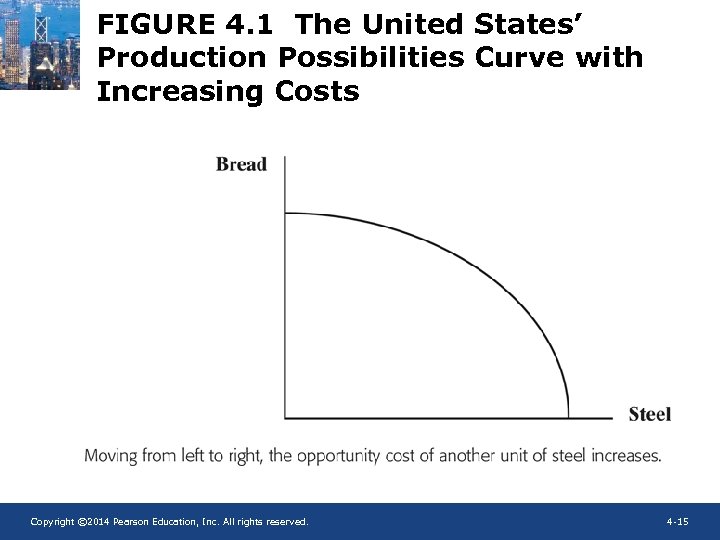

Other implications • Another crucial assumption of the HO model is that each country has a rising opportunity cost for each type of production, i. e. the more you produce of one good the more it costs to produce it. • So there is less tendency toward specialization than in the Ricardian model, where full specialization was the best outcome. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -14

Other implications • Another crucial assumption of the HO model is that each country has a rising opportunity cost for each type of production, i. e. the more you produce of one good the more it costs to produce it. • So there is less tendency toward specialization than in the Ricardian model, where full specialization was the best outcome. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -14

FIGURE 4. 1 The United States’ Production Possibilities Curve with Increasing Costs Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -15

FIGURE 4. 1 The United States’ Production Possibilities Curve with Increasing Costs Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -15

Other implications: trade and the income distribution • Differently from the Ricardian model, the HO model allows to study the effect of trade on the income distribution within a country. In general, the Ricardian model ruled out the potentially harmful effects of trade for some member of the society. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -16

Other implications: trade and the income distribution • Differently from the Ricardian model, the HO model allows to study the effect of trade on the income distribution within a country. In general, the Ricardian model ruled out the potentially harmful effects of trade for some member of the society. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -16

Trade and Income Distribution • The HO model provides a more sophisticated way to analyze gains and losses from trade because it drops unrealistic assumptions – Labor can be divided into categories of different skill levels – Other types of inputs can be included – Industries can require different mixes of various inputs • There is a systematic relationship between the factor endowments of a country and the winners and losers from trade • Let’s analyze this claim further… Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -17

Trade and Income Distribution • The HO model provides a more sophisticated way to analyze gains and losses from trade because it drops unrealistic assumptions – Labor can be divided into categories of different skill levels – Other types of inputs can be included – Industries can require different mixes of various inputs • There is a systematic relationship between the factor endowments of a country and the winners and losers from trade • Let’s analyze this claim further… Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -17

The Stolper-Samuelson Theorem • Derived from the HO model • Assumptions: – Labor earns wages proportionate to its skill level – Owners of capital earn profits – Landowners earn rents – The amount of income earned per unit of input depends on both the demand for inputs and the supply of inputs (demand for an input such as labour = derived demand) – If an output is in high demand, its price is high and the inputs used to produce it receive higher returns Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -18

The Stolper-Samuelson Theorem • Derived from the HO model • Assumptions: – Labor earns wages proportionate to its skill level – Owners of capital earn profits – Landowners earn rents – The amount of income earned per unit of input depends on both the demand for inputs and the supply of inputs (demand for an input such as labour = derived demand) – If an output is in high demand, its price is high and the inputs used to produce it receive higher returns Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -18

The Stolper-Samuelson Theorem (cont. ) • An increase in the price of a good raises the income earned by factors that are used intensively in its production. Since the price of export increases with international trade, owners of the factor used intensively in the exported good sector gain (skilled labour in the US). • Conversely, a fall in the price of a good lowers the income of the factors used intensively in its production. Since the price of the good imported declines with inter. trade, owners of the factor used intensively in the import-competing industry loose (unskilled labour in the US). Copyright © 2011 Pearson Addison-Wesley. • Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -19

The Stolper-Samuelson Theorem (cont. ) • An increase in the price of a good raises the income earned by factors that are used intensively in its production. Since the price of export increases with international trade, owners of the factor used intensively in the exported good sector gain (skilled labour in the US). • Conversely, a fall in the price of a good lowers the income of the factors used intensively in its production. Since the price of the good imported declines with inter. trade, owners of the factor used intensively in the import-competing industry loose (unskilled labour in the US). Copyright © 2011 Pearson Addison-Wesley. • Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -19

Remark • As in the Ricardian model, the earnings of the inputs used intensively in the production of the good exported increase because these earnings are proportional to the demand of the exported good and so to its price, both increasing with trade. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -20

Remark • As in the Ricardian model, the earnings of the inputs used intensively in the production of the good exported increase because these earnings are proportional to the demand of the exported good and so to its price, both increasing with trade. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -20

The Stolper-Samuelson Theorem (cont. ) • The main idea is that trade of goods is equivalent to trade of production factors. • Since international trade reallocates the production of goods across countries, it changes also the demand of factors of production across countries. • There will be factors of production whose demand declines after trade (i. e. workers in the apparel and textile industry in the US) and factors of production whose demand increases (i. e. ICT engineers, managers in the financial sector or software developers in the US) Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -21

The Stolper-Samuelson Theorem (cont. ) • The main idea is that trade of goods is equivalent to trade of production factors. • Since international trade reallocates the production of goods across countries, it changes also the demand of factors of production across countries. • There will be factors of production whose demand declines after trade (i. e. workers in the apparel and textile industry in the US) and factors of production whose demand increases (i. e. ICT engineers, managers in the financial sector or software developers in the US) Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -21

The Stolper-Samuelson Theorem (cont. ) • Note: Not all factors used in the export industries will be better off, and not all factors used in import competing industries get hurt: in general abundant factors will benefit, while scarce ones will be hurt. • Why? Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -22

The Stolper-Samuelson Theorem (cont. ) • Note: Not all factors used in the export industries will be better off, and not all factors used in import competing industries get hurt: in general abundant factors will benefit, while scarce ones will be hurt. • Why? Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -22

Answer • What really matters is the change in the total demand of each factor of production, no the change in each industry: in particular, the unskilled labour displaced in the textile sector (that uses intensively unskilled labour) cannot be fully relocated to the IT or financial sector (that uses intensively skilled labour). Therefore, the demand of unskilled workers in the US declines and so their wage. • A fraction of the displaced unskilled labour is re-employed in the IT sector that expanded and can hire more unskilled workers, but not all as it is a skill-intensive sector. • What we can do with the rest? Well: displaced unskilled workers should accept lower wages to make their employment profitable for firms or, in the long run, they should acquire better skills to find a job in the export Copyright © 2011 Pearson Addison-Wesley. sector. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -23

Answer • What really matters is the change in the total demand of each factor of production, no the change in each industry: in particular, the unskilled labour displaced in the textile sector (that uses intensively unskilled labour) cannot be fully relocated to the IT or financial sector (that uses intensively skilled labour). Therefore, the demand of unskilled workers in the US declines and so their wage. • A fraction of the displaced unskilled labour is re-employed in the IT sector that expanded and can hire more unskilled workers, but not all as it is a skill-intensive sector. • What we can do with the rest? Well: displaced unskilled workers should accept lower wages to make their employment profitable for firms or, in the long run, they should acquire better skills to find a job in the export Copyright © 2011 Pearson Addison-Wesley. sector. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -23

The Stolper-Samuelson Theorem (cont. ) • Ultimately, the effects of international trade on factor’s income depends on the flexibility of the affected factors – If labor is stuck in bread production and unable to move to making steel, it will be hurt much worse than when it is flexible and free to move – U. S. avocado producers might not oppose Mexican avocado imports as fiercely as they do, if they could easily move to producing other goods or use the land to build houses. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -24

The Stolper-Samuelson Theorem (cont. ) • Ultimately, the effects of international trade on factor’s income depends on the flexibility of the affected factors – If labor is stuck in bread production and unable to move to making steel, it will be hurt much worse than when it is flexible and free to move – U. S. avocado producers might not oppose Mexican avocado imports as fiercely as they do, if they could easily move to producing other goods or use the land to build houses. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -24

A variant of the HO model: the Specific Factors Model • The HO model assumes that factors are mobile, meaning that they can migrate easily from one sector to another • The Specific Factors model assumes that: (1) land, capital and certain types of skilled labour are immobile and cannot migrate (specific factors); and (2) other types of labour with general skills can fully mobile and can migrate from one sector to another (variable factor) Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -25

A variant of the HO model: the Specific Factors Model • The HO model assumes that factors are mobile, meaning that they can migrate easily from one sector to another • The Specific Factors model assumes that: (1) land, capital and certain types of skilled labour are immobile and cannot migrate (specific factors); and (2) other types of labour with general skills can fully mobile and can migrate from one sector to another (variable factor) Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -25

Examples • • An agent of a Rock star cannot be easily relocated to become an agent of a football player. A PC can be productively used in several applications. A nuclear plant cannot easily be redesign to produce energy from carbon, while a carbon plant can be restructured to produce energy from gas. A human resource manager can be reemployed easily in another sector An engineer specialized in nuclear energy cannot be easily relocated in projecting wind turbines (that requires competences in aerodynamics). An IT expert might find it difficult to suddenly shift to Linux from windows A typewriter might find it difficult to shift from a keyboard (i. e. QWERTY) to another. • Reemploying a specific factor of production from a sector to another is often a matter of time and depends upon the implementation of the appropriate supportive policies (e. g. retraining, education). Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -26

Examples • • An agent of a Rock star cannot be easily relocated to become an agent of a football player. A PC can be productively used in several applications. A nuclear plant cannot easily be redesign to produce energy from carbon, while a carbon plant can be restructured to produce energy from gas. A human resource manager can be reemployed easily in another sector An engineer specialized in nuclear energy cannot be easily relocated in projecting wind turbines (that requires competences in aerodynamics). An IT expert might find it difficult to suddenly shift to Linux from windows A typewriter might find it difficult to shift from a keyboard (i. e. QWERTY) to another. • Reemploying a specific factor of production from a sector to another is often a matter of time and depends upon the implementation of the appropriate supportive policies (e. g. retraining, education). Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -26

Specific Factors Model (cont. ) • A country’s endowment of a specific factor plays a critical role in determining comparative advantage and the distribution of income – When trade opens, incomes rise for the owners of the abundant specific factor – The income distribution effect on the mobile factor (call it ‘labour’ for simplicity) is indeterminate, as workers can easily move to the expanding sector Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -27

Specific Factors Model (cont. ) • A country’s endowment of a specific factor plays a critical role in determining comparative advantage and the distribution of income – When trade opens, incomes rise for the owners of the abundant specific factor – The income distribution effect on the mobile factor (call it ‘labour’ for simplicity) is indeterminate, as workers can easily move to the expanding sector Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -27

TABLE 4. 2 A Specific Factors Model, example Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -28

TABLE 4. 2 A Specific Factors Model, example Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -28

Implications of the model • Quite similar to the implications of the HO model for the income distribution and the patterns of trade (export the good using the abundant factor, import the good using the scarce one). • The only difference is that the model allows to better understand the effect of trade on sector-specific factors of production and why the owners of relatively immobile factors fiercely oppose any trade liberalization (political determinants of trade policies, see lecture 2 on policies). – In particular, why some sectors oppose so much to trade liberalization. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -29

Implications of the model • Quite similar to the implications of the HO model for the income distribution and the patterns of trade (export the good using the abundant factor, import the good using the scarce one). • The only difference is that the model allows to better understand the effect of trade on sector-specific factors of production and why the owners of relatively immobile factors fiercely oppose any trade liberalization (political determinants of trade policies, see lecture 2 on policies). – In particular, why some sectors oppose so much to trade liberalization. Copyright © 2011 Pearson Addison-Wesley. Copyright © 2014 Pearson Education, All rights reserved. Inc. All rights reserved. 4 -29

Empirical Tests of the Theory of Comparative Advantage • Tests of theories based on factor endowments (such as HO) yield mixed results - Empirical tests are difficult: how to measure factor endowments or prices in an autarky, for example • Besides factor endowments, trade is affected by – – Technological differences Economies of scale Corporate structures Economic policies Empirical evident supports Ricadian but not H-O model Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -30

Empirical Tests of the Theory of Comparative Advantage • Tests of theories based on factor endowments (such as HO) yield mixed results - Empirical tests are difficult: how to measure factor endowments or prices in an autarky, for example • Besides factor endowments, trade is affected by – – Technological differences Economies of scale Corporate structures Economic policies Empirical evident supports Ricadian but not H-O model Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -30

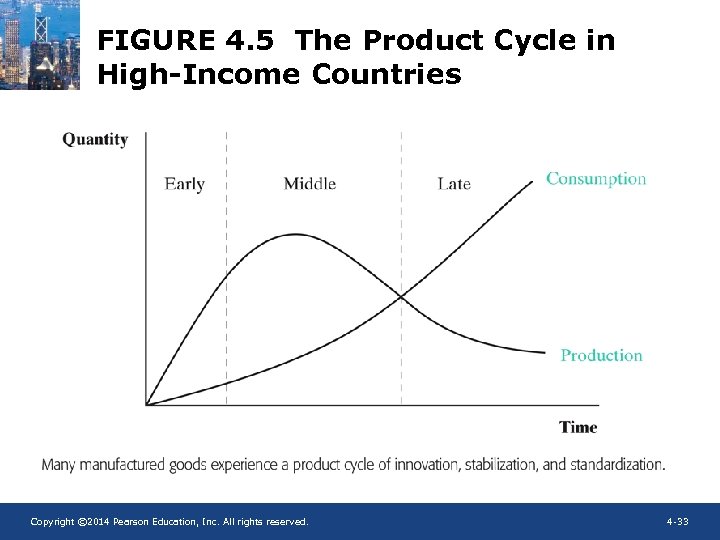

Extension of the HO Model: The Product Cycle • The product cycle was developed by Raymond Vernon • Production of a good is cyclical – In the early stage of production, manufacturers need to be near a high-income market where consumer feedback is greatest. – Experimentation with fundamentally new designs begins to wane as product development shifts toward incremental improvements in a basic design. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -31

Extension of the HO Model: The Product Cycle • The product cycle was developed by Raymond Vernon • Production of a good is cyclical – In the early stage of production, manufacturers need to be near a high-income market where consumer feedback is greatest. – Experimentation with fundamentally new designs begins to wane as product development shifts toward incremental improvements in a basic design. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -31

Product Cycle (cont. ) • In the middle phase, production begins to shift to countries with low labor costs. • consumption of the good in a high-income country exceeds its production: production moves where labor costs are lower • Countries reach the late phase of the product cycle when consumption in high income nations begins to exceed production. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -32

Product Cycle (cont. ) • In the middle phase, production begins to shift to countries with low labor costs. • consumption of the good in a high-income country exceeds its production: production moves where labor costs are lower • Countries reach the late phase of the product cycle when consumption in high income nations begins to exceed production. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -32

FIGURE 4. 5 The Product Cycle in High-Income Countries Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -33

FIGURE 4. 5 The Product Cycle in High-Income Countries Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -33

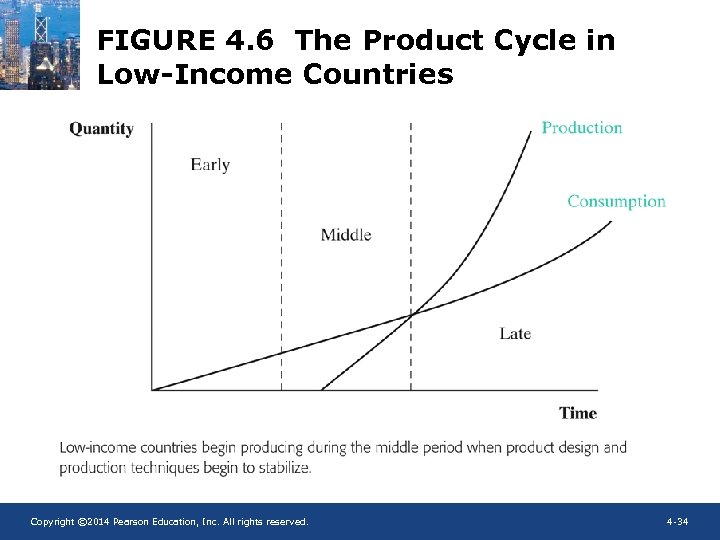

FIGURE 4. 6 The Product Cycle in Low-Income Countries Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -34

FIGURE 4. 6 The Product Cycle in Low-Income Countries Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -34

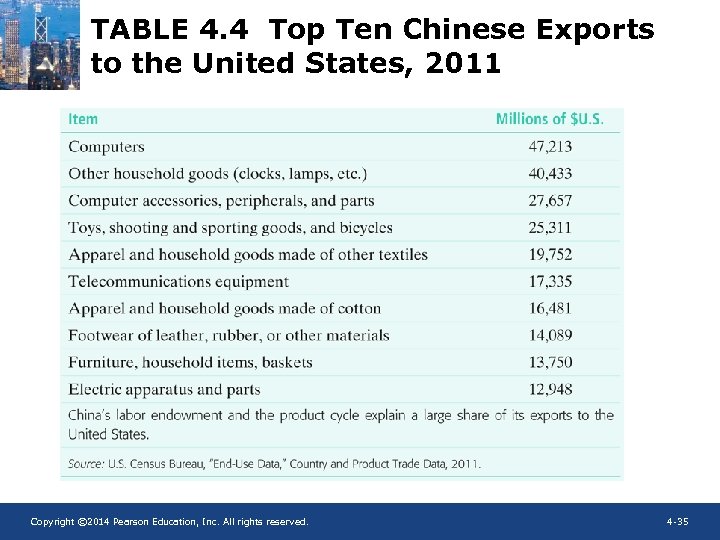

TABLE 4. 4 Top Ten Chinese Exports to the United States, 2011 Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -35

TABLE 4. 4 Top Ten Chinese Exports to the United States, 2011 Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -35

The Impact of Trade on Wages and Jobs • In the short-run, trade may (1) reduce jobs in an industry that is not competitive vis-àvis foreign industries and (2) increase jobs in competitive industries • In the medium- and long-run, trade has very little effect on the number of jobs – The abundance or scarcity of jobs is a function of (1) labor market policies, (2) incentives to work, and (3) government macroeconomic policies Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -36

The Impact of Trade on Wages and Jobs • In the short-run, trade may (1) reduce jobs in an industry that is not competitive vis-àvis foreign industries and (2) increase jobs in competitive industries • In the medium- and long-run, trade has very little effect on the number of jobs – The abundance or scarcity of jobs is a function of (1) labor market policies, (2) incentives to work, and (3) government macroeconomic policies Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -36

Example: Trade and Unemployment • Trade shifts jobs from import-competing to export sector. – Process not instantaneous – some workers will be unemployed as they look for new jobs. • How much unemployment can be traced back to trade? – From 1996 to 2008, only about 2. 5% Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -37

Example: Trade and Unemployment • Trade shifts jobs from import-competing to export sector. – Process not instantaneous – some workers will be unemployed as they look for new jobs. • How much unemployment can be traced back to trade? – From 1996 to 2008, only about 2. 5% Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -37

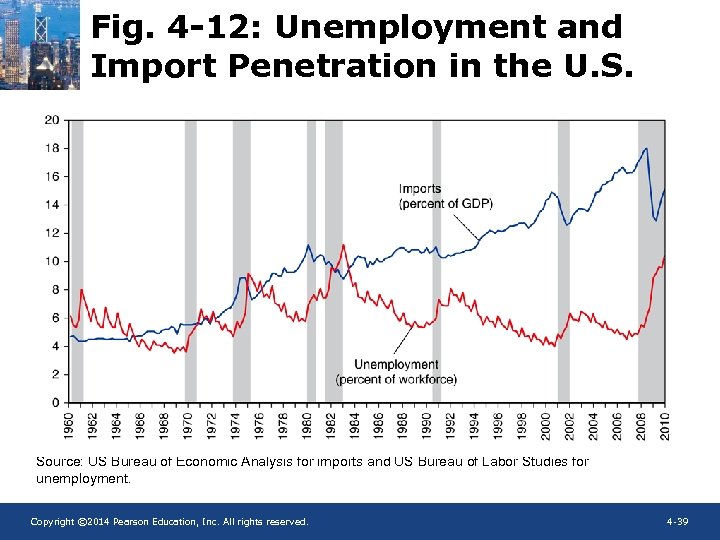

Example: Trade and Unemployment • Figure 4 -12 shows that there is no obvious correlation between unemployment rate and imports relative to GDP for the U. S. – Unemployment is primarily a macroeconomic problem that rises during recessions. – The best way to reduce unemployment is by adopting macroeconomic policies to help the economy to recover, not by adopting trade protection. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -38

Example: Trade and Unemployment • Figure 4 -12 shows that there is no obvious correlation between unemployment rate and imports relative to GDP for the U. S. – Unemployment is primarily a macroeconomic problem that rises during recessions. – The best way to reduce unemployment is by adopting macroeconomic policies to help the economy to recover, not by adopting trade protection. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -38

Fig. 4 -12: Unemployment and Import Penetration in the U. S. Source: US Bureau of Economic Analysis for imports and US Bureau of Labor Studies for unemployment. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -39

Fig. 4 -12: Unemployment and Import Penetration in the U. S. Source: US Bureau of Economic Analysis for imports and US Bureau of Labor Studies for unemployment. Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -39

Income Inequality • Trade might increase Income Inequality in Short run • Long run: Income inequality is due to technology change, which increases the demand for skilled labor Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -40

Income Inequality • Trade might increase Income Inequality in Short run • Long run: Income inequality is due to technology change, which increases the demand for skilled labor Copyright © 2014 Pearson Education, Inc. All rights reserved. 4 -40